DIpil Das

Introduction

What’s the Story? We are seeing tech-savvy CPG startups drive innovation with new, environmentally friendly products. As part of our Retail Innovators series, we present five companies innovating in the CPG market with a focus on sustainability, spanning the beverages, groceries, home care, personal care and pest control categories. We cover how each company has impacted or disrupted the market, the tailwinds and headwinds it faces, and the impact of each company on traditional market players. Why It Matters In the slow-growing CPG market, brands must remain innovative and competitive with their sustainability standards. Recently, startups have driven innovation in the CPG market with their competitive new products. These innovators make for an insightful discussion of how to drive sustainability standards forward and meet consumer demand for reduced environmental impact in the retail industry.CPG Innovators: Coresight Research Analysis

Figure 1 provides an overview of the five retail innovators we present in this report.Figure 1. Retail Innovators in the CPG Market [wpdatatable id=2007] 1. by Humankind By Humankind is a personal care CPG business that produces plastic-free products, including deodorant, shampoo and mouthwash. The company challenges other brands in its category with its high sustainability and wellness standards.

Figure 2. by Humankind: Key Facts [wpdatatable id=2008]

Source: Crunchbase How Has by Humankind Disrupted the Market? The company aims to reduce packaging consumption for personal care products with its monthly, subscription-based refill model. After a customer purchases a reusable, refillable container, by Humankind supplies them with regular product refills. By doing so, the company states it eliminates single-use plastic by 90% compared to other companies. By Humankind also takes pride in its "high-performance" products, including its deodorant, which kills odor-causing bacteria 40% faster than other leading natural deodorants, according to the company. Competitive Advantage: Sustainability, DTC Model and Natural Ingredients In a world where sustainability is increasingly important to consumers, by Humankind continues to find ways to cut down on waste and environmentally harmful practices. As well as reducing plastic use with its refill model, the company uses biodegradable, bamboo-fiber-based materials for shipping packaging. Through a partnership with Pachama, a forest project developer, by Humankind has also been carbon neutral since 2019, offsetting all production and shipping emissions by replenishing forests. The DTC refill subscription model also helps maintain consumer loyalty, as customers need to initially invest in the company's refillable containers, creating a sunk cost. However, consumers' investments are rewarded not only with more sustainable personal care products, but also with packaging and design that ensures the products arrive quickly and have a long shelf life. For instance, by Humankind's shampoo and mouthwash refills are dehydrated and concentrated, making them easy to ship and ensuring they last longer than most of their liquid-format competitors. [caption id="attachment_148275" align="aligncenter" width="700"]

by Humankind’s mouthwash is sold as a dissolvable tablet to cut down on packaging

by Humankind’s mouthwash is sold as a dissolvable tablet to cut down on packaging Source: by Humankind [/caption] [caption id="attachment_148276" align="aligncenter" width="700"]

by Humankind’s shampoo bar reduces plastic requirements

by Humankind’s shampoo bar reduces plastic requirementsSource: by Humankind [/caption] [caption id="attachment_148277" align="aligncenter" width="701"]

by Humankind’s deodorant comes in a refillable plastic roller, with paper-pod refills called “kindfills”

by Humankind’s deodorant comes in a refillable plastic roller, with paper-pod refills called “kindfills” Source: by Humankind [/caption] In addition to its sustainability efforts, by Humankind uses natural ingredients while ensuring compliance with scientifically proven personal care standards. This provides a competitive advantage as many natural personal care brands compromise on industry standards in order to focus on the provenance of their ingredients or the format of their product. For example, by Humankind’s toothpaste tablets contain fluoride, an FDA-approved ingredient deemed essential for preventing tooth decay and cavities, but is rarely included in competitors’ toothpaste tablets. Tailwinds and Headwinds We expect the sustainability trend to support growth for by Humankind. Globally, 85% of consumers have become more eco-friendly in their purchases, according to a 2021 study conducted by Simon-Kucher & Partners. Moreover, one of the first ways consumers move toward more eco-friendly products is by changing their day-to-day toiletry and cosmetic products. As such, by Humankind’s sustainable packaging and natural ingredients have already attracted considerable attention. However, by Humankind’s one-type-fits-all product variety may not work for all skin or hair types and can result in a lack of personalization for the consumer, which could deter consumers from committing to the brand. Separately, by Humankind’s natural deodorant faces a distinct potential headwind: its effects are not instantaneous. When transitioning to a natural deodorant, consumers often experience a two-to-four-week body detox period, during which levels of odor-causing bacteria increase because the aluminum compounds in mass-produced antiperspirants that prevent sweating are no longer applied, according to the founder of Kaia Naturals, a clean beauty brand. This detox period may deter consumers from switching to by Humankind’s deodorant products and cause them to reconsider the brand as a whole. Impact on Traditional Players Many other players in the personal care industry have already started developing more environmentally friendly products, but few can match by Humankind’s minimalistic approach to packaging. Although the company is not a significant threat to established personal care producers yet, it has helped set new standards for clean ingredients and plastic usage in the category, bringing attention to the importance of decreasing plastic consumption. 2. Calyxia Calyxia is a microcapsule and biodegradable plastics company that partners with homecare and sustainable agriculture brands. Its non-toxic, biodegradable EnviroCaps have no microplastics—a fragment of plastic less than 5 mm in length—in them. While the product is primarily used by scented laundry detergent manufacturers, it has potential application in many other industries as well.

Figure 3. Calyxia: Key Facts [wpdatatable id=2009]

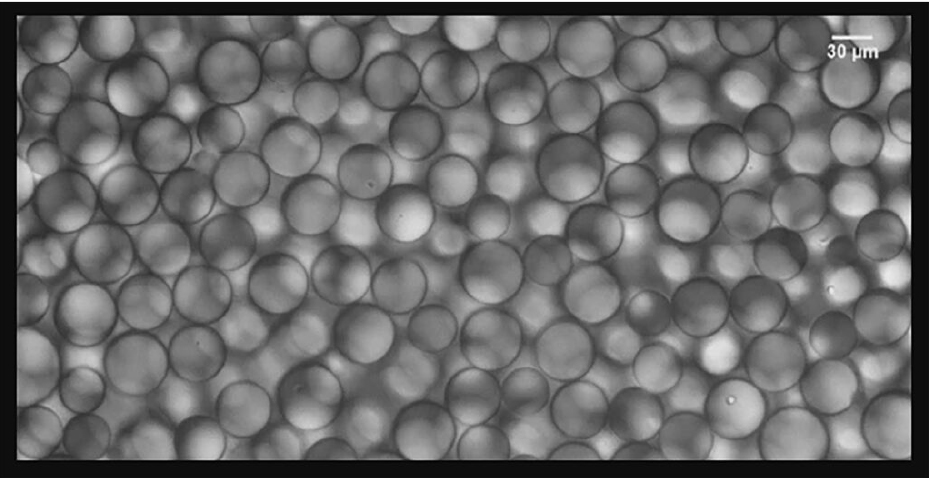

Source: Crunchbase How Has Calyxia Disrupted the Market? In 2018, Calyxia’s EnviroCaps became the world’s first non-toxic and readily biodegradable fragrance microcapsule designed for use by laundry care product manufacturers. EnviroCaps provide long-lasting fragrance performance in laundry care and replace current microplastic-based fragrance microcapsules, according to the company. [caption id="attachment_148278" align="aligncenter" width="700"]

Microcapsules under a magnifying glass

Microcapsules under a magnifying glass Source: Calyxia [/caption] Competitive Advantage: Sustainability and Technological Edge Over Competitors There are an estimated 24 trillion pieces of microplastics in the ocean, according to a 2021 study from Kyushu University, while land-based microplastics deteriorate soil quality, leading to decreased crop yields, according to the United Nations Environment Programme. As a result, many consumers and producers view reducing microplastic use as a sustainability priority. In addition to their lack of microplastics, Calyxia’s biodegradable EnviroCaps go through a more environmentally friendly production process, saving energy and water compared to the manufacturing of other microcapsules. EnviroCaps are highly versatile and have the potential to be incorporated into a variety of household cleaning products and industries, including agriculture, electronics, automotive and transportation. The company can control the microcapsules’ size and porosity, allowing for a timed release (via chemical triggering) of the ingredients within and prolonging the product’s in-use lifespan by more than 10 times. EnviroCaps’ ability to extend the lifespan and biodegradability of plastic materials has also led the startup to begin work on an extensive portfolio of products, including coatings, composites, foams and “crop protection,” according to its official website. Tailwinds and Headwinds The European Union’s European Chemical Agency passed new regulations banning all “intentionally added microplastics,” which will go into effect in 2024. These new proposals will help drive demand for Calyxia’s EnviroCaps, as the company is currently the only commercially available solution for manufacturers looking for microplastic-free microcapsules. Meanwhile, its growing portfolio of products will allow the company to penetrate many markets. However, despite the environmental benefits of Calyxia’s products, the company remains in the biodegradable plastics market, one often viewed negatively by consumers. While biodegradable plastics break down more rapidly than traditional plastics, they still take time to disintegrate fully and can end up in the ocean while breaking down. To combat this perception, Calyxia has subjected its technology to independent testing, showing that its products are completely biodegradable, break down quickly and even meet the rigorous standards of the OECD 301 biodegradability test. Pricing is another key issue Calyxia faces, as manufacturers pay a high up-front cost to incorporate the company’s microcapsules into their products. According to a September 2020 report from the European Environmental Bureau, "corporate lobbyists" are attempting to extend the microplastic ban, which could slow widespread implementation of Calyxia’s products. Impact on Traditional Players Calyxia’s technology could substantially impact household cleaning brands by enabling them to meet their sustainability goals and create more effective products. Its EnviroCaps target the European Union’s $24.2 billion (€22 billion) laundry care market, in which fragrance microcapsules represent a $548.8 million (€500 million) business, according to the European Commission. As the European Chemical Agency starts to enforce its recently passed regulations, we expect EnviroCaps to play a key role in the laundry care market, among others. 3. Med-X Med-X is a chemical and pharmaceutical company developing innovative, all-natural pest control solutions with its Nature-Cide brand. Not only is Nature-Cide 100% non-toxic and environmentally safe, but it also outperforms top pest control products, according to the Florida Mosquito Association.

Figure 4. Med-X: Key Facts [wpdatatable id=2010]

Source: Crunchbase How Has Med-X Disrupted the Market? Med-X’s patented Nature-Cide all-natural pest control uses a blend of environmentally friendly essential oils that outperforms top pest control products without the risk of poisonous exposure. A third-party study, published in the Florida Mosquito Association’s official journal, proved the effectiveness of Nature-Cide. The study named the product the top-performing mosquito insecticide, outperforming both the study’s top green competitor, Essentria IC3, as well as the three best-selling synthetic pyrethroid mosquito insecticides. These achievements could disrupt the pest control market, as mosquito control is a top global health priority—17% of all infectious diseases are vector-borne, meaning they are carried by organisms that can transmit them to humans, according to Scientific American. [caption id="attachment_148279" align="aligncenter" width="700"]

Nature-Cide’s All Purpose Insecticide

Nature-Cide’s All Purpose Insecticide Source: Amazon [/caption] Competitive Advantage: Safe and Effective Formula According to the New York State Department of Health, a toxic substance is “a substance that can be poisonous or cause health effects,” and products that many consumers use daily, including pesticides, can “also be toxic.” As such, many see traditional, chemical-intensive pesticides as a potential health risk. However, Nature-Cide’s pesticide uses 100% non-toxic, natural and environmentally safe ingredients in its formula, such as clove and cottonseed oil, giving it a significant advantage over traditional pesticides. Nature-Cide is also registered with EPA offices in the 39 states that require it, lending it a legitimacy that non-registered brands cannot match. Tailwinds and Headwinds There is a high demand for environmentally friendly pest control products as consumers become increasingly educated about the health concerns of potentially toxic pesticides. Nature-Cide’s non-toxic formula is ideal for use in homes, grocery stores, hotels, hospitals and schools, among other public venues. However, the pest control industry as a whole faces a variety of challenges, ranging from insecticide resistance to the seasonality of the business. Insect and pest populations are becoming resistant to pesticides, resulting in high R&D costs for pest control producers. The market is also highly seasonal, as insect populations peak in summer, meaning businesses in the market need to handle fluctuating cash flow—keeping up with demand in the summer and preparing for a slower season in the winter. Impact on Traditional Players Med-X’s Nature-Cide poses a challenge to established pest control brands, especially those that rely on toxic chemicals. While it is not a serious threat to traditional players yet, the brand is working to establish itself in the market. For example, Nature-Cide has partnered with professional pest control organizations to speed up widespread adoption, including a direct distribution deal with Pestmaster Services, an in-person pest control company that only uses products with non-toxic or low-toxic EPA ratings. 4. MyForest Foods MyForest Foods, formerly known as Atlast Foods, is a food brand creating plant-based meat substitutes. It stands out in the vegan meat market due to its mycelium-based technology that can replicate whole-cut animal meats, while most other plant-based meats only mimic the minced texture of ground meat. Its first signature product is MyBacon, a plant-based bacon substitute.

Figure 5. MyForest Foods: Key Facts [wpdatatable id=2011]

Source: Crunchbase How Has MyForest Foods Disrupted the Market? Mycelium—the vegetative root structure of mushrooms—features long branching fibers, allowing it to mimic traditional meat cuts in both texture and flavor. Combined with fats, flavorings and other ingredients, MyForest Foods’ MyBacon replicates the taste and texture of real bacon, providing an opportunity for disruption in the plant-based meat market. In the future, the company plans to disrupt the steak market using the Beefsteak Polypore mushroom. While MyForest Foods has limited distribution currently, it plans to expand its production capacity soon via a partnership with Ecovative—a mycelium technology company—to supply the CPG, foodservice and grocery industries with plant-based meats. [caption id="attachment_148280" align="aligncenter" width="700"]

MyBacon in a pan

MyBacon in a pan Source: MyForest Foods [/caption] Competitive Advantages: Scalable, Environmentally Friendly and Healthy Mycelium has a rapid growth rate—producing enough to create a 100-foot-by-10-foot sheet in 10 days—and its texture can be altered through the tuning of porosity, texture, strength, resilience and fiber orientation. Growing and processing mycelium for MyBacon takes only 13 days, a substantial advantage compared to the months or years it can take for farmers to raise animals for slaughter. Furthermore, the entire process produces far less greenhouse gas emissions than traditional meat processing. MyForest’s mycelium ingredient is rich in fiber, vitamins, protein, amino acids and minerals, according to the company. In contrast, bacon is notorious for its high-fat and low nutrition content. The nutritional advantages of MyBacon and its similarity to real bacon make it a potentially worthwhile addition to the wellness consumer’s diet. Tailwinds and Headwinds The mycelium used in MyBacon does not present novel food safety concerns—meaning the product can skip regulatory delays—and can be used as the basis for a variety of other whole-cut meat imitations. For example, in MyForest Food’s “Feast of the Future” tasting events, the company provided samples of mycelium-based beef, chicken, fish and shellfish, suggesting the potential of this technology. Mycelium’s versatility and fast growth will make MyBacon a competitive product once MyForest scales its business and prices decrease. These attributes also make MyForest a more reliable food supplier than the meat industry, which suffered recent supply shortages due to Covid-19 infections in meat processing plants and supply chain challenges. MyBacon is currently priced at premium pork levels and is not yet competitive with conventional bacon due to its startup costs. However, the price is expected to decrease over time as the business scales up. Currently, the company is limited by how fast it can commission new farms and food production kitchens. To mitigate these issues, MyForest Foods plans to expand its infrastructure by developing 120,000 square feet of new facilities in its headquarters in Saratoga Springs, NY, and the world’s largest indoor vertical mycelium farm in Green Island, NY, by the end of summer 2022. Still, even with increased production, plant-based meats remain niche food items, and bacon’s taste and place in American cuisine cannot be overstated. Mainstream consumers will need to be convinced to switch to a meatless bacon imitation. Impact on Traditional Players MyForest Foods’ MyBacon will impact processed meat sellers, given the public’s perception of the latter as unhealthy and increasing concern over animal welfare. MyBacon’s similarity to real bacon and the company’s interest in expanding its line of products makes it a serious competitor to the meat industry. 5. waterdrop Austria-based drink startup waterdrop has created the “world’s first microdrink,” a dissolvable cube made from compressed vitamins and natural fruit juices after sugar and water components have been removed. The company’s products are made from real fruit and plant extracts sourced directly from farmers around the globe, and are free from artificial flavors, sugar, gluten and lactose. The microdrinks come in 10 different flavors—each containing different vitamins and minerals—with each flavor pack containing 12 dissolvable cubes.

Figure 6. waterdrop: Key Facts [wpdatatable id=2012]

Source: Crunchbase How Has waterdrop Disrupted the Market? The company claims that its microdrink design eliminates 98% of unnecessary packaging and CO2 emissions compared to the manufacturing process used in traditional drinks. As a result, in 2021, waterdrop became the fastest-growing CPG brand in Europe—having surpassed $100 million in sales within five years of its 2017 launch date—according to a company press release. It began selling in the US the same year. Competitive Advantages: Sustainability, Emerging Tech Use and DTC Model Waterdrop not only provides a sustainable alternative to other beverages due to its minimal packaging, but the company has also become plastic-positive through its five-year partnership with Plastic Bank, which removes one plastic bottle from the environment for every microdrink pack sold. Since the start of the partnership, the CPG brand has helped eliminate over 30 million plastic bottles from landfills. The company also sells steel, glass and bamboo water bottles—as well as other reusable beverage accessories—which account for 20% of its revenue and help reduce plastic bottle use. Furthermore, microdrinks’ smaller volume-per-drink ratio makes them easier to transport, cutting supply chain and fuel costs.

- For more on the growing sustainability trend, see Coresight Research’s sustainability coverage.

waterdrop’s reusable water bottles (left) and its microdrink packs (right)

waterdrop’s reusable water bottles (left) and its microdrink packs (right) Source: waterdrop [/caption] Tailwinds and Headwinds Waterdrop has seen substantial success in its social media marketing, especially with women between the ages of 20 and 50, which make up 85% of its core demographic. Women are waterdrop’s key consumers as they are usually more aware of hydration’s beauty benefits, according to waterdrop’s Co-Founder and CEO, Martin Murray. Still, microdrinks remain a niche beverage category that consumers do not widely know about or use. It remains unknown what percentage of them will accept this novel product as a beverage replacement. Furthermore, several barriers stand in the way of waterdrop’s goal of attaining 100% biodegradable packaging—currently, each cube is wrapped in plastic. According to the company, current biodegradable solutions offer low shelf life, and edible packaging does not dissolve quickly or sufficiently enough. Impact on Traditional Players Waterdrop’s low plastic use and novel take on beverage products make it a disruptive force that redefines sustainability standards and the criteria of what products belong in the CPG beverage category. Microdrinks are particularly disruptive to prefilled bottled beverages—especially the $18.1 billion bottled water market, which is increasingly seen as environmentally detrimental. According to waterdrop, 500 billion plastic bottles are produced a year. Even PepsiCo is aware of its environmental impacts and has pledged to use 25% more recycled content in its plastic packaging by 2025. Still, waterdrop faces intense competition from PepsiCo and Coca-Cola—which dominate the global non-alcoholic beverage industry—and the beverage market’s requirements for low product complexity.