albert Chan

Post-Crisis Trends: Five New, Five Updates

Against the backdrop of a major crisis for global retail, we update our 10 trends for 2020. In this report, we introduce five new post-crisis trends and update five of the most relevant trends that we discussed back in January.

Five New Retail Trends, Post Crisis

Retail Prepares for a “Mask Economy” #1: Retailers Will Implement Contact-Light Retail with Urgency

Brick-and-mortar retailers are racing to implement contact-light retail, and this will become a hallmark of retail into 2021. We will see this play out in several ways in physical formats:

- Contactless collection, including contact-free curbside-pickup services. Even post lockdown, a number of retailers are continuing to extend curbside collection.

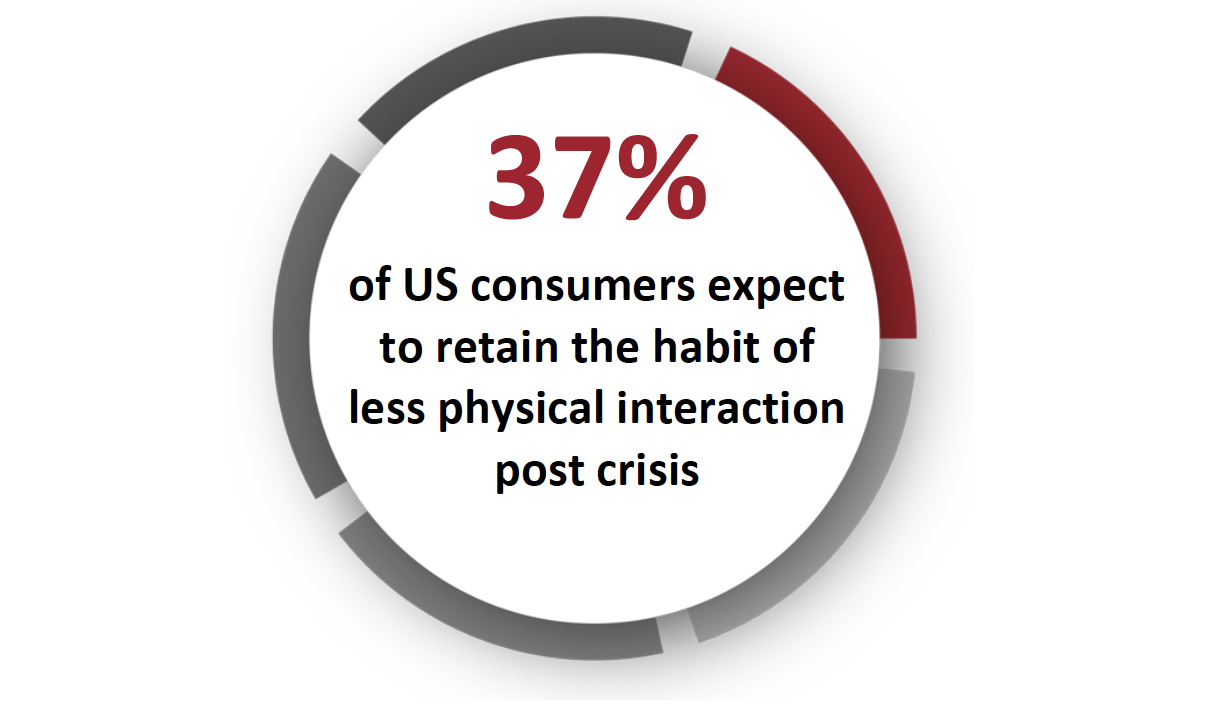

- Heightened uptake of contactless payments. On June 10, 27.4% of respondents to our weekly survey of US consumers reported that they expect to retain heightened use of contactless payment after the crisis ends.

- Eliminating checkout processes: Greater offering and adoption of self-scan in store. The concept of “bring your own device” was originally coined as a term for the workforce, but we expect it to become just as applicable to the consumer.

Retailers can achieve contact-light retail through accelerated app development, the deployment of QR codes and the use of artificial intelligence (AI). A number of grocery retailers pushed out nascent self-scan apps during Covid-19 lockdowns. In the US, Walmart used QR codes to make its Walmart Pay service touch-free. AI applications and services can integrate solutions for social distancing and contactless shopping. We expect to see retail continue to iterate and launch new digital products rapidly, continuing the tendency for agility we saw during lockdown periods.

