albert Chan

On March 31, 2021, Deborah Weinswig, CEO and Founder of Coresight Research, presented the “China’s New Retail and E-Commerce” keynote session at the seventh edition of the Retail Leaders Circle (RLC) MENA Summit. She was joined by Zarina Kanji, Head of Business Development (Health, Wellness, and Food and Beverage Brands) at Alibaba Group UK & Nordics.

The topic of this year’s virtual RLC MENA summit, which took place from March 29 to 31, was “The Global Retail Reset: Disruption, Resilience and the Power of Collaboration.” More than 50 thought leaders from 30 countries presented on global retail issues during the event. Supported by the New York School of Management, RLC is an international platform for expert-led debates between CEOs, industry innovators and influencers, with the power to impact the future of the retail agenda.

In this report, we present key insights from Weinswig’s presentation, covering two key drivers of China’s e-commerce growth and two trends that brands and retailers can leverage for success in the country’s e-commerce space in the wake of the pandemic.

RLC 2021: China’s New Retail and E-Commerce—Key Insights

China’s Growing E-Commerce Market

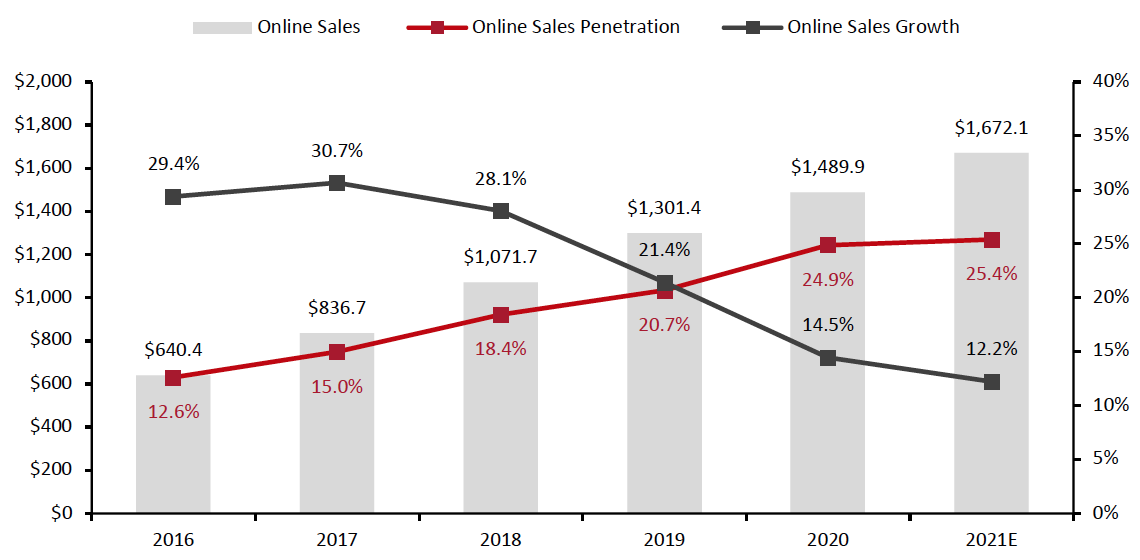

China’s online sales have grown consistently since 2016, reaching ¥9.8 trillion (around $1.5 trillion) amid the pandemic in 2020. With e-commerce disrupting traditional retail, the online penetration rate for e-commerce sales in China reached nearly one-quarter at 24.9% in 2020.

Although Coresight Research expects year-over-year online sales growth to continue to slow in 2021, we predict a continued increase in the online sales value, reaching ¥11.0 trillion (around $1.7 trillion). Notably, we expect the online penetration rate to surpass one-quarter in 2021, reflecting the continued shift of consumer spending to digital channels.

Figure 1. Online Retail Sales in China (USD Bil., Right Axis.) and YoY % Growth (Left Axis)

[caption id="attachment_125821" align="aligncenter" width="700"] Online sales include food service, automobiles and gasoline

Online sales include food service, automobiles and gasolineSource: China’s National Bureau of Statistics/Coresight Research[/caption]

Weinswig highlighted two key drivers of e-commerce growth in China, which we detail below.

