albert Chan

Introduction: Our Updated 10 Retail-Tech Startup Trends for 2020

In January, we identified 10 retail-tech startup trends that we predicted would help reshape the future of retail in the year ahead. However, the global coronavirus pandemic has turned the retail industry upside down, causing widespread retail store closures and significantly changing the way consumers interact and shop with brands. Covid-19 has accelerated some of the digital shifts that we were already witnessing in retail. Consumers have been turning to digital options during the crisis, driving the penetration of e-commerce and prompting more brands and retailers to focus on their digital channels. In our January 2020 outlook, we said that retailers and brands will need to collaborate more than ever with technology startups to futureproof their businesses and be better equipped to meet fast-changing consumer demand and behavior. The shifts that have taken place in light of the global pandemic have heightened this position. With the steady increase in competition, large retailers and brands are increasingly recognizing the enormous potential offered by highly specialized startups. Against this backdrop and consequent changes to consumer behavior, we introduce five new, post-crisis trends in this report. We also note five of the trends we identified at the beginning of the year that have played out during the Covid-19 environment and that we expect to have reinforced importance through the remainder of 2020 and over the longer term.

Five New Trends, Post Crisis

Demand for Contact-Light Retail Will Drive Omnichannel Fulfillment Options The coronavirus outbreak has accelerated retailers’ adoption of innovative fulfillment options, as they seek to facilitate contact-light interactions across all retail touchpoints. Such services include variations on BOPIS (buy online, pick up in store), delivery towers and lockers, in-app ordering and autonomous delivery vehicles such as robots and drones. According to Adobe Analytics data from the UK and the US, the number of BOPIS orders increased by 208% between April 1 and 20, 2020, compared to the year-ago period. A recent Coresight Research proprietary survey also found that almost three-quarters of US consumers are switching spending online. We therefore expect a proliferation of omnichannel fulfillment options that enable retailers to meet demand. Figure 1 highlights recent updates regarding order fulfillment, as well as key statistics for major US retailers. Figure 1. Selected Retailers: Key Statistics and Insights on Order Fulfillment| Retailer | Insights on Order Fulfillment |

| Best Buy | • In the company’s first-quarter 2021 earnings call, Best Buy CEO Corie Barry reported that during the six weeks in which Best Buy ran its curbside-only model, domestic online sales were up more than 300% compared to last year. • In the third-quarter 2020 earnings call, Barry said that the company is offering curbside pickup in a few New York stores and some other markets, allowing customers to pick up their orders without getting out of the car. • In its first-quarter 2020 earnings call on May 23, 2019, Hubert Joly, Senior Executive at Best Buy, highlighted the importance of the BOPIS service and cited its growing popularity among shoppers. In-store pickup of online orders accounted for 40% of total online revenue during the period. |

| Kohl’s | • During its first quarter ended April 30, 2020, more than 40% of the company’s online orders were fulfilled using “ship from store” and BOPIS. • During the first-quarter earnings call, Senior EVP and CFO at Kohl’s, Jill Timm, underlined the importance of stores as fulfillment centers and said that Kohl’s curbside-pickup offering fulfilled 15% of the total digital demand—exceeding that from BOPIS. |

| Macy’s | • On its investor day on February 5, 2020, Macy’s then-Chief Digital Officer Jill Ramsey said that online pickup increased 62% year over year in the fiscal year ended January 2020, accounting for 9% of the total digital sales. • Online pickup orders have allowed Macy’s to upsell through personalized recommendations, with BOPIS shoppers buying 25% more on an average, according to Chief Financial Officer Paula Price. |

| Target | • For its fiscal year ended January 31, 2020, Target’s pickup service grew 50% year over year, and its curbside-pickup service “Drive Up” increased by over 500%. • One in three customers that visited Target stores to pick up online orders made additional purchases. |

Source: Company reports/Coresight Research

We expect these market dynamics to put increased pressure on friction points such as inventory management and delays in order delivery after a customer has arrived at the store. Technology companies will play a critical role in increasing retailers’ visibility into the supply chain and help them to optimize operations. In Figure 2, we outline three examples of innovators that are offering disruptive technologies on this front. Figure 2. Fulfillment Innovators| Company | Description |

| Bringg | Tel Aviv-based startup Bringg’s curbside-pickup and click-and-collect services offer flexible order-location tracking, presenting real-time order updates to customers. |

| Bringoz | Bringoz is an end-to-end delivery-management platform that consolidates multiple sources of delivery demand, including websites, mobile apps and in-store delivery requests. |

| Position Imaging | Position Imaging’s “iPickup” platform, an e-commerce fulfillment solution, leverages computer vision to expedite the fulfillment of BOPIS and curbside-pickup orders. |