[caption id="attachment_112452" align="aligncenter" width="550"] June 10, 2020

June 10, 2020Source: Coresight Research[/caption]

Retail Prepares for a “Mask Economy” #2: Brick-and-Mortar Retail Will Shift Back to Product

After several years of brick-and-mortar retail migrating toward experiences and services, we see the offline channel shifting its focus back to product: less shopping, more buying. As part of the move toward contact-light retail, the “experience” that shoppers appreciate from physical stores will now be that of getting a product in a shopping journey that is as friction-free as possible, rather than dwelling for in-store treatments, classes or other events that draw crowds or require physical contact.

Such a shift implies a depletion in the points of difference between retailers with physical stores. Faced with more limited opportunities to offer experiential services, they must focus on convenience and quality of customer service. They must also ensure that they excel at e-commerce and omnichannel, to serve shoppers who want to limit their visits to stores.

Stores’ pivot to functionality and raised demand online could align with physical outlets serving a greater role in fulfillment—namely, in collection (including at the curbside) and in ship-from-store. This trend will accelerate the integration of stores and e-commerce operations.

However, unless stores can figure out ways to reintroduce closer-contact events and experiences, one implication will be a reduced need for physical stores and possibly space per store (social-distancing requirements notwithstanding): Retailers will not need the space for high-touch services, and shoppers are likely to be spending less time in stores.

[caption id="attachment_112453" align="aligncenter" width="550"] June 10, 2020

June 10, 2020Source: Coresight Research[/caption]

Retail Prepares for a “Mask Economy” #3: Experiential E-Commerce Is Here To Stay

While stores are focused on low-friction shopping, e-commerce is likely to maintain momentum in its push toward experiences, service and interactions. Retailers used the crisis to offer more experiential e-commerce over typical functional shopping.

- Livestreaming and video consultations: We have seen early moves by Western retailers in these areas, and we expect to see a greater use of livestreaming and video consultations after the pandemic ends, as a result of raised consumer expectations and rapid adoption of such media by retailers during the crisis. In 2019, Amazon and Wayfair ventured into livestreaming. In 2020, brands including Clinique, Pomelo, Monki and Tommy Hilfiger launched livestreaming. Meanwhile, in the UK, Dixons Carphone and John Lewis were among those to have offered virtual consultations during lockdown.

- Events: Retailers have placed a greater emphasis on social media, and we expect companies to continue bringing physical experiences to consumers through social platforms, too, such as expert Q&A sessions to entertainment events such as music performances to fashion shows. Amid lockdown, luxury brand Fendi streamed a Fendi Renaissance—Anima Mundi musical event online while the UK’s Selfridges provided a six-hour comedy show on Instagram in aid of charity.

- Virtual stores, augmented reality (AR) and virtual reality (VR): These digital tools are bringing a richer experience to online retail, with AR and VR bridging the gap between the physical and the digital. During the crisis, we saw Christian Dior launch its “Dior Maison” virtual boutique, a digital copy of its flagship store on the Champs-Elysées in Paris; ASOS scaled its AR size-and-fit feature “See My Fit” to offer shoppers customized views of up to 500 products each week; and Lamborghini deployed AR to virtually launch a new car model.

The ending of lockdowns may make the need for such digital experiences seem less urgent, but social-distancing requirements and the near future of contact-light retail mean that there remain opportunities to enhance e-commerce with experiences. Online-only retailers, lacking the interaction possibilities of stores, are likely to see the greatest benefit from experiential e-commerce. However, multichannel retailers must ensure they are not left behind: After years of emphasizing the experience elements of stores, these multichannel retailers must explore how they can offer better experiences digitally.

[caption id="attachment_112454" align="aligncenter" width="550"] June 2020

June 2020Source: Coresight Research[/caption]

Retailers and Suppliers Will Shake Up Sourcing

The shock of the crisis will drive retailers to review where and how they source, and will change how suppliers deal with retailers. We see retailers moving away from China, paying renewed attention to digitalization and seeking greater supply-chain resilience.

