Nitheesh NH

What’s the Story?

Restaurants and bars saw sales drop severely last year but are likely to see a rebound as the Covid-19 pandemic fades. We expect the recovery of the US restaurant industry to accelerate in the spring and summer of 2021, highlighted by a resurgence of high-price-point restaurants. As a result, sales growth in the grocery sector—which has remained strong amid the pandemic—is likely to turn slightly negative, particularly at grocers which target high earners.Why It Matters

Restaurants and bars lost out on $150 billion in sales in 2020, while food and beverage stores saw sales increase by about $90 billion, according to data from the US Census Bureau. It is key for retailers and foodservice companies to understand how these spending shifts will shake out in 2021 and beyond, in order to adapt to the “new normal” food spending habits of consumers.The Impact of the Upcoming Restaurant Boom on the US Grocery Sector: In Detail

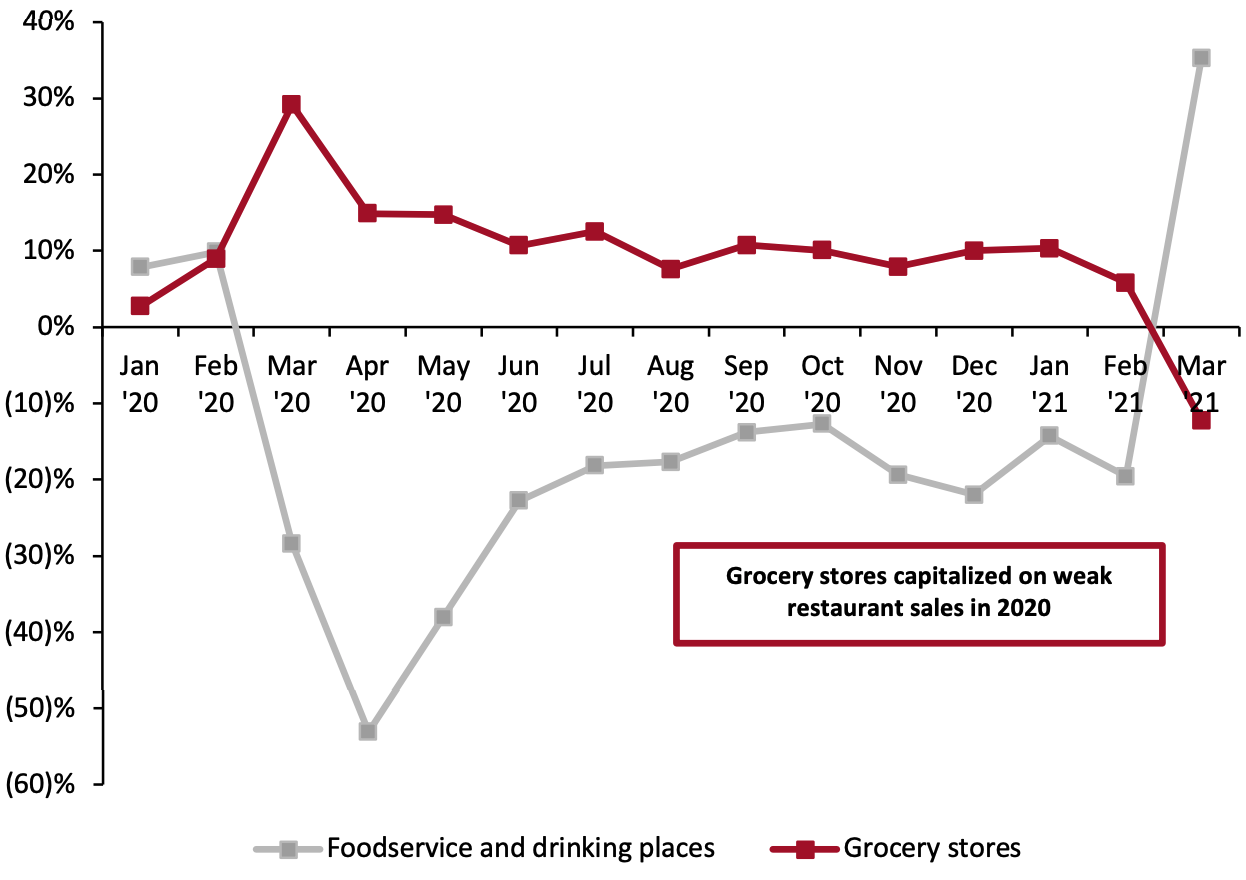

Recovery of the Foodservice Industry Stalls but Is Set To Accelerate in SummerSpending at restaurants and bars (classified by the US Census Bureau as “foodservice and drinking places”) recovered sharply after seeing a fall of more than 50% year over year in April 2020, in part due to forced closures of foodservice locations in much of the US. However, as the weather got colder and virus cases surged again, consumer spending at restaurants and bars took a hit in the early winter (see Figure 1).

By contrast, year-over-year grocery sales growth spiked when the pandemic hit the US in March and saw growth hold steady at around 10% across 2020—predictably showing less responsiveness to weather and virus caseloads.

The trends in foodservice and grocery retail sharply reversed in March 2021 as these sectors annualized the changes from March 2020.

