Source: Company reports/Fung Global Retail & Technology

4Q16 Results

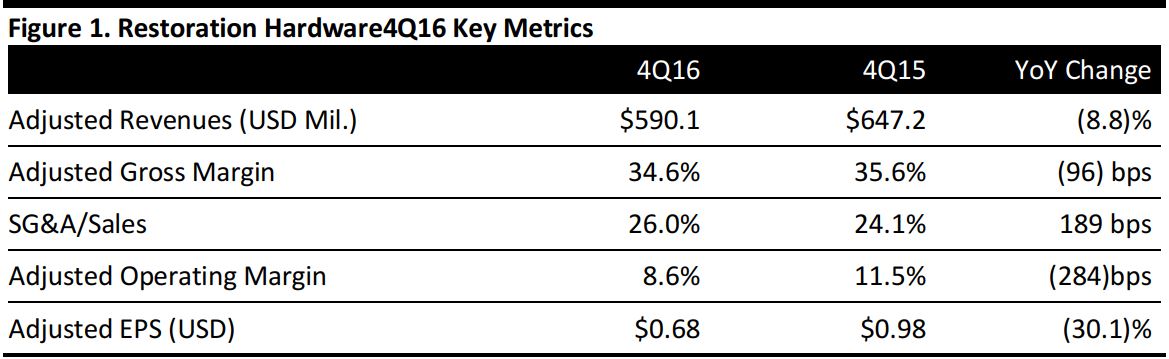

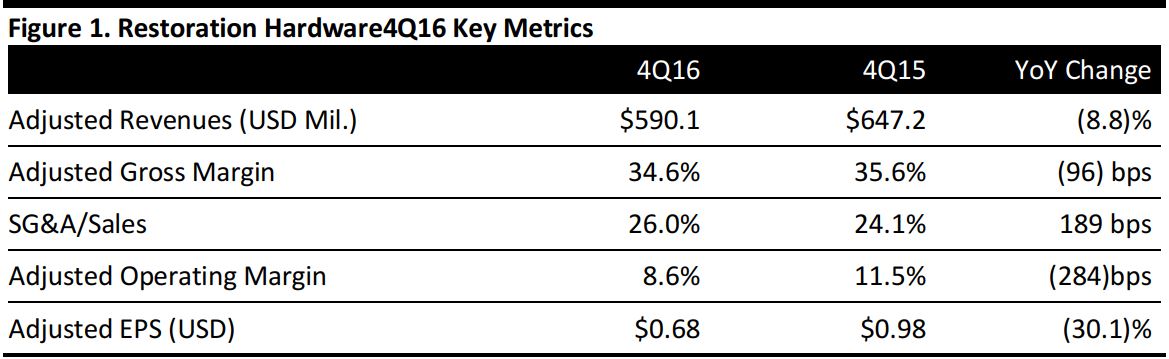

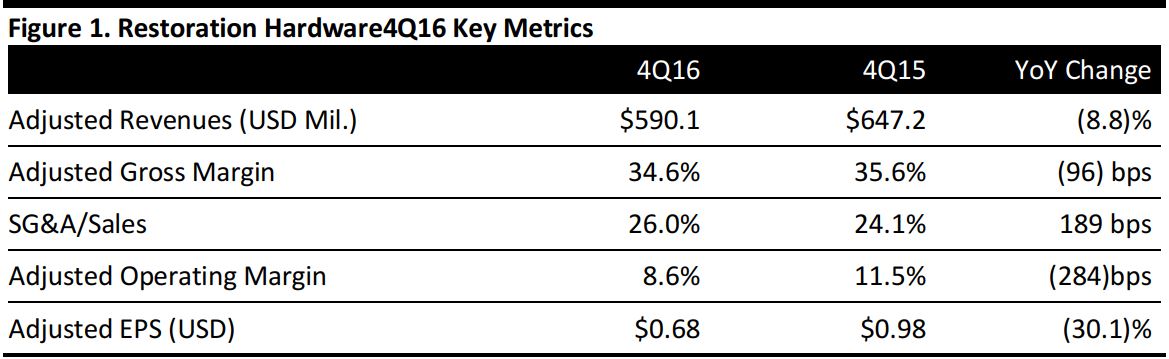

Restoration Hardware reported adjusted revenue of $590.1 million, down 8.8% from $647.2 million in the year-ago quarter but above the $584.2 million consensus estimate and inline with the company’s previous guidance.

Total company comps, which include direct comps, declined by 18% during the quarter, compared with 9% growth for the same period the prior year. Store revenues decreased by 4% year over year, to $306.2 million. Direct revenues decreased by 15% year over year, to $280.5 million. Direct revenues represented 48% of total net revenues, compared with 51% in the year-ago period.

The company reported 4Q16 adjusted EPS of $0.68, beating the consensus estimate of $0.65 and coming in at the higher end of the company’s EPS guidance range of $0.60–$0.70.

Management noted that the business is being affected by changes made to its business model in fiscal 2016. These changes include costs related to the launch of RH Modern (reducing EPS by approximately $0.30), the timing of recognizing membership revenues related to the transition from a promotional model to a membership model (reducing EPS by approximately $0.25), and efforts to reduce inventories and rationalize SKU count (reducing EPS by approximately $0.45).

FY16 Results

For FY16, Restoration Hardware’s adjusted revenues rose by 1%, to $2.14 billion. Total company comps were down 7% year over year, compared with 11% growth in the previous year. Store revenues increased by 9%, to $1.18 billion, representing 55% of total net sales. Direct revenues decreased by 7%, to $956 million. Direct revenues represented 45% of total net revenues in FY16, compared with 49% in FY15.

The company reported full-year adjusted EPS of $1.27, down 53.3% from $2.72 the previous year.

FY17 Outlook

Full-year guidance calls for EPS of $1.78–$2.19, a wide range compared with the $1.94 consensus estimate. The company expects FY17 revenues of $2.30–$2.40 billion, inline with the $2.33 billion consensus estimate.

Management noted that 2016 was a year of transformation and transition. In 2017, the company’s focus will be on executing its new business model, utilizing a new back-end operating platform and maximizing cash flow.