- The crisis is likely to prompt a shift in sourcing away from China. Political rhetoric and consumer sentiment have turned against the country amid controversy of its handling of the outbreak. This comes on top of strained relationships due to the US-China tariff conflict of 2018–19. Other countries will seek to attract sourcing business that has hitherto gone to China, and this shift could accelerate nearshoring, allowing retailers to respond to demand more quickly.

- We expect to see accelerated digitalization, including greater adoption of digital sourcing platforms, virtual sampling and 3D design. This will be driven by a need for flexibility, speed and responsiveness in the wake of inventory accumulations and volatile consumer demand; the need to reduce physical contact, including with objects such as samples; and the inability to travel to sourcing locations in the near term.

- Retailers will look for suppliers that offer enhanced risk-mitigation options, to help ensure resilience, and we are likely to see some consolidation to fewer, larger suppliers. However, much of the awareness of new levels of risk now lies with suppliers. We are seeing suppliers deal with retailers with renewed caution, including withholding orders in some cases due to concerns over potential financial difficulty at some retail customers. We also expect suppliers to review who they work with over the longer term, to limit their risk as a growing number of retailers file for bankruptcy.

Among the short-term effects, meanwhile, are apparel retailers focusing their buying on more limited ranges and with deeper buying in the most relevant styles. With some apparel retailers undertaking “pack and hold” of spring/summer 2020 inventory until next year, we will see reduced orders for spring/summer 2021.

The shock of the pandemic is having immediate effects on how and what companies source, and it is likely to impact the supply chain for many months.

Crisis Impacts Will Linger Longer for Some Retail Sectors—Negatively and Positively

For some sections of retail, a recovery needs more than just an ending of lockdowns or a revival in shoppers’ willingness to spend: These sectors will see the after-effects of the crisis continue through to 2021 and possibly beyond.

Travel retail will feel the impact long after regular, or domestic-focused, retail sees a recovery. The sought-after Chinese consumer will be light on the ground, but travel fuels a large volume of retail purchases by Western consumers too.

The luxury sector will feel the heavy impacts of reduced travel. We estimate that fully 70% of Chinese consumers’ total luxury spend was made outside of China in 2019; this equates to around 24% of total global sales of personal luxury goods, based on Bain data. Factoring in international spending by the citizens of all the other nations of the world, the share of the market impacted by reduced travel will be much more substantial. Global luxury brands must encourage greater domestic purchases, and digital channels—especially experiential e-commerce, discussed earlier—are levers they can pull to cultivate domestic demand. (Read more about our assessment of how Covid-19 has impacted the US luxury market, and its potential path to recovery, in our separate Coronavirus Insights report.)

The counterbalance is that the positive after-effects will linger longer for some sectors. Likely medium-term shifts—and possibly structural moves—toward more working at home and (in part related to that) less dining out, as well as many more staycations, are likely to fuel growth in some segments.

- Furniture will see pockets of opportunity, as people not only work at home (boosting home-office furniture sales) but also spend more leisure time at home. Staycations should boost outdoor-living categories, including garden furniture, and outdoor leisure products such as pools.

- Similarly, home-improvement retailers will see demand as people spend more time at home. In the US, this sector saw demand hold up during lockdowns, and we estimate that it will be the top-performing store-based nonfood sector in the US in 2020.

- Food spending remains elevated in many countries, with expected lower levels of dining out and more working at home meaning more eating at home.

- Fitness equipment is like to remain in demand, as wary consumers avoid fitness centers. Major retailers in some markets sold out of big-ticket equipment through lockdowns. In the US, sporting goods and leisure retailers saw year-over-year sales growth turn positive to a solid 6% in May (per the US Census Bureau) as lockdowns eased and consumers could return to stores.

So, while retail will recover, that recovery will be far from evenly distributed—even within discretionary retail.

[caption id="attachment_112455" align="aligncenter" width="550"] Average percentage response for share of total luxury shopping undertaken while traveling internationally, by US respondents who had purchased luxury goods in the past 12 months, surveyed in June 2020

Average percentage response for share of total luxury shopping undertaken while traveling internationally, by US respondents who had purchased luxury goods in the past 12 months, surveyed in June 2020Source: Coresight Research[/caption]

Five Trend Updates

Luxury Will Move Faster from Exclusivity to Inclusivity

Now, more than ever, inclusivity is a mainstream expectation: With a renewed focus on larger consumers to disabled shoppers and, most recently, minority ethnic consumers, global luxury brands are taking inclusivity and diversity more seriously.

