albert Chan

The post-coronavirus world is yet to be shaped, and the long-term effects of the pandemic’s economic disruption remain to be seen. In the short to medium term, we will see disruptions (such as in supply) and innovations (such as in fulfillment). In categories such as apparel, we will see sourcing demand impacted not only by a severe slowdown in consumer spending but by brands and retailers holding over stock from spring 2020 to spring 2021—which will have ramifications for sourcing and the supply chain even once stores reopen and the retail recovery is under way.

With those implications and uncertainties noted, we turn in this report to more clearly established, structural changes that are impacting various stages of the supply chain. We see these forces as enduring in a post-Covid world, even if they are joined by further disruptive trends.

This is the first report in the Reshaping Supply Chains for the 2020s series, in which we analyze the technologies and trends that are enabling the evolution of the supply chain. Here, we focus on five long-term forces driving change in supply chains.

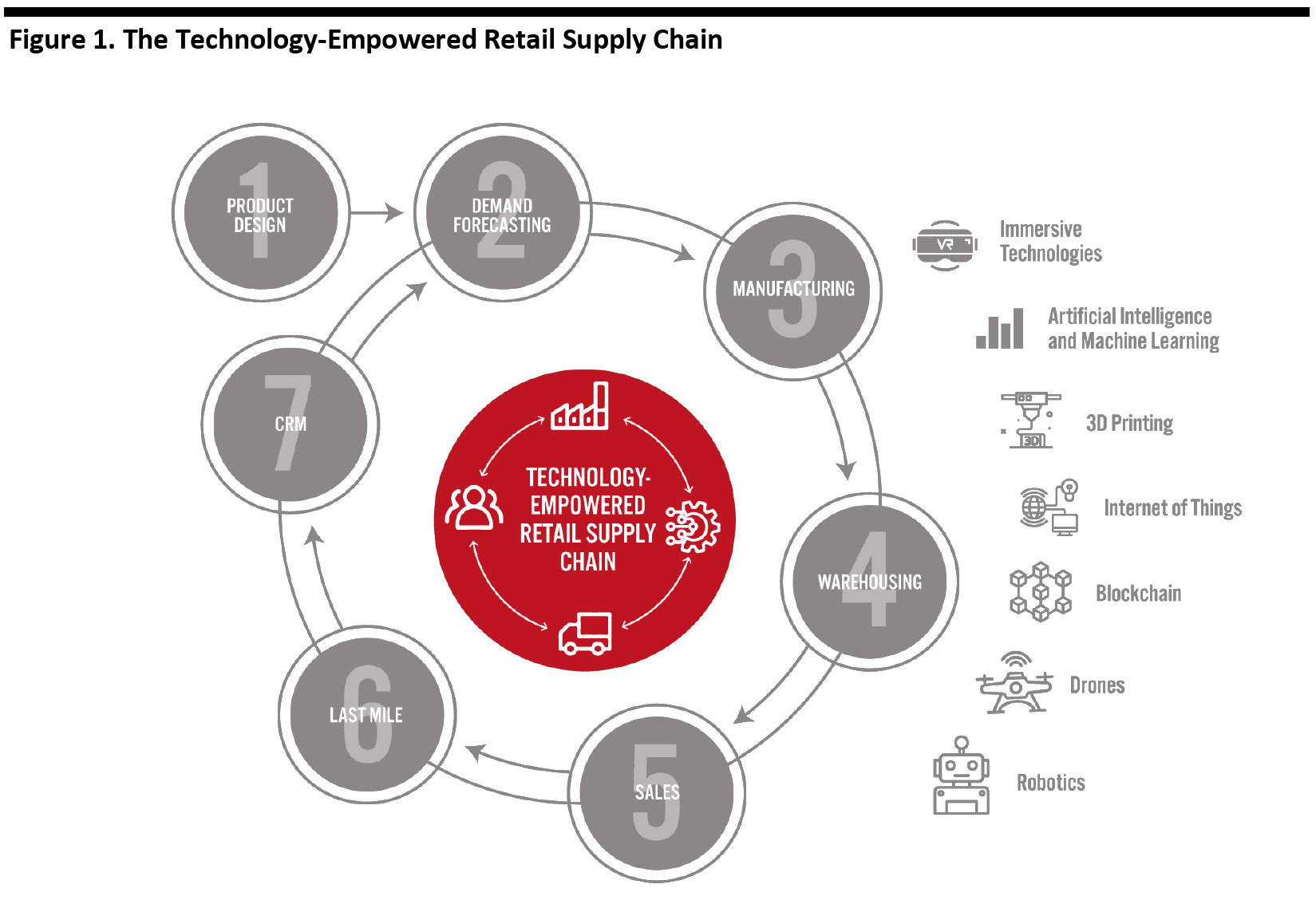

We identify seven major components of the supply chain, with each integral to a retailer’s business model and potentially representing a key source of competitive advantage and differentiation: Companies that get their products to market faster and more efficiently than their competitors can better harness the opportunity to make a positive impact in the market. The execution of component processes is supported by various technologies throughout the supply chain—from product design to end consumer.

