DIpil Das

Introduction: 2020 Will Be a Year for Innovation and Expansion in China’s E-Commerce Market

In 2020, we expect China’s e-commerce market to be full of innovation, strong expansion into recommerce and faster delivery.- Livestreaming and short videos are providing modern means for retailers and brands to interact with consumers and promote their products.

- Alternative shopping channels—including group buying and mini programs—will thrive alongside dominant e-commerce platforms.

- We expect the vertical e-commerce sites will see strong growth in 2020.

- The growing adoption of technologies and use of data in the retail industry will enable the proliferation of the consumer-to-manufacturer (C2M) business model as well as faster delivery services.

- Cross-border e-commerce will be consolidated through Alibaba’s acquisition of the Kaola platform, further solidifying the company’s dominance in the online sector.

1. Livestreaming will become an even more important sales medium

Livestreaming became a bigger influence on consumer shopping behavior in 2019, and it will continue to play an increasingly important role in China’s e-commerce market in 2020. This sales medium is similar to television shopping—think QVC—but upgraded for the 21st century. Livestreaming sessions host real-time broadcasting of video content by presenters such as social media influencers that model or try out products. Viewers are able to purchase featured items while watching a video through embedded online links. Just like presenters on QVC, livestreaming hosts sell a wide range of products, from apparel and cosmetics to electronics and cars. There are a few reasons that shoppers are attracted to livestreaming:- A curated selection of products: Livestreaming hosts carefully curate their product selection to their fans’ tastes, which appeals to viewers and also leads to high conversion rates. Indeed, Taobao claimed that it had and 65% conversion rate across livestreaming in 2018.

- A wide range of products: A variety of products are promoted through livestreaming, across the beauty, fashion and grocery sectors, for example. Some hosts even sell movie tickets and hotel packages.

- Low prices: Taobao Live hosts often work with brands to give out gifts or product discounts to their fans, as livestreaming viewers are typically price-sensitive.

- Prize draws: Prize draws are a popular way for hosts to engage with viewers. For instance, popular Chinese key opinion leader (KOL) Li Jiaqi—known as “The Lipstick King”—usually starts his livestreaming sessions by launching a competition to win high-value electronics, such as Dyson hairdryers, iPhone 11s and Xiaomi televisions.

- Limited-quantity and limited-time offers: Livestreaming hosts often adopt a flash-sale strategy, where each sale lasts for only a short time and the number of products available is limited. In addition, hosts will periodically announce the remaining quantities available in order to increase the sense of urgency for viewers to make a purchase.

- Overcoming the “paradox of choice”: If shoppers are offered too many options, they might feel confusion over what to buy and therefore not purchase anything. A trusted host who interacts and engages with consumers during livestreaming sessions may provide recommendations to help consumers focus on one product and make a purchasing decision more easily.

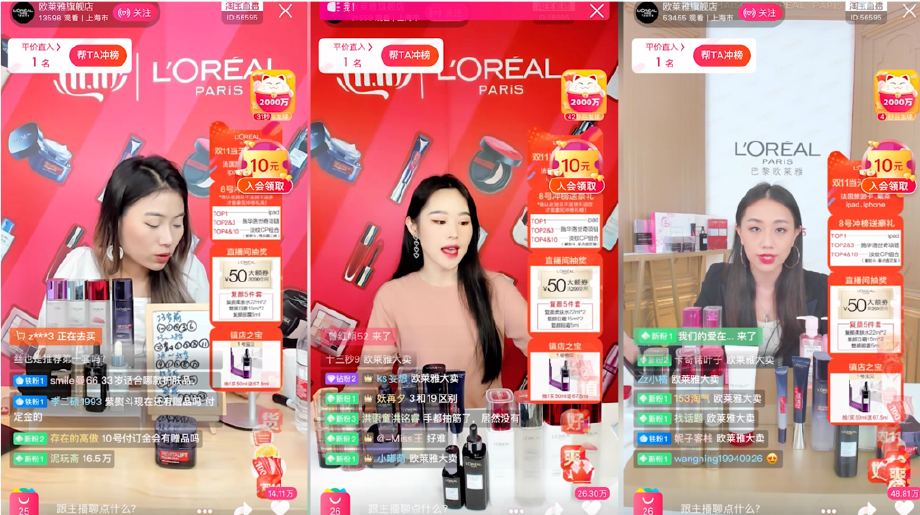

Livestreaming of L’Oréal’s products by key opinion leaders during Singles’ Day 2019

