Source: Company reports/Coresight Research

2Q18 Results

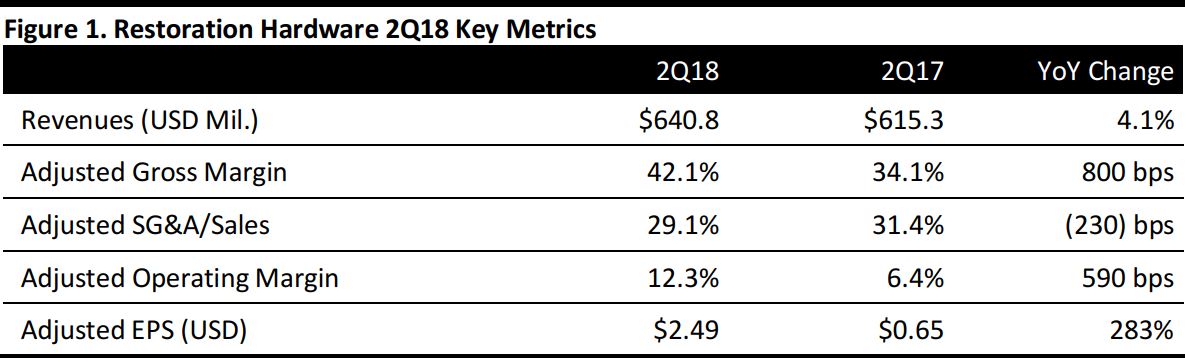

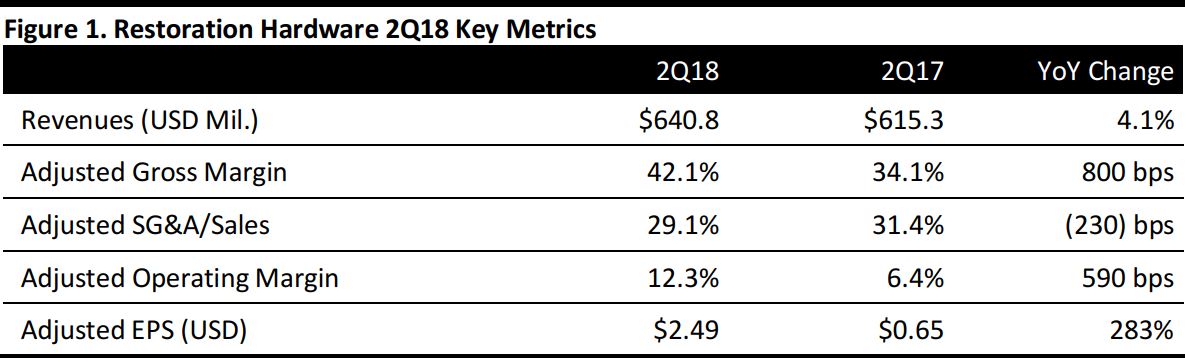

Restoration Hardware reported 2Q18 adjusted EPS of $2.49, up from $0.65 in the year-ago period and above the $1.75 consensus estimate. Revenues were $640.8 million, up 4.1% year over year but below the $660.9 million consensus estimate.Revenues were negatively impacted by three points by SKU rationalization and by three points by incremental outlet sales from last year. Excluding those two negative impacts, adjusted revenues increased by 10% year over year.

Retail store revenues represented 56% of total revenues, down 1% from the year-ago period, while online revenues represented 44% of total revenues.Comps were up 5%, following a 7% increase in the year-ago quarter,but were below the 8% consensus estimate. Adjusted for last year’s three-point negative impact from inventory reductions, comps increased by 8%.

The company’s adjusted gross margin increased by 800 basis points, to 42.1% from 34.1% in the year-ago quarter, driven by less discounting, lower outlet revenues and a more streamlined distribution and reverse logistics network. Over the year, Restoration Hardware consolidated its distribution center network from four facilities to two, driving more streamlined operations throughout the supply chain, which has resulted in more efficient cost and working capital processes. Adjusted figures reflect costs and inventory charges associated with product recalls, distribution center closures and post-acquisition-related legal costs.

EPS growth was driven by revenue growth, an expanded adjusted operating margin and a lower effective tax rate. The company’s adjusted operating margin increased by 590 basis points year over year, to 12.3%, driven primarily by a higher gross margin and lower SG&A expenses. During the quarter, Restoration Hardware’s effective tax rate was 4.4%, compared with 39% in the year-ago quarter.

The company plans to execute its strategy of optimizing operations, redesigning its supply chain network, rationalizing its product offering and optimizing its distribution centers to capture benefits associated with reverse logistics. The closure of two distribution centers in 2017 helped the company simplify its reverse logistics and outlet model and reduce inventory.

The company ended the quarter with a total of 85 Retail Galleries, consisting of 18 Design Galleries, 44legacy Galleries, two RH Modern Galleries and six RH Baby & Child Galleries throughout the US and Canada and 15 Waterworks showrooms throughout the US and the UK.

Outlook

Restoration Hardware’s stated long-term growth guidance remains at 8%–12% for revenues and 15%–20% for EPS annually. The company noted a long-term goal of generating North American revenues of $4–$5 billion and said that it sees significant potential for the brand internationally.

The company has several new brand extension plans in the development pipeline, such as RH Beach House and RH Color, which are launching in 2019. Additionally, Restoration Hardware plans to expand assortments in key categories and accelerate the introduction of new collections over the next year. The company added that it has developed a new prototype Design Gallery with reduced square footage and efficient design that will enable it to deploy capital more efficiently.

Restoration Hardware plans to increase investment in RH Interior Design, with the goal of expanding from creating and selling products to offering design and installation services. RH Interior Design will have an expanded presence in RH Interior and RH Modern Source Books and in the company’s IMAGINE print advertising campaign.

The company raised its full-year EPS guidance, but trimmed its revenue guidance. Management noted its strategy of refraining from chasing low-quality sales at the expense of profitability, and said that it is instead focused on optimizing its new business model of membership while driving more long-term sustainable growth.

- The company raised its FY18 EPS outlook to $7.35–$7.75 from $6.34–$6.83 previously; the consensus estimate calls for full-year EPS of $6.72.

- Restoration Hardware lowered its $2.53–$2.57 billion revenue guidance by 2%, implying that it now expects full-year revenues of $2.49–$2.52 billion. That range is below the $2.56 billion consensus estimate and would represent 4%–5% growth over 2017.

- The company forecasts that its efforts to improve profitability and capital efficiency will generate ROIC in excess of 30% by 2021, an increase from the 22% expected in FY18 and the 10% recorded in FY17.

- The company will refocus on its product and brand expansion strategy, which had been on hold as it focused on membership and the architecture of its new operating platform.