Nitheesh NH

What’s the Story?

This report is part of the Reshaping Supply Chains for the 2020s series, in which we analyze the technologies and trends that are enabling the evolution of the supply chain. Warehouses are currently carrying more inventory due to the coronavirus pandemic and need new space to store it—posing immediate supply-chain issues in the short term. In the long term, technology advances will assist warehousing to become smarter and increasingly automated, which will elevate the overall operational efficiency of retail supply chains and businesses. With consumer demand for sustainability in the retail industry continuing to grow, we also expect warehousing to seek to minimize its environmental impact.Why It Matters

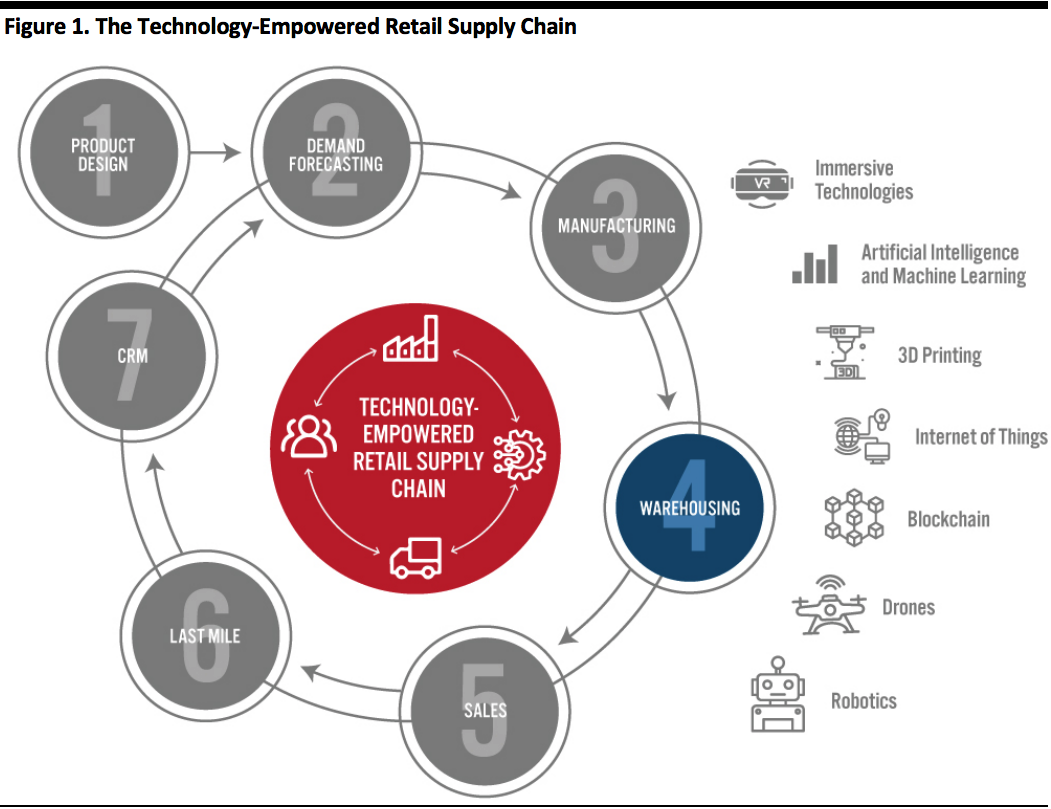

We identify seven major components of a technology-empowered supply chain that are integral to a retailer’s business model and can represent key sources of competitive advantage and differentiation: Companies that get their products to market faster and more efficiently than their competitors can better harness the opportunity to make a positive impact in the market. The execution of component processes is supported by various technologies throughout the supply chain—from product design to end-consumer. [caption id="attachment_114361" align="aligncenter" width="700"] Source: Coresight Research[/caption]

The ways in which companies store, pick, pack and ship their products comprise a critical component of fast-moving, global supply chains; by optimizing warehousing, costs and lead time to market can be reduced. In this report, we look at the state of warehousing for the retail industry in global supply chain management and the major technologies that are introducing innovation. We also discuss case studies from relevant retailers.

Source: Coresight Research[/caption]

The ways in which companies store, pick, pack and ship their products comprise a critical component of fast-moving, global supply chains; by optimizing warehousing, costs and lead time to market can be reduced. In this report, we look at the state of warehousing for the retail industry in global supply chain management and the major technologies that are introducing innovation. We also discuss case studies from relevant retailers.

