DIpil Das

What’s the Story?

Innovators in the grocery space are developing products to help retailers cater to continually evolving consumer preferences and behaviors.

As part of our Retail Innovators series, we present five retail technology companies that are disrupting the US grocery market. We selected the companies as leaders in arming grocers with innovative tech for supply chain, online fulfillment, in-store shopping, inventory management and last-mile capabilities. We cover how each company has disrupted the market, as well as tailwinds and headwinds, and the impact of innovation on traditional market players.

Why It Matters

Pandemic-induced changes in the grocery retail space have brought the solutions offered by each company we present to the forefront of the market, and it is crucial that retail players keep up to date on opportunities to improve through innovation. We expect the companies covered in this report to become major disruptors in the grocery US market in the coming years.

Figure 1. Retail Innovators in the US Grocery Sector [caption id="attachment_135000" align="aligncenter" width="725"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Figure 2. Afresh Technologies: Overview [wpdatatable id=1378 table_view=regular]

Source: Company reports How Has Afresh Technologies Disrupted the Market? For grocery stores, fresh food presents a logistical challenge. The short shelf life and risk of spoiling is one of the main reasons that customers still prefer food shopping in physical stores over online. Unlike other software built for the static nature of center-store items, Afresh Technologies’ AI-based platform provides complete analysis of the dynamics of fresh foods—including seasonality, promotions and shelf life—to predict the right order amount to order for each product. The company claims that it has prevented 6.88 million pounds of food waste with its existing clients since it was founded in 2017. By the end of 2021, 10% of produce in the US will be ordered through Afresh’s system, according to the company. Tailwinds and Headwinds According to the Food and Agriculture Organization of the United Nations, roughly one-third of the food produced worldwide for human consumption every year (approximately 1.3 billion tons) gets lost or wasted. Out of fear of running out of inventory, retailers often over-order—resulting in excessive loss of profits and food waste. American grocery retailers typically see annual in-store losses of 43 billion pounds of food, according to the company. Retailers are recognizing this fact and are taking the help of innovators such as Afresh Technologies to combat the massive food waste problem and improve top and bottom line revenue. The company is likely to face headwinds from growing competition from startups offering similar solutions including Relex Solutions. Impact on Traditional Players According to Afresh Technologies, clients using Afresh have increased sales across entire produce departments by 3%, reduced food waste by 25% and reduced out of stocks by 80% on average. Afresh provides chainwide coverage of retailers including Fresh Thyme, Heinen’s and Winco and has rapidly expanded its customer base in 2021 with new pilots at regional and national chains including, Basha’s, Cub Foods and New Seasons. 2. Caper Caper offers AI-based automated checkout solutions for offline retail. The company’s flagship product is its smart cart, which uses deep learning and computer vision technology to identify customers’ items as they place them in the cart. This enables customers to self-checkout without the need to join lines for cashiers. The company also launched an autonomous point-of-sale countertop named Caper Counter in October 2020 that uses AI to offer a seamless self-checkout experience. Caper has raised $13 million to date. The company’s latest funding was raised from a Series A round in September 2019. In October 2021, online grocery delivery platform Instacart acquired Caper with the aim of helping retailers to integrate their in-store and online shopping experiences for customers.

Figure 3. Caper: Overview [wpdatatable id=1379 table_view=regular]

Source: Company website How Has Caper Disrupted the Market? Caper provides an autonomous shopping experience without requiring a significant store overhaul. The company’s smart shopping carts feature barcode scanners, cameras, scales and point-of-sale card readers that enable shoppers to bypass cashier lines. Moreover, Caper’s smart carts can direct consumers to items located around the store for easier product navigation, as well as alert shoppers to new products and promotions through the interactive screens as they approach the relevant parts of the physical store. According to Caper, its smart cart technology has helped grocers the grocers it works with to increase the average basket size by 18%. The Caper Counter is primarily designed for small-format retailers. It uses computer vision technology to visually identify items placed on the countertop and automatically adds the items to the total amount. Shoppers can tap their chip cards directly on the device or use a payment app to complete their transactions quickly. [caption id="attachment_135003" align="aligncenter" width="725"] Caper Counter