Luxury continues to transform from a culture of exclusivity and uniqueness to one of inclusivity, transparency and egalitarianism. We are seeing this play out not only in marketing but in the types of products being launched by luxury houses. Social values expressed through luxury products now include gender equality, size inclusion, design diversity and selection of ambassadors—although the exclusivity associated with a high price remains.

Diversity is represented in sizes. Online platform 11 Honoré and direct-to-consumer brand Reformation are only two examples of brands pursuing plus-size luxury shoppers.

Gender diversity is evident too, with a number of high-end luxury designers, such as Chanel and Salvatore Ferragamo, designing unisex clothes and products.

In cultural terms, inclusivity includes the moves into streetwear by luxury brands to connect with a younger and more diverse customer base, grooming the next generation of loyal luxury customers. In 2020, we expect luxury brands to continue taking style inspiration from streetwear and skateboard trends, and to incorporate more sporty and casual urban aesthetics into designs.

[caption id="attachment_112456" align="aligncenter" width="550"] Source: Bain & Co.[/caption]

Source: Bain & Co.[/caption]

Inclusivity’s Shift from Marketing to Product in the Mass Market Will Accelerate

The shift to greater inclusivity in the mass market encompasses a move from marketing to product. More mass-market brands and retailers are seeing inclusion not as a desirable marketing add-on, but as an essential factor shaping their product offering.

- In the beauty sector, Sephora pledged in June to dedicate 15% of its shelf space to brands from black-owned firms. In apparel, Rent the Runway has made a similar promise.

- In the apparel sector, adaptive clothing and footwear—which is designed for those with disabilities—is one such opportunity. In the UK and the US, ASOS, Kohl’s, Marks & Spencer and Target have launched dedicated offerings for consumers with disabilities.