The Future of Warehousing: In Detail

Implications of E-Commerce Growth The growth of e-commerce, both before and in response to the coronavirus lockdowns, is driving rising demand for warehousing space and storage capacity. According to the US Census Bureau, US retail e-commerce sales for the first quarter of 2020 amounted to $160.3 billion after seasonal variation adjustment—an increase of 14.8% from the same period of 2019. As retailers require 1.2 million square feet of distribution space for each $1 billion in e-commerce sales—according to Prologis, a real estate investment trust headquartered in San Francisco—this translates to demand for approximately 24.7 million square feet of additional space to fulfill online orders, versus the first quarter of 2019. During the pandemic, retailers struggled to fulfill online orders and adjust inventory across multiple warehouses. Many warehouses that remained open during the crisis but had to function with less labor faced a number of challenges, such as efficiently picking goods from backup or incoming inventory, managing picker walking paths and increases in order volumes, and forecasting demand for certain products. Intelligent solutions can be incorporated into warehouse practices to address these pain points. Investments in Warehouse Space Several leading retailers have recently invested in larger warehouse spaces to increase storage capacity, as well as in technologies that enable digitalization and automation of warehouse processes.- Amazon signed a lease for a new 1 million-square-foot warehouse (which includes a multistory parking structure) in New York City on June 24, 2020.

- Garden Products leased a 552,000-square-foot warehouse in North Jacksonville, Florida on July 17, aiming to expand inventory stock and improve fulfillment capabilities as it prepares to head into the peak holiday shopping season in November.

- On June 8, Kroger announced its plan to build three robot-powered fulfillment centers in the Pacific Northwest, Great Lakes and West regions of the US. The company has also discussed plans to build 20 Ocado-run fulfillment centers of varying sizes across the country to serve as delivery hubs for online orders. Kroger’s goal is to build a flexible fulfillment network that combines larger and smaller formats to speed up order processing and better meet consumer demand for online grocery shopping.

- NIKE is investing in a new regional service center on the US West Coast to fulfill demand through the holiday period, the company announced on its fourth-quarter 2020 earnings call on June 25. Matt Friend, Executive VP and Chief Financial Officer, said that the facility will leverage advanced analytics and demand-sensing capabilities from Celect, a retail predictive analytics and demand-sensing firm based in Boston that NIKE acquired in August 2019.

- Walmart announced on July 20 that it would invest $2.6 billion over the next five years to modernize its infrastructure in Canada. The 550,000-square-foot Vaughan facility is expected to open in 2024 and will incorporate technology from Vanderlande, a Dutch material handling and logistics automation company. Another Walmart Canada warehouse, which manages health and beauty and other small general merchandise items, will incorporate “cobots” in 2021—also known as collaborative robots, this technology enables direct human-robot interaction within a shared space.

- As of August 2020, mall-owner Simon Property Group is reportedly in talks with Amazon to convert a number of closed JCPenney and Sears stores to Amazon fulfillment centers.

- In June 2020, Washington Prime Group announced plans to turn a former Sears location at its Morgantown Mall into a fulfillment center that provides logistics and warehousing solutions.

- A prominent example from 2018 is the Randall Park and Euclid Square Malls in Cleveland, which were demolished and replaced with Amazon distribution centers.

- Robotics

The Geek+ Goods-to-Person solution involves robots bringing items to operators for order picking

