Source: Company reports/FGRT

3Q17 Results

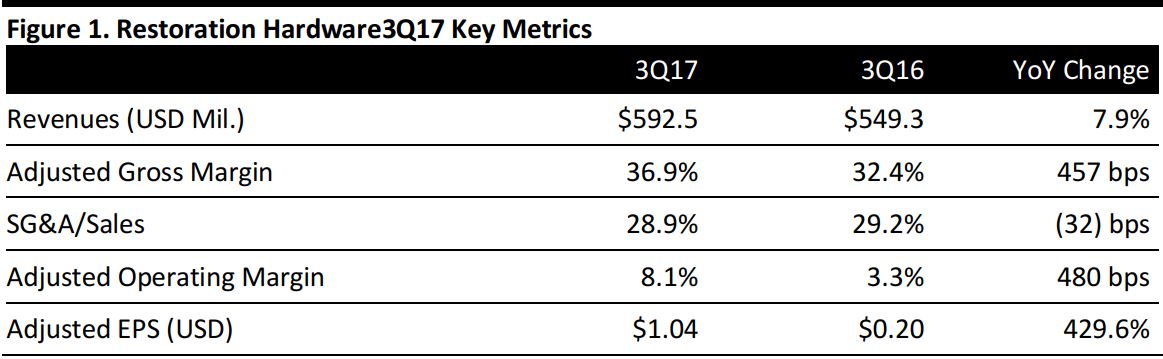

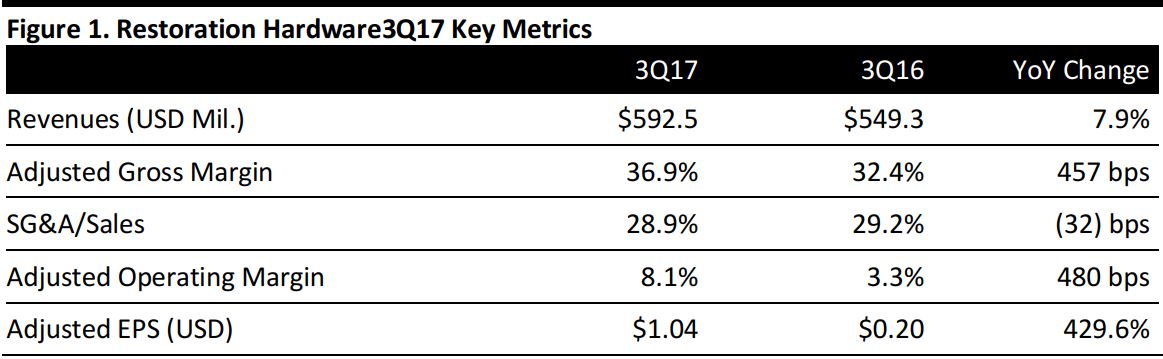

Restoration Hardware reported 3Q17 revenues of $592.5 million, up 7.9% year over year and slightly ahead of the consensus estimate. The company reported that Hurricanes Harvey and Irma reduced revenues by about 1%.

Comps were 6.0%, ahead of the 5.5% consensus estimate and flat versus the year-ago quarter.

Adjusted EPS was $1.04, up more than 400% year over year and beating the $1.02 consensus estimate. GAAP EPS was $0.56, compared with $0.06 in the year-ago quarter. GAAP figures include charges to cost of goods sold, SG&A, amortization of debt discount and a loss on the extinguishment of debt, plus the associated tax effects.

Management commented that the company’s core RH business continued to build momentum, as evidenced by comparable revenue growth, with merchandise margins up sharply versus last year. Investments in the RH Interior Design business continue to evolve the brand from creating and selling products to conceptualizing and selling spaces, deepening the relationship with customers and positioning RH as a leading US luxury interior design platform.

Details from the Quarter

Management commented that over the past 18 months, it has transformed the business from a promotional model to a membership model that is enhancing the brand, streamlining operations and improving the customer experience. Simultaneously,management began the redesign of the supply chain network, rationalizing the company’s product offering and transitioning inventory into fewer facilities, creating a more capital-efficient model.

The company categorized its efforts and opportunities into four main areas:

- Creating a simplified and more efficient business model and operating platform.

- New design galleries have the potential to double retail sales in every market.

- Looking forward, driving high-quality, sustainable growth.

- Building a brand with no peer and a customer experience that cannot be replicated online.

Outlook

Management provided the guidance detailed below, noting that recent increases in the company’s stock price and its impact on the fully diluted share count can affect the figure for diluted shares outstanding, which is used to compute adjusted diluted earnings per share.

For 4Q17, the company expects:

- Net revenues of $655–$680 million,including a negative impact of $9 million due to the company’s decision to delay the opening of its New York Design Gallery.

- Adjusted net income of $37–$41 million, which corresponds to EPS of $1.57–$1.74 (above consensus of $1.55) using the 3Q17 share count. The company expects this despite a negative impact of approximately $1.5 million due to the decision to delay the opening of the New York Design Gallery to spring-summer 2018. The figure includes an expected tax benefit of approximately $2 million (which corresponds to an expected 35% tax rate).

For FY17, the company expects:

- Adjusted net income of $125–$145 million—which corresponds to EPS of $3.53–$3.70 (above consensus of $2.91) using the 3Q17 share count—despite the decision to delay the opening of the New York Design Gallery.

For 2018, the company expects:

- Net revenues of $2.58–$2.62 billion (compared with consensus of $2.60 billion), representing growth of 6%–7% on a 52-week versus 53-week basis. On a comparable 52-week basis, the company expects net revenue growth of 8%–9%.

- Adjusted operating margin of 9%–10%.

- Adjusted net income of $125–$145 million, which corresponds to EPS of $5.31–$6.16 (above consensus of $4.89) using the 3Q17 share count.

- Net capital expenditures of $65–$75 million.

- Free cash flow in excess of $240 million.