Nitheesh NH

What’s the Story?

This is the sixth report in the Reshaping Supply Chains for the 2020s series, in which we analyze the technologies and trends that are enabling the evolution of the supply chain. The term “last mile” refers to the final delivery of products to the customer (B2C), as opposed to shipping for products further up the supply chain (B2B or intra-company). In recent years, last-mile delivery has become critically important in generating revenue and positive customer experiences, in line with the increasing demand for e-commerce. Consumer demand for faster, more secure and more visible last-mile fulfillment is driving the last-mile delivery market to expand and adapt. In this report, we look at last-mile delivery technologies and strategies for the retail industry in global supply chain management and the major trends and pain points for retailers. We also discuss case studies of relevant retailers and brands.Why It Matters

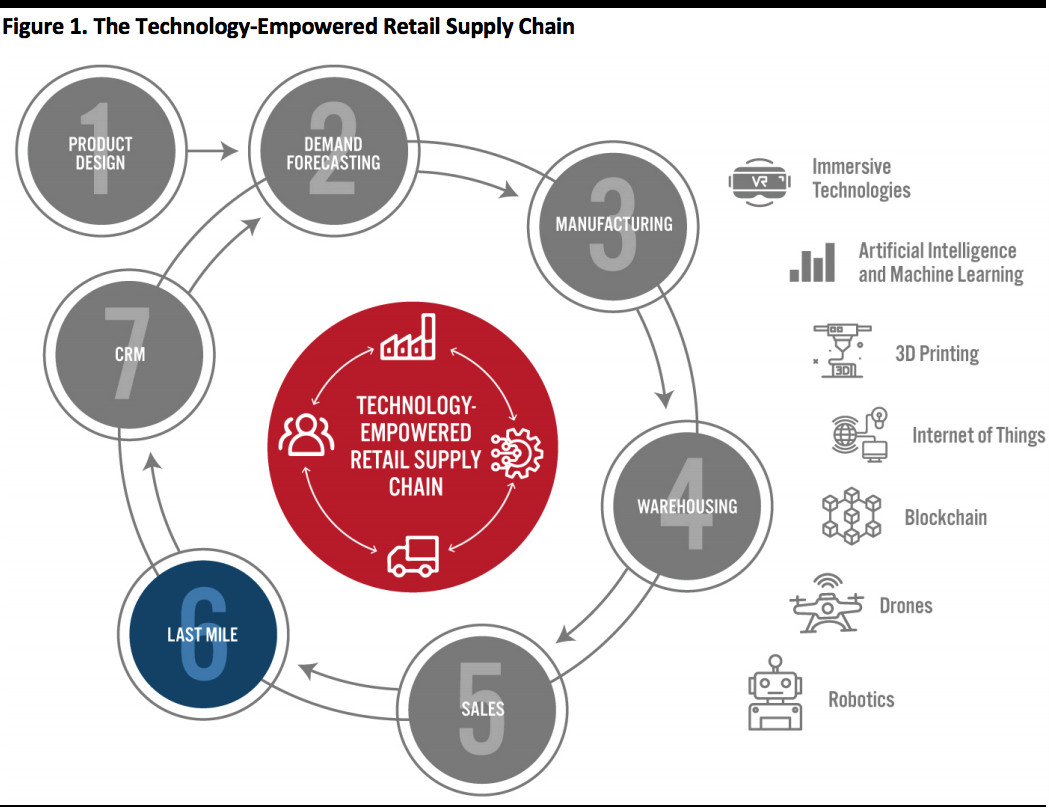

We identify seven major components of a technology-empowered supply chain that are integral to a retailer’s business model and can represent key sources of competitive advantage and differentiation: Companies that get their products to market faster and more efficiently than their competitors can better harness the opportunity to make a positive impact in the market. The execution of component processes is supported by various technologies throughout the supply chain—from product design to end-consumer. [caption id="attachment_118000" align="aligncenter" width="700"] Source: Coresight Research[/caption]

We expect to see increased adoption of autonomous delivery technologies such as drones and robots by brands and retailers. We also anticipate increasing numbers of retailers and brands using their physical store spaces as fulfillment centers to optimize their delivery strategies.

Source: Coresight Research[/caption]

We expect to see increased adoption of autonomous delivery technologies such as drones and robots by brands and retailers. We also anticipate increasing numbers of retailers and brands using their physical store spaces as fulfillment centers to optimize their delivery strategies.

