DIpil Das

What’s the Story?

This report is part of the Reshaping Supply Chains for the 2020s series, in which we analyze the technologies and trends that are enabling the evolution of the supply chain. The way in which companies sell their products is critical in the fast-moving, global supply chain landscape. Sales processes are increasingly recognized as an important step in attracting traffic and boosting revenues. This is accentuated by the interconnected position of sales within supply chains as a process that can influence decision making in product design, demand forecasting and last mile operations. In this report, we look at retail industry sales strategies in global supply chain management and the major technologies that are introducing innovation to the process. We also discuss case studies of relevant retailers and brands.Why It Matters

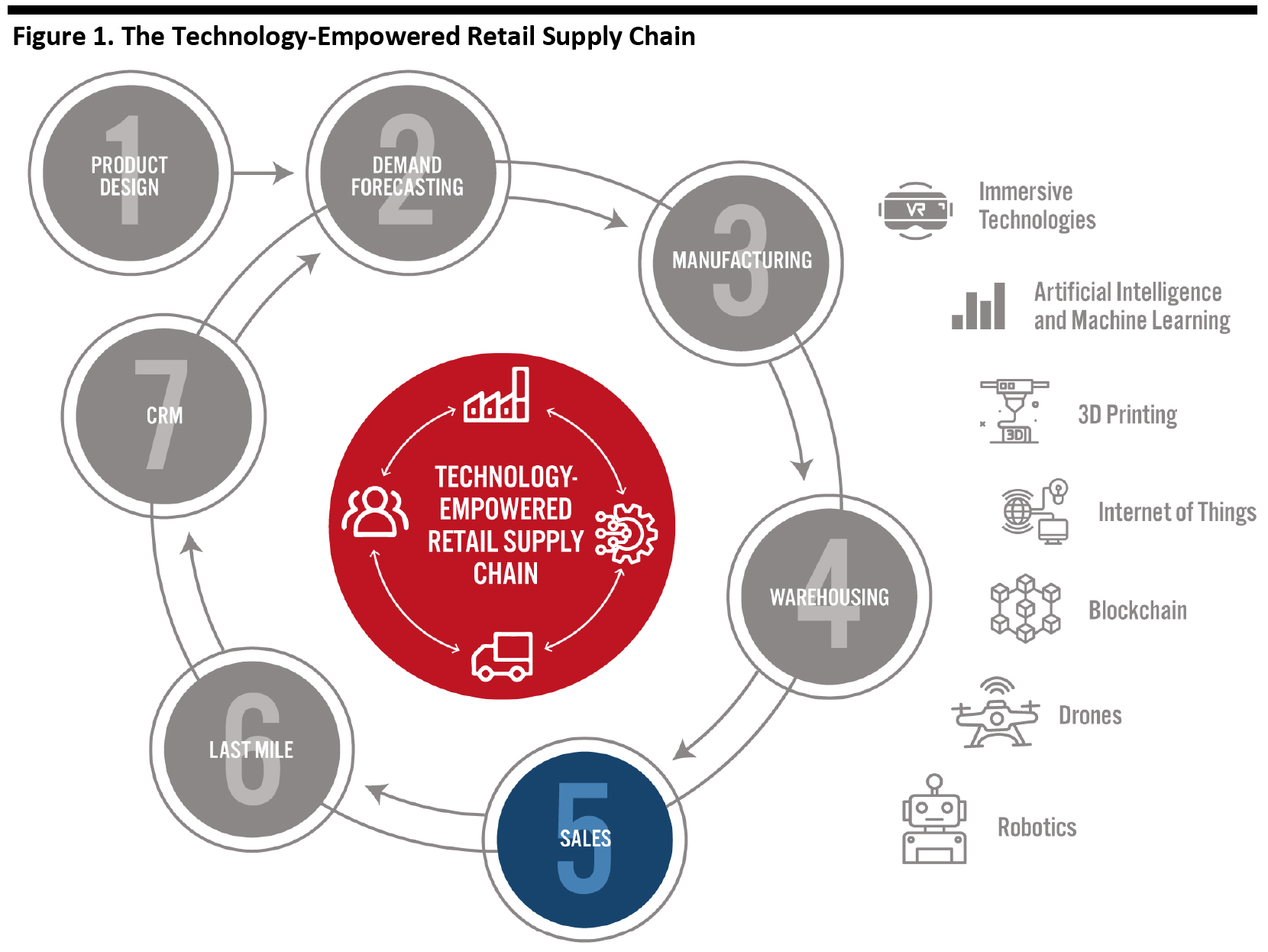

We identify seven major components of a technology-empowered supply chain that are integral to a retailer’s business model and can represent key sources of competitive advantage and differentiation: Companies that get their products to market faster and more efficiently than their competitors can better harness the opportunity to make a positive impact in the market. The execution of component processes is supported by various technologies throughout the supply chain—from product design to end-consumer. [caption id="attachment_116903" align="aligncenter" width="700"] Source: Coresight Research[/caption]

We expect to see a wave of in-store retail transformation after brick-and-mortar stores reopen and traffic recovers after the pandemic. Leveraging appropriate strategies and technologies to boost sales is vital for all retail sectors. Retailers and brands that use technologies to provide unique online and in-store experiences are likely to experience enhanced sales growth.

Source: Coresight Research[/caption]

We expect to see a wave of in-store retail transformation after brick-and-mortar stores reopen and traffic recovers after the pandemic. Leveraging appropriate strategies and technologies to boost sales is vital for all retail sectors. Retailers and brands that use technologies to provide unique online and in-store experiences are likely to experience enhanced sales growth.

Sales Management in Supply Chains: In Detail

Supply chain management involves managing the flow of goods and services—one component of which is sales management. Whether retailers are planning big price reductions, a seasonal introduction sale or just maintaining the normal flow of inventory, it is important to consider sales patterns and the go-to-market strategy. Ensuring smooth sales processes while reducing costs is a balancing act that involves a range of players and processes. Key Technologies for Improving Sales Efficiency: AI and Analytics- Analytics