Livestreaming of L’Oréal’s products by key opinion leaders during Singles’ Day 2019 Source: Alizila [/caption] Implications for brands: The livestreaming e-commerce market is estimated to be worth ¥440 billion (around $63 billion) in 2019, and it is expected to grow in 2020, according to Chinese financial services firm Everbright Securities. In 2019, livestreaming accounted for almost 9% of total e-commerce sales in China ($723 billion as estimated by Statista) or roughly 1% of total retail sales of consumer goods, based on data from the National Bureau of Statistics of China and Coresight Research estimates. Livestreaming offers brands a means to boost sales and increase brand awareness. The platform of choice is dependent on the retail category—for instance, TikTok is the most appropriate for specifically targeting beauty consumers, whereas Taobao Live offers greater range across the apparel, beauty and parent-and-baby sectors.

2. Brands will move away from using KOLs and adopt KOC marketing strategies

Key opinion consumers (KOCs) are average consumers that create videos and posts to share their own product reviews and recommendations. This emerging trend will offer an alternative avenue for brands and retailers to employ influencer marketing methods, rather than using KOLs. Thanks to the popularity of a few Chinese social apps—including Kwai, RED and TikTok—KOCs can share their product reviews easily, which impact other shoppers’ purchasing decisions. These KOCs usually do not have a large number of followers each; often, they have just a few hundred. One reason that KOCs are gaining popularity is that consumers are becoming increasingly aware that KOLs are being sponsored by brands to make product recommendations, so they tend to believe that the information presented by them is less credible and authentic. On the other hand, KOCs are themselves everyday consumers who offer impartial product reviews. A KOC named Xiao Shiwu, who has 458 followers, posts product reviews on lipsticks. One of these has gained 14,500 likes and a few hundred comments as of December 6, 2019. [caption id="attachment_102431" align="aligncenter" width="704"] KOC Xiao Shiwu on TikTok

KOC Xiao Shiwu on TikTok Source: TikTok [/caption] The rising popularity of KOCs is also partly due to the fact shoppers want to seek advice from everyday consumers. For instance, new parents look for advice from their friends and other experienced parents in the selection of parent-and-baby products. Through the latest social apps, these shoppers can now watch videos and reviews from more-experienced shoppers before making purchase decisions. KOC marketing is actually one of the key components of Perfect Diary’s marketing plan that has helped it to become one of the top cosmetics brands in China. In the early days, the brand began working with KOCs on a mass scale—they comprised 80% of the influencers that Perfect Diary worked with, according to the company. The KOCs shared their experiences of using Perfect Diary products, and this made it appear to the average consumer that the brand was quite popular because everyone was talking about it. Implications for brands: Considering that KOCs’ reviews can have a strong impact on customers, it can be beneficial for brands to incorporate them into a broader marketing strategy. KOCs can help to boost a brand’s image and drive sales by influencing consumers’ purchasing decisions. Brands would need to identify suitable KOCs, as they usually do not have many followers, which makes them difficult to find. Thecontent-distribution algorithm of social media platform RED allows brands to see posts in the news feed that are generating high levels of engagement, not necessarily from top KOLs.