Source: Company reports/Coresight Research

Unstaffed and Cashierless Store Experiences Will Become More Common Unstaffed and cashierless stores are an established trend across the retail industry, with China leading the way. Increased consumer preference for contact-light retail in the context of the coroanavirus crisis will drive the adoption of technologies that facilitate this, and make these formats even more commonplace. For example, a 2020 global consumer survey by technology firm Shekel Brainweigh revealed that 87% of respondents reported that they would likely change their shopping behavior to choose stores with contactless or self-checkout options due to Covid-19 pandemic. This past year, Amazon further developed its cashierless “Just Walk Out” system, which is powered by computer vision and sensors. Customers can now enter Amazon Go stores using a credit card, without requiring the use of a dedicated app. As consumers gravitate to more self-guided store experiences, we believe that the next progression will be touch-free shopping experiences. This would involve shoppers scanning bar codes or QR codes to receive information about desired products through their smartphones—further reducing direct, in-store interactions and creating a more contactless experience. Technologies that enable this digital transformation include computer vision systems, sensors, IoT (Internet of Things) devices, RFID (radio-frequency identification) and voice and facial recognition. We believe that retailers will look for external partners to execute on these in-store experiences. Figure 3. Self-Checkout Innovators Using Computer Vision and Advanced Analytics| Company | Initiative |

| Caper | Caper’s autonomous checkout carts leverage deep learning and computer vision to automatically detect items when they are added to the cart. The technology allows shoppers to pay via a screen on the cart using credit/debit cards or through mobile payment. |

| Grabango | Grabango offers checkout-free shopping technology to retailers, enabling them to check on items that customers add to their baskets in real time and offering options to pay at the cashier counter or through a smartphone, without having to scan all the items at checkout. |

| Perpule | Perpule offers a self-checkout app for offline retailers, allowing shoppers to scan items using their smartphone and digitally pay for the items. |

| Shopic | Shopic offers a mobile checkout platform to retailers and brands. In addition, the company’s loss-prevention solution CartWatch leverages AI to detect anomalies in shopper behavior. Shopic’s offerings include a virtual point-of-sale (POS) system that identifies items in a cart. |

| Standard Cognition | Standard Cognition enables brick-and-mortar stores to offer autonomous checkout to their shoppers. The technology leverages computer vision and AI to identify the items selected by a shopper, removing the need for products to be scanned at checkout. |

| Trigo | Trigo leverages ceiling-mounted cameras to create a 3D image of the store. With the help of sensors and computer vision, its technology records all the products picked by customers from the shelves to charge the shopper automatically. |

| WalkOut | WalkOut provides on-cart screens that enable autonomous checkout for in-store shoppers. The company’s proprietary AI technology facilitates product identification and allows retailers to employ personalization in marketing and promotions. |

Source: Coresight Research

Retailers Will Turn to ML-Powered Demand Forecasting Prior to the coronavirus crisis, retailers were looking for demand forecasting solutions to help manage their inventory levels and better match supply to demand. The global pandemic then heightened the importance of demand forecasting. More accurate forecasts can help retailers to minimize inventory costs, optimize distribution and merchandising, and streamline the selling process. The question that many retailers are likely to ask now is around how they can better anticipate customer demand and be better prepared for shifts in buying behavior. Some 42% of US retail executives said that demand forecasting is the largest pain point that they need to resolve, and 46% of them wish to have robust technology, according to a Coresight Research poll of 80 senior-level retail executives conducted in March 2020. Improving demand forecasting has thus become a key initiative for retail leaders. Many retail businesses are looking to leverage big data, combined with demand forecasting (powered by ML), to optimize their supplier relationships, manufacturing processes, logistics and marketing campaigns. Compared to traditional forecasting methods, ML approaches feature a higher degree of automation, are easier to implement, provide real-time data and are adaptable to changes. Retailers are increasingly looking to partners to mine their data (POS and customer data), along with bringing in external data (product data, economic factors and more), to optimize their demand forecasting systems. Retailers are recognizing the importance in investing in demand forecasting solutions. For example, NIKE announced in June that it is accelerating its investments in demand sensing, insight gathering and inventory management. In 2019, NIKE acquired Celect, which uses data analytics to predict retail demand. In Figure 4, we summarize other examples of retailer-startup partnerships in the demand forecasting space. Figure 4. Demand Forecasting: Retailer-Startup Partnerships| Company | Initiative |

| Belk | Inventory management: Belk, an American department-store chain, used Antuit.ai’s demand-forecasting solutions to generate an accurate enterprise demand signal that drives improved planning and fulfillment at the SKU (stock-keeping unit) level across the entire organization. The retailer’s previous forecasting practices did not incorporate statistical modeling, and replenishment plans were based on the average rate of historical sales rather than future predictions. The forecast now takes into account seasonality, promotions, events and other relevant variables to arrive at a stable and accurate forecast. |

| Soludos | Merchandise planning: Soludos, a footwear company founded in 2010, offers hundreds of SKUs across multiple categories and solved pain points in merchandising planning by working with Alloy, an analytics platform. Alloy helped the brand to collect and understand POS and inventory data across direct-to-consumer, e-commerce and retail operations to analyze product performance and identify merchandise that sells well, by features such as style, size and color. |