Figure 1. Foodservice vs. Grocery: Sales Growth (YoY % Change) [caption id="attachment_126651" align="aligncenter" width="720"]

Source: US Census Bureau[/caption]

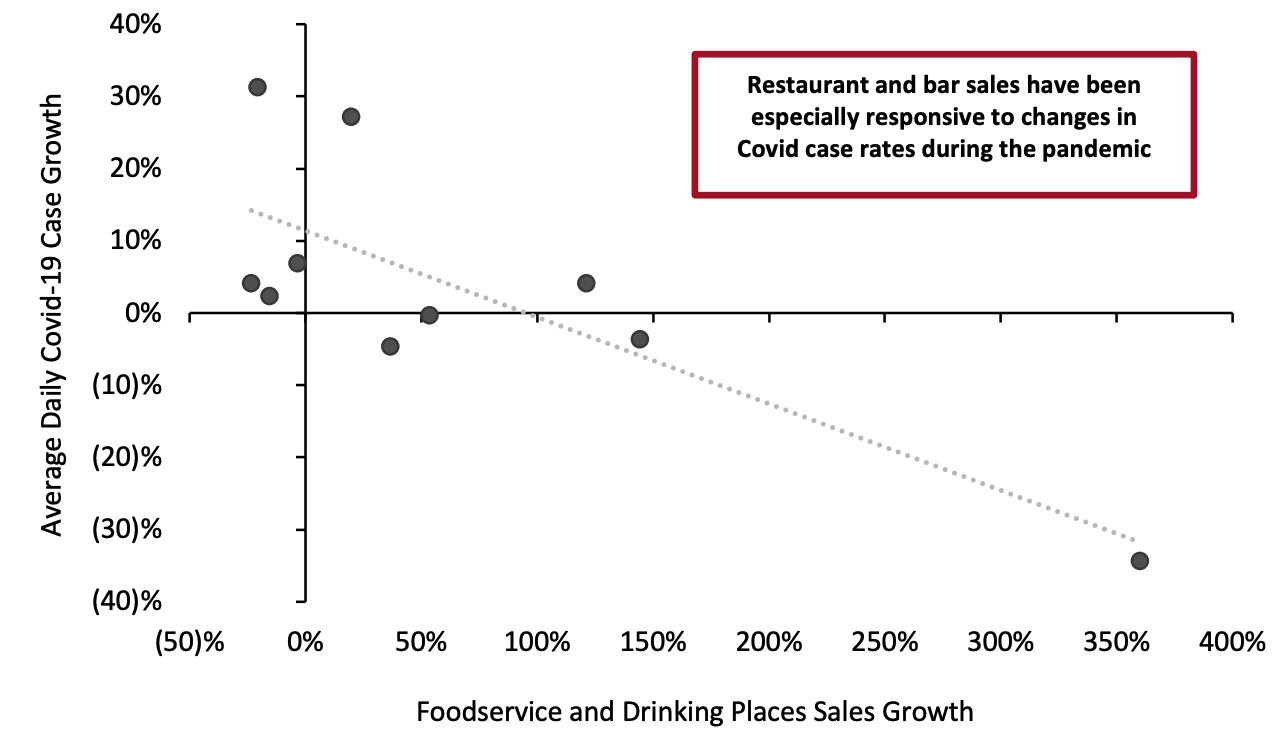

We expect restaurants and bars to see a spike in customers moving through spring and into summer. Virus cases are declining across nearly the entire country, with many areas lifting or easing restrictions on high-risk activities such as indoor dining. While consumers have been largely irresponsive to virus caseload changes when it comes to many categories of retail sales, they do seem to factor case trends into their decisions of whether or not to eat out. We can see that there has been a clear correlation between lower virus caseloads and increased spending at restaurants and bars since April 2020 (see Figure 2).

Source: US Census Bureau[/caption]

We expect restaurants and bars to see a spike in customers moving through spring and into summer. Virus cases are declining across nearly the entire country, with many areas lifting or easing restrictions on high-risk activities such as indoor dining. While consumers have been largely irresponsive to virus caseload changes when it comes to many categories of retail sales, they do seem to factor case trends into their decisions of whether or not to eat out. We can see that there has been a clear correlation between lower virus caseloads and increased spending at restaurants and bars since April 2020 (see Figure 2).

Figure 2. Average Daily Covid-19 Cases (MoM % Change) vs. Sales at Foodservice and Drinking Places (MoM % Change), April 2020–January 2021 [caption id="attachment_126615" align="aligncenter" width="720"]

Source: CDC/US Census Bureau[/caption]

