albert Chan

What’s the Story?

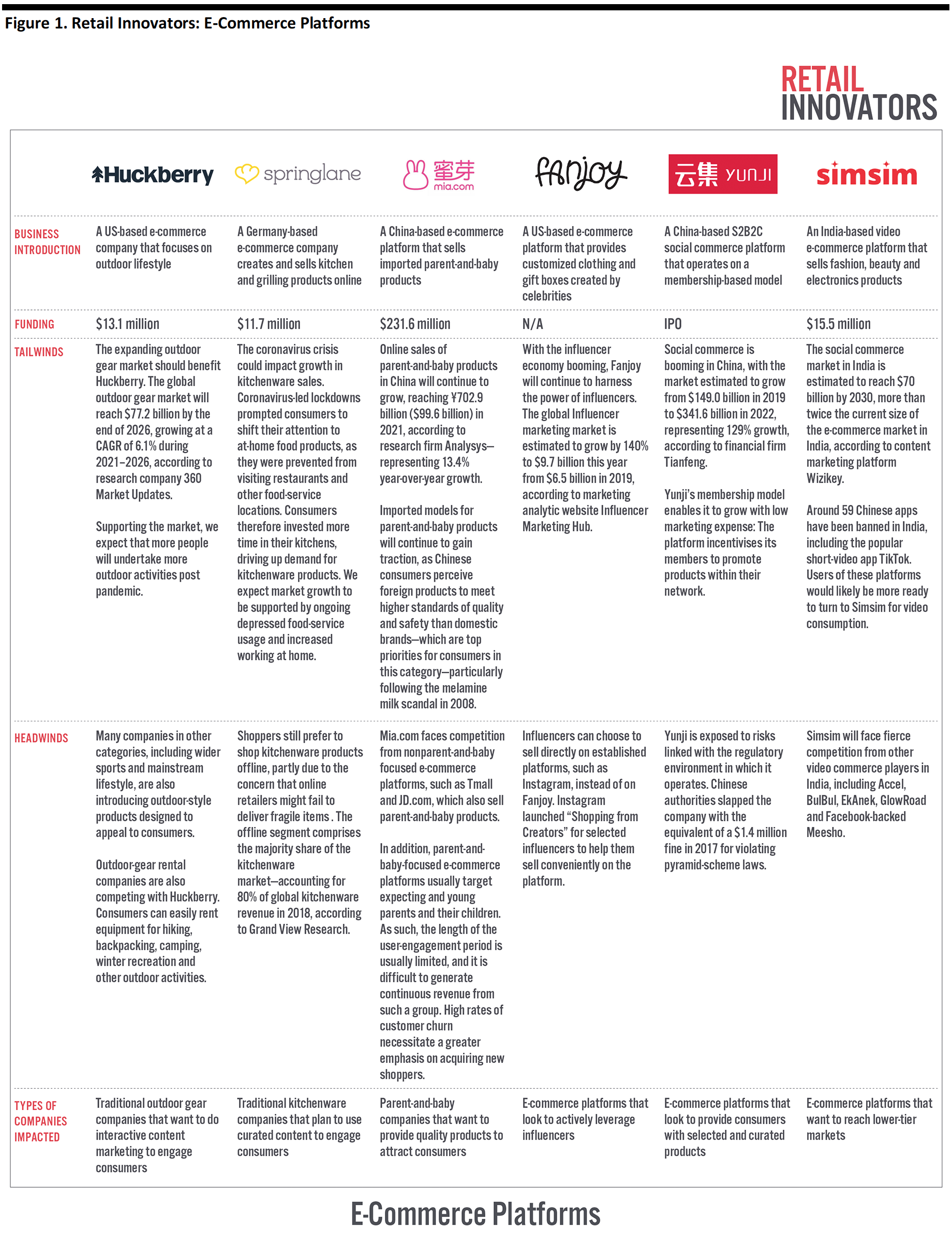

With increasing e-commerce adoption, we are seeing more innovative players emerge in the online retail market. The Covid-19 pandemic has driven the use of e-commerce by shoppers due to temporary brick-and-mortar store closures and widespread stay-at-home orders.

In this report—which is part of the Coresight Research Retail Innovators series—we take a look at six e-commerce platforms (founded since 2011) that are disrupting the e-commerce market.

Why It Matters

We discuss these industry players in the context of changing consumer behavior in the e-commerce sector and the influence of social commerce. We provide company profiles and consider the following key topics for each innovator, covering different sectors, such as apparel and kitchenware:

- How the company has disrupted the market—including growth strategies and omnichannel ecosystems landscape

- Tailwinds and headwinds

- Impact on traditional players

Source: 360 Market Updates/Analysys/company reports/Influencer Marketing Hub/Tianfeng/Wizikey/Coresight Research[/caption]

Source: 360 Market Updates/Analysys/company reports/Influencer Marketing Hub/Tianfeng/Wizikey/Coresight Research[/caption]

E-Commerce Innovators: A Deep Dive

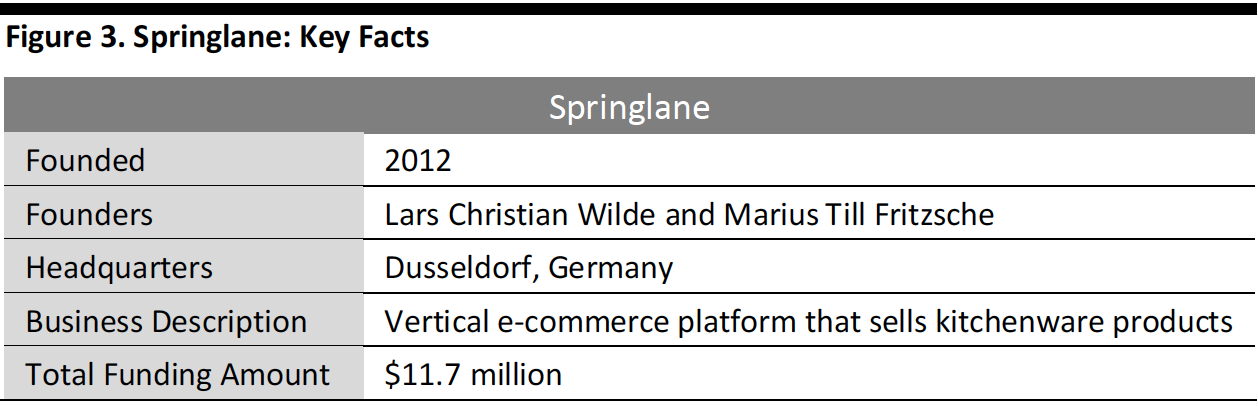

Huckberry

Founded in 2011, Huckberry is a US-based e-commerce company that focuses on outdoor lifestyle. It mainly sells outdoor gear to male consumers for outdoor adventures. The company also sells men’s apparel, sneakers, sunglasses and other accessories. The products sold on the platform are from third-party brands—such as shoe brand XTRATUF and fashion brand Evergoods—as well as its own brands (e.g., menswear brand Wellen). The company is based in San Francisco, California, with offices in Columbus, Ohio.

Huckberry has raised $13.1 million in funding so far, according to community-based competitive-insights platform Owler. Its investors include members of the Nordstrom family. The company’s revenues rose 9,900% year over year to $1 million in 2018. Huckberry was named as one of the Interactive Advertising Bureau‘s most disruptive consumer brands of 2019.

[caption id="attachment_115245" align="aligncenter" width="700"] Source: Crunchbase/Company reports/Coresight Research[/caption]

Source: Crunchbase/Company reports/Coresight Research[/caption]

How Has Huckberry Disrupted the Market?

Huckberry uses content marketing to build credibility and establish its reputation as a go-to source of information for its customers. Consumers can find interesting discoveries for outdoor adventure (e.g., music playlists, book picks, travel guides) through the retailer. The company shares content via various formats, including Huckberry’s blog (called “Journal”), website, email and social media channels, such as Instagram.

The attractive and engaging nature of Huckberry’s content helps the company to connect with shoppers who are not yet customers and increases the likelihood of the content being shared among wider networks—consumers could mention content to their contacts or recommend a product to their friends as a holiday gift.

One example of the platform’s content is from its recent blog post published on July 16, 2020, in which Huckberry’s photographer Bryson Malone shared why everyone should have a point-and-shoot camera. The content was curated through a personal story perspective.

[caption id="attachment_115246" align="aligncenter" width="450"] Source: Company website[/caption]

Source: Company website[/caption]

Furthermore, the company has made active acquisitions to extend its supply chain—enabling it to produce its own products. Huckberry acquired clothing manufacturing brand Flint and Tinder in 2016 and premium menswear brand Wellen in 2018. These acquisitions gave the company the ability to create products that customers can buy only through Huckberry, and tell the story of how these products came to be. For instance, for the Flint and Tinder waxed trucker jacket, the company told a story that links the clothes to Levi Strauss and to fishermen from Scotland. The company was not only able to display its own outdoorsy brand aesthetic but also leverage the credibility from the big brand.

[caption id="attachment_115247" align="aligncenter" width="550"] Flint and Tinder waxed trucker jacket

Flint and Tinder waxed trucker jacketSource: Company website[/caption]

Leverage Influencer Marketing

To amplify its story, Huckberry worked with companies that already had an impact on their core audiences. This enabled Huckberry to gain credibility in a market full of ultra-credible players. For example, Huckberry partnered with famous boots brand Danner to release the tactical hiking boot Fullbore.

[caption id="attachment_115248" align="aligncenter" width="500"] Hiking boot Fullbore

Hiking boot FullboreSource: Instagram[/caption]

Through cooperation with well-known brands, Huckberry is building a network to support its story as a true outdoor brand. Without these partnerships, Huckleberry’s story would not have the same impact.

The platform also had an ambassador program in which it would work with influencers who were fitting to the outdoor lifestyle brand. The retailer set up a dedicated page for each influencer—where the influencer shares his/her favourite gear on the platform. For instance, the retailer worked with Johnie Gall, who is a writer, photographer and environmental advocate.

[caption id="attachment_115249" align="aligncenter" width="500"] Influencer Johnie Gall’s page on Huckberry

Influencer Johnie Gall’s page on HuckberrySource: Company website[/caption]

Tailwinds and Headwinds

With consumers’ increasing participation in outdoor activities, the outdoor apparel, footwear and gear market is growing. The global outdoor gear market, including outdoor apparel, equipment and gear, as well as outdoor footwear, will reach an estimated $77.2 billion by the end of 2026, growing at a CAGR of 6.1% during 2021–2026, according to research company 360 Market Updates.

There is likely to be a boom post pandemic, too. We expect that more people will undertake outdoor activities, as they were constrained at home due to forced quarantines and have typically avoided enclosed spaces in favor of lower-risk open spaces. A reduction in international travel and consequent boost to staycations may also support outdoor gear in some markets. We have seen a post-crisis increase in demand for outdoor gear in China. Sports retailer Decathlon launched a 24-hour sales campaign together with Alibaba’s Tmall e-commerce platform on April 24, 2020—through which it sold protective sports gear, skateboards and roller blades, outdoor apparel and tents on the platform. Decathlon saw sales of its outdoor products rise considerably during the campaign, and the company sold around 10,000 trampolines in just 10 minutes before running out of stock.

However, there will be some headwinds that are likely to drag on growth. Many companies in other categories, including wider sports and mainstream lifestyle companies and supermarket chains, are also introducing outdoor-style products designed to appeal to consumers. For instance, Walmart launched a line of backpacking gear, called Lithic, on May 14, 2020—the prices of these products are as much as 40% cheaper than similar products in the market.

Outdoor-gear rental companies are also competing with Huckberry. Consumers can easily rent equipment for hiking, backpacking, camping, winter recreation and other outdoor activities; this means that they do not have to pay a higher price to buy equipment that they only use once in a while.

Another challenge for the outdoor sector as a whole, not only Huckberry, is that it needs to continue to deliver exciting and functional products and services to its core consumers, while also finding ways to attract new customers—such as through visually appealing product designs, as outdoor products usually focus on function over style and fashion.

Impact on Traditional Players

Content marketing is a great way for companies to engage, attract and retain consumers. Many traditional outdoor gear brands also actively use content marketing:

- Sports brand REI has started to share engaging stories on its Instagram account, from outdoor recipes to how to design an outdoor tent.

- Dick’s Sporting Goods has adopted an interactive approach to engaging with consumers—for instance, asking consumers on Instagram their thoughts on a perfect summer hiking spot.

Legacy multicategory outdoor retailers will likely face competition from Huckberry.

Springlane

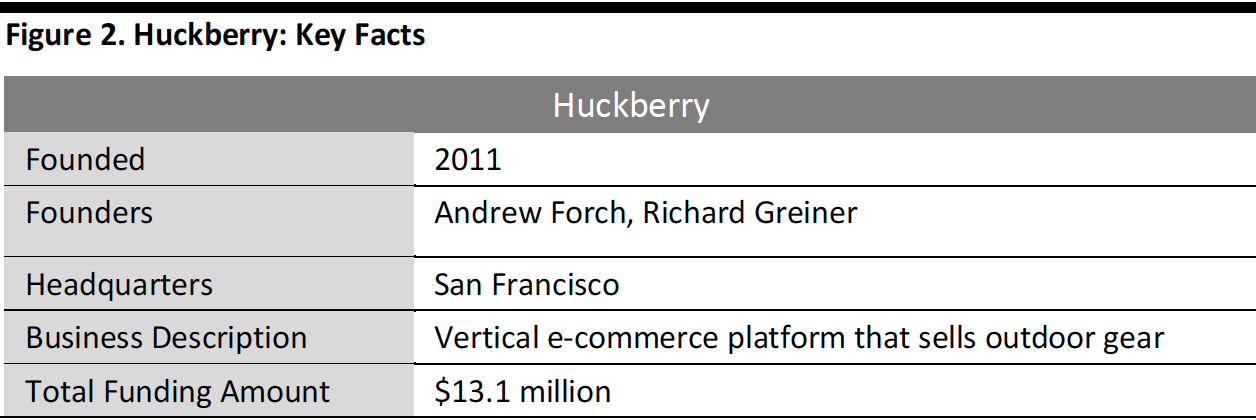

Founded in 2012, Springlane is a Germany-based e-commerce platform that creates and sells kitchen and grilling products, such as ice-cream machines, mixers, pasta machines, pots and crockery. The platform has products from well-known brands, such as Delonghi and Zwilling, as well as from its own private-label brands, including “Springlane Kitchen” and “Burnhard.” It also shares content on cooking tips and recipes.

The company has raised $11.7 million in funding so far, according to business intelligence platform Crunchbase. It operates in Austria, France, Germany, Italy, Spain and the UK.

[caption id="attachment_115250" align="aligncenter" width="700"] Source: Crunchbase/company reports/Coresight Research[/caption]

Source: Crunchbase/company reports/Coresight Research[/caption]

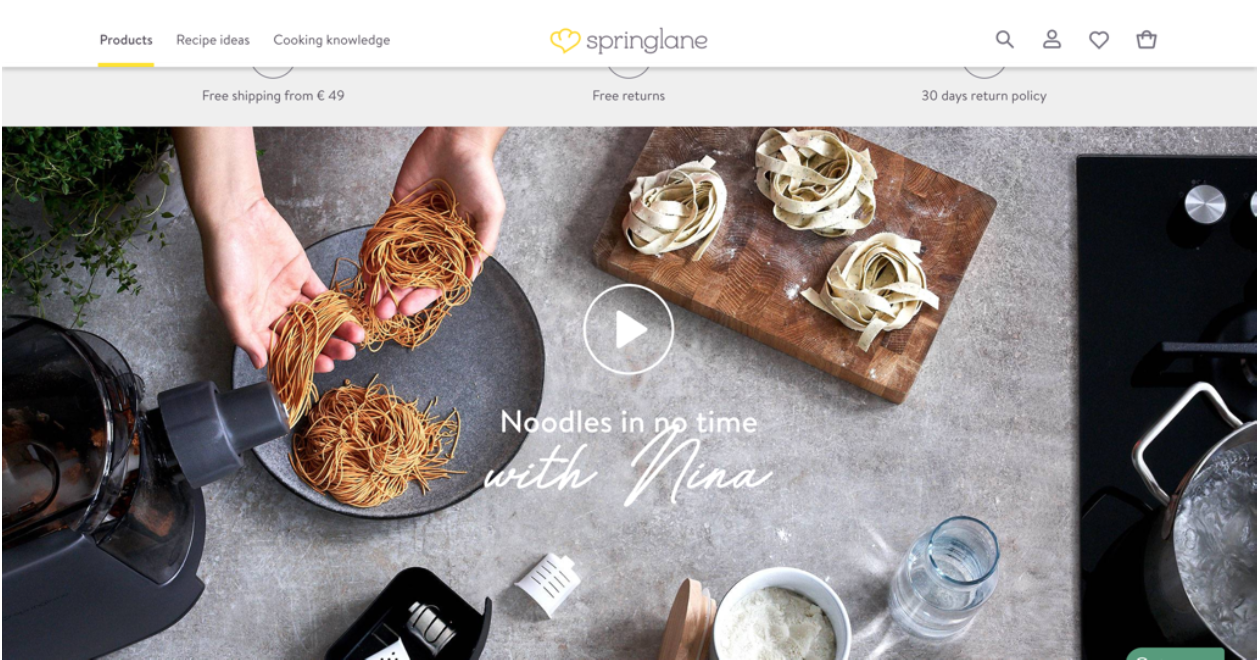

How Has Springlane Disrupted the Market?

Springlane’s strategy centers around building an active food community in which consumers share content for cooking, baking and grilling. The platform actively shares recipe ideas and cooking knowledge to engage with consumers. Springlane tries out different recipes in its own test kitchen and shares them with its customers—who can also glimpse behind the scenes of Springlane, such as by seeing the decoration style in the test kitchen.

[caption id="attachment_115251" align="aligncenter" width="500"] Springlane’s test kitchen

Springlane’s test kitchenSource: Company website[/caption]

Springlane makes efforts to develop kitchen products that are fun and make everyday cooking easier. For instance, it designed the “Hugo Springlane Table Grill” which is a smoke-free charcoal grill with active ventilation: Consumers can easily use it indoors or on a balcony as it is smoke-free. The shape and design are interesting and mimic the open grill in the garden. The charcoal grill is portable and offers a round and large grill area for frequent use.

[caption id="attachment_115252" align="aligncenter" width="500"] Hugo Springlane Table Grill

Hugo Springlane Table GrillSource: Amazon[/caption]

Integrate Content and Commerce

The creation of content for the community is a significant area for Springlane. This prompted the company to focus on creating a shop system that optimally integrates content and commerce.

Springlane had product detail pages with a full-surface design, appealing pictures and detailed explanations and invites customers to rate their purchases. Product videos are also integrated into product detail pages, with explanations of how to use the products correctly. The customer can also access relevant recipes through the product page.

[caption id="attachment_115253" align="aligncenter" width="500"] A product video on Springlane’s website

A product video on Springlane’s websiteSource: Company website[/caption]

Tailwinds and Headwinds

The coronavirus crisis could drive growth in kitchenware sales. Coronavirus-led lockdowns prompted consumers to shift their attention to at-home food-related products, as they were prevented from visiting restaurants and other food-service locations. Consumers therefore invested more time in their kitchens, driving demand for kitchenware products. We expect ongoing depressed food-service usage and increased working at home to support market growth.

The cookware and bakeware segments in particular are likely to see growth. Bakeware was estimated to register the fastest CAGR, of 5.0%, in the forecast period, according to Grand View Research. This estimate was made before the pandemic, and we expect that growth will be further accelerated by the crisis, as some consumers, finding that they had more time amid lockdown, turned to home baking—accelerating an existing trend fueled in part by popular content such as The Great British Bake Off—which drove sales of bread makers. This habit will likely continue for a while after the crisis calms down.

One main challenge for Springlane is that shoppers still prefer to shop for kitchenware products offline, partly due to the concern that online retailers might fail to deliver fragile items carefully. According to Grand View Research, the offline segment comprises the majority share of the kitchenware market—accounting for 80% of global kitchenware revenue in 2018.

Impact on Traditional Players

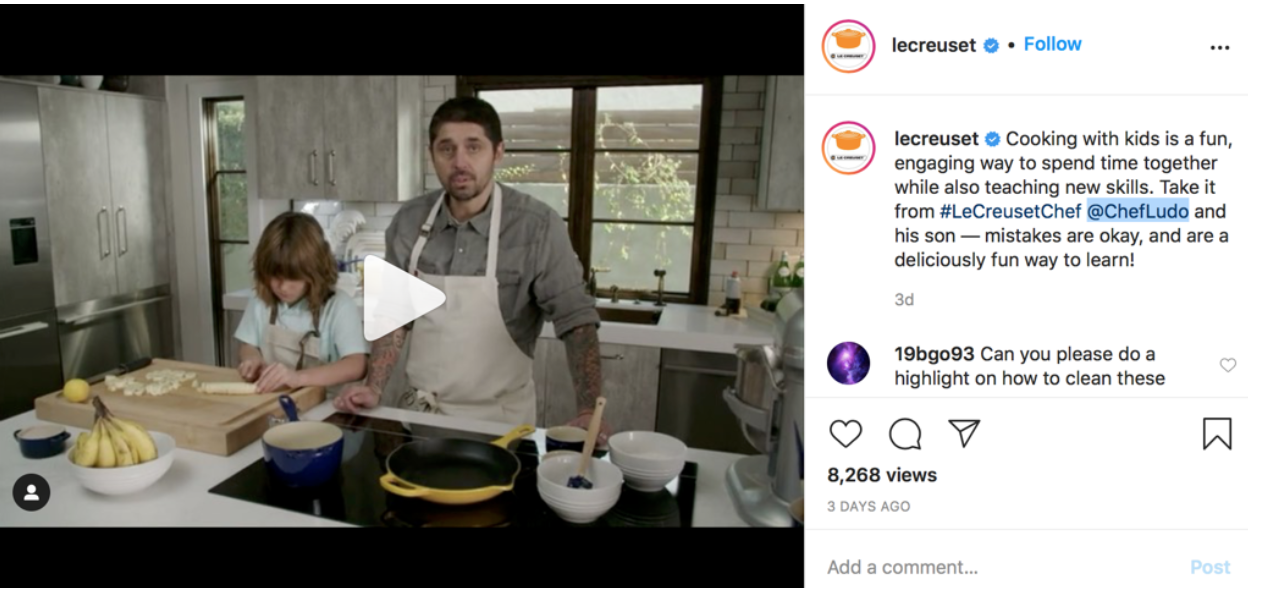

Producing curated content is helpful in building a community for consumers. Some big-name kitchenware brands have begun to do this. For instance, Le Creuset worked with Chef Ludo, who has 182,000 followers on Instagram, to create a campaign to reach its target audience. Ludo launched a video showcasing how to cook with kids together during quarantine-at-home time. The video gained 8,341 views within four days of its launch on July 21, 2020.

[caption id="attachment_115254" align="aligncenter" width="500"] Source: Instagram[/caption]

Source: Instagram[/caption]

In a connected, social environment, kitchenware companies who fail to innovatively engage with consumers through quality content may fall behind. Especially in more premium segments, we see successful kitchenware brands merging into lifestyle brands (e.g., UK-based kitchenware manufacturer Joseph Joseph). Similarly, retailers must connect with consumers in ways that resonate beyond functionality. Brands and retailers must make efforts to produce products that are fun as well as those that make everyday cooking easier.

Springlane is a new, albeit niche, competitive threat for department stores—already challenged by newer rivals—in the category of kitchen products. In Germany, Galeria Karstadt Kaufhof is the leading department store company. Legacy specialist kitchenware retailers will likely also face competitive challenges from Springlane.

Mia.com

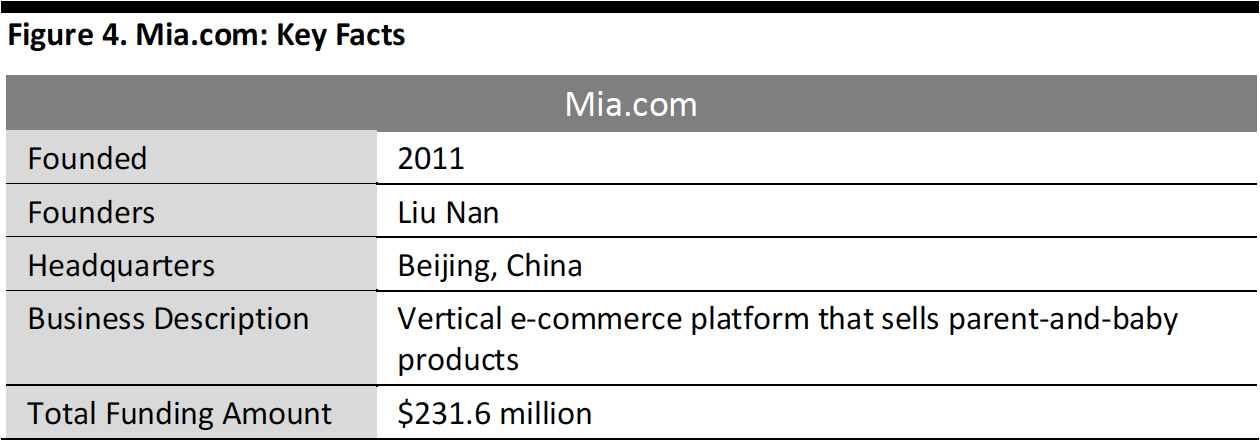

Founded in 2011, Mia.com is a China-based e-commerce platform that sells imported parent-and-baby products, including diapers, infant formula, toys and baby clothes in China. The company also provides private-label products, such as Mompick. Its customers are mainly middle- and high-income families. Around 60% of Mia’s consumers are from Tier 1 or 2 cities in China, with a good education and high income, according to research firm Juyimei.

Mia.com has raised $231.6 million in funding so far, according to Crunchbase. The company was valued at $1 billion by a $150 million fundraising round in September 2019.

[caption id="attachment_115255" align="aligncenter" width="700"] Source: Crunchbase/Company reports/Coresight Research[/caption]

Source: Crunchbase/Company reports/Coresight Research[/caption]

How Has Mia.com Disrupted the Market?

Mia.com positions itself as a one-stop platform where consumers can shop, exchange ideas and seek help in the area of parenting. The company is highly aware of the importance of providing value-added service, such as parenting tips, to engage with consumers: Mia.com added a live classroom on its app that provides a professional platform for sharing parenting tips as well as for consumers to share their experiences and/or questions about using products.

[caption id="attachment_115256" align="aligncenter" width="300"] Live classroom offerings on Mia.com

Live classroom offerings on Mia.comSource: Company website[/caption]

Another significant feature on Mia.com is Mia Moments, a function similar to Facebook feeds. Users can share their shopping list and tag brands in their posts. Audiences can then click the tag to be directed to the brand’s product page from which they can add items into shopping carts and place orders. Users can follow popular accounts and also be friends with each other—enabling them to view more content.

Serve a Wide Range of Consumers and Expand Offline

Mia.com also serves customers lower-tier cities, which are seeing high numbers of newborns; data firm Muyinguancha reported that around 80% of newborns are from Tier 3–6 cities in 2019.

The company has previously reported that consumers in Tier 1 and Tier 2 cities are more likely to purchase underwear, snacks and smart appliances, whereas shoppers in lower-tier cities prefer to buy apparel, latex pillows and juice extractors.

Mia.com has launched stores offline:

- It partnered with the RYB Education Institution, China’s leading education center, to set up offline sales channels in over 1,300 kindergartens across 300 cities.

- Mia.com has collaborated with the Tianyu Hotel in the Hainan province to open a 3,000-square-foot store in the hotel, at which it sells imported commodities such as feeding supplies, snacks, outdoor water toys, luggage, skincare products and other products that are frequently used during vacation.

Mia.com’s shop in Tianyu Hotel

Mia.com’s shop in Tianyu HotelSource: Weibo[/caption]

Tailwinds and Headwinds

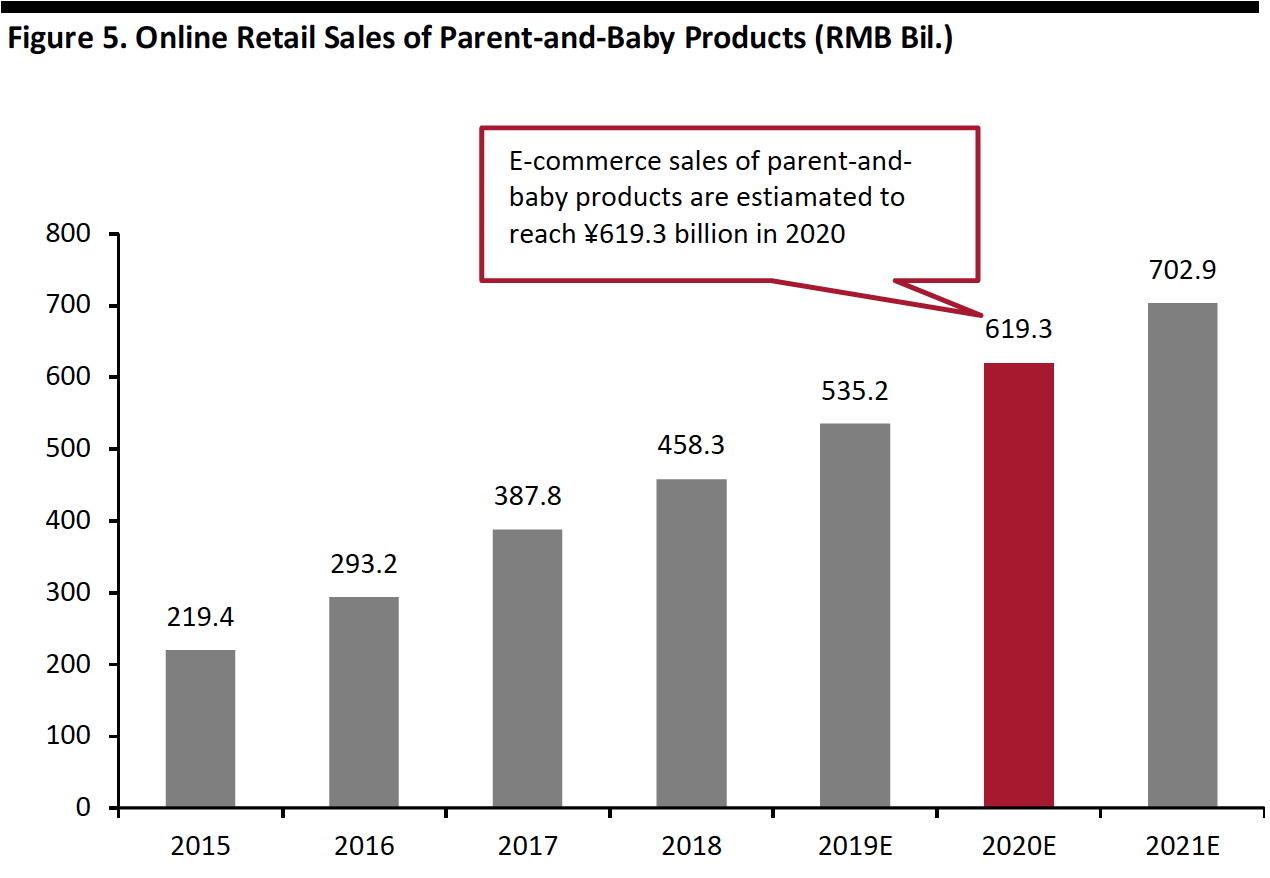

The Chinese market for parent-and-baby products has grown rapidly in recent years, with online retail sales growing at a CAGR of 23.1% between 2015 and 2020, reaching ¥619.3 billion ($88.7 billion) in 2020, according to Analysys. Online sales of parent-and-baby products are projected to reach ¥702.9 billion ($99.6 billion) in 2021.

[caption id="attachment_115258" align="aligncenter" width="700"] Source: Analysys[/caption]

Source: Analysys[/caption]

Imported models for parent-and-baby products will continue to gain traction, as Chinese consumers often perceive foreign products to meet higher standards of quality and safety than domestic brands—which are top priorities for consumers in this category—particularly following the melamine milk scandal in 2008.

The popularity of international brands is demonstrated by their performance in the build up to Singles’ Day 2019 (Alibaba’s annual Chinese shopping holiday on November 1). On October 21—the first day of the Singles’ Day pre-sales period on Tmall—NIKE achieved ¥65.2 million ($9.2 million) in sales of baby clothing and footwear products, and Aptamil reached ¥27.3 million ($3.9 million) for its infant formula, according to ECdataway.

In terms of headwinds, Mia.com faces competition from nonparent-and-baby-focused e-commerce platforms, such as Tmall and JD.com. Tmall was the biggest online platform for the parent-and-baby category in 2018, accounting for an estimated 52.9% in online business-to-consumer sales, according to research firm CBNData. The second-biggest e-commerce player was JD.com, accounting for 17.7% of online sales in the sector.

Also, parent-and-baby-focused e-commerce platforms usually target expecting and young parents and their children. As such, the length of the user-engagement period is usually limited, and it is difficult to generate continuous revenue from such a group. In turn, this implies a need for sustained customer acquisition efforts and associated marketing costs.

Impact on Traditional Players

Mia.com’s imported model, which provides consumers with assurance about product quality, has made some players actively look for ways to work with foreign brands. For instance, Babytree, a parenting forum that has an e-commerce site called Meitun Mama, has announced its strategic cooperation with Tokyo MX, a Japanese TV station, to source quality Japanese consumer goods for parents and babies in China. In the future, the company plans to partner with more Japanese brands to source high-quality items for Chinese moms and their families.

E-commerce companies that fail to deliver quality parent-and-baby products will likely lose market share, as consumers are more willing and eager to buy quality products, partly due to the melamine milk scandal, as well as rising family income.

Offline parent-and-baby retailers will also likely face fierce competition from Mia.com. Examples include Chinese department store operator Tianhong, which runs stores that sell imported parent-and-baby products.

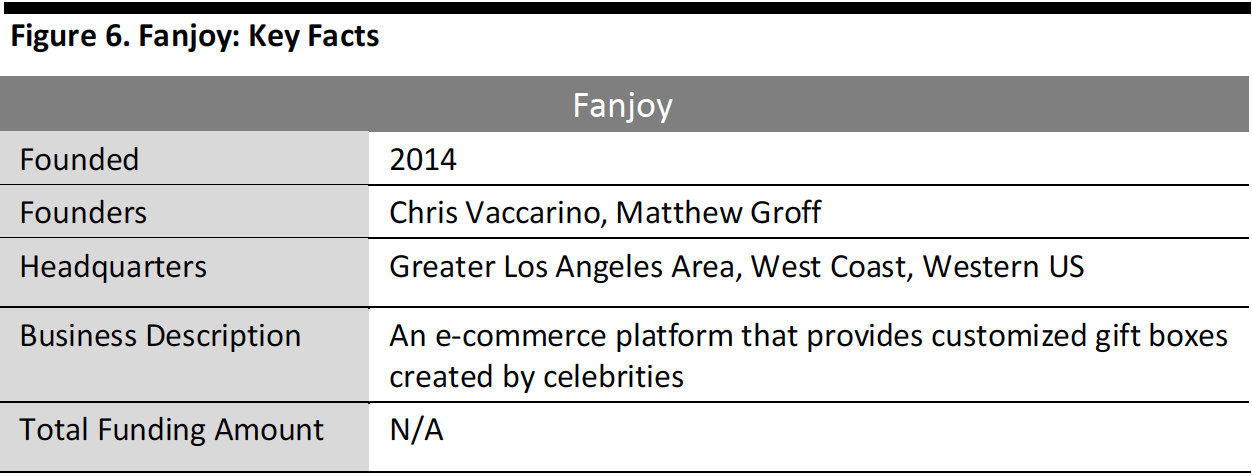

Fanjoy

Fanjoy, founded in 2014, is an e-commerce platform that provides customized clothing and gift boxes that are created by celebrities. Each artist and influencer (e.g., Hilary Duff, Jake Paul, Mariah Carey and Pentatonix) creates meaningful products based on their real-life experiences, interests and expertise. Products include fashion items (e.g., apparel), toys and DIY items.

Fans can buy individual items or subscribe to receive products on a quarterly basis. For the subscription box, the contents are kept as a surprise for customers.

Fanjoy has kept its funding status private, but the company has seen steady growth—it reached net sales of $16.9 million in 2019 from $1.2 million in 2016, according to data platform ecommerceDB.

[caption id="attachment_115259" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

How Has Fanjoy Disrupted the Market?

Fanjoy’s primary differentiator is its ability to leverage the enormous reach and influence of artists/influencers, as well as to fulfill fans’ desire to connect with the celebrities that they look up to.

Fanjoy provides each fan with insights of what these artists love, as well as surprising them by adding some new artist merchandise inside each box. Products relate to each celebrity’s favourite foods, interests and hobbies or their expertise, such as music.

The company also helps artists to do roadshows to market products. For instance, it worked with famous Youtube celebrity Jake Paul to launch a merchandise truck tour. Fanjoy had Paul’s Fanjoy store URL printed on each truck tire.

[caption id="attachment_115260" align="aligncenter" width="500"] Youtuber Jake Paul’s merchandise truck

Youtuber Jake Paul’s merchandise truckSource: YouTube[/caption]

Source For New Influencers and Organize Offline Events

The company is constantly scouring the Internet for new influencers to collaborate with. It pays close attention to platforms where new superstars are emerging, including different apps, such as short-video platform TikTok. The company tries to discover new talent before anyone else.

Fanjoy has also expanded into live events. It organizes pop-up shops that double as YouTuber meet-and-greets. This creates space for fans to meet their stars but also provides opportunities for the platform to sell more products offline. For instance, the retailer worked with popular vlogger David Dobrik and launched a pop-up store in Los Angeles to sell apparel designed by Dobrik.

[caption id="attachment_115261" align="aligncenter" width="500"] Source: YouTube[/caption]

Source: YouTube[/caption]

Tailwinds and Headwinds

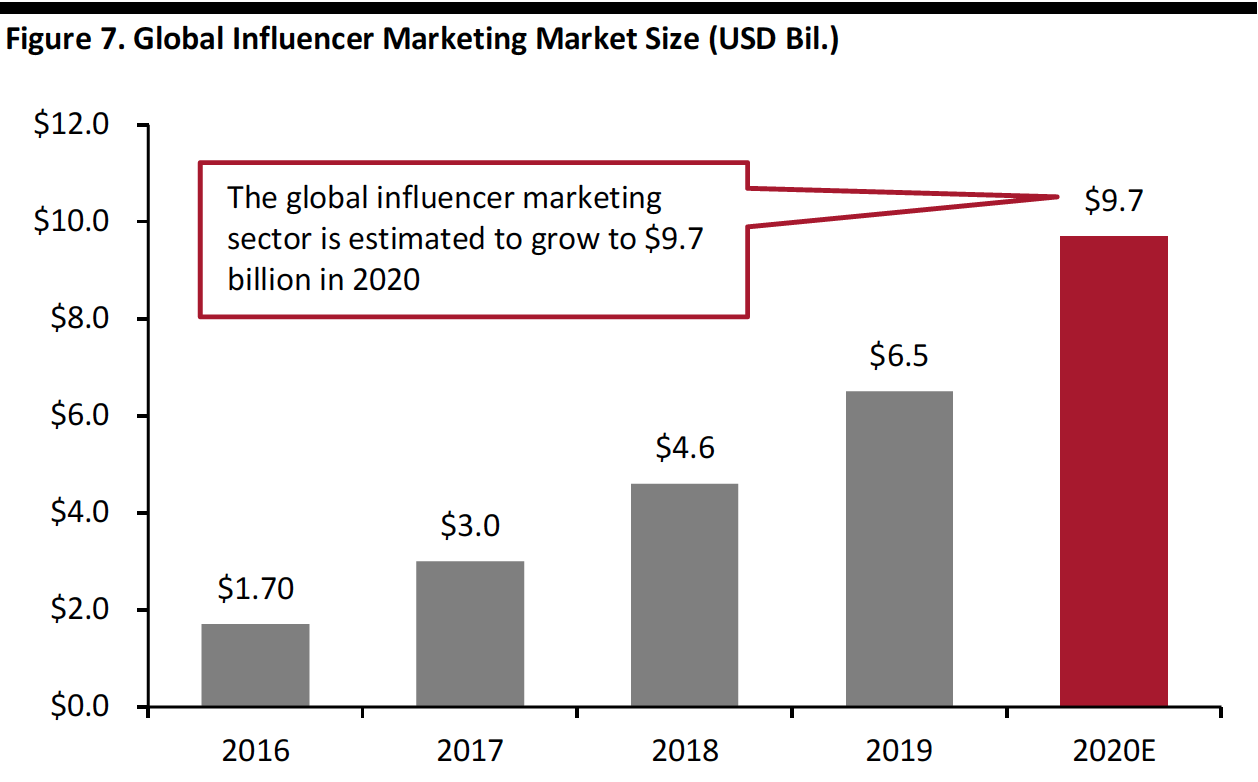

A booming influencer economy is a tailwind that Fanjoy can ride. The global influencer marketing sector is estimated to grow by 140% to $9.7 billion in 2020 from $6.5 billion in 2019, according to marketing analytics website Influencer Marketing Hub.

[caption id="attachment_115262" align="aligncenter" width="700"] Source: Influencer Marketing Hub[/caption]

Source: Influencer Marketing Hub[/caption]

There will also be some headwinds that are likely to drag on growth. For instance, influencers can choose to sell directly on established platforms, such as Instagram, instead of through Fanjoy. Instagram launched “Shopping from Creators” for selected influencers to help them sell conveniently on the platform. These influencers can use the platform’s checkout function to enable shoppers to place orders through the site without being redirected—making it easier for influencers to promote products and driving conversion.

Impact on Traditional Players

Fanjoy’s business model is to leverage partnerships with influencers/celebrities. Some e-commerce giants have also moved into this space and launched parentships with celebrities. For example:

- Alibaba hired Chinese singer Ouyang Nana and actress Liu Tao in March 2020 to work as influencers to promote new products. Ouyang Nana had 19.8 million followers on Weibo as of July 27, 2020, and Liu Tao had 44.0 million followers on Weibo as of July 27, 2020.

- Amazon launched “The Celebrity Store” in October 2018 to leverage influencer marketing. The store works as a place for customers to find and buy products that are endorsed by celebrities.

- In March 2017, Amazon also launched its Amazon Influencer Program to allow people with large social media followings to set up an Amazon storefront.

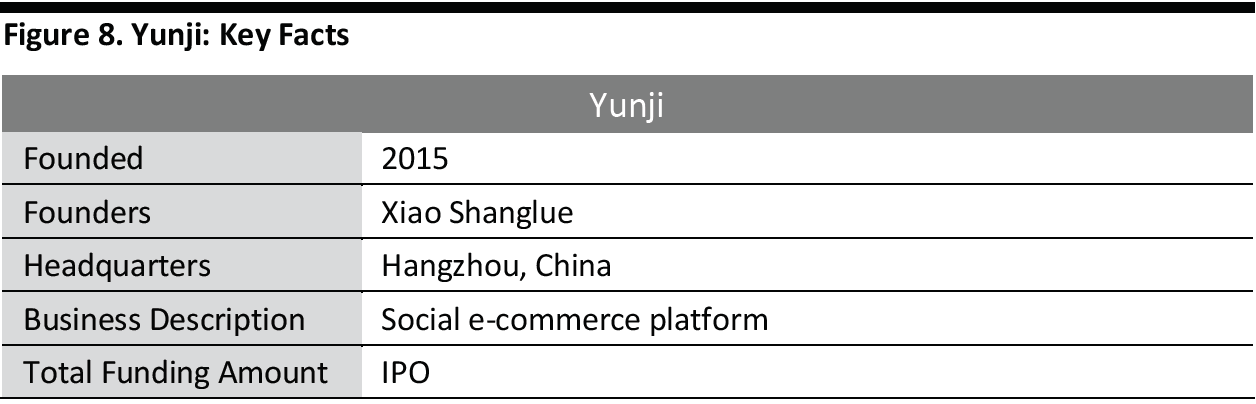

Yunji

Founded in 2015, Yunji is a China-based S2B2C social commerce platform. S2B2C platforms connect merchants (B) to suppliers (S). Merchants sell products within their own networks (C). This is similar to drop-shipping, enabling merchants to sell products without holding inventories, thus allowing them to focus on better serving and engaging with consumers—the platform links merchants to a pool of suppliers, so they do not need to worry about the supply chain.

The platform sells beauty, personal care, electronics, maternal and grocery products. Yunji members can receive monetary rewards if they share products and related content with their contacts—such as through WeChat groups, official accounts and moments.

Yunji listed on the Nasdaq Stock Exchange in 2019, raising $121 million in its initial public offering (IPO). According to the company’s financial report, the number of Yunji transacting members (those who generate at least one order by promoting products) increased from 4.2 million to 9.4 million in the 12 months ended September 30, 2019—an increase of 122.7% year over year.

[caption id="attachment_115263" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

How Has Yunji Disrupted the Market?

Yunji’s operation model is somewhere between Costco and Amway. Consumers need to sign up as members to access the platform. They can then access special discounts/offers and open their own stores on the platform. Members are motivated to promote their products to other users, such as via WeChat, as they can receive some benefits, such as discounts for future purchases. Members are consumers who are encouraged to share products to receive points or coupons when others use their referral links.

Members are the key participants on the platform. Yuji makes sure it deals with all logistics, IT integration and customer service, so that members just handle the promotion of the products.

Yunji’s products are more carefully selected and curated for its largely middle-class client base. Yunji offered an average of 837 popular SPUs (standard product units) on its platform on a daily basis in December 2016, 2,315 in December 2017 and 6,613 in December 2018, according to its prospectus.

To better meet consumer needs, Yunji also adopts the customer-to-manufacturer (C2M) model—a data-driven business model that has been widely adopted by e-commerce giants in China. Under this model, e-commerce platforms use artificial intelligence, big data and cloud technologies to enable brands and manufacturers to better understand consumer needs with real-time analytics—and launch customized products at attractive price points in a much shorter timeframe.

With C2M, Yunji helps suppliers to develop new and customized products, and the platform co-develops private-label products with manufacturing partners—such as the Solo Life, Yuan Sheng Huang and Unibeauty private labels.

Focus On Building Supply Chain Capacity

Yunji focuses on building strong supply chain capacity, including by finding its own manufacturing partner and building a number of consumer-favourite brands. In April, the company partnered with Zhongshan, an integrated FMCG company which has good manufacturing capacities. It serves product design, research and development, production and transportation. The partnership will enhance Yunji’s competitiveness in high-quality product supply. Zhongshan launched its French skincare brand BOCÉANIDE, which was developed and introduced exclusively on the Yunji platform in June 2020. In the future, Yunji and Zhongshan will increasingly develop and introduce more imported products, including body care, oral care and makeup products.

[caption id="attachment_115264" align="aligncenter" width="300"] BOCÉANIDE on Yunji

BOCÉANIDE on YunjiSource: Yunji[/caption]

Tailwinds and Headwinds

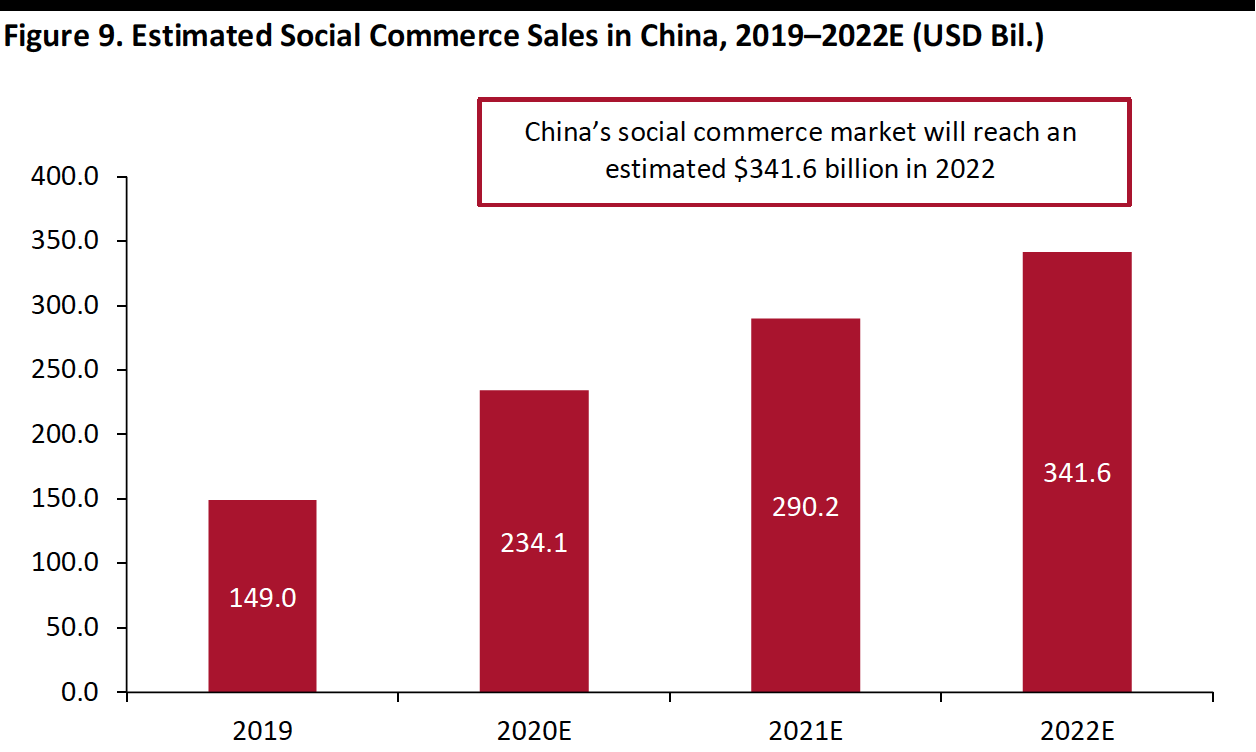

Social commerce is booming in China, with its market size estimated to grow from $149.0 billion in 2019 to $341.6 billion in 2022, representing 129% growth, according to financial firm Tianfeng. This partly reflects the huge number of Internet users in China, amounting to 904 million as of March 2020—close to 64.6% of the nation’s population.

[caption id="attachment_115265" align="aligncenter" width="700"] Source: Tianfeng[/caption]

Source: Tianfeng[/caption]

Yunji’s membership model enables it to grow with low marketing expense: It heavily relies on its members to promote products within their network. The platform’s membership base grew to 13.8 million in 2019 from 900,000 in 2016.

Yunji is exposed to risks linked with the regulatory environment in which it operates. Chinese authorities slapped the company with the equivalent of a $1.4 million fine in 2017 for violating pyramid-scheme laws. Because of the risk of being considered as a pyramid scheme—it relies mostly on members selling other memberships, with no real sales happening—Yunji faces the risk of being shut down.

Impact on Traditional Players

Yunji’s carefully selected and curated product strategy also encourages e-commerce giants to further leverage the C2M model.

- Alibaba plans to partner with 1,000 manufacturers over the next three years to produce C2M products worth ¥100 million ($14 million) for each manufacturer.

- JD.com signed a partnership with South Korean manufacturer LG Electronics in May to develop products under the C2M model. JD.com aims to sell ¥5 billion ($707 million) worth of products produced from this partnership on its platform.

Offline retailers that sell beauty, personal care and electronics products that do not carefully select products will likely face competition from Yunji.

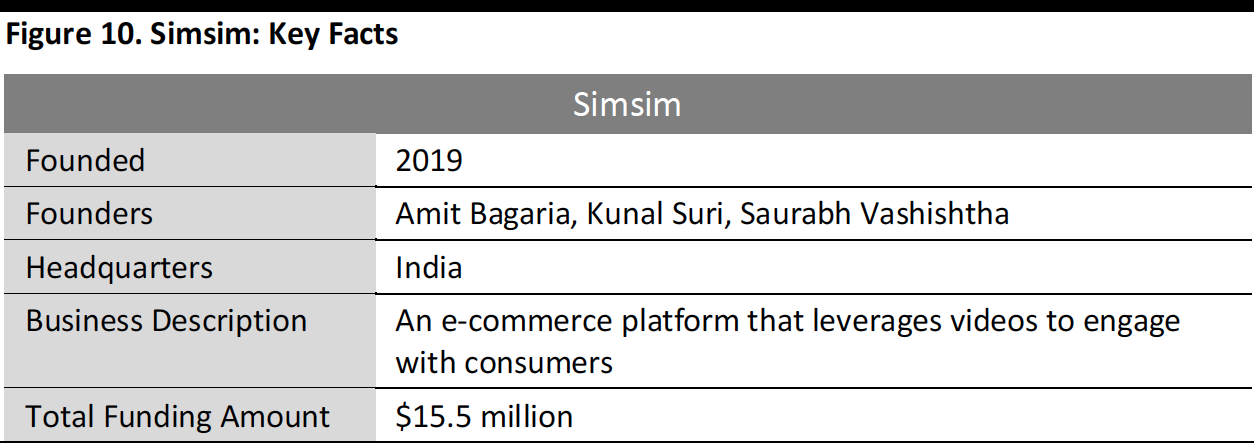

Simsim

Simsim, founded in June 2019, is an India-based video e-commerce platform that sells fashion, beauty and electronics products as well as health and wellness items. The platform is known for its strategy of having influencers produce videos to promote products.

The company has raised $15.5 million in funding to date, according to Crunchbase. The company said its revenue grew sixfold in the September 2019 quarter from the June 2019 quarter.

[caption id="attachment_115266" align="aligncenter" width="700"] Source: Crunchbase/company reports/Coresight Research[/caption]

Source: Crunchbase/company reports/Coresight Research[/caption]

How Has Simsim Disrupted the Market?

The company leverages videos to attract more customers, engage them in a more informative way and thus drive conversion. Simsim works with influencers, known as “community opinion leaders.” These influencers create informative videos related to the products sold on the platform. Instead of going to the description segment of the product page for production information, Simsim shoppers can receive product information by watching these videos. Influencer videos also help to create an offline retail experience that shoppers would gain from talking to a store associate.

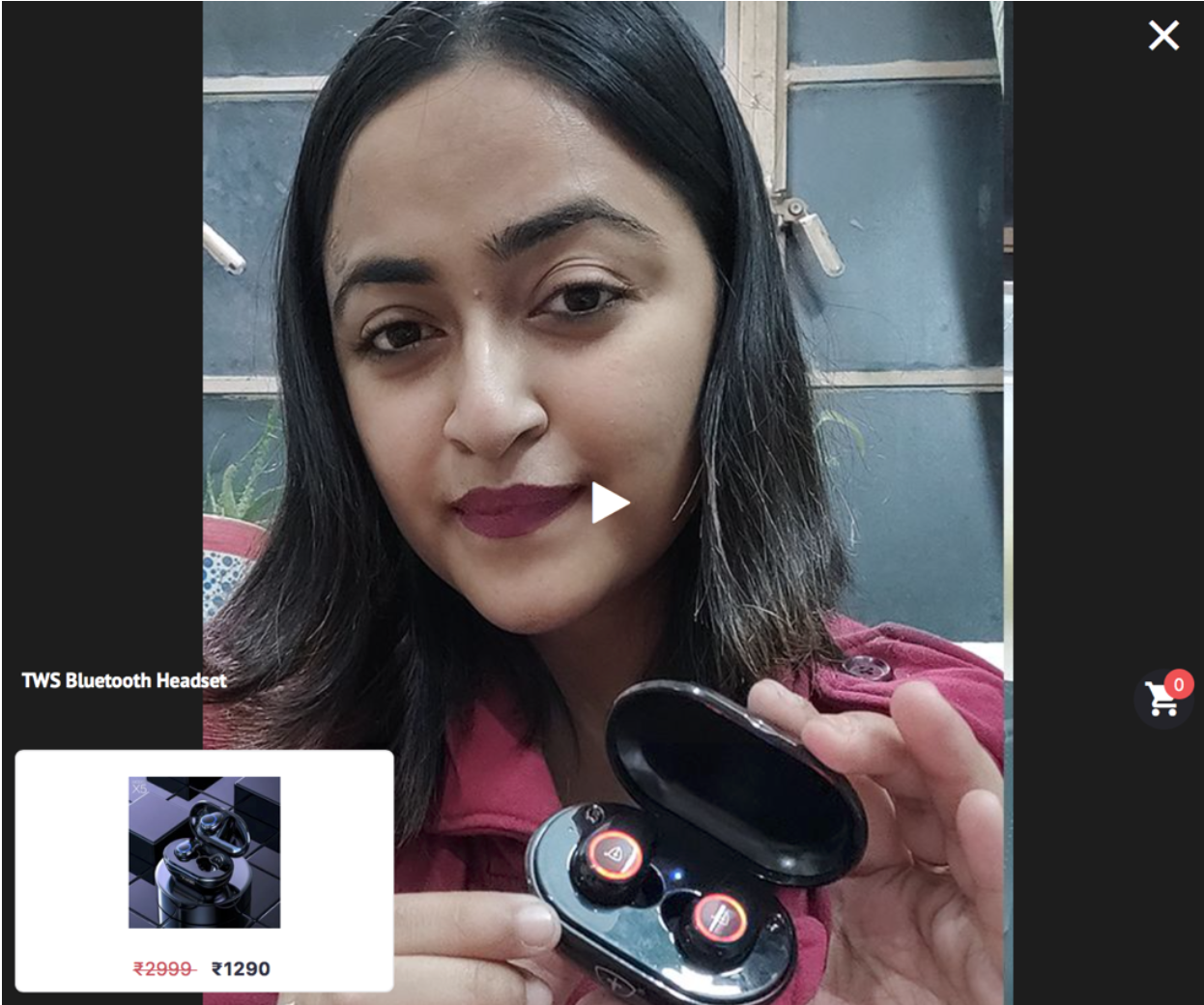

[caption id="attachment_115267" align="aligncenter" width="500"] Influencer Pallabi Guha demonstrates a TWS Bluetooth Headset

Influencer Pallabi Guha demonstrates a TWS Bluetooth HeadsetSource: Company website[/caption]

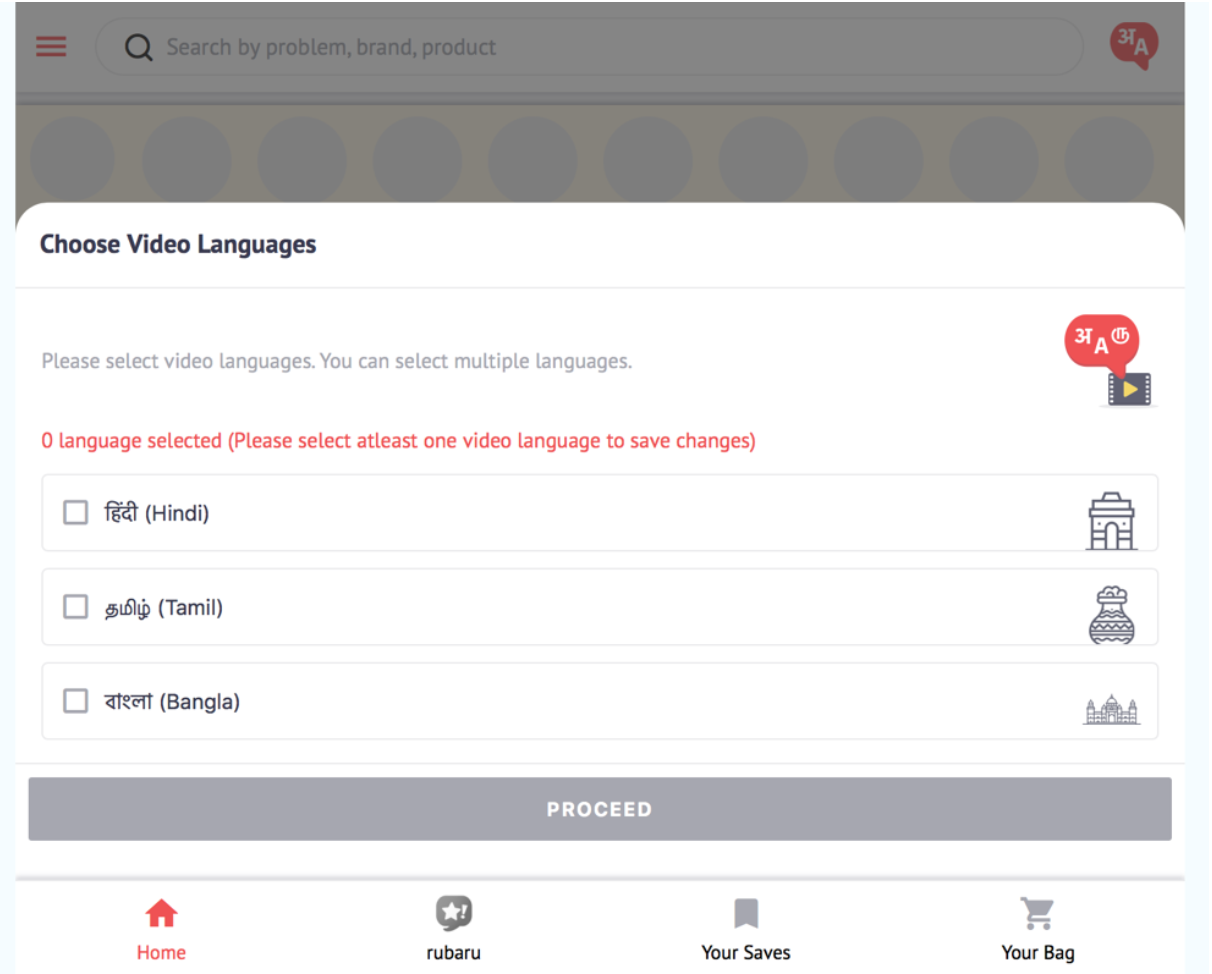

Simsim’s growth strategy centers around targeting India’s lower-tier markets. The platform adds local language and dialects on its platform to attract shoppers from these markets; currently, there are three regional languages on the platform—Bengali, Hindi and Tamil. According to the company, around 70% of its users are from outside of India’s top-10 cities.

[caption id="attachment_115268" align="aligncenter" width="500"] Different language options on Simsim

Different language options on SimsimSource: Company website[/caption]

Increase Penetration into Lower-Tier Cities

Simsim will further invest in its influencer video strategy and plans to recruit 100,000 influencers by February 2021. The company currently has 1,200 influencers.

To further its reach to users from Tier 3 and Tier 4 cities, the platform plans to add 20 regional languages on its platform by 2020. Most e-commerce platforms in India are English-first, and it is difficult for people in lower-tier cities to understand their terms and conditions. By adding more regional languages, Simsim is helping these users to obtain relevant information in their first language.

Tailwinds and Headwinds

The social commerce market in India is estimated to reach $70 billion by 2030, more than twice its current size, according to content marketing platform Wizikey. This growth is closely linked to increasing Internet penetration and the growing number of social media users. India’s Internet penetration rate will reach 50% in 2020, according to Statista. This means that about half of the 1.37 billion population will have access to the Internet in 2020. The penetration rate of social network users will account for 31% of India’s population by 2023, rising from 24% in 2018, according to Statista.

The 2020 ban of Chinese apps in India will likely increase the number of users on Simsim. Around 59 Chinese apps have been banned in India, including popular short-video app TikTok. Users of these apps are likely to be more ready to turn to Simsim for video consumption.

Simsim will also face fierce competition. Other video commerce players in India include Accel, BulBul, EkAnek, GlowRoad and Facebook-backed Meesho. Bulbul is one of the biggest competitors. It raised $5 million in a round led by Sequoia in October 2019 and reported 400,000 transactions on its platform in seven months, as of October 2019.

Impact on Traditional Players

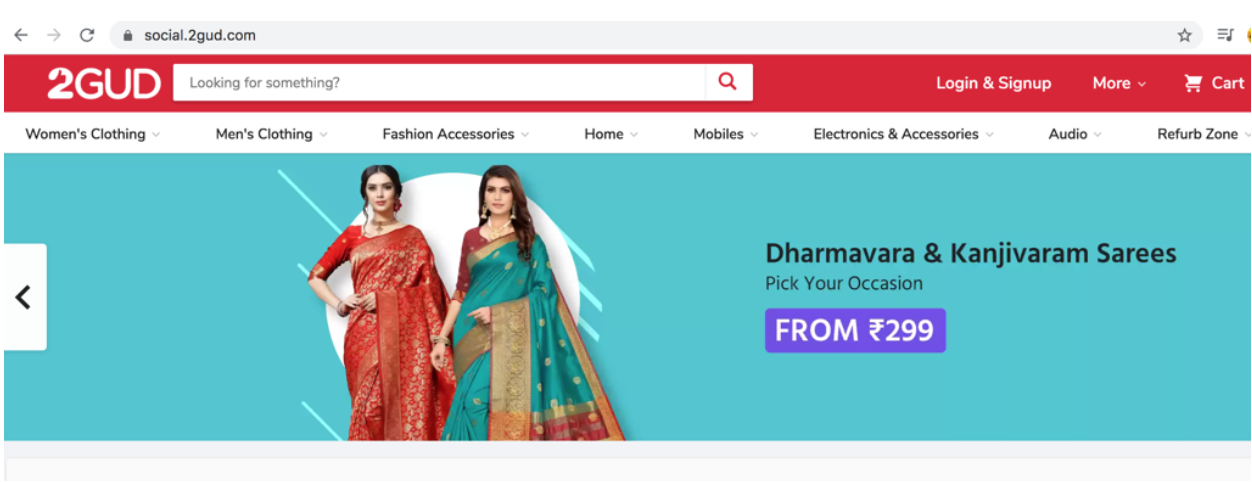

Simsim’s strategy of using video to reach lower-tier cities has drawn attention from other giant players. For instance, Flipkart is trying to develop a new e-commerce platform named 2GudSocial, where influencers can sell fashion items, mobile phones and accessories through video commerce. This platform will specifically target consumers from lower-tier cities.

[caption id="attachment_115269" align="aligncenter" width="500"] Flipkart’s Social2Gud.com

Flipkart’s Social2Gud.comSource: Company website[/caption]

Incumbent e-commerce players such as e-commerce platform Paytm Mall may face competition from Simsim.

What We Think

We have seen different types of e-commerce platforms disrupt the sector, including vertical e-commerce companies that focus on specific groups of consumers, as well as social commerce platforms that leverage influencer marketing.

Implications for Apparel Brands and Retailers

- Brands and retailers can choose to leverage certain vertical e-commerce platforms to build deeper relationships with consumers, as these platforms usually focus on providing relevant content and building a community of like-minded shoppers.

- Brands and retailers can also work with social commerce platforms that usually enjoy higher user stickiness. Social commerce will continue to grow, partly driven by the Covid-19 crisis: The pandemic-induced quarantines have changed consumer behavior, such as increasing the time they spend on social media.

- Brands and retailers can actively learn from the success of social e-commerce platforms, which invest in recruiting influencers and produce engaging content about products to better connect with consumers.

- Brands and retailers can collaborate with e-commerce platforms that enable them to produce data-driven products to meet customers’ specific needs.