| Family Dollar | Markdown optimization: Family Dollar successfully replaced its enterprise-wide markdown strategy with a localized markdown plan by partnering with Revionics, a startup that offers lifecycle price-, promotion- and markdown-optimization solutions for the retail industry. Revionics’ predictive science supports replenished merchandise and category-management processes, and it can forecast markdowns that could improve profit margins. Following the partnership, Family Dollar has seen 10% higher sell-through for categories under testing. |

| RaceTrac | Marketing: RaceTrac, which operates a chain of gasoline service stations across the Southern US, partnered with business-intelligence solutions provider Prevedere to understand the expected future outcome of advertising campaigns and improve forecasts of guest counts, margins and labor expenses. Prevedere’s correlation engine identifies relevant indicators from among millions of data series using the computing power of the cloud, and its patented genetic algorithm generates the optimal forecast model for the business. |

Source: Company reports/Coresight Research

Looking at the future of demand forecasting, we expect to see the following trends play out:

- Highly automated—More retailers and brands will focus on AI and ML as the core technologies underlying demand forecasting solutions, as these can realize a high degree of automation—applying algorithms with minimum intervention from data scientists. Some innovators have already begun to disrupt this sector. For example, in the last three years, Blue Yonder has built ML within a framework called “Cyclic Boosting.” The framework allows users to have transparency over demand forecasting and the automated decision-making behind it—which is applicable to grocery retail operations, for instance.

- More granular and in real time—The future of demand forecasting will not only be based on historical data but also on real-time information as it is streamed from connected devices. Retailers will strive to gain more granular insights, taking into account all available data—such as weather, store-opening hours, in-store behavior, shopping baskets, POS, events and SKU-level data—in a dynamic and fast-adapting forecast solution.

- Cross-functional—Demand forecasting will adopt a cross-functional role instead of representing a silo in the supply chain. It is increasingly important for retailers to have a holistic strategy to improve the accuracy of demand forecasting, comprising enterprise data, applications of advanced forecasting methods and synchronized cross-functional business processes.

| Company | Initiative |

| Centricity | Centricity leverages AI and ML to understand the shopper journey across channels and categorize shoppers. It leverages sales data and big data to help retailers understand consumer needs in real time, thus allowing them to make shopper-centric decisions. |

| Carto | Carto enables retailers to forecast demand using geospatial techniques, such as spatial modeling and clustering, to predict and test future demand scenarios. |

| Skubana | Through its unified platform, Skubana provides business insights into multichannel operations, such as revenue, orders and number of units sold. The company helps its clients to optimize their inventory levels and automatically issue purchase orders based on sales velocity, lead times and seasonality. |

Source: Coresight Research

Figure 6. Demand Forecasting Innovators: Supply Chain Management| Company | Initiative |

| Convey | Convey’s Delivery Experience Management platform leverages ML to optimize all steps of the shopper journey. The platform offers insights into transportation, the post-purchase customer experience and last-mile delivery in real time. |

| Dsco | Dsco’s distributed inventory platform leverages ML and analytics to offer real-time SKU-level inventory data from across the supply chain. |

| Suplari | Suplari uses predictive analytics and ML to automatically integrate and categorize procurement data, such as contracts, spend and invoices. |

Source: Coresight Research

AR-Powered Experiential E-Commerce Is Here To Stay Stay-at-home measures during the global coronavirus crisis have prevented consumers from visiting stores or attending events in recent months. Retailers have therefore leveraged digital tools to stay connected with their customers during the lockdowns. The pandemic has accelerated the shift to online shopping, and augmented shopping experiences are picking up traction quicker than many previously expected—we see it as a shift to experiential e-commerce. By incorporating AR technology, retailers can adopt an omnichannel strategy to align with the anticipated new normal in consumer behavior. Amid the ongoing pandemic, experiential retail is likely to continue shifting from stores to e-commerce, prompting a growing number of companies to create 3D environments and experiences to establish increased immersion spaces. The real-estate and travel sectors already use 360-degree videos, and we think that this type of media will become more prevalent in retail in 2020. Furthermore, we expect collaborations between technology companies and brands/retailers to intensify through 2020, as part of strategies to implement and enhance augmented shopping experiences. In Figure 7, we outline some existing collaborations in this space. Figure 7. Selected Retailers: Augmented Shopping Initiatives| Company | Initiative |

| ASOS | UK-based fashion pure play ASOS is scaling its size-and-fit feature “See My Fit” to offer shoppers customized views of up to 500 products each week. The tool, which was launched in collaboration with Israeli tech firm Zeekit in January this year, allows shoppers to view the products on six real-life models to better see the cut and fit of apparel items. According to ASOS, digitally mapping products onto models provides realistic views of the clothing for consumers and removes the need for the models to come into ASOS Studios for photoshoots—supporting social distancing during the current coronavirus crisis. |