Last-Mile Delivery in Supply Chains: In Detail

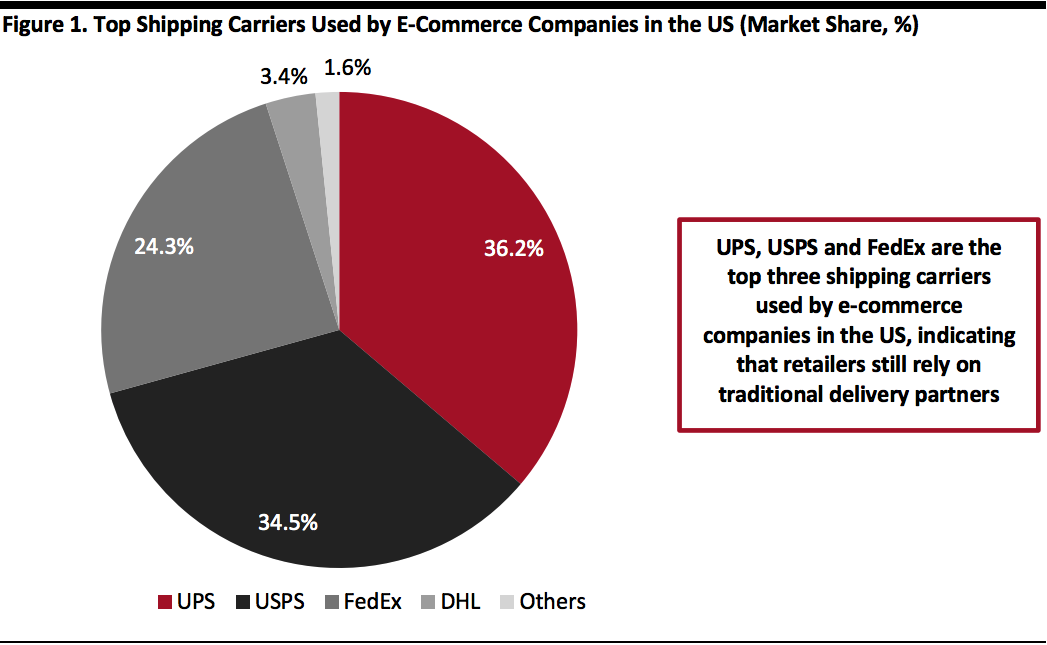

Top Shipping Carriers Used by E-Commerce Companies in the US Retailers that ship a diverse range of goods often rely on carriers to create a seamless fulfillment experience. The carrier’s service selection must align with consumer shipping preferences as well as retailers’ internal processes and inventory types. According to PipeCandy, UPS, USPS and FedEx are the top three shipping carriers used by e-commerce companies in the US (see Figure 1). This indicates that retailers still largely rely on traditional delivery partners and have not taken direct control of last-mile delivery. However, we are beginning to see some retailers move away from a dependence on traditional shipping couriers to develop their own last-mile delivery capabilities, as we discuss in the next section. [caption id="attachment_118001" align="aligncenter" width="700"] Source: PipeCandy[/caption]

Retailers and Partnered Carriers Expand Last-Mile Shipment Capabilities

In many markets, e-commerce grew rapidly after the outbreak of Covid-19, and we expect this upward trend to continue. According to Coresight Research’s weekly survey, 66.2% of US consumers are currently buying more online than they used to before the pandemic. At the same time, consumers have come to expect faster and more convenient services, with shipping costs and delivery times an important factor in their purchasing decisions.

Retailers are rethinking their last-mile processes and working to improve fulfillment efficiency as part of this, including shortening delivery times, using stores as fulfillment centers, expanding fulfillment network capacity and embracing advanced technologies. America’s major retailers—Amazon, Target and Walmart—have each made significant investments to enhance their delivery capabilities. In many cases, this involves taking more control over last-mile deliveries, whether directly or through new partnerships with service providers, instead of handing over deliveries to traditional shipping carriers.

Source: PipeCandy[/caption]

Retailers and Partnered Carriers Expand Last-Mile Shipment Capabilities

In many markets, e-commerce grew rapidly after the outbreak of Covid-19, and we expect this upward trend to continue. According to Coresight Research’s weekly survey, 66.2% of US consumers are currently buying more online than they used to before the pandemic. At the same time, consumers have come to expect faster and more convenient services, with shipping costs and delivery times an important factor in their purchasing decisions.