Caper Counter

Source: Caper [/caption] Tailwinds and Headwinds Automated checkouts are poised to make a big impact on the way people shop in physical stores, helping to eliminate waiting in line, reduce touch points and speed up the overall shopping process. Though these benefits have driven the technology’s development from the start, the safety concerns posed by the pandemic expedited demand for autonomous checkout solutions. Smart carts enable retailers to avoid having to retrofit their stores with cameras and sensors, as is required for other cashierless checkout solutions, such as those offered by Grabango and Zippin. This process is time intensive and costly. However, a retailer adopting smart carts only needs to deploy the new carts at its stores in order to implement the automated technology. Smart carts can also potentially reduce the number of checkout stations required in a store, creating more retail selling space. Cost remains a top headwind for adopting and scaling smart cart technology. A typical smart cart can cost upward of $5,000 and requires higher maintenance and upkeep compared to simple shopping carts. Smart cart makers must ensure that the screens, cameras and other systems on their carts will stand the test of time, and that replacing any components would not be prohibitively expensive. Impact on Traditional Players Caper’s smart cart simplifies the in-store shopping and checkout experience and can be integrated easily into existing retail operations and scaled quickly. In January 2021, Kroger introduced a line of “KroGo” shopping carts, developed by Caper, at one of its stores in Cincinnati—indicating that mainstream retailers are keen to adopt this technology. 3. Radius Networks Radius Networks offers an AI-powered proximity platform that helps retailers and other businesses to conduct location-based transactions. Its technology uses mobile wireless signals, such as Wifi, Bluetooth and GPS, to detect when shoppers are nearby so that their collection orders can be prepared ready for their arrival. The technology can also be used to identify when visitors are near important locations to provide retailers with a better understanding of customer shopping patterns and behaviors. Radius networks has raised $25.5 million to date. Its latest funding was raised in October 2019 from a Series A round.

Figure 4. Radius Networks: Overview [wpdatatable id=1380 table_view=regular]

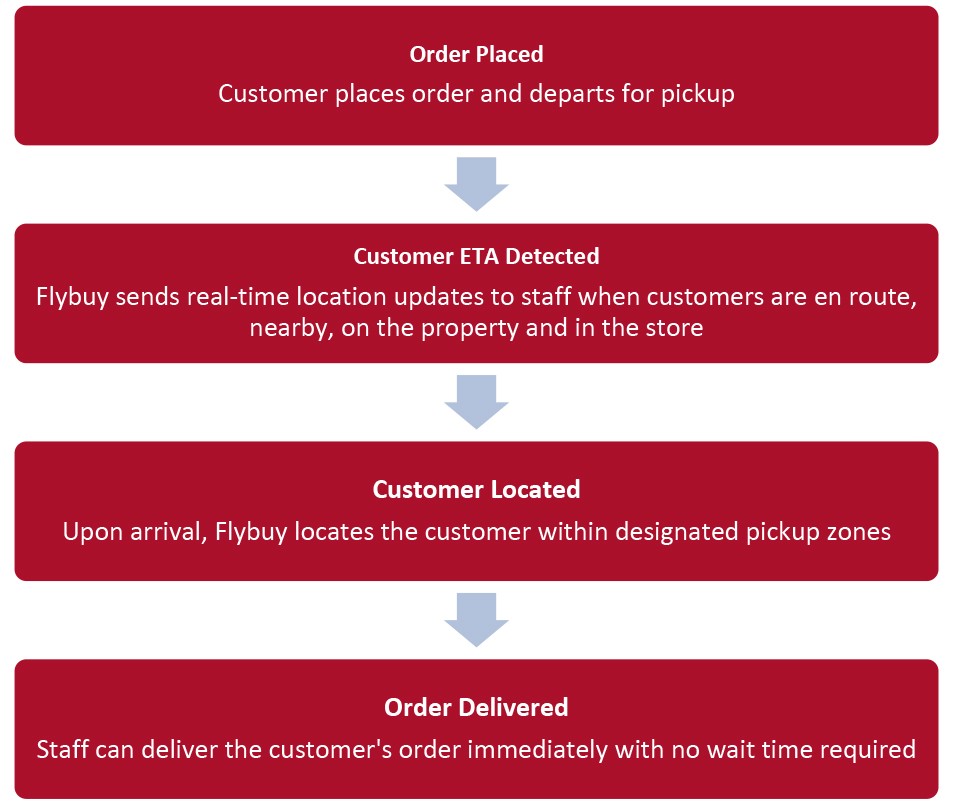

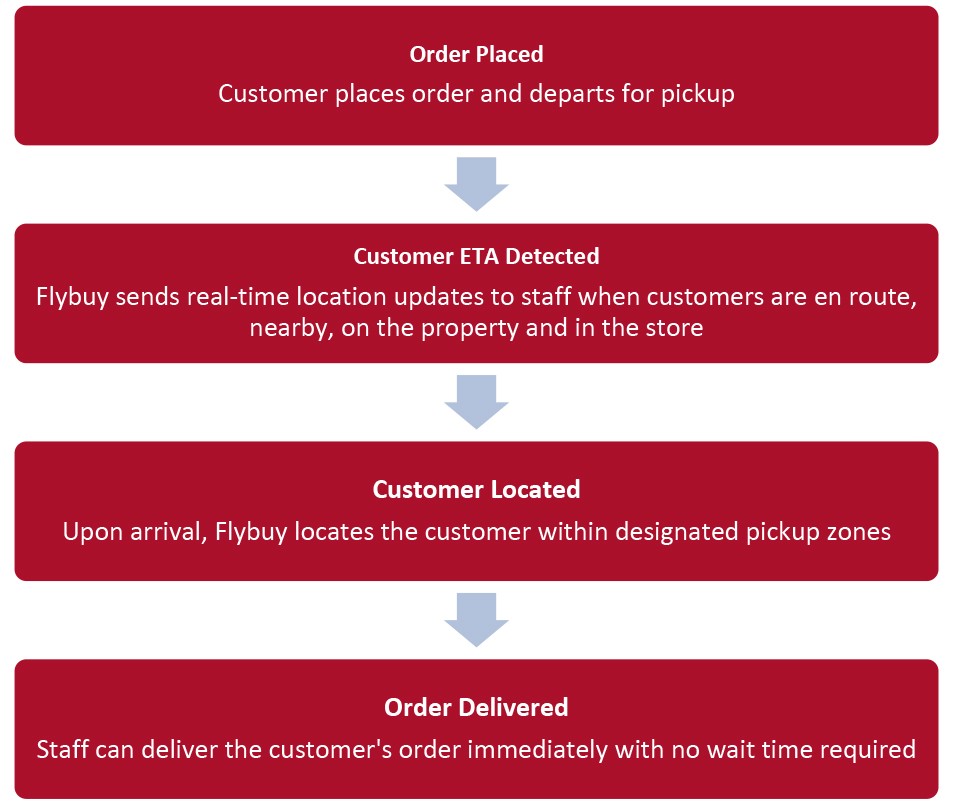

Source: Company website How Has Radius Networks Disrupted the Market? Radius Networks’ Flybuy platform uses proprietary location technology that sends timely customer arrival notifications to store staff so orders can be ready promptly for customers to collect. Flybuy provides a turnkey, end-to-end solution that eliminates customer wait time, optimizes staff efficiency and improves profitably in order for retailers to scale BOPIS and curbside pickup operations.

Figure 5. Radius Network’s Flybuy Solution [caption id="attachment_135002" align="aligncenter" width="725"] Source: Radius Networks[/caption]

Tailwinds and Headwinds

BOPIS and curbside pickup service models have gained immense popularity amid the Covid-19 pandemic. They are less margin erosive for retailers than delivery, and many price-conscious consumers prefer the lower services fees for in-store pickup and curbside services. According to Coresight Research data from September 2021, some 26% of respondents who expect to shop online this holiday season plan to use BOPIS to receive their purchases, while 20% expect to use curbside pickup.

Retailers are now turning to technology providers such as Radius Networks to readjust and refine their BOPIS and curbside services to increase operational efficiency, decrease wait times and further enhance the customer experience.

However, proximity technologies raise concerns about customer privacy and data security. Technology providers must implement strong privacy frameworks and follow best practices in order for retailers and consumers alike to see the benefit of this technology.

Impact on Traditional Players

Radius Networks has partnered with several major grocery retailers to help them streamline their BOPIS and curbside pickup functionality. In September 2020, Radius Network implemented its Flybuy pickup location technology to optimize curbside and in-store pickup at Giant Eagle stores. Similarly, Lowe’s Foods, SpartanNash and Albertsons-owned United Supermarkets launched Radius Network’s Flybuy system in 2020 to make curbside pickup faster and more effective.

4. Takeoff Technologies

Takeoff Technologies provides automated, hyperlocal micro-fulfillment solutions for grocery retailers. The company offers end-to-end solutions for retailers including customer user interface, assortment optimization, fulfillment, spoke routing, and pickup and delivery.

Takeoff Technologies has raised around $86 million in funding at present, with its latest reported funding round taking place in September 2019.

Source: Radius Networks[/caption]

Tailwinds and Headwinds

BOPIS and curbside pickup service models have gained immense popularity amid the Covid-19 pandemic. They are less margin erosive for retailers than delivery, and many price-conscious consumers prefer the lower services fees for in-store pickup and curbside services. According to Coresight Research data from September 2021, some 26% of respondents who expect to shop online this holiday season plan to use BOPIS to receive their purchases, while 20% expect to use curbside pickup.

Retailers are now turning to technology providers such as Radius Networks to readjust and refine their BOPIS and curbside services to increase operational efficiency, decrease wait times and further enhance the customer experience.

However, proximity technologies raise concerns about customer privacy and data security. Technology providers must implement strong privacy frameworks and follow best practices in order for retailers and consumers alike to see the benefit of this technology.

Impact on Traditional Players

Radius Networks has partnered with several major grocery retailers to help them streamline their BOPIS and curbside pickup functionality. In September 2020, Radius Network implemented its Flybuy pickup location technology to optimize curbside and in-store pickup at Giant Eagle stores. Similarly, Lowe’s Foods, SpartanNash and Albertsons-owned United Supermarkets launched Radius Network’s Flybuy system in 2020 to make curbside pickup faster and more effective.

4. Takeoff Technologies

Takeoff Technologies provides automated, hyperlocal micro-fulfillment solutions for grocery retailers. The company offers end-to-end solutions for retailers including customer user interface, assortment optimization, fulfillment, spoke routing, and pickup and delivery.

Takeoff Technologies has raised around $86 million in funding at present, with its latest reported funding round taking place in September 2019.

Figure 6. Takeoff Technologies: Overview [wpdatatable id=1381 table_view=regular]

Source: Company reports How Has Takeoff Technologies Disrupted the Market? Takeoff Technologies’ MFCs operate in small spaces, making them an ideal solution for dense metros and suburban metros where e-commerce demand volume is high. These micro sites can also be built quickly and at a fraction of the cost of larger warehouse solutions like those built by Kroger in partnership with Ocado. According to the company, its automated centers only take up one-eighth of the space of a traditional store space and can be assembled in a few months. Its MFC can assemble an average order in fewer that 15 minutes, which is 10 times faster than manual picking in store. Tailwinds and Headwinds The long-forecasted online grocery boom happened materialized in 2020. Total US food and beverage e-commerce sales grew to $55.3 billion in 2020, Coresight Research estimates, up 81.5% year over year—a vastly greater increase than any recent previous year. We expect the online channel to maintain some permanent gains as consumer preferences for shopping online amid the pandemic become long-term habits, which will support solid online growth in the coming years. To keep pace with growing e-commerce and omnichannel demand, grocery retailers must not only accelerate order fulfillment and delivery, but also support buy online and pick up in store (BOPIS) and curbside pickup in grocery retail environments. Grocery retailers must seek to make these fulfillment developments whilst retaining profitability, which can be optimized through automation. The main cost driver in the grocery is human labor, the fulfillment process does not benefit from economies of scale. Although MFCs streamline the picking and packing process, they still require some level of human interactions, such as picking for bulk items or frozen/refrigerated items. This is a significant contrast to competing automated fulfillment solutions such as Ocado sheds, which are fully automated. A further potential challenge is that MFCs still depend on stores for order fulfillment, a process that is prone to out-of-stock scenarios and product substitutions. Impact on Traditional Players Against the backdrop of upward e-commerce trends, many retailers are stepping up investment in warehouse automation infrastructure to streamline their order fulfillment processes and achieve profitability in online operations. Takeoff Technologies has been at the forefront of this transformation, partnering with major US grocery retailers to deliver hyperlocal picking solutions. Takeoff Technologies’ key US partnerships include Albertsons, Big Y, Sedano, Shoprite (Wakefern) and Stop & Shop (Ahold Delhaize). 5. Trax Trax offers a computer vision and analytics platform that helps retailers to track stock on shelves and optimize their in-store execution strategy and product availability levels. The company’s platform employs proprietary images, machine learning and Internet of Things technology to turn everyday shelf images into real-time, actionable insights that drive positive shopper experiences and unlock revenue opportunities at all points of sale. Trax has raised $1.02 billion in funding to date. The company’s latest funding was raised in April 2021 from a Series E round.