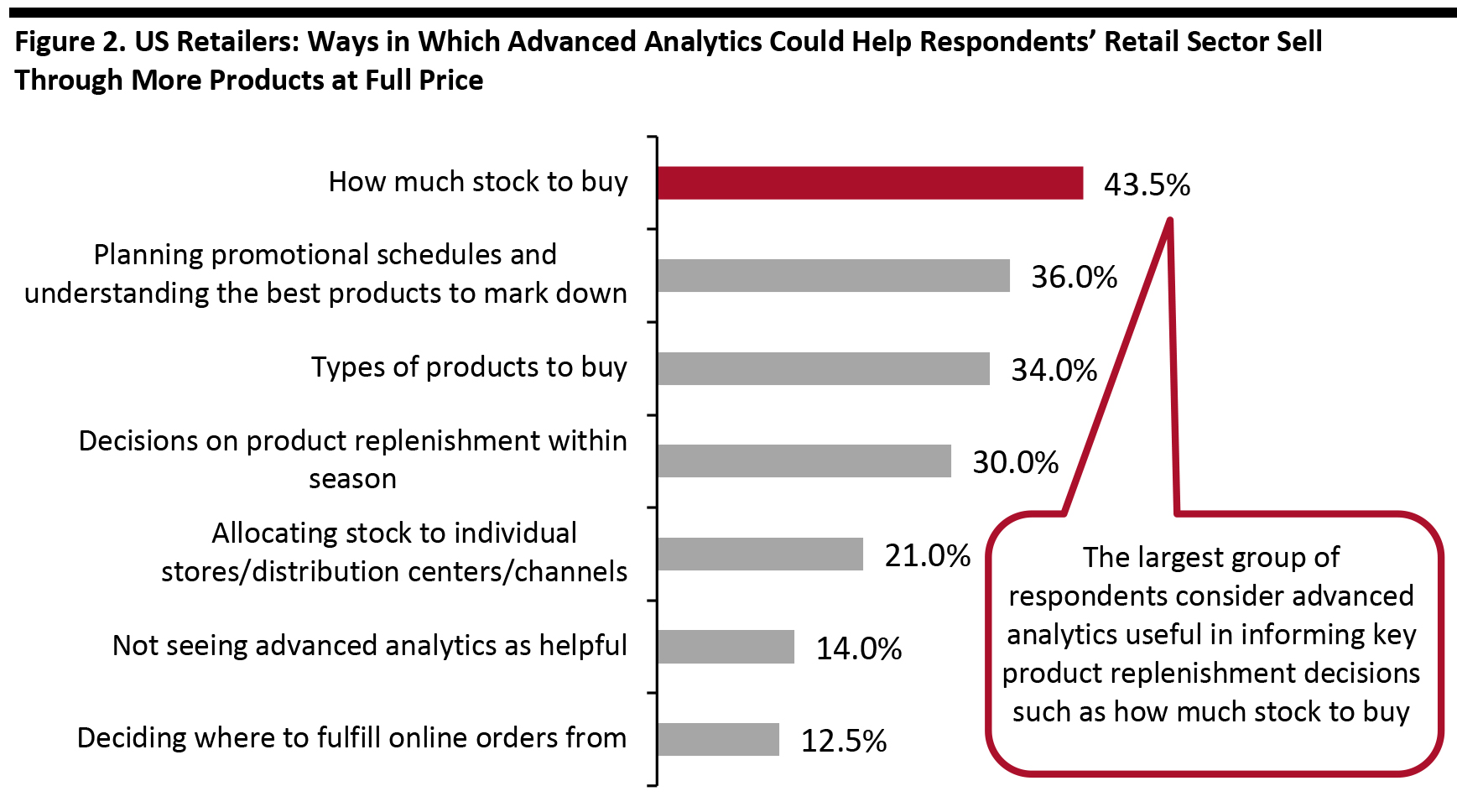

Base: 200 US senior retail decision makers, October 2018

Base: 200 US senior retail decision makers, October 2018 Source: Celect/Coresight Research [/caption] Many retailers have leveraged analytics to guide marketing initiatives and plan promotional schedules. Dick’s Sporting Goods utilized analytics to extract actionable insights and data patterns from its ScoreCard loyalty program—with over 20 million active users these customers account for more than 70% of the company’s sales, according to the company. The data from this program drives digital and direct marketing efforts, which was put into action by the company during the second quarter of 2020 to enable more personalized communications with customers. Best Buy has used localized data and analytics to pilot various sales process pilot services, such as opening stores an hour earlier exclusively for product consultations. Using data and analytics has also allowed the company to quickly customize operations to be most productive in different local situations, where necessary. For example, the company uses analytics to understand where the density in shipping volumes will come from. This knowledge helped the company to launch its own same-day delivery service at a lower cost than using a third-party provider. For retailers that use or sell analytics, improving technology capabilities is of paramount importance. Chinese e-commerce platform Pinduoduo announced plans to focus on agriculture as its next strategic product—the company is developing a proprietary agriculture analytics system. By considering historical and projected data such as price, quantity, geographic distribution and logistical availability, the system will better advise farmers on which crops offer the highest economic value, how to optimize quality over quantity and how to achieve more timely distribution. The increasing number of uses for the system will boost revenue for Pinduoduo. Providing a combination of descriptive and predictive analytics, prescriptive analytics can help retailers to solve numerous challenges regarding product usability, capacity, labor, efficiency and revenue growth. For example, if sales of a certain brand of shampoo drop to zero, prescriptive analytics technologies will generate a message to stores to instruct associates to put the product back on the shelf. Likewise, prescriptive analytics can identify if a competitor’s store is selling a product that is not stocked by the retailer and send instructions to address the inventory gap.