| Drest | Drest is an experience-lifestyle gaming app that allows users to dress digital avatars while participating in styling challenges. Drest’s latest collaboration with makeup artist Mary Greenwell from May 2020 will see the app incorporate a new makeup assortment created by Greenwell—who has ongoing collaborations with Armani and Chanel and counts actresses Cate Blanchett and Uma Thurman among her clients. |

| Lamborghini | Luxury sports-car brand Lamborghini used AR to virtually launch its new model on May 7, 2020, claiming to be “the first automotive brand” to do so. The Huracán EVO RWD Spyder was unveiled on the brand’s website utilizing Apple’s AR technology—clicking the “See in AR” button generates a scale model of the car overlaid onto users’ real-life environments through their smart-device cameras—such as their gardens, driveways or even living rooms. |

| Lowe’s | Lowe’s Vision app partnered with Google and Lenovo to help customers more easily measure any room in the home with the touch of a button, and style it with virtual Lowe’s products in real time. |

| Macy’s | Macy’s partnered with 3D-product visualization platform Marxent to roll out virtual reality (VR) installations in 70 stores nationwide. The VR headsets help consumers visualize furniture selections before buying. According to the company, across the three pilot stores, VR-influenced furniture sales grew more than 60% compared to their non-VR counterparts and cut returns to less than 2%. |

| YOOX | YOOX Net-A-Porter created an avatar called Daisy that can be customized according to the user’s specifications of weight, height, skin color and general body shape to virtually try on clothing. Users can also upload a photograph to create a digital avatar that resembles them. |

Source: Company reports/Coresight Research

Retailers will increasingly rely on extended reality to engage shoppers that are browsing products. Virtual models of the human form, created through 3D technology or otherwise, will progressively guide purchasing decisions. Innovative practices will continue to disrupt the industry with various approaches to retail operations, including those summarized in Figure 8. Figure 8. AR Innovators in Retail| Company | Initiative |

| 3DLOOK | 3DLOOK uses computer vision, ML and statistical modeling to process and measure the human body from two photos from any mobile device, to create a realistic digital avatar. 3DLOOK won the third edition of the LVMH Innovation Award in May 2019. |

| Marxent | Marxent offers a cloud-based 3D product-visualization platform for furniture and kitchen retailers and manufacturers. Marxent recently extended its product-visualization platform to include bathroom retailers. |

| Obsess | Obsess' 3D Commerce Cloud platform leverages AR and VR to enable fashion, home and lifestyle brands and retailers to digitize their stores. |

| Trivver | Trivver provides an exchange platform for extended reality (XR) advertisements, including 3D, AR, VR and mixed reality ads. Advertisers and brands can create a single 3D object to implement across all XR platforms. |

Source: Company reports/Coresight Research

Retailers Will Leverage AI and ML for In-Store Inventory Visibility Retailers are increasingly turning to AI-driven shelf-monitoring and inventory management tools. With the rise in e-commerce and omnichannel retail, it has become more important than ever for retailers to understand their in-store inventory levels. In today’s complex retail environment, poor in-store execution can easily lead to issues such as infrequent stock replenishment, misplaced SKUs and noncompliance with planograms, prices and promotions, all of which cost sales. Seeking to optimize store management and enhance the in-store experience, many retailers are exploring advanced technology solutions such as computer vision, which uses complex image-processing algorithms that turn digital images of the shelf into information and analytics around areas such as out-of-stocks and planogram compliance. Efficiency in store operations is key to delivering a consistent, high-quality shopping experience. Many retailers are testing computer vision to strengthen store management, as issues in this area can lead to lost sales. According to a Coresight Research survey, 10–15% of sales are lost every year to poor in-store execution for more than half of retailers surveyed. By adopting systems that use computer vision, retailers can gain greater visibility into their inventory operations, which should translate into enhanced operational efficiency. Stock can be continuously monitored in real time, enabling retailers to quickly replenish out-of-stock items and track misplaced product. Moreover, the greater availability of data resulting from the use of this technology should generate insights to inform product positioning and promotional strategies. A number of retailers have started collaborating with technology providers to integrate computer-vision systems into their in-store inventory management operations, and we see this trend accelerating.- Walmart has entered into a partnership with Massachusetts, US-based Alert Innovation for the AlphaBot deployment, to enable efficient pickup and transport of inventory items.