Figure 7. Trax: Overview [wpdatatable id=1382 table_view=regular]

Source: Company website How Has Trax Disrupted the Market? While poorly managed shelves result in missed sales and negatively impact customer experience, retailers often do not have the manpower to spot every error as it happens. Trax’s solutions help to resolve this issue by automatically scanning shelves, analyzing conditions and identifying fixes to unlock each aisle’s full potential. Trax uses deep learning algorithms to help consumer goods companies and retailers get actionable insights on inventory. The system works for images taken via smartphone or auto-captured by fixed cameras or robots. Trax uses complex image processing algorithms to return detailed product and category information including out-of-shelf, share of shelf, planograms and pricing insights within minutes. It also immediately alerts the company if products are out of place or missing from the shelves. As such, this solution ensures that out-of-stock items are replenished efficiently, while expired items are pulled off from the shelves, thereby eliminating operational inefficiencies and providing customers with smooth in-store experiences. Tailwinds and Headwinds Poor in-store execution can lead to issues such as infrequent stock replenishment, misplaced SKUs, and, non-compliance with planograms, prices and promotions—all of which cost sales. Coresight Research surveyed 200 global grocery retailers in October 2019, revealing that over 51% of grocery retailers lose 5%–10% of sales to store operational issues, while more than one-quarter (26%) said this amounts to 10%–15% of sales. Retailers are, therefore, seeking to optimize store operations by incorporating the right store tracking technology to prevent stockouts, ensure high on-shelf availability and improve margins in retail stores. However, installing the dome and shelf-edge cameras required and deploying shelf-scanning robots can be an expensive proposition. Additionally, autonomous bots can clog up store aisles and may startle shoppers. In fact, Walmart ended its contract with shelf-scanning robot provider Bossa Nova in November 2020, citing that it had found simpler solutions to tracking shelf inventory. Impact on Traditional Players For retailers that operate at scale, small improvements to increase efficiency can have a big impact on the bottom line. One of the ways to boost profits, according to Trax, is better shelf inventory management. Out-of-stock scenarios caused by surge buying amid the pandemic in 2020 cost grocery retailers an estimated $76 billion in lost revenues according to Trax. Many retailers are therefore trialing computer vision and analytics to strengthen store management. According to Trax, it helped one of its partner supermarket operators to improve shelf availability by 3% and decrease price volatility by up to 75% within just a few months of deployment. On average, Trax states that its solutions reduce out-of-stocks by 30%, improve price accuracy by 80% and win back 250 labor hours per associate.

Figure 1. Retail Innovators in the US Grocery Sector [caption id="attachment_135000" align="aligncenter" width="725"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Grocery Retail Innovators: Coresight Research Analysis

1. Afresh Technologies Afresh Technologies helps grocery retailers to manage their supply chain to increase profitability and avoid fresh-food waste. The company uses AI to forecast demand, calculate inventory and generate item-level recommendations to enable grocers to optimize the quantity of perishable goods carried in specific stores at a given time and streamline store operations. Retailers can use the solutions to optimize store-level ordering and merchandising, manage inventory and gain chainwide, item-level visibility. Afresh Technologies has raised $32.8 million to date. Its latest funding was raised in November 2020 as part of a Series A round.Figure 2. Afresh Technologies: Overview [wpdatatable id=1378 table_view=regular]

Source: Company reports How Has Afresh Technologies Disrupted the Market? For grocery stores, fresh food presents a logistical challenge. The short shelf life and risk of spoiling is one of the main reasons that customers still prefer food shopping in physical stores over online. Unlike other software built for the static nature of center-store items, Afresh Technologies’ AI-based platform provides complete analysis of the dynamics of fresh foods—including seasonality, promotions and shelf life—to predict the right order amount to order for each product. The company claims that it has prevented 6.88 million pounds of food waste with its existing clients since it was founded in 2017. By the end of 2021, 10% of produce in the US will be ordered through Afresh’s system, according to the company. Tailwinds and Headwinds According to the Food and Agriculture Organization of the United Nations, roughly one-third of the food produced worldwide for human consumption every year (approximately 1.3 billion tons) gets lost or wasted. Out of fear of running out of inventory, retailers often over-order—resulting in excessive loss of profits and food waste. American grocery retailers typically see annual in-store losses of 43 billion pounds of food, according to the company. Retailers are recognizing this fact and are taking the help of innovators such as Afresh Technologies to combat the massive food waste problem and improve top and bottom line revenue. The company is likely to face headwinds from growing competition from startups offering similar solutions including Relex Solutions. Impact on Traditional Players According to Afresh Technologies, clients using Afresh have increased sales across entire produce departments by 3%, reduced food waste by 25% and reduced out of stocks by 80% on average. Afresh provides chainwide coverage of retailers including Fresh Thyme, Heinen’s and Winco and has rapidly expanded its customer base in 2021 with new pilots at regional and national chains including, Basha’s, Cub Foods and New Seasons. 2. Caper Caper offers AI-based automated checkout solutions for offline retail. The company’s flagship product is its smart cart, which uses deep learning and computer vision technology to identify customers’ items as they place them in the cart. This enables customers to self-checkout without the need to join lines for cashiers. The company also launched an autonomous point-of-sale countertop named Caper Counter in October 2020 that uses AI to offer a seamless self-checkout experience. Caper has raised $13 million to date. The company’s latest funding was raised from a Series A round in September 2019. In October 2021, online grocery delivery platform Instacart acquired Caper with the aim of helping retailers to integrate their in-store and online shopping experiences for customers.