Retailers are rethinking their last-mile processes and working to improve fulfillment efficiency as part of this, including shortening delivery times, using stores as fulfillment centers, expanding fulfillment network capacity and embracing advanced technologies. America’s major retailers—Amazon, Target and Walmart—have each made significant investments to enhance their delivery capabilities. In many cases, this involves taking more control over last-mile deliveries, whether directly or through new partnerships with service providers, instead of handing over deliveries to traditional shipping carriers.

- Amazon launched one-day shipping in the US in June 2019 and is leveraging multiple fulfillment centers to enable faster same-day delivery.

- Target acquired batched delivery technology from delivery startup Deliv in May 2020 in order to expand its one-day shipping capability.

- Walmart launched an express delivery service in April 2020 to deliver more items from its store to customers in under two hours. It also rolled out its same-day delivery service across the US.

- In 2018, Kroger started using autonomous vehicles for deliveries made in Arizona and expanded the capability to Houston in May 2019.

- In December 2019, Walmart initiated a partnership with Nuro to use its robot cars to deliver groceries in Houston, and it teamed up with Zipline to offer drone delivery services from September 2020.

- CVS began working with UPS to deliver prescriptions by drone in Florida in May 2020.

- Amazon announced the expansion of its six-wheel, self-driving delivery robot, Scout, to two more cities in Georgia and Tennessee in July 2020.

- Alibaba launched Xiaomanlv, its autonomous logistics robot for last-mile deliveries, in September 2020.

Source: Company reports/Coresight Research

Retailers and Their Carriers Invest in Last-Mile Visibility Tools Shoppers now expect more visibility throughout the supply chain. Around 67% of consumers believe that inventory visibility across stores, online and on mobile phones is an important service to offer, according to enVista, a supply chain solutions provider. The greatest issue facing the logistics industry in achieving end-to-end visibility is the lack of collaboration, according to Blue Yonder. Some 38% of surveyed global supply chain professionals said that they felt that the industry is still far too siloed and lacks the flexibility required to achieve visibility across the entire supply chain. We are currently seeing that a small number of large retailers and carriers are capable of investing in last-mile visibility tools to ensure shoppers are informed of the delivery process, from in-transit status to final arrival date. For example, UPS now offers visibility tools such as UPS Tracking and Quantum View and USPS uses Informed Visibility, a tool that takes the customer through three delivery stages in real time. Similarly, the FedEx tracking tool InSight utilizes reference numbers to give customers a complete view of the delivery process. Shipping technology company Pitney Bowes enables customers to track the delivery and receipt of their mail in real time and in detail. Amazon now provides a visual MapTracker showing how many stops a delivery driver has to make before reaching a drop-off destination. Customers are notified via text message or email when a package is delivered at their residence or alternative pickup location, such as an Amazon locker. We expect to see continued growth in the number of retailers investing in technologies to improve visibility in the supply chain. Last-Mile Delivery Investment Costs: A Challenge for Retailers As delivery becomes increasingly important in the retail sector, the costs of providing these delivery services is rising. The gross output of truck transportation in 2019 was worth $358.9 billion, or approximately 28% of the gross output of the transportation and warehousing industry, according to the Bureau of Economic Analysis—indicating that transportation costs already account for more than one-quarter of overall supply chain costs. Some retailers are willing to absorb part of delivery costs at expense of lower margins, while others are rethinking their strategies to cut delivery spending. Amazon is one of the retailers that has absorbed last-mile costs. It reported fulfillment costs of $13.8 billion globally for the second quarter of its fiscal year 2020, ended June 30—48.9% higher than in the year-ago period. Amazon company resumed regular one- and two-day delivery services after delays following rising online orders during coronavirus lockdowns. As e-commerce continues to grow, retailers face a number of challenges:- Stock-outs, leading to delays in product delivery to shoppers

- Ensuring accurate shipping for online orders accurately amidst irregular spikes in demand

- Complex route planning for millions of last-mile deliveries and returns

Source: Company reports/Coresight Research

What We Think

Implications for Retailers and Brands- Brands and retailers will need to work more closely with couriers to offer faster delivery services in order to compete with the capabilities of major e-commerce players such as Amazon, Target and Walmart.

- We anticipate that more brick-and-mortar stores, especially those in densely populated areas, will serve as mini fulfillment centers, in response to consumer demand for faster online order delivery. Brands and retailers that start shipping from stores can realize the benefits of having a large base of inventory close to consumers and thus the ability to deliver products with shorter lead times.

- We expect to see increased investment into, and greater adoption of, autonomous delivery technologies such as drones and robots by brands and retailers. There is therefore great opportunity for technology companies to collaborate with retailers to help improve delivery efficiency.