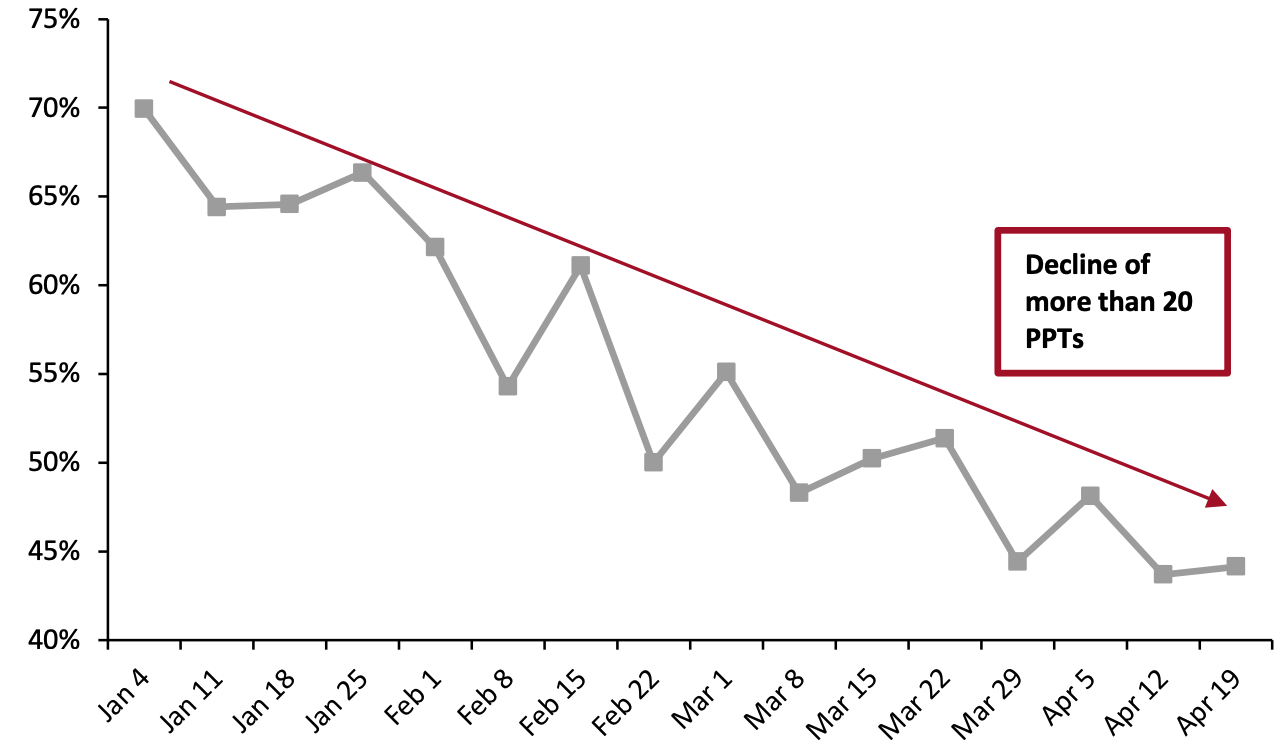

Recent findings from our US Consumer Tracker show a decline in the avoidance rate for bars and restaurants. Our recent survey conducted on April 19 found that 44.2% of consumers reported that they are currently avoiding restaurants and bars, down from 69.9% on January 4.

Source: CDC/US Census Bureau[/caption]

Recent findings from our US Consumer Tracker show a decline in the avoidance rate for bars and restaurants. Our recent survey conducted on April 19 found that 44.2% of consumers reported that they are currently avoiding restaurants and bars, down from 69.9% on January 4.

Figure 3. US Consumers Who Report Avoiding Restaurants and Bars, 2021 (% of Respondents) [caption id="attachment_126616" align="aligncenter" width="720"]

Base: US consumers aged 18+

Base: US consumers aged 18+Source: Coresight Research[/caption] Beginning in spring and leading into the summer, we expect avoidance to continue to decline. As of April 26, more than four in 10 Americans have received at least one vaccine shot, while many more have attained at least some immunity to the virus having contracted and recovered from it. Furthermore, a rise in temperatures should, by virtue of creating a more pleasant outdoor dining experience, encourage more consumers who are still worried about the virus to eat out at restaurants. The Largest Restaurant Markets Have the Most Room for Growth The US is already seeing restaurant spending recovery at a faster pace than other Western countries. In Germany, which has seen strict lockdowns over longer periods. The number of consumers making reservations at restaurants was down more than 99% year over year as recently as March and remains down over 96%, according to data from online reservation platform OpenTable. The UK was in a similar position in March but has since seen traffic recovery swiftly through strong vaccine rollout and the easing of restrictions. Canada initially eased lockdowns more than those Western European countries, but a resumed lockdown has driven traffic down more than 90% from pre-crisis levels in recent weeks. By contrast, restaurant traffic declines in the US have been less severe—down just 28.6% as of April 16, according to OpenTable data. That comparatively moderate decrease has been held in check by strong traffic in southern states, led by Texas and Florida, two of the nation’s three most populous states, which saw year-over-year restaurant traffic declines of just 1.8% and 3.9%, respectively, as of April 16.