[caption id="attachment_109159" align="aligncenter" width="700"] Source: Coresight Research[/caption]

E-Commerce Fuels Expectations of Fast Delivery

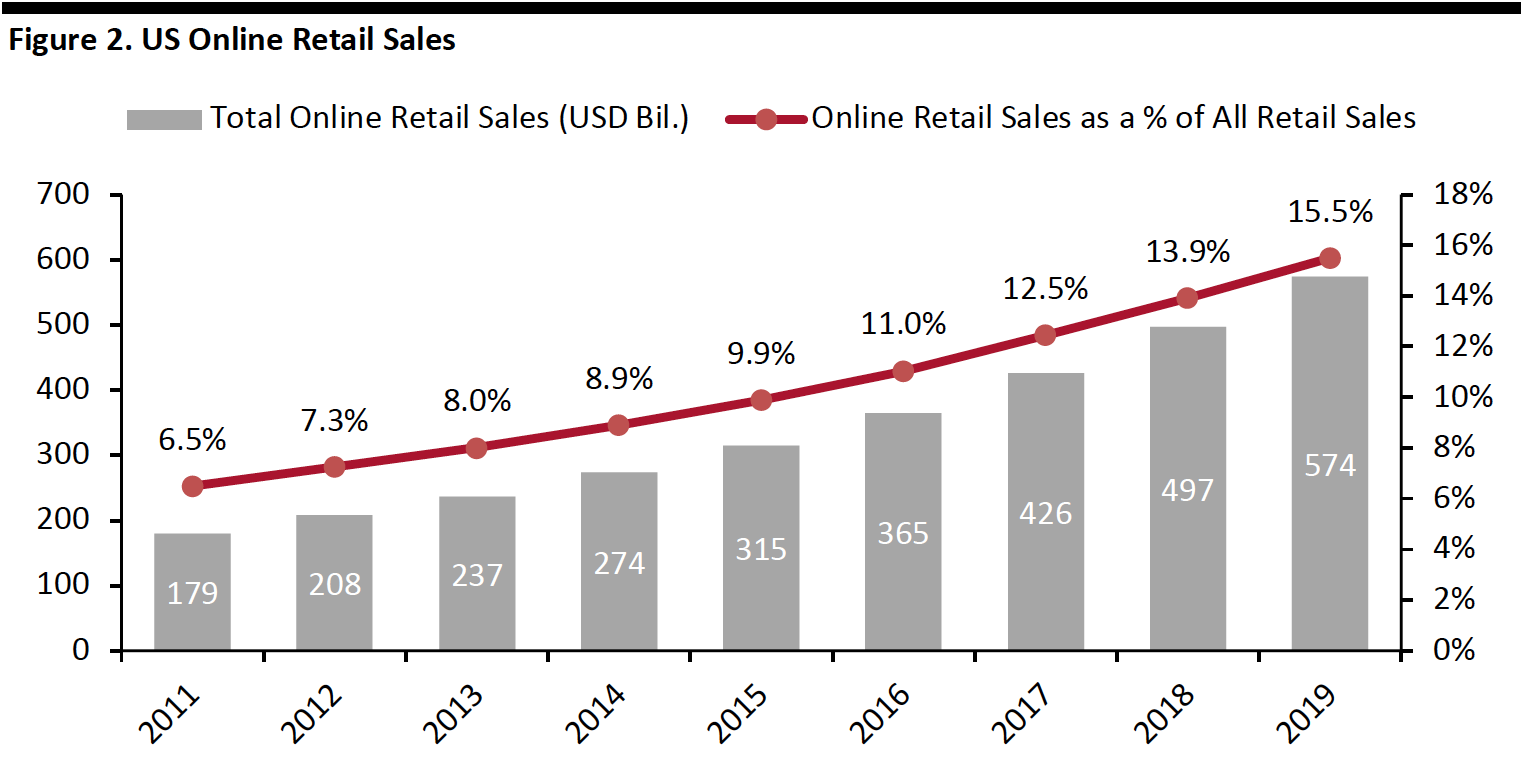

The growth of e-commerce is an apparently inexorable trend—and the coronavirus lockdown is only fueling this trend. In particular, we see the outbreak driving up penetration rates for online grocery shopping. In 2019, total online retail sales in the US amounted to $574 billion, comprising a 15.5% share of total US retail sales, we estimate from Census Bureau data.