- UK-based Ocado, one of the largest online-only grocery retail companies in the world, is currently using a picking and packing system based on a computer-vision algorithm.

| Company | Initiative |

| Pensa Systems | Pensa Systems, an Austin, US-based startup is tapping into the potential of autonomous drones to promote detailed understanding of on-shelf inventory. The company has trialed computer-vision algorithms for in-store inventory management and has recently invested fresh capital into an acquisition to support its work. |

| ShelfX | ShelfX’s hardware converts standard refrigerators into smart fridges. Shoppers can use credit/debit cards or their smartphones to unlock ShelfX refrigerators, and weight-sensor technology automatically bills the shoppers for the items they select. Retailers can access live inventory reports through ShelfX’s cloud-based apps. |

| Trax | Trax provides a store-monitoring and intelligence platform that uses computer vision to help retailers track stock on shelves and implement store-execution technology. |

| Vispera | Vispera's image-recognition engine enables FMCG retailers and suppliers to carry out tasks such as identifying out-of-stock items, matching price tags with products and ensuring planogram compliance. The company has a dedicated mobile app that is compatible with Android and iOS devices. |

| WiseShelf | WiseShelf enables retailers to have real-time visibility of store shelves. The company offers a sensor-based hardware appliance, wireless communications network and a cloud-based system to analyze the data streamed from shelves. |

Source: Company reports/Coresight Research

Five Trend Updates

Autonomous Robots Will Gain Traction in Last-Mile Delivery The acceleration in e-commerce caused by Covid-19 has heightened the need for retailers to improve delivery efficiency and reduce logistics costs. We expect that this will power the development of more advanced and cost-effective aerial delivery drones and ground delivery solutions—which also facilitate social distancing and contactless retail. Investment into autonomous last-mile delivery solutions is likely to increase through 2020 and into 2021, with large industry player acquisitions and partnerships, as well as venture capital investment. The use of robotics in retail is now a new concept: Sales of logistics robotics (the most significant application) increased by 53% year over year to $3.7 billion in 2018, according to the latest data from the International Federation of Robotics. There have also been several tests of autonomous vehicles for delivering food and groceries in China, the UK and the US. To make deliveries, these vehicles must have access to intricate maps of city streets, including trees, curbs and other potential impediments; similar to self-driving cars, the robots must also possess the ability to avoid unexpected obstacles such as humans, bicycles and animals. More robots will be trained to recognize objects by their semantic (natural language) labels, giving them a sense of what things are, in real time, as well the ability to interact with customers. Engineers at the Massachusetts Institute of Technology, for example, recently created a navigation method that enables robots to plan out a route using semantic terms such as “front door” or “garage,” rather than coordinates on a map. As such technology advances, we expect to see the wider adoption of robots and drones for last-mile delivery. We may also see AI play a larger role in streamlining delivery operations through the rest of 2020 and into next year, as retailers make efforts to reduce distribution costs. Startups and larger, more established retailers are developing solutions for autonomous-based last-mile delivery, as we examine in Figure 10. Figure 10. Automated Robotics in Retail: Select Ground Delivery Initiatives| Company | Initiative |

| JD.com | JD.com uses autonomous home-delivery robots, using machines equipped with cameras, sensors and AI to interact with shoppers, including through facial recognition. The robot delivery vehicles have so far been deployed in more than 10 cities in China. |

| Nuro | Nuro, a self-driving car company founded by two former Google employees, announced in March 2019 that it would expand its driverless delivery partnership with Kroger. |

| Starship Technologies | Starship Technologies has been operating autonomous delivery robots in Milton Keynes, UK, since April 2018. The company partnered with grocery stores Co-op and Tesco to provide deliveries in as little as 15 minutes in the town, to locations within a two-mile (3.2km) radius of stores. With a global fleet of such robots, Starship Technologies announced in April 2019 that it had passed a milestone of 50,000 commercial deliveries. |

Source: Company reports/Coresight Research

Aerial delivery drones will finally see more use, led by Amazon, UPS, Uber, and Google’s Wing. Major retailers are also investing in drone technology for last-mile delivery. Figure 11. Automated Robotics in Retail: Select Drone Delivery Initiatives| Company | Initiative |

| Amazon | Amazon's all-electric Prime Air drone is fully electric, autonomous and can fly packages of up to 2.2kg as far as 15 miles (24km) in under 30 minutes. |

| Google parent company Alphabet is taking a macro approach to the technology through Project Wing, run through its innovation arm, X. The program is developing a solution to manage a high volume of drones from different operators. | |

| JD.com | JD.com operates an innovation lab in China called JDX, which focuses largely on last-mile logistics technology, including drones. |

Source: Company reports/Coresight Research

Warehouses are central to supply chain management, and some of the most exciting innovations in the field focus on making them smarter. Innovations in robotics are optimizing and automating the storage, packing and flow of goods within warehouses to make such processes more efficient. Amazon has greatly benefited from robotics, lowering operating costs by 20% in recent years and creating a 50% gain in warehouse space due to more efficient use, according to Business Insider. Retailers are already implementing robotics in daily operations, often in collaboration with technology firms. Figure 12. Automated Robotics in Retail: Select Fulfillment Initiatives| Company | Initiative |

| Bossa Nova | In 2020, Bossa Nova will launch a new robot to capture inventory data and apply AI to retail. The company’s technology provides real-time insights into shopping patterns to help retailers optimize the location and stocking of inventory. Walmart is one of Bossa Nova’s clients. |

| Fabric | Founded in Tel Aviv in 2015, Fabric is developing micro-fulfillment centers to enable retailers to fulfill orders on demand, including one-hour deliveries. The company closed a $110 million Series B funding in October 2019 and has 14 sites under contract, one of which is scheduled to open in the first quarter of 2020 in New York City, US. |

| Kroger | Kroger and Ocado formed a partnership in May 2018 to build 20 automated warehouses within two years, and started construction on the first 335,000-square-foot customer fulfillment center in June 2019. The $55 million facility will use digital and robotics technology to fulfill online grocery orders. |