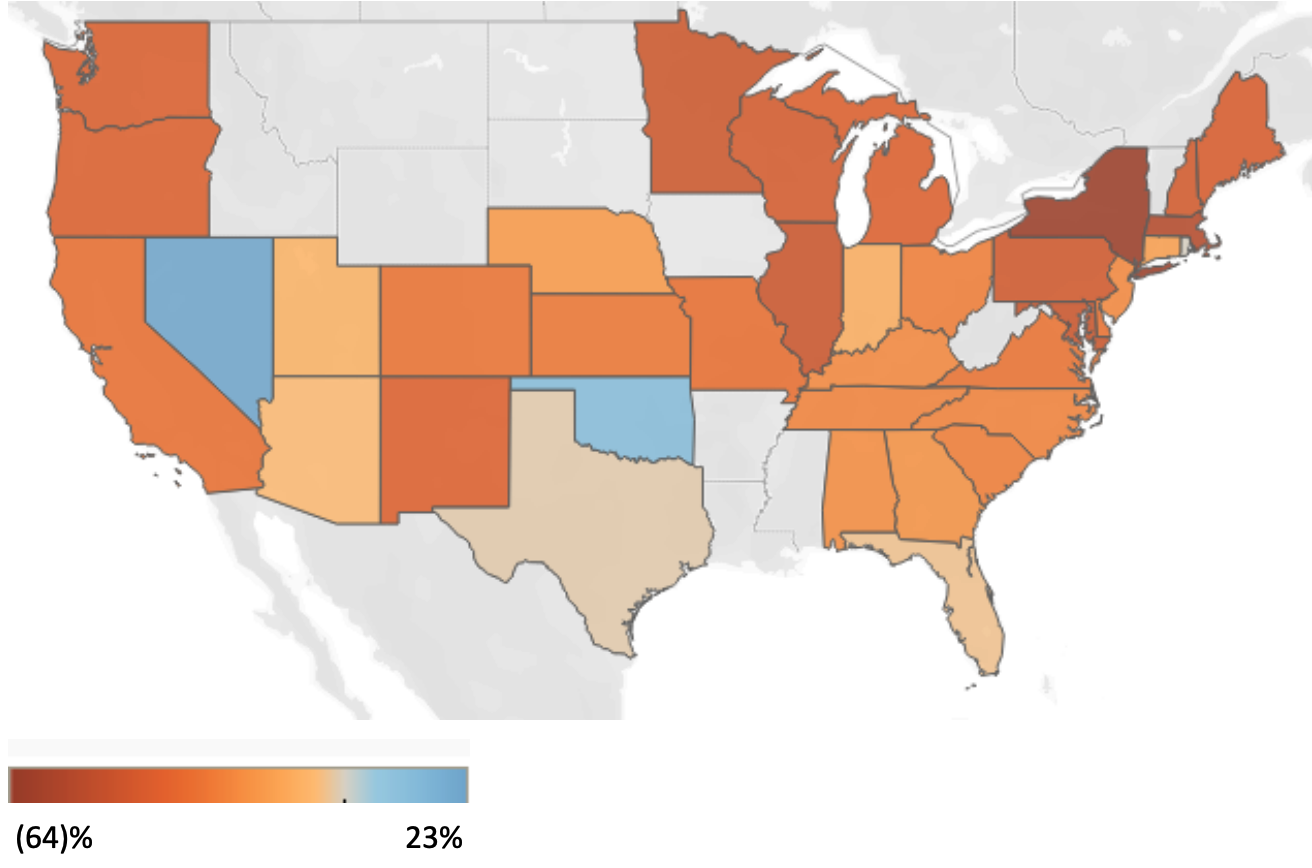

Figure 4. Seated Diners by State, Seven-Day Average as of April 16, 2021 [caption id="attachment_126617" align="aligncenter" width="720"]

Source: OpenTable[/caption]

