DIpil Das

What’s the Story?

The Reshaping Supply Chains for the 2020s series analyzes the technologies and trends that are enabling the evolution of CRM solutions, including B2B (business-to-business) and B2C (business-to-consumer) software. We also discuss case studies of relevant retailers and technology companies. The term CRM refers to approaches that allow a company to manage and analyze its interactions with past, current and potential customers. In this report, we specifically look at the following types of CRM, with specific applications in the retail industry:- Operational—Solutions that streamline customer-facing business processes including sales, marketing and services

- Analytical—Solutions for analyzing customer data to drive insights for better decision making

- Collaborative—Solutions that enable a company to share customers’ information among its various business units or with partners

Why It Matters

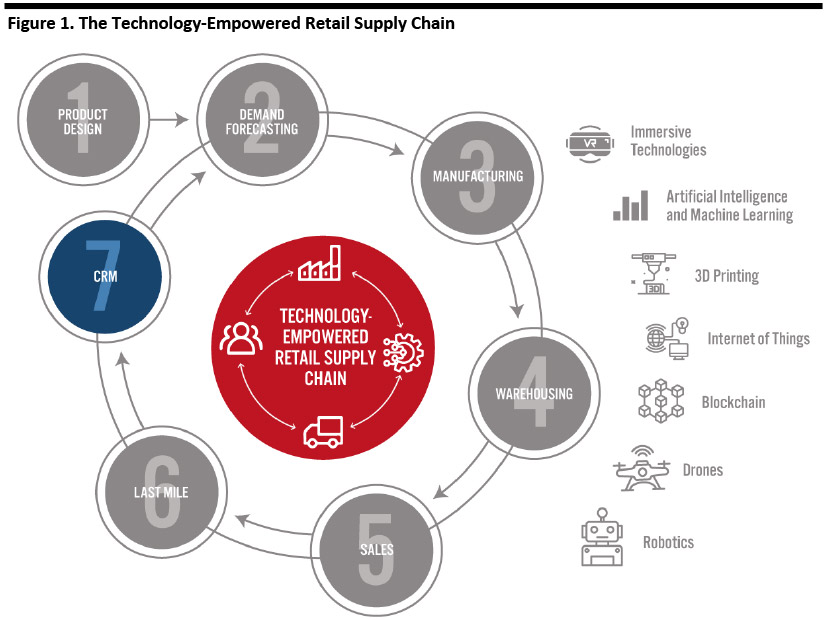

We identify seven major components of a technology-empowered supply chain that are integral to a retailer’s business model and can represent key sources of competitive advantage and differentiation: Companies that get their products to market faster and more efficiently than their competitors can better harness the opportunity to make a positive impact in the market. The execution of component processes is supported by various technologies throughout the supply chain—from product design to end-consumer. [caption id="attachment_119903" align="aligncenter" width="700"] Source: Coresight Research[/caption]

In recent years, the retail industry has witnessed increased reliance on technology, with many companies reaping the benefits of CRM solutions to improve business efficiencies. We expect to see the further adoption of customer-centric CRM solutions that offer smooth user experiences.

Source: Coresight Research[/caption]

In recent years, the retail industry has witnessed increased reliance on technology, with many companies reaping the benefits of CRM solutions to improve business efficiencies. We expect to see the further adoption of customer-centric CRM solutions that offer smooth user experiences.

CRM: In Detail

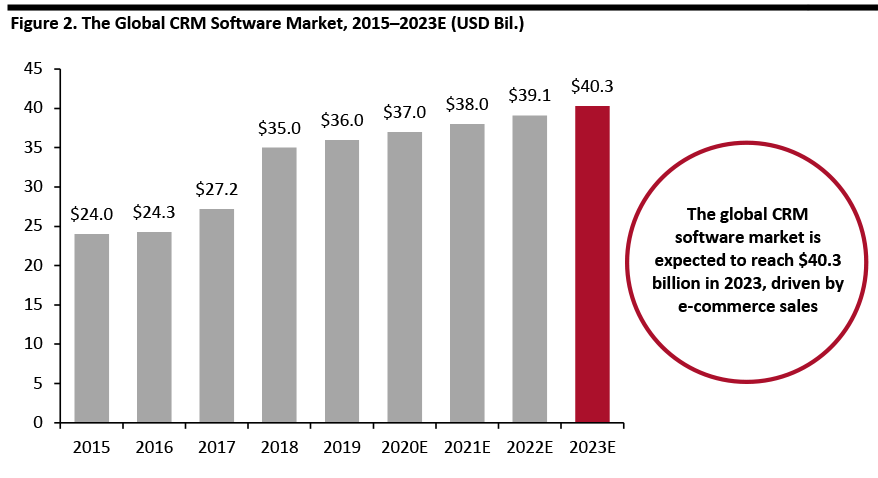

An Overview of the Global CRM Market The global market for CRM software is forecast to grow to $37.0 billion in 2020 and reach $40.3 billion by 2023, according to Statista. The main driver of the market is growing e-commerce sales as people shop more online, driving businesses’ needs for a seamless platform to communicate with customers and manage inventory, logistics, online orders and post-sale customer services. [caption id="attachment_119921" align="aligncenter" width="700"] Source: Statista[/caption]