Source: Company reports/Coresight Research

Data Privacy Will Require a More Collaborative Approach, as Retailers Balance Data Privacy with Personalization Data-centric strategies have become increasingly important in today’s retail environment, as effective marketing and advertising are crucial for companies to stay engaged with their customers during the Covid-19 crisis and beyond—particularly as more consumers are opting to shop online. With older consumers now adopting digital shopping in addition to the typically younger demographics of e-commerce, there will be more opportunities for retailers to leverage customer data to provide engaging and personalized experiences. Retailers will have to implement new policies to comply with regulations. Policies will be supported by technologies that safeguard customer data while also ensuring that it can be leveraged for useful insights. The introduction of the EU’s General Data Protection Regulations (GDPR) and the California Consumer Privacy Act (CCPA) is ushering in a new era for retailers. If companies do not track the data they collect or where it is stored, there is an increased risk of privacy violations, regulatory action, security incidents and customer backlash. Enterprises across the world are increasing their investment in data compliance, privacy and governance: The data privacy market is forecast to be worth $158 billion by 2024, according to Market Research Engine. We expect to see more retailers and brands introduce data privacy practices in collaboration with startups, such as those included in Figure 13 below. Figure 13. Data Privacy Startups| Company | Initiative |

| BigID | BigID’s AI tools allow companies to comply with global data privacy regulations and be better privacy stewards for their customers, offering insights into what and whose data they collect and process. The company raised $100 million in September 2019 and has won business from IBM, Oracle and a raft of smaller companies such as Symantec, Talend and Varonis. |

| OneTrust | The OneTrust software solution helps companies comply with privacy and security regulations. The company claims to have more than 3,000 customers in over 100 countries, and it has raised $200 million in a Series A funding round led by Insight Partners. Clients include 21st Century Fox, Allianz , Criteo, Kickstarter and Oracle. Marriott International enlisted OneTrust to help its customers determine whether their data had been compromised during a massive data breach in 2018. |

| Preclusio | Preclusio has developed a “machine learning-fueled solution” to help companies comply with both the EU GDPR and California CCPA regulations. Preclusio helps companies to identify what data they are collecting, how they are using it, where it is being stored and how it should be protected. Preclusio has finished the first version of its product and is running pilots. The company initially focused on Amazon AWS users but is now adding support for customers of Microsoft Azure and Google Cloud. |

Source: Company reports/Coresight Research

The increased limitations on harvesting consumer data also mean that contextual marketing—which thrives on consumer engagement based on real-time behavior—will have to shift data collection to be less invasive. We expect more solution providers to offer more data collection tools to comply with new requirements while also delivering results.- Anagog, an Israeli startup, uses smartphone sensors that offer retailers insights into customer activities, whereabouts and context. By building profiles of customer behavior, Anagog’s Edge-AI technology helps retailers to better understand the customer’s lifestyle and routines in real time. It then provides highly personalized and contextual offers. The AI engine runs on the mobile device itself, enhancing user privacy because there is no need to transmit data to a central server, so no private data leaves the phone without the customer’s permission. Skoda is one of Anagog’s main clients.

| Company | Initiative |

| Amazon | Amazon recently launched Amazon Care, a virtual clinic designed to lower health-care costs for its employees. This follows the 2018 acquisition of online pharmacy PillPack for $753 million. Amazon is known for testing concepts such as Amazon Go on its own employees first, so this could be an indication of a gradual move into the primary-care business. |

| Best Buy | Best Buy hired a chief medical officer and announced a gamut of new services, including remote monitoring of seniors. The company already has 1 million customers for its remote health-monitoring services and hopes to have 5 million within the next five years. |

| CVS | At its investor day in June 2020, CVS announced plans to turn 1,500 of its more than 9,000 stores into “HealthHubs,” which will have a larger clinic, offer access to a greater range of diagnostic tests and feature wellness rooms for activities such as yoga. |

| Walgreens | In July 2020, Walgreens announced it will invest $1 billion in debt and equity over the next three years into VillageMD, which operates a chain of primary-care clinics. |

| Walmart | Over the past year, Walmart has opened several standalone primary-care clinics in the US. The first was launched in Calhoun, Georgia, and allows patients to see doctors for routine checkups and treatment of chronic conditions, even if they lacked health insurance. |