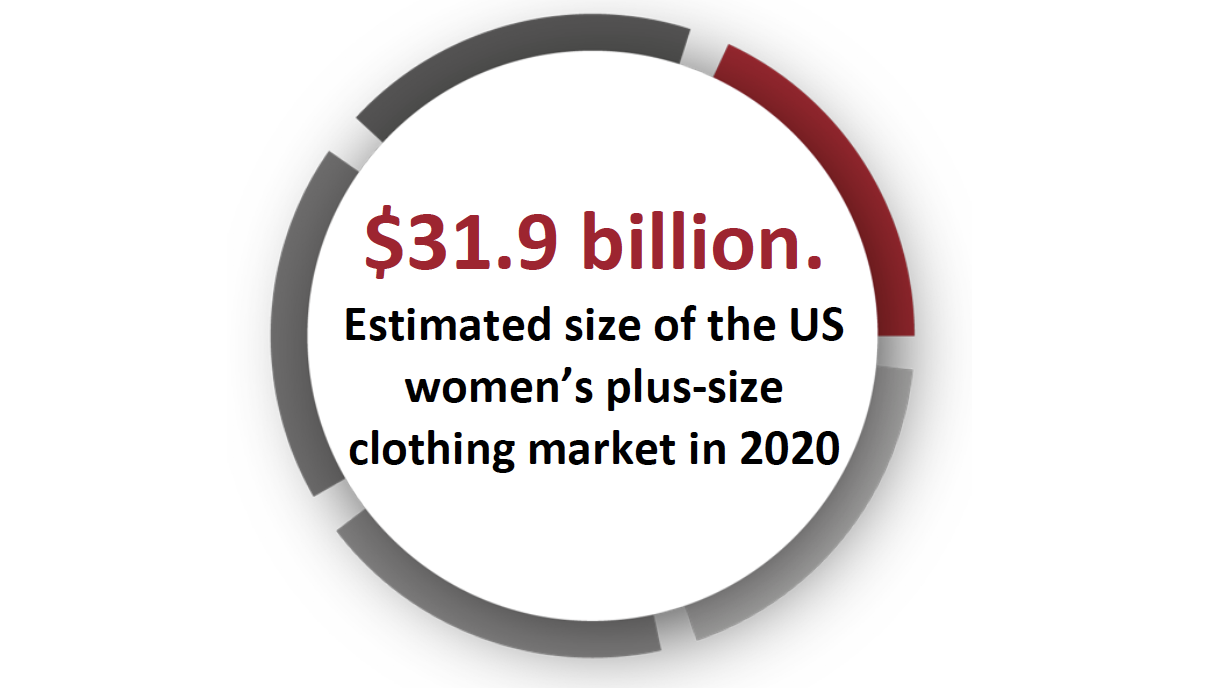

- Larger women, once marginalized, are now courted by designers, retailers and brands—and plus-size offerings are moving beyond the core apparel staples of jeans, tops and dresses. We have seen companies build out offerings in sportswear, intimates and bridal dresses. These and other niche areas present opportunities for retailers to cater to a still-underserved consumer segment, and capture share in a market that we estimate will be worth nearly $32 billion in the US in 2020.

Esimated before the coronavirus pandemic

Esimated before the coronavirus pandemicSource: Coresight Research[/caption]

Experiential E-Commerce Will Fuel the Battle To Be the West’s Super App

In the move to experiential e-commerce, social commerce is set to see strong growth as video- and image-heavy platforms become the go-to places for virtual events, product launches and video consultations.

WeChat is China’s super app, enabling instant messaging, photo sharing, audio and video calls, engagement with brands through WeChat stores, digital payments, sending gifts and more. In 2020, we expect social and communications platforms in the West to move closer to this super-app model.

Facebook looks to have a headstart, supported by its ownership of WhatsApp and Instagram, but TikTok is muscling in on the space. These brands have both been adding features to enable social commerce:

- WhatsApp now offers a catalog or storefront feature, and Instagram now includes a checkout function.

- In June 2020, Instagram expanded access to Instagram Shopping for more types of businesses, enabling creators to connect with shoppers and sell their merchandise on the platform.

- Also in June, TikTok added new functionalities for marketers, including allowing a brand or product to be added to a video in a 2D, 3D or AR format in either the foreground or background of the video. TikTok launched shoppability through its Hashtag Plus feature, introduced in 2019.

- Facebook has launched Facebook Pay across its platforms, while Alphabet-owned YouTube offers shoppable ads.

Shoppable social media continues to have a long runway for development in the West, given that even the efforts noted above are fragmented and incremental. We see image- and video-heavy platforms such as Instagram and TikTok gaining an advantage, not least because of their typically younger user bases, representing consumers who we think are are likely to be earlier adopters of social shopping.

When Coresight Research surveyed US consumers in late 2019, some 61% of social media users said they use social media platforms as part of the shopping process. In descending order, Facebook, Instagram, YouTube and Pinterest are the top platforms used as part of the shopping journey, according to our survey. However, among the youngest adult age group (18–24), Instagram leapfrogged Facebook to capture the number-one spot for shopping.

[caption id="attachment_112458" align="aligncenter" width="700"] November 2019

November 2019Source: Coresight Research[/caption]

Shopping Festivals Will Continue To Gain Momentum Post Crisis

Existing shopping festivals will continue to get bigger, better, more entertaining and more engaging—not least because retailers will be looking to encourage shoppers to spend and drive consumers back into their stores while, in many cases, seeking to clear inventory backlogs.

Digital-first retailers will continue to take festivals into the “real world” with pop-ups, entertainment events, marketing campaigns and tie-ups with physical stores. For e-commerce retailers that focus more on functional shopping than fun shopping, shopping holidays are an opportunity to build relationships with customers in the real world.

