Nitheesh NH

What’s the Story?

E-commerce adoption in India is on the rise among consumers and retailers, prompting more innovative players to emerge and expand in the online retail market. In this report—which is part of the Coresight Research Retail Innovators series—we look at six e-commerce platforms (founded after 2013) that are disrupting the e-commerce market in India.- Look out for our upcoming Market Outlook: India E-Commerce report for more on the size and performance of India’s online retail market, as well as its competitive landscape.

Why It Matters

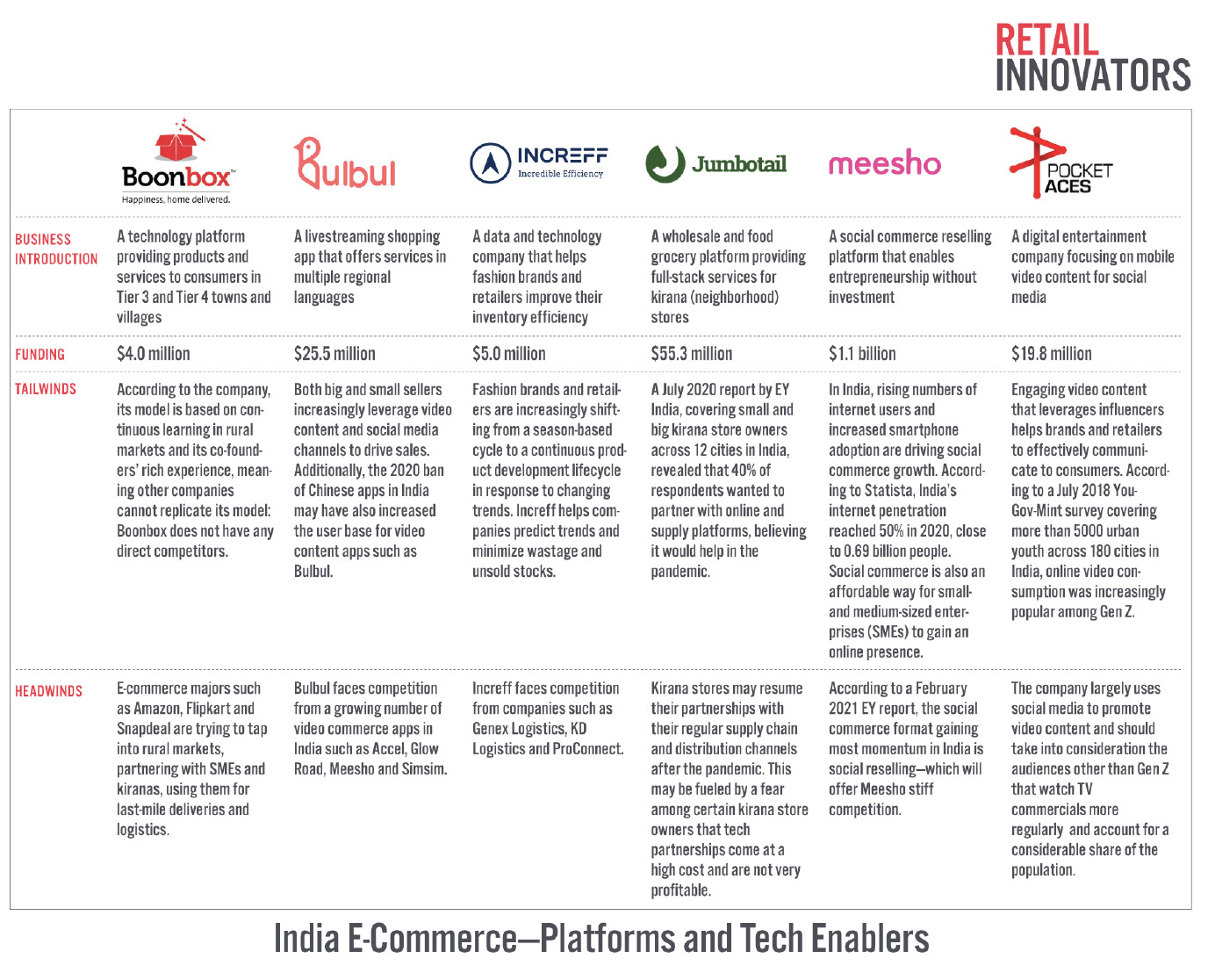

We discuss these industry players in the context of changing consumer behavior and technology initiatives in the e-commerce sector and the influence of social commerce. We have selected six companies that make for insightful discussion of how to enable high-tech development in the Indian e-commerce ecosystem.Figure 1. Retail Innovators in India E-Commerce: Platforms and Tech Enablers [caption id="attachment_137685" align="aligncenter" width="700"]

Source: Company reports/Crunchbase/YourStory/Coresight Research[/caption]

Source: Company reports/Crunchbase/YourStory/Coresight Research[/caption]

Retail Innovators in India E-Commerce: Coresight Research Analysis

1. Boonbox Profile Founded in 2013, Boonbox is a technology platform that provides products and services to consumers in Tier 3 and Tier 4 towns and rural markets. The company’s network of local affiliates caters to small towns and villages that otherwise have very limited access to e-commerce, offering rural markets previously unavailable brands and products. Boonbox directly partners with brands and helps them establish a presence in rural markets. The company aggregates demand for products and then places orders with the brands. Boonbox offers 15 different product categories across 200 name brands, with over 150,000 stock-keeping units (SKUs), according to the company. [caption id="attachment_137686" align="aligncenter" width="701"] Boonbox’s network

Boonbox’s network Source: Company website [/caption] To date, Boonbox has raised $4 million in funding over three rounds, according to business intelligence platform Crunchbase. Its latest funding round was completed on January 1, 2019.

Figure 2. Boonbox: Key Facts [wpdatatable id=1519]

Source: Crunchbase/Company reports/YourStory/Coresight Research How Has Boonbox Disrupted the Market? Boonbox positions itself as a rural e-commerce firm. The company believes that the following three elements are critical for success in rural India:

- Trust and credibility—Boonbox prides itself on building trust within rural communities. It has nearly a decade of experience building rural networks with a deep understanding of rural purchase patterns and consumer behavior.

- A human element—Boonbox operates with a local affiliate in each town and village the company serves. Its local affiliates help consumers place orders and also collect payments for the company.

- An integrated ecosystem—Boonbox delivers products through its hub-and-spoke fulfillment model. The startup also regularly follows up with customers and offers after-sales services.

- Boonbox remodeled its business to help rural India fight Covid-19. During the pandemic, Boonbox partnered with state and central governments, corporate foundations, financial institutions and trusts to ensure rural areas were provided with a continuous supply of essential services. Its “Mission Lifeline Bharat” program offered basic home essentials, FMCG goods, medicines and sanitation products in rural areas of Karnataka, Orissa and Tamil Nadu.

- Boonbox has been praised for its initiatives to uplift rural India. In July 2019, on the 38th foundation day of the government-backed National Bank for Agriculture and Rural Development (NABARD), the bank praised five startups, including Boonbox, for its use of technology to connect and engage rural India. Boonbox is also one of 50 startups funded by NABARD through its alternative investment funds, with an outlay of ₹2.7 billion ($36.6 million)

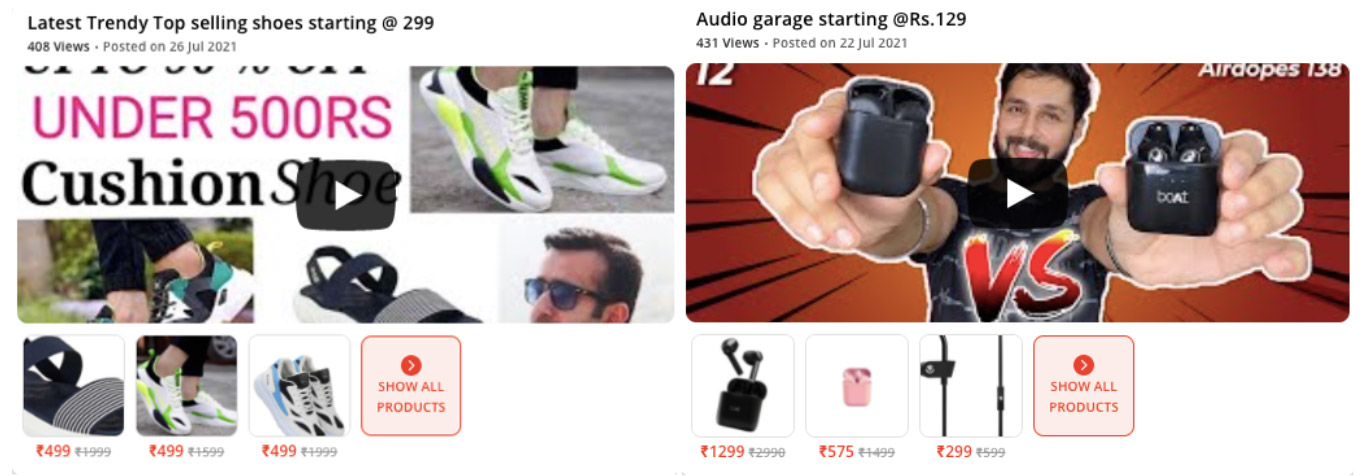

Bulbul’s product description videos

Bulbul’s product description videos Source: Company website [/caption] To date, the startup has raised a total of $25.5 million over three funding rounds. Its latest round was completed on July 28, 2020, a Series A round led by India-based Info Edge for $8.7 million, according to Crunchbase.

Figure 3. Bulbul: Key Facts [wpdatatable id=1518]

Source: Company reports/Tracxn/Coresight Research How Has Bulbul Disrupted the Market? Bulbul was India’s first livestreaming video shopping app, introducing the model to India’s social commerce ecosystem. The startup leverages video content to engage consumers and drive conversion. Rather than reading product description pages, Bulbul offers videos and livestreams to offer product information, created by hosts, sellers, and even consumers. These videos help consumers engage with products and make informed purchase decisions—in a way, closer to the offline retail experience than traditional online product descriptions. Recent Company Developments

- To manage its growing order volumes, Bulbul partnered with Unicommerce, an e-commerce enablement technology platform, in January 2020. The partnership enabled Bulbul access to seamless fulfillment from warehouse to the end customer, through Unicommerce’s warehouse management and vendor panel. The partnership also helped Bulbul expand its seller base and ensured the availability of a wider catalogue—Unicommerce’s panel updates inventory availability regularly.

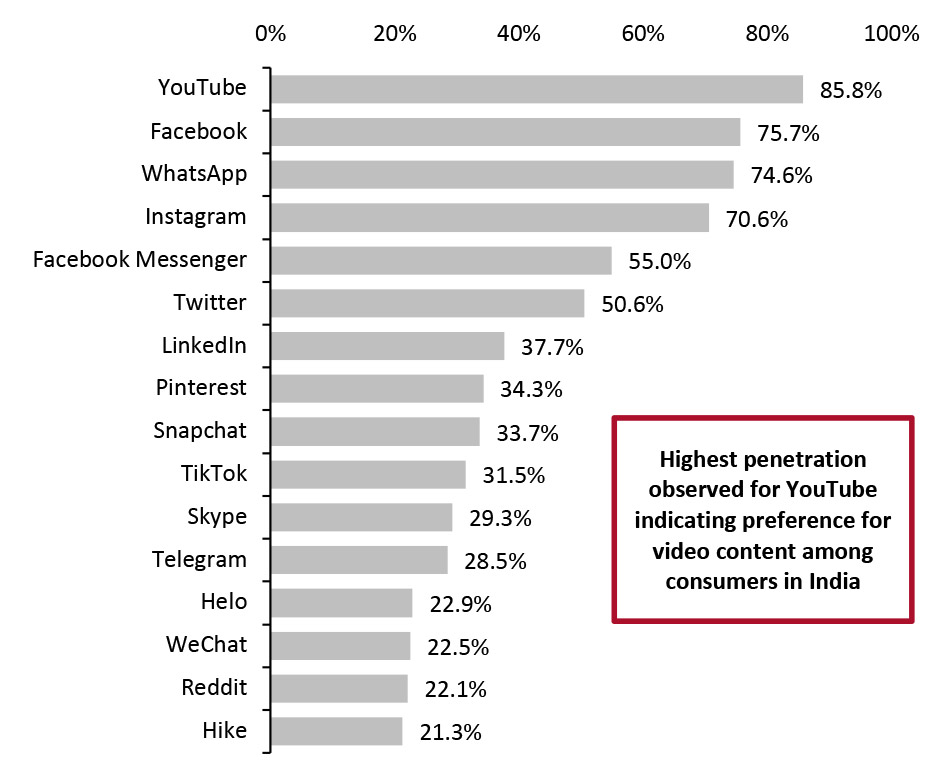

Figure 4. India: Leading Social Media Penetration by Channels [caption id="attachment_137688" align="aligncenter" width="700"]

Source: Statista[/caption]

India has the highest number of YouTube users worldwide, with 372.8 million as of 2020, according to Statista estimates. For millennial and Gen Z consumers, social media influencers will play a prominent role in influencing their purchase decisions. Moreover, the 2020 ban of Chinese apps in India, including platforms such as TikTok, may have also increased the user base for video content apps like Bulbul.

However, Bulbul will also face competition from growing number of video e-commerce apps in India such as Accel, Glow Road, Meesho and Simsim. Simsim is one of its biggest competitors and has raised $15.5 million in funding to date, according to Crunchbase.

Impact on Traditional Players

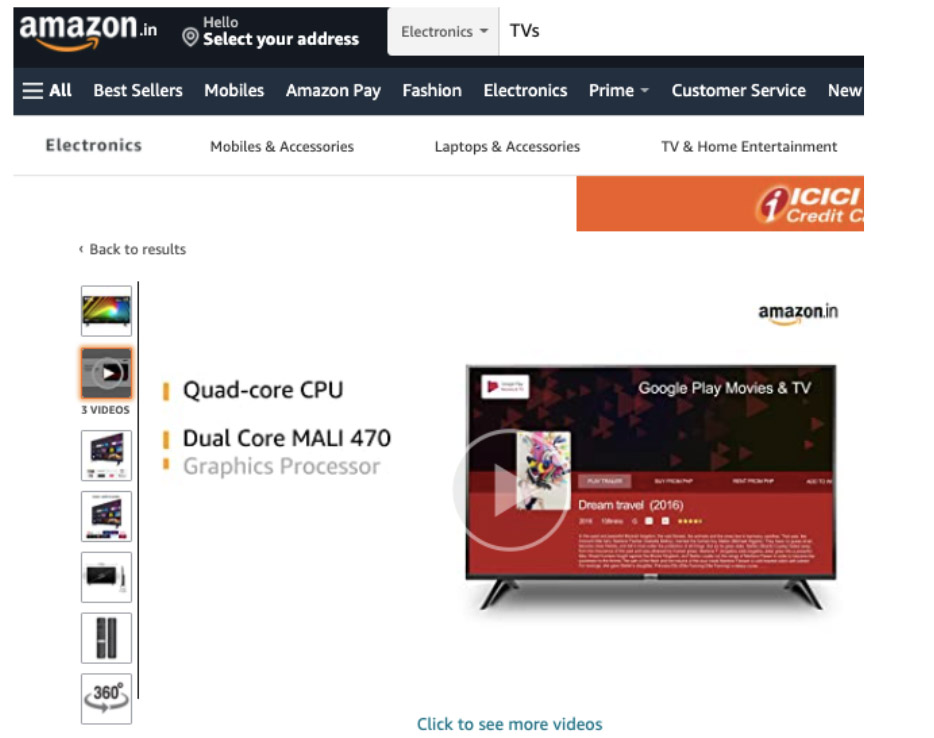

The growing adoption of video content promoted by startups like Bulbul and Simsim has prompted traditional e-commerce players to integrate video in their product pages. Amazon and Flipkart have begun adding videos to their product description pages in order to help customers understand features and specifications better.

[caption id="attachment_137689" align="aligncenter" width="700"]

Source: Statista[/caption]

India has the highest number of YouTube users worldwide, with 372.8 million as of 2020, according to Statista estimates. For millennial and Gen Z consumers, social media influencers will play a prominent role in influencing their purchase decisions. Moreover, the 2020 ban of Chinese apps in India, including platforms such as TikTok, may have also increased the user base for video content apps like Bulbul.

However, Bulbul will also face competition from growing number of video e-commerce apps in India such as Accel, Glow Road, Meesho and Simsim. Simsim is one of its biggest competitors and has raised $15.5 million in funding to date, according to Crunchbase.

Impact on Traditional Players

The growing adoption of video content promoted by startups like Bulbul and Simsim has prompted traditional e-commerce players to integrate video in their product pages. Amazon and Flipkart have begun adding videos to their product description pages in order to help customers understand features and specifications better.

[caption id="attachment_137689" align="aligncenter" width="700"] Amazon has begun adopting video product descriptions

Amazon has begun adopting video product descriptions Source: Amazon.in [/caption] 3. Increff Profile Founded in August 2016 and headquartered in Bangalore, Increff is a data and technology company that enables fashion brands and retailers to optimize their inventory efficiency across business-to-business (B2B) and business-to-consumer (B2C) sales channels. Its smart merchandising solution enables the automation of buying, distribution and merchandise planning processes. Its supply chain management platform comprises verticals such as design intelligence, fulfillment technology, technology-led merchandising, pricing and services. The startup helps brands with merchandising and fulfillment operations, building systems to gather data and develop algorithms for recommendations. Its clientele includes brands such as Esprit, Mango, Myntra, Puma and Reliance Ajio. The company has raised a total of $5 million in funding over three rounds. In its latest round in April 2019, the company raised $3 million, led by 021 Capital and Flipkart co-founder Binny Bansal.

Figure 5. Increff: Key Facts [wpdatatable id=1520]

Source: Crunchbase/company reports/YourStory/Coresight Research How Has Increff Disrupted the Market? Fashion industries often face challenges adapting to current trends and changing seasons. To prevent wastage and unsold stock, manufacturers and retailers need to be able forecast trends effectively. Increff’s solutions aim to resolve these issues, using its technology to focus on demand forecasting, inventory control and order fulfillment. Increff’s customized technology-led recommendation systems aim to ensure the availability of the right product in right quantity and at the right location. The company has stated that it will use its latest funding to expand its customer pipeline, enhance its product offerings and move into international markets. Recent Company Developments

- In December 2020, Increff launched a new solution called Regional Utilization (RU) to effectively manage e-commerce warehouses. The offering enables e-commerce brands to translate insights into concrete actions, helping e-commerce companies estimate the demand-wise distribution of stock across the country, according to the company. The RU module facilitates faster deliveries through efficient management of inventory and minimizes returns rates by optimally allocating SKUs to warehouses in proportion to regional demand. It offers faster demand fulfillment through smart inventory split across multiple warehouses, leading to significant savings on logistics cost. It also analyzes each warehouse, suggesting SKUs based on seasonality, warehouse capacity and other factors. The company states that brands can increase efficiency and save 10%–12% on logistics, increasing overall margins and enhanced regional fulfillment by 30%.

- Increff plans for a major expansion in the Middle East and North Africa (MENA) region and in September 2021 finalized a partnership deals with two of UAE’s big brands in fashion and logistics—Namshi and Aramex. The company is also in talks with many more e-commerce ventures and marketplaces, retail companies and third-party logistics operators in the MENA region, according to Co-Founder Anshuman Agarwal.

Figure 6. Jumbotail: Key Facts [wpdatatable id=1521]

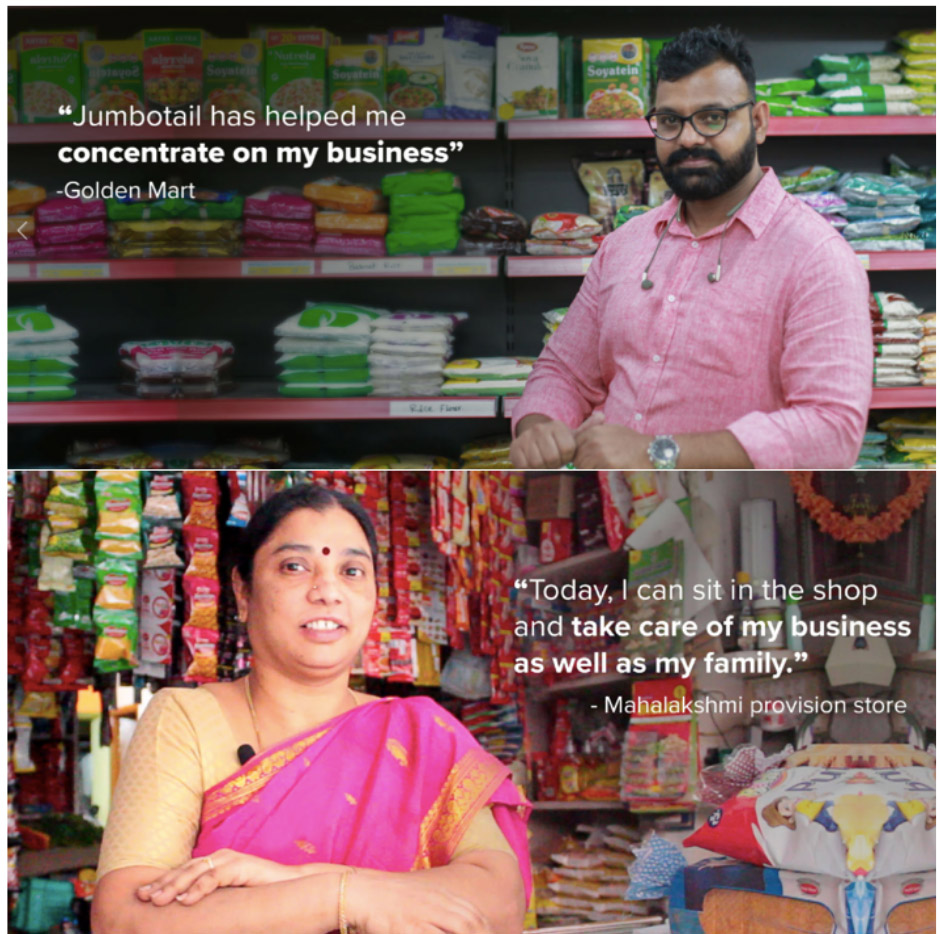

Source: Crunchbase/company reports/YourStory/Coresight Research How Has Jumbotail Disrupted the Market? Jumbotail enables kirana store owners to operate their stores on a retail-as-a-service model, integrating PoS with its fintech, retail and supply chain platforms. The company transforms traditional unorganized kirana stores into modern convenience grocery stores through its four inhouse proprietary platforms, comprising a B2B online marketplace, supply chain and logistics, fintech for SME lending, and a retail platform named Goldeneye. The retail platform offers a procurement portal integrated into its marketplace, where store owners can track inventory levels, see live market prices, margins, offers, and substitutes for currently unavailable products. The platform also helps track incoming credit balances, deliveries and payments. The company aims to organize the country’s food and grocery ecosystem by leveraging data science, design and technology. [caption id="attachment_137690" align="aligncenter" width="700"]

Kirana store owners using Jumbotail’s platform

Kirana store owners using Jumbotail’s platform Source: Company website [/caption] Furthermore, the company helps brands and manufacturers directly connect with retailers, forgoing the necessity for investments in physical distribution networks. It also connects kirana stores with financial institutions, helping them obtain credit and financial aid. Recent Company Developments

- Jumbotail is scaling operations and plans to expand its national footprint to 13 cities and 50 smaller towns across India. The company is also investing in supply chain and logistics infrastructure and extending its fintech services for SME lending to kirana stores in its new geographies. According to Co-Founder Ashish Jhina the company is onboarding a large number of brands to its platform and aims to reach 200,000 kirana stores in more than hundred Tier 3 and Tier 4 towns. The company also states that is saw 50%–100% growth in the number of retailers in its fast-moving consumer goods (FMCG), home-care and personal care categories between around February and July 2021. Additionally, Jumbotail is investing heavily in design, people, product and technology to scale economically.

- The startup is looking to hire more than 400 employees across functions, including product, technology, supply chain operations and retail services. Jumbotail stated that it plans to hire for all levels, ranging from junior roles to leadership positions, as well heads of functions across departments. The company aims to hire the new employees by May 2022, across the same geographies it plans to expand into.

Figure 7. Meesho: Key Facts [wpdatatable id=1523]

Source: Crunchbase/company reports/YourStory/Coresight Research How Has Meesho Disrupted the Market? Small businesses in India often use apps including Facebook and WhatsApp to market products to online consumers. However, very few end customers in India trust small online businesses—Meesho aims to solve this issue by offering an customers an established platform and providing efficient logistics and payment systems. Meesho users share links to products listed on the platform on their social media accounts, including Facebook and WhatsApp. Once consumers shortlist products, resellers place the order with Meesho and provide the customer’s name and address—Meesho then takes care of logistics and delivery. Resellers earn through margins from their sale proceeds, while Meesho takes a 10–15% commission. [caption id="attachment_137691" align="aligncenter" width="699"]

Supplier Testimonials and Meesho Supporting Small Businesses

Supplier Testimonials and Meesho Supporting Small Businesses Source: Company website [/caption] Recent Company Developments

- Meesho aims to target 100 million small businesses, planning to bring in more small sellers who are currently only selling offline, according to Co-Founder Vidit Aatrey.

- The startup plans to expand its product categories to include grocery and fast-moving consumer goods (FMCG). Meesho has formed a partnership with online grocery player Farmiso to expand its reach to low-income households. Indian grocery sales on social commerce accounted for nearly 1% of online sales in 2020, which translates to about $3 billion in value, according to management consultancy firm, RedSeer Consulting—offering a large untapped market for the company.

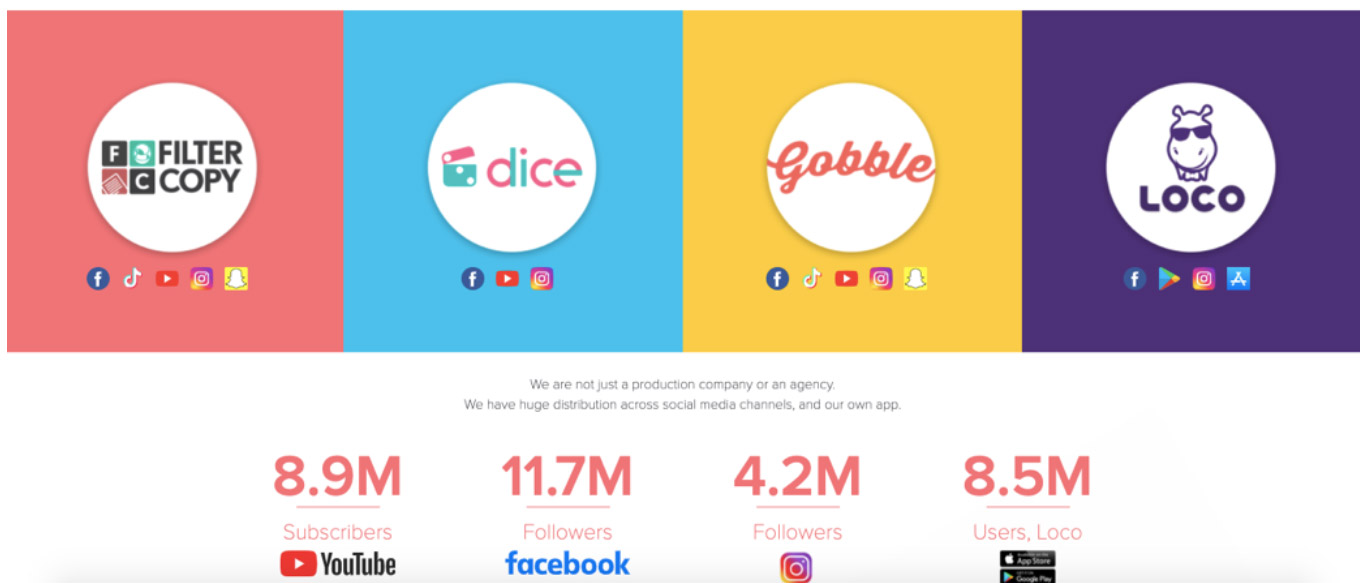

Pocket Aces’ social channels and social media followers

Pocket Aces’ social channels and social media followers Source: Company website [/caption] Pocket Aces has raised a total of $19.8 million in funding over four rounds. Its latest funding completed on January 6, 2021, raising $2.3 million led by Stride Ventures, according Crunchbase.

Figure 8. Pocket Aces: Key Facts [wpdatatable id=1524]

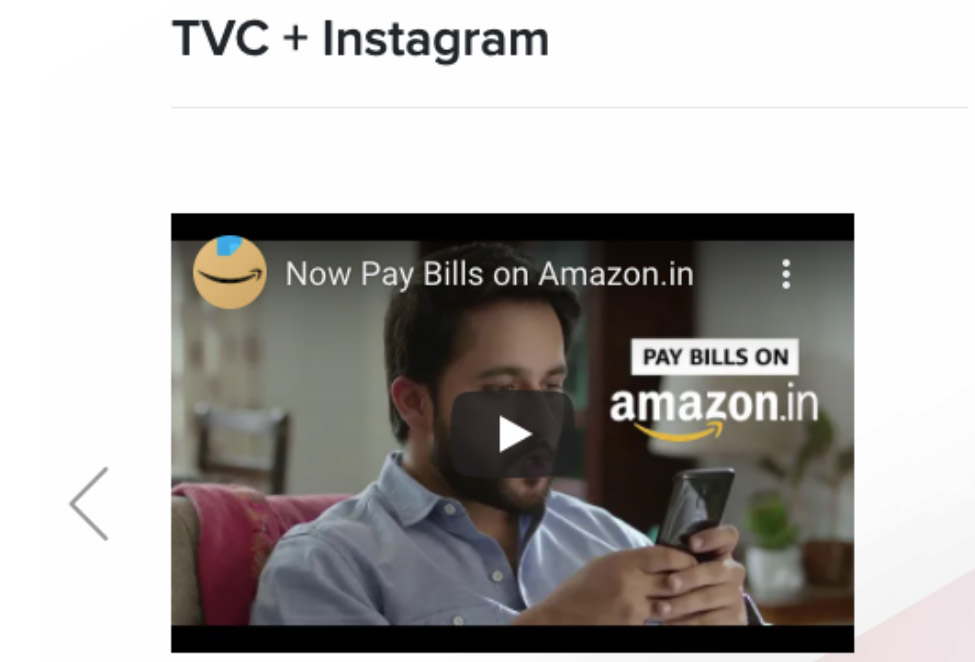

Source: Crunchbase/company reports/YourStory/Coresight Research How Has Pocket Aces Disrupted the Market? Through its various channels, Pocket Aces specializes in creative and servicing capabilities—and created content for companies such as Amazon, Cadbury, Flipkart, HUL, Licious, Lifestyle, Myntra, Nykaa and Swiggy. Pocket Aces also manages some of India’s most popular influencers, including actors and content creators, leveraging them for brand campaigns. For example, the company used actor Veer Rajwant for its Amazon Pay campaign, who introduced and highlighted the initiative’s Pay Bills feature through an interactive and engaging short video. [caption id="attachment_137693" align="aligncenter" width="700"]

Influencer campaign for Amazon Pay powered by Pocket Aces

Influencer campaign for Amazon Pay powered by Pocket Aces Source: Company website [/caption] The company has also signed content distribution partnerships with platforms such as Ola Play, Reliance Jio, Tata Sky, and China-based companies Youku Tudou and ByteDance. Additionally, the startup also provides in-flight entertainment options to passengers flying on Cathay Pacific, Emirates and other global airlines. It also enables content platforms such as Netflix to create content that maximizes its audience’s attention, using its long-video format app Dice Media. It licenses this content across mediums such as flights, cabs, over-the-top-media services and TV for greater reach. Recent Company Developments

- In July 2021, Pocket Aces announced that it has spun off its gaming and esports app, Loco, led by Pocket Aces Co-Founders Ashwin Suresh and Anirudh Pandita. Its third Co-Founder, Aditi Shrivastava, became CEO. Aditi was responsible for the growth of Dice Media and led the company’s revenue expansion, creating its influencer management division. Ashwin and Anirudh remain shareholders of Pocket Aces and are members of its Board.

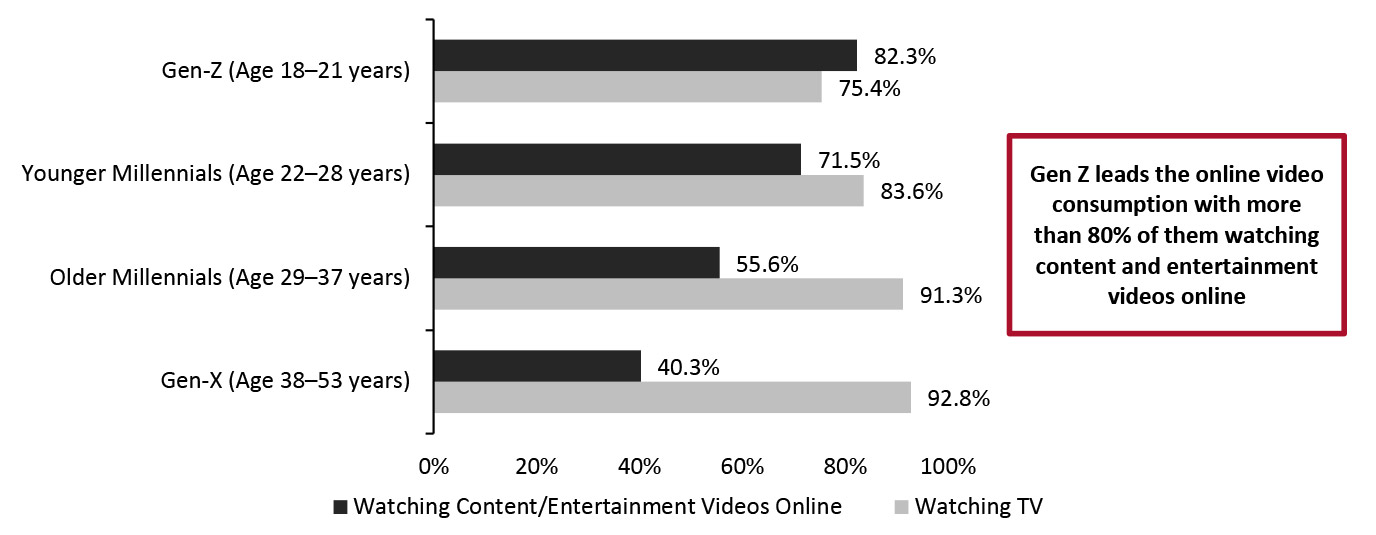

Figure 9. India: Video Consumption by Generation [caption id="attachment_137694" align="aligncenter" width="700"]

Online entertainment includes online platforms such as Hotstar/Netflix

Online entertainment includes online platforms such as Hotstar/Netflix Source: YouGov-Mint Millennial Survey (July 2018) [/caption] E-commerce companies now often focus on providing engaging content through livestreaming and influencer videos—providing substantial growth opportunities for video content creators like Pocket Aces. However, millennials and Gen X in India still prefer watching TV for video consumption. Pocket Aces, which largely uses social media to promote video content, should also take this into consideration as these generations account for a considerable share of the population. Despite social media channels gaining popularity among the younger generation, television commercials (TVCs) are still an important and preferred medium for middle-aged and older generations. Impact on Traditional Players Many brands and retailers are using video content to engage consumers. Companies specializing in this kind of content, such as Pocket Aces, provide a convenient path. E-commerce majors are also leveraging engaging video content to communicate the launch of new offers or service announcements. For example, Flipkart recently launched an advertising campaigns market grocery deals, primarily through TVCs and YouTube. [caption id="attachment_137695" align="aligncenter" width="699"]

Flipkart now leverage video content to communicate about grocery deals.

Flipkart now leverage video content to communicate about grocery deals. Source: YouTube.com [/caption]

What We Think

Implications for Brands/Retailers- Brands and retailers looking to enter lower tier towns and villages must understand the market to develop a presence there. Strategic partnerships with platforms such as Boonbox, which has a deep knowledge of lower tier towns and rural markets, will help brands scale their rural presence.

- Consumers in India increasingly watch videos for content consumption, product discovery and product information. Brands and retailers should leverage social media influencers and celebrities, creating engaging video content to communicate offerings.

- Technology partnerships are crucial for fashion brands and retailers to anticipate and meet evolving consumer needs, helping to optimize their inventory and supply chain—as well as product improvisation and curation of new and personalized products.

- Small retailers should look to adopt technology and omnichannel initiatives to cater to online consumers, scale operations easily and conveniently, and establish a pan-India presence.

- We believe that social commerce will take off rapidly in India—driven by consumer preferences and its convenience. Brands and retailers should increasingly use social media channels to scale their online presence and reach.

- As brands and retailers expand their rural presence and with e-commerce logistics and warehousing also attracting huge investments, real estate companies can offer ample space to support warehousing facilities—especially in lower tier cities.

- Thousands of kirana stores in the lower city tiers are preparing to launch a digital presence, providing growth opportunities for app providers, technology vendors and platforms.

- Media-technology companies should partner with social commerce platforms to develop engaging video content showcasing their products and services for their social media audience.