Source: Company reports/Coresight Research

We will likely see more activity in this space through 2020. As millennials cross into their 30s and start families of their own, consumer interest may turn to fertility and reproductive health. There are a number of startups innovating in this space (see Figure 16). Figure 15. Health-Care Startups: Funding on the Rise| Company | Initiative |

| Dadi | Dadi offers sperm storage and analysis; it recently secured $7 million in a funding round. |

| Kindbody | Kindbody provides health and fertility services for women; it has raised $21 million in venture capital. |

| Natalist | Natalist supplies products for women trying to get pregnant; it recently closed a $5 million funding round. |

| Progyny | Progyny is a venture-backed company that helps employers provide fertility services to employees. |

Source: Company reports/Coresight Research

Sustainability Will Remain a Key Priority in Retail Post crisis, we expect sustainability to remain at the top of retailers’ medium-term priorities, with opportunities for renewed vigor in implementation as companies search for cost savings. Underscoring this, in late May 2020—the depths of the crisis in many countries—Zalando announced that by 2023, all fashion brands on its platform would have to be assessed against the Higg Brand & Retail Module from the Sustainable Apparel Coalition; this means that brands will be rated on measures such as performance around ethical and environmental parameters—including human rights, fair wages and carbon-dioxide emissions. The apparel industry is now said to be the second-largest polluter in the world, beset by energy-intensive processes, high water consumption, use of non-renewable resources and general excess. In the last 15 years, the industry has doubled production, but the average length of time an article of clothing is worn before being discarded has plummeted by 40% in the same time frame. According to global non-profit organization BSR, 93% of global consumers want to see more of the brands they buy from support environmental issues, and three in four teenagers want to buy more sustainable products. Many retailers are already working on sustainability initiatives. To cut waste, some companies have introduced initiatives focused on recycling and reuse, which we outline in Figure 16. Figure 16. Select Retailers’ Sustainability Initiatives| Company | Initiative |

| Burberry | Burberry signed a deal with sustainable luxury manufacturer Elvis & Kresse to use 130 tons of leather offcuts from the scrap heap over the next five years to create new products. |

| NIKE | NIKE created Nike Grind, which uses production scraps in new footwear, apparel and sports surfaces. NIKE has also created a reuse-a-shoe program. |

| REI | Outdoor retailer REI set up a used-gear website that promotes itself under a modification of the standard environmental refrain it calls “reduce, reuse, adventure.” |

| Levi Strauss | Levi Strauss promotes its commitment to sustainability with its Water<Less products, which are made with less water than conventional products. |

| Patagonia | Patagonia connects with consumer values through its Worn Wear campaign, helping consumers to repair, reuse or recycle clothing. The brand trumpets its strong labor-rights policies and the fact that it uses recycled, rather than virgin, polyester. It has also committed to reducing energy use and carbon emissions. |

Source: Company reports/Coresight Research

Startups will continue to disrupt the industry with innovative, sustainably based approaches to retail manufacturing. Figure 17. Startups with Sustainability Solutions| Company | Initiative |

| Frank & Oak | Frank & Oak designs men’s and women’s clothing using recycled materials. It also offers a clothing subscription service. The Canada-based company has raised $39.8 million. |

| SupplyCompass | SupplyCompass, a sustainable sourcing platform, developed new compostable packaging for fashion brands as an alternative to conventional plastic. The corn-based biopolymer is said to be as durable as plastic but breaks down in six months. |

| Vollebak | Vollebak is a tech-based clothing startup that aims to “make the future of clothing.” It launched a T-shirt made entirely from algae and wood pulp sourced from sustainably managed forests. The T-shirt breaks down in soil or in a composter within three months. |