3. Short-video apps will continue to embrace e-commerce

Short-video apps have been making forays into the e-commerce market, and we expect this trend to continue in 2020. Short videos are typically 10–20 seconds in length and feature a variety of fun content, ranging from lip-syncing to songs to interactions with pets. Short videos are rich in content, and some users reportedly spend hours on short-video-hosting apps. Users are encouraged to spend time on these platforms through the tailoring of personalized content based on their browsing history and preferences, thanks to embedded artificial intelligence technology and algorithms. The short-video industry is thriving in China, where the number of users exceeds 820 million, as of June 2019. This total reflects an increase of 32% year over year, according to business intelligence provider QuestMobile. Short-video apps such as Kwai and TikTok are used by an average of 7.2 out of 10 mobile Internet users in China. The amount of time spent on these platforms has increased by 8.6% year over year from June 2018, totaling more than 22 hours per month, according to QuestMobile. To capitalize on these statistics and consumer behavior patterns, short-video apps have taken steps to monetize their user traffic:- In October 2019, TikTok added a new e-commerce feature called Marketing Label, which assigns alabel to content in order to help retailers target consumers who want to search for products. For example, a lipstick retailer that works with TikTok KOLs to produce lipstick-promotion videos might use a “black lipsticks” marketing label. Viewers would then be able to click the label to be redirected to a page where they can explore more content related to that theme.

- In November 2019, TikTok extended its restrictions to allow all users to sell products through the platform. Previously, the social app had placed a minimum requirement of 3,000 followers for a user to access the e-commerce function. This move could help TikTok, which has 3.2 billion daily active users, transform into a video-based e-commerce site.

4. Recommerce will become the new hit

Recommerce—the buying and selling of previously owned goods—will become increasingly popular in China. The recommerce market will reach ¥1.25 trillion (around $178 billion) in 2020, according to data firm MobData. This equates to almost 46% of the total sharing economy market in China in 2020 (¥2.7 trillion as estimated by the Sharing Economy Work Committee of the China Internet Association). The shift to recommerce is being driven by growing customer demand for product variety, sustainability and affordability: Consumers want to possess the latest in clothing trends; there is a growing emphasis on reusing and recycling to keep the planet green; and budget constraints are an ongoing consideration for most shoppers. Recommerce is also particularly prevalent in e-commerce compared to physical retail, as shoppers can access a greater range of previously owned merchandise online. There are around 99 million users of resale-focused apps as of August 2019, according to data firm Getui and the China Internet Network Information Center. Leading apps include Alibaba’s Xianyu and Tencent-backed Zhuanzhuan, with monthly active users totaling around 14 million and 7 million respectively as of May 2019, according to data firm iResearch. Implications for brands: The previously owned goods market has seen rapid growth in China, growing from ¥132.8 billion (around $18.9 billion) in 2014 to ¥740 billion (around $105 billion) in 2018, with a compound annual growth rate (CAGR) of 53.64%, according to e-commerce research center 100ec. This may impact the number of new goods that consumers will buy, potentially affecting total retail sales. Brands need to find ways to embrace, acquire or partner with resale business models, because customer adoption of recommerce is likely to continue. In China, the majority of users on resale apps are young and from higher-tier cities—around 89% of the users are under 34 years old, and 58% are from tier-1 and tier-2 cities as of August 2019, according to Getui and data firm Jiguang. Consumers will continue to look for ways to recycle, resell or upcycle, and will be drawn to the value of buying previously owned goods.5. Group buying will continue to grow as major e-commerce platforms launch their own group buying functions

E-commerce platforms will increasingly embrace group buying in 2020, which offers products and services at significantly reduced prices if consumers buy in large quantities. This shopping model is attractive for shoppers with a limited budget, especially those in lower-tier cities, as they can join together to take advantage of the lower prices. Major e-commerce players are launching group-buying platforms to tap into this segment of shoppers:- Pinduoduo has experienced explosive growth since its launch in 2015. It is now the fifth-largest Internet company in terms of market capitalization after Alibaba, Tencent, Meituan and JD.com, surpassing Baidu as of November 29, 2019. Pinduoduo’s success is largely due to its group-buying model, with consumers making purchases with friends to secure a better deal.

- JD.com started its group-buying mini program on WeChat in June 2018 and launched its group-buying app Jingxi in April 2019. Suning established its own group-buying app in July 2018.

- Alibaba launched its flash-sale and group-buying platform Juhuasuan in 2010. Alibaba’s Alipay launched a function named Pingou in March 2018, which is another addition to Juhuasuan.