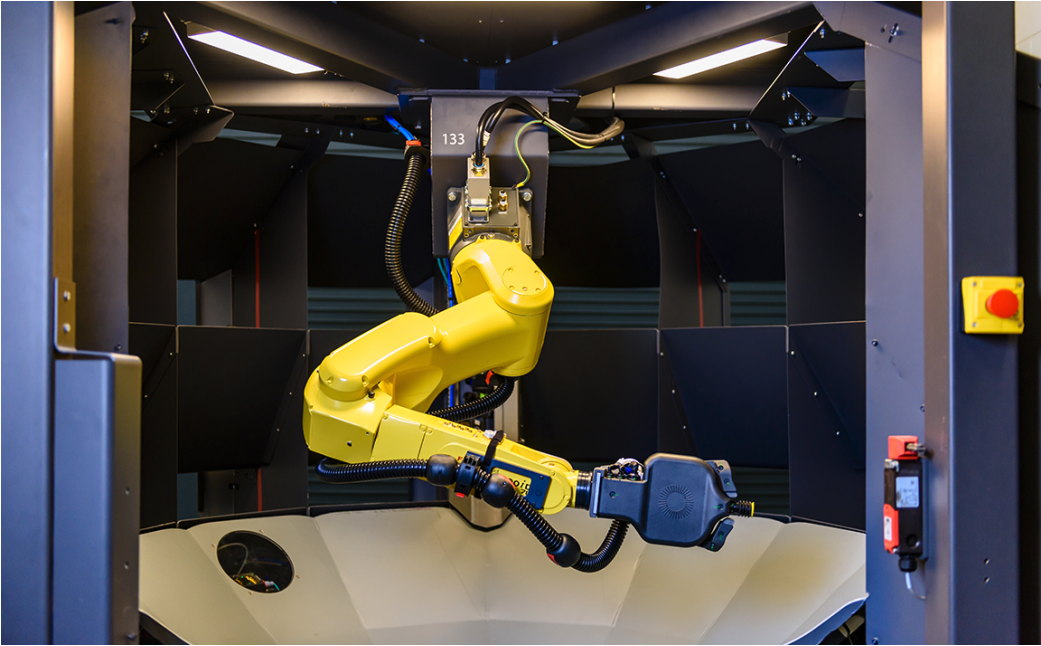

The Geek+ Goods-to-Person solution involves robots bringing items to operators for order pickingSource: Geek+[/caption] Large retailers such as Amazon and Walmart are expanding their robotics footprints in international markets: Walmart is investing in warehouses in Canada that feature collaborative robots (as previously discussed); and Amazon is building its first robotics fulfillment center in Australia. Amazon’s 2 million-square-foot facility will feature several types of robotics technology, including robotic arms that attach to palletizers—designed to identify and pick tote boxes from conveyor belts and stack them on pallets for shipping or stowing—and robots that transport packages around the warehouse. Apparel retailer Gap Inc. is also accelerating its implementation of warehouse robots for assembling online orders. Supplied by artificial intelligence and robotics company Kindred, Gap’s robotic technology system, known as SORT, uses industrial robotic arms to pick merchandise. [caption id="attachment_114363" align="aligncenter" width="700"]

The Kindred SORT System

The Kindred SORT SystemSource: Kindred[/caption] On June 24, 2020, DHL launched a robotics platform with leading supply-chain software vendor Blue Yonder. Hosted on Microsoft Cloud, the platform is designed to accelerate the implementation of warehouse robotics. It gives customers greater flexibility in selecting and integrating different robotics vendors into a single solution. The first implementation at a DHL warehouse in Madrid has already reduced integration time by 60%.

- IoT

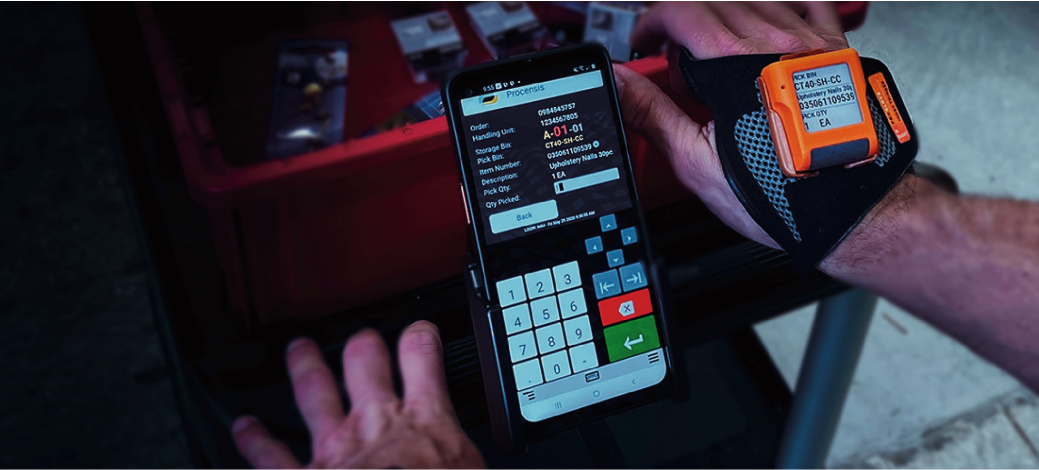

- Wearable Augmentation Technology

Samsung’s new wearable picking bundle allows warehouse workers to improve productivity during the picking process

Samsung’s new wearable picking bundle allows warehouse workers to improve productivity during the picking processSource: Samsung[/caption] To better adhere to social-distancing regulations, Amazon is also testing a wearable device that lights up and beeps when warehouse workers get too close to each other. “Green” Warehouse Practices Retailers are recognizing that warehousing sustainability is an integral part of minimizing the industry’s environmental impact. Large amounts of waste are generated in warehouse processes, surplus inventory, excess packaging, unused scrap materials or finished products— in addition to the energy that is required to maintain inventories. To respond to growing e-commerce volumes, warehouses will have to optimize operations and move towards streamlined and sustainable systems that will ultimately see them become increasingly “eco-friendly”. Retailers are already taking actions to incorporate warehousing sustainability into a circular economy.

- Amazon began installing solar panels on the rooftops of its fulfillment centers across the world five years ago—as of July 2019, it has 51 rooftop installations (32 in the US, 12 in Europe and 7 in India), which total 98 megawatts of solar power. The company also operates 61 freestanding solar- and wind-power installations that generate an annual energy output of 3.1 million megawatt hours.

- In July 2020, Ralphs and Food 4 Less, subsidiaries of The Kroger Company, announced the installation of a photovoltaic solar-power array at its 300,000-square-foot bakery facility in La Habra, California. The rooftop installation features nearly 3,000 solar panels, with an annual capacity of 2,009 megawatt hours. This amount of energy is sufficient to power 240 homes for a full year and is equivalent to the emission reduction of having 300 fewer cars on the road for one year.

- Danish grocery chain Coop Denmark is also equipping its store and warehouse roofs with solar panels.

- In May 2019, industrial real estate firm Prