Nitheesh NH

Introduction: Innovative Startups and REITs

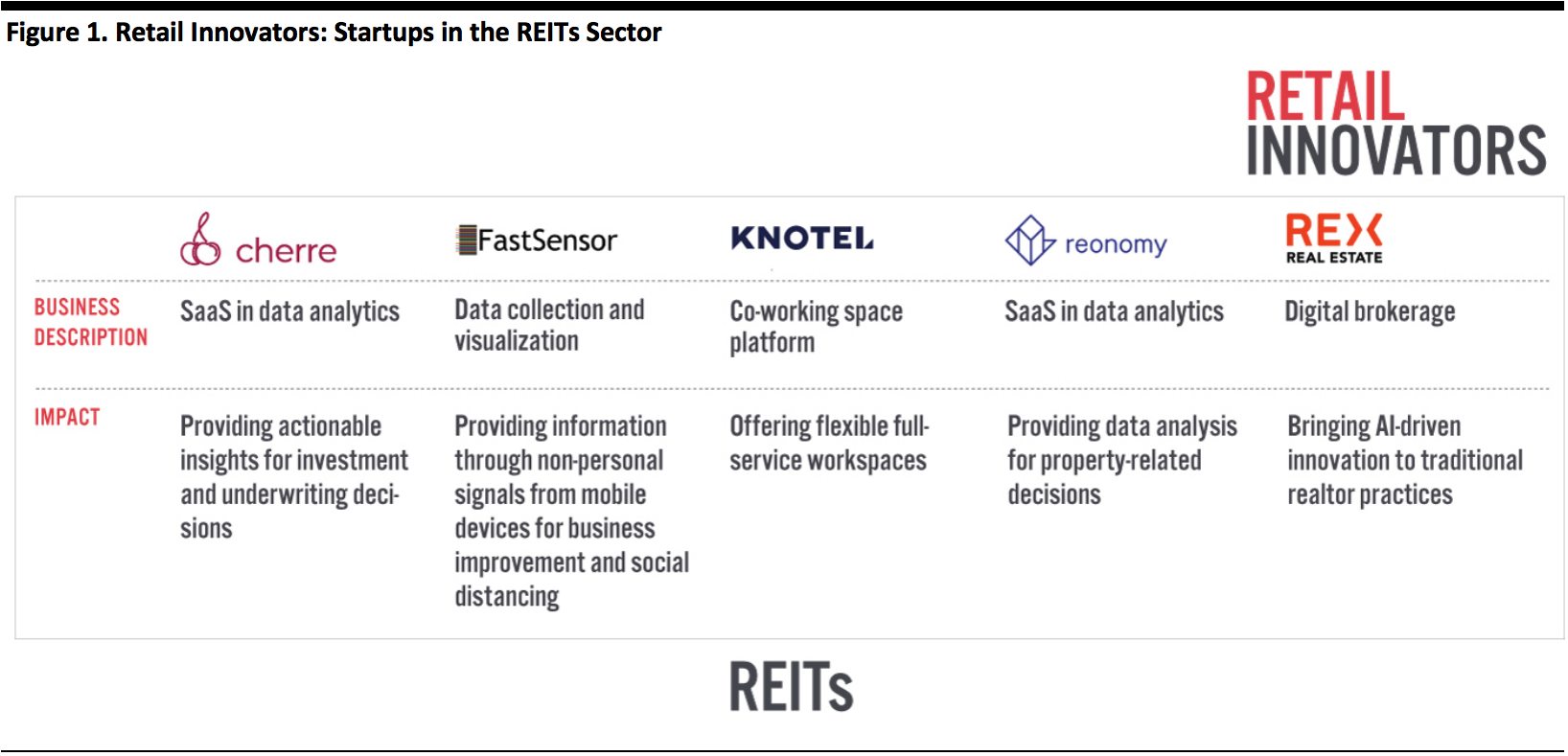

As the retail industry continues to evolve, landlords have been forced to keep pace with change in order to remain competitive. In this report—which is part of the Coresight Research Retail Innovators series—we will look at five startups that have been disrupting the REITs sector by offering data and technology to help real-estate owners digitalize their processes and make better-informed decisions (see Figure 1). [caption id="attachment_111959" align="aligncenter" width="700"] Source: Company websites/Coresight Research[/caption]

REITs are not a new concept. The first, American Realty Trust, was founded in 1961 in the US. While there are many disruptors like WeWork, established REITs are also embracing innovation to stay competitive, such as remodeling their current spaces, acquiring other assets and focusing on niche markets.

For example, REITs are increasingly opening mixed-use properties, which combine retail, restaurants and office space. With the outbreak of Covid-19 emphasizing the importance of grocery in consumers’ daily lives, we expect that grocers could take up some of the empty space from permanent store closures in the wake of the crisis.

Furthermore, as consumers and corporations become more interested in sustainability, several REITs are taking meaningful action to reduce their environmental impact and improve their environmental, social and governance (ESG) ratings.

Source: Company websites/Coresight Research[/caption]

REITs are not a new concept. The first, American Realty Trust, was founded in 1961 in the US. While there are many disruptors like WeWork, established REITs are also embracing innovation to stay competitive, such as remodeling their current spaces, acquiring other assets and focusing on niche markets.

For example, REITs are increasingly opening mixed-use properties, which combine retail, restaurants and office space. With the outbreak of Covid-19 emphasizing the importance of grocery in consumers’ daily lives, we expect that grocers could take up some of the empty space from permanent store closures in the wake of the crisis.

Furthermore, as consumers and corporations become more interested in sustainability, several REITs are taking meaningful action to reduce their environmental impact and improve their environmental, social and governance (ESG) ratings.

Startups in the REITs Sector

While real estate is generally considered a traditional business, a number of startups are disrupting the industry by introducing innovation. Some of these players aggregate and analyze data from various sources to generate actionable insights, while others digitalize the business process. We discuss five such innovators below. Cherre Launched in 2016, Cherre is a software-as-a-service (SaaS) firm that uses AI to help in making investment and underwriting decisions. The company’s platform leverages data from both public and private sources to generate a single source of real-estate data for the entire organization, allowing users to obtain actionable insights. In addition, the company claims to have the largest mapped collection of real-estate data in the world, with over 2 billion data points. It offers property valuations, based on over 450 million transactions, and detailed ranges for over 100 million properties. Cherre raised $16 million from Intel Capital and other firms in February 2020. [caption id="attachment_111960" align="aligncenter" width="700"] Cherre’s CoreConnect solution

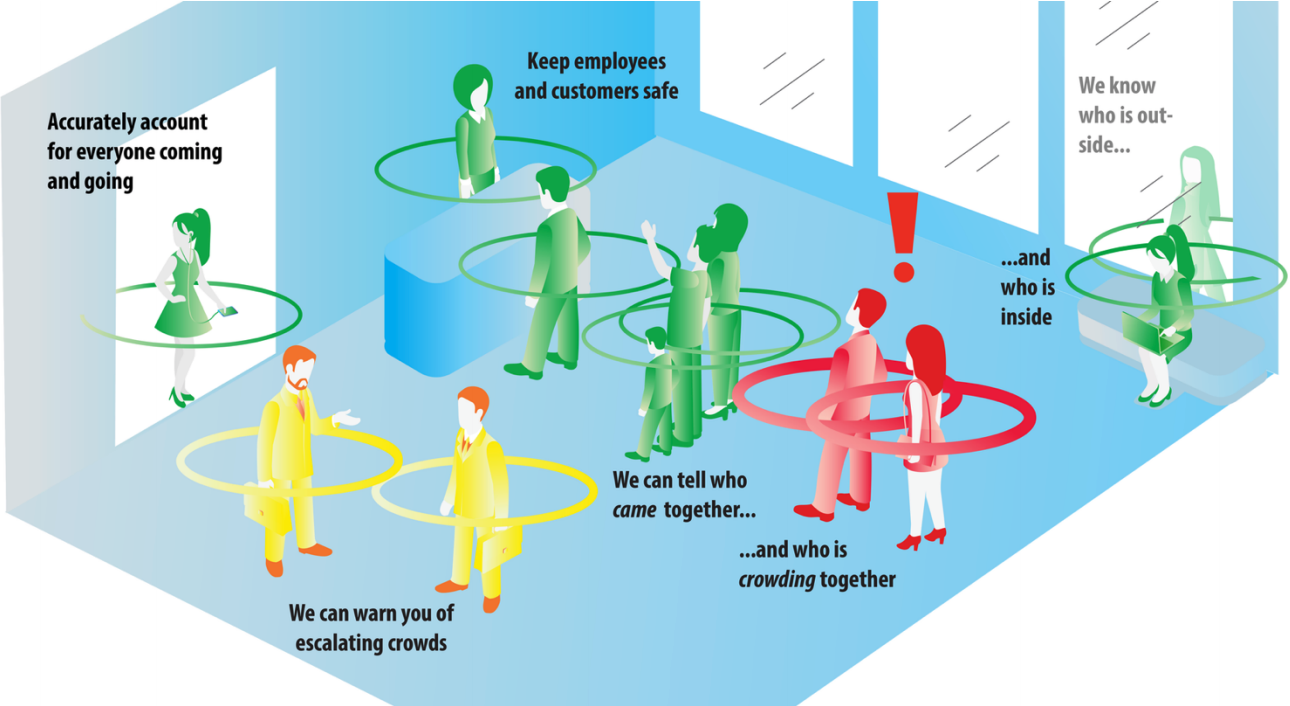

Cherre’s CoreConnect solutionSource: Cherre[/caption] FastSensor Founded in 2013, FastSensor offers solutions that gather information through non-personal signals from mobile devices for business improvement. Its technology protects customers’ identities and only transmits data through a secure network. After recording customers’ movements and actions in different locations, FastSensor presents a unified view on its cloud platform. The company’s Covid-19 solution ADAM (Active Distance Alert and Monitoring) leverages sensors to determine the number and relative location of personal devices in real time, enabling businesses to implement social distancing measures. [caption id="attachment_111961" align="aligncenter" width="700"]