6. Mini programs will supplement shopping platforms for brands

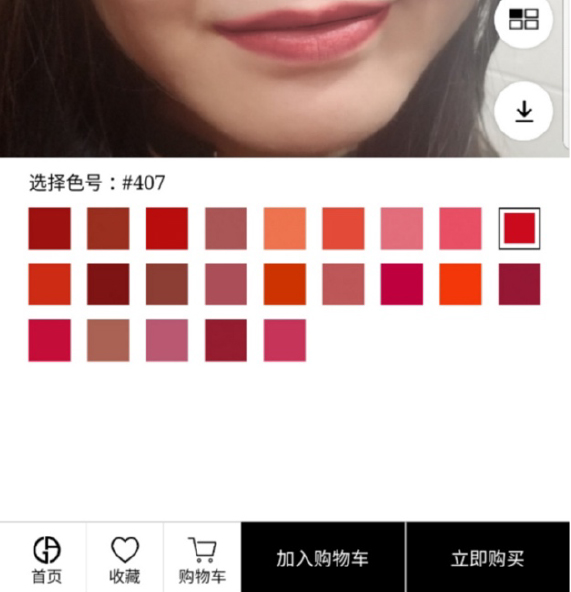

Mini programs operate within apps such as Alipay, Meituan and WeChat. They offer brands an additional online platform to market and sell their products, and users can perform similar functions without having to download a separate app. Brands can use mini programs as supplements to, not substitutes for, large-scale e-commerce platforms. Used as a secondary sales channel, mini programs can list in-demand items that sell quickly through flash sales promotions. Mini programs can also be used as a branding tool—brands can create interactive, visual mini programs to better engage customers and encourage them to share content with friends. WeChat mini programs now support augmented reality (AR), which overlays virtual imagery onto the physical world. The first of this type was Armani’s cosmetics mini program, which allows users to test the appearance of different makeup items, such as various shades of lipstick, through users’ self-facing camera on their cell phones. [caption id="attachment_102432" align="aligncenter" width="571"] Source: Armani’s WeChat Mini-Program[/caption]

Mini programs offer advantages for brands looking to penetrate lower-tier markets, as shoppers may have cheaper data plans and lower storage on their phones and are therefore more reluctant to download new apps. Brands can incorporate mini programs with group buying to access WeChat users in lower-tier cities.

Implications for brands: As mini-programs are light in capacity, it is good for brands to invest there for marketing, customer engagement and e-commerce. WeChat, the pioneer of mini-programs, reported it had 700 million users as of July 2019, and they used mini-programs 42.6 times per month. It is also a good way to reach out to consumers in lower-tier cities, who usually do not want to download apps due to cheap data plans. Furthermore, with mini-programs being able to support AR, brands will enable users to relate to the product and makes it easier to select the right product.

Source: Armani’s WeChat Mini-Program[/caption]

Mini programs offer advantages for brands looking to penetrate lower-tier markets, as shoppers may have cheaper data plans and lower storage on their phones and are therefore more reluctant to download new apps. Brands can incorporate mini programs with group buying to access WeChat users in lower-tier cities.

Implications for brands: As mini-programs are light in capacity, it is good for brands to invest there for marketing, customer engagement and e-commerce. WeChat, the pioneer of mini-programs, reported it had 700 million users as of July 2019, and they used mini-programs 42.6 times per month. It is also a good way to reach out to consumers in lower-tier cities, who usually do not want to download apps due to cheap data plans. Furthermore, with mini-programs being able to support AR, brands will enable users to relate to the product and makes it easier to select the right product.