Figure 3. Caper: Overview [wpdatatable id=1379 table_view=regular]

Source: Company website How Has Caper Disrupted the Market? Caper provides an autonomous shopping experience without requiring a significant store overhaul. The company’s smart shopping carts feature barcode scanners, cameras, scales and point-of-sale card readers that enable shoppers to bypass cashier lines. Moreover, Caper’s smart carts can direct consumers to items located around the store for easier product navigation, as well as alert shoppers to new products and promotions through the interactive screens as they approach the relevant parts of the physical store. According to Caper, its smart cart technology has helped grocers the grocers it works with to increase the average basket size by 18%. The Caper Counter is primarily designed for small-format retailers. It uses computer vision technology to visually identify items placed on the countertop and automatically adds the items to the total amount. Shoppers can tap their chip cards directly on the device or use a payment app to complete their transactions quickly. [caption id="attachment_135003" align="aligncenter" width="725"]

Caper Counter

Caper Counter Source: Caper [/caption] Tailwinds and Headwinds Automated checkouts are poised to make a big impact on the way people shop in physical stores, helping to eliminate waiting in line, reduce touch points and speed up the overall shopping process. Though these benefits have driven the technology’s development from the start, the safety concerns posed by the pandemic expedited demand for autonomous checkout solutions. Smart carts enable retailers to avoid having to retrofit their stores with cameras and sensors, as is required for other cashierless checkout solutions, such as those offered by Grabango and Zippin. This process is time intensive and costly. However, a retailer adopting smart carts only needs to deploy the new carts at its stores in order to implement the automated technology. Smart carts can also potentially reduce the number of checkout stations required in a store, creating more retail selling space. Cost remains a top headwind for adopting and scaling smart cart technology. A typical smart cart can cost upward of $5,000 and requires higher maintenance and upkeep compared to simple shopping carts. Smart cart makers must ensure that the screens, cameras and other systems on their carts will stand the test of time, and that replacing any components would not be prohibitively expensive. Impact on Traditional Players Caper’s smart cart simplifies the in-store shopping and checkout experience and can be integrated easily into existing retail operations and scaled quickly. In January 2021, Kroger introduced a line of “KroGo” shopping carts, developed by Caper, at one of its stores in Cincinnati—indicating that mainstream retailers are keen to adopt this technology. 3. Radius Networks Radius Networks offers an AI-powered proximity platform that helps retailers and other businesses to conduct location-based transactions. Its technology uses mobile wireless signals, such as Wifi, Bluetooth and GPS, to detect when shoppers are nearby so that their collection orders can be prepared ready for their arrival. The technology can also be used to identify when visitors are near important locations to provide retailers with a better understanding of customer shopping patterns and behaviors. Radius networks has raised $25.5 million to date. Its latest funding was raised in October 2019 from a Series A round.

Figure 4. Radius Networks: Overview [wpdatatable id=1380 table_view=regular]

Source: Company website How Has Radius Networks Disrupted the Market? Radius Networks’ Flybuy platform uses proprietary location technology that sends timely customer arrival notifications to store staff so orders can be ready promptly for customers to collect. Flybuy provides a turnkey, end-to-end solution that eliminates customer wait time, optimizes staff efficiency and improves profitably in order for retailers to scale BOPIS and curbside pickup operations.

Figure 5. Radius Network’s Flybuy Solution [caption id="attachment_135002" align="aligncenter" width="725"]

Source: Radius Networks[/caption]

Tailwinds and Headwinds

BOPIS and curbside pickup service models have gained immense popularity amid the Covid-19 pandemic. They are less margin erosive for retailers than delivery, and many price-conscious consumers prefer the lower services fees for in-store pickup and curbside services. According to Coresight Research data from September 2021, some 26% of respondents who expect to shop online this holiday season plan to use BOPIS to receive their purchases, while 20% expect to use curbside pickup.