Source: Company reports/Coresight Research

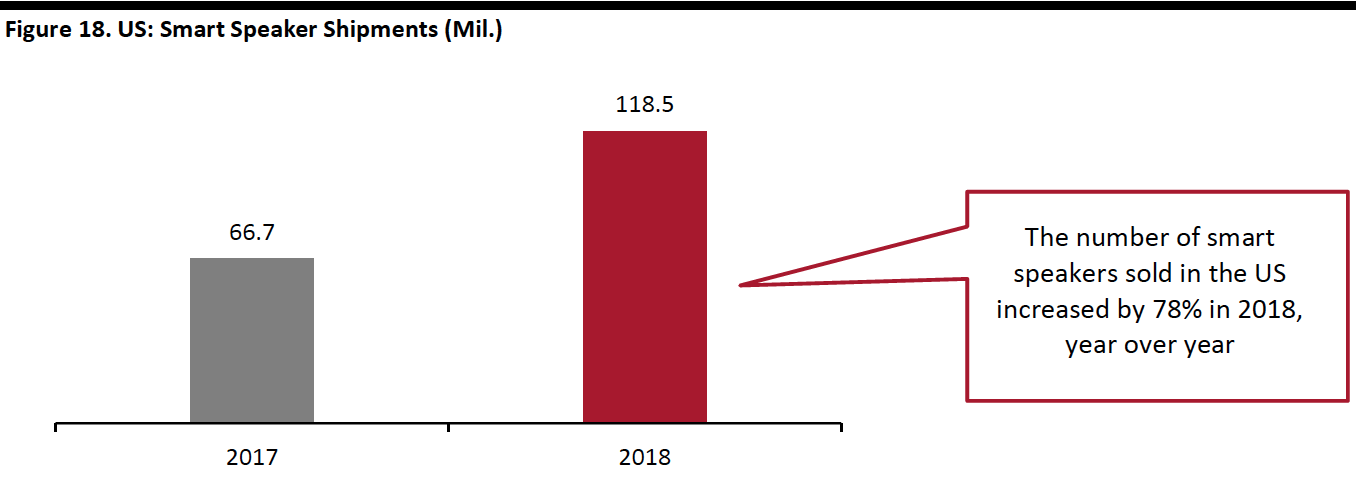

Retailer and Consumer Interest in Voice-Assisted Commerce Will Continue To Rise While e-commerce may provide a convenient and efficient channel for consumers to make purchases, in today’s environment, they are also likely to find it a safer alternative to visiting a physical store, where the risk of being exposed to Covid-19 is greater. According to a June 2020 US consumer survey on shifting preferences by PYMNTS.com, consumers want to see safety measures that include contactless payment options (favored by 59.7% of respondents) and payment methods that do not require touching a card reader (58.6%). Given those findings, it seems likely that consumers will have more interest in using voice-activated devices in commerce. As demonstrated by a recent tie-up between Google and French grocery chain Carrefour—with the two companies planning to launch a voice-activated grocery shopping service in France—manufacturers of voice assistants are increasingly seeking to forge relationships with grocery stores. In late 2019, a partnership was announced between Apple and Walmart, to allow the Siri voice assistant to help iPhone users manage their grocery lists and arrange purchases through Walmart. While neither company has released any figures on usage rates yet, anecdotal reports suggest that as online grocery orders spiked during the pandemic, so too did grocery-related requests through Siri. The usage and ownership of virtual assistants has likely increased amid the pandemic. The expansion of virtual assistants such as Amazon’s Alexa, Apple’s Siri, Bixby, Microsoft Cortana and Google Home Assistant are changing the way we interface with the digital world. More than 60 million people now have at least one smart speaker system at home. In retail and e-commerce, voice-assisted technologies support product searches and sales through voice recognition. In 2020 and beyond, we expect retailers to use audio technology more: Innovation in audio advertising, sonic logos and branded podcasts are a few of the options available. As smart speakers and voice commerce become more advanced, such technology will continue to revolutionize the future of retail. Below, we outline several examples of how retailers are enhancing the customer experience via voice ordering systems.- 7-Elevenlaunched its 7NOW Delivery app. By using Google Assistant or Amazon’s Alexa, customers can open their 7NOW app with the phrase “Hey, Alexa! Open 7NOW,” and place goods into the cart through voice commands.

- Harrods uses a podcast to bolster its digital presence, engaging potential customers to explore what luxury means today. Although part of its digital growth strategy, the podcast also expands the company’s potential customer base.

- Lululemon runs audio ads, of between 15 and 30 seconds in length, via Amazon Alexa (to users who do not subscribe to ad-free Prime).

- Walmart launched its Walmart Voice Order service, enabling shoppers to place orders using voice commands. Shoppers can use any device and platform powered by Google Assistant or Siri.

Source: NPR/Edison Research[/caption]

Despite its growth, voice-assistant technology is still a largely untapped resource with tremendous potential. A recent study by OC&C Strategy Consultants forecasts global voice-commerce sales to rise to about $40 billion by 2022 from just $2 billion today.

We expect that 2020 will see an expansion of voice shopping in the retail sector.

Source: NPR/Edison Research[/caption]

Despite its growth, voice-assistant technology is still a largely untapped resource with tremendous potential. A recent study by OC&C Strategy Consultants forecasts global voice-commerce sales to rise to about $40 billion by 2022 from just $2 billion today.

We expect that 2020 will see an expansion of voice shopping in the retail sector.

- 1-800 Flowers became one of the first retailers to use Samsung’s Bixby to enable voice shopping, and to pay with Samsung Pay, in early 2019.

- Mmuze is extending voice shopping to grocery retailers, allowing them to compete directly with Amazon’s Alexa voice-based grocery shopping. The Israel-based conversational AI company offers online grocery retailers a platform that provides a natural conversational experience. Mmuze’s platform-agnostic solutions already power cross-channel commerce for leading online retail brands, including ASOS, Perry Ellis and US Polo.

- NIKE’s digital performance expert Nike Coach uses Google Assistant to chat with shoppers to help them find sneakers. It also uses Apple’s Siri voice assistant to tighten and release laces on NIKE’s new Adapt Huarache sneakers, while the company’s FitAdapt software and Nike Adapt app also turn the shoes into another voice-controlled IoT device.