- AI

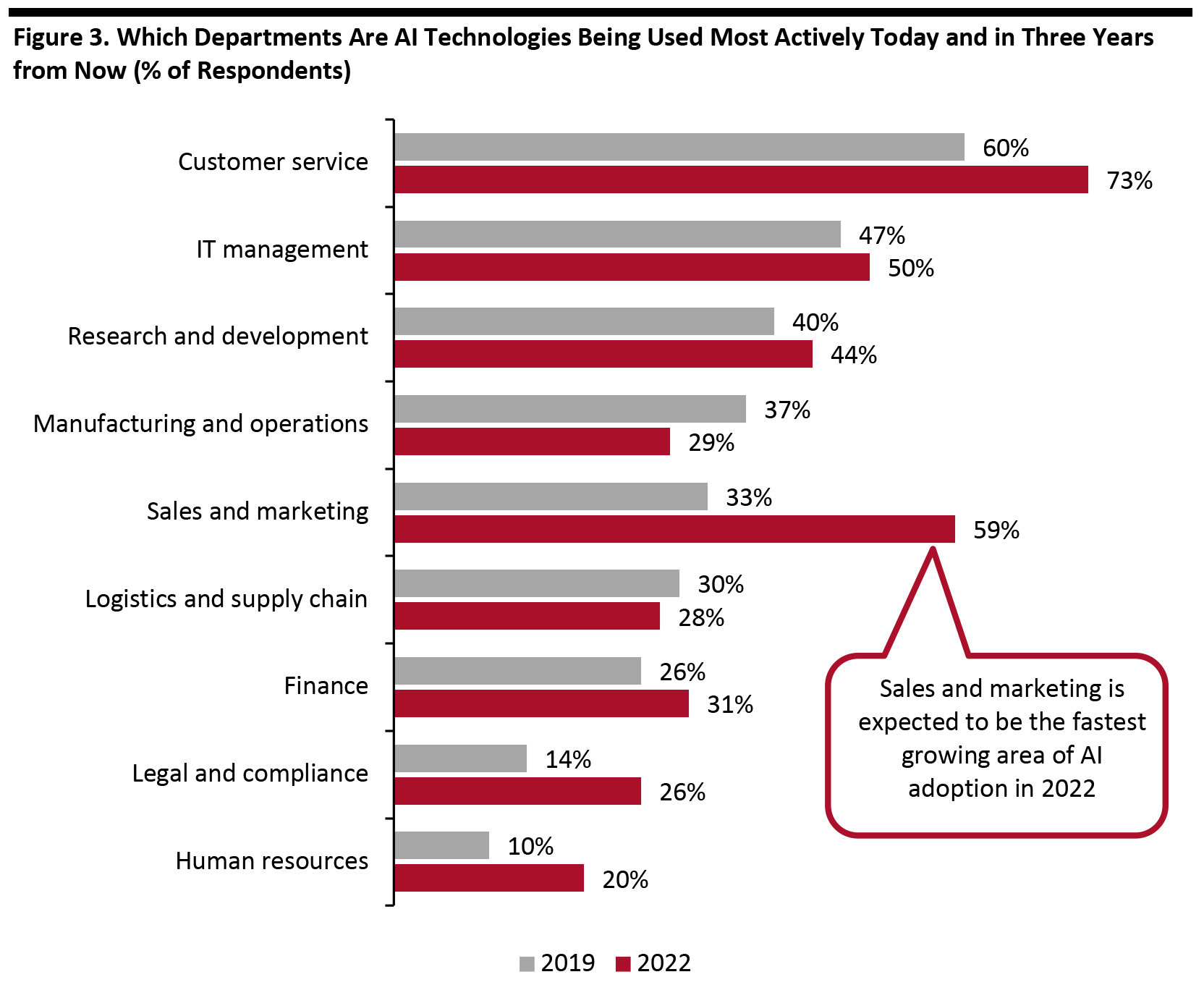

Base: 1,004 business leaders worldwide, March 2020

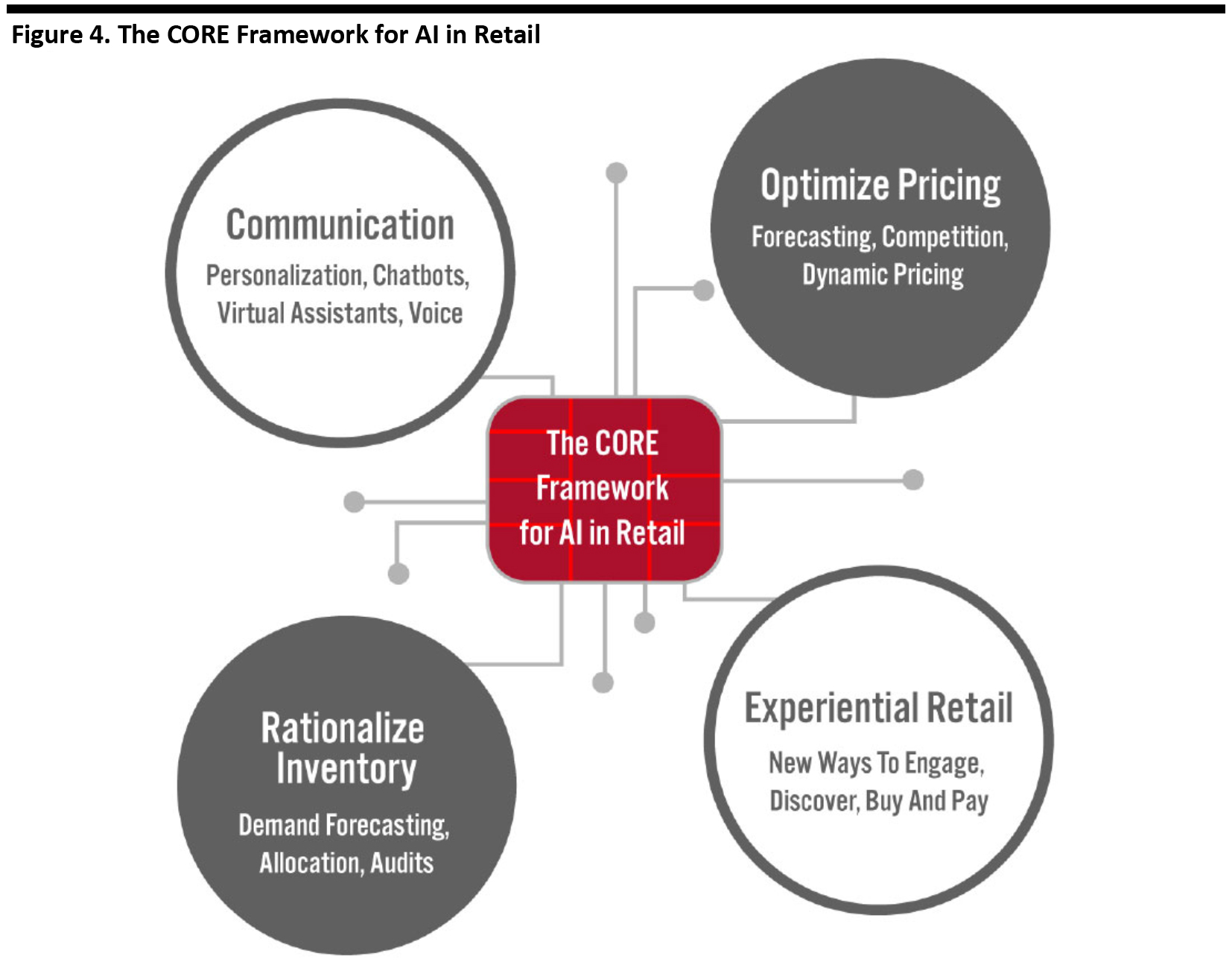

Base: 1,004 business leaders worldwide, March 2020 Source: MIT Technology Review Insights “Global AI Agenda” Survey [/caption] The application of AI in sales management includes personalized communication, optimized pricing, inventory rationalization and experiential retail opportunities, as identified in Coresight Research’s proprietary CORE framework. [caption id="attachment_116906" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

In addition, retailers can use AI and advanced algorithms to better understand customer interests based on information such as demographic data, social media behavior and purchase patterns. For instance, global apparel company PVH Corp. has been working with third-party intelligence groups to use machine learning techniques to analyze purchasing patterns among its customers and categorize target groups based on their preferred products, brands and budgets.