Digital transformation

The Covid-19 pandemic has resulted in a consumer shift to e-commerce to avoid exposure to the virus in physical retail: In the first half of 2020, the number of online shoppers in China increased by 100 million compared to the year-ago period, according to the country’s Ministry of Commerce.

Existing investment in digital transformation accelerated to cater to this shift. Brands and retailers will look to capitalize on their newly acquired or enhanced digital infrastructure in the long term as they make efforts to keep consumers spending online by providing the best possible digital shopping experiences.

The development of new technologies in China will support brands and retailers in providing these optimum online shopping experiences. Weinswig noted that the country’s focus on developing 5G Internet capabilities as part of the government’s latest five-year plan is a significant advantage for the e-commerce market, translating to more potential customers browsing online, with faster websites and apps to serve them in record times.

New E-Commerce Regulation

Increased e-commerce market regulation is boosting consumer and retailer confidence in online sales channels. Weinswig explained that in March 2021, Chinese market regulators began formulating new responsibility requirements for e-commerce operators and drafting new regulations for the sector—as announced by state-owned news agency Xinhua.

As part of the stricter regulation on the country’s e-commerce market, Chinese authorities are targeting false online sales information, issuing some 23,100 rectification orders to online platforms and shutting down 6,665 non-compliant online stores from October to December 2020.

Two Key Trends in China’s E-Commerce Market

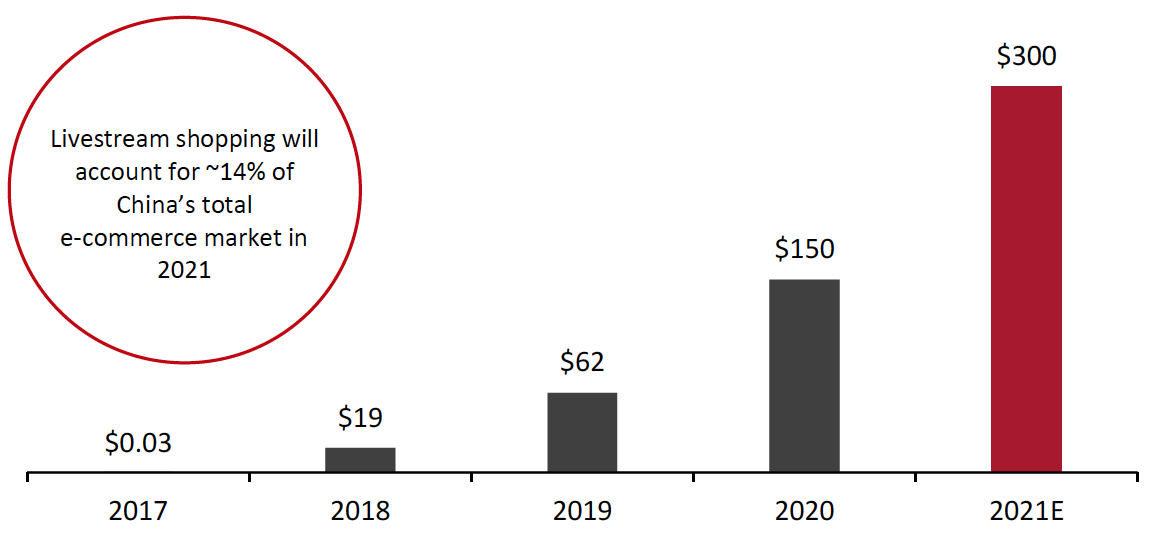

1. LivestreamingWeinswig emphasized that livestreaming will continue to witness significant growth in 2021 as an online sales channel. Coresight Research expects e-commerce sales via livestreaming to continue on a strong growth trajectory in 2021, doubling to $300 billion from an estimated $150 million in 2020. This will see livestream shopping account for around 14% of China’s total e-commerce market in 2021, up from 8% last year.

Figure 2. China’s Livestream Shopping Market (USD Bil.)

