Nitheesh NH

Introduction

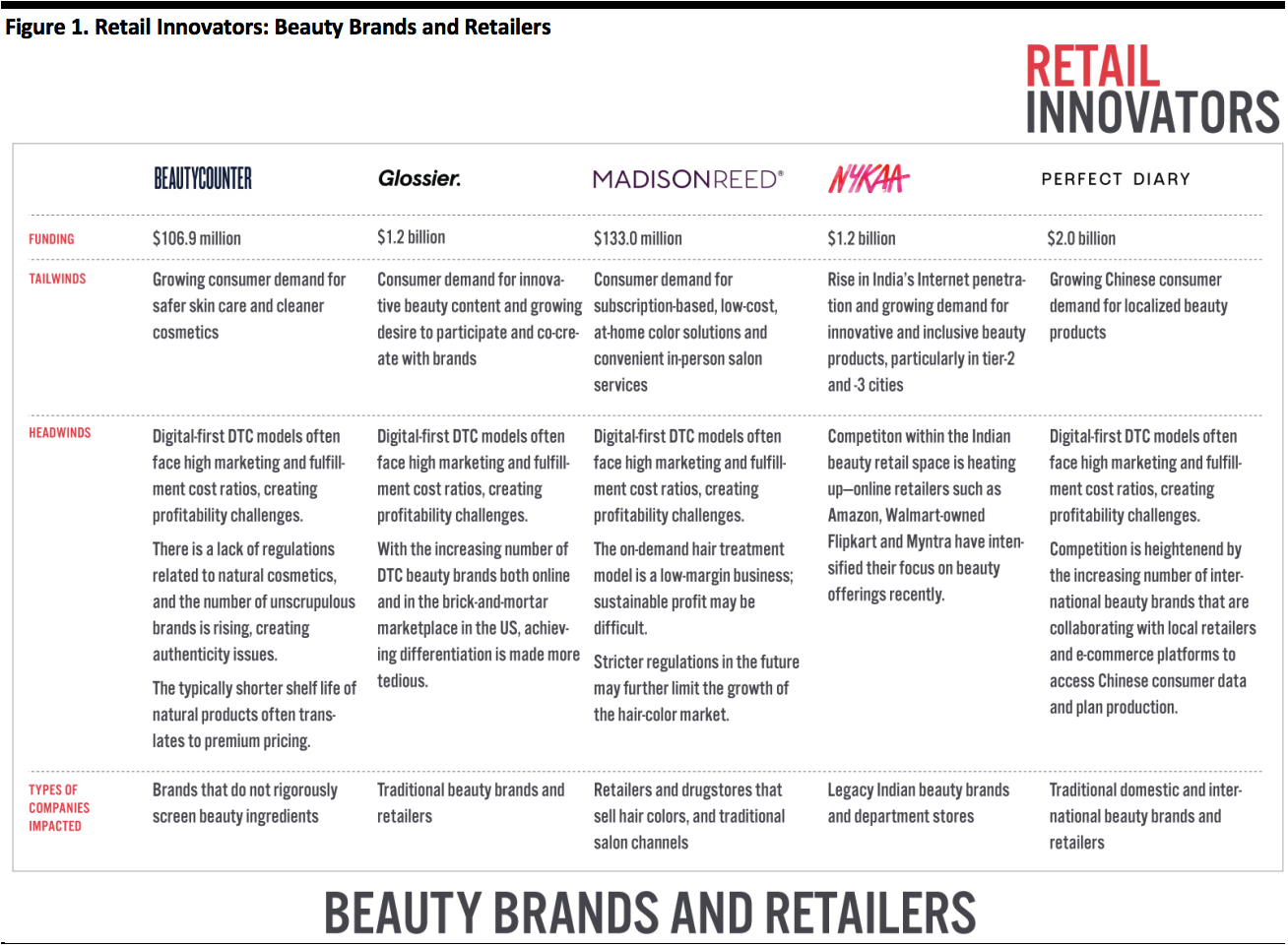

Beauty consumers’ product research and shopping habits have changed rapidly with the proliferation of online product-recommendation sites, social media platforms and beauty blogs. Changing demand is leading a new wave of beauty businesses that are disrupting the way the current industry model works. Innovative beauty startups and newcomers around the world are developing products for new consumer needs that don’t currently exist, forcing longstanding brands and retailers to consider alternative business models. Furthermore, these emerging companies are contributing to the already intense and competitive beauty landscape. In this report—which is part of the Coresight Research Retail Innovators series—we take a look at five companies (founded since 2012) that are disrupting the beauty market:- Beautycounter, a multilevel marketing company

- Glossier, a DTC beauty brand

- Madison Reed, an at-home haircare service provider

- Nykaa, an India-based digitally native retailer

- Perfect Diary, a Chinese cosmetic brand

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Beautycounter

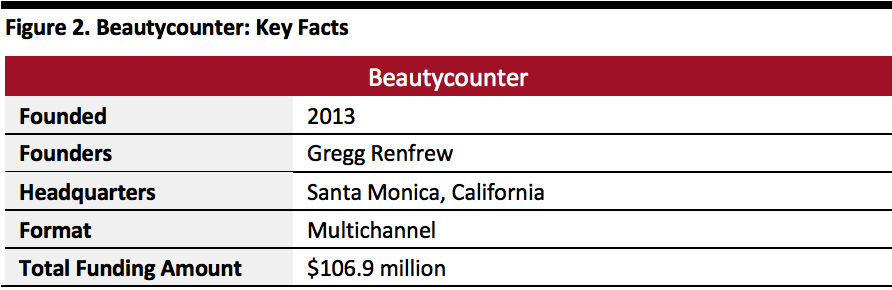

Profile Beautycounter is a cosmetics and skincare brand that sells products through a multichannel distribution platform. Founded in 2013 and headquartered in Santa Monica, California, Beautycounter operates as a Certified B Corporation—a business that balances profit and purpose. Certified B Corporations are legally required to consider the impact of their decisions on their customers, suppliers, employees, community and environment. Beautycounter has raised around $106.9 million in funding so far, according to community-based competitive insights platform Owler. The company’s revenues rose 33% year over year to $325 million in 2018. [caption id="attachment_109875" align="aligncenter" width="580"] Source: Owler/company reports/Coresight Research[/caption]

How Has Beautycounter Disrupted the Market?

Beautycounter’s primary differentiator is its trademarked “The Never List,” through which it has prohibited more than 1,800 harmful or questionable ingredients in its product formulations, much above the 30 banned by US law. In addition, the brand has been questioning the non-regulated and harmful ingredients present in the majority of beauty products.

More than 80% of the ingredients in Beautycounter’s products are natural or plant-based, according to the company. Furthermore, Beautycounter states that it is the only company in the industry that does not use heavy metals in its beauty products. The brand ranked first in the beauty category of Fast Company’s annual list of the World’s Most Innovative Companies for 2020, marking the third consecutive year that Beautycounter has received the honor of being included in this list.

Beautycounter’s focus on clean beauty is clear through its social activism and legislative efforts: The brand has been working extensively at the federal level to improve accountability and transparency in the beauty market; and it advocates for stronger cosmetic safety laws, which have not changed much since 1938. In December 2019, the Beautycounter Founder and CEO Gregg Renfrew testified as an expert witness before Congress in a hearing on cosmetic reform—the second in 40 years.

Furthermore, Beautycounter focuses on ethical and cruelty-free sourcing. For the past two years, the brand has been auditing its mica (a common base for powder formulations in cosmetics) supply chain in person to ensure responsibly sourcing and that no unethical practices are followed, such as forced or child labor and wage theft. Beautycounter aims to complete its auditing by the end of 2020, according to Lindsay Dahl, Beautycounter SVP of social mission.

Multichannel Retail Distribution Platform

The company offers beauty products through a multichannel distribution strategy that includes e-commerce, a network of independent consultants and a number of strategic partners, such as retailers J.Crew and Target and modern lifestyle brand “goop” (whose Founder and CEO is actress and author Gwyneth Paltrow).

However, Beautycounter’s largest retail channel is its network of independent consultants. As of December 2019, Beautycounter had more than 44,000 independent consultants in the US and Canada. To remain active, consultants must meet $1,200 in qualifying volume (own purchases plus sales) in each six-month period from their enrollment dates. Consultants join Beautycounter by buying a $98.00 “Enrollment Kit,” which includes products, sales materials and a personal website for one year. Each consultant is responsible for selling Beautycounter’s products to their own clients—placing orders and then delivering to customers. To advertise their products, consultants use social media platforms (such as Instagram and blogs), host social events, send sample products in the mail and have family and friends try the products. In 2019, consultants earned an average annual income of $2,060.

Previously, Beautycounter had relied on launching pop-up shops to create an offline presence. However, it is now focusing on opening more permanent physical locations, along with expanding its product selection and enhancing its e-commerce platform. The brand opened its first permanent retail store in SoHo, New York City, in October 2018 and a second location in Denver in April 2019. The launch of physical stores has helped Beautycounter to acquire new clients and offer an experiential retail environment to its customers, the company’s CEO Gregg Renfrew told WWD in October 2019. Renfrew said, “There will be multiple new locations coming next year. We are also looking at opening smaller-footprint, smaller-format stores like the one we have in Denver.”

[caption id="attachment_109876" align="aligncenter" width="580"]

Source: Owler/company reports/Coresight Research[/caption]

How Has Beautycounter Disrupted the Market?

Beautycounter’s primary differentiator is its trademarked “The Never List,” through which it has prohibited more than 1,800 harmful or questionable ingredients in its product formulations, much above the 30 banned by US law. In addition, the brand has been questioning the non-regulated and harmful ingredients present in the majority of beauty products.

More than 80% of the ingredients in Beautycounter’s products are natural or plant-based, according to the company. Furthermore, Beautycounter states that it is the only company in the industry that does not use heavy metals in its beauty products. The brand ranked first in the beauty category of Fast Company’s annual list of the World’s Most Innovative Companies for 2020, marking the third consecutive year that Beautycounter has received the honor of being included in this list.

Beautycounter’s focus on clean beauty is clear through its social activism and legislative efforts: The brand has been working extensively at the federal level to improve accountability and transparency in the beauty market; and it advocates for stronger cosmetic safety laws, which have not changed much since 1938. In December 2019, the Beautycounter Founder and CEO Gregg Renfrew testified as an expert witness before Congress in a hearing on cosmetic reform—the second in 40 years.

Furthermore, Beautycounter focuses on ethical and cruelty-free sourcing. For the past two years, the brand has been auditing its mica (a common base for powder formulations in cosmetics) supply chain in person to ensure responsibly sourcing and that no unethical practices are followed, such as forced or child labor and wage theft. Beautycounter aims to complete its auditing by the end of 2020, according to Lindsay Dahl, Beautycounter SVP of social mission.

Multichannel Retail Distribution Platform

The company offers beauty products through a multichannel distribution strategy that includes e-commerce, a network of independent consultants and a number of strategic partners, such as retailers J.Crew and Target and modern lifestyle brand “goop” (whose Founder and CEO is actress and author Gwyneth Paltrow).

However, Beautycounter’s largest retail channel is its network of independent consultants. As of December 2019, Beautycounter had more than 44,000 independent consultants in the US and Canada. To remain active, consultants must meet $1,200 in qualifying volume (own purchases plus sales) in each six-month period from their enrollment dates. Consultants join Beautycounter by buying a $98.00 “Enrollment Kit,” which includes products, sales materials and a personal website for one year. Each consultant is responsible for selling Beautycounter’s products to their own clients—placing orders and then delivering to customers. To advertise their products, consultants use social media platforms (such as Instagram and blogs), host social events, send sample products in the mail and have family and friends try the products. In 2019, consultants earned an average annual income of $2,060.

Previously, Beautycounter had relied on launching pop-up shops to create an offline presence. However, it is now focusing on opening more permanent physical locations, along with expanding its product selection and enhancing its e-commerce platform. The brand opened its first permanent retail store in SoHo, New York City, in October 2018 and a second location in Denver in April 2019. The launch of physical stores has helped Beautycounter to acquire new clients and offer an experiential retail environment to its customers, the company’s CEO Gregg Renfrew told WWD in October 2019. Renfrew said, “There will be multiple new locations coming next year. We are also looking at opening smaller-footprint, smaller-format stores like the one we have in Denver.”

[caption id="attachment_109876" align="aligncenter" width="580"] Beautycounter’s store in SoHo, New York

Beautycounter’s store in SoHo, New YorkSource: Beautycounter[/caption] Landscape, Tailwinds and Headwinds Natural and organic ingredients are hot topics that are trending in the beauty market as the definition of beauty expands into wellness, self-care, health, supplements, medicine and food. The global natural cosmetics market is expected to grow from $36 billion in 2019 to $54 billion by 2027, driven by shifting consumer perceptions around natural ingredients in their cosmetics, according to UK-based research firm Future Market Insights. With consumer attention on beauty wellness, the clean beauty category is witnessing a growing number of entrants. For example, Credo Beauty and Follain are two beauty brands that have a restricted ingredients list and go above and beyond to test every ingredient in their formulas. Similar to Beautycounter’s The Never List, Credo Beauty provides a “Dirty List” that prohibits the use of 2,700 ingredients due to safety/sustainability reasons, although these are used in mainstream beauty products. In order to boost sales and conversion rates, a number of these brands are also establishing and expanding their physical presence with a view to directly interact with customers who can experience the products. Beautycounter’s multichannel retail distribution platform augurs well for its growth. However, as always, there will be some headwinds that are likely to drag on growth and returns. The increasing number of DTC brands both online and in the brick-and-mortar marketplace represent headwinds for the clean beauty industry, as achieving differentiation from competitors is made more tedious. Moreover, achieving profitability remains challenging for DTC brands, given the costs associated with their approaches to marketing and fulfillment. Like regular online-only retailers, digital-first DTC brands typically see variable costs account for a greater proportion of costs than brick-and-mortar stores, where fixed costs have traditionally dominated. In particular, marketing and fulfillment often represent two substantial, and rising, costs associated with pure-play retailing, including DTCs. The variable nature of these costs mitigates the benefits of scale that may otherwise be enjoyed—and in the broader pure-play space, such costs have often risen even when measured as a share of (growing) revenues. In other words, the marketing- or fulfillment-cost ratio often does not get eroded even as online-only retailers reach much greater scale. A greater number of DTC brands (in all retail sectors) than traditional retailers are doubtful of their profitability, according to a 2019 online survey that polled 100 senior retail executives, conducted by CommerceNext and sponsored by Oracle Customer Experience (CX) Cloud. Reflecting the need to spend on marketing, the CommerceNext/Oracle survey found that 78% of DTC marketers indicated that their 2019 marketing budget was higher than they had in 2018, compared to 60% of traditional retailers. In line with these findings, Beautycounter expanded its advertising and media spend by 25% in 2019 to deepen its positioning as a social activist brand. Moreover, the survey founded that 40% of DTC brands identified “achieving profitability at scale” as a major barrier to meeting e-commerce marketing goals for 2018, in contrast to 11% of traditional retailers. Furthermore, the authenticity of clean beauty products is challenging for consumers to determine, as the US government does not set a specific definition for natural/clean/organic cosmetics; both well-meaning brands and unscrupulous brands are competing in the natural cosmetic market. Another challenge in clean beauty is price, as natural products typically have a shorter shelf-life, often translating to premium pricing. Clean beauty, organic and natural ingredients and sustainability are all key trends that are driving growth in the US beauty market. To harness consumer demand, beauty brands and retailers must carefully consider their compliance strategies and retail channels, as well as how to position themselves in an increasingly competitive market in order to grow and gain share. Impact on Traditional Players Beautycounter has identified a niche in the market with its clean beauty mission, which has put the onus on traditional players to match up to these rigorous standards for ingredients. With the clean beauty mission gaining strong momentum, some mainstream beauty brands and retailers are making efforts to prove their clean credibility:

- In 2017, CVS Pharmacy announced that it would remove certain chemicals (parabens and phthalates) from around 600 beauty and personal care products across a number of store-brand lines.

- Sephora introduced a clean-beauty seal, “Clean at Sephora,” in June 2018, which designates that products are free of certain ingredients, such as parabens, sulfates and formadehydes.

- Global beauty giant L’Oréal offers paraben- and alcohol-free beauty products.

Glossier

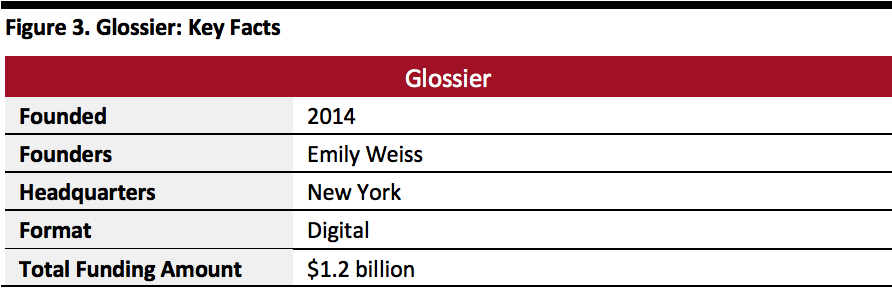

Profile Glossier is a DTC beauty brand that was founded in 2014 and is headquartered in New York. The company was born out of the “Into The Gloss” blog, which was launched in 2010 and quickly gained popularity among female consumers as a valuable source of information about makeup and skincare products. Glossier operates in eight countries and now has over 3 million customers. In 2018, the companys’s annual revenues grew to $100 million—double those from 2017 and marking the fourth consecutive year of triple-digit revenue growth. Glossier’s CEO Emily Weiss credits 90% of the company’s revenue growth to word-of-mouth marketing by the brand’s fans, most of whom are aged 18–35. In March 2019, Glossier raised $100 million through a Series-D funding round led by Sequoia Capital, taking its total funding to $1.2 billion, cementing the company’s position as a unicorn startup. [caption id="attachment_109877" align="aligncenter" width="580"] Source: Bloomberg/company reports/Coresight Research[/caption]

How Has Glossier Disrupted the Market?

Glossier captures millennial and Gen-Z consumers’ desire to participate and co-create with brands to reach beyond simple user engagement; it is building a community brand. The customer’s feedback shapes Glossier’s advertising strategies, product development and the kinds of new brands it spins out: The company’s crowdsourcing approach informs its research and development and production departments, facilitating consumer-centric operations.

Glossier’s Instagram channel, which has 2.7 million followers, and its beauty blog “Into The Gloss” enable the company to engage with consumers and tap into the user community to generate new product ideas as well as improvements for existing products. The company incorporates member profiles into blog browsing, online shopping and in-person shopping, with member check-ins or location recognition.

Furthermore, Glossier leverages its blog to track and analyze consumer data using machine learning and other tools. The brand has built a strong connection with its Into The Gloss readers to ensure that they become Glossier customers—consumers who read the blog are 40% more likely to buy products than consumers who only visit the Glossier website, according to the company’s Chief Technology Officer, Bryan Mahoney.

Omnichannel Strategy

Glossier is adapting to the omni-shopping phenomenon by bridging the online/offline experience. The company operates two permanent store locations, in Los Angeles and New York City (flagship store). The company’s proprietary point-of-sale system helps Glossier to swiftly move product from its warehouses to its storerooms. It also gives store representatives real-time context about their consumers to guide and educate them while shopping. In addition, Glossier offers “buy online, pick up in store” options.

From a branding perspective, each physical location is viewed by the company as a community center, where beauty customers can try new products and create content to share with the wider community. Glossier’s stores are therefore set up to provide photo opportunities through its decadent décor. According to the company, its flagship store attracts more than 50,000 visitors per month, with a conversion rate of over 50%.

In addition to its permanent store locations, Glossier utilizes the pop-up shop format. For example, in December 2019, Glossier collaborated with Nordstrom to open pop-up stores at seven department stores across the US for the holiday season, including at Nordstrom’s flagship location in New York from December 3, 2019 through February 16, 2020.

[caption id="attachment_109878" align="aligncenter" width="580"]

Source: Bloomberg/company reports/Coresight Research[/caption]

How Has Glossier Disrupted the Market?

Glossier captures millennial and Gen-Z consumers’ desire to participate and co-create with brands to reach beyond simple user engagement; it is building a community brand. The customer’s feedback shapes Glossier’s advertising strategies, product development and the kinds of new brands it spins out: The company’s crowdsourcing approach informs its research and development and production departments, facilitating consumer-centric operations.

Glossier’s Instagram channel, which has 2.7 million followers, and its beauty blog “Into The Gloss” enable the company to engage with consumers and tap into the user community to generate new product ideas as well as improvements for existing products. The company incorporates member profiles into blog browsing, online shopping and in-person shopping, with member check-ins or location recognition.

Furthermore, Glossier leverages its blog to track and analyze consumer data using machine learning and other tools. The brand has built a strong connection with its Into The Gloss readers to ensure that they become Glossier customers—consumers who read the blog are 40% more likely to buy products than consumers who only visit the Glossier website, according to the company’s Chief Technology Officer, Bryan Mahoney.

Omnichannel Strategy

Glossier is adapting to the omni-shopping phenomenon by bridging the online/offline experience. The company operates two permanent store locations, in Los Angeles and New York City (flagship store). The company’s proprietary point-of-sale system helps Glossier to swiftly move product from its warehouses to its storerooms. It also gives store representatives real-time context about their consumers to guide and educate them while shopping. In addition, Glossier offers “buy online, pick up in store” options.

From a branding perspective, each physical location is viewed by the company as a community center, where beauty customers can try new products and create content to share with the wider community. Glossier’s stores are therefore set up to provide photo opportunities through its decadent décor. According to the company, its flagship store attracts more than 50,000 visitors per month, with a conversion rate of over 50%.

In addition to its permanent store locations, Glossier utilizes the pop-up shop format. For example, in December 2019, Glossier collaborated with Nordstrom to open pop-up stores at seven department stores across the US for the holiday season, including at Nordstrom’s flagship location in New York from December 3, 2019 through February 16, 2020.

[caption id="attachment_109878" align="aligncenter" width="580"] Glossier’s flagship store in New York

Glossier’s flagship store in New YorkSource: Glossier[/caption] Landscape, Tailwinds and Headwinds The US beauty landscape is increasingly being shaped by DTC brands. The rise of Glossier and other DTC brands such as ColourPop Cosmetics and Drunk Elephant has shown that despite having a small footprint, DTC brands can quickly prominence. On the other hand, the growing number of DTC brands represents headwinds for the US beauty industry, as it becoming more challenging for brands to achieve a competitive advantage. Many DTC beauty brands are caving to pressure from venture capitals to meet the valuation expectations of the market, instead of focusing on early profitability. Moreover, increasing social media ad prices are driving up customer-acquisition costs for DTC companies: The social media advertising cost-per-thousand worldwide increased from $3.73 in the first quarter of fiscal year 2017 to $6.78 at the end of 2019, according to a March 2020 report from digital advertising platform Kenshoo. A string of negative events in February 2020 showcased the challenges that DTC beauty brands face. Firstly, US-based e-commerce company Brandless (which used to sell food, beauty and personal care, and healthcare products under its own name) shut down operations due to operational and financial difficulties, high customer-acquisition costs and the difficulty of bringing online intimacy to the brick-and-mortar front. Edgewell Personal Care then backed out of its deal to acquire Harry’s for $1.37 billion after the Federal Trade Commission sued to block the transaction, alledging that the proposed combination would eliminate one of the most significant competitive forces in the shaving industry. This came as a surprise, because Harry’s only holds a small share of the US razor market. For venture investors and private equity, this case highlights that antitrust risks might limit available exit strategies for those pursuing investments in disruptive beauty startups. The DTC space is reaching a new level of maturity, indicated slowing growth rates in recent years. In 2019, the DTC marketplace posted 22% year-over-year growth, down from 41% and 32% growth in 2017 and 2018, respectively, according to a February 2020 report from GroupM, a media investment company. However, we believe that DTC companies are more agile and can therefore adapt more easily than legacy retail brands. If DTC brands and retailers are able to overcome the early growth challenges of profitability, they could continue to gain market share. In order to boost sales and conversion rates, a number of DTC beauty brands are establishing and expanding their physical presence, with a view to directly interact with customers and enhance their shopping experiences. Omnichannel strategies are becoming more imperative for DTC brands to sustain growth. Glossier’s emphasis on its offline presence therefore augurs well, as evidenced by its conversion rates at the flagship store in New York. Unlike the CEOs of beauty industry incumbents, Glossier’s CEO Emily Weiss is actually a member of the consumer community that her company serves—she has leveraged Into The Gloss as a source of inbound marketing and for digital content creation, comprising a competitive advantage for Glossier. Furthermore, the company uses television advertising to scale up as well as to create exclusive advertising packages. In September 2019, Glossier launched its first 30-second TV advert, “Feeling like Glossier,” exclusively with the American Broadcasting Company (ABC). In addition to TV ads, the beauty company’s deal with the broadcaster includes content for ABC’s website and app. Impact on Traditional Players Glossier has a critical first-mover advantage in winning younger audiences compared to legacy players, which have been slow to adopt innovation in their marketing strategies. Through its social media channels, Glossier has changed the way in which consumers engage, shop and perceive their relationship with the brand. Responding to this change in the industry, some of the big beauty players are introducing new retail concepts and strategies to win younger consumers. For example, both Estée Lauder and L’Oréal have adopted DTC business models. Estée Lauder’s DTC business has grown more than 40% in recent years, and in fiscal year 2019, it saw 1.3 billion website visits. Similarly, L’Oréal’s DTC business is a major driver for the company’s luxury beauty brands. Furthermore, legacy players are acquiring young brands to offer personalized and exclusive products to shoppers:

- L’Oréal acquired South Korean beauty brand Nanda and Pulp Riot Hair Color in May 2018 to help it keep up with the booming popularity of domestic beauty products.

- In recent years, Estée Lauder has invested in Deciem, “The Abnormal Beauty Company,” as well as buying cosmetics brands Becca and Too Faced, which stand in contrast to its massive traditional labels, Clinique and La Mer.

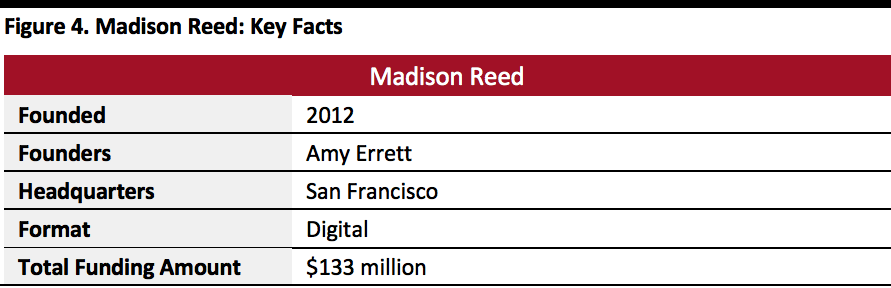

Madison Reed

Profile Madison Reed first entered the market as a DTC brand providing at-home color services. It later expanded into physical salons by opening “Color Bars” that offer hair-coloring products and services. Madison Reed broadened its retail distribution through an exclusive wholesale partnership with Ulta Beauty in April 2019. Under the alliance, Ulta Beauty carries all of Madison Reed’s products, including hair-color kits, color-protecting shampoos and conditioners and hair-color primers in 1,200 stores and online at Ulta.com. Since its founding in 2013, Madison Reed has raised a total funding of $133 million over four rounds, with the latest Series-D funding round having taken place in January 2019. In 2018, the brand achieved annual revenues of $50 million, with the majority of its sales coming from e-commerce, followed by its Color Bars. [caption id="attachment_109879" align="aligncenter" width="580"] Source: Crunchbase/company reports/Coresight Research[/caption]

How Has Madison Reed Disrupted the Market?

Traditionally, the hair-coloring industry was largely split between the very high-end salon experience that requires several hours and dollars and inexpensive off-the-shelf drugstore products. Madison Reed filled the by offering salon-quality, affordable, at-home hair-color products, which are free from harsh ingredients commonly used by other brands—parabens, ammonia, gluten, PPD resorcinol, phthalates, SLS and titanium dioxide—and are enriched with ingredients like argan oil, keratin and ginseng root.

In addition to one-off purchases, consumers can enroll in Madison Reed’s membership program to have products delivered up to every eight weeks, costing $19.95 per box. Membership also comes with other perks, such as exclusive discounts, birthday gifts, free consultations with colorists and free samples.

Further to its at-home color products and services, Madison Reed has disrupted traditional salon channels through its “Color Bars,” which offer quick hair treatments at affordable prices. The company’s membership program extends to its physical locations, offering product discounts and “unlimited roots services” at certain locations for a monthly fee, for example.

At its Color Bars, Madison Reed provides transparency for consumers, differentiating it from traditional salons. For example, it allows clients to buy the exact color formula and products that were used on their hair by the professional colorists and consultants, and consumers can also book free color consultations in which colorists provide advice on how to color hair at home.

[caption id="attachment_109880" align="aligncenter" width="580"]

Source: Crunchbase/company reports/Coresight Research[/caption]

How Has Madison Reed Disrupted the Market?

Traditionally, the hair-coloring industry was largely split between the very high-end salon experience that requires several hours and dollars and inexpensive off-the-shelf drugstore products. Madison Reed filled the by offering salon-quality, affordable, at-home hair-color products, which are free from harsh ingredients commonly used by other brands—parabens, ammonia, gluten, PPD resorcinol, phthalates, SLS and titanium dioxide—and are enriched with ingredients like argan oil, keratin and ginseng root.

In addition to one-off purchases, consumers can enroll in Madison Reed’s membership program to have products delivered up to every eight weeks, costing $19.95 per box. Membership also comes with other perks, such as exclusive discounts, birthday gifts, free consultations with colorists and free samples.

Further to its at-home color products and services, Madison Reed has disrupted traditional salon channels through its “Color Bars,” which offer quick hair treatments at affordable prices. The company’s membership program extends to its physical locations, offering product discounts and “unlimited roots services” at certain locations for a monthly fee, for example.

At its Color Bars, Madison Reed provides transparency for consumers, differentiating it from traditional salons. For example, it allows clients to buy the exact color formula and products that were used on their hair by the professional colorists and consultants, and consumers can also book free color consultations in which colorists provide advice on how to color hair at home.

[caption id="attachment_109880" align="aligncenter" width="580"] Madison Reed’s Color Bar & Hair Salon in Fort Worth

Madison Reed’s Color Bar & Hair Salon in Fort WorthSource: Madison Reed[/caption] Franchising Growth Strategy To Upscale Physical Retail Compared to other DTC brands, Madison Reed plans to turn to brick-and-mortar retail at a much faster pace. In September 2019, the company announced that it will franchise Color Bars through a joint venture with consulting firm Franworth, to unlock the ability to upscale its physical retail presence. Madison Reed plans to have 600 stores—100 company-owned locations and 500 franchised stores—by 2024, according to Retail Dive, representing about 6,500% growth in the retailer’s footprint. Madison Reed claims to be the first digitally native vertical brand to use a franchise business model as a growth strategy. The company’s CEO Amy Errett said that the franchise agreements will require a $350,000 finish-out investment and will be sold for $45,000 apiece or three for $90,000. Landscapes, Tailwinds and Headwinds The global hair-color industry is set to grow from $17.8 billion in 2019 to $28.5 billion by 2024, at a CAGR of 8.2%, according to market research firm 360 Research Reports. Hair-color service providers such as Madison, eSalon and Hairprint are finding growing relevance with millennials and young professionals, who consider at-home solutions to be convenient and cost-effective. Despite the competition, Madison Reed remains well-positioned in the growing hair-color market through its omnichannel strategy. However, there are challenges to growth in this market, including stricter regulations by the US government regarding chemicals used in the production of hair color. Furthermore, the on-demand hair-treatment model is a low-margin industry, so making a sustainable profit may be difficult. With a physical retail space, there may be pressure to consistently fill the salon to justify rent and other overhead costs. As we discussed earlier, DTC brands may see marketing and fulfillment represent two substantial, and rising, costs, offsetting benefits of scale. This wider-market challenge is applicable to Madison Reed. Madison Reed spends a significant portion of its budget on Facebook advertising, where cost per click has increased over the last few years: The median cost per click for Facebook News Feed ads rose from $0.50 in the second quarter of fiscal year 2018 to $0.62 in the second quarter of fiscal year 2019, according to digital marketing company Adstage. To optimize its user acquisition costs, Madison Reed has been working with artificial intelligence technology startup Retina since 2017. Retina is helping the company to predict customers’ lifetime value, enabling Madison Reed to make informed budgeting decisions for marketing. The company currently uses this lifetime-value data to power its look-alike modeling on Facebook, which has increased its return on investment by 50% in some cases, according to Madison Reed’s CFO Carrie Kalinowski. Impact on Traditional Players The global hair-color industry has long been dominated by L’Oréal and Coty’s Clairol. However, with consumers’ changing demands and preferences, even these established brands are reshaping their strategies to be more relevant.

- In May 2019, L’Oréal launched Color&Co, a DTC at-home hair-color brand that targets consumers aged 30–50. The brand offers personalized product recommendations through free video consultations with certified colorists. Customers can make a one-time order or join on a subscription basis.

- In December 2018, Clairol launched “Clairol Color Expert,” a hands-free, voice-activated guide to hair coloring that is availble on Google Home smart speakers.

Nykaa

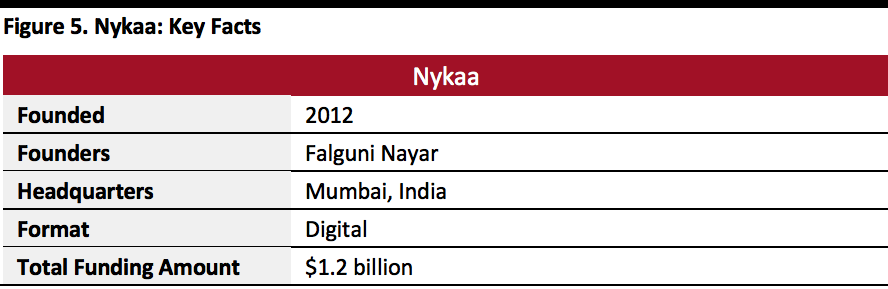

Profile Nykaa is an Indian DTC beauty retailer founded in 2012 by Falguni Nayar, an investment banker turned entrepreneur. The company sells products from more than 1,000 global beauty brands, including Clinique, L’Oréal and Mac. In addition to products, Nykaa also provides in-salon and at-home services. Nykaa owns a 33% share of the Indian online beauty market, with 3 million active users, according to Switzerland-based consulting firm Frederic Fernandez & Associates. Within five years of its launch, Nykaa was processing 10,000 orders per day, according to Falguni Nayar. The retailer is currently valued at $1.2 billion, making Nykaa the only women-led Indian startup to become a unicorn company. Nykaa’s annual revenues increased from $10 million in fiscal year 2016 to $157 million in fiscal year 2019, according to Frederic Fernandez & Associates. Segmentwise, the company’s premium and luxury segments account for 60% of its revenues. By product category, skin care and color cosmetics together account for nearly 75% of its total revenues. The company’s private-label brand, Nykaa Cosmetics, generates 10% of total revenues. [caption id="attachment_109881" align="aligncenter" width="580"] Source: Moneycontrol/company reports/Coresight Research[/caption]

How Has Nykaa Disrupted the Market?

Back in 2012, when the Indian beauty market was disorganized and e-commerce was at a nascent stage in the country, Nayar looked to combine beauty and e-commerce to fill the gap in the market, which was lacking niche/beauty-focused online players with long-tail assortments. Through its DTC model and low-cost structure, Nykaa was able to aggressively penetrate tier-2 and tier-3 cities, which previously had limited access to the beauty sector.

When legacy brands and retailers followed the clichéd single standard of beauty, Nykaa spearheaded the inclusive beauty wave in India through brand innovations. Furthermore, it became the first retailer in the country to work with make smaller international beauty brands available to Indian shoppers at affordable prices—such as cruelty-free vegan brand Ciaté London, South Korean Innisfree, luxury haircare brand Rene Furterer and Huda Kattan’s Huda Beauty, among others.

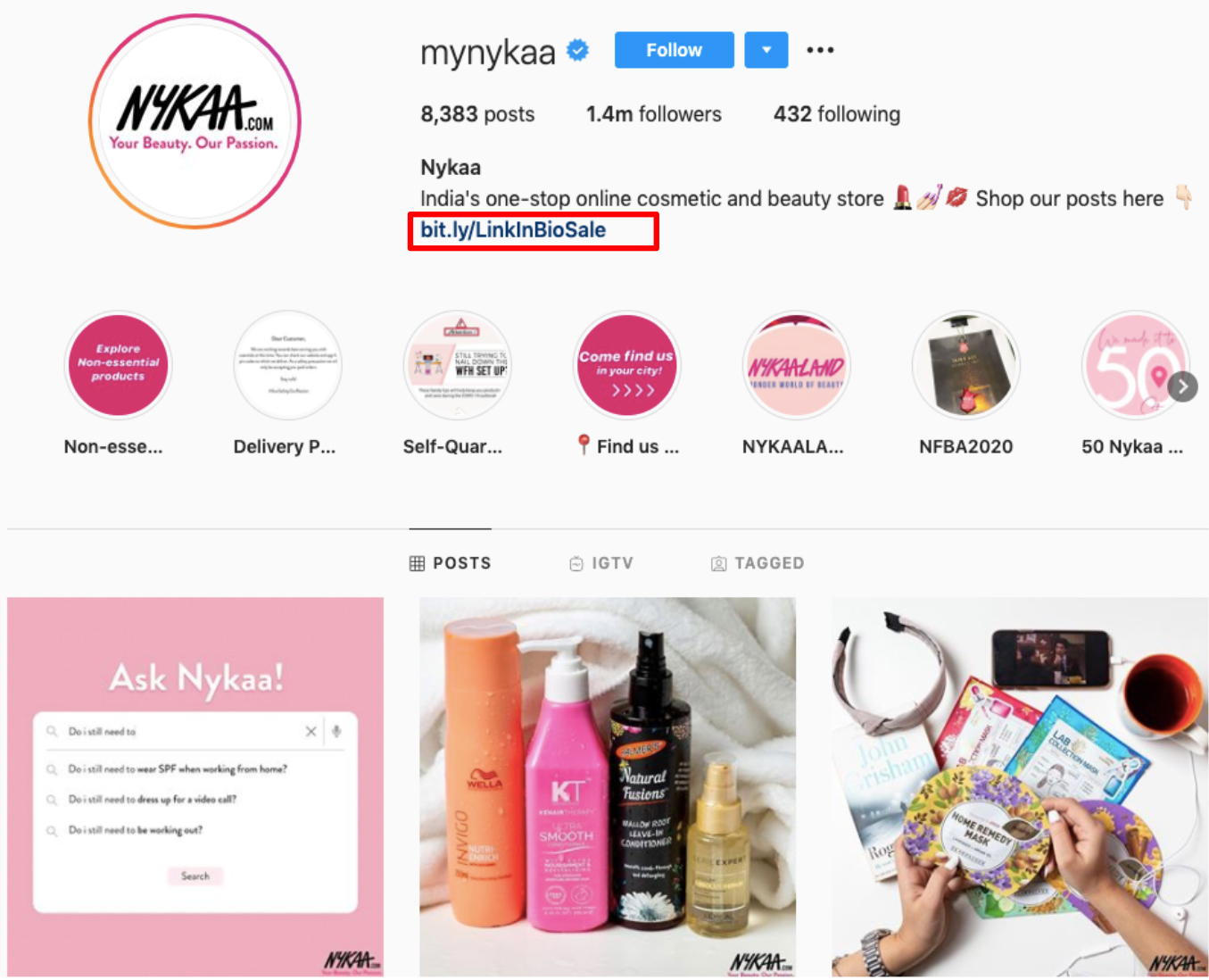

Unlike traditional Indian beauty players, Nykaa capitalized on social commerce to personalize the shopping experience and thus drive conversion. The retailer’s Instagram channel, which has 1.4 million followers, provides makeup tutorials, customer product reviews and advice from global industry leaders. It directly connects with the DTC website, providing a frictionless shopping experience for consumers. Nykaa has also integrated the “Shop Now” option on Facebook, a platform on which it has 3.3 million followers. Furthermore, Nykaa runs its own YouTube Channel, “Nykaa TV,” that has more than 980,000 subscribers (figures accurate as of early May 2020). By leveraging various social media platforms, the beauty retailer has created a knowledge-sharing community through which beauty shoppers can access news, share advice and ask beauty experts about their specific concerns.

[caption id="attachment_109904" align="aligncenter" width="700"]

Source: Moneycontrol/company reports/Coresight Research[/caption]

How Has Nykaa Disrupted the Market?

Back in 2012, when the Indian beauty market was disorganized and e-commerce was at a nascent stage in the country, Nayar looked to combine beauty and e-commerce to fill the gap in the market, which was lacking niche/beauty-focused online players with long-tail assortments. Through its DTC model and low-cost structure, Nykaa was able to aggressively penetrate tier-2 and tier-3 cities, which previously had limited access to the beauty sector.

When legacy brands and retailers followed the clichéd single standard of beauty, Nykaa spearheaded the inclusive beauty wave in India through brand innovations. Furthermore, it became the first retailer in the country to work with make smaller international beauty brands available to Indian shoppers at affordable prices—such as cruelty-free vegan brand Ciaté London, South Korean Innisfree, luxury haircare brand Rene Furterer and Huda Kattan’s Huda Beauty, among others.

Unlike traditional Indian beauty players, Nykaa capitalized on social commerce to personalize the shopping experience and thus drive conversion. The retailer’s Instagram channel, which has 1.4 million followers, provides makeup tutorials, customer product reviews and advice from global industry leaders. It directly connects with the DTC website, providing a frictionless shopping experience for consumers. Nykaa has also integrated the “Shop Now” option on Facebook, a platform on which it has 3.3 million followers. Furthermore, Nykaa runs its own YouTube Channel, “Nykaa TV,” that has more than 980,000 subscribers (figures accurate as of early May 2020). By leveraging various social media platforms, the beauty retailer has created a knowledge-sharing community through which beauty shoppers can access news, share advice and ask beauty experts about their specific concerns.

[caption id="attachment_109904" align="aligncenter" width="700"] Nykaa’s Instagram account

Nykaa’s Instagram accountSource: Instagram[/caption] Omnichannel Consumer-Centric Ecosystem Launched as a pure play, Nykaa has evolved into an omnichannel consumer-centric ecosystem, with 67 outlets across more than 30 cities in the country. In physical retail, the company has created two separate entities: Nykaa On Trend stores, which sell the retailer’s bestselling products; and Nykaa Luxe stores that feature all of the premium brands. Nykaa’s offline retail channel was conributing less than 10% of its total sales, as of June 2019, according to Anchit Nayar, CEO of Nykaa Retail. In June 2019, the company announced that it would expand the store network to 180 outlets within five years. Anchit Nayar expects offline retail to contribute 15–20% of total sales in that time, according to The Economic Times. Each store requires a capital expenditure of ₹6–8 million (roughly $86,000–115,000), according to Anchit Nayar, who also stated at the time, “There are no immediate plans to raise funds to support growth plans. We have achieved break-even. We can fund our growth plans by ourselves.” Landscapes, Tailwinds and Headwinds The Indian beauty retail industry has always been fragmented, be it online or offline. Nykaa’s closest competitor is India-based DTC beauty retailer Purplle, but compared to Purplle, Nykaa offers a broader and more comprehensive product range and has more followers, higher incoming traffic and higher annual revenues. In the offline space, Nykaa competes with multi-brand retailers, such as Sephora and Shoppers Stop, which mostly sell luxury and mass products, respectively—whereas Nykaa sells both high-end and mass products. Sephora was a relatively late entrant in the Indian beauty market, having entered in 2015. The Indian online beauty market was valued at $15.9 billion in 2018 and is set to grow to $22.5 billion by 2022, according to India-based consulting firm Redseer. Growth will be driven by a rise in purchasing power, increased Internet penetration in the country, increased demand for exclusive products and greater authenticity, as well as increased reliability in the supply chain. While profitability is the biggest concerns for DTC retailers, Nykaa has managed to buck the trend of e-commerce losses by achieving a break-even point within five years of its launch. By 2017, Nykaa had also brought down its customer-acquisition costs to ₹200 ($3) from ₹650–1,000 (around $12–18) in 2012. In fiscal year 2019, the company reported profits of ₹20.3 million ($292,600). In the coming years, Nykaa might face some serious challenges from online retailers such as Amazon, Walmart-owned Flipkart and Myntra, which have recently intensified their focus on beauty offerings. Currently, Nykaa is well-placed with its low cost of customer acquisition and digital marketing strategy. To protect its hard-won lead, Nykaa needs to step up its game across the business, from beauty product categories to delivery. Impact on Traditional Players Nykaa positively changed the power dynamics in the Indian beauty industry. Despite being one of the most ubiquitous beauty brands in India, Lakmé’s (owned by Hindustan Unilever Limited, a unit of Unilever) pace of innovation and rate of new product launches had been slow. However, with the market evolving, Lakmé has increased its pace of innovation nearly threefold over the past few years, according to Sandeep Kohli, Executive Director (Personal Care) at Hindustan Unilever Limited. In December 2018, Lakmé launched an e-commerce portal to capitalize on the growing demand for beauty products online. The brand also launched premium and organic beauty products to expand its portfolio; Lakmé had traditionally served value-seeking shoppers. Through innovation and social commerce, Nykaa is catching up to legacy brands like Lakmé in terms of popularity and market share. The expansion of its private label may further help Nykaa to have more control over product prices and markup, which can significantly boost profitability.

Perfect Diary

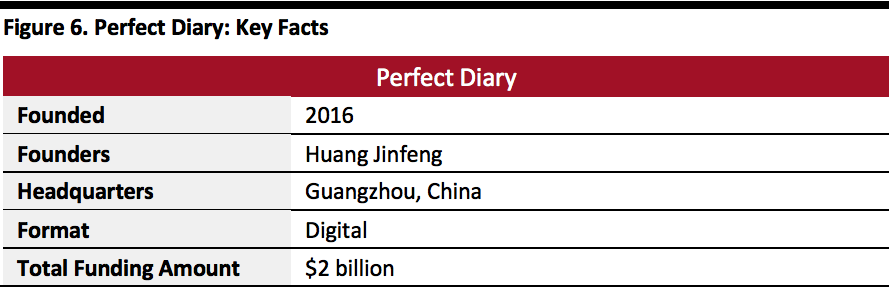

Profile Perfect Diary is a Chinese cosmetics brand that offers products at a mass-market price point, targeting women aged 20–35. The brand was founded in 2016 and is headquartered in Guangzhou. Perfect Diary has leveraged various online platforms to expand its reach and enhance customer engagement. In March 2017, the brand started its online business on Tmall and Taobao. Half a year later, Perfect Diary opened a WeChat store, became an early adopter of Xiaohongshu (Little Red Book) and hosted three pop-up stores in Shanghai. In 2018, it established a store on JD.com. Perfect Diary became the first cosmetics brand to achieve a one-day sales volume of more than ¥100 million ($14 million) during the Single’s Day shopping holiday on Tmall on November 11, 2018—and took only one hour 28 minutes to hit that mark, according to Tmall. The following year, the brand reached this target in just 13 minutes. Perfect Diary has raised around $2.0 billion in funding to date. [caption id="attachment_109883" align="aligncenter" width="580"] Source: CB Insights/company reports/Coresight Research[/caption]

How Has Perfect Diary Disrupted the Market?

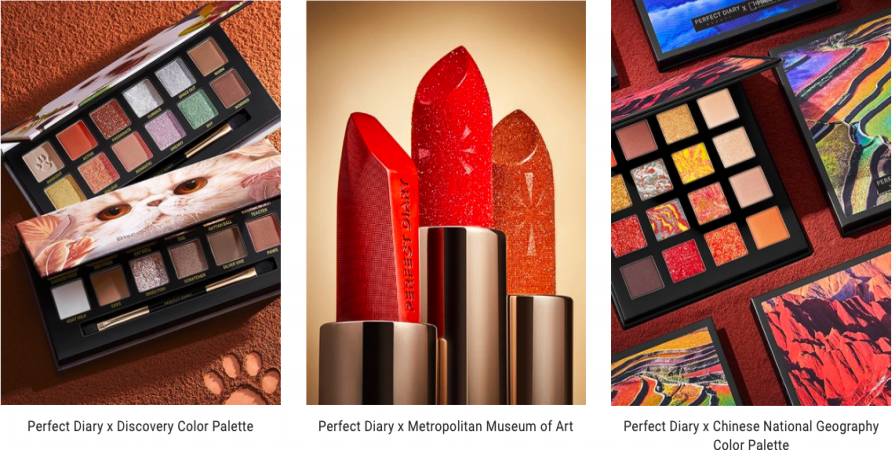

Perfect Diary offers high-quality cosmetics products at low prices, making it popular among younger consumers in China. The brand has also entered into innovative collaborations to increase its consumer reach. For example, Perfect Diary partnered with Discovery Channel in March 2019 to launch Explorer, a collection of wild-animal-inspired 12-color eye-shadow palettes, which attracted over 100,000 pre-orders. Similarly, in early 2019, the brand collaborated with the Metropolitan Museum of Art in New York to release a lipstick collection that used the royal portraits inside the museum as inspiration. During the “618 Festival” in June 2019, Perfect Diary sold over 800,000 lipsticks.

Although the ascent of Perfect Diary in China is similar to Glossier’s rise in the US, the major difference arises due to China’s unique digital ecosystem. While Glossier relies on US apps like Instagram, Perfect Diary instead capitalizes on Chinese community-based platform Little Red Book, which has more than 200 million users as of May 2020. Perfect Diary invests heavily in engaging users on Little Red Book through sampling and hashtag campaigns, collaborations with key opinion leaders (KOLs) and celebrities, offline event promotions and the reposting of users’ content on its own account. As of February 2020, Perfect Diary had 1.79 million followers on Little Red Book versus Maybelline’s 150,000 and luxury label Yves Saint Laurent’s 92,000.

In addition to Little Red Book, Perfect Diary has successfully harnessed other social media channels, such as WeChat, TikTok, Weibo and Bilibili, which offers word-of-mouth marketing that is more cost-effective than traditional advertising. The brand also engages with key opinion consumers (KOCs), which have no more than a few hundred fans on their social media accounts. These KOCs are more relatable to their followers than celebrities and are generally deemed more trustworthy, particularly as sponsored content posted by KOLs can be obviously bias to certain brands’ products.

Perfect Diary has become a good example of operating private traffic, which refers to users that can be reached freely and communicated with repeatedly. Building a brand-owned traffic pool is a less expensive way to reach consumers than other digital channels. To maximize this pool, Perfect Diary launches exclusive promotions to encourage shoppers to engage with the brand on WeChat. Perfect Diary also created a virtual brand advocate called Xiaowanzi, who represents a similar profile to the brand’s target consumers and serves as a beauty adviser, friend and customer service resource in the group. There are hundreds of Xiaowanzi personal WeChat accounts run by the company’s employees that operate multiple WeChat groups; the character is used as an influencer to share product information and promotional material based on its fictional daily life and interests.

[caption id="attachment_109884" align="aligncenter" width="580"]

Source: CB Insights/company reports/Coresight Research[/caption]

How Has Perfect Diary Disrupted the Market?

Perfect Diary offers high-quality cosmetics products at low prices, making it popular among younger consumers in China. The brand has also entered into innovative collaborations to increase its consumer reach. For example, Perfect Diary partnered with Discovery Channel in March 2019 to launch Explorer, a collection of wild-animal-inspired 12-color eye-shadow palettes, which attracted over 100,000 pre-orders. Similarly, in early 2019, the brand collaborated with the Metropolitan Museum of Art in New York to release a lipstick collection that used the royal portraits inside the museum as inspiration. During the “618 Festival” in June 2019, Perfect Diary sold over 800,000 lipsticks.

Although the ascent of Perfect Diary in China is similar to Glossier’s rise in the US, the major difference arises due to China’s unique digital ecosystem. While Glossier relies on US apps like Instagram, Perfect Diary instead capitalizes on Chinese community-based platform Little Red Book, which has more than 200 million users as of May 2020. Perfect Diary invests heavily in engaging users on Little Red Book through sampling and hashtag campaigns, collaborations with key opinion leaders (KOLs) and celebrities, offline event promotions and the reposting of users’ content on its own account. As of February 2020, Perfect Diary had 1.79 million followers on Little Red Book versus Maybelline’s 150,000 and luxury label Yves Saint Laurent’s 92,000.

In addition to Little Red Book, Perfect Diary has successfully harnessed other social media channels, such as WeChat, TikTok, Weibo and Bilibili, which offers word-of-mouth marketing that is more cost-effective than traditional advertising. The brand also engages with key opinion consumers (KOCs), which have no more than a few hundred fans on their social media accounts. These KOCs are more relatable to their followers than celebrities and are generally deemed more trustworthy, particularly as sponsored content posted by KOLs can be obviously bias to certain brands’ products.

Perfect Diary has become a good example of operating private traffic, which refers to users that can be reached freely and communicated with repeatedly. Building a brand-owned traffic pool is a less expensive way to reach consumers than other digital channels. To maximize this pool, Perfect Diary launches exclusive promotions to encourage shoppers to engage with the brand on WeChat. Perfect Diary also created a virtual brand advocate called Xiaowanzi, who represents a similar profile to the brand’s target consumers and serves as a beauty adviser, friend and customer service resource in the group. There are hundreds of Xiaowanzi personal WeChat accounts run by the company’s employees that operate multiple WeChat groups; the character is used as an influencer to share product information and promotional material based on its fictional daily life and interests.

[caption id="attachment_109884" align="aligncenter" width="580"] Perfect Diary has leveraged collaborations to launch innovative product collections

Perfect Diary has leveraged collaborations to launch innovative product collectionsSource: Perfect Diary[/caption] Expand Brick-and-Mortar Stores Perfect Diary upgraded its strategy to focus on “new retail” in early 2019. It opened 40 offline stores that year and integrated them with its online channel. By establishing a brick-and-mortar presence, the brand aims to improve the shopping experience and create a new private traffic pool. According to Perfect Diary, its offline stores will reach 65% of new customers—those who have not bought products from the brand online. In December 2019, Perfect Diary announced that it would expand its offline presence by launching 600 brick-and-mortar stores countrywide over three years. In line with the pace of opening offline stores, the brand is set to recruit 3,000 beauty consultants, including more than 500 makeup artists, according to Feng Qiyao, Ppresident of the New Retail Division at Perfect Diary’s parent company Yixian E-commerce. Landscapes, Tailwinds and Headwinds With the number of DTC brands growing both online and in brick-and-mortar retail in the China beauty market, achieving differentiation from competitors has become more challenging. Perfect Diary has capitalized on local trends and buying habits, as many Chinese shoppers prefer local brands versus foreign imports, according to a May 2019 survey by Tencent. The survey found that 42% of Chinese consumers prefer local brands to foreign imports for the same products. According to the survey, local brands comprise 56% of the ¥215 billion ($30.59 billion) Chinese makeup and skincare market. Perfect Diary’s ample funding allows the company to invest in more typical Chinese marketing practices, such as the tried-and-true method of working with young, male pop idols to drive social engagement and e-commerce sales. Owing to big-brand homogeneity, Perfect Diary has gained momentum among consumers seeking product differentiation. Most Chinese DTC beauty brands are witnessing rising costs of marketing and fulfillment, and the growing number of foreign beauty brands in the market represent headwinds for domestic beauty players. Through collaborations with local retailers and e-commerce platforms, international brands are accessing local consumer data to create customer profiles, analyze consumption characteristics and plan production. For example, L’Oréal collaborated with The Tmall Innovation Centre by the Alibaba Group in September 2018, taking a consumer-to-business approach to developing a male beauty line specifically for the China market. Impact on Traditional Players Within the first year of its launch, Perfect Diary became the top-mentioned beauty brand on Little Red Book, ahead of big brands like Estée Lauder, L’Oréal and Tom Ford. Despite the credibility of renowned international beauty brands, China’s beauty shoppers are giving local brands a chance—and these local brands have the upper hand in understanding local consumer needs. International brands are learning from Perfect Diary’s meteoric rise and are engaging with customers on various Chinese social media platforms and marketplaces. For example, L’Oréal launched a livestreaming channel on Alibaba’s Taobao/Tmall for the pre-sale period of Singles’ Day 2019. In total, L’Oréal served more than 10.34 million orders over 392 livestreaming hours. In addition to Tmall, L’Oréal is expanding its presence in China by working with influencers on other social media platforms, including Little Red Book, WeChat and TikTok.