[caption id="attachment_109047" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

E-Commerce Fuels Expectations of Fast Delivery

The growth of e-commerce is an apparently inexorable trend—and the coronavirus lockdown is only fueling this trend. In particular, we see the outbreak driving up penetration rates for online grocery shopping. In 2019, total online retail sales in the US amounted to $574 billion, comprising a 15.5% share of total US retail sales, we estimate from Census Bureau data.

[caption id="attachment_109047" align="aligncenter" width="700"] Source: US Census Bureau/Coresight Research[/caption]

Source: US Census Bureau/Coresight Research[/caption]

A shift to digital commerce from traditional brick-and-mortar retail has a major impact on retailers’ supply chains. The online channel presents a further opportunity for brands and retailers globally to extend their reach to consumers, and the supply chain must respond quickly to keep up with e-commerce giants such as Amazon in terms of logistics. Traditional one-week delivery timelines are no longer competitive, and in the US, two-day deliveries have become the norm.

Furthermore, in order to effectively respond to changing consumer demand, retailers must look to implement an end-to-end review of forecasting, demand, planning, production and distribution. By implementing a reactive supplier network and making investments in logistics infrastructure—such as additional distribution centers and delivery vehicles—companies can create a more responsive supply chain. Enterprise resource planning, for example, allows for the supplier network to share information between themselves and along the distribution and transportation logistics pipeline.

The expansion of e-commerce is also presenting challenges for retailers around product returns. In addition to changing product demand and higher delivery expectations, consumers now look for seamless and low-cost returns processes. Returns impact all facets of a business, from operations to inventory and customer experience. Reverse logistics—the movement of goods from customer drop-off to a place of manufacture, sale or disposal—involves a number of costs, including administrative processing, transportation, refurbishing, warehousing and reselling (or disposal if products are unusable and cannot be put back into inventory). One way in which retailers are looking to mitigate these costs is by encouraging consumers to return products purchased online to physical stores rather than by mail.

Fast Fashion and Lean Manufacturing

Consumer demand for immediacy is rising, and in the apparel industry, the growing fast-fashion market has resulted in a supply chain that delivers new products often and with shorter lead times. The supply chain must be lean, able to adapt quickly and minimize overproduction in order to adjust to changing consumer tastes: This is made possible through centralized networks and information sharing. Short and lean supply chain cycles enable the production of items in small batches, reducing inventory-holding risk for retailers and facilitating rapid market response to meet product demand.

In a cross-functional operations strategy, there is continual communication. Supply chain planners must liaise with designers, production planners, the marketing team and procurement specialists to make decisions on product inventory—considering factors such as manufacturing costs, the availability of raw materials, capacity and resource commitment for production. In addition, retail store performance should feed into the system in order to effectively analyze consumer demand and take action accordingly; ERP allows for frequent analysis and adjustment of inventory levels. This results in less unwanted inventory and waste at the end of each season. With a lean manufacturing model, there is minimal inventory and frequent small batches of deliveries.

Inditex, one of the world's largest fashion retailers (which comprises eight brands including Pull&Bear and Zara) adapts its internal and supplier production for each commercial campaign according to changing consumer trends. The company conducts most of its manufacturing in production centers that are located in close proximity to its design headquarters in Spain, allowing the flexibility and quality control required to introduce new designs to market quickly. Demand forecasting is taken into account to incorporate new designs, and Inditex operates a continuous feedback loop that influences the design of future product concepts.

The Growth of Discount Formats

Although excess inventory can be minimized through lean manufacturing, as discussed above, it remains a common business challenge, due to the incorrect forecasting of consumer trends or demand. To reduce the impact of excess inventory on the company’s bottom line, retailers can look to adopt a markdown approach, through which there are options to recirculate stock rather than dispose of it.

Liquidation companies will buy merchandise at low price points below profit, allowing some cash recovery for retailers and freeing up storage space. Corporate trade enables the sale of inventory typically equal to the acquisition price, so retailers should make efforts to establish relationships with off-price retailers in order to decrease cash loss or even turn a small profit. Furthermore, off-price companies may have shorter supply chains that start and end in the same geographic region as the retailer, which also saves on logistics costs and can mean a faster turnaround for both parties.

Discount retail is a growing industry in which inventory moves quickly. Top US off-price retailers include those from the TJX Companies (Homegoods, HomeSense, Marshalls, Sierra and TJMaxx), Burlington and Ross Stores. Share prices for each retailer matched or outperformed the S&P 500 in 2019. Generally speaking, brick-and mortar discount formats—from off-price to dollar stores—are bucking the trend of store closures in US retail and tending to report solid underlying sales growth, even as a number of them eschew e-commerce.

