Nitheesh NH

Introduction

What’s the Story? Even before the pandemic, the global luxury sector was in a state of flux. Luxury shoppers are wary of counterfeits, seeking improved verifications of authenticity for goods they purchase, and are increasingly concerned about product sustainability. In addition, many luxury consumers have become conditioned to buying online and may likely retain this behavior and drive some level of shift away from in-person luxury consumption even after the pandemic subsides. As part of our Retail Innovators series, we present five companies that are disrupting the global luxury market with high-tech innovation. We cover how each company has disrupted the market, as well as tailwinds and headwinds and the impact on traditional market players. Why It Matters In the context of changing consumer behavior in the luxury sector, it is crucial that retail players keep up to date on opportunities to improve through innovation. We have selected five companies in the report that make for insightful discussion of how to enable high-tech development of the luxury ecosystem.Luxury Innovators: Coresight Research Analysis

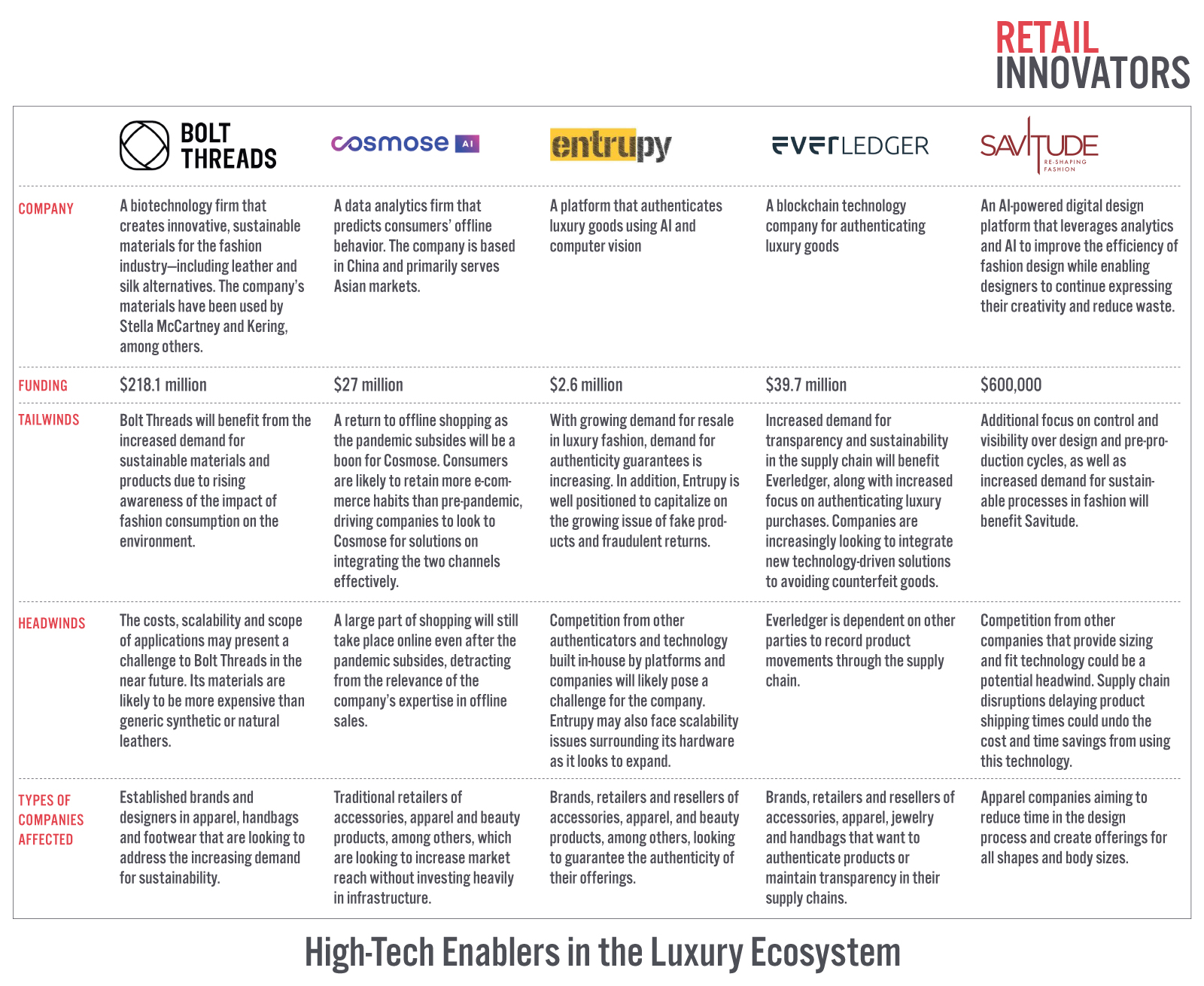

Figure 1 provides an overview of the five retail innovators we present in this report.Figure 1. Retail Innovators: High-Tech Enablers in the Luxury Ecosystem [caption id="attachment_139359" align="aligncenter" width="700"]

Source: Company reports [/caption]

1. Bolt Threads

Bolt Threads is a US-based biotech firm that creates sustainable materials for the fashion and beauty sector. The company’s key products include:

Source: Company reports [/caption]

1. Bolt Threads

Bolt Threads is a US-based biotech firm that creates sustainable materials for the fashion and beauty sector. The company’s key products include:

- Mylo: A synthetic leather material produced from the root structure of mushrooms

- Microsilk: A synthetic silk fiber made from the proteins found in spiders webs

- B-Silk Protein: An ingredient made by fermenting sugar, bioengineered yeast and water, which is formulated into a soft powder used in beauty and personal care products.

Figure 2. Bolt Threads: Key Facts

| Bolt Threads | |

| Founded | 2009 |

| Founders | Dan Widmaier, David Breslauer, Ethan Mirsky |

| Headquarters | Emeryville, California |

| Business Description | A biotech firm that creates sustainable materials for the fashion sector |

| Total Funding Amount | $218.1 million |

Source: Bolt Threads/TechCrunch/Coresight Research

How Has Bolt Threads Disrupted the Market? Bolt Threads has developed sustainable materials that mimic natural ones, including leather and silk, and established a supply chain that can produce them at scale for commercial use. Additionally, Bolt Threads markets its products as being more sustainable than animal-derived materials. Producing real leather and silk is not just expensive but also time-consuming and has a large environmental impact. Leather production involves rearing animals whose skin can be developed into leather, a resource-intensive process that can take many years. Additionally, the animal skin needs to go through tanning, dyeing and other processes before the material is ready for use. Similarly, rearing silkworms and spiders at scale is a costly process. However, Bolt Threads’ processes do not involve raising livestock. Its Mylo fabric is grown in indoor vertical farms and is ready to harvest within days. [caption id="attachment_139360" align="aligncenter" width="700"] Lab-grown mycelium (left) and the processed material, named Mylo (right).

Lab-grown mycelium (left) and the processed material, named Mylo (right).Source: Mylo-unleather.com[/caption] Competitive Advantage: Innovation in Sustainable Luxurious Materials Bolt Threads uses a variety of innovative techniques to produce its materials. its Mylo synthetic leather is made by growing mycelium cells in labs at its facilities. The company describes mycelium as “a sprawling, infinitely renewable, interlaced web, [that] threads through soil, plant bodies, and along riverbeds to break down organic matter and provide nutrients to plants and trees. Mushrooms are the fruit of mycelium.” The Mycelia cells are fed sawdust and organic material in conditions where humidity, temperature and other variables are controlled to enable optimal growth. Bolt Threads then processes and dyes the mycelium and transforms it into sheets used to make footwear, handbags and other products. Any byproducts of the process can be composted. However, while Mylo is made from infinitely renewable mycelium, the final product is not biodegradable. Bolt Threads states that it is working on this issue and will “create versions of Mylo material that can be repurposed and reused for as long as possible.” Bolt Threads’ Microsilk uses laboratory-made spider silk proteins to create its fibers, the process does not involve actual spiders or silkworms. Natural silk fibers derived from silkworms are resource- and time-intensive—requiring a large number of silkworms, mulberry leaves and large amounts of space. Bolt Threads states that the main input material to create Microsilk is plant-based sugar. The company also claims that the renewability of its fiber sources makes its products more sustainable. For instance, the plant-based sugar plants and mycelia cells it uses can be grown, harvested and replanted, making this a renewable process. Bolt Threads claims that it is producing its engineered silk fibers at a commercial scale, and at a cost that makes it viable for widespread use in consumer products such as apparel—a feat that no other firm has been able to realize yet. The company’s go-to market strategy is partnering with established brands in apparel and luxury whose values align with Bolt Threads’. Stella McCartney was one of the first designers to use Mylo commercially. In March 2021, McCartney unveiled a bustier top and utilitarian trouser set made from recycled nylon scuba overlaid with panels made from Mylo. [caption id="attachment_139361" align="aligncenter" width="700"]

Stella McCartney’s bustier and trouser set made with Mylo.

Stella McCartney’s bustier and trouser set made with Mylo.Source: Mylo-Unleather.com[/caption] In April 2021, Adidas revealed a version of its iconic Stan Smith sneaker made using Mylo. The engineered leather is used for the outer upper, three stripe decoration and heel tab overlay, while the midsole is made of natural rubber. [caption id="attachment_139364" align="aligncenter" width="480"]

Adidas Stan Smith Mylo sneakers.

Adidas Stan Smith Mylo sneakers.Source: Mylo-Unleather.com[/caption] Tailwinds and Headwinds Consumers are increasingly seeking sustainable alternatives for the products they purchase—in a Coresight Research survey of US consumers from July 26, 2021, some 28.5% of consumers said that the pandemic has made environmental sustainability more of a factor when shopping versus 13.8% that said it is now less of factor. According to a March 2021 report by nonprofit firm Material Innovation Initiative, 55% of US consumers prefer leather alternatives to animal leather. Of those, 92% thought alternatives are good for animals and 75% thought they are good for the environment. About two-thirds that preferred alternatives were prepared to pay more for them and about half of those that preferred animal leather would also be willing to spend more for alternatives. As consumers continue to become more conscious of their shopping habits, they will seek out brands and retailers that have sustainability at the core of their activities. Furthermore, many brands and retailers are increasingly focusing on environmental and social issues, incorporating them into their strategies. This presents a tailwind for Bolt Threads as its current and potential partners are likely to invest further in material innovation solutions—particularly as they rethink their supply chains in the wake of the pandemic, climate change discussions and other uncertainties that have impacted global markets. A further tailwind is that Bolt Threads’ facilities are based in the US and Europe—an advantage as it is close to major fashion and luxury companies, which may consider near-shoring at least some parts of their production to improve resilience to potential shocks. While Microsilk is biodegradable due to its protein base, Mylo is not currently—and this likely constitutes a barrier for some of the company’s target audience. Mylo also partners with tanning companies that work on non-vegan leather products, although the actual tanning process does not involve animal products. In addition, as the material and technology are new, products made from Mylo and the company’s other materials are likely to be more expensive than those made conventionally from animal and synthetic leathers and adopted by the market at large. It will likely take time for the price to come down, presenting a headwind for the company, with only luxury players who are likely to pay the premium for its exclusivity. Impact on Traditional Players At its current level, Bolt Threads is unlikely to take away any meaningful business from existing animal leather suppliers, silk suppliers and clean beauty ingredient producers—while it is able to produce to on a commercial scale, it will need to bring the cost down further to achieve mass-market adoption. Nevertheless, traditional suppliers should be on guard and look into creating their own innovative materials sooner rather than later—if Bolt Threads becomes able to scale to a global level and if more players producing similar materials enter the market, producers of animal leather may have intense competition. Brands and retailers could look to our EnCORE framework for guidance on framing their sustainability strategy. 2. Cosmose Cosmose is an analytics firm that uses AI to assess and predict how consumers shop offline by collecting and analyzing anonymized mobile user data. The company’s proprietary technology helps offline retailers increase sales by connecting offline stores with online advertisements. With the data from this connection, Cosmose predicts the times and physical stores that consumers will shop, enabling brands and retailers to track and target this audience, aiming to measure the offline impact of their online marketing campaigns. To date, Cosmose has raised $27 million from investment firms Experior Venture Fund, OTB Ventures, TDJ Pitango Ventures and Tiga Investments, according to the company.

Figure 3. Cosmose: Key Facts

| Cosmose | |

| Founded | 2014 |

| Founders | Miron Mironiuk |

| Headquarters | Shanghai, China |

| Business Description | A data analytics firms that predicts and provides insights into offline shoppers’ behaviors |

| Total Funding Amount | $27 million |

Source: Bolt Threads/TechCrunch/Coresight Research

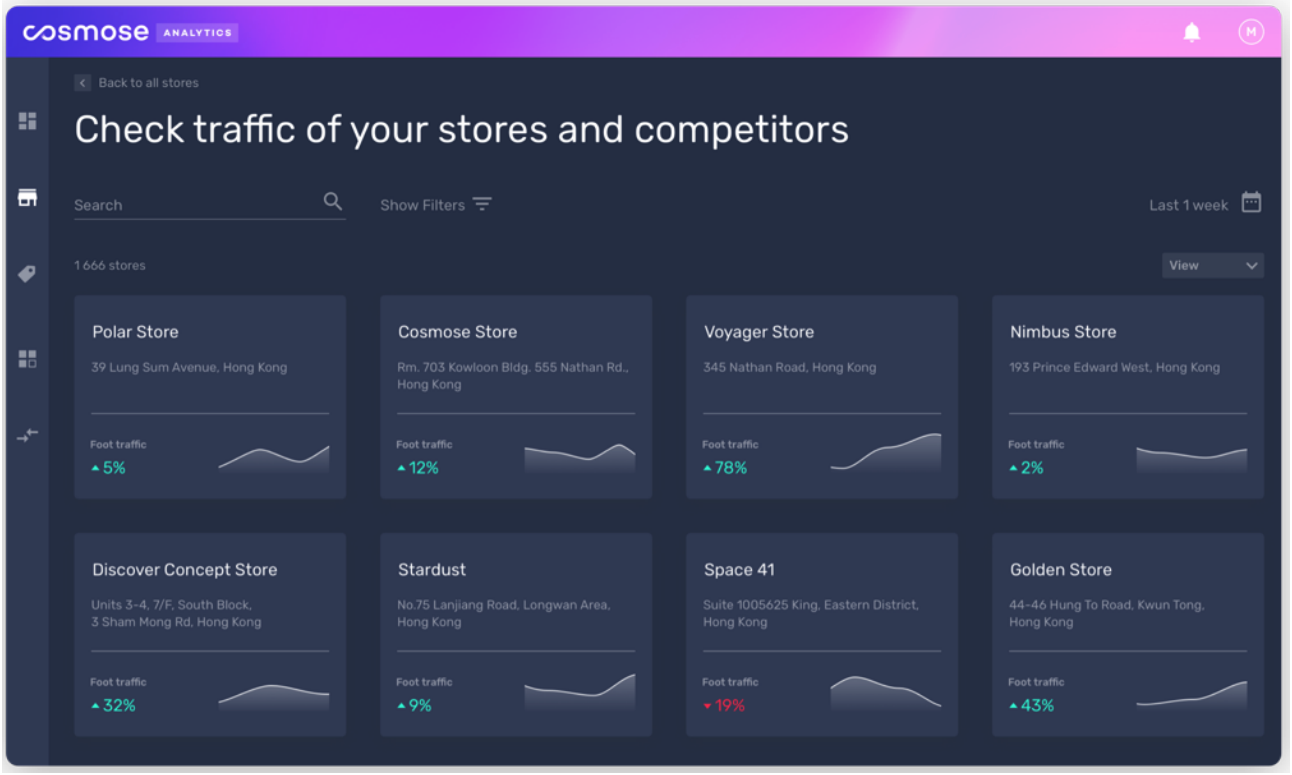

How Has Cosmose Disrupted the Market? The Cosmose application helps offline retailers—which form close to 80% of the retail sector—track, predict and influence offline shopping behavior, based on location data from its partner apps, without the retailers having to invest in additional hardware and installations. In 2020, the company claims to have delivered a net 30% uplift in revenues to its clients despite the pandemic. Cosmose has partnered with over 400,000 apps to gather consumer data, according to the company. It works with all major social platforms, including Facebook, Google, Line, WeChat and Weibo. The company’s technology is based on artificial neural networks, which estimate shoppers’ locations to an accuracy of two meters, according to the company. Its predictive shopping program predicts when, where and who will shop. Cosmose states that this program has delivered 73% accuracy for the beauty category. The company states it has gathered data from 1.1 billion devices globally, including 800 million phones in China, and has absorbed 360,000 physical stores into its ecosystem. Competitive Advantage: Seamless Integration with Existing Architecture Cosmose applications are accessible through a desktop or mobile app; retailers do not need to install additional infrastructure. The company offers three main products:- Cosmose Analytics: This offering helps brands and retailers to check metrics such as store traffic versus their competitors’, time of day with the greatest traffic, the proportion of customers shared with a specific competitor, and where the brand or retailer should open stores.

Cosmose Analytics platform comparing metrics of various stores.

Cosmose Analytics platform comparing metrics of various stores.Source: Cosmose[/caption]

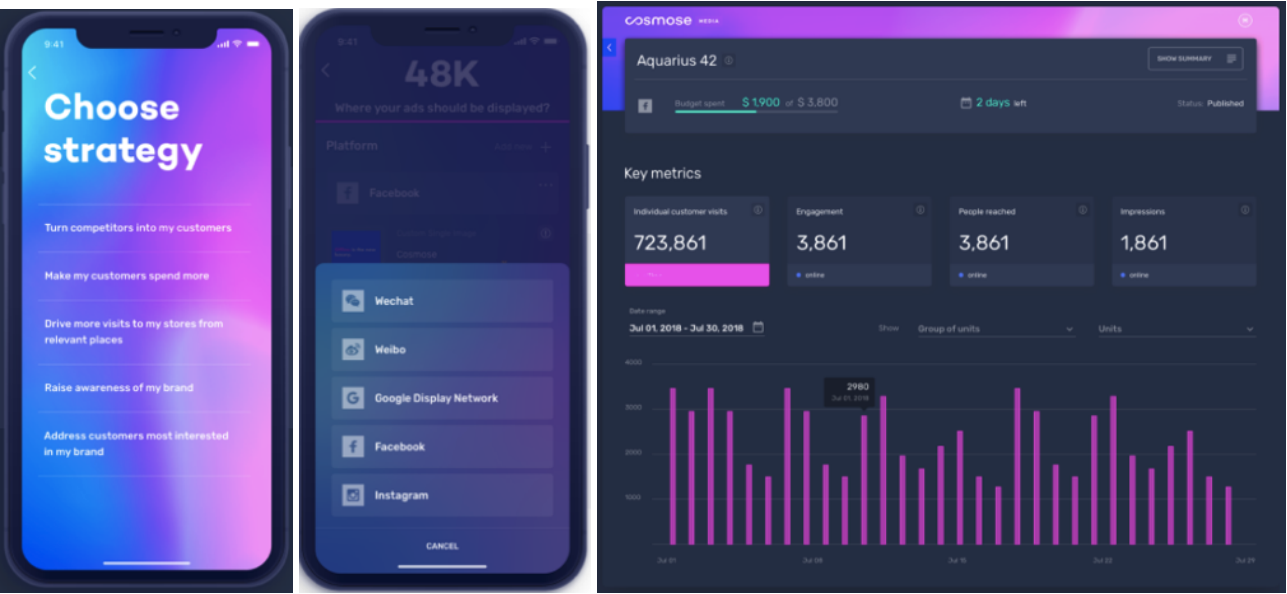

- Cosmose Media: Available via the company’s app, this offering helps brands and retailers send location-based targeted advertisements. Within the app, companies can choose their target audience for advertisements—such as those who visited their stores and left without making a purchase or those visiting competitor stores, among other options. Cosmose has partnerships with 400,000 apps, including cab hailing, food-delivery, social media and weather apps. If a potential customer has downloaded one of its partner apps, Cosmose is able to capture the customer’s behavior in stores even if they have not made a purchase, as it estimates customer location with an accuracy of up to two meters. If the customer leaves the store without purchasing anything, it is considered a lost sale and the retailer has the option to show the customer adverts on select social media platforms. If the customer then returns to the store and makes a purchase, Cosmose attributes it to the advert when calculating the offline conversion rate.

Cosmose Media platform gives brands different options for their advertising strategy and subsequent analytics

Cosmose Media platform gives brands different options for their advertising strategy and subsequent analyticsSource: Cosmose[/caption]

- Cosmose AI: The company’s AI engine uses artificial neural networks to improve the accuracy of location positioning, predict which consumers are likely to visit specific stores, and analyze which consumers should see its client’s marketing campaigns to meet preset sales goals. Cosmose sells this offering to businesses that work with brands and retailers. In September 2020, Cosmose partnered with data and AI company ADA to expand Cosmose’s presence in Southeast Asia. ADA has launched three products powered by Cosmose AI as part of this partnership, serving ADA’s existing clients in fast moving consumer goods, restaurants, retail and shopping malls:

- ADA Media Planning: aims to help retailers recover store traffic once stores fully reopen.

- ADA Location Analytics: aims to deliver anonymized data on consumer behavior.

- Offline software development kit (SDK): aims to help retailers integrate their mobile apps with offline stores and provide a seamless shopping experience.

Figure 4. Entrupy: Key Facts

| Entrupy | |

| Founded | 2012 |

| Founders | Ashlesh Sharma, Lakshminarayana Subramanian, Vidyuth Srinivasan |

| Headquarters | New York, US |

| Business Description | A platform that authenticates luxury goods using AI and computer vision |

| Total Funding Amount | $2.6 million |

Source: Entrupy/Coresight Research

How Has Entrupy Disrupted the Market? Entrupy’s offerings help solve costly issues brought about by counterfeit goods, and fraudulent returns as well as enabling brands, retailers and resellers to provide transparency and authenticity to the products they sell, thereby helping to retain brand value. In 2021, Coresight Research estimated the fashion resale market to have grown to 7.4% of the total fashion market, returning to the pre-pandemic value of $28 billion, and set for further strong growth in 2022 and beyond. Along with growth in demand for resold fashion products, the share of returns and the likelihood of fraudulent returns is bound to increase. The National Retail Federation found that fraudulent returns amounted to $25.3 billion in 2020, accounting for 5.9% of total returns, slightly down from 8.8% or $27 billion in 2019 as total retail sales declined in 2020. With a retail sales rebound in 2021 and expected growth in 2022, returns are likely to be higher, and thus the possibility of fraud, too—increasing retailer demand for applications that can help curb this occurrence. Competitive Advantage: Using Deep Learning To Detect Fakes Entrupy offers three main services:- Luxury authentication: Entrupy’s luxury authentication offering helps businesses to validate handbags from 15 of the largest global luxury brands, including Balenciaga, Burberry, Coach, Hermès, Louis Vuitton and Prada, using AI and advanced computer vision programs. The luxury authentication hardware consists of a mobile device installed with Entrupy’s software. Users move the scanning device over the product to collect images that the device runs through a data warehouse of millions of microscopic surface images obtained from over 200,000 genuine and fake products. The authentication algorithms are trained to distinguish between real and fake items almost instantly, with a 99.1% accuracy rate, according to the company. With each authentication, Entrupy’s algorithms become more sophisticated, learning and improving their datasets. Entrupy provides an authentication certificate for each item verified by its system.

Entrupy’s luxury items authentication system

Entrupy’s luxury items authentication systemSource: Entrupy[/caption]

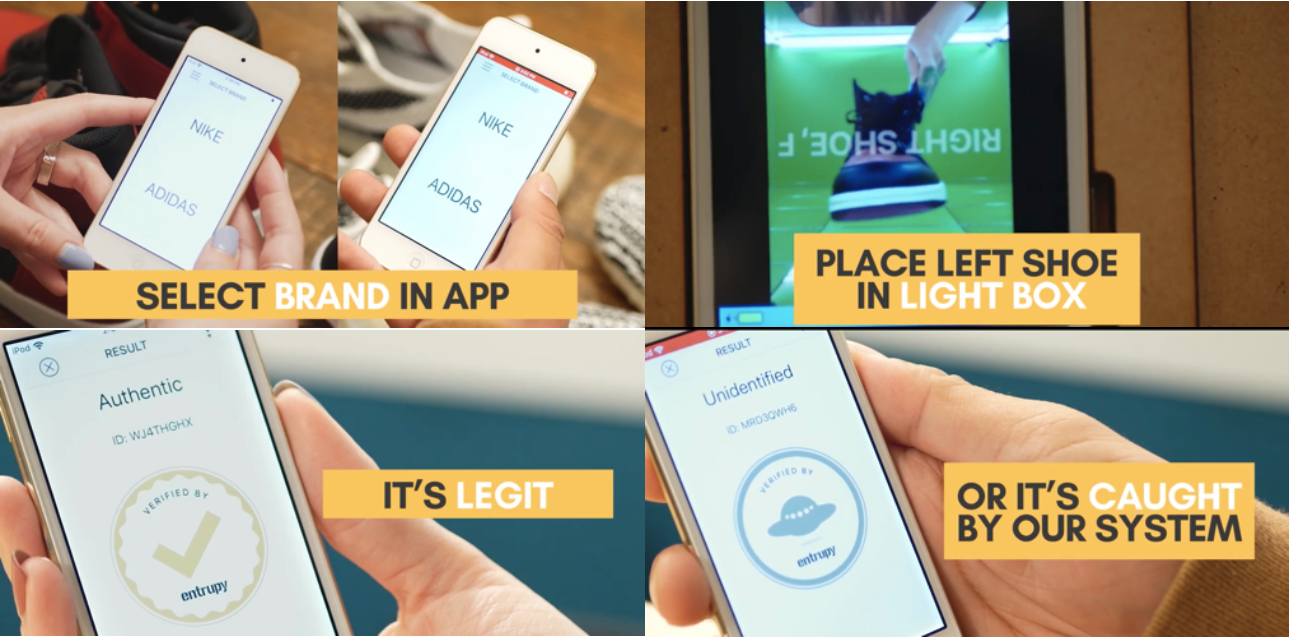

- Sneaker authentication: The company’s sneaker authentication module comprises a box with eight cameras that capture microscopic images of the product placed inside and works alongside an app. Users need to first select the brand on the app and then take a picture of the tag from each shoe. Information from the tag is automatically populated into the app. The user then places one shoe at a time into the box and the cameras capture its intricate details. The system analyzes the images and the tag details, comparing against its own dataset, then indicates whether the sneakers are authentic or not. Currently, the device can only authenticate unused sneakers from NIKE and Adidas with a focus on the Jordan and Yeezy models.

Entrupy’s sneaker authentication system.

Entrupy’s sneaker authentication system.Source: Entrupy[/caption]

- Fingerprinting: Entrupy’s digital fingerprint offering is meant for brands and retailers that want to detect returns fraud or simply maintain a traceable product journey. The solution consists of a scanning device that takes microscopic images of the product at the point of sale, using the company’s scanning hardware. The captured image is associated with a unique ID and if the product is returned, it is scanned again to check that the microscopic images match. Entrupy states that each physical product has unique features which distinguish it from all others, even products made in the same factory or part of the same batch of production. While these unique attributes are invisible to the human eye, Entrupy’s algorithm can discriminate between them using the microscopic images.

Entrupy’s Fingerprinting device capturing the microscopic images of a purse.

Entrupy’s Fingerprinting device capturing the microscopic images of a purse.Source: Entrupy[/caption] Tailwinds and Headwinds The company is likely to experience tailwinds from the growing need for authenticating products as resale and rental platforms proliferate across global markets, along with the rising number of counterfeits. It is likely that brands and retailers experiencing higher online sales are also encountering higher return rates—and the chances of receiving fraudulent items increases proportionately. Entrupy is likely to encounter headwinds including competition from other authenticators, such as Everledger, and technology built in-house by platforms and brands. For example, luxury handbag resale platform Rebag has its own authentication engine named Clair AI. Deploying devices at scale may also pose Entrupy a challenge, as the scanners need to be manually run over each item and its sneaker authentication boxes can only handle one shoe at a time. Impact on Traditional Players Traditional players that experience higher returns rates or those whose customers are seeking evidence of a product’s journey will benefit from Entrupy’s plug-and-play applications. Employing a ready-to-use application will be cost effective compared to developing technologies in-house for most companies—aside from those that have the resources and scale to justify heavy investments. 4. Everledger Everledger helps businesses gather asset information across their supply chains, using a combination of technologies, including blockchain, AI and IoT. The company enables brands and retailers to track and trace the origin, ownership and characteristics of their products and increase supply chain transparency. The company serves the art, apparel, batteries, diamond, gemstones, insurance, luxury goods, and wines and spirits industries. Everledger has raised $39.7 million so far from investors, including China-based multinational holding company Tencent, Japanese e-commerce company Rakuten, and investment and venture capital firms such as Bloomberg Beta, Techstars and TempoCap.

Figure 5. Everledger: Key Facts

| Everledger | |

| Founded | 2015 |

| Founders | Leanne Kemp |

| Headquarters | London, UK |

| Business Description | A blockchain technology company for authenticating luxury goods |

| Total Funding Amount | $39.7 million |

Source: Everledger/Coresight Research

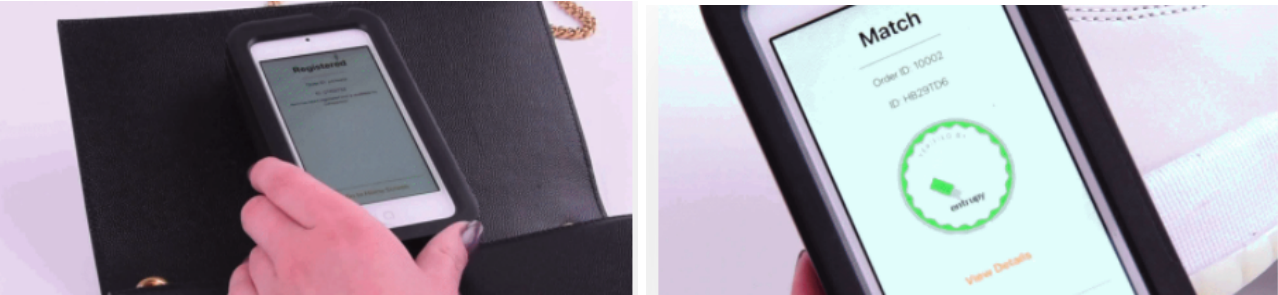

How Has Everledger Disrupted the Market? Customers, employees and investors across sectors are calling for supply chain transparency and accountability. Everledger’s technology helps businesses to maintain a digital ledger, share the provenance of a product accurately and optimize adherence to compliance measures. Everledger uses a variety of technologies depending on the item under verification, meaning that it is one of the few authentication companies able to serve multiple markets. The majority of companies tend to serve specific markets or product categories. Everledger verifies art products with IoT and forensic identifiers to trace the ownership history of the product, while near-field communication (NFC) tags are used in apparel, along with blockchain technology—which ensures its records are secure and permanent. Blockchain technology does not allow anyone to delete or alter ownership information, eliminating the chances of fraudulent activity. Competitive Advantage: Promoting a Circular Economy with Secure Records of Provenance Everledger is committed to promoting a circular economy and serves several industries. For example, Everledger ensures its clients from the diamond and electronics sectors adhere to regulations, including ethical sourcing of raw materials and responsible extraction of minerals, among others. These companies likely work with many suppliers, meaning maintaining accurate sourcing records can be challenging. Everledger collects and populates its records over a single system. Unifying this information helps its clients take further action more efficiently, such as ensuring products are labeled with information that complies with regulations, recycling products and others. In August 2020, Everledger announced a partnership with Chinese e-commerce platform JD.com and the Gemological Institute of America (GIA), to help increase transparency in diamond provenance. Everledger helps feed GIA diamond-grading information into JD.com’s blockchain anti-counterfeiting and tracing platform. The GIA keeps a record of diamonds it has certified. Once a consumer buys an item of jewelry with a GIA-certified diamond on JD.com, the certificate is registered to the buyer on the system using blockchain technology. This ensures ownership registration is secure and cannot be altered. It also eliminates the chances that multiple diamonds are sold using the same report. Customers can access verified diamond certificates and origin information through JD.com’s app and its desktop and mobile websites. [caption id="attachment_139372" align="aligncenter" width="280"] A GIA certificate showing the registration of the diamond to a consumer.

A GIA certificate showing the registration of the diamond to a consumer.Source: Everledger[/caption] In 2020, Everledger also partnered with fashion house Alexander McQueen to launch a blockchain-powered peer-to-peer platform called MCQ for the label’s products. The platform’s users can access a host of information about the company’s offerings, such as the source of the garment, the number produced and when they were made. The clothes come with a near-field communication (NFC) tag—NFC is a set of communication protocols, and the tags contain the information about the product. Users can swipe their phones across the tag to access product information. Further detail on the product’s journey is recorded on the blockchain platform. [caption id="attachment_139373" align="aligncenter" width="480"]

An Alexander McQueen product with the NFC tag.

An Alexander McQueen product with the NFC tag.Source: Everledger[/caption] Tailwinds and Headwinds Everledger is well positioned to serve the increasing demand for transparency and sustainability in supply chains—particularly in luxury, where it is imperative for brands to establish the authenticity and provenance of the raw materials used in production. However, Everledger is dependent on third parties to enable the recording of product movements through the supply chain. Failure of these parties to correctly record information may defeat the technology’s purpose. Impact on Traditional Players Established retailers and brands can leverage such technologies to maintain records and ensure adherence to compliance procedures. A number of retailers have already implemented the technology to track items through the product lifecycle, from raw materials to the finished product. We expect the use of blockchain to proliferate across industries further as deployment costs reduce and the technology advances further. 5. Savitude Savitude offers digital design applications that combine analytics and efficiency with creativity. It helps designers and brands to streamline the design process without compromising aesthetics or inventiveness. The company’s software allows designers to create custom designs based on over 700 body-type templates. Its applications facilitate the inclusion of various trends, inspirations and body types, accelerating the process while allowing designers autonomy to make changes as needed. To date, Savitude has raised $600,000 from about 13 investors, according to the company and data from Crunchbase. In November 2020, Savitude was chosen for the five-month Startupbootcamp STAR virtual program in Milan, Italy, with Prada, Valentino and Accenture as partners.

Figure 6. Savitude: Key Facts

| Savitude | |

| Founded | 2016 |

| Founder | Camilla Olson |

| Headquarters | Palo Alto, California |

| Business Description | A digital ideation and design solutions provider that leverages analytics and AI to improve the efficiency of fashion design |

| Total Funding Amount | $600,000 |

Source: Savitude/Crunchbase/Coresight Research

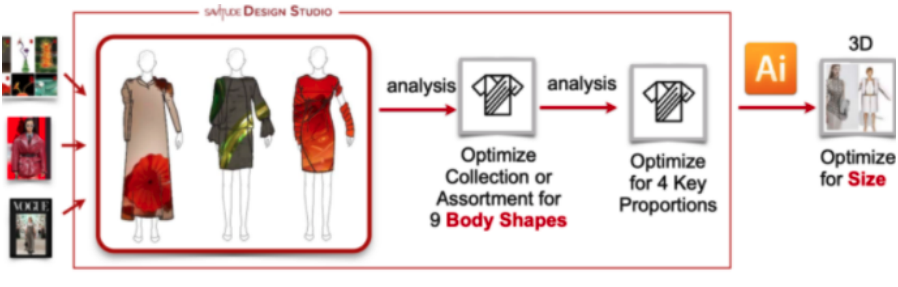

How Has Savitude Disrupted the Market? Savitude intends to solve recurring problems for both consumers and fashion designers. Savitude’s software, called Design Studio, aims to aid designers to create products that are better suited to consumers’ unique body sizes, shapes and types—ultimately helping consumers find well-fitting clothes. Savitude’s AI-powered digital design suite also helps designers speed up the design process and find new ideas, enabling them to quickly incorporate fleeting consumer trends and demands. In the luxury sector, delivering exclusivity and speed in design is crucial for brands to stay ahead of the market. Savitude can help luxury brands maintain exclusivity by designing quickly and dramatically reducing time to market. [caption id="attachment_139374" align="aligncenter" width="700"] An illustration of Savitude’s Design Studio platform

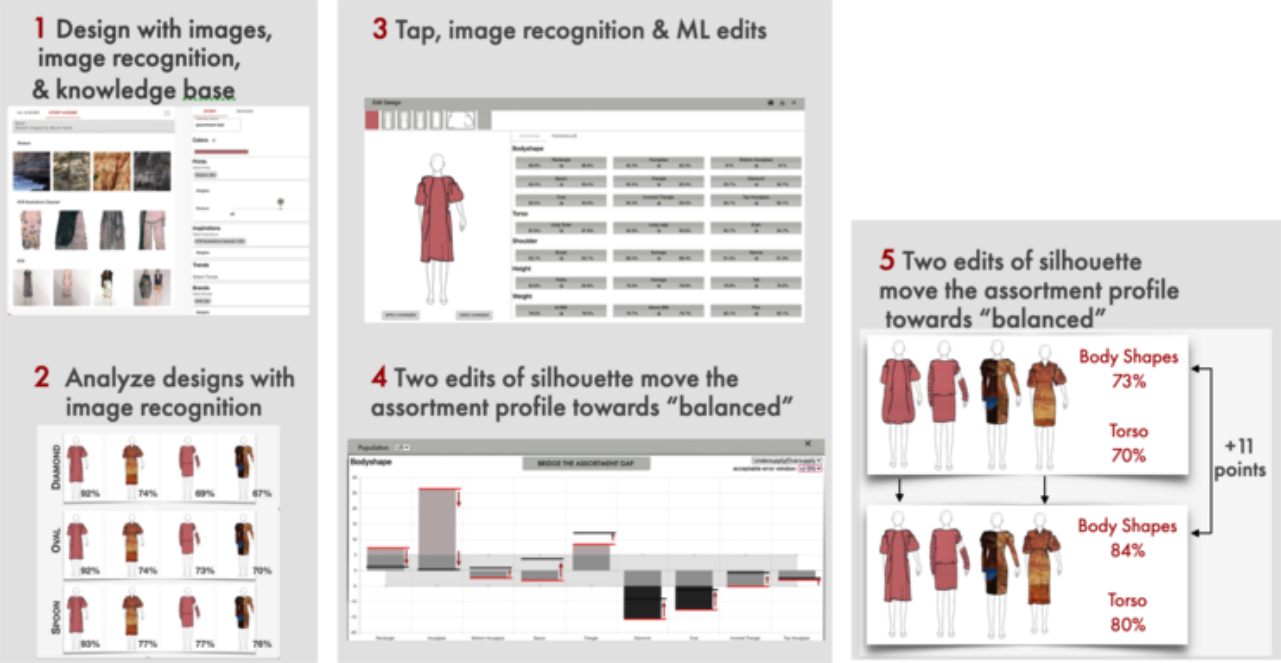

An illustration of Savitude’s Design Studio platformSource: Savitude[/caption] Competitive Advantage: Combining On-Trend Fashion Data with the Design Process Most existing software applications in the market serve a single design purpose, such as efficiency but not creativity or vice versa. However, Savitude enables brands and designers to envisage ideas both more efficiently and creatively. The company helps to integrate trends, inspiration and “brand DNA” (the unique look and feel that runs through a brand’s products) effortlessly into designs. For a particular item of clothing, users select the features they would like the AI application to consider when generating customized designs. Users can also determine the degree of the three inputs—inspiration, brand DNA and trends—that the software should consider in the output designs, using sliders ranging from 0 to 100. Users can then integrate brand identity into the automatically generated designs by uploading sketches or images of the brand’s previous clothing or archive. [caption id="attachment_139375" align="aligncenter" width="700"]

A visualization of the steps prior to generating AI-created designs on the Savitude platform

A visualization of the steps prior to generating AI-created designs on the Savitude platformSource: Savitude[/caption] Savitude states that its software generally saves designers at least four weeks, a critical amount of time in a market that is increasingly seeking on-demand fashion and short lead times. While conventional design ideation alone typically takes between two and 12 weeks, Savitude notes that its ideation process takes as little as five minutes and a maximum of five days. Savitude’s offerings include templates that are adapted to hundreds of body types, allowing users to break from the convention of focusing on the hourglass figure and to be flexible designing for all shapes and sizes. This could help cut down consumer returns due to poor fit. In a November 2020 survey, Coresight Research found that over half of consumers who had returned a product in the last 12 months had returned clothes, primarily due to poor fit. The company’s digital design software can also help cut the down time and costs associated with the pre-production process, which typically involves product development and sampling. As Savitude’s process is entirely digital, users can visualize thousands of designs, making fewer physical samples, which are largely discarded at the process’s end. Tailwinds and Headwinds The luxury sector thrives on exclusivity and bespoke design, and Savitude’s offerings can help deliver customers a high level of exclusivity. Luxury brands are likely to find themselves in a more competitive environment to make up for lost sales during the pandemic—and they will look to strategies that can give them the additional edge to serve existing customers and gain new ones. The ability to provide highly customized designs in a short span of time will help brands bring collections to market faster and more efficiently, as well as catering to consumers more quickly. Savitude’s digitalization and optimization of the design process may also help promote sustainability in fashion—an issue that is increasingly under intense scrutiny for brands, consumers and retailers alike. Brands and retailers can reap significant benefits from emphasizing sustainability within their strategies: some 56% of global consumers report willingness to pay, on average, a 35% premium for sustainably made products, according to a 2020 survey by the National Retail Federation. Furthermore, growing uncertainties, including the pandemic, political and diplomatic conflicts, and unforeseen climate events have increased demand for more resilient and agile supply chains. Digital design and product development equips brands and designers with greater control and visibility over pre-production cycles, as well as shortening lead times to bring products to market. We think these factors will help support demand for Savitude—however, the company is likely to face a few headwinds that will impact growth. Other companies offer digital body measuring and design, such as 3DLOOK and Unmade. In addition, clothing sales have been the hit hard during the pandemic, which might impact Savitude’s growth in the medium term. Impact on Traditional Players We expect luxury brands, retailers and e-commerce players to continue seeing increased online sales and returns. The ability to incorporate better sizing and fit data into their products at the design stage could help bring down some of the returns costs associated with increased online sales.

What We Think

The luxury sector saw a strong rebound in 2021 after a steep decline in 2020, and there is likely to be intense competition among industry players as they try to maintain sales momentum in the coming year. Companies should look to enhance their competitive edge and embrace technologies that enable innovation solutions. Implications for Brands/Retailers- Consumers are increasingly seeking sustainability: In the products they buy, the way they are made and their recyclability. Four of the five startups profiled here focus on materials produced sustainably and those that can be recycled safely, and on verifying the authenticity of products, typically on resale/rental platforms.

- Cosmose focuses on analyzing offline consumer behavior; while offline retail was severely impacted through 2020 and despite a resurgence in 2021, it is likely to take a hit with the threat of the Omicron variant and further uncertainty through the year

- Companies should look to innovate further in the luxury space, as many retail technology applications tend to be created for general retail and do not focus on the exclusivity of luxury. Blockchain technology and innovation in sustainable materials have immense scope for success in luxury due to the exclusivity they can deliver.