[caption id="attachment_125822" align="aligncenter" width="700"] Source: iMedia Research/Coresight Research[/caption]

Source: iMedia Research/Coresight Research[/caption]

Weinswig noted that as well as driving sales, livestreaming is a valuable marketing tool for brands and retailers, helping them to engage with consumers from afar and enabling businesses to become more agile and resilient amid the pandemic and beyond.

Kanji highlighted Chinese consumers’ increasing receptiveness to livestreaming. She gave the example of beauty brand Noral Mego, which saw a 900% year-over-year increase in viewers of its livestream sessions on Alibaba’s Tmall Global platform during the 2020 Singles’ Day shopping festival.

[caption id="attachment_125823" align="alignnone" width="550"] Deborah Weinswig, CEO and Founder of Coresight Research (left), and Zarina Kanji, Head of Business Development (Health, Wellness, and Food and Beverage Brands) at Alibaba Group UK & Nordics (right)

Deborah Weinswig, CEO and Founder of Coresight Research (left), and Zarina Kanji, Head of Business Development (Health, Wellness, and Food and Beverage Brands) at Alibaba Group UK & Nordics (right)Source: RLC[/caption] 2. Wellness

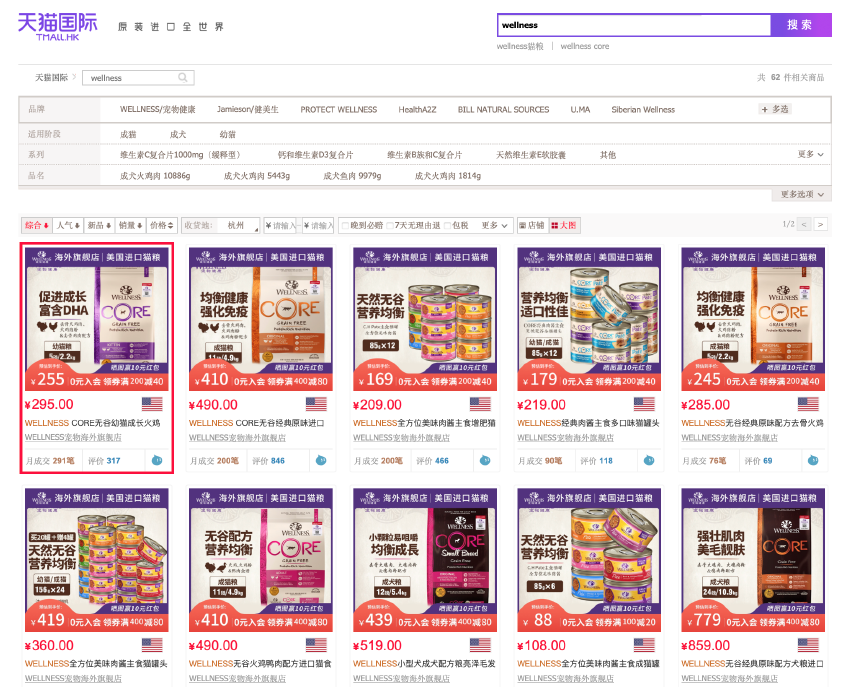

The Covid-19 pandemic has heightened consumer focus on health and wellness, with consumers paying more attention to the products and ingredients in the beauty, skincare and food products they buy. Kanji stated that around 70% of Chinese consumers that buy health and wellness products on Tmall are under the age of 40, making the younger demographic a key driver of increased wellness e-commerce spending.

Weinswig stated that wellness trends provide significant commercial potential for brands and retailers. In terms of demographics, she pointed to the strong purchasing power and disposable income of China’s growing middle class; there are more than 350 million middle-class consumers in the country, and this number is set to grow in 2021. These consumers are increasingly looking for high-quality products, with their category focus shifting to health and wellness as they look to boost their immune systems, reduce stress levels and improve overall wellbeing in the wake of the health crisis.

[caption id="attachment_125824" align="aligncenter" width="550"] Wellness-related products on Tmall Global

Wellness-related products on Tmall GlobalSource: Tmall[/caption]