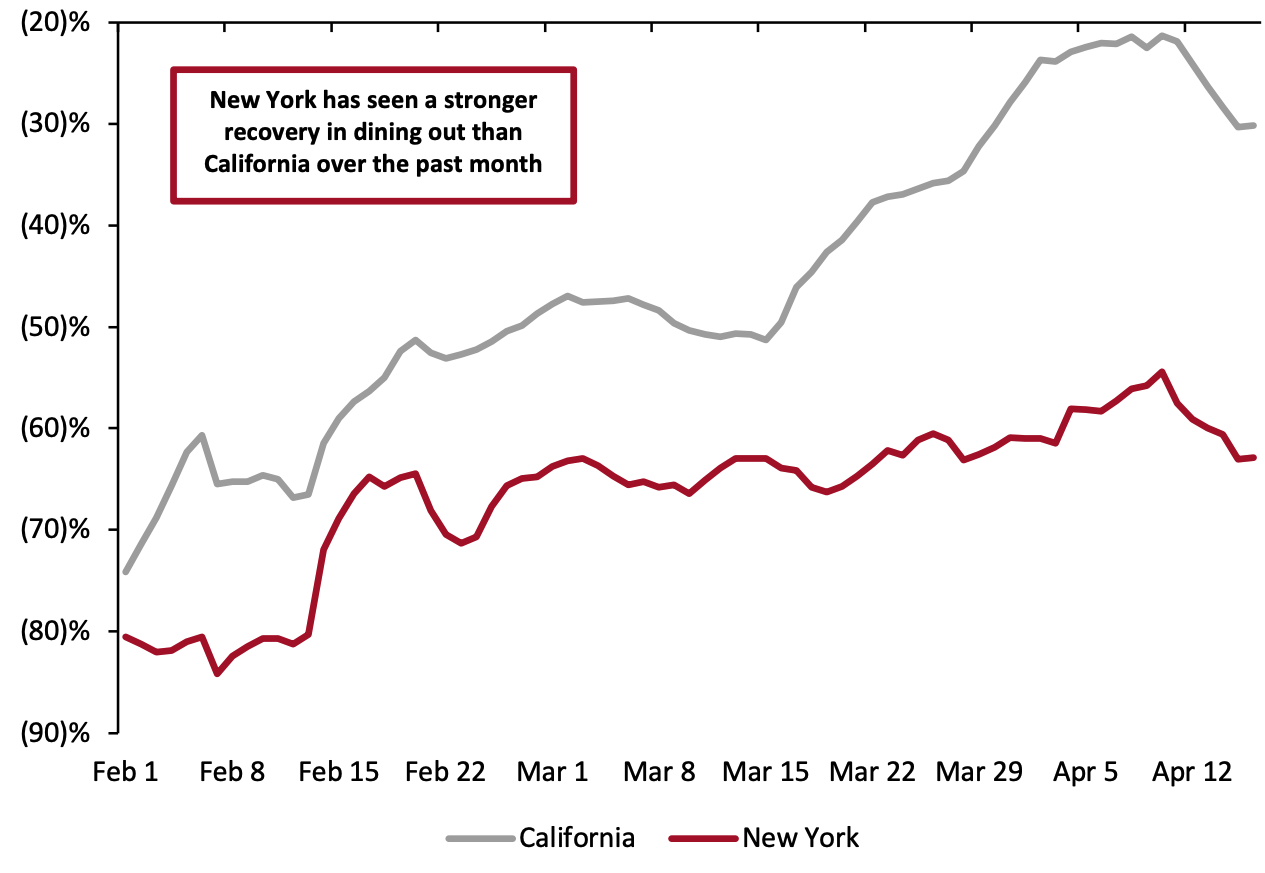

Those states, along with many of the southern states that have also seen strong restaurant traffic, have benefited from looser pandemic-related restrictions. As restrictions loosen in states such as California and New York, typically hubs of fine dining, the combination of a higher proportion of wealthy consumers in these regions and the loosening of restrictions primes them well to see the most substantial growth in restaurant spending in the spring and summer. While they lag behind their southern counterparts, these two states—particularly New York—have already begun to see a recovery in restaurant goers in tandem with their reopenings, as illustrated by the figure below.

Source: OpenTable[/caption]

Those states, along with many of the southern states that have also seen strong restaurant traffic, have benefited from looser pandemic-related restrictions. As restrictions loosen in states such as California and New York, typically hubs of fine dining, the combination of a higher proportion of wealthy consumers in these regions and the loosening of restrictions primes them well to see the most substantial growth in restaurant spending in the spring and summer. While they lag behind their southern counterparts, these two states—particularly New York—have already begun to see a recovery in restaurant goers in tandem with their reopenings, as illustrated by the figure below.

Figure 5. Seated Diners from Online, Phone and Walk-In Reservations (YoY % Change) [caption id="attachment_126618" align="aligncenter" width="720"]

Source: OpenTable/Coresight Research[/caption]

Between February 1 and April 16, the seven-day average year-over-year decline in restaurant reservations improved by 17.7 percentage points in California and by 44.0 percentage points New York.

In spring and summer, we expect consumers in the Northeast and on the West Coast who have been more virus conscious to most drastically improve their spending at restaurants, continuing a strong upward trend we have already seen as caseloads have decreased over the winter.

High-Income Consumers Lead the Charge Back to Dining

The return to restaurants has thus far been led by high-income consumers, some of whom have been vaccinated or already had the virus, most of whom have retained their main sources of income during the pandemic, and all of whom are likely weary of eating in seven days a week. While low-income consumers are likely equally fatigued by virus restrictions, fewer have the means to go out to eat at restaurants at a time where the unemployment rate for the bottom quartile of American earners likely remains above 20%, according to comments made in January by the Federal Reserve.