FastSensor’s ADAM Solution

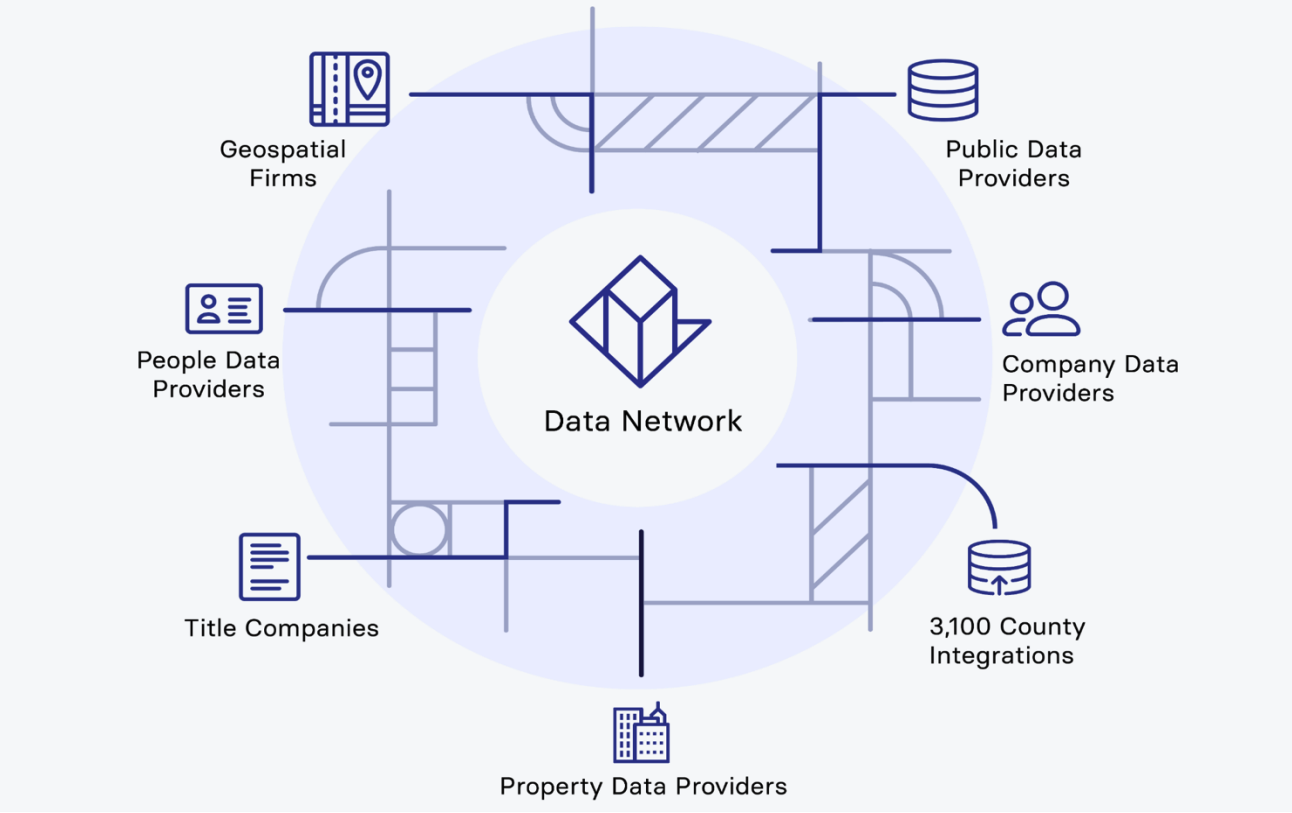

FastSensor’s ADAM SolutionSource: FastSensor[/caption] Knotel Founded in 2016, Knotel offers flexible full-service workspaces. The company has millions of square feet across 200 locations in Dublin, London, Los Angeles, New York, Tokyo and more. Knotel raised $400 million in funding at a valuation of $1 billion in August 2019. Following the outbreak of Covid-19, the company plans to update its app to allow contact tracing. The app will use location services to track members who were in proximity to an infected person. Reonomy Reonomy provides property intelligence, leveraging big data, partnerships and machine learning. The company created Reonomy ID to allow customers to identify commercial assets in the US. Its database includes over 50 million properties, 80 million companies, 38 million mortgages, 68 million property sales and more. The company offers customized solutions for both enterprises and individuals. [caption id="attachment_111962" align="aligncenter" width="700"]

Reonomy’s Data Network

Reonomy’s Data NetworkSource: Reonomy[/caption] In November 2019, Reonomy raised $60 million from institutional investors, including Citibank and Wells Fargo. REX Launched in 2015, REX is the first licensed, residential real-estate brokerage to leverage AI and big data to innovate traditional realtor practices. It uses predictive analytics and transformative technology to price homes more accurately and target qualified buyers through websites such as Facebook, Google and Zillow. REX offers both home buyers and sellers an enhanced experience at a lower cost. The company also offers escrow, titling, mortgages and insurance at competitive prices. In 2019, the number of listings that REX handled increased by over 300% from the prior year. Since its foundation, REX has represented homes cumulatively valued at over $2 billion. The company raised $40 million from Ken Griffin, the founder and CEO of Citadel, and other investors in November 2019.

Innovation from REITs

In this section, we discuss innovations from three REITs focused on retail or leisure. Brookfield Properties: Innovative Lease Structure Brookfield Properties is a global real-estate services company with more than 170 retail properties across 43 states in the US, representing over 146 million square feet of leasable space. The company has solid mixed-use development capabilities and focuses on amplifying asset value through “placemaking”—i.e., creating places where consumers can create good experiences and memories. The company is a leader in retail transformation and offers innovative solutions to collaborate with brands and retailers. In recent years, a number of digitally native brands have emerged, and Brookfield Properties has worked with many of them to identify the best possible locations for brick-and-mortar stores by overlaying brand data with Brookfield Properties’ own consumer data. For retailers who want to test a new format or market, Brookfield Properties offers short-term pop-up leasing—reducing the risk and cost for both parties. For example, sustainable e-commerce swimwear brand Fair Harbor recently opened its first pop-up shop at Brookfield Place in New York City; it saw online sales grow by 100% in the Lower Manhattan area following the store’s opening. [caption id="attachment_111963" align="aligncenter" width="700"] The Fair Harbor pop-up store at Brookfield Place, New York

The Fair Harbor pop-up store at Brookfield Place, New YorkSource: Brookfield Properties[/caption] In addition, Brookfield Properties aims to minimize the environmental impact of its operations, fostering energy efficiency, conserving natural resources and reducing waste. Solar power now supplies more than 25% of the electricity needs of common areas within the Brookfield’s portfolio. In total, the company has spent more than $300 million to improve energy efficiency in its retail properties. EPR Properties: Adding Entertainment to Properties Based in Kansas City, Missouri, EPR Properties specializes in building enduring, experiential properties. The company invests in theme parks, theaters, family entertainment centers and more, focusing on how consumers spend their leisure-time dollars. The company owns more than 13 skiing locations, 55 “eat and play” properties and 18 attractions. EPR Properties aims to engage consumers and create memorable experiences. The company implements an element of play into its culture venues, offering visitors experiences with animals, art or history. For example, an ERP portfolio holding, City Museum in St. Louis, set up an art display in a way that invites guests to interact and explore—visitors can climb on an old castle and a historic Ferris Wheel on the roof—in addition to presenting repurposed architectural displays. [caption id="attachment_111964" align="aligncenter" width="700"]