Leading Vendors of CRM Solutions

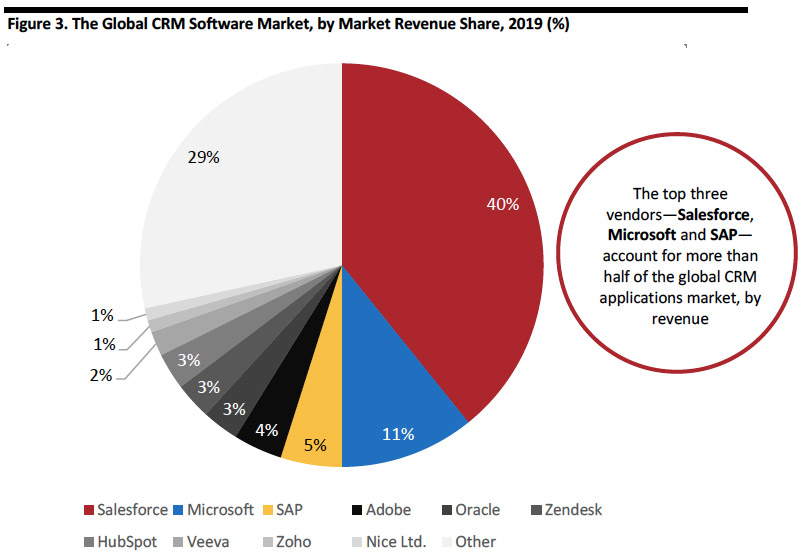

Salesforce is the leading vendor in the CRM applications market worldwide, with a market share of 40% in 2019, followed by Microsoft (11%), SAP (5%), Adobe (4%) and Oracle (3%). The market is relatively fragmented, but the leading vendors have been fairly stable in capturing market share. We expect Salesforce to sustain its leading position over the next five years.

[caption id="attachment_119904" align="aligncenter" width="700"]

Source: Statista[/caption]

Leading Vendors of CRM Solutions

Salesforce is the leading vendor in the CRM applications market worldwide, with a market share of 40% in 2019, followed by Microsoft (11%), SAP (5%), Adobe (4%) and Oracle (3%). The market is relatively fragmented, but the leading vendors have been fairly stable in capturing market share. We expect Salesforce to sustain its leading position over the next five years.

[caption id="attachment_119904" align="aligncenter" width="700"] Source: Apps Research & Buyer Insight[/caption]

Figure 4 provides an overview of the CRM solutions offered by the five leading vendors.

Source: Apps Research & Buyer Insight[/caption]

Figure 4 provides an overview of the CRM solutions offered by the five leading vendors.

Figure 4. Overview of CRM Solutions Offered by Leading Vendors [wpdatatable id=580 table_view=regular]

Source: Company reports CRM Solutions: Three Key Trends 1. Increasing Social Media Data Integration We are seeing a rise of CRM tools that integrate social media data with customer management, allowing retailers to personalize conversations with customers. These tools help to benchmark and track customers across social platforms to provide better experiences and deepen customer engagement. A key driver of this integration is a growing expectation of “hyper-personalization” among consumers, as identified by market research firm Forrester. , CRM is an optimal channel for businesses to generate intelligence out of unstructured interactions to fuel one-to-one conversations that feel more authentic. Technology companies are taking steps to gain share in this market segment:

- SAP launched its Customer Data Platform on October 16, 2020, to enable businesses to deliver hyper-personalized experiences in real time while generating insights from large quantities of customer data. SAP explained that it is committed to connecting every data source, including activity streams, first-party CRM data, third-party data and offline data—along with broader data on demographics, conversational styles, buying indicators, and social and life events. The platform identifies individual customers, including when they were last seen on a social media or e-commerce site, their total spend, total order quantities and conversion rates used.

- Alida (formerly Vision Critical) announced its collaboration with data analytics company Stratifyd on October 15, 2020. The partnership aims to exploit multiple data sources to understand customer retention and identify the root causes of emerging issues by tracking customer anomalies and behavior changes.

- Salesforce launched a new feedback management solution, AI Einstein, on August 5, 2020, designed to enable businesses to improve their responses to customer and employee needs. This solution is also built into the Salesforce SaaS platform, allowing businesses to collect real-time, actionable feedback. The addition enhances the Customer 360 solution with unified feedback on customer service, such as the name of the service representative, the item purchased and the date of service. The data is then be mapped back into the Salesforce platform, which allows users to create customizable lifecycle maps to define the interactions that are important to their success.

- In March 2020, IBM began investing in developing the natural language processing capabilities of its CRM solutions to improve text analysis functions. The IBM AI-based Watson Solution can be integrated into Salesforce platforms, to focus more on assessing sales activities and contact with customers by email, mail and phone. All relevant information is collected for future use in research and analysis of the customer relationship.

- Tech company Swiss Moonshot AG launched aiaibot, a chatbot enterprise solution in October 2020. An advanced tool that intelligently digitizes customer dialogue with fast and accurate responses, this chatbot does not require coding work on the client’s end as it is built for plug-and-play integration, thereby cutting user costs dramatically. The solution is also flexible, allowing businesses to customize their chatbot with brand-specific file upload options, pictures and videos, and surveys—among many other features.

- SAP has helped businesses to revolutionize user experiences with chatbots. The company deploys conversational AI interfaces with an end-to-end chatbot building platform, which can be used to guide customers to the right page of a website and answer FAQs.

Figure 5. Selected Companies with Niche CRM Solutions [wpdatatable id=581 table_view=regular]

Source: Company reports

What We Think

Implications for Retailers and Brands- We anticipate that personalization will continue to be a key theme in consumers’ shopping choices and retailers’ service offerings. Brands and retailers will need to work more closely with CRM solution providers in this age of big data and growing e-commerce business in order to compete with the capabilities of major retail players such as Amazon, Target and Walmart.

- Large software companies are integrating technologies such as AI in their platforms to be more competitive in this large and important category.

- We expect to see increased investment into, and greater adoption of, AI and analytics by CRM solution providers.

- There are opportunities for technology companies to collaborate with retailers to help improve CRM efficiency.