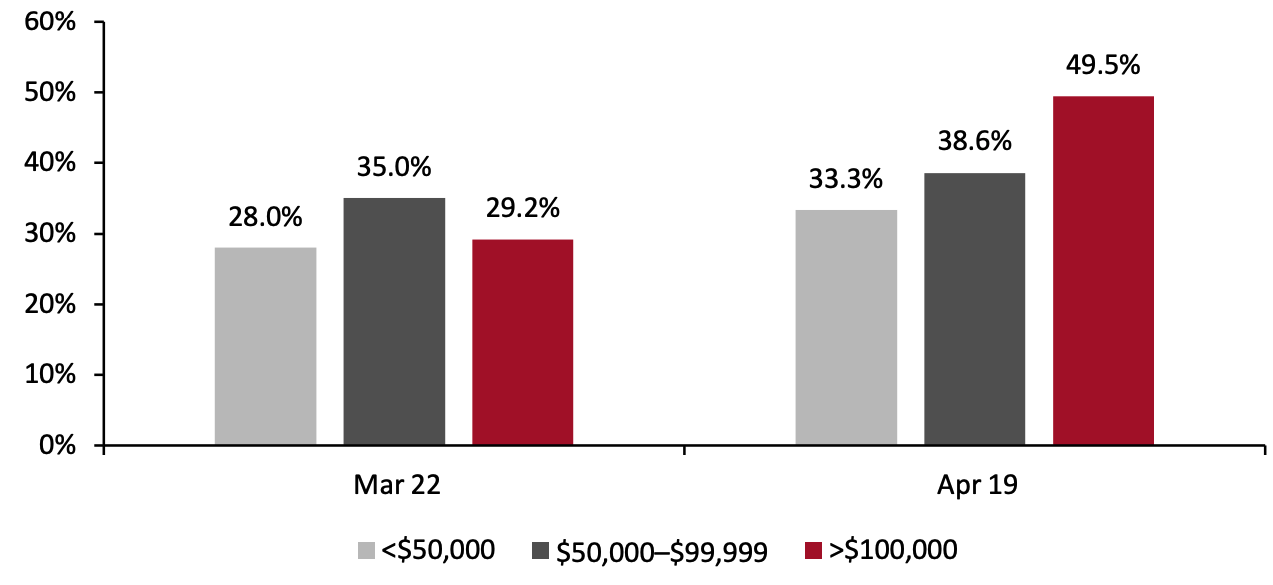

Our US Consumer Tracker has seen this income division play out in consumers’ activities. Our April 19 survey manifested a more than 10-percentage-point gap between the proportion of consumers with incomes over $100,000 who reported going to a restaurant within the prior two weeks and those with less than six-figure incomes that did the same. And while it is worth noting that wealthier consumers typically spend more than lower income consumers on restaurant eating, this gap has been growing, not stagnating, as we recover from the pandemic. In our March 22 survey, the proportion of consumers going to restaurants was relatively stable across age groups, as opposed to the double-digit gap between earners of over $100,000 and all others that appeared in the April 19 iteration.

Source: OpenTable/Coresight Research[/caption]

Between February 1 and April 16, the seven-day average year-over-year decline in restaurant reservations improved by 17.7 percentage points in California and by 44.0 percentage points New York.

In spring and summer, we expect consumers in the Northeast and on the West Coast who have been more virus conscious to most drastically improve their spending at restaurants, continuing a strong upward trend we have already seen as caseloads have decreased over the winter.

High-Income Consumers Lead the Charge Back to Dining

The return to restaurants has thus far been led by high-income consumers, some of whom have been vaccinated or already had the virus, most of whom have retained their main sources of income during the pandemic, and all of whom are likely weary of eating in seven days a week. While low-income consumers are likely equally fatigued by virus restrictions, fewer have the means to go out to eat at restaurants at a time where the unemployment rate for the bottom quartile of American earners likely remains above 20%, according to comments made in January by the Federal Reserve.

Our US Consumer Tracker has seen this income division play out in consumers’ activities. Our April 19 survey manifested a more than 10-percentage-point gap between the proportion of consumers with incomes over $100,000 who reported going to a restaurant within the prior two weeks and those with less than six-figure incomes that did the same. And while it is worth noting that wealthier consumers typically spend more than lower income consumers on restaurant eating, this gap has been growing, not stagnating, as we recover from the pandemic. In our March 22 survey, the proportion of consumers going to restaurants was relatively stable across age groups, as opposed to the double-digit gap between earners of over $100,000 and all others that appeared in the April 19 iteration.

Figure 6. US Consumers That Reported Going to a Restaurant in the Past Two Weeks, by Income (% of Respondents) [caption id="attachment_126619" align="aligncenter" width="720"]