City Museum in St. Louis

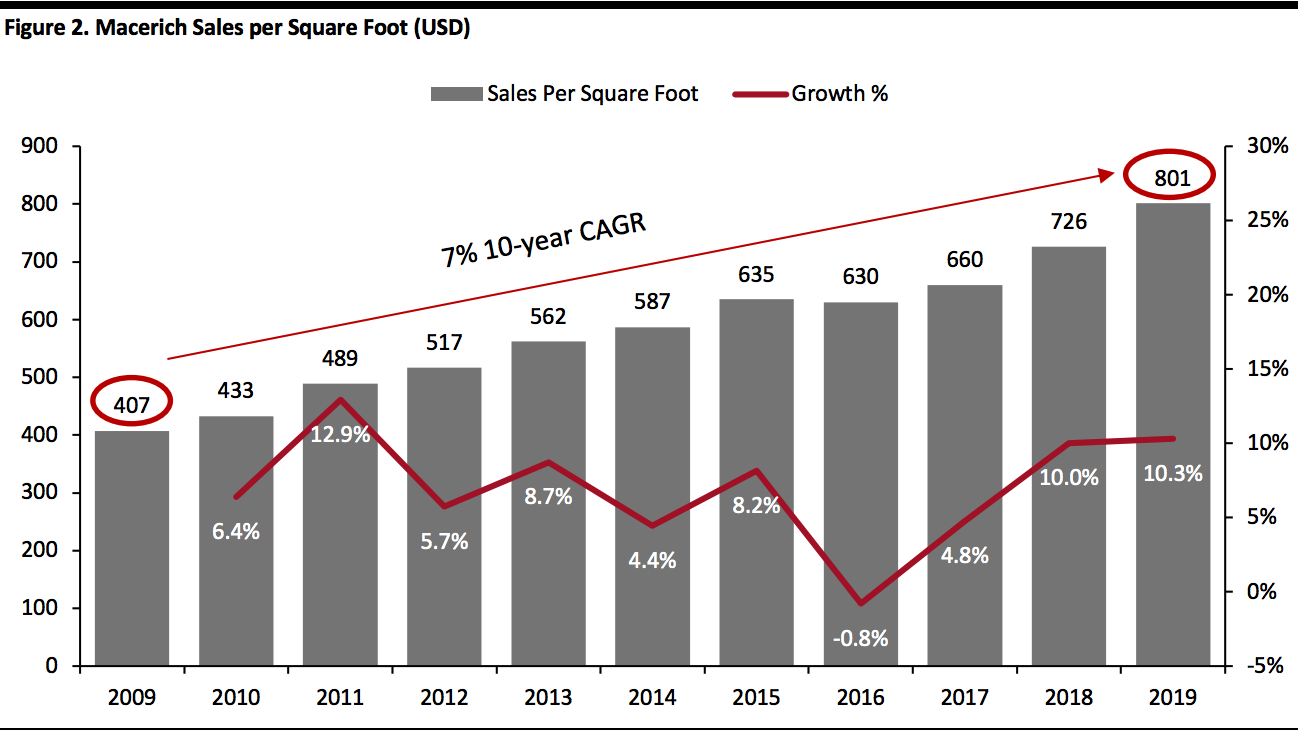

City Museum in St. LouisSource: City Museum[/caption] EPR Properties leverages new technology to create a more immersive, interactive and personalized experience to encourage repeat visits. While experiential properties suffered during coronavirus lockdowns, they are likely to recover as consumers better appreciate outside activities following a long period of staying at home. The challenge for property owners going forward will be in ensuring a clean and safe environment for visitors. Macerich: Reshaping Physical Retail Macerich is a pure-play mall REIT. The company has 47 trophy properties located in affluent and populated areas in the US, spanning 51 million square feet of retail space. Macerich is reshaping physical retail by expanding dining offerings, reducing department-store exposure, inviting clicks-to-bricks retailers and offering co-working spaces. The company replaced a number of underperforming stores with trend-setting shops, such as Tesla and Ulta Beauty, to drive traffic. The company reported tenant sales of $801 per square foot for fiscal year 2019, up 10.3% year over year. [caption id="attachment_111965" align="aligncenter" width="700"]

Source: Macerich[/caption]

Macerich is also pursuing a longer-term sustainability goals through its “Innovating to Zero” initiative, which targets generating zero energy waste and near-zero emissions, zero water waste and zero landfill impact. From 2015 to 2019, Macerich achieved the number-one ranking in the North American Retail Sector by the Global Real Estate Sustainability Benchmark, an investor-driven organization that assesses the sustainability performance of real estate portfolios globally. Macerich has over 219 electric-vehicle charging stations at 30 properties and provides 16-megawatt grid relief from solar installations across 12 properties.

Source: Macerich[/caption]

Macerich is also pursuing a longer-term sustainability goals through its “Innovating to Zero” initiative, which targets generating zero energy waste and near-zero emissions, zero water waste and zero landfill impact. From 2015 to 2019, Macerich achieved the number-one ranking in the North American Retail Sector by the Global Real Estate Sustainability Benchmark, an investor-driven organization that assesses the sustainability performance of real estate portfolios globally. Macerich has over 219 electric-vehicle charging stations at 30 properties and provides 16-megawatt grid relief from solar installations across 12 properties.