Payment security during the sales process is also a significant area of AI investment—PayPal has leveraged fraud detection AI algorithms to protect customer’s online transactions since 2013. Over the last few years, the company has made the security detection system to learn thousands of purchase patterns or “features”. The system can now decipher between friends who are buying concert tickets simultaneously and a thief making the same kind of purchases with a list of stolen accounts.

Brand Success: Unique Online and In-store Sales Experience Technologies

We explore technologies and strategies used by key retailers to elevate sales processes to a new level.

Source: Coresight Research[/caption]

In addition, retailers can use AI and advanced algorithms to better understand customer interests based on information such as demographic data, social media behavior and purchase patterns. For instance, global apparel company PVH Corp. has been working with third-party intelligence groups to use machine learning techniques to analyze purchasing patterns among its customers and categorize target groups based on their preferred products, brands and budgets.

Payment security during the sales process is also a significant area of AI investment—PayPal has leveraged fraud detection AI algorithms to protect customer’s online transactions since 2013. Over the last few years, the company has made the security detection system to learn thousands of purchase patterns or “features”. The system can now decipher between friends who are buying concert tickets simultaneously and a thief making the same kind of purchases with a list of stolen accounts.

Brand Success: Unique Online and In-store Sales Experience Technologies

We explore technologies and strategies used by key retailers to elevate sales processes to a new level.

- Virtual services and clienteling: Wedding dress providers such as David's Bridal and Brideside, and size-inclusive apparel provider Universal Standard, launched virtual stylist services and virtual appointments to keep their business operating during coronavirus-related store closures. Larger retailers that aggregate fashion pieces for sale, such as Neiman Marcus and Tanger Factory Outlet Centers, also launched digital platforms that offer virtual services in order to remain competitive and attract target customers.

- Livestreaming: Global apparel retailer PVH engaged with shoppers through Chinese messaging and social media appWeChat. The company leverage livestreaming technology to showcase its brand offerings and connect with consumers. This led to significant sales growth versus a typical day, according to company’s recent 1Q21 earnings call.

- Interactive brick-and-mortar retail: Burberry and Tencent collaborated to launch the luxury fashion brand’s first digitally immersive retail store, which opened in Shenzhen Bay MixC, China, on July 31, 2020. The store comprises a series of spaces, each with its own concept and characteristics, offering a unique interactive experience for customers to explore.

- Innovative technologies: In July 2020, NIKE opened a new store in Paris featuring its latest Bra Fit technology and a “Mission Control” wall. The Bra Fit by NIKE Fit technology takes a customer’s measurements in the store to give size recommendations for apparel suited to different types of sports. The “Mission Control” wall is a visual representation and live feed of NIKE member data, NIKE sports information and even weather from around the world. It projects real-time information on the number of consumers using the app, the number of miles they have run and the kind of sports being played, among other insights.

Mission Control wall at NIKE Paris

Mission Control wall at NIKE Paris Source: NIKE [/caption]

- Virtual fitting experiences: Brookfield Properties collaborated with FIT:Match to open store spaces offering 3D body scans for consumers to identify their measurements and improve their shopping experience. This technology is available in three shopping centers— the Oakbrook Center in Chicago, the Glendale Galleria in Los Angeles and the Stonebriar Centre in Dallas. The 10-second body scan takes more than a dozen measurements of each customer, which are then uploaded to the technology system and synced with the inventory carried at each retailer partner in the shopping centers. This highlights items that might interest and fit the consumer and hides inventory that would not fit.

What We Think

Implications for Retailers/Brands- Online and in-store traffic, product development, customer services, marketing and post-sale fulfillment are all important steps of the sales cycle; however, they do not stand alone. It is important for retailers and brands to assess all aspects of their businesses in order to build a more comprehensive supply chain.

- We are seeing brands combine technologies and fashion to provide unique online and in-store experiences to drive sales.

- Opportunities exist for providers of analytics and AI technology to integrate these solutions into the sales process to boost sales growth and revenue.