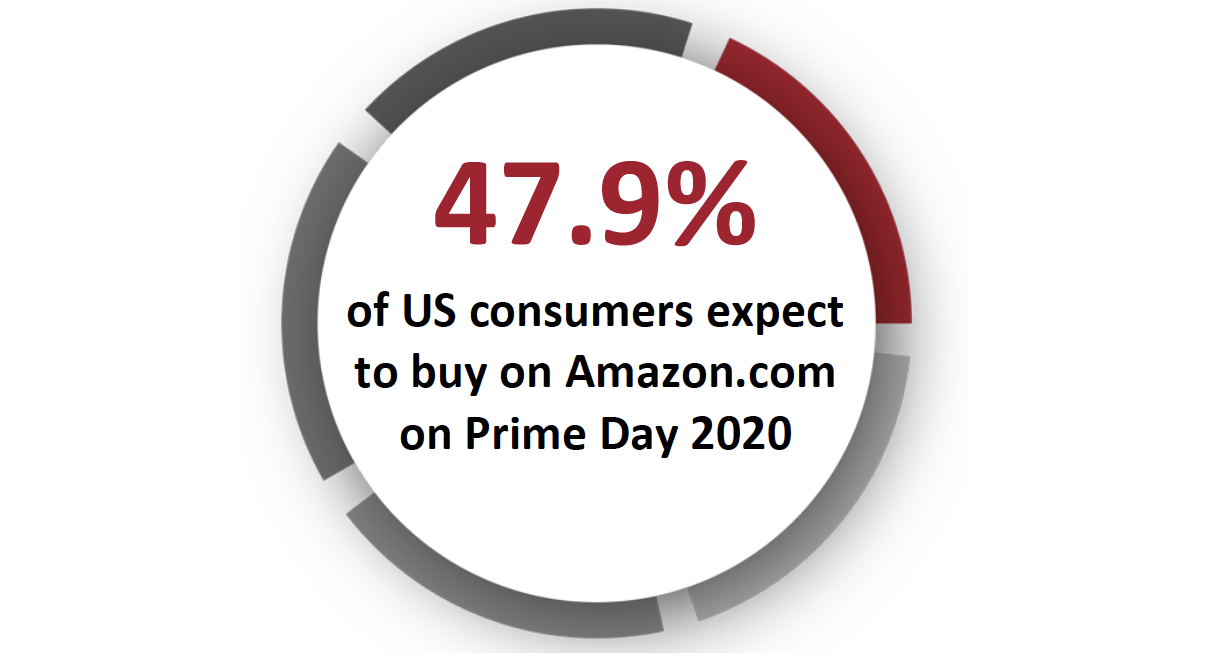

The impact of bigger, more engaging shopping holidays will not only be a short-term boost for the retailers operating the festivals (and possibly a hit to their rivals), but we expect the gravitational pull of festivals to continue the incremental distortion of established shopping patterns. In the US, we have already seen the importance of the traditional holiday season diluted as consumers increasingly shop for the holidays year-round and as events such as Prime Day (likely to be in September in 2020) and Black Friday in July pull forward spending from the year-end peak.

- The biggest retailers can create their own shopping holidays, and “own” them in the way that Amazon owns Prime Day and Alibaba owns Singles’ Day. This year, we saw Amazon launch a new summer fashion event—which, although akin to many other companies’ apparel sales, could become another calendar event.

- We also see opportunities to grow existing events, such as Black Friday in July, which is still an emerging event in the US.

- Retailers could piggyback on festivals making their way from one region to another: For example, Amazon launched on China e-commerce platform Pinduoduo for Black Friday in 2019, which is still an emerging event in China.

June 2020

June 2020Source: Coresight Research[/caption]

Sustainability Remains a Top Priority Post Crisis as Companies Look for Cost Savings

Post crisis, we expect sustainability to remain at the top of retailers’ medium-term priorities, with opportunities for renewed vigor in implementation as companies search for cost savings. Industry conversations suggest that sustainability remains top of mind among retailers when looking to source as well as when laying out medium-term plans.

Underscoring this, in late May—the depths of the crisis in many countries—Zalando announced that by 2023, all fashion brands on its platform would have to be assessed against the Higg Brand & Retail Module from the Sustainable Apparel Coalition; this means that brands will be rated on measures such as performance around ethical and environmental parameters—including human rights, fair wages and carbon-dioxide emissions.

We expect that brands and retailers will provide more detail on the sourcing and composition of products than ever before, as sustainability evolves to become “sustainability + transparency.” Vague claims about supply-chain sustainability will look increasingly insufficient in the eyes of consumers: Sustainability will further focus on disclosure.

Already, supply-chain transparency has moved firmly into the mass market, with Amazon publishing details of its private-label suppliers and H&M disclosing information on materials, production country, suppliers and factories for every product it offers.

We see this shift tying into trends mentioned above in sourcing—namely, greater digitalization (and so, implicitly, traceability) and consolidating of supplier bases into fewer, better-equipped sourcing partners. Mass-market retailers looking to compete on these terms will need to have renewed confidence in their supply-chain partners, or risk disclosure backfiring.

[caption id="attachment_112460" align="aligncenter" width="550"] February 2020

February 2020Source: Coresight Research[/caption]