Web Developers

Many consumers have at least one of them in their wallet or hooked to their keychain—a loyalty card for their local retailer. Lots of retailers offer loyalty programs in an attempt to attract new customers and satisfy loyal ones. With rewards ranging from coupon offers to regular savings to exclusive, personalized experiences, loyalty programs provide perks and value to members. But do they really engender customer loyalty?

According to the Boston Consulting Group, some companies generate up to 60% of their revenues from loyalty program members. Others, such as warehouse clubs, operate a membership-only business model, where customers have to pay a membership fee before they can shop at an outlet.

In a number of countries, consumption patterns have undergone dramatic changes in recent years. Disruptors such as discounters and online retailers have forced established retailers to invest more in understanding their customers’ needs. For these traditional retailers, loyalty programs can provide valuable customer data that they can use to personalize offers and ensure that their program perks are relevant to customers.

Perceptions of loyalty programs vary among consumers in different regions, and can be affected by a country’s economic situation or cultural preferences. In the UK, some experts argue that, in the grocery sector, price is becoming more important to consumers than the rewards offered by loyalty programs. In the US, the number of memberships continues to grow, but actual engagement with loyalty programs is declining. In other regions, such as Germany, consumers have long held concerns over data privacy, which can inhibit participation in loyalty programs.

In this report, we summarize some of the major loyalty programs offered in the UK, the US and elsewhere, and look at customer usage data and attitudes toward such programs by country. We also examine shopper demand for mobile-focused loyalty programs.

Fully 92% of adults in the UK are registered with at least one loyalty program, according to a research by Loyalive, a UK-based company that offers a free app to help consumers keep track of their loyalty points. The average adult in the UK is a member of three loyalty programs, Loyalive says. The three biggest loyalty programs in the UK, by number of cardholders, are Nectar, Boots Advantage Card and Tesco Clubcard.

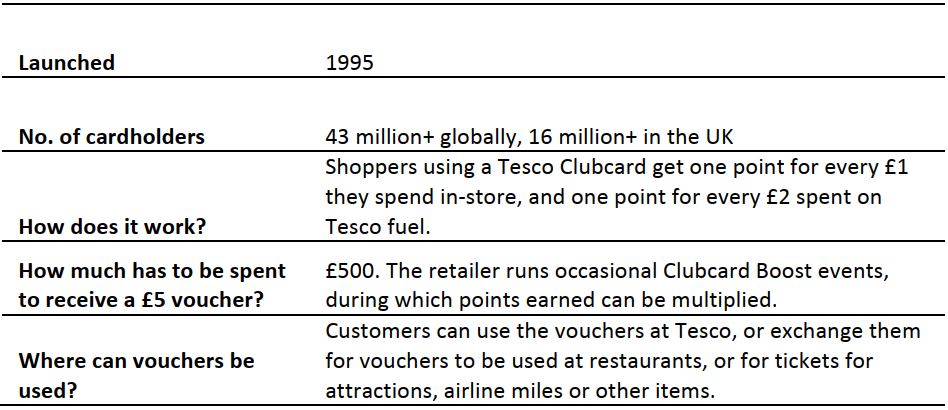

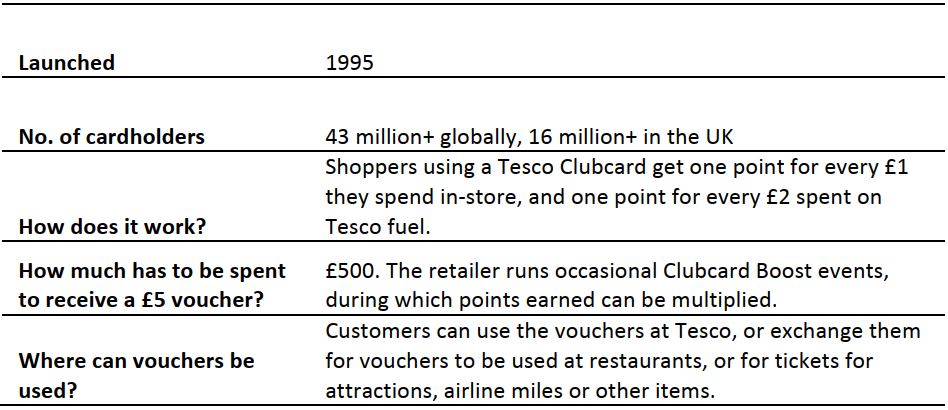

Grocery retailer Tesco’s Clubcard program, which was launched in 1995, kicked off modern-day retail loyalty programs in the UK. Members receive personalized coupons based on their shopping history, and customers apparently welcomed the Clubcard perks, as Tesco overtook Sainsbury’s to become the leading supermarket chain in the UK a few years later, in fiscal year 1998.

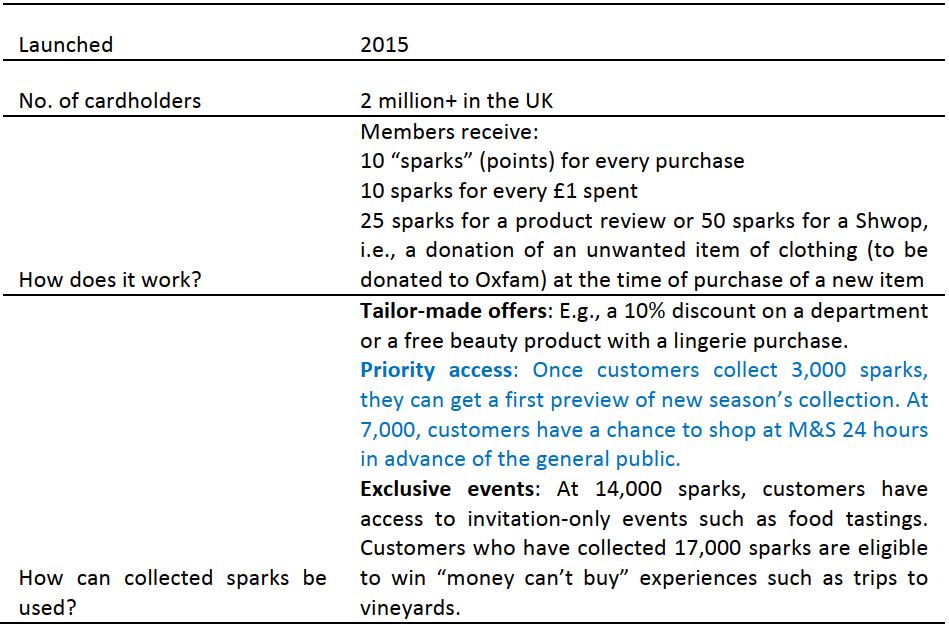

One of the most recent loyalty program launches in the UK was Marks & Spencer’s (M&S’s) Sparks, which offers exclusivity and “money can’t buy” experiential offers to its loyal customers. M&S is a retailer of contrasting halves: outperforming food and underperforming general merchandise. We suspect the new Sparks loyalty program was designed to encourage some of its food customers to consider buying clothing and other general merchandise from M&S, too.

We review the major UK loyalty schemes below, in order of date launched.

Fully 92% of adults in the UK are registered with at least one loyalty program, according to a research by Loyalive, a UK-based company that offers a free app to help consumers keep track of their loyalty points. The average adult in the UK is a member of three loyalty programs, Loyalive says. The three biggest loyalty programs in the UK, by number of cardholders, are Nectar, Boots Advantage Card and Tesco Clubcard.

Grocery retailer Tesco’s Clubcard program, which was launched in 1995, kicked off modern-day retail loyalty programs in the UK. Members receive personalized coupons based on their shopping history, and customers apparently welcomed the Clubcard perks, as Tesco overtook Sainsbury’s to become the leading supermarket chain in the UK a few years later, in fiscal year 1998.

One of the most recent loyalty program launches in the UK was Marks & Spencer’s (M&S’s) Sparks, which offers exclusivity and “money can’t buy” experiential offers to its loyal customers. M&S is a retailer of contrasting halves: outperforming food and underperforming general merchandise. We suspect the new Sparks loyalty program was designed to encourage some of its food customers to consider buying clothing and other general merchandise from M&S, too.

We review the major UK loyalty schemes below, in order of date launched.

The Clubcard membership program is one of the key reasons Tesco overtook Sainsbury’s in the 1990s to become the largest supermarket chain in the UK, by revenue. With Clubcard, Tesco was able to analyze and predict its customers’ shopping habits like never before. Twelve months after the program launched, Clubcard holders were reported to be spending 28% more than they did before at Tesco, and 16% less at Sainsbury’s, according to multiple sources.

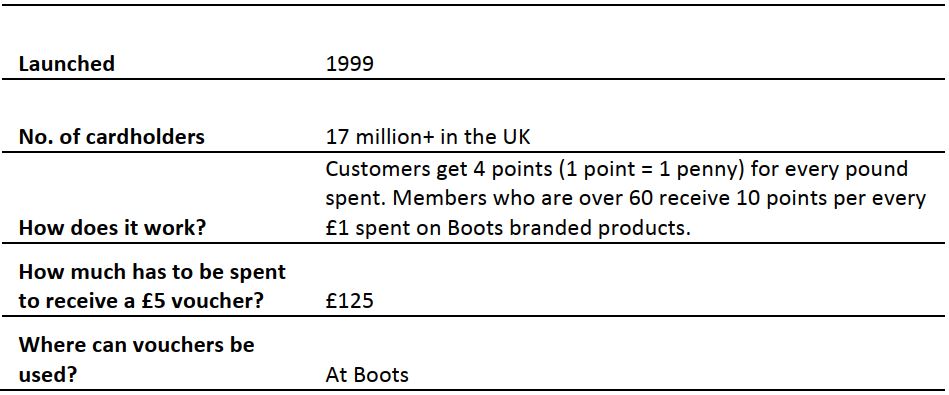

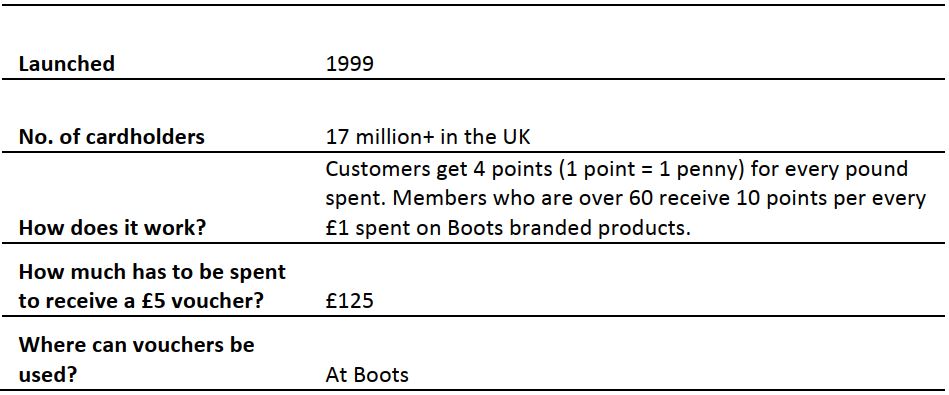

Boots is the UK’s largest pharmacist and health and beauty chain. The company’s Advantage Card is one of the most generous loyalty cards in the UK, by ratio of points paid out for every pound spent. Boots is part of Walgreens Boots Alliance, which was formed in 2014. Walgreens is the largest drugstore chain in the US.

Boots is the UK’s largest pharmacist and health and beauty chain. The company’s Advantage Card is one of the most generous loyalty cards in the UK, by ratio of points paid out for every pound spent. Boots is part of Walgreens Boots Alliance, which was formed in 2014. Walgreens is the largest drugstore chain in the US.

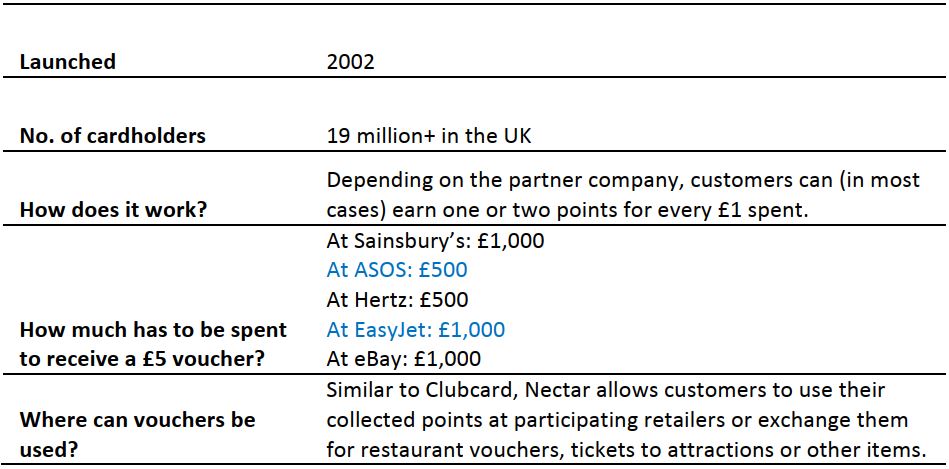

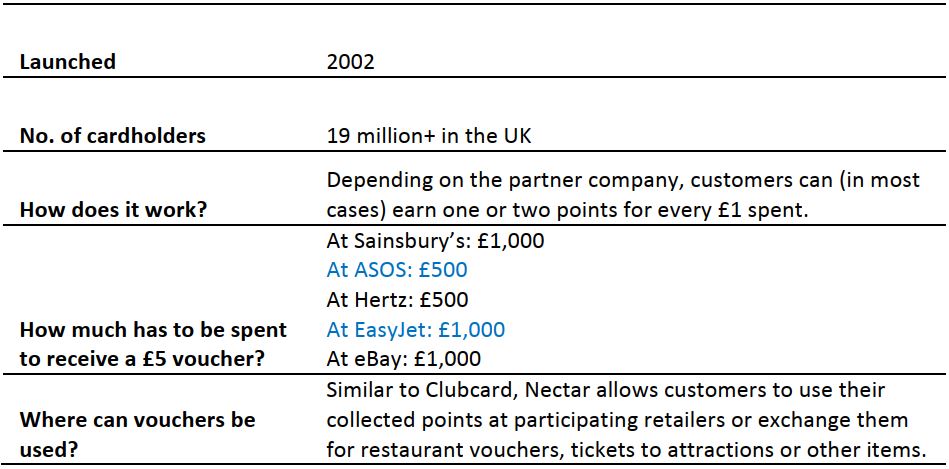

In 2002, when Nectar was launched, Sainsbury’s was one of the four first partners in the program, and it remains the biggest. Other original partners were BP (formerly known as British Petroleum), which is still a partner, and Barclaycard and Debenhams, neither of which is still a partner.

Cardholders can currently collect Nectar points at Expedia and Hertz in addition to Sainsbury’s and BP, and at over 500 online retailers, including ASOS and eBay. In April 2015, Sainsbury’s halved the number of points customers receive, from two to one for every £1 spent. In the Nectar card program, the amount of points a customer receives varies depending on the partner company.

In 2002, when Nectar was launched, Sainsbury’s was one of the four first partners in the program, and it remains the biggest. Other original partners were BP (formerly known as British Petroleum), which is still a partner, and Barclaycard and Debenhams, neither of which is still a partner.

Cardholders can currently collect Nectar points at Expedia and Hertz in addition to Sainsbury’s and BP, and at over 500 online retailers, including ASOS and eBay. In April 2015, Sainsbury’s halved the number of points customers receive, from two to one for every £1 spent. In the Nectar card program, the amount of points a customer receives varies depending on the partner company.

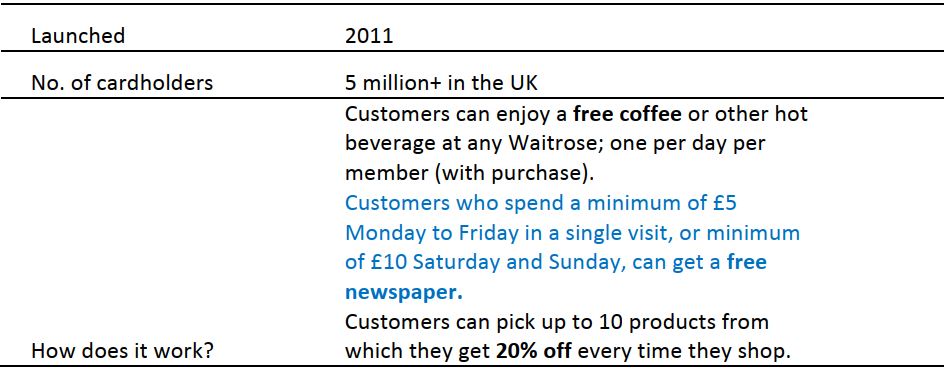

Supermarket chain Waitrose launched its loyalty program in 2011, eschewing coupons for added extras. For members of the myWaitrose program, the core perk is free coffee (or another hot drink). The retailer claims that it is now the UK’s second-largest coffee provider, after McDonald’s, serving over 1 million cups of coffee a week. Such was the popularity of the scheme that Waitrose had to change the terms of the offer: it was attracting loyalty card members who were not actually shopping at Waitrose. Now, members who wish to enjoy a free hot beverage in a Waitrose café or bakery with a seating area must purchase another item from the café or bakery.

Supermarket chain Waitrose launched its loyalty program in 2011, eschewing coupons for added extras. For members of the myWaitrose program, the core perk is free coffee (or another hot drink). The retailer claims that it is now the UK’s second-largest coffee provider, after McDonald’s, serving over 1 million cups of coffee a week. Such was the popularity of the scheme that Waitrose had to change the terms of the offer: it was attracting loyalty card members who were not actually shopping at Waitrose. Now, members who wish to enjoy a free hot beverage in a Waitrose café or bakery with a seating area must purchase another item from the café or bakery.

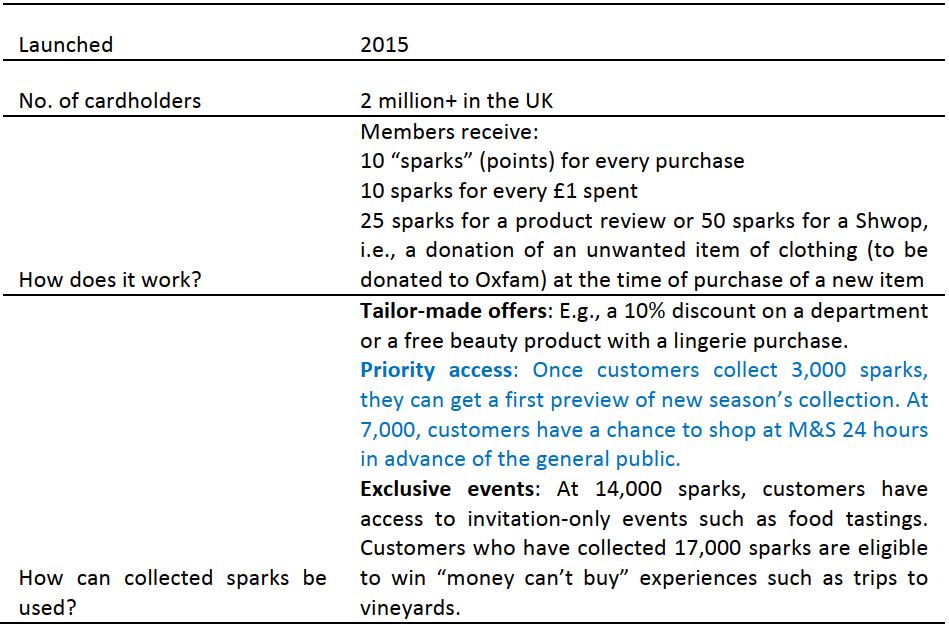

M&S launched its members club, Sparks, in October 2015. When members register for the program, they are asked to give details of their hobbies, interests and lifestyle. M&S Sparks is a move away from money-off and coupon loyalty programs. Like myWaitrose, M&S Sparks focuses on added extras rather than money-saving coupons; Sparks members are offered firsthand previews of upcoming clothing lines and invitations to exclusive events.

M&S launched its members club, Sparks, in October 2015. When members register for the program, they are asked to give details of their hobbies, interests and lifestyle. M&S Sparks is a move away from money-off and coupon loyalty programs. Like myWaitrose, M&S Sparks focuses on added extras rather than money-saving coupons; Sparks members are offered firsthand previews of upcoming clothing lines and invitations to exclusive events.

An average US household holds memberships in 29 loyalty programs, and actively uses 12 of them, according to a biennial report from loyalty marketing company Colloquy. This total includes some nonretail loyalty programs, such as credit card and airline loyalty programs.

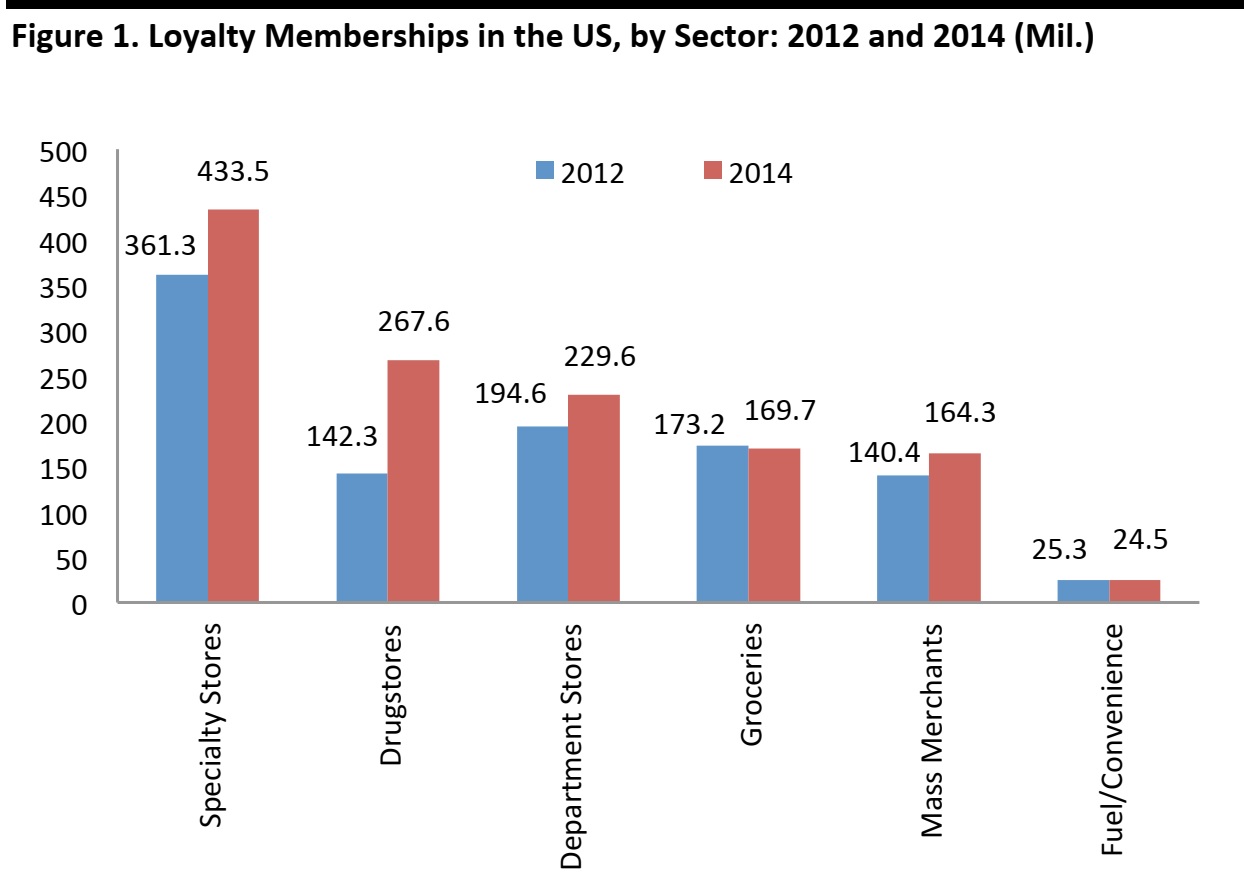

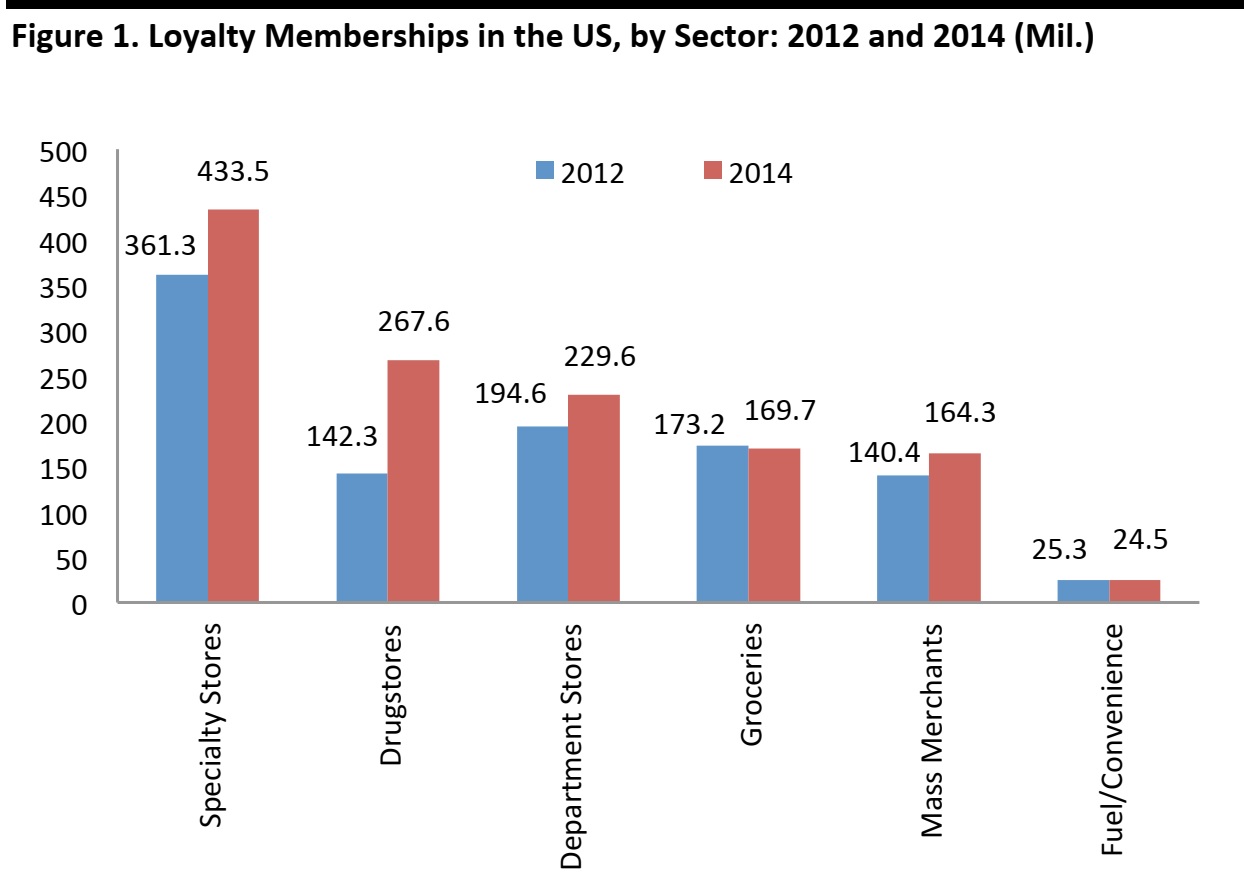

Specialty retailers, including Best Buy, Gap and GameStop, make up the largest retail subsector in terms of memberships, which totaled 433.5 million in 2014. Drugstores saw the biggest increase in number of loyalty program members in the two years to 2014, with growth of 88%. The launch of Walgreens’ Balance Rewards loyalty program in 2012 made a significant contribution to the growth in drugstore memberships. After department stores, grocery retailers were the fourth-largest retail subsector in terms of loyalty memberships, reflecting the substantial department-store sector in the US.

Colloquy’s study also showed that the level of engagement in loyalty programs is declining in the US, despite the growing number of memberships. According to the report, 58% of loyalty program members were “inactive” in 2014, up from 54% in 2010.

An average US household holds memberships in 29 loyalty programs, and actively uses 12 of them, according to a biennial report from loyalty marketing company Colloquy. This total includes some nonretail loyalty programs, such as credit card and airline loyalty programs.

Specialty retailers, including Best Buy, Gap and GameStop, make up the largest retail subsector in terms of memberships, which totaled 433.5 million in 2014. Drugstores saw the biggest increase in number of loyalty program members in the two years to 2014, with growth of 88%. The launch of Walgreens’ Balance Rewards loyalty program in 2012 made a significant contribution to the growth in drugstore memberships. After department stores, grocery retailers were the fourth-largest retail subsector in terms of loyalty memberships, reflecting the substantial department-store sector in the US.

Colloquy’s study also showed that the level of engagement in loyalty programs is declining in the US, despite the growing number of memberships. According to the report, 58% of loyalty program members were “inactive” in 2014, up from 54% in 2010.

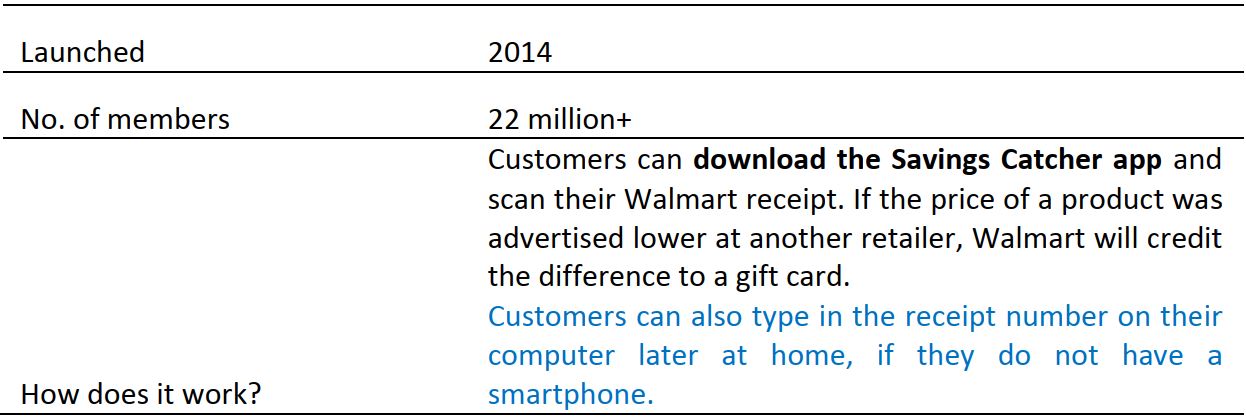

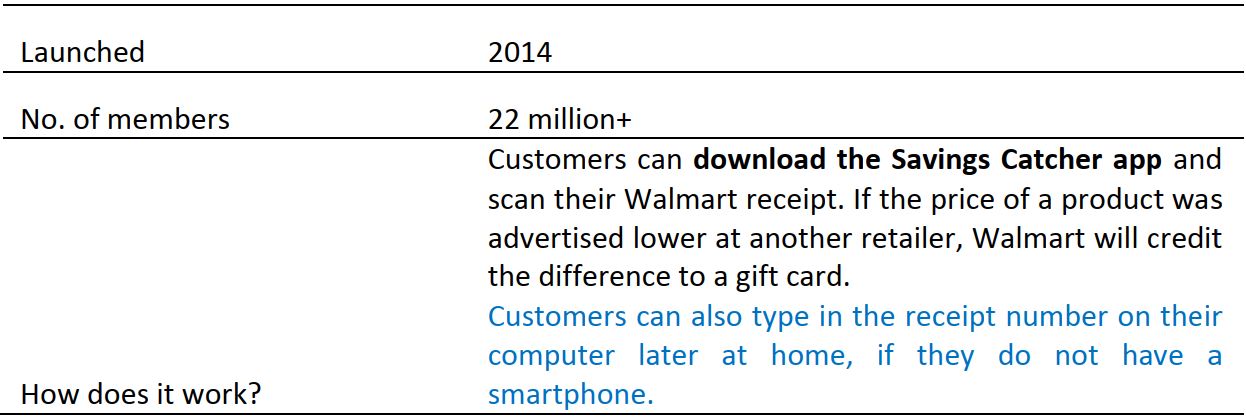

In 2014, retail giant Walmart launched Savings Catcher, a loyalty program through which customers can automatically receive the difference in price on a product if it is cheaper elsewhere. For years, Walmart claimed that it preferred to offer savings to everyone, not to just certain people. Savings Catcher was developed for customers who were trying to find the best deals—with the Savings Catcher app, they do not have to go through the trouble of checking prices at different retailers, as the app does it for them. The system compares Walmart’s price with any local competitor’s price on a printed ad for an identical product. A year after its launch, Savings Catcher became the third-most-downloaded retail app in the US, behind Amazon’s and eBay’s, according to Business Insider.

In 2014, retail giant Walmart launched Savings Catcher, a loyalty program through which customers can automatically receive the difference in price on a product if it is cheaper elsewhere. For years, Walmart claimed that it preferred to offer savings to everyone, not to just certain people. Savings Catcher was developed for customers who were trying to find the best deals—with the Savings Catcher app, they do not have to go through the trouble of checking prices at different retailers, as the app does it for them. The system compares Walmart’s price with any local competitor’s price on a printed ad for an identical product. A year after its launch, Savings Catcher became the third-most-downloaded retail app in the US, behind Amazon’s and eBay’s, according to Business Insider.

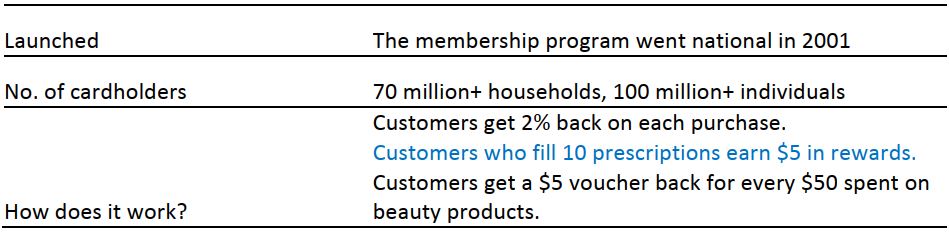

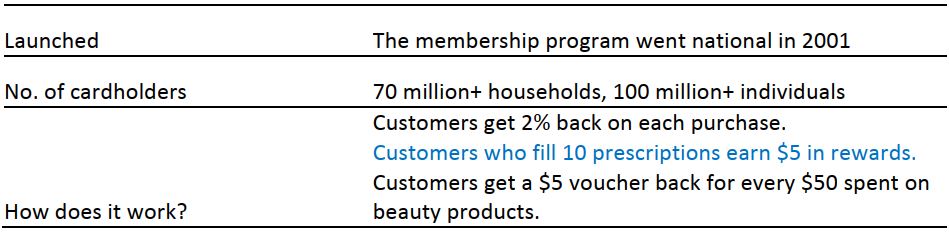

Pharmacy retailer CVS claims its Extra Care is the industry’s most successful loyalty program. As mentioned above, Colloquy found that, of all retail subsectors in the US, drugstores saw the biggest increase in the number of new members who joined loyalty programs between 2012 and 2014.

Pharmacy retailer CVS claims its Extra Care is the industry’s most successful loyalty program. As mentioned above, Colloquy found that, of all retail subsectors in the US, drugstores saw the biggest increase in the number of new members who joined loyalty programs between 2012 and 2014.

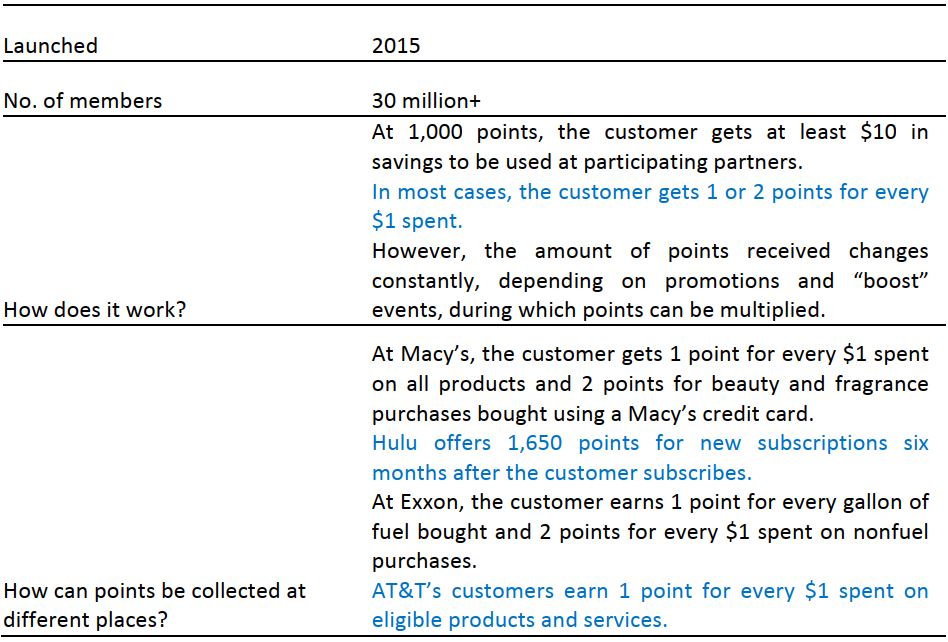

American Express launched Plenti, a rewards program through which customers can earn rewards points from multiple companies, in May of 2015. American Express also offers a Plenti credit card, but members can participate in the Plenti rewards program without having a credit card. Macy’s, Rite Aid and Home Depot are some of the participating retailers, but customers can also collect points when they buy fuel or pay a phone or energy bill. Since launch, 30 million+ members have enrolled in the program.

American Express launched Plenti, a rewards program through which customers can earn rewards points from multiple companies, in May of 2015. American Express also offers a Plenti credit card, but members can participate in the Plenti rewards program without having a credit card. Macy’s, Rite Aid and Home Depot are some of the participating retailers, but customers can also collect points when they buy fuel or pay a phone or energy bill. Since launch, 30 million+ members have enrolled in the program.

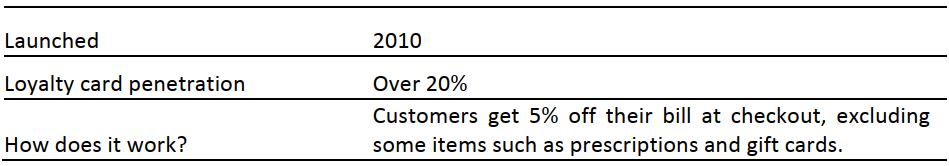

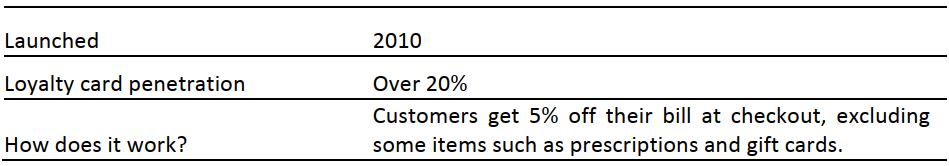

Target offers 5% off nearly all of its products to customers who use its REDcard debit or credit card. The retailer is also tapping into the retail app market following a launch of a beta version of REDperks in early 2015. REDperks allows members to earn 10 points for every $1 spent, and at 5,000 points, they get 5% off their total purchase at Target. The app also reminds users how many points they have and how many they need to collect in order to get discounts and special offers.

Target offers 5% off nearly all of its products to customers who use its REDcard debit or credit card. The retailer is also tapping into the retail app market following a launch of a beta version of REDperks in early 2015. REDperks allows members to earn 10 points for every $1 spent, and at 5,000 points, they get 5% off their total purchase at Target. The app also reminds users how many points they have and how many they need to collect in order to get discounts and special offers.

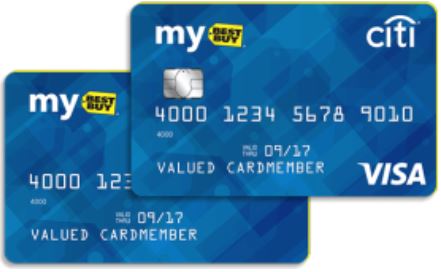

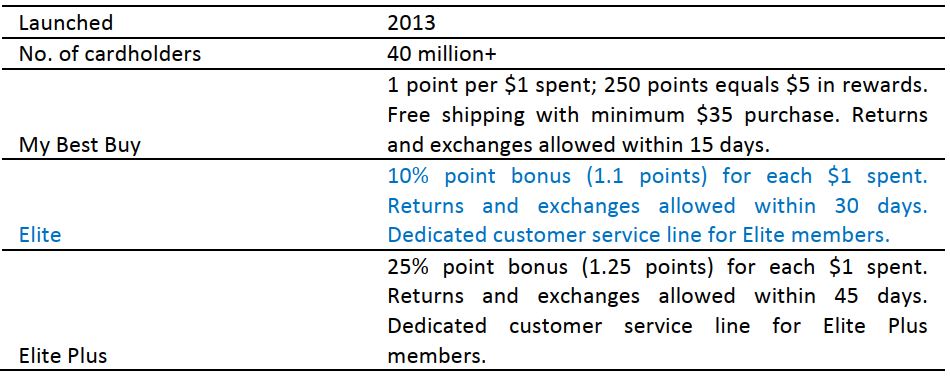

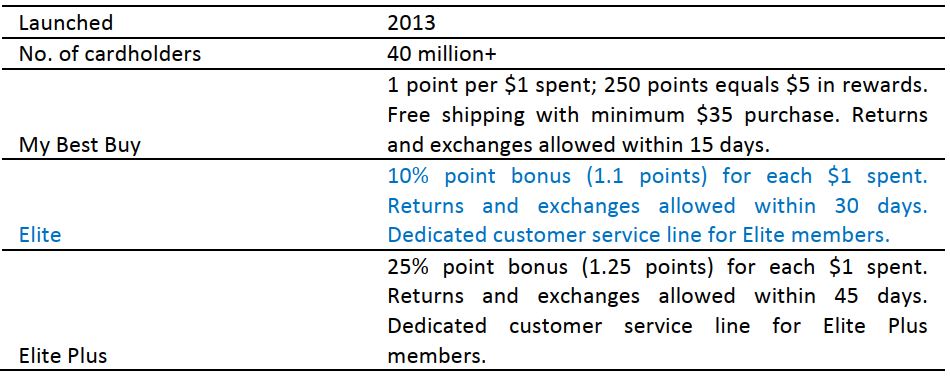

Best Buy’s loyalty program was called Reward Zone until 2013, after which it became My Best Buy. Anyone can enroll in the program to receive instant benefits and to qualify for the Elite or Elite Plus program. To receive the better levels of benefits, customers have to spend a minimum of $1,500 or $3,500 per calendar year. The consumer electronics retailer offers also banking services, in partnership with Citibank.

Best Buy’s loyalty program was called Reward Zone until 2013, after which it became My Best Buy. Anyone can enroll in the program to receive instant benefits and to qualify for the Elite or Elite Plus program. To receive the better levels of benefits, customers have to spend a minimum of $1,500 or $3,500 per calendar year. The consumer electronics retailer offers also banking services, in partnership with Citibank.

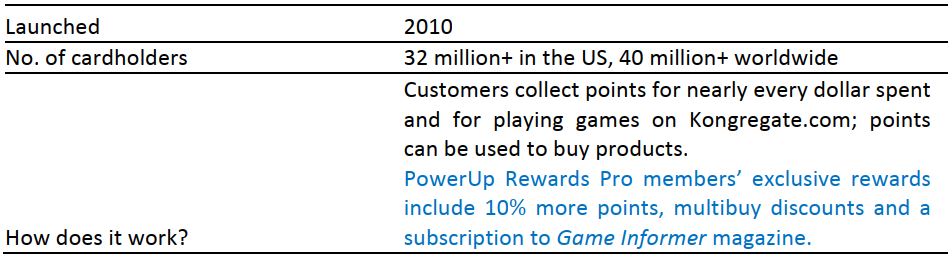

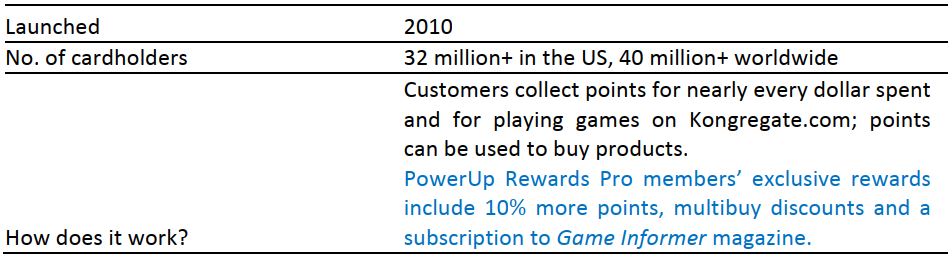

GameStop is the world’s largest multi-channel video game retailer. According to loyalty marketers’ association Loyalty360, a significant portion of GameStop’s high brand loyalty is attributable to its successful PowerUp Rewards loyalty program. The retailer offers a basic membership, which is free to join, and a PowerUp Rewards Pro membership for annual cost of $14.99.

GameStop is the world’s largest multi-channel video game retailer. According to loyalty marketers’ association Loyalty360, a significant portion of GameStop’s high brand loyalty is attributable to its successful PowerUp Rewards loyalty program. The retailer offers a basic membership, which is free to join, and a PowerUp Rewards Pro membership for annual cost of $14.99.

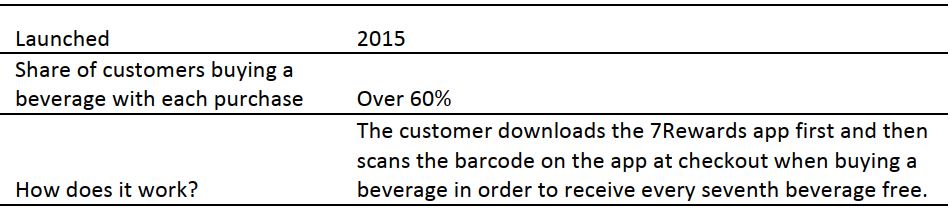

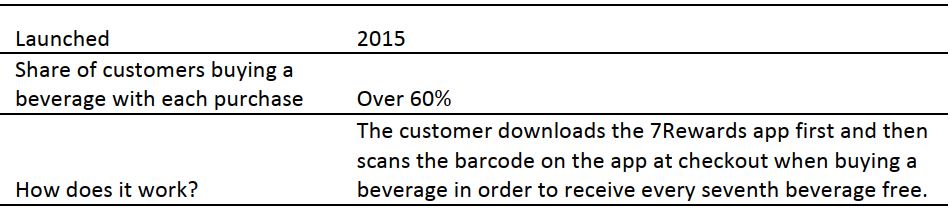

7‑Eleven is the world’s largest convenience store chain, operating in 18 countries. In March 2015, the convenience retailer launched 7Rewards, an app that enables customers to get every seventh beverage free, in the US.

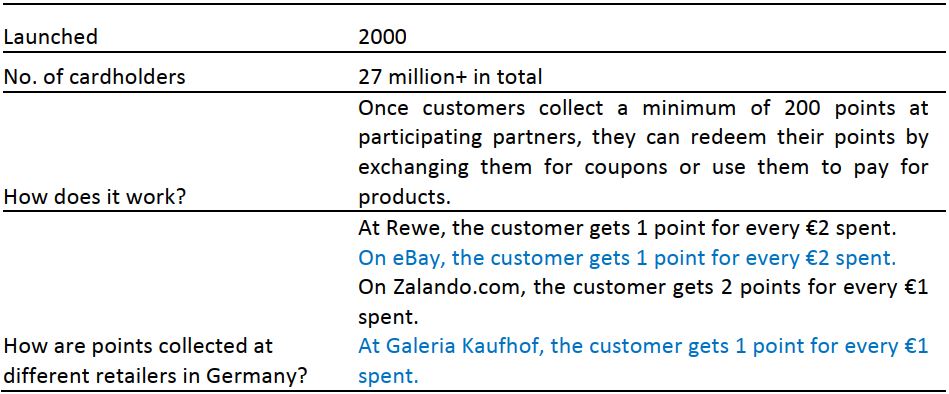

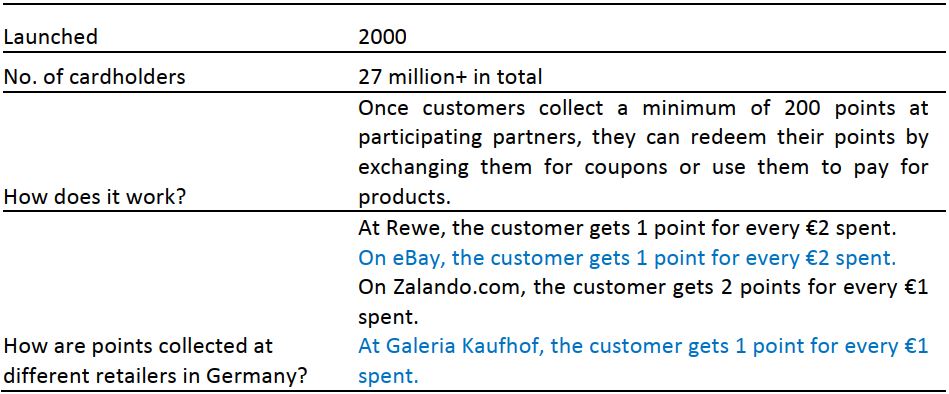

The Payback coalition loyalty program was launched in Germany in 2000 by a German customer relationship management company called Loyalty Partner. In 2011, American Express acquired Loyalty Partner. However, cardholders are not required to link their Payback loyalty card to a credit card.

According to Loyalty Magazine, Payback played an instrumental role in changing loyalty laws in Germany, where incentive and reward programs previously faced legal challenges. The loyalty program operates in five countries (Germany, Italy, Poland, India and Mexico) and in 2015, American Express launched a similar coalition program, Plenti, in the US.

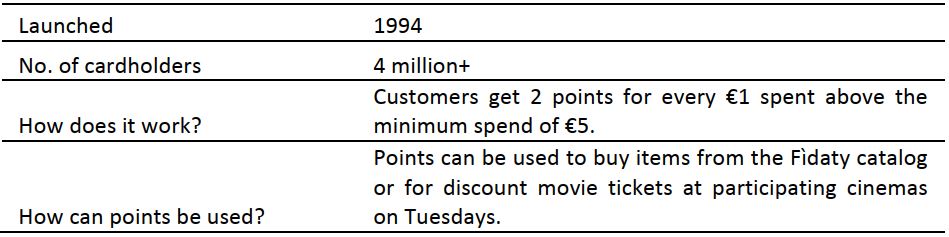

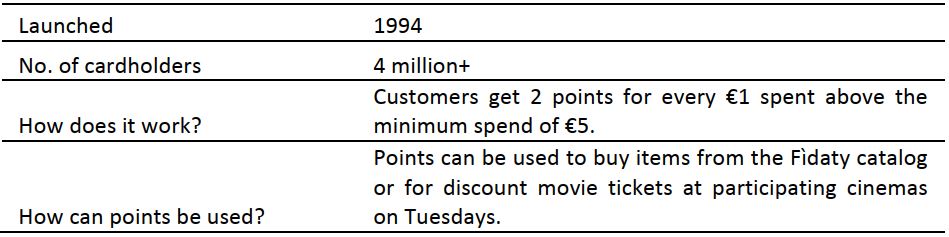

Esselunga is a family-owned grocery retailer in Italy that launched a loyalty program in 1994. With Esselunga’s Fìdaty Card, members can exchange collected points for products from the Fìdaty product catalog or for cinema tickets.

Esselunga is a family-owned grocery retailer in Italy that launched a loyalty program in 1994. With Esselunga’s Fìdaty Card, members can exchange collected points for products from the Fìdaty product catalog or for cinema tickets.

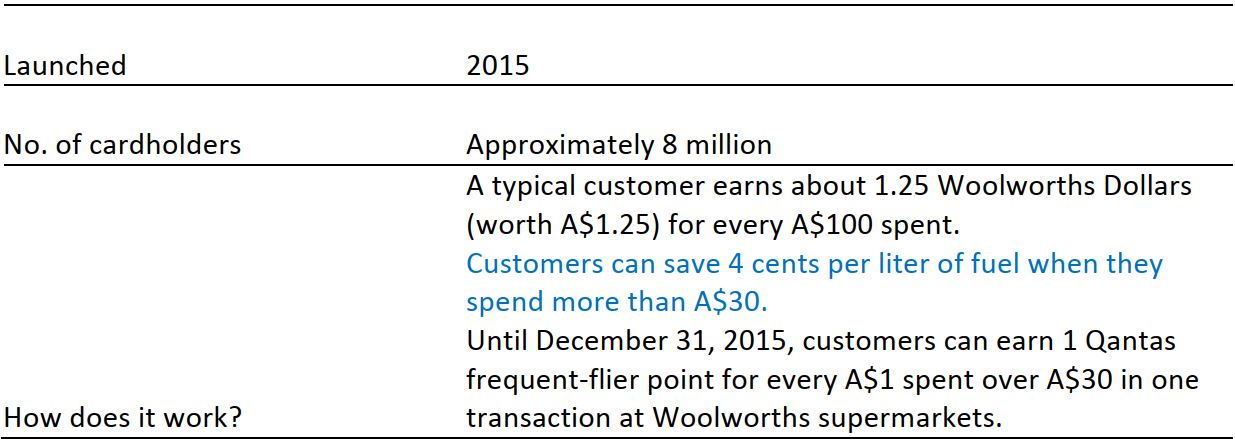

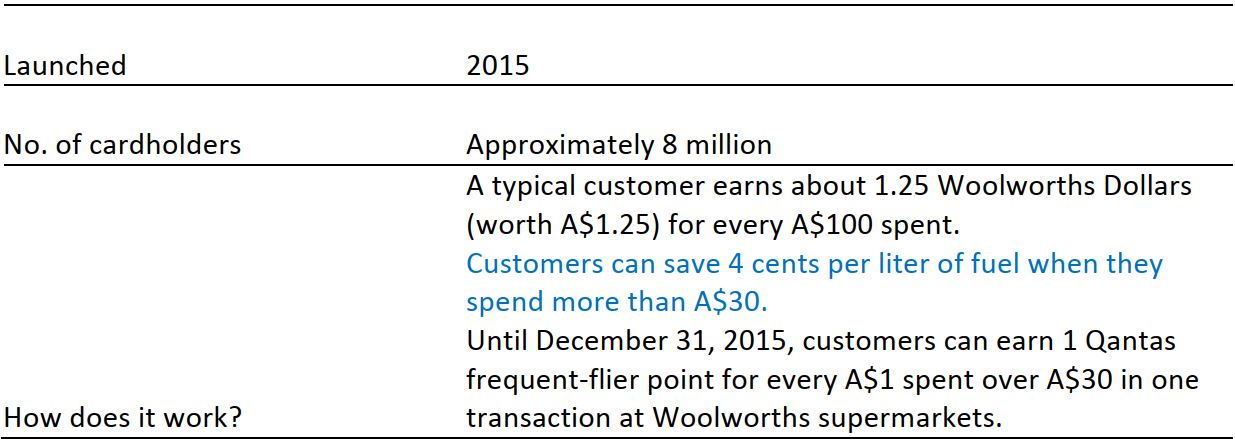

The largest retailer in Australia and New Zealand changed the name of its loyalty program from Woolworths Everyday Rewards to Woolworths Rewards in 2015. The revamped program allows customers to receive money off their grocery bills, partly to allow Woolworths to compete with low-price rivals such as Coles and Aldi. Previously, members were able to collect Qantas frequent-flier points when shopping at Woolworths, but the current partnership with Qantas will end at the end of 2015. According to The Sydney Morning Herald, the partnership has cost the retailer about A$80 million (US$70 million) a year. Discontinuing the frequent-flier points offering could boost Woolworths’ margins, but could also drive customers to rivals.

The largest retailer in Australia and New Zealand changed the name of its loyalty program from Woolworths Everyday Rewards to Woolworths Rewards in 2015. The revamped program allows customers to receive money off their grocery bills, partly to allow Woolworths to compete with low-price rivals such as Coles and Aldi. Previously, members were able to collect Qantas frequent-flier points when shopping at Woolworths, but the current partnership with Qantas will end at the end of 2015. According to The Sydney Morning Herald, the partnership has cost the retailer about A$80 million (US$70 million) a year. Discontinuing the frequent-flier points offering could boost Woolworths’ margins, but could also drive customers to rivals.

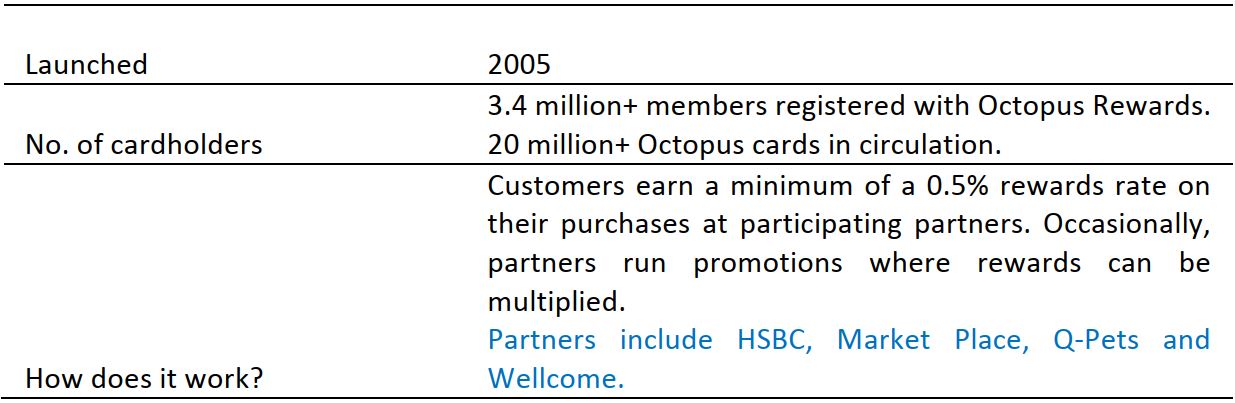

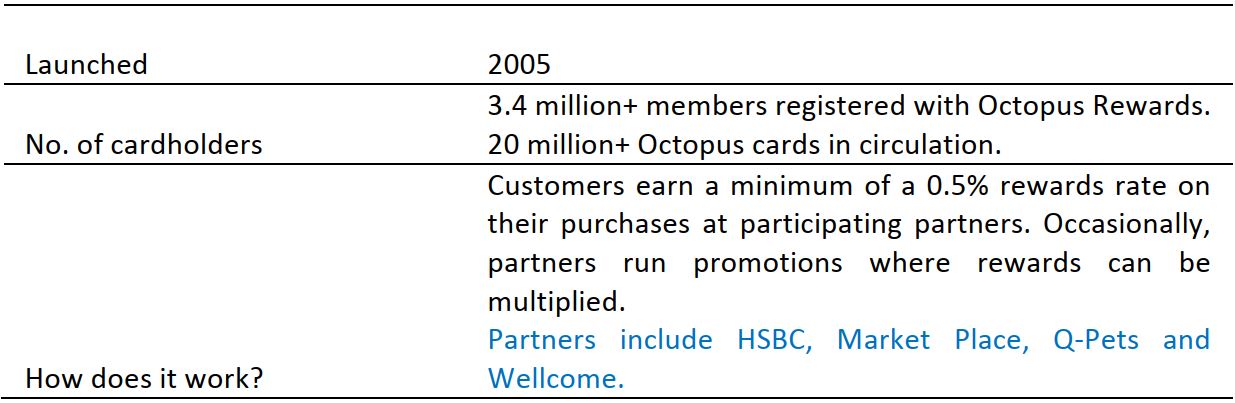

The Octopus card was launched in 1997 as a contactless payment option that commuters could use to pay for fares on Hong Kong’s transport system. Octopus Rewards was launched in 2005, allowing registered Octopus customers to earn and redeem rewards at retail and other companies.

The Octopus card was launched in 1997 as a contactless payment option that commuters could use to pay for fares on Hong Kong’s transport system. Octopus Rewards was launched in 2005, allowing registered Octopus customers to earn and redeem rewards at retail and other companies.

MEMBERSHIP PROGRAMS IN THE UK

Fully 92% of adults in the UK are registered with at least one loyalty program, according to a research by Loyalive, a UK-based company that offers a free app to help consumers keep track of their loyalty points. The average adult in the UK is a member of three loyalty programs, Loyalive says. The three biggest loyalty programs in the UK, by number of cardholders, are Nectar, Boots Advantage Card and Tesco Clubcard.

Grocery retailer Tesco’s Clubcard program, which was launched in 1995, kicked off modern-day retail loyalty programs in the UK. Members receive personalized coupons based on their shopping history, and customers apparently welcomed the Clubcard perks, as Tesco overtook Sainsbury’s to become the leading supermarket chain in the UK a few years later, in fiscal year 1998.

One of the most recent loyalty program launches in the UK was Marks & Spencer’s (M&S’s) Sparks, which offers exclusivity and “money can’t buy” experiential offers to its loyal customers. M&S is a retailer of contrasting halves: outperforming food and underperforming general merchandise. We suspect the new Sparks loyalty program was designed to encourage some of its food customers to consider buying clothing and other general merchandise from M&S, too.

We review the major UK loyalty schemes below, in order of date launched.

Fully 92% of adults in the UK are registered with at least one loyalty program, according to a research by Loyalive, a UK-based company that offers a free app to help consumers keep track of their loyalty points. The average adult in the UK is a member of three loyalty programs, Loyalive says. The three biggest loyalty programs in the UK, by number of cardholders, are Nectar, Boots Advantage Card and Tesco Clubcard.

Grocery retailer Tesco’s Clubcard program, which was launched in 1995, kicked off modern-day retail loyalty programs in the UK. Members receive personalized coupons based on their shopping history, and customers apparently welcomed the Clubcard perks, as Tesco overtook Sainsbury’s to become the leading supermarket chain in the UK a few years later, in fiscal year 1998.

One of the most recent loyalty program launches in the UK was Marks & Spencer’s (M&S’s) Sparks, which offers exclusivity and “money can’t buy” experiential offers to its loyal customers. M&S is a retailer of contrasting halves: outperforming food and underperforming general merchandise. We suspect the new Sparks loyalty program was designed to encourage some of its food customers to consider buying clothing and other general merchandise from M&S, too.

We review the major UK loyalty schemes below, in order of date launched.

Tesco Clubcard

Source: Company reports

Boots Advantage Card

Boots is the UK’s largest pharmacist and health and beauty chain. The company’s Advantage Card is one of the most generous loyalty cards in the UK, by ratio of points paid out for every pound spent. Boots is part of Walgreens Boots Alliance, which was formed in 2014. Walgreens is the largest drugstore chain in the US.

Boots is the UK’s largest pharmacist and health and beauty chain. The company’s Advantage Card is one of the most generous loyalty cards in the UK, by ratio of points paid out for every pound spent. Boots is part of Walgreens Boots Alliance, which was formed in 2014. Walgreens is the largest drugstore chain in the US.

Source: Company reports

Nectar

In 2002, when Nectar was launched, Sainsbury’s was one of the four first partners in the program, and it remains the biggest. Other original partners were BP (formerly known as British Petroleum), which is still a partner, and Barclaycard and Debenhams, neither of which is still a partner.

Cardholders can currently collect Nectar points at Expedia and Hertz in addition to Sainsbury’s and BP, and at over 500 online retailers, including ASOS and eBay. In April 2015, Sainsbury’s halved the number of points customers receive, from two to one for every £1 spent. In the Nectar card program, the amount of points a customer receives varies depending on the partner company.

In 2002, when Nectar was launched, Sainsbury’s was one of the four first partners in the program, and it remains the biggest. Other original partners were BP (formerly known as British Petroleum), which is still a partner, and Barclaycard and Debenhams, neither of which is still a partner.

Cardholders can currently collect Nectar points at Expedia and Hertz in addition to Sainsbury’s and BP, and at over 500 online retailers, including ASOS and eBay. In April 2015, Sainsbury’s halved the number of points customers receive, from two to one for every £1 spent. In the Nectar card program, the amount of points a customer receives varies depending on the partner company.

Source: Company reports

myWaitrose

Supermarket chain Waitrose launched its loyalty program in 2011, eschewing coupons for added extras. For members of the myWaitrose program, the core perk is free coffee (or another hot drink). The retailer claims that it is now the UK’s second-largest coffee provider, after McDonald’s, serving over 1 million cups of coffee a week. Such was the popularity of the scheme that Waitrose had to change the terms of the offer: it was attracting loyalty card members who were not actually shopping at Waitrose. Now, members who wish to enjoy a free hot beverage in a Waitrose café or bakery with a seating area must purchase another item from the café or bakery.

Supermarket chain Waitrose launched its loyalty program in 2011, eschewing coupons for added extras. For members of the myWaitrose program, the core perk is free coffee (or another hot drink). The retailer claims that it is now the UK’s second-largest coffee provider, after McDonald’s, serving over 1 million cups of coffee a week. Such was the popularity of the scheme that Waitrose had to change the terms of the offer: it was attracting loyalty card members who were not actually shopping at Waitrose. Now, members who wish to enjoy a free hot beverage in a Waitrose café or bakery with a seating area must purchase another item from the café or bakery.

Source: Company reports/The Guardian

M&S Sparks

M&S launched its members club, Sparks, in October 2015. When members register for the program, they are asked to give details of their hobbies, interests and lifestyle. M&S Sparks is a move away from money-off and coupon loyalty programs. Like myWaitrose, M&S Sparks focuses on added extras rather than money-saving coupons; Sparks members are offered firsthand previews of upcoming clothing lines and invitations to exclusive events.

M&S launched its members club, Sparks, in October 2015. When members register for the program, they are asked to give details of their hobbies, interests and lifestyle. M&S Sparks is a move away from money-off and coupon loyalty programs. Like myWaitrose, M&S Sparks focuses on added extras rather than money-saving coupons; Sparks members are offered firsthand previews of upcoming clothing lines and invitations to exclusive events.

Source: Company reports

An average US household holds memberships in 29 loyalty programs, and actively uses 12 of them, according to a biennial report from loyalty marketing company Colloquy. This total includes some nonretail loyalty programs, such as credit card and airline loyalty programs.

Specialty retailers, including Best Buy, Gap and GameStop, make up the largest retail subsector in terms of memberships, which totaled 433.5 million in 2014. Drugstores saw the biggest increase in number of loyalty program members in the two years to 2014, with growth of 88%. The launch of Walgreens’ Balance Rewards loyalty program in 2012 made a significant contribution to the growth in drugstore memberships. After department stores, grocery retailers were the fourth-largest retail subsector in terms of loyalty memberships, reflecting the substantial department-store sector in the US.

Colloquy’s study also showed that the level of engagement in loyalty programs is declining in the US, despite the growing number of memberships. According to the report, 58% of loyalty program members were “inactive” in 2014, up from 54% in 2010.

An average US household holds memberships in 29 loyalty programs, and actively uses 12 of them, according to a biennial report from loyalty marketing company Colloquy. This total includes some nonretail loyalty programs, such as credit card and airline loyalty programs.

Specialty retailers, including Best Buy, Gap and GameStop, make up the largest retail subsector in terms of memberships, which totaled 433.5 million in 2014. Drugstores saw the biggest increase in number of loyalty program members in the two years to 2014, with growth of 88%. The launch of Walgreens’ Balance Rewards loyalty program in 2012 made a significant contribution to the growth in drugstore memberships. After department stores, grocery retailers were the fourth-largest retail subsector in terms of loyalty memberships, reflecting the substantial department-store sector in the US.

Colloquy’s study also showed that the level of engagement in loyalty programs is declining in the US, despite the growing number of memberships. According to the report, 58% of loyalty program members were “inactive” in 2014, up from 54% in 2010.

Source: Colloquy/FBIC Global Retail & Technology

Walmart Savings Catcher

In 2014, retail giant Walmart launched Savings Catcher, a loyalty program through which customers can automatically receive the difference in price on a product if it is cheaper elsewhere. For years, Walmart claimed that it preferred to offer savings to everyone, not to just certain people. Savings Catcher was developed for customers who were trying to find the best deals—with the Savings Catcher app, they do not have to go through the trouble of checking prices at different retailers, as the app does it for them. The system compares Walmart’s price with any local competitor’s price on a printed ad for an identical product. A year after its launch, Savings Catcher became the third-most-downloaded retail app in the US, behind Amazon’s and eBay’s, according to Business Insider.

In 2014, retail giant Walmart launched Savings Catcher, a loyalty program through which customers can automatically receive the difference in price on a product if it is cheaper elsewhere. For years, Walmart claimed that it preferred to offer savings to everyone, not to just certain people. Savings Catcher was developed for customers who were trying to find the best deals—with the Savings Catcher app, they do not have to go through the trouble of checking prices at different retailers, as the app does it for them. The system compares Walmart’s price with any local competitor’s price on a printed ad for an identical product. A year after its launch, Savings Catcher became the third-most-downloaded retail app in the US, behind Amazon’s and eBay’s, according to Business Insider.

Source: Company reports/Forbes

CVS

Pharmacy retailer CVS claims its Extra Care is the industry’s most successful loyalty program. As mentioned above, Colloquy found that, of all retail subsectors in the US, drugstores saw the biggest increase in the number of new members who joined loyalty programs between 2012 and 2014.

Pharmacy retailer CVS claims its Extra Care is the industry’s most successful loyalty program. As mentioned above, Colloquy found that, of all retail subsectors in the US, drugstores saw the biggest increase in the number of new members who joined loyalty programs between 2012 and 2014.

Source: Company reports

Plenti

American Express launched Plenti, a rewards program through which customers can earn rewards points from multiple companies, in May of 2015. American Express also offers a Plenti credit card, but members can participate in the Plenti rewards program without having a credit card. Macy’s, Rite Aid and Home Depot are some of the participating retailers, but customers can also collect points when they buy fuel or pay a phone or energy bill. Since launch, 30 million+ members have enrolled in the program.

American Express launched Plenti, a rewards program through which customers can earn rewards points from multiple companies, in May of 2015. American Express also offers a Plenti credit card, but members can participate in the Plenti rewards program without having a credit card. Macy’s, Rite Aid and Home Depot are some of the participating retailers, but customers can also collect points when they buy fuel or pay a phone or energy bill. Since launch, 30 million+ members have enrolled in the program.

Source: Company reports/Colloquy

Target REDcard

Target offers 5% off nearly all of its products to customers who use its REDcard debit or credit card. The retailer is also tapping into the retail app market following a launch of a beta version of REDperks in early 2015. REDperks allows members to earn 10 points for every $1 spent, and at 5,000 points, they get 5% off their total purchase at Target. The app also reminds users how many points they have and how many they need to collect in order to get discounts and special offers.

Target offers 5% off nearly all of its products to customers who use its REDcard debit or credit card. The retailer is also tapping into the retail app market following a launch of a beta version of REDperks in early 2015. REDperks allows members to earn 10 points for every $1 spent, and at 5,000 points, they get 5% off their total purchase at Target. The app also reminds users how many points they have and how many they need to collect in order to get discounts and special offers.

Source: Company reports

My Best Buy

Best Buy’s loyalty program was called Reward Zone until 2013, after which it became My Best Buy. Anyone can enroll in the program to receive instant benefits and to qualify for the Elite or Elite Plus program. To receive the better levels of benefits, customers have to spend a minimum of $1,500 or $3,500 per calendar year. The consumer electronics retailer offers also banking services, in partnership with Citibank.

Best Buy’s loyalty program was called Reward Zone until 2013, after which it became My Best Buy. Anyone can enroll in the program to receive instant benefits and to qualify for the Elite or Elite Plus program. To receive the better levels of benefits, customers have to spend a minimum of $1,500 or $3,500 per calendar year. The consumer electronics retailer offers also banking services, in partnership with Citibank.

Source: Company reports

GameStop PowerUp Rewards

GameStop is the world’s largest multi-channel video game retailer. According to loyalty marketers’ association Loyalty360, a significant portion of GameStop’s high brand loyalty is attributable to its successful PowerUp Rewards loyalty program. The retailer offers a basic membership, which is free to join, and a PowerUp Rewards Pro membership for annual cost of $14.99.

GameStop is the world’s largest multi-channel video game retailer. According to loyalty marketers’ association Loyalty360, a significant portion of GameStop’s high brand loyalty is attributable to its successful PowerUp Rewards loyalty program. The retailer offers a basic membership, which is free to join, and a PowerUp Rewards Pro membership for annual cost of $14.99.

Source: Company reports/Loyalty360

7Rewards

7Rewards

7‑Eleven is the world’s largest convenience store chain, operating in 18 countries. In March 2015, the convenience retailer launched 7Rewards, an app that enables customers to get every seventh beverage free, in the US.

Source: Company reports/PYMNTS.com

MAJOR MEMBERSHIP PROGRAMS ELSEWHERE

Payback (Germany, Italy, Poland, India and Mexico)

Payback (Germany, Italy, Poland, India and Mexico)

The Payback coalition loyalty program was launched in Germany in 2000 by a German customer relationship management company called Loyalty Partner. In 2011, American Express acquired Loyalty Partner. However, cardholders are not required to link their Payback loyalty card to a credit card.

According to Loyalty Magazine, Payback played an instrumental role in changing loyalty laws in Germany, where incentive and reward programs previously faced legal challenges. The loyalty program operates in five countries (Germany, Italy, Poland, India and Mexico) and in 2015, American Express launched a similar coalition program, Plenti, in the US.

Source: Company reports

Esselunga (Italy)

Esselunga is a family-owned grocery retailer in Italy that launched a loyalty program in 1994. With Esselunga’s Fìdaty Card, members can exchange collected points for products from the Fìdaty product catalog or for cinema tickets.

Esselunga is a family-owned grocery retailer in Italy that launched a loyalty program in 1994. With Esselunga’s Fìdaty Card, members can exchange collected points for products from the Fìdaty product catalog or for cinema tickets.

Source: Company reports/Reuters

Woolworths Rewards (Australia)

The largest retailer in Australia and New Zealand changed the name of its loyalty program from Woolworths Everyday Rewards to Woolworths Rewards in 2015. The revamped program allows customers to receive money off their grocery bills, partly to allow Woolworths to compete with low-price rivals such as Coles and Aldi. Previously, members were able to collect Qantas frequent-flier points when shopping at Woolworths, but the current partnership with Qantas will end at the end of 2015. According to The Sydney Morning Herald, the partnership has cost the retailer about A$80 million (US$70 million) a year. Discontinuing the frequent-flier points offering could boost Woolworths’ margins, but could also drive customers to rivals.

The largest retailer in Australia and New Zealand changed the name of its loyalty program from Woolworths Everyday Rewards to Woolworths Rewards in 2015. The revamped program allows customers to receive money off their grocery bills, partly to allow Woolworths to compete with low-price rivals such as Coles and Aldi. Previously, members were able to collect Qantas frequent-flier points when shopping at Woolworths, but the current partnership with Qantas will end at the end of 2015. According to The Sydney Morning Herald, the partnership has cost the retailer about A$80 million (US$70 million) a year. Discontinuing the frequent-flier points offering could boost Woolworths’ margins, but could also drive customers to rivals.

Source: Company reports/The Sydney Morning Herald

Octopus Rewards (Hong Kong)

The Octopus card was launched in 1997 as a contactless payment option that commuters could use to pay for fares on Hong Kong’s transport system. Octopus Rewards was launched in 2005, allowing registered Octopus customers to earn and redeem rewards at retail and other companies.

The Octopus card was launched in 1997 as a contactless payment option that commuters could use to pay for fares on Hong Kong’s transport system. Octopus Rewards was launched in 2005, allowing registered Octopus customers to earn and redeem rewards at retail and other companies.

Source: Company reports

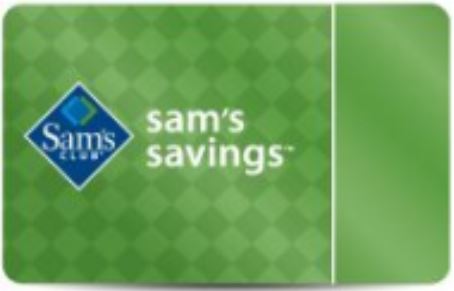

MEMBERSHIP-ONLY RETAILER PROGRAMS

While membership programs are an added perk offered by some retailers, for others, such as warehouse clubs, membership is the lifeblood of their business. Traditional retailers generate the majority of their earnings from actual sales, whereas warehouse clubs generate most of their earnings from membership fees, and then sell their goods at near-cost prices. Costco and Sam’s Club are the major US-based warehouse clubs. They both rely on warehouse-style/no-frills business models where customers pay a membership fee to shop for cheaper-priced products, often in larger quantities than they could get at traditional retail outlets. This retail format can be hugely successful, as customers tend to buy products in bulk, and many of the warehouse clubs enjoy high membership retention rates. Costco

Costco

- As of November 18, 2015, Costco had a total of 81.3 million cardholders.

- The retailer operated in 686 locations in nine countries as of August 30, 2015.

- In 2014, Costco was the second-largest retailer in the US and the fourth-largest retailer globally.

- Annual standard membership costs $55 for an individual.

Sam’s Club

Sam’s Club

- Sam’s Club is owned and operated by Walmart.

- The retailer serves over 47 million cardholders in over 750 clubs.

- A basic individual membership costs $45 annually.

- Brick-and-mortar retailers are not the only ones offering membership-only programs; online retailers are offering them, too. One of the most well-known disrupters in retail across the globe is Amazon, an online retailer that offers a service with many perks—Amazon Prime—for which customers pay an annual membership fee.

Amazon Prime

Amazon Prime

- Amazon Prime was launched in 2005 in the US to provide members-only offers and services.

- At first, Amazon offered free two-day shipping to its paying members in the US. Today, the service has expanded into different categories, such as movie and TV show streaming, and to same-day (and in some places, even one-hour) delivery, including of fresh food.

- Amazon Prime is currently available in nine countries.

- An annual individual membership in the US costs $99.

COMPANIES PROVIDING LOYALTY PROGRAMS

Loyalty programs deliver benefits for both customers and retailers. Customers are often rewarded with discounts, vouchers and exclusivity when they join these programs. Retailers, however, get access to valuable shopping data and analytics. Aimia

Aimia

- Canadian marketing and loyalty analytics company Aimia was founded in 1984. Originally, the company was called Aeroplan, and it managed a frequent-flier loyalty program for Air Canada.

- In 2007, the company acquired Nectar, the largest coalition loyalty program in the UK.

- Aimia operates globally in frequent-flier programs, retail loyalty schemes and data analytics.

Brierley+Partners

Brierley+Partners

- Brierley+Partners was founded in 1985 in Dallas by Hal Brierley.

- GameStop launched its hugely successful loyalty program in 2010 with Brierley+Partners.

- The company’s clients also include American Eagle Outfitters, 7-Eleven and Hilton Worldwide.

Dunnhumby

Dunnhumby

- Customer science company dunnhumby was founded in 1989 in the UK by Edwina Dunn and Clive Humby.

- In 1995, dunnhumby established Tesco’s Clubcard loyalty program, which specializes in predicting buying habits.

- dunnhumby is wholly owned by Tesco. In 2015, the retailer revealed its intention to sell the data analytics unit to reduce its debt; however, for the time being, dunnhumby remains under Tesco’s ownership.

- In April 2015, US supermarket chain Kroger acquired dunnhumby USA’s data-mining technology. The new company is called 84.51°.

Epsilon

Epsilon

- Epsilon was founded in 1969 in Irving, Texas.

- The company’s clients include Walgreens, Staples, Dell and GMC.

REGIONAL DIFFERENCES AFFECTING PERCEPTIONS OF LOYALTY PROGRAMS

Consumer perceptions of loyalty programs differ by region. Loyalty card penetration can vary depending on issues such as data privacy concerns and economic factors. Aimia reports that consumers in Germany tend to be reluctant to join loyalty programs, compared to consumers in other countries. According to Aimia, 31% of Germans refuse to participate in any loyalty programs, compared to 10%–16% of respondents in other regions. Germans are also highly price sensitive and easily switch brands and retailers. Therefore, loyalty programs add little of value to them. Consumers in Germany also highly value their personal information and often are skeptical about joining programs that would require them to share details about their private lives or shopping habits. In Spain, on the other hand, high loyalty program engagement could be linked to economic instability. According to Aimia, Spanish consumers are exceptionally influenced by rewards, and to increase their incomes, they are willing to share their personal information. In Japan, consumers have particularly strong loyalty to brands, but not necessarily to retailers. According to Epsilon’s research, quality and products that fit Japanese consumers’ lifestyles are the highest loyalty motivators. Nearly two-thirds of Japanese consumers are members of at least one grocery loyalty program, and coalition loyalty programs, such as T Card and Ponta, are popular. However, one-to-one and personal engagement at the brand level, rather than at the retailer level, are expected to remain strong in Japan.USING APPS TO ENHANCE LOYALTY PROGRAMS

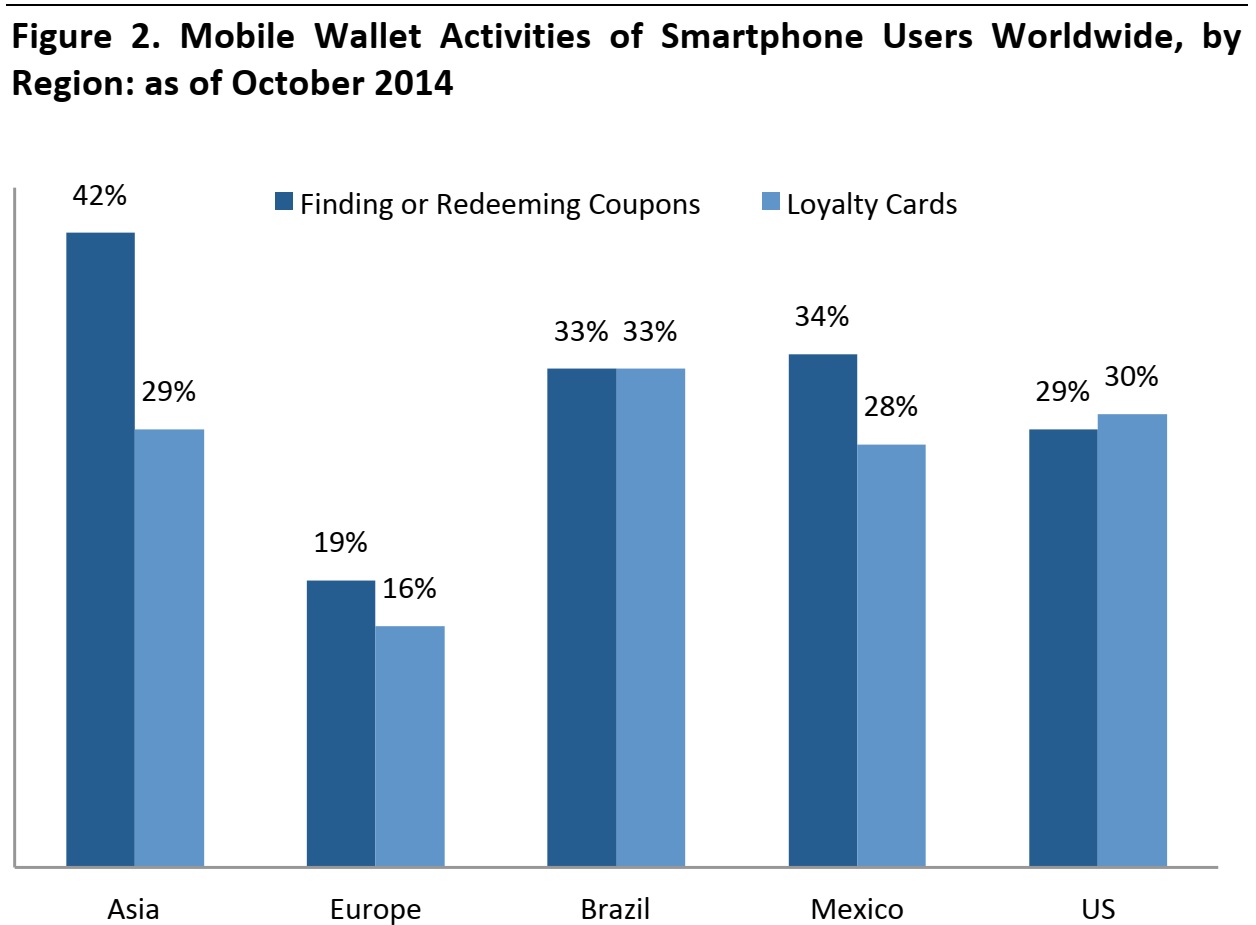

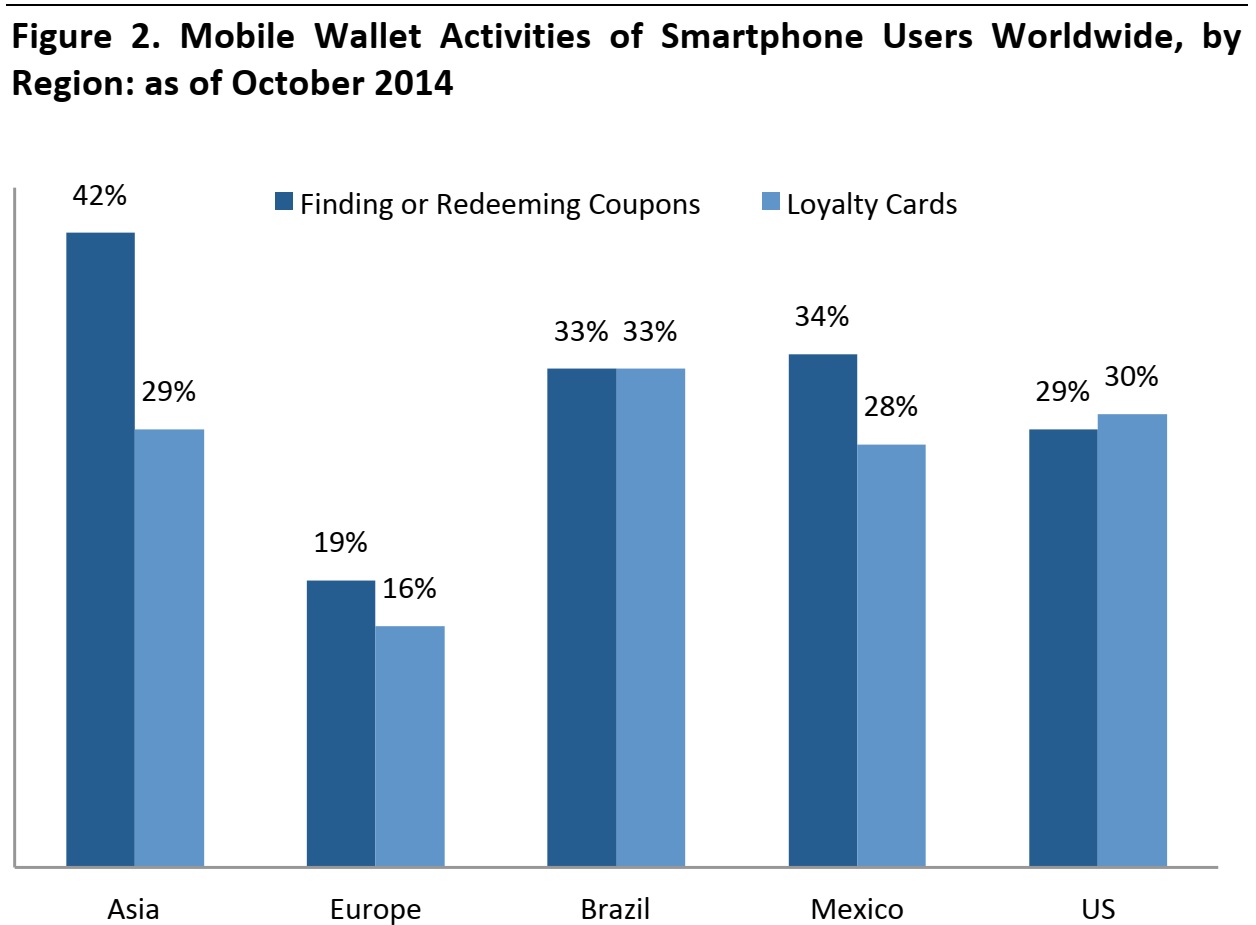

There can be little doubt that smartphone apps are set to become more prominent in loyalty programs, with many members likely to use their smartphones in place of plastic membership cards in the years ahead. Mobile apps allow retailers to engage and communicate with customers easily. Apps can be used to notify customers about their unclaimed loyalty points or to push personalized, geotargeted offers to customers based on their previous purchase history. In the US, Walmart has succeeded with its Savings Catcher app by combining price and loyalty factors without requiring customers to visit multiple stores in order to find the best deals. Walmart has also successfully tackled the issue of making it easy to claim points without hassle: customers simply scan their receipt, and if any product is being sold cheaper elsewhere, the system will automatically refund the difference on a gift card. Over 40% of smartphone users in Asia say they use their phones to find or redeem coupons more often than they use them to engage with loyalty programs. Mobile coupons are frequently offered by popular Asian mobile payment apps, such as Alipay Wallet and WeChat Wallet. In the US, smartphones are more often used for loyalty cards, such as with 7-Eleven’s 7Rewards, than for coupons. Europeans, on the other hand, show low levels of smartphone activity for both coupons and loyalty programs. However, as e-commerce and mobile payments continue to grow globally, retailers are likely to invest in app functions that could generate sales and loyalty.

Source: Statista

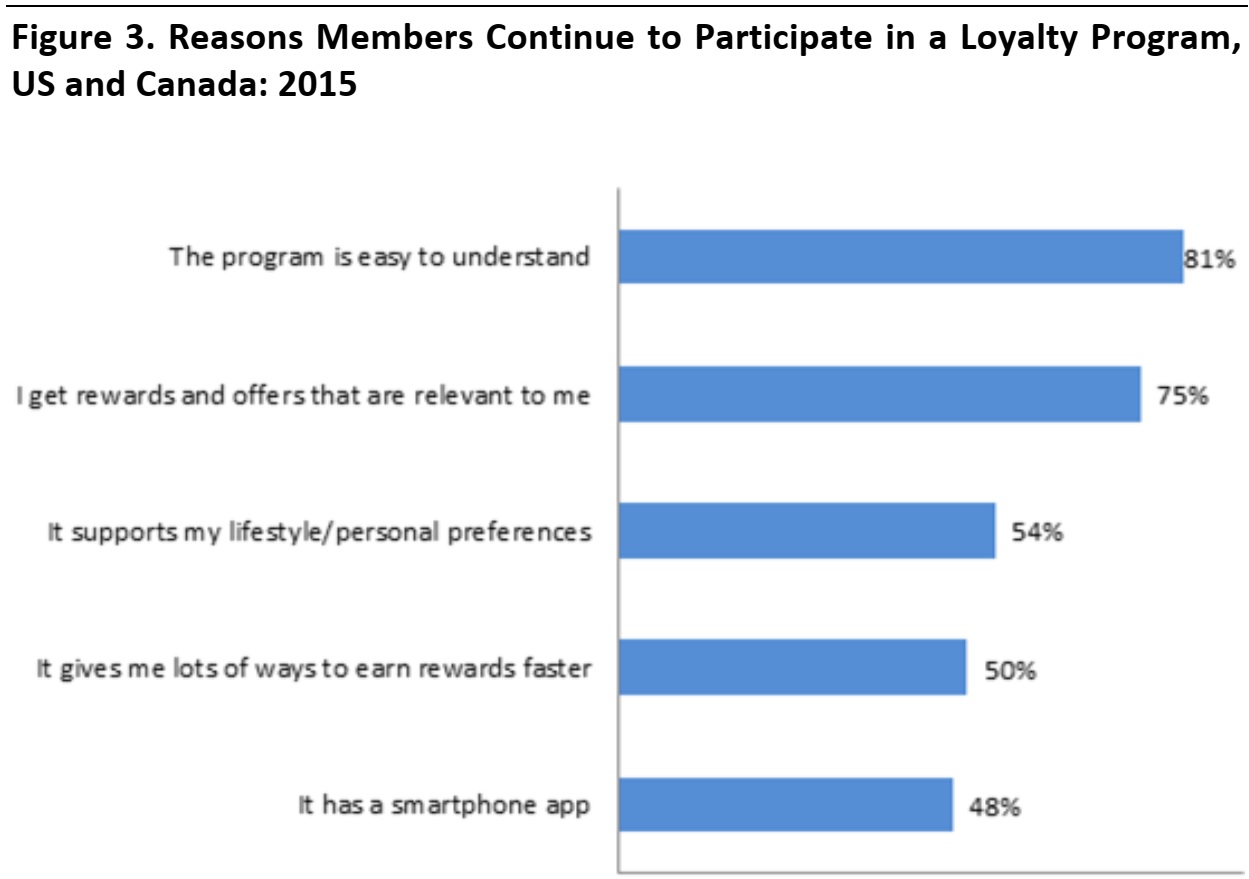

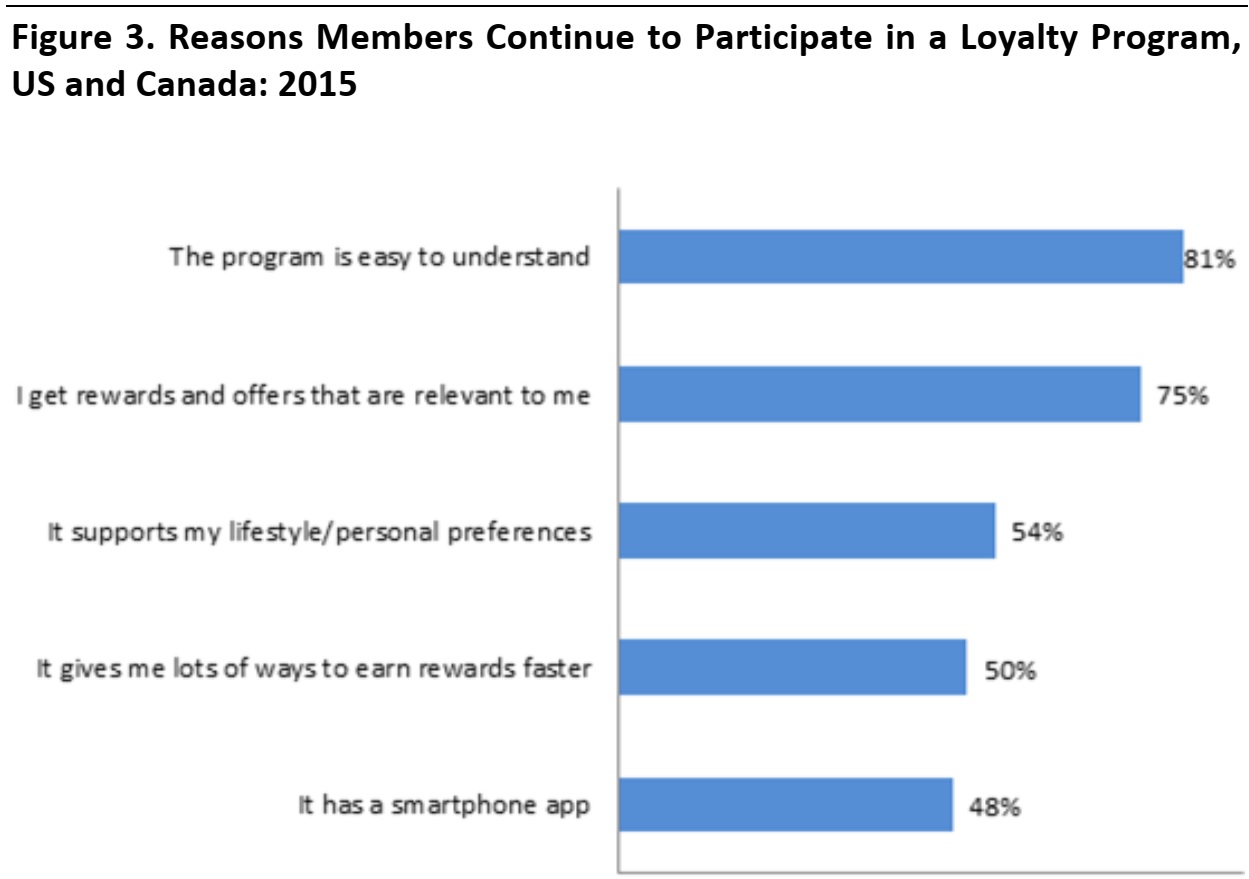

For nearly half of the loyalty program members in the US and Canada, the option to use a smartphone app is a determining factor for continued membership in a program, according to Colloquy. The smartphone option remains less important than more fundamental factors such as the program being easy to understand and providing relevant rewards—but it highlights the fact that a sizeable proportion of loyalty program members are driven by mobile.