Source: Company reports/ Coresight Research

Source: Company reports/ Coresight Research

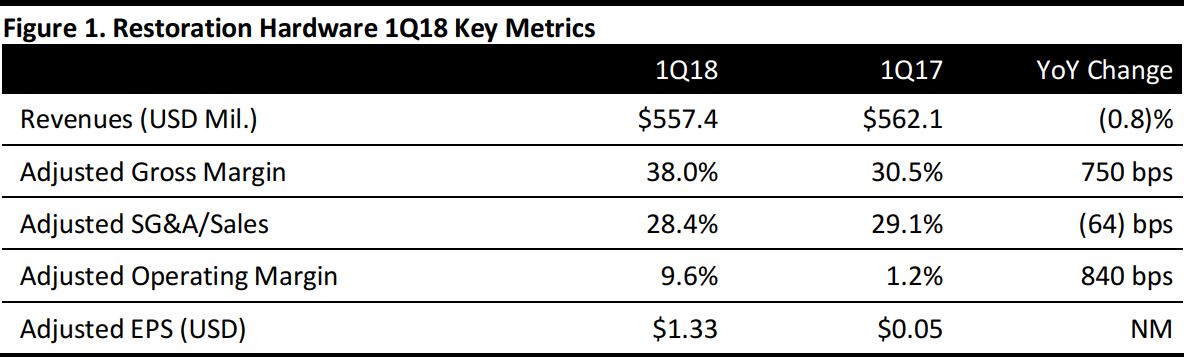

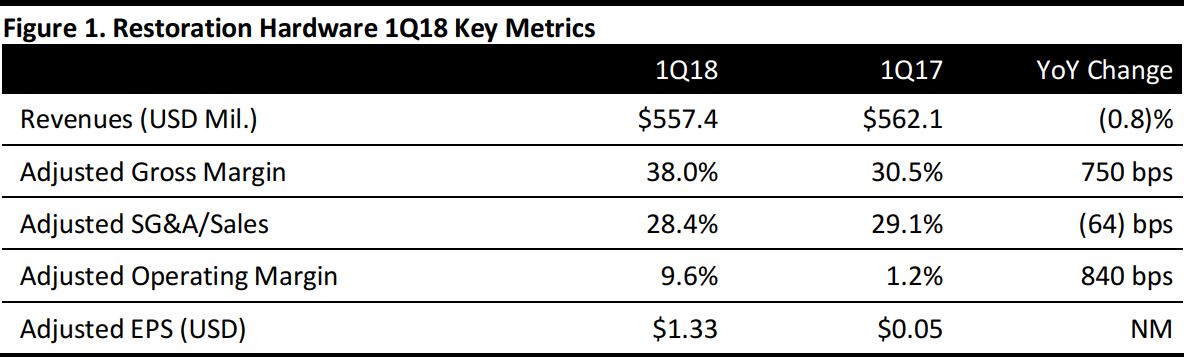

1Q18 Results

Restoration Hardware reported 1Q18 adjusted EPS of $1.33, up from $0.05 in the year-ago period and above the $1.01 consensus estimate. Revenues were $557.4 million, down 0.8% year over year and below the $563 million consensus estimate. Revenues were negatively impacted by SKU rationalization (a four-point impact) and incremental outlet sales (a two-point impact) from last year.

Retail store revenues, which represent 56% of total revenues, were $312.1 million, down 1% year over year. Online revenues were $245.3 million, up 23% from the year-ago quarter, and represent 44% of total revenues.

Comps were up 1%, topping the (1.3)% consensus estimate. Adjusted for last year’s 4-point negative impact from inventory reductions, comp revenues increased by 5%.

Adjusted gross margins increased 750 basis points in the quarter, driven by less discounting, lower outlet revenues and a more streamlined distribution and reverse logistics network. Over the year, Restoration Hardware has consolidated its distribution center network from four facilities to two, driving more streamlined operations throughout the supply chain, which has resulted in more efficient cost and working capital processes.

Adjusted figures reflect costs and inventory charges associated with product recalls, distribution center closures and post-acquisition-related legal costs.

The company plans to execute its strategy of optimizing operations, redesigning its supply-chain network and rationalizing its product offering. Over 2017, Restoration Hardware closed two distribution centers, simplifying the reverse logistics and outlet model and reducing inventory.

The company ended the quarter with a total of 84 Retail Galleries, consisting of 17 Design Galleries, 46 Legacy Galleries, two RH Modern Galleries and four RH Baby & Child Galleries throughout the US and Canada, and 15 Waterworks showrooms throughout the US and the UK.

Outlook

Restoration Hardware’s stated long-term growth remains at 8%–12% for revenues and 15%–20% for EPS annually. The company noted a long-term goal of North American revenues of $4–$5 billion and significant potential for the RH brand internationally; the company continues to explore opportunities to open in London.

The retailer said it has new brands in its pipeline that it will reveal next year. The company added that it has developed a new prototype Design Gallery with reduced square footage and efficient design that will enable it to deploy capital more efficiently with less time and cost risk.

Management provided the following guidance for FY18:

- Restoration Hardware raised its adjusted EPS guidance for FY18 to $6.34–$6.83, versus previous guidance of $5.45–$6.20 and the $5.87 consensus estimate.

- The company expects full-year adjusted revenues of $2.53–$2.57 billion, implying growth of 5%–7%, in line with the $2.55 billion consensus estimate.

- The company raised its long-term target for return on invested capital (ROIC), reflecting its target of improving profitability and capital efficiency. The company forecasts ROIC in excess of 30% by 2021, an increase from the 22% expected in FY18 and 10% in FY17.

Management provided the following guidance for 2Q:

- For the second quarter, the company guided for revenues of $655–$662 million, and adjusted EPS of $1.70–$1.77. The consensus estimate expects EPS of $1.50 and revenues of $655 million.

Source: Company reports/ Coresight Research

Source: Company reports/ Coresight Research