albert Chan

Introduction

The home-furnishings retail sector has seen innovative newcomers steal share from incumbents and force longstanding retailers to consider alternative business models. Wayfair’s e-commerce disruption in the home-furnishing space is well documented, while mattress firms such as Casper and Purple have brought new models, such as DTC, to the furniture market. In terms of online design platforms, Houzz remains the biggest disruptor.

Established players such as IKEA and Williams-Sonoma have also been innovative in recent times by enhancing their digital capabilities through augmented reality (AR) and virtual reality (VR) technologies. In an environment where omnichannel retail is growing in prominence, IKEA is also experimenting with alternative brick-and-mortar formats; the retailer has introduced smaller stores, deviating from its established large-format store model.

Meanwhile, e-commerce giant Amazon and mass merchandisers such as Target and Walmart have expanded their presence in the furniture category by means of various partnerships or private-label lines.

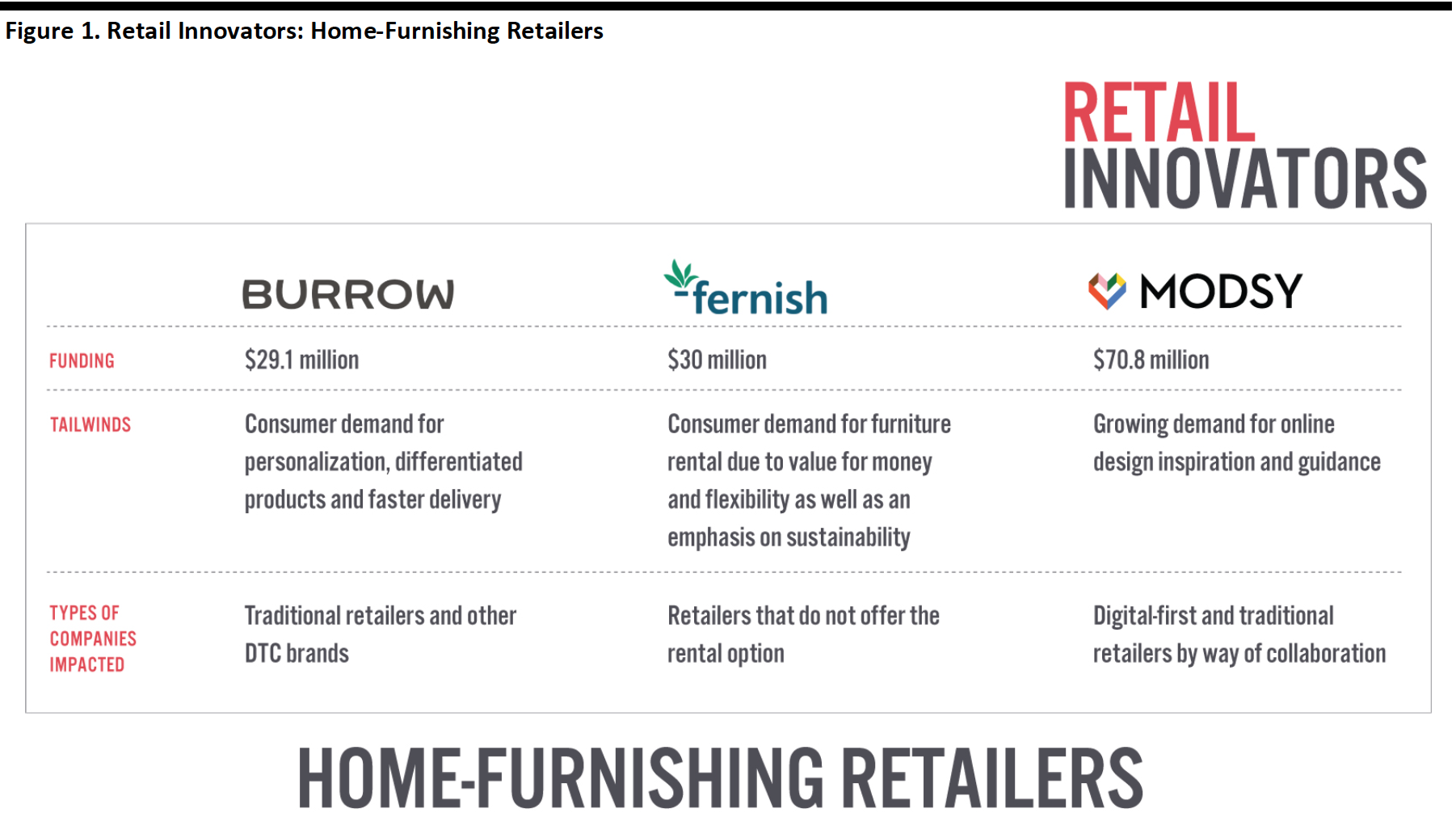

Contributing to the intensifying industry competition are emerging companies that are disrupting the market through innovation and have the potential to scale up signficantly. In this report—which is part of the Coresight Research Retail Innovators series—we take a look at three such companies that have been founded since 2015: DTC brand Burrow, furniture rental startup Fernish and design platform Modsy.

[caption id="attachment_105054" align="aligncenter" width="700"] Source: Burrow/Fernish/Modsy/Coresight Research[/caption]

Source: Burrow/Fernish/Modsy/Coresight Research[/caption]

Burrow

Profile

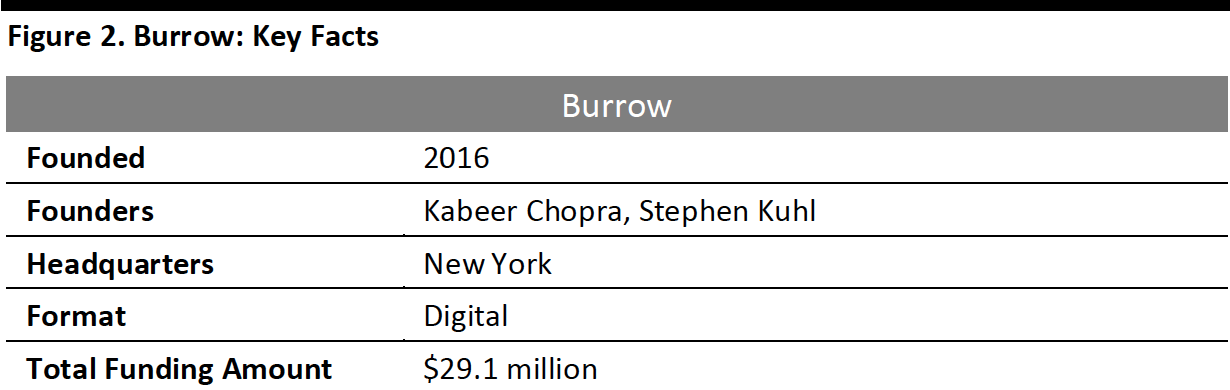

Burrow is a DTC furniture company that designs, manufactures and supplies sofas and sectionals, sleepers, armchairs, ottomans and other seating products. The company was founded in 2016 and is headquartered in New York. Burrow officially launched in April 2017.

Although it began as a digital-only retailer, the company currently operates six partner showrooms in addition to its flagship Burrow House showroom in New York and a store in Chicago. Burrow has also forged partnerships with various retail stores, coffee shops and co-working spaces around the country to offer customers a ‘try before you buy’ opportunity before making an online purchase.

The DTC brand’s primary differentiator is modularity—designing sofas that offer consumers convenience, as they can adapt the furniture to fit into living spaces of different shapes and sizes.

Burrow has raised around $29.1 million in funding so far. Within its first two years, the company gained a customer base of over 16,000 and generated more than $5 million in total sales. It has achieved average month-over-month sales growth of 18% since its launch, according to a company spokesperson as reported by DigitalCommerce360.

[caption id="attachment_104824" align="aligncenter" width="500"] Source: Burrow/Coresight Research[/caption]

Source: Burrow/Coresight Research[/caption]

How Has Burrow Disrupted the Market?

The founders of Burrow, Kabeer Chopra and Stephen Kuhl, took inspiration from bed-in-a-box mattress firms that disrupted the mattress industry with innovation in the shipping process. They decided to replicate the model by flat-packing sofa products.

The flat-packing of furniture is not a recent innnovation—with IKEA being the first to popularize and perfect the method and a number of DTC brands adopting this model to enter the home-furnishings industry. However, Burrow has made an impact in the market by identifying a consumer pain point: IKEA products often require tools to put them together, and the assembly process can be tedious. Burrow has addressed this challenge by creating innovative designs that enable customers to assemble products quickly and conveniently. In addition, the company features gif tutorials on its website to aid consumers through the assembly process. While IKEA posts its own assembly videos on its website, there are often more steps involved.

Apart from ease of assembly, Burrow’s USP includes relatively fast delivery of between five and nine business days. The company’s products fall in the mid-market range and are more expensive than typical IKEA products.

Brick-and-Mortar Presence

Burrow opened its first retail store in SoHo, New York, in August 2018 and a second location in Chicago’s Fulton Market in June 2019. The company had previously relied on launching pop-up shops to create an offline presence, but Burrow’s omnichannel strategy is now focused on opening more permanent physical stores as well as expanding its product selection and enhancing its e-commerce platform.

According to a company spokesperson, the opening of Burrow’s New York store increased the conversion rate among New York shoppers by 100%, and the retailer hopes to achieve similar results with its Chicago store.

In February 2020, Burrow moved into its new larger flagship store Burrow House in SoHo, New York. Interestingly, in a move that may become a trend in online-to-offline retail, the company invited two other DTC brands to share the space—online paint retailer Clare and plant retailer The Sill. The store arrangement is such that Burrow’s furniture offerings are complemented with potted plants from The Sill while the walls, backdrops and room dividers are painted using popular shades from Clare. While the partners don’t pay rent to Burrow, they are part of affiliate marketing programs, according to Forbes.

Burrow House has been designed to offer an experiential retail environment, with customers encouraged to have a cup of coffee and watch Netflix in the “living rooms” and create their own videos in a green-screen studio.

[caption id="attachment_104825" align="aligncenter" width="500"] Burrow’s Burrow House flagship store in SoHo, New York

Burrow’s Burrow House flagship store in SoHo, New YorkSource: Burrow[/caption]

Landscape and Tailwinds

With consumers increasingly demanding better shopping experiences that include personalization and efficient delivery, the home goods category is seeing a growing number of DTC brands enter the market.

In addition to Burrow, Campaign and Floyd are two examples of other DTC brands that offer flat-pack delivery, and more companies are emerging that have adopted this method for their supply chain. In order to boost sales and conversion rates, a number of these brands are also establishing and expanding their physical presence with a view to directly interact with customers who can experience the products.

Omnichannel strategies are becoming more imperative for home-furnishing retailers as they make efforts to sustain growth. Burrow’s emphasis on its offline presence therefore augurs well, as evidenced by the success of its New York store in enhancing conversion rates.

On the other hand, the increasing number of DTC brands both online and in the brick-and-mortar marketplace represent headwinds for the furniture industry, as achieving differentiation from competitors is made more challenging. Moreover, investors and analysts seem to be becoming skeptical of the prospects for profitability of DTC brands, given the costs associated with their approaches to marketing and fulfillment, for example. This skepticism was reflected in the lower-than-expected pricing of Casper’s IPO at the start of February 2020.

That said, Burrow has so far managed to draw appeal for its products by incorporating creative design features—such as integrating USB cable ports into sofas—and offering easy product assembly and a flexible returns policy.

Impact on Traditional Players

DTC brands such as Burrow have identified a niche in the market with their easy-to-assemble products that are offered with quick delivery sevices, which has put the onus on traditional players to match up to these standards.

Although it adopts a similar approach to shipping, Burrow does not seem to be competing directly against IKEA. Its target market looks to be shoppers who are accustomed to the IKEA model but are willing to pay more to upgrade their furniture. Burrow’s main competitors are other DTC brands such as Article, Campaign, Floyd, Hem and Interior Define.

Fernish

Profile

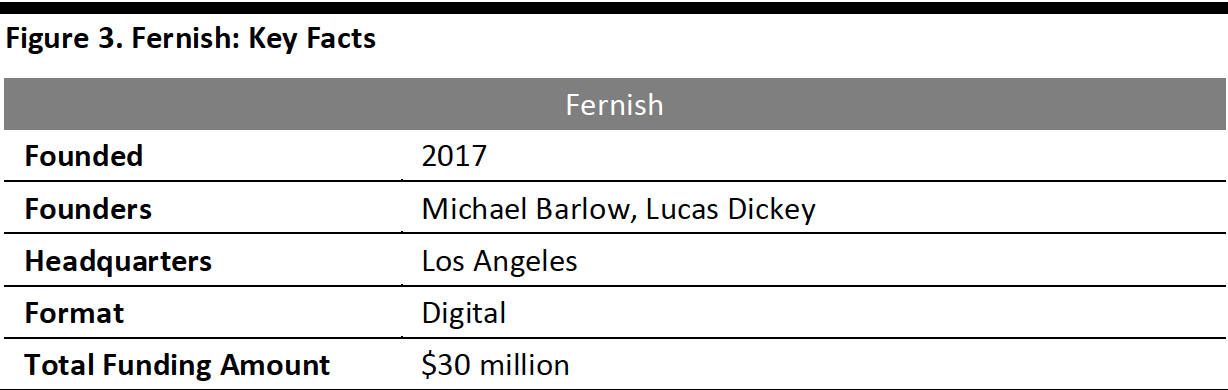

Fernish is a DTC furniture-as-a-service company with a subscription-based rental business model. Customers can pay monthly installments to rent furniture and have the option to swap, buy or return products at the end of the lease term. Fernish was founded in 2017 by Michael Barlow and Lucas Dickey. The company’s first market was Los Angeles in 2018, and it has subsequently expanded to the Seattle area. While Fernish does not have its own exclusive physical store, the retailer sells its products through online outlets such as Crate & Barrel, CB2 and Floyd.

[caption id="attachment_104826" align="aligncenter" width="500"] Source: Fernish/Coresight Research[/caption]

Source: Fernish/Coresight Research[/caption]

How Has Fernish Disrupted the Market?

The appeal of Fernish for consumers is the option of having access to quality furniture with the flexibility of not having to pay full price. For a monthly subscription fee, customers can select home-furnishing products and use them for a time period of their choosing. Customers can then swap, buy or return furniture to the company at the end of the subscription period.

Rent-to-own furniture is not really a new concept—Rent-A-Center has used this business model since 1973. However, the target market that Fernish caters to is different: Rent-A-Center outlets are typically situated in low-income neighborhoods and military bases, whereas Fernish provides its services to some of the more affluent cities in the US.

The key aspect to Fernish’s USP is “flexibility.” The market gap that the company is trying to fill is in meeting the furniture demands of millennials and young professionals living in big cities; in the context of the impermanency of their living arrangements, these consumers are seeking temporary access to quality products that they do not wish to move from one place to another.

Brick-and-Mortar Presence

In April 2019, Fernish teamed up with real-estate operating company Alliance Residential to open a number of showrooms as part of its growth strategy. These showrooms also function as co-working spaces and apartment complexes, enabling customers in Los Angeles and Seattle to gain real, physical experiences of the company’s furniture. According to the retailer’s website, Fernish currently has three showrooms in Los Angeles and four in Seattle.

[caption id="attachment_104827" align="aligncenter" width="500"] The BW by CLG apartment complex which doubles up as a showroom for Fernish

The BW by CLG apartment complex which doubles up as a showroom for FernishSource: Fernish[/caption]

Landscape and Tailwinds

As discused above, a growing number of millennials and young professionals who live in big cities today consider the option of furniture rental to be more viable for their lifestyle. It is in this context that the services provided by furniture rental startups like Fernish and Feather are finding growing relevance with these consumers, representing flexibility and value for money.

In addition to flexibility, these types of retailers actively promote the advantages of sustainability that rental services provide, in order to enhance the popularity of renting furniture over buying it outright. Sustainability is a hot topic that is trending across a number of retail sectors in line with increasing consumer awareness of environmental issues and the impact of company supply chains and consumption. According to a 2018 survey by The Nielsen Company, around 48% of US consumers would modify their consumption habits to reduce their impact on the environment.

Impact on Traditional Players

Rental remains a niche part of the furniture market, so the near-term impact on major furniture retailers are minor. However, with the rise of the sharing economy, traction for rental and subscription business models in the US is growing and with it the long-term threat to incumbent retailers—and some of them are taking notice.

IKEA began piloting a furniture rental service in February 2019, citing its inspiration as the retailer’s focus on employing eco-friendly business practices and responding to consumer interest in sustainability. The pilot commenced in the Netherlands, Sweden and Switzerland, with IKEA trialing the lease of desks, beds and sofas. The company also stated that it will offer a series of subscription-based leasing offers in all 30 of its markets by 2020.

West Elm collaborated with Rent the Runway in the summer of 2019 to offer premium bedding and other furniture products to customers on a rental basis.

Although traditional retailers are looking to tap into the rental market by adding subscription-based services into their portfolios, they face a number of potential challenges, including the cannibalization of existing sales and high customer-acquisition and order-fulfillment costs. Furthermore, digital-first retailers are responding to the competition from established players by ramping up their offline presence, with the backing of venture capital funding.

Modsy

Profile

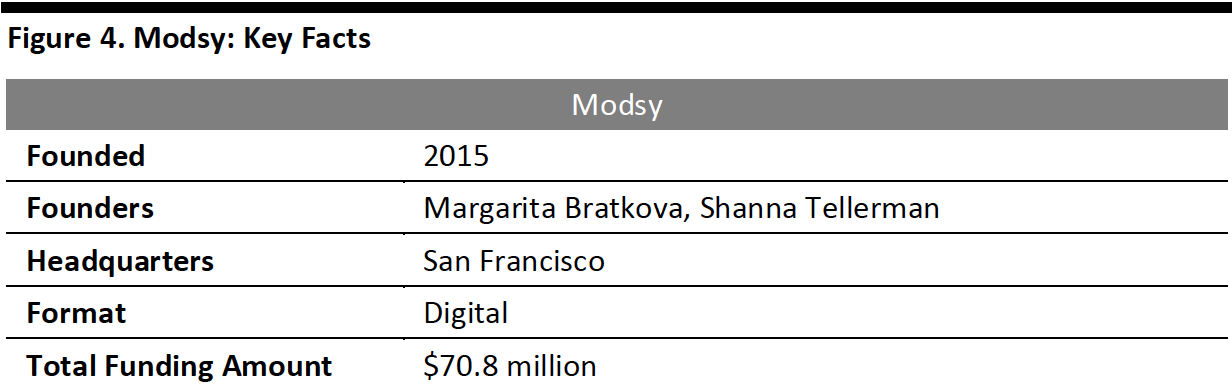

Modsy is an on-demand design and product discovery and delivery platform. It offers customers home design guidance and plans using advanced 3D graphics, computer vision and creative curation. The company was founded in 2015 and is headquartered in San Francisco.

Users of Modsy services first take a style quiz by selecting photos of rooms that they find appealing, liking and disliking sample furniture pieces and stating the goals of their home-design project. They can then upload photographs of their room to create a personalized, 360-degree view.

Modsy offers its services at two price points for a single room, with the base service priced at $89 and the premium service at $159. The company also offers a multi-room package for $259 and a full-service luxury premium package for $499.

In May 2019, Modsy raised $37 million through a Series-C funding round led by TCV, taking its total funding to $71 million.

The brand has partnerships in place with well-known retailers such as Crate & Barrel, Target, Wayfair and West Elm, and enables customers to discover products from these and other retailers that are in line with their individual tastes and requirements.

While Modsy has not specified its revenues, the brand stated that it saw 1,000% growth in revenue in 2018. Since its last funding round in December 2017, the company grew its customer base by 450% and its headcount from 47 employees to 118 by May 2019.

[caption id="attachment_104828" align="aligncenter" width="500"] Source: Modsy/Coresight Research[/caption]

Source: Modsy/Coresight Research[/caption]

Landscape and Tailwinds

According to Modsy’s CEO Shanna Tellerman, the “inspiration” category is thriving in the home design space. Although competition in the market exists in the form of Houzz and Pinterest, which have been around for a while, Modsy is successfully growing, raising funding and carving a niche in the home-furnishing industry.

In March 2019, Modsy launched its first in-house collection of sofas and chairs called Minna Home. The design of this collection was significantly influenced by data on its customers’ preferences, which Modsy collected over four years. The company stated that it will not incentivize its in-house furniture offerings and will instead let designers recommend the options that best suit each client’s needs.

The launch of its own brand offering could turn into a profit center for Modsy. With the online design-platform market becoming increasingly competitive, platforms whose revenue sources are solely design fees and sales commission may struggle to sustain themselves over the longer term in a compeititive market. Having an in-house offering means that retailers will have more control over product prices and markup, which can significantly boost profitability.

How Has Modsy Disupted the Market?

One of the biggest challenges for consumers in buying furniture is in ascertaining what specific products would look like in the context of their home. Modsy’s USP is in using 3D rendering technology to address this challenge by offering a convenient ‘try before you buy’ experience.

The platform targets consumers who would rather play a part in designing and decorating their spaces than handing over the reins completely to an interior designer, which is often expensive. Modsy does this by helping shoppers to recognize and communicate their own personal style, and this is supported by packages that provide users with access to remote style advisers.

Modsy developed a tool called “Style Genome,” which Tellerman describes as an “algorithm that helps users identify their unique style without having to tell us in words.” The algortithm analyzes the choices made by a user in the style quiz and matches them to various styles, which enables the platform’s stylists to recommend products that cater to the user’s taste. Another key advantage that Modsy offers is that users can delete additional embellishments that do not appeal to them and replace these with other, more suitable options. Once customers have their renderings ready, they can order the chosen products through Modsy’s centralized shopping cart.

Modsy has been successful in becoming a recognizable name in the market, owing to the company meeting a couple of key consumer trends: growing expectation for quick and efficient online services; and emerging demand for custom, personalized shopping experiences.

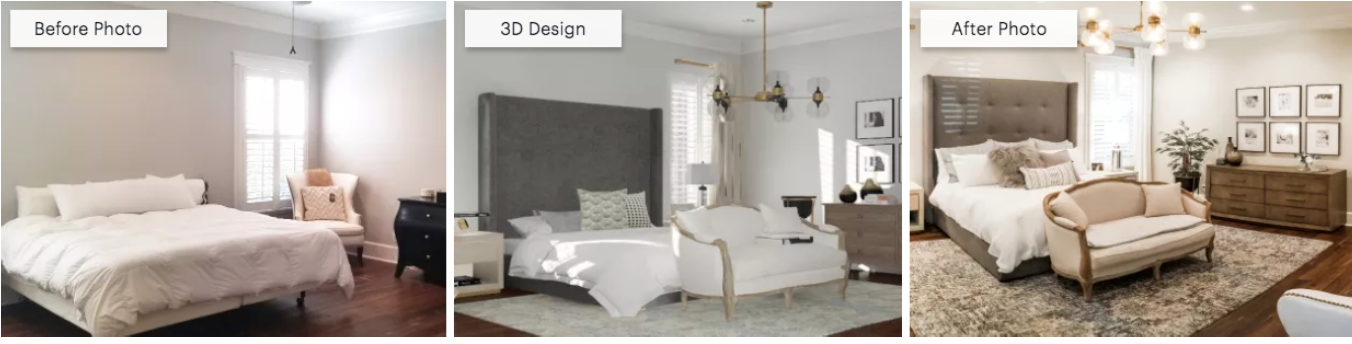

[caption id="attachment_104829" align="aligncenter" width="500"] Example of a Modsy-inspired design transformation story

Example of a Modsy-inspired design transformation storySource: Modsy[/caption]

Impact on Traditional Players

Modsy’s main competitors are other digital design platforms, such as Havenly and Houzz.

According to Tellerman, Modsy currently collaborates with over 100 retail partners, which include Target, Wayfair and West Elm among others. These retailers stand to gain from these partnerships through increased sales, as the reach of their products is extended by being featured on the Modsy platform. Currently, Modsy’s in-house offerings remain limited to Minna Home and Ravine Home, but in future, the platform could scale up its in-house offerings to effectively pit Modsy as a competitor against incumbent players in the industry.

Key Insights

As is evident from the examples of the three companies profiled in this report, we can see that changing consumer preferences and behaviour are creating an environment that is conducive for continued innovation and disruption in the sector.

Consumer demand for easy-to-assemble products along with speedy and efficient delivery presented an opportunity for Burrow to address a gap in the market—although questions remain over the sustainability of DTC models.

For Fernish, the dynamic lifestyle of millennials and young professionals in big cities—along with a heightened emphasis on sustainability—is working in the retailer’s favor, as it has enhanced the appeal for subscription-based furniture rental services.

Consumers are also increasingly looking online for design inspiration and guidance to set up their homes, and Modsy has capitalized on that by addressing the “technological hole in the interior design market.”