Surplus stock ties up capital, and using off-price retailers are a good tactic to offset incorrect demand forecasting and to increase a retailer’s ability to re-invest in the business.

The economic impact of the coronavirus crisis is likely only to support further market-share gains by discount formats, just as the Great Recession heralded the sustained switch to discount formats seen in recent years. In the meantime, most nonfood retailers are likely to exit the coronavirus crisis with a glut of inventory. Some apparel retailers have already indicated that they will hold over stock to 2021, but many others will look to liquidate inventory. Retailers may do this through formats such as off-price or via their own stores—although such is the likely volume of stock they will have to clear, those stores may begin to look akin to off-price formats, providing strong competition to the “real” off-pricers in the near term.

Greater Demand for Sustainability

Sustainability has been moving up the agenda of shoppers and retailers, placing new demands on companies’ supply chains. Previously, brands have limited consumers’ understanding of their business practices in order to maintain competitive advantage, control the narrative and keep some wasteful procedures under the radar. Consumers have been putting pressure on retailers to be more transparent, and sustainability efforts are becoming a huge part of this. Woven into business processes, sustainable initiatives enable retailers to satisfy consumer demand while driving efficiency and cost savings, in addition to ultimately reducing the environmental impact of their products and practices.

From the research and design phase to product delivery, retailers must plan to convert waste into reusable resources whenever possible throughout the value chain. As the conversation around sustainability intensifies, we expect to see an increased desire among retailers for responsible sourcing, which includes using non-polluting chemicals and eco-friendly raw materials wherever possible. A recycling program should also be incorporated into retailers’ business models to introduce circularity and resource efficiency. Sustainability in sourcing is not only beneficial for a brand’s image, but can also result in cost savings where energy use is reduced or manufacturing processes become more streamlined. A responsible supply chain contributes greatly to a retailer’s overall sustainability strategy.

Not yet established is the extent of the “bounce back” for sustainability demands, given the economic shock of the coronavirus pandemic. Should we see a prolonged recession, growth in consumer prioritization of sustainability could slow or halt, as shoppers reconsider priorities in favor of saving money. However, even if it is over the long term, we expect consumers to return to the theme of sustainability and reward those brands and retailers that do likewise.

Moving to a “Pull” Supply Chain Strategy

The traditional “push” supply chain is driven by long-term projections of product demand: Historical ordering patterns inform the quantities of products that are pushed through the value chain from production to a retailer. Although this approach may be beneficial for retailers that have high-volume requirements and long-term plans for raw materials when requirements do not require expediting, dependence on projected demand can result in excess inventory, high carrying costs, discounting and disposal.

In building a sustainability strategy, a “pull” supply chain is leaner and more responsive than the traditional “push” model. This strategy is based on real-time consumption, integrating stock-keeping unit and point-of-sale data from physical stores. Customer demand drives the manufacturing process, and there is less inventory along the value chain. Material entering the supply chain is triggered by demand, so it is imperative that the supply chain is responsive, otherwise retailers could see an increase in stockouts with not enough inventory to fill shelves. Less-responsive supply chains also result from long supplier lead times, causing higher costs for retailers without economies of scale during production.

Information sharing is crucial to ensuring this responsiveness in the “pull” model, as real-time data on customer purchasing behaviors is required to ensure accurate inventory orders. This means an integrated, centralized network comprising multiple stakeholders across production, operations and logistics must be able to access the same information on sales and trends. As discussed previously, the reduction of excess inventory—which is one benefit of “pull” supply chains—results in lower carrying costs for retailers as well as fewer markdowns and minimized waste.

ERP allows for real-time, cross-functional visibility of information across sales, procurement, production, finance, logistics and operations—as well as visibility of inventory throughout the logistics pipeline. ERP enables retailers to locate required stock and dispatch product from stores or distribution centers, whether fulfilling requirements for online sales or to rebalance inventory. Such planning is designed to frequently analyze demand and adjust requirements, enabling optimal inventory placement.

Key Insights

In the near term, the slump in consumer demand for discretionary categories and the clamor for essential products will reverberate through supply chains. In the longer term, we expect that the forces discussed here will retain their influence over retail supply chains. We expect production cycles to continue to become faster, with retailers adopting short and lean supply chains that deliver small batches of strong-selling products to market quickly.

In the wake of the coronavirus crisis, the e-commerce and discount channels are likely to see a boost—even if the extent of sustained migration to these channels is yet to be determined.