Base: US consumers aged 18+, surveyed on April 19, 2021

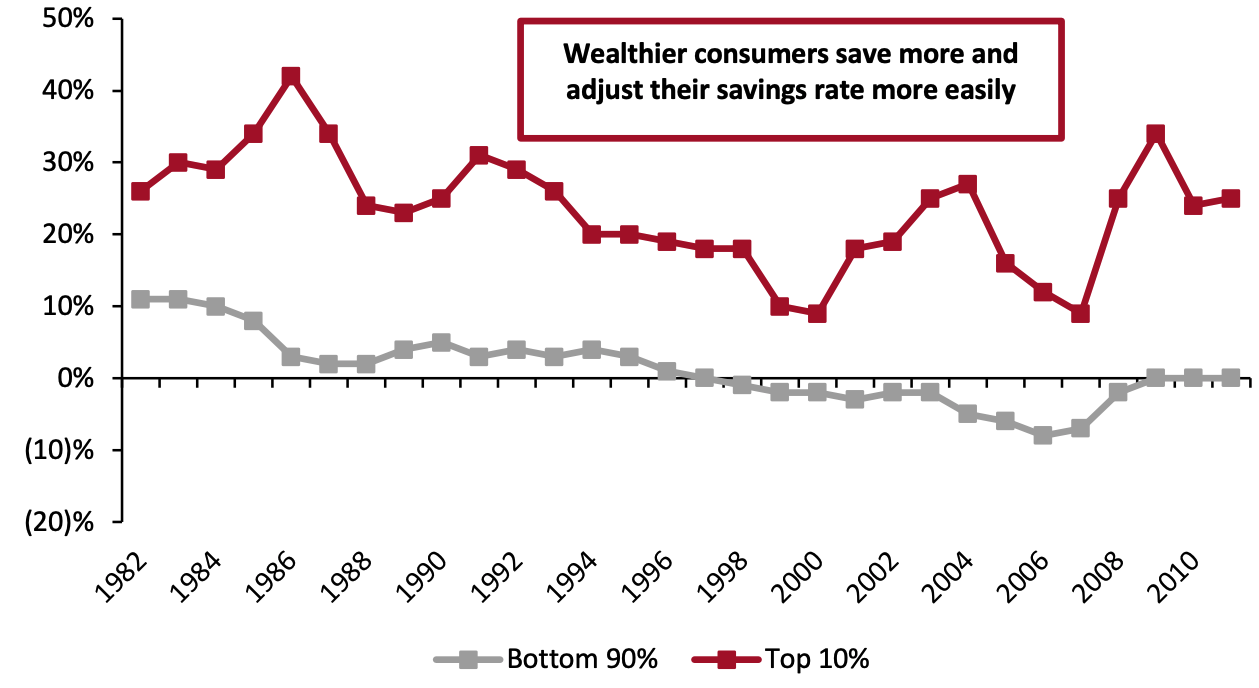

Base: US consumers aged 18+, surveyed on April 19, 2021Source: Coresight Research[/caption] Restaurants that cater to wealthier consumers are therefore likely to thrive in 2021, while those that market toward lower-income consumers may see disappointing sales for longer. In most recession recoveries, wealthier consumers come out far ahead of their low-income counterparts. Wealthy consumers have had the luxury of keeping their jobs and benefited from a strong stock and housing market, helping them save money and giving them more spending firepower once the economy fully opens. Lower-income consumers, on the other hand, have much less flexibility to adjust their savings and will therefore have less cash available to spend at dining and drinking establishments in 2021. As we discuss in our Leading Indicators of US Retail Sales series, the latest data from the US Bureau of Economic Analysis shows that the personal savings rate was 13.6% in February 2021 after shooting up in January due to the issuance of stimulus checks. The rate peaked in April 2020, at 33.7%. In Figure 7, we show the historical gap in savings rates between wealthy consumers and the rest of the US population.

Figure 7. US Personal Savings Rate, by Income Level [caption id="attachment_126620" align="aligncenter" width="720"]

Source: “Wealth Inequality in the United States since 1913: Evidence from Capitalized Income Tax Data,” The Quarterly Journal of Economics, May 2016[/caption]

Flush with cash and with fewer opportunities to spend, wealthy consumers likely hiked their savings rates drastically during 2020, and are probably still saving at higher rates than they were prior to the pandemic.

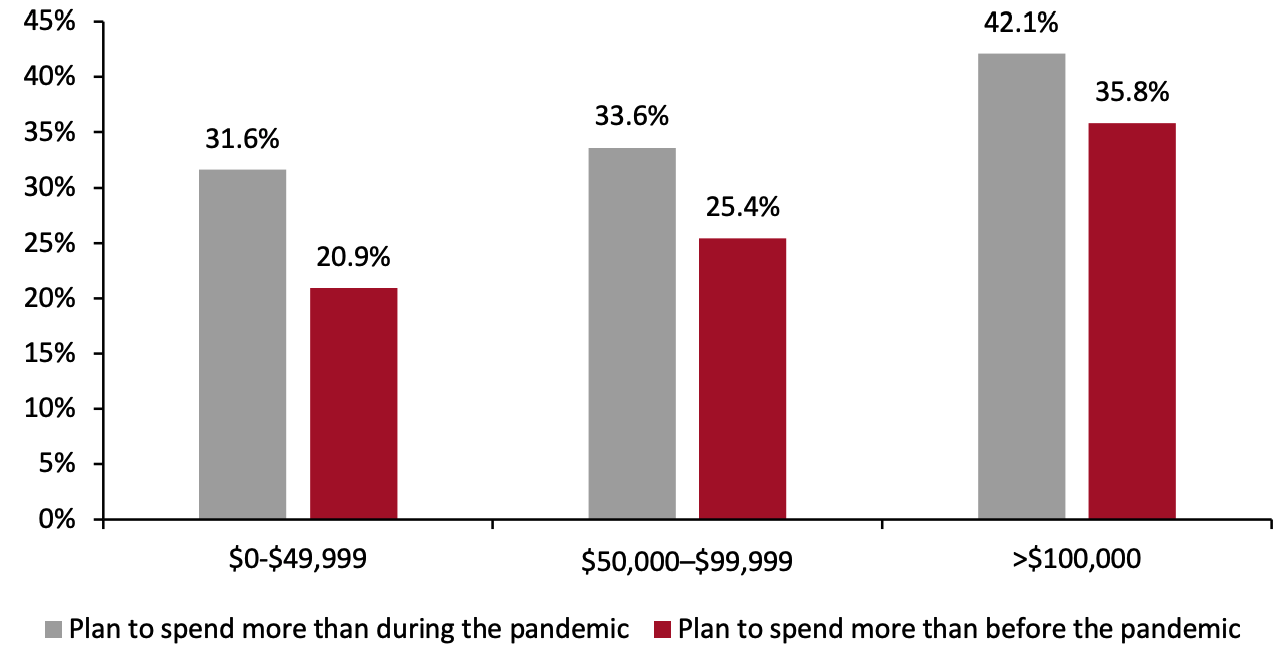

However, high-income consumers appear to be well on their way to spending at restaurants, tapping into their wealth of savings. According to a recent Coresight Research survey, 42.1% of US consumers who had received or plan to receive a Covid-19 vaccine with incomes of $100,000 or higher plan to spend more on dining out than they did during the pandemic—compared to just 31.6% of the low-income respondents. Furthermore, 35.8% of the high-income group plan to spend more dining out than they did prior to the pandemic, by far the highest percentage of any income category (see Figure 8).