Retailers are now turning to technology providers such as Radius Networks to readjust and refine their BOPIS and curbside services to increase operational efficiency, decrease wait times and further enhance the customer experience.

However, proximity technologies raise concerns about customer privacy and data security. Technology providers must implement strong privacy frameworks and follow best practices in order for retailers and consumers alike to see the benefit of this technology.

Impact on Traditional Players

Radius Networks has partnered with several major grocery retailers to help them streamline their BOPIS and curbside pickup functionality. In September 2020, Radius Network implemented its Flybuy pickup location technology to optimize curbside and in-store pickup at Giant Eagle stores. Similarly, Lowe’s Foods, SpartanNash and Albertsons-owned United Supermarkets launched Radius Network’s Flybuy system in 2020 to make curbside pickup faster and more effective.

4. Takeoff Technologies

Takeoff Technologies provides automated, hyperlocal micro-fulfillment solutions for grocery retailers. The company offers end-to-end solutions for retailers including customer user interface, assortment optimization, fulfillment, spoke routing, and pickup and delivery.

Takeoff Technologies has raised around $86 million in funding at present, with its latest reported funding round taking place in September 2019.

Source: Radius Networks[/caption]

Tailwinds and Headwinds

BOPIS and curbside pickup service models have gained immense popularity amid the Covid-19 pandemic. They are less margin erosive for retailers than delivery, and many price-conscious consumers prefer the lower services fees for in-store pickup and curbside services. According to Coresight Research data from September 2021, some 26% of respondents who expect to shop online this holiday season plan to use BOPIS to receive their purchases, while 20% expect to use curbside pickup.

Retailers are now turning to technology providers such as Radius Networks to readjust and refine their BOPIS and curbside services to increase operational efficiency, decrease wait times and further enhance the customer experience.

However, proximity technologies raise concerns about customer privacy and data security. Technology providers must implement strong privacy frameworks and follow best practices in order for retailers and consumers alike to see the benefit of this technology.

Impact on Traditional Players

Radius Networks has partnered with several major grocery retailers to help them streamline their BOPIS and curbside pickup functionality. In September 2020, Radius Network implemented its Flybuy pickup location technology to optimize curbside and in-store pickup at Giant Eagle stores. Similarly, Lowe’s Foods, SpartanNash and Albertsons-owned United Supermarkets launched Radius Network’s Flybuy system in 2020 to make curbside pickup faster and more effective.

4. Takeoff Technologies

Takeoff Technologies provides automated, hyperlocal micro-fulfillment solutions for grocery retailers. The company offers end-to-end solutions for retailers including customer user interface, assortment optimization, fulfillment, spoke routing, and pickup and delivery.

Takeoff Technologies has raised around $86 million in funding at present, with its latest reported funding round taking place in September 2019.

Figure 6. Takeoff Technologies: Overview [wpdatatable id=1381 table_view=regular]

Source: Company reports How Has Takeoff Technologies Disrupted the Market? Takeoff Technologies’ MFCs operate in small spaces, making them an ideal solution for dense metros and suburban metros where e-commerce demand volume is high. These micro sites can also be built quickly and at a fraction of the cost of larger warehouse solutions like those built by Kroger in partnership with Ocado. According to the company, its automated centers only take up one-eighth of the space of a traditional store space and can be assembled in a few months. Its MFC can assemble an average order in fewer that 15 minutes, which is 10 times faster than manual picking in store. Tailwinds and Headwinds The long-forecasted online grocery boom happened materialized in 2020. Total US food and beverage e-commerce sales grew to $55.3 billion in 2020, Coresight Research estimates, up 81.5% year over year—a vastly greater increase than any recent previous year. We expect the online channel to maintain some permanent gains as consumer preferences for shopping online amid the pandemic become long-term habits, which will support solid online growth in the coming years. To keep pace with growing e-commerce and omnichannel demand, grocery retailers must not only accelerate order fulfillment and delivery, but also support buy online and pick up in store (BOPIS) and curbside pickup in grocery retail environments. Grocery retailers must seek to make these fulfillment developments whilst retaining profitability, which can be optimized through automation. The main cost driver in the grocery is human labor, the fulfillment process does not benefit from economies of scale. Although MFCs streamline the picking and packing process, they still require some level of human interactions, such as picking for bulk items or frozen/refrigerated items. This is a significant contrast to competing automated fulfillment solutions such as Ocado sheds, which are fully automated. A further potential challenge is that MFCs still depend on stores for order fulfillment, a process that is prone to out-of-stock scenarios and product substitutions. Impact on Traditional Players Against the backdrop of upward e-commerce trends, many retailers are stepping up investment in warehouse automation infrastructure to streamline their order fulfillment processes and achieve profitability in online operations. Takeoff Technologies has been at the forefront of this transformation, partnering with major US grocery retailers to deliver hyperlocal picking solutions. Takeoff Technologies’ key US partnerships include Albertsons, Big Y, Sedano, Shoprite (Wakefern) and Stop & Shop (Ahold Delhaize). 5. Trax Trax offers a computer vision and analytics platform that helps retailers to track stock on shelves and optimize their in-store execution strategy and product availability levels. The company’s platform employs proprietary images, machine learning and Internet of Things technology to turn everyday shelf images into real-time, actionable insights that drive positive shopper experiences and unlock revenue opportunities at all points of sale. Trax has raised $1.02 billion in funding to date. The company’s latest funding was raised in April 2021 from a Series E round.

