Looking Ahead

The 2010s were a period of unprecedented upheaval and disruption in global retail. We saw the impact of sustained channel shifts in mature markets such as the US and major growth and development in markets such as China. As we enter the 2020s, we see this phase of disruption crystalizing into a new retail landscape. In mature markets in particular, we expect retailers to respond less retroactively to “negative” developments and more proactively seek to reshape retail.

We outline our predictions for how retail will look by 2030, with a focus on the US and similarly developed markets such as Western Europe. We expect retail in 2030 to have four characteristics: lean, spectacular, transparent and frictionless.

First, we outline how we expect physical stores to rediscover their role in the retail landscape.

By 2030, Physical Stores Will Gravitate around Four Purposes

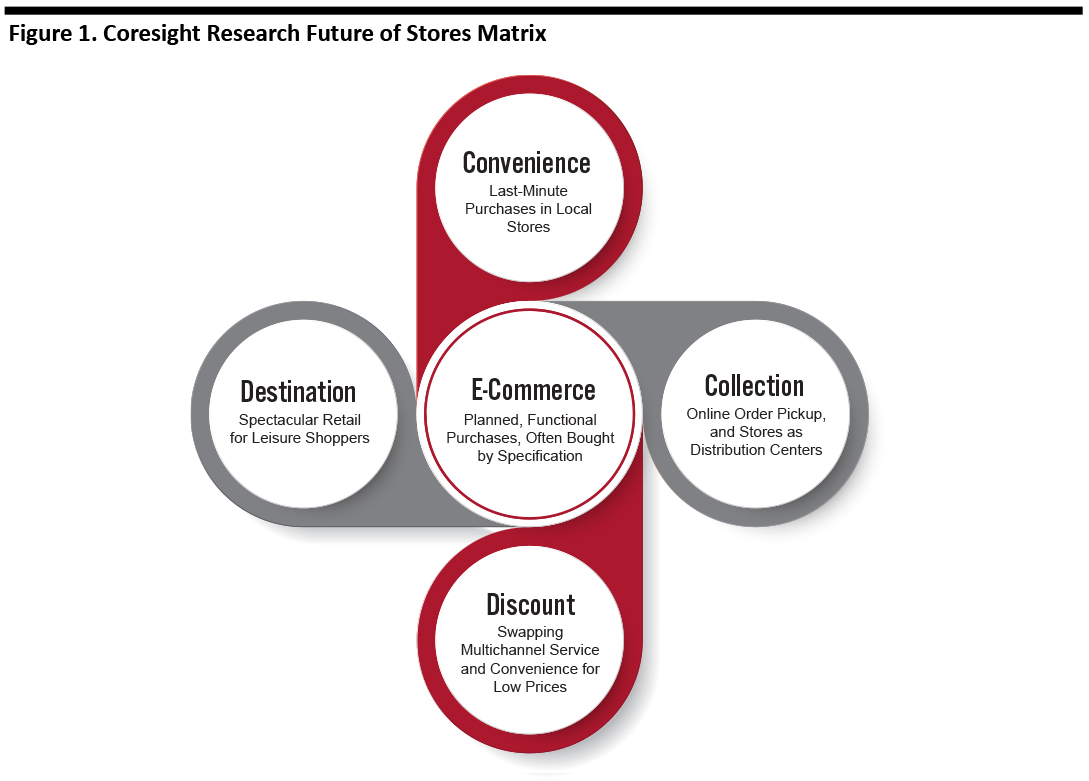

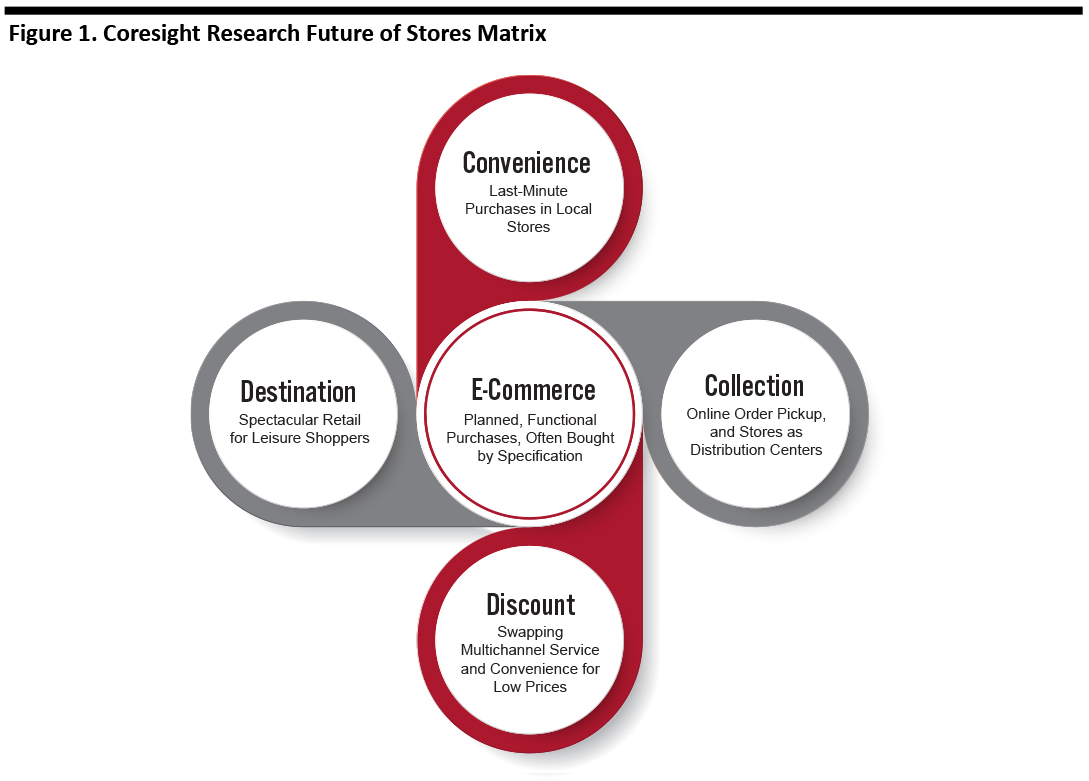

Over the next decade, we expect physical retail formats to serve four purposes—each of which complements e-commerce, filling the gaps that online retail cannot serve.

This reshaping will be most radical in discretionary retail. In 2030, we estimate that e-commerce will account for over 40% of all US nonfood sales—twice its share of around 20% in 2019 and representing a major erosion of in-store spending over the space of a few decades. We expect e-commerce to capture an approximate 10% share of US food retail sales in 2030.

Online retail will capture spend that is planned, because one- or two-hour delivery is unlikely to be the norm, even by 2030. It will be functional, because there is less chance to touch or experience the products in person. In addition, most products will be bought by specification, because the huge choice and remote nature of e-commerce have always suited comparison purchases.

As we show in our Future of Stores Matrix below, physical retail formats will be shaped by four key factors:

- Convenience (such as immediacy) and demand for a frictionless store experience

- Collection and also distribution as more stores become pick-up and fulfillment points

- Discount options, such as off-price and dollar stores

- Destination stores that offer spectacular retail experiences

[caption id="attachment_103086" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research[/caption]

Four Themes

Lean Retail

The overarching concept in mature markets will be lean retail: physical retail networks that are radically slimmed down and nimbler, and so are more responsive to changes in demand.

The huge numbers of store closures in Europe and the US are not a short-term event. We expect them to continue on a sustained basis as sales progressively move online and as more shoppers explore retail alternatives such as rental. However, we expect the most significant wave of closures to be front-weighted; by the later 2020s, we expect retailers in mature markets such as the US to slow the pace of closures following more aggressive culling in the early twenties and an incremental slowing in e-commerce growth.

By 2030, we expect the total square footage of US department stores (as we know them today) to be cut in half, driven by bankruptcies, further store-closure programs and conversions to higher-growth formats such as discount and off-price. Moreover, we expect most major large-store nonfood retailers in the US to have launched smaller-store programs by 2030—such as that already implemented by Target. We also expect inventory-free concepts such as Nordstrom Local to become more commonplace. Even in sectors in which store numbers hold up, total square footage could still shrink.

Meanwhile, e-commerce will grow more rapidly in food than in nonfood. E-commerce creeping toward a double-digit share of US food retail sales will raise the question: Will US food retail begin to confront the need to resize as nonfood retail has done?

Across the 2020s, we’ll see sustained collaboration between retailers, notably in sharing spaces to create traffic-driving synergies, and large-store retailers looking for co-tenants so they can repurpose excess space. Shorter leases and more short-term stores will make physical retail more responsive. Fewer retailers will be willing to sign long leases in the wake of the dramatic shifts seen in the 2010s.

In mature retail markets, we predict the majority of major retailers in big-ticket discretionary categories (such as home furnishing) to implement augmented reality (AR) or virtual reality (VR) as a complement to online retail and smaller stores holding limited collections.

We anticipate that selected retailers will deploy reality technology even further, trialing AR- or VR-driven stores that hold no stock or display items but instead rely on virtual visualizations to showcase products or tell a brand’s story. In a similar vein, 3D printing will open opportunities for on-demand stores to become more commonplace in selected categories. The longevity of such formats will rest on whether retailers can win shoppers beyond an initial curiosity stage.

Physical expansion by digital brands will continue, but the pace will moderate. By 2030, today’s digital brands are likely to be established landmarks in the physical landscape. Moreover, given increasing investor skepticism about the sustainability of online, direct-to-consumer brands, we predict fewer digital-first brands to emerge in the coming years. Unless the direct-to-consumer model proves it is viable in the intervening years, there may be no meaningful flow of new digital brands that need to convert to physical retail by 2030, which would close another avenue to fill open retail space.

Spectacular Retail

Hand in hand with lean retail will be the entrenchment of spectacular retail in discretionary retail sectors. Already, we are seeing monobrand retailers launch a new generation of flagship stores that offer spectacular shopping environments, in-store experiences and digital integration. By 2030, retail will become more concentrated around these spectacular, brand-building stores.

Spectacular retailers will be the anchors for shopping districts and centers for urban consumers. Shoppers will become accustomed to experience-rich stores offering a huge choice of product and add-ons such as customization and personalization. Brands and retailers will measure the success of these formats not simply by four-wall profitability, but rather by the value they bring to their brands (although we expect successful spectacular retail outlets to be highly profitable).

These stores will act as the counterpoint to digital commerce, while still being fully integrated with e-commerce at critical touchpoints such as researching, browsing, ordering, purchasing and returning items. Digital integration using still-nascent technologies such as AR and VR will add even more spectacle to spectacular retail.

This trend will be driven principally by powerful brands and monobrand retailers. However, we will also see multibrand retailers at the upper end of the market use it—think prestige department stores such as Selfridges and Nordstrom. Spectacular retail will not work in all sectors or segments: Shoppers will still be happy to trade experience for low prices when shopping channels such as supermarkets, mass merchants and off-pricers. Instead, spectacular retail will be driven by brands and retailers in discretionary categories such as apparel, beauty and electronics, and it will inherently serve demand for leisure shopping, where the product story, brand experience and merchandise trialing will be paramount for shoppers.

Transparent Retail

The information asymmetry between retailers and shoppers has powered brands’ stories and retailers’ margins for decades, but it is eroding rapidly. By 2030, we expect that most large retailers will have been compelled to hand more power to the consumer through ever-greater transparency.

Customers, investors and employees will demand greater transparency on issues relating to sustainability and social impact. Companies will routinely publish previously confidential information so that shoppers can make better informed purchases—from raw material origins, production locations and worker conditions in the supply chain to product-related issues such as the carbon footprint, microplastic “emissions” and end-of-life disposal. Major names such as Amazon and H&M are already taking steps in some of these areas. This disclosure will push retailers—increasingly in collaboration at industry level—to raise supply-chain standards, reduce waste and encourage sustainable product disposal.

In sourcing, brands and retailers must be sure they have supply-chain visibility for themselves—a prerequisite to ensure they can offer transparency to customers. Retailers will rework supply chains to serve this need. In some cases, retailers may source more directly to minimize the number of intermediaries. In other cases, retailers will look to trusted sourcing giants that will increasingly build their reputations on the quality of compliance regimes—compliance that, increasingly, will not be to meet legal or industry minimums, but rather to create higher standards for things such as product origin and production standards.

The option of lowest-cost, “see no evil, hear no evil” supply chains will no longer be an option—at some cost to mass-market brands and retailers, albeit a necessary cost.

Post purchase, the pattern for organized product recovery programs is already set. In Europe, the Waste Electrical and Electronic Equipment Directive requires manufacturers and retailers to deal with product waste—so retailers have to accept electrical and electronic goods for recycling. By 2030, this kind of end-of-life obligation will extend to other categories such as apparel.

Furthermore, shoppers will be equipped with the tools for total price transparency. The greater adoption of dynamic pricing will unleash new tools that enable shoppers to navigate this landscape of rapidly changing prices and ultimately let them select how much they want to pay. Such digital tools will not only show consumers prices, but the information flow will be bidirectional: Retailers will get information on how much shoppers are willing to pay. In short, we could regress from a system of fixed prices to one more akin to haggling, in which digital platforms allow sellers and buyers to negotiate prices.

Frictionless Retail

Frictionless retail will become more predictive, support more intelligent interventions and feature a higher degree of automation to drive out the pain points of shopping.

Frictionless means retailers taking a holistic, smart approach that integrates AI automation, human intervention and data sharing to provide personalized and predictive interactions between innumerable touchpoints and across multiple channels. More sophisticated deployment of artificial intelligence will see retailers suggest products consumers will want—but did not yet know it.

This predictive power will evolve into anticipatory retailing, and shopper familiarity with AI-powered communications will intensify demand for smart, anticipatory interactions. This will manifest in more intelligent interventions by retailers, such as preemptive cart filling and automated replenishment based on past purchases.

On a more fundamental level, retailers will focus on traditional pain points such as checkout for in-store shopping and delivery for online purchases.

As we noted earlier, demand for convenience and immediacy will remain a driver for in-store retail in 2030. Shoppers will still turn to stores for groceries for tonight or last-moment purchases. “Just-walk-out” technology of the kind deployed by Amazon Go will be commonly deployed in high-traffic stores focused on frequent and “chore” purchases, such as supermarkets and convenience stores.

We expect deployment costs of checkout-free technology to come down sharply by 2030, making adoption more common as retailers seek to manage rising labor costs, even if not in every convenience store. However, even though the cost of installation may come down, maintenance and upgrades for frictionless technologies mean they are not a simple, one-off solution. Instead, they will become a new cost of doing business—just as those associated with e-commerce have become.

Meanwhile, shoppers will enjoy new services that erode a traditional barrier to online shopping: delivery. Drone deployment for last-mile delivery promises to solve this problem, but implementation will depend in part on regulations that are only now emerging. Perhaps more certain is the deployment of land-based robotic vehicles for delivery—whether they are small, autonomous robots or full-size self-driving vehicles. Faster delivery, coupled with auto replenishment and rapid delivery options, could see online orders turn up at the door before consumers have even thought of shopping for them.

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]