Source: “Wealth Inequality in the United States since 1913: Evidence from Capitalized Income Tax Data,” The Quarterly Journal of Economics, May 2016[/caption]

Flush with cash and with fewer opportunities to spend, wealthy consumers likely hiked their savings rates drastically during 2020, and are probably still saving at higher rates than they were prior to the pandemic.

However, high-income consumers appear to be well on their way to spending at restaurants, tapping into their wealth of savings. According to a recent Coresight Research survey, 42.1% of US consumers who had received or plan to receive a Covid-19 vaccine with incomes of $100,000 or higher plan to spend more on dining out than they did during the pandemic—compared to just 31.6% of the low-income respondents. Furthermore, 35.8% of the high-income group plan to spend more dining out than they did prior to the pandemic, by far the highest percentage of any income category (see Figure 8).

Figure 8. US Consumers Who Have Already Received or Plan To Receive a Covid-19 Vaccine: Proportion Who Plan to Spend More on Dining Out Once They are Vaccinated, by Income Level (% of Respondents) [caption id="attachment_126621" align="aligncenter" width="720"]

Base: 475 US Internet users aged 18+, surveyed in April 2021

Base: 475 US Internet users aged 18+, surveyed in April 2021Source: Coresight Research[/caption] While low-income consumers have had equally few opportunities to spend at restaurants and bars over the past year, few of them have built up a stockpile of savings ready to be spent once the crisis is over. Instead, the return to dining will be powered by wealthy consumers looking to go to high price-point restaurants as a post-crisis treat. Premium Grocery Likely to See the Largest Hit

With wealthy consumers set to eat out at restaurants more frequently, premium grocers which have benefited from surging purchases by high-income consumers—who shifted food spending from restaurants to grocers—will be negatively impacted. Many grocers are likely to see declining sales in 2021 due to the unprecedented rate at which the sector grew in 2020. Price-competitive grocery stores such as Kroger and Walmart may see sales decline at a slower rate than higher-price-point stores such as Whole Foods, as wealthier consumers move away from grocery at a higher rate. We estimate that the market as a whole will see a low-single-digit decline in sales in 2021, potentially driven by mid- to high-single digits at higher-price-point grocers that are likely to lose a larger portion of their newly acquired customer base.

Competition between grocers is likely to heat up in 2021 as the total amount of grocery spending decreases. Instead of focusing on growing capacity, as industry leaders did in 2020, grocers must now turn their focus to differentiation. Meeting consumers’ heightened expectations for delivery and pickup services in the fresh grocery sector will be key to retaining omnichannel grocery shoppers in 2021. Retailers should also leverage loyalty programs to retain customers they acquired during the pandemic and who may be at risk of reducing their spending. In September 2020, Walmart finally launched its long-awaited Walmart+ subscription service to improve customer retention—a well-timed move, as the company had its largest ever base of existing customers to keep hooked with the program. Walmart+ members get free delivery from store, including same day delivery on groceries. In December, the company also dropped the $35 minimum order requirement for customers to get free shipping for online orders as part of Walmart+, further affirming its commitment to the service. It is widely believed that Walmart+ was crafted in response to Amazon Prime, the e-commerce giant’s subscription service that offers a plethora of perks ranging from free two-day shipping, to access to Prime Video, to discounts at Whole Foods. Especially in the case of Whole Foods, a chain that disproportionately attracts consumers of greater means, effectively leveraging these platforms to retain customers that flocked to grocery stores during the height of the pandemic will be key to ensuring grocers do not lose out to foodservice providers in 2021.What We Think

We are likely to see a spending boom in the US in the summer of 2021 as Covid-19 is brought under control. Where consumers direct this spending, however, remains to be seen. We have previously predicted that the resurgence in spending will likely be concentrated on services. Grocery retailers should be wary of consumers shifting their food spending back to restaurants after a year-long stretch of very strong food and beverage retail sales growth. We expect this spending shift to be the most pronounced among wealthy consumers and in the Northeast and on the West Coast, likely dealing blows to premium grocery retailers in these regions. Implications for Brands/Retailers- Through 2021, grocery retailers should expect to retain their low-income customer base but potentially lose out on spending by higher earners who are most likely to switch spending back to restaurants—a trend that will disproportionately impact premium grocers.

- Grocery retailers should invest in measures to retain customers they acquired in the midst of the pandemic; strong loyalty programs and consistent, fast fulfillment services will be key to differentiation.