DIpil Das

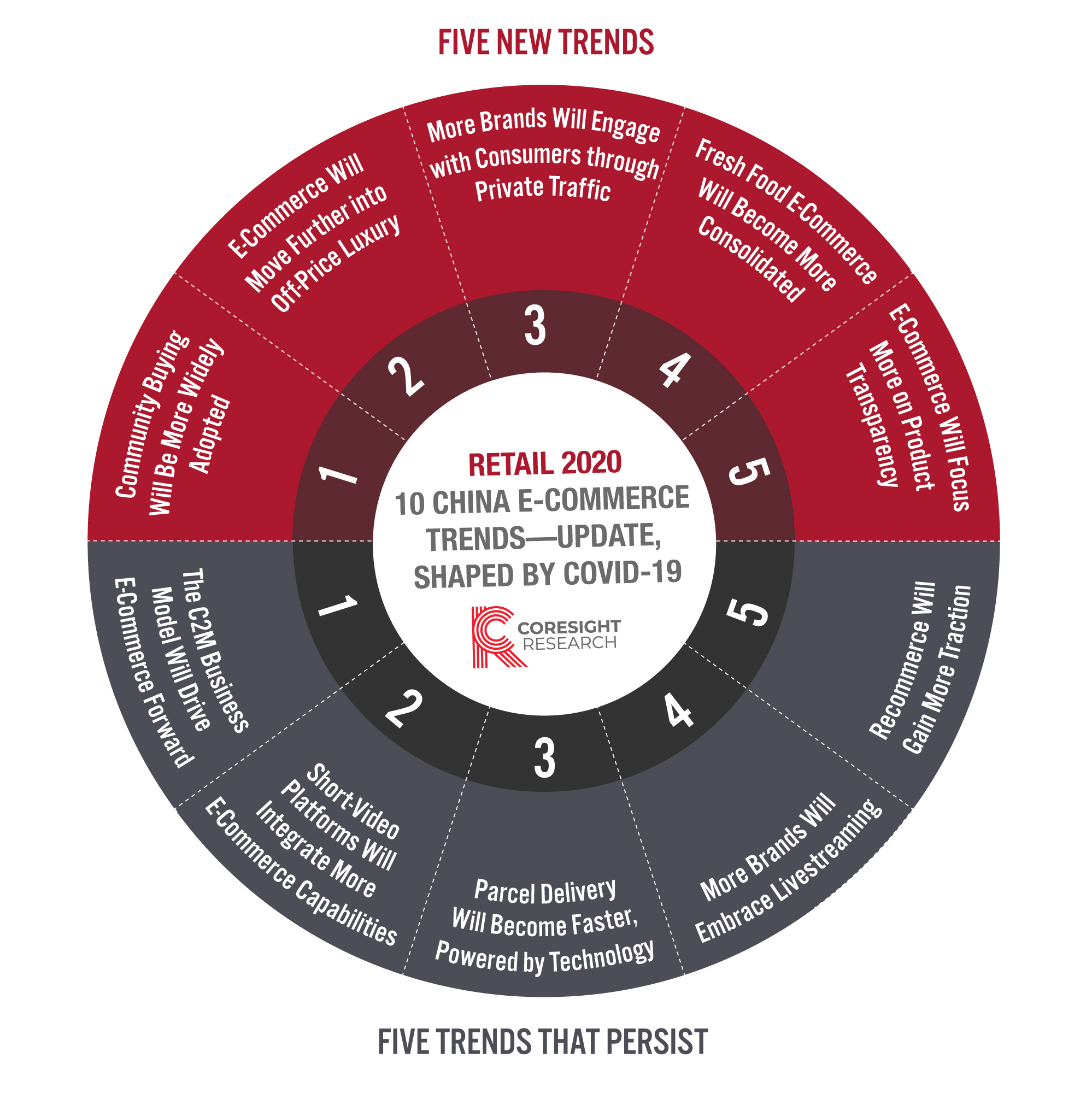

Introduction: Our Updated 10 Trends for China E-Commerce for 2020

In January, we identified 10 trends for Chinese e-commerce that we predicted will play out over the course of 2020. However, the global coronavirus pandemic in this first half of the year caused widespread retail shutdowns, significantly altering the nature of how consumers engage with brands and make purchases. In China, as elsewhere, consumers have been turning to digital options during the coronavirus crisis, driving e-commerce sales and prompting more brands and retailers to focus on digital channels. With brands and retailers having to find innovative ways to adapt to the new environment, the landscape of China’s e-commerce market has significantly changed. In this report, we provide an update to our previous 10 trends to incorporate five new trends that have emerged in the context of the coronavirus pandemic and consequent changes in Chinese consumer behavior. We also look at five of the trends we identified at the beginning of the year that have played out during the Covid-19 environment, which we expect will continue through the remainder of 2020.

Five New Trends

1. Community Buying Will Be More Widely Adopted, Particularly in Lower-Tier Cities We expect community buying—a location-based approach of selling in bulk to people living in close proximity—to continue to scale up, particularly in lower-tier cities. We predicted in our previous report that group buying will further grow as major e-commerce platforms launch their own group-buying functions. However, the coronavirus pandemic has given rise to a new trend born out of consumer behavior rather than driven by technological developments—that of community buying. Purchases through community-buying programs can be initiated by a community leader on behalf of local residents in a WeChat group, for example. This form of social buying was increasingly adopted during the coronavirus crisis as demand for daily essentials surged and strict quarantine measures were implemented across China—group buying and community delivery services remove the need for individual consumers to visit grocery stores, thus minimizing their contact with other people in order to curb the spread of the virus. As with standard group buying, the community-based model has captured consumers’ attention because it offers convenience, and products are often available at significantly reduced prices through such programs. The escalating popularity of this type of purchasing is evident from the performance of major platforms in China:- Tencent-backed community group-buying platform Xingsheng Youxuan reported that during the coronavirus pandemic, it saw total orders placed increase by 300%, and the number of new users grow four-fold from the pre-coronavirus period.

- Alibaba-backed community e-commerce platform Nice Tuan continued to grow in April, reporting a GMV increase of more than 30% over March.

- Pinduoduo also launched its own community group-buying platform Kuaituantuan in the beginning of March 2020, which covers over 10,000 neighborhoods.

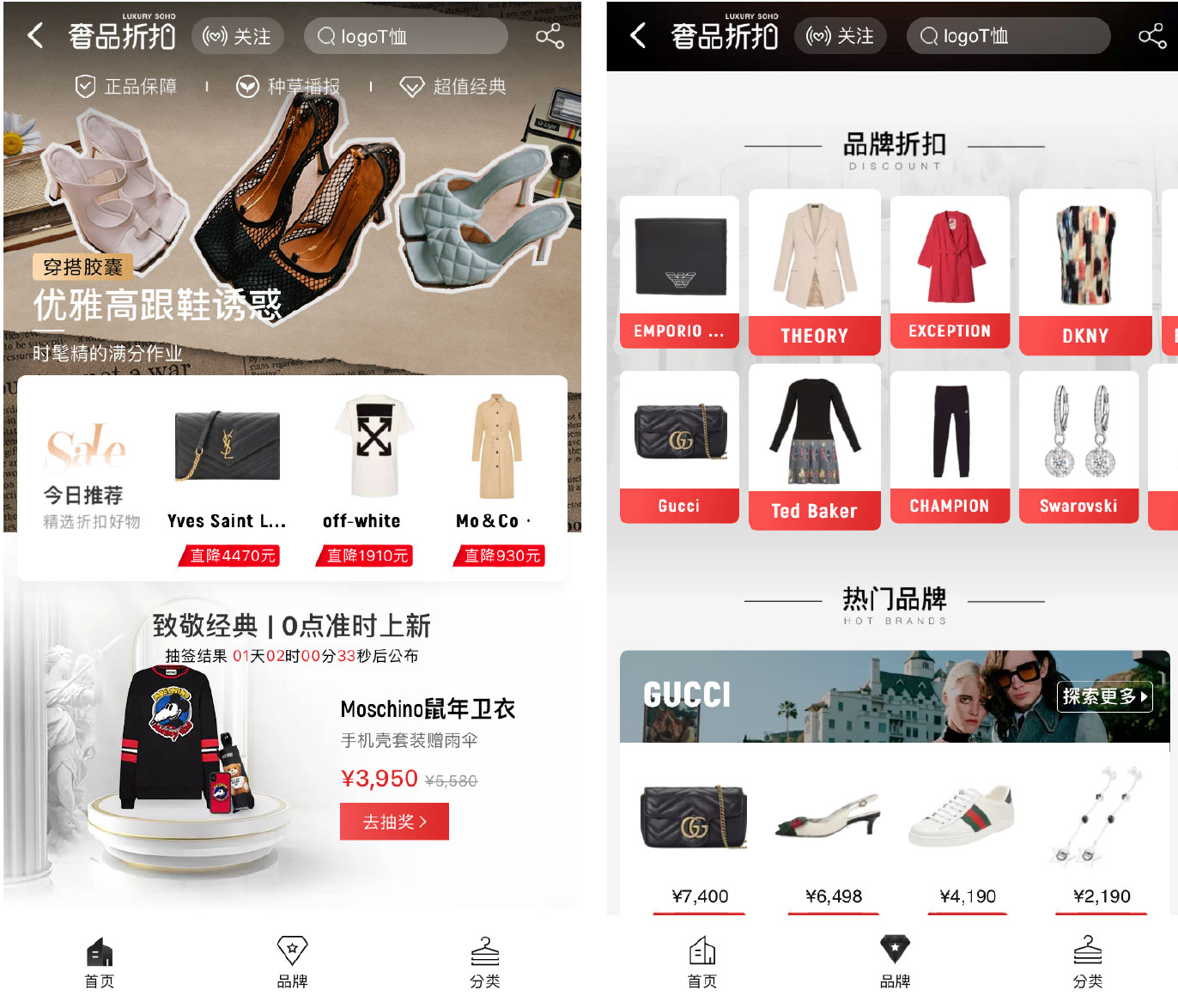

- Xiaomi Youpin, the e-commerce platform operated by Chinese electronics company Xiaomi, opened a portal offering discounted luxury products on April 3, 2020.

- In its first-quarter 2020 earnings call, French luxury group Kering noted that it will take some discount and markdown actions to boost sales.

- Alibaba launched a new luxury outlet channel on Tmall for seasonal items on April 20, 2020, called “Luxury Soho.” According to Tmall, Luxury Soho is catered to price-sensitive but fashion-loving young consumers.

Source: Taobao app[/caption]

Implications for retailers and brands: The off-price channel provides an avenue for luxury brands to discount overstocked inventory in a challenging macro environment, but they need to clear stock discreetly. Off-price e-commerce could cannibalize full-price sales, and steep discounting could harm a brand’s image. Brands will need to find the right platforms to strategically clear inventory and boost sales in the wake of the coronavirus crisis.

3. More Brands Will Engage with Consumers through Private Traffic

We expect that more brands will make further changes to their marketing strategies, with a focus on leveraging private traffic to engage with shoppers.

Unlike public traffic, which is generated from third-party platforms, private traffic provides a direct channel between content providers and consumers to enable social selling. WeChat, the largest social media site in China, is a key channel for brands to build up private traffic. Some brands adapted well to the Covid-19 environment—leveraging WeChat to connect with consumers in a more personal way than previous marketing strategies. This is significant because brands had to find ways to remain relevant and encourage customer loyalty during the period of widespread store closures, as well as to drive sales through e-commerce. By posting on WeChat Moments and in private WeChat group conversations, brands aim to convert traffic to potential sales on their own e-commerce platforms.

[caption id="attachment_110176" align="aligncenter" width="700"]

Source: Taobao app[/caption]

Implications for retailers and brands: The off-price channel provides an avenue for luxury brands to discount overstocked inventory in a challenging macro environment, but they need to clear stock discreetly. Off-price e-commerce could cannibalize full-price sales, and steep discounting could harm a brand’s image. Brands will need to find the right platforms to strategically clear inventory and boost sales in the wake of the coronavirus crisis.

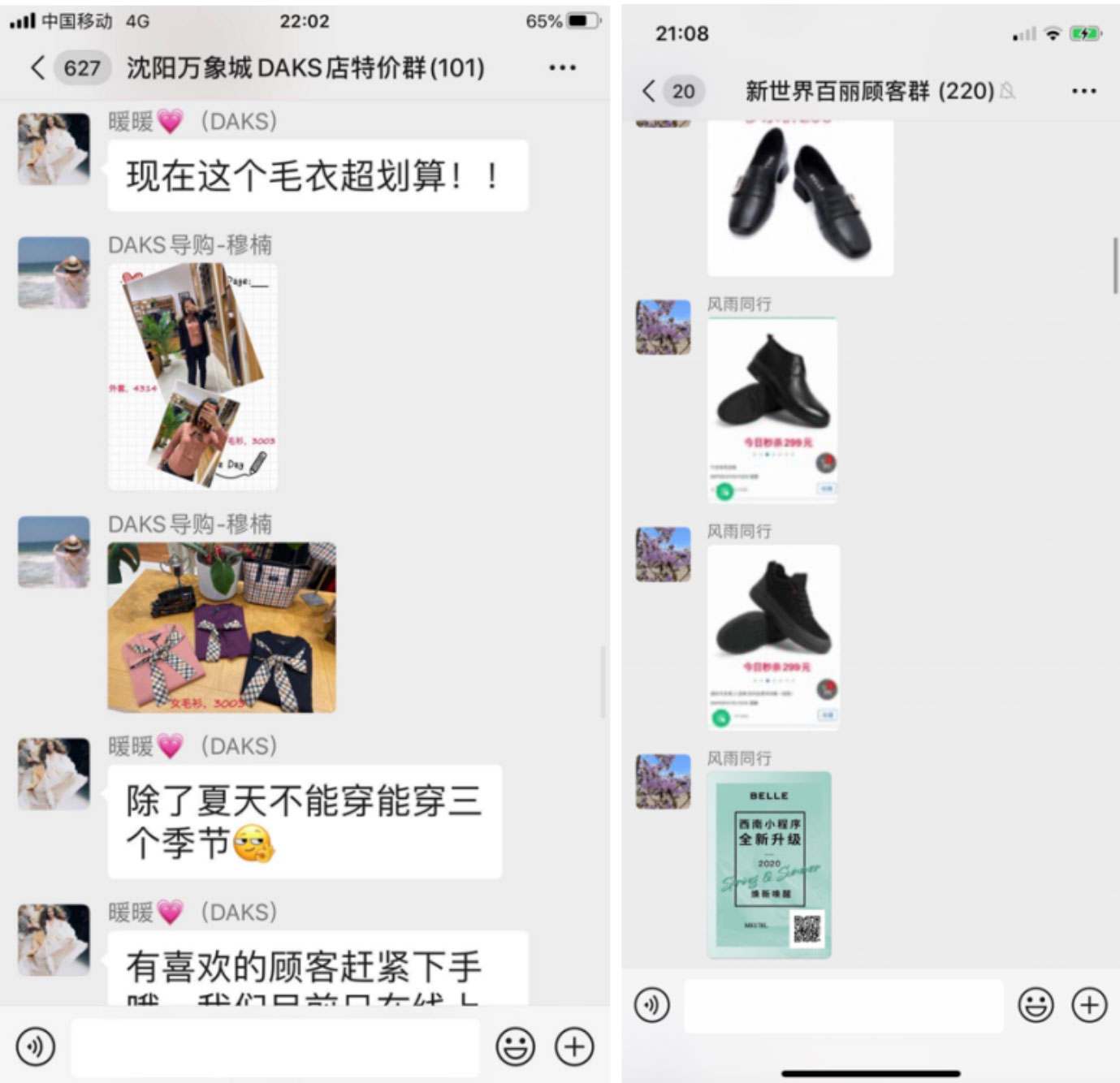

3. More Brands Will Engage with Consumers through Private Traffic

We expect that more brands will make further changes to their marketing strategies, with a focus on leveraging private traffic to engage with shoppers.

Unlike public traffic, which is generated from third-party platforms, private traffic provides a direct channel between content providers and consumers to enable social selling. WeChat, the largest social media site in China, is a key channel for brands to build up private traffic. Some brands adapted well to the Covid-19 environment—leveraging WeChat to connect with consumers in a more personal way than previous marketing strategies. This is significant because brands had to find ways to remain relevant and encourage customer loyalty during the period of widespread store closures, as well as to drive sales through e-commerce. By posting on WeChat Moments and in private WeChat group conversations, brands aim to convert traffic to potential sales on their own e-commerce platforms.

[caption id="attachment_110176" align="aligncenter" width="700"] British brand Daks (left) and Chinese footwear brand Belle (right) used WeChat private groups to promote products during the coronavirus pandemic

British brand Daks (left) and Chinese footwear brand Belle (right) used WeChat private groups to promote products during the coronavirus pandemic Source: WeChat [/caption] Clothing company Bestseller—which owns brands such as Jack & Jones, ONLY, Selected and Vero Moda— was an early adopter of the private-traffic promotional model, having launched such activities in China in 2018. Bestseller’s store associates can invite in-store shoppers to a WeChat private group, through which consumers are sent information about new products and promotions to prompt them to purchase through the company’s WeChat mini-program store, WeMall. In February 2020, during Covid-19 offline store closures, GMV on WeMall surged thirteenfold year over year, thanks to its already accumulated private traffic. Implications for retailers and brands: Private traffic gives brands control over their audiences and lowers the cost of customer acquisition by removing fees to third-party platforms. Brands should develop their private traffic in parallel with public traffic to form a holistic omnichannel marketing strategy. 4. Fresh Food E-Commerce Will Become More Consolidated We expect that China’s fresh-food e-commerce market will continue to consolidate: Top players—such as Alibaba’s Freshippo, JD Daojia, Meituan Maicai and Tencent-backed Missfresh—have the capability to scale up the business and invest in improved logistics to offer a better shopping experience. Grocery is fundamentally a low-margin business in retail. Online grocery is a highly competitive market in China, and it is considered to be a difficult business due to the high attrition rate of perishable goods and heavy investments into cold-chain logistics. Attesting to the challenging environment, multiple smaller businesses and startups bowed out of the market in 2019, including Dailuobo, Fresh Super and Mr.Please. Grocery in general has been boosted by the coronavirus crisis due to stockpiling trends. However, it has also led to the growing popularity of online grocery, with consumers having to stay at home under government measures. According to China’s National Bureau of Statistics, online food sales increased by 32.7% in the first quarter of 2020, compared to 24.6% in the same quarter last year. The outbreak exposed more Chinese consumers, especially older generations, to the convenience of online grocery, and we expect that the market will continue to grow through the remainder of 2020 as consumers continue the online shopping habits that they have adopted over the past few months. Nevertheless, during recovery from Covid-19 and beyond, online grocery companies will face challenges in retaining new users. Winning brands and retailers are likely to be those that offer value products and faster service, as well as operating a complete logistics network. Implications for retailers and brands: The online grocery market is set to experience strong growth in 2020, positively impacted by the coronavirus pandemic. Brands could look to work with larger platforms backed by deep-pocketed e-commerce giants to effectively penetrate the market and maintain growth momentum. 5. E-Commerce Will Focus More on Product Transparency Chinese e-commerce will leverage technology to provide details on product sourcing to consumers, in order to gain their trust and drive conversion. The wellness trend in China has been accelerated by the coronavirus crisis, with consumers focusing on their health and wellbeing when they shop for all kinds of products—from food to beauty. Product sourcing is a large part of this and trust can be an influencing factor in shoppers’ choice of brands, so online sites that provide a high level of transparency and traceability through the supply chain can assure consumers of brand authenticity and care, leading to better rates of conversion. Chinese e-commerce giants have been embracing blockchain technology to increase transparency. Alibaba’s Freshippo and JD.com’s 7Fresh supermarkets allow consumers to track the farm-to-shelf journey of their food products. On March 16, 2020, Alibaba also announced that its cross-border e-commerce platform Kaola upgraded the product-traceability system to include blockchain. By scanning a QR code with Alipay, consumers can access details around the sourcing of specific goods. Alibaba plans to scale the solution to cover almost 3,000 categories and 7,500 brands. Implications for retailers and brands: As Chinese shoppers increase product scrutiny and seek out authentic and transparent options, it is important for brands to utilize blockchain technology to gain consumer trust.

Five Previously Noted Trends That Will Continue To Play Out

1. The C2M Business Model Will Drive E-Commerce Forward We expect to see the acceleration of the data-based C2M model, as manufacturers recognize the importance of being consumer-centric to meet changing demand in the period of recovery following Covid-19. China’s manufacturers experienced pressure under the coronavirus situation, with industrial profits dropping 36.7% year over year in the first quarter of 2020, according to China’s National Bureau of Statistics. Due to sluggish global demand, more manufacturers are pivoting towards serving domestic demand by collaborating with e-commerce giants. Alibaba strengthened its focus on the C2M business by launching Taobao’s C2M system in March 2020, to prompt the digitalization of traditional factories in China. The system manages raw materials and product inventories based on consumer data. Alibaba aims to bring 10 billion new orders to factories across the country over the next three years and improve productivity for manufacturers. In addition, Taobao has officially launched its designated app for direct-from-factory deals, called Taobao Deals, making it a direct competitor of Pinduoduo. Consumers can find a wide range of products at bargain prices on the app. [caption id="attachment_110177" align="aligncenter" width="349"] Taobao Deals App

Taobao Deals App Source: Taobao Deals [/caption] C2M appears to be a win-win situation for e-commerce platforms, consumers and manufacturers. The C2M model enables Alibaba to penetrate China’s lower-tier markets, as well as to fulfill increasing consumer demand for customized products. During Alibaba’s recent Women’s Day Festival, the company reported that the number of C2M orders on Taobao increased by 370% year over year. Implications for retailers and brands: C2M products will continue to gain momentum through 2020. Under this model, brands are able to better understand consumerneeds by leveraging data provided by e-commerce platforms, and they can develop new products in a much shorter time frame. 2. Short-Video Platforms Will Integrate More E-Commerce Capabilities Short-video platforms gained new users during the coronavirus lockdowns in China. These platforms will continue expanding their e-commerce features, mostly within their own ecosystem, in order to monetize this traffic. Demonstrating the increasing popularity of short-video platforms in China during the coronavirus crisis, the number of monthly active users on Douyin in March 2020 increased by 14.7% to 518 million and by 35.4% to 443 million on Kuaishou, according to data provider QuestMobile. Also in March, the average time spent on the platforms per month grew by 72.5% on Douyin and 64.7% on Kuaishou. Douyin’s parent company ByteDance announced in early April this year that it is actively looking for e-commerce vendors and partners in content production, business operations and branding, to expand Douyin’s e-commerce platform. Douyin also encouraged more users to sell products through its own platform by removing previous restrictions and offering training classes. Similarly, Kuaishou is focused on building its own e-commerce ecosystem, aiming to generate value within its own app. Short-video platforms are also becoming a popular destination for livestreaming. According to a February survey by the China Consumers Association, 57.8% of respondents used Douyin for livestream shopping, the second-most-used platform after Taobao Live. Kuaishou came in third at 41.0%. The combination of user-generated content and e-commerce allows short-video platforms to further challenge e-commerce giants Alibaba, JD.com and Pinduoduo. Implications for retailers and brands: The growing popularity of short-video apps in China, particularly among young consumers, make them an appealing platform for brands to grab viewers’ attention and create a marketing buzz. By providing increased e-commerce functionality, short-video platforms will offer brands and retailers the ability to convert traffic to sales. 3. Parcel Delivery Will Become Faster, Powered by Technology We expect e-commerce logistics networks to become more efficient by employing advanced technology—including 5G connectivity, the Internet of Things, big data, artificial intelligence (AI) and robotics—thus making parcel delivery even faster in the near future. Although the coronavirus crisis posed challenges for logistics, Chinese e-commerce giants were able to fulfill consumers’ online orders by leveraging technology. For example, Alibaba’s Cainiao Network has an AI-enabled digital inventory system that connects online and offline stores, with merchants’ brick-and-mortar stores serving as a distribution network. Similarly, JD Logistics—the smart supply-chain solutions division of JD.com—operates an innovative program that matches online orders with the nearest offline supply source in real time, and arranges a courier for timely delivery. Driven by its self-operated logistics network, JD.com was able to resume full operation quickly after the Chinese New Year. Its automated warehouses integrate technologies such as AI, deep learning and image recognition, enabling the company to fulfill orders efficiently across China during the pandemic. To address last-mile delivery needs, JD.com also used autonomous vehicles and drones for faster and safer delivery. [caption id="attachment_110178" align="aligncenter" width="700"]

A JD.com autonomous robot makes a delivery in Shanghai

A JD.com autonomous robot makes a delivery in Shanghai Source: JD corporate blog [/caption] Implications for retailers and brands: Covid-19 has accelerated the use of new technologies in retail logistics, enabling more efficient delivery services in China. By leveraging the logistics network provided by Chinese e-commerce, brands can also expand sales to consumers in harder-to-reach areas. 4. More Brands Will Embrace Livestreaming We expect livestreaming to become a valuable marketing tool for more brands post coronavirus, helping their businesses to become more agile and resilient. Furthermore, with the widespread adoption of technologies such as 5G and augmented reality, the livestreaming experience between hosts and viewers will also become richer and more diversified. From the end of January 2020—when retail stores in China were shut down and people began having to stay at home—livestreaming became a useful tool for brands to engage with consumers and offset sales declines in their offline business. Alibaba’s livestreaming platform Taobao Live reported that the number of new merchants on its platform increased 719% in February 2020 from the previous month, and the number of livestream sessions spiked by 110% year over year. Forest Cabin Cosmetics, a Chinese beauty brand, saw over half of its 300 stores close during the coronavirus outbreak—and sales fell by 90%. It used livestreaming to boost its online business and consequently saw sales surge 120% year over year in February 2020, saving the brand from bankruptcy. Department store Intime Mall also trained its sales assistants to become livestreaming hosts on Taobao, enabling the retailer to continue operations during Covid-19. According to Estée Lauder, the sales of one livestream session was equivalent to one week of offline performance. [caption id="attachment_110179" align="aligncenter" width="700"]

Intime Mall’s staff used livestreaming to sell products during the coronavirus pandemic

Intime Mall’s staff used livestreaming to sell products during the coronavirus pandemic Source: Alizila [/caption] Implications for retailers and brands: Livestreaming has been boosted by the coronavirus pandemic, with brands turning to live video content as a way of engaging with consumers and drive sales during offline store shutdowns. We expect that livestreaming will continue to boom, now that more brands have recognized its value as a marketing tool. To better utilize livestreaming as a sales medium, brands should provide interactive and interesting content that can attract viewers. Brands can also consider working with key opinion leaders to reach a wider audience. 5. Recommerce Will Gain More Traction Reiterating our original expectations for the recommerce trend through 2020, we believe that this retail channel will gain traction over the rest of the year, as Chinese consumers become more sustainability conscious and more wary about their discretionary spending in the period of recovery from the coronavirus pandemic. The stay-at-home measures implemented in China to curb the spread of the coronavirus saw shoppers focus their discretionary spending on home products: On Alibaba’s secondhand marketplace, Idle Fish, GMV from big-ticket items—such as furniture—increased by 271.4% in February 2020, and electronics soared 70%. In addition, the home quarantines prompted consumers to declutter their homes and sell unwanted items online. reported that the number of new users grew by 38.8% year over year in March 2020, and there was a 40% increase in new product listings on the platform. Consumers also showed preferences for purchasing pre-owned luxury goods as disposable incomes declined; according to China’s National Bureau of Statistics, real per-capita disposable income dipped 3.9% in the first quarter of 2020. Luxury resale platforms in China therefore witnessed user growth, with the monthly number of unique devices using secondhand luxury platform Plum increasing 40.4% in February 2020, for example, according to research firm iResearch. Although consumer demand for discretionary items may rebound quickly post Covid-19, many consumers will face constrained budgets, making recommerce an appealing option. Sustainability will also remain a trending topic for consumers, influencing their choice of brands and changing the way they shop—such as through recommerce. A March survey from McKinsey showed that some 64% of Chinese consumers agree or strongly agree that they will consider purchasing products that are environmentally friendly. Implications for retailers and brands: The recommerce trend may impact the number of new products that consumers will buy going forward. Furthermore, consumer attitudes to sustainability could lead shoppers to purchase more environmentally friendly products and to try out rental services post coronavirus. Brands that implement sustainable practices should share that message as part of their marketing strategies, to resonate with consumers and win business.