7. Parcel delivery will get even faster

In 2020, we expect logistics providers to offer faster delivery by upgrading their logistics infrastructure and increasing capacity at bonded warehouses. Same-day delivery would then be possible for a broader range of products. Alibaba’s Cainiao aims to digitalize and accelerate the entire delivery process by helping logistics firms to deploy Internet of Things (IoT) solutions on a large scale. Cainiao plans to connect 100 million smart devices to its IoT technologies between 2020 and 2022, including its warehouses, delivery robots and algorithm-backed management systems. Cainiao will also set up 100,000 pickup stations through “Cainiao Post,” a last-mile delivery business of Cainiao, to increase delivery options. Cainiao Post offers services such as scheduled deliveries, smart lockers and delivery outlet pickups. Through the adoption of 5G technology, logistics providers will be able to provide more efficient and faster deliveries. JD Logistics opened its first 5G-powered smart logistics park in Beijing on October 28, 2019, and used the latest-generation connectivity to conduct real-time monitoring of locations and routes for forklifts, as well as to provide pre-emptive alerts of abnormal situations. Implications for brands: New technology will power the further acceleration of deliveries in China. Brands and retailers can leverage tools such as smart routing, which uses machine learning algorithms to optimize delivery routes, to increase efficiency in deliveries.8. China’s data-based C2M model will drive e-commerce forward

China’s consumer-to-manufacturer (C2M) model will become a new driver in e-commerce development, helping businesses to better address consumers’ needs and achieve sales growth. In the C2M model, factories become consumer-centric. Retailers and manufacturers collect data from customers and use big data to create customer profiles, analyze consumption characteristics and plan production. This helps manufacturers to anticipate product demand and reduce inventory and supply chain risks, which also benefits brands and retailers. During the 2019 Singles’ Day shopping festival, users on Tmall snapped up 170 million C2M products. One company reported that sales of its “Roaman Xiaoguoshua” electric toothbrush reached 25,000 on November 11. Roaman used consumer insights from Tmall to influence the design of the toothbrush, such as the size of the brush head and the dark-green color of the toothbrush. [caption id="attachment_102433" align="aligncenter" width="700"] Electric toothbrush “Roaman Xiaoguoshua” Source: Roaman [/caption]

The C2M model also aligns with the increasing demand for product personalization in China, which is being led by post-80s’ consumers (people born 1980-1989) and post-90s’ consumers (people born 1990-1999). The C2M model will allow manufacturers and retailers to produce products according to consumers’ needs.

Implications for brands: The C2M market in China reached ¥17.5 billion ($2.5 billion) in 2018 and is expected to reach ¥42 billion ($6 billion) in 2022, with a CAGR of 24.4%, according to Chinese research company iResearch. This equates to around 0.4% of total e-commerce sales in China in 2018 and 0.6% in 2022 (as estimated by Statista). Brands can use the C2M model to better address consumer demand, as well as to improve efficiency throughout their supply chains.

Electric toothbrush “Roaman Xiaoguoshua” Source: Roaman [/caption]

The C2M model also aligns with the increasing demand for product personalization in China, which is being led by post-80s’ consumers (people born 1980-1989) and post-90s’ consumers (people born 1990-1999). The C2M model will allow manufacturers and retailers to produce products according to consumers’ needs.

Implications for brands: The C2M market in China reached ¥17.5 billion ($2.5 billion) in 2018 and is expected to reach ¥42 billion ($6 billion) in 2022, with a CAGR of 24.4%, according to Chinese research company iResearch. This equates to around 0.4% of total e-commerce sales in China in 2018 and 0.6% in 2022 (as estimated by Statista). Brands can use the C2M model to better address consumer demand, as well as to improve efficiency throughout their supply chains.

9. Vertical e-commerce sites will gain traction

Vertical marketplaces are e-commerce platforms on which goods and services are sold to specific groups of customers, who can then engage with each other through the online community. We expect this type of site to thrive in 2020. Sites and apps such as Babytree (which focuses on parent-and-baby products) and Gegejia.com (a global food importer that targets the female market) are examples of successful vertical markets.- Vertical platforms naturally bind like-minded consumers together and lead to strong social communities that are centered around a particular sector or product. For instance, for parent-and-baby marketplace Babytree, users on the platform share parenting tips and recommendations for baby products.

- Vertical platforms are providing better content that helps users to make buying decisions. According to a survey by Mckinsey in 2019, two-thirds of China’s digital consumers use the information they collect from vertical websites to influence their purchasing decisions.