Figure 7. Trax: Overview [wpdatatable id=1382 table_view=regular]

Source: Company website How Has Trax Disrupted the Market? While poorly managed shelves result in missed sales and negatively impact customer experience, retailers often do not have the manpower to spot every error as it happens. Trax’s solutions help to resolve this issue by automatically scanning shelves, analyzing conditions and identifying fixes to unlock each aisle’s full potential. Trax uses deep learning algorithms to help consumer goods companies and retailers get actionable insights on inventory. The system works for images taken via smartphone or auto-captured by fixed cameras or robots. Trax uses complex image processing algorithms to return detailed product and category information including out-of-shelf, share of shelf, planograms and pricing insights within minutes. It also immediately alerts the company if products are out of place or missing from the shelves. As such, this solution ensures that out-of-stock items are replenished efficiently, while expired items are pulled off from the shelves, thereby eliminating operational inefficiencies and providing customers with smooth in-store experiences. Tailwinds and Headwinds Poor in-store execution can lead to issues such as infrequent stock replenishment, misplaced SKUs, and, non-compliance with planograms, prices and promotions—all of which cost sales. Coresight Research surveyed 200 global grocery retailers in October 2019, revealing that over 51% of grocery retailers lose 5%–10% of sales to store operational issues, while more than one-quarter (26%) said this amounts to 10%–15% of sales. Retailers are, therefore, seeking to optimize store operations by incorporating the right store tracking technology to prevent stockouts, ensure high on-shelf availability and improve margins in retail stores. However, installing the dome and shelf-edge cameras required and deploying shelf-scanning robots can be an expensive proposition. Additionally, autonomous bots can clog up store aisles and may startle shoppers. In fact, Walmart ended its contract with shelf-scanning robot provider Bossa Nova in November 2020, citing that it had found simpler solutions to tracking shelf inventory. Impact on Traditional Players For retailers that operate at scale, small improvements to increase efficiency can have a big impact on the bottom line. One of the ways to boost profits, according to Trax, is better shelf inventory management. Out-of-stock scenarios caused by surge buying amid the pandemic in 2020 cost grocery retailers an estimated $76 billion in lost revenues according to Trax. Many retailers are therefore trialing computer vision and analytics to strengthen store management. According to Trax, it helped one of its partner supermarket operators to improve shelf availability by 3% and decrease price volatility by up to 75% within just a few months of deployment. On average, Trax states that its solutions reduce out-of-stocks by 30%, improve price accuracy by 80% and win back 250 labor hours per associate.

What We Think

The pandemic has highlighted the importance of technology in enabling grocery retailers to manage their long-term growth and improve shopping experiences amid everchanging retail environments. Implications for Retailers- Grocers have a window to equip themselves for the strategic challenges ahead before life returns to normalcy and off-premise consumption regains its full strength. They must use this time gap to enhance consumer experiences through technology that could sustain the market’s momentum in the coming months.

- Improving online shopping experiences should be a priority for grocery retailers. This includes making apps and websites easier to use, increasing e-commerce supply chain efficiency, and providing friction-free last-mile services.

- Retailers have ramped up their BOPIS and curbside services. However, those that have differentiated themselves with digitally enhanced offerings to reduce friction stand to gain the most through increased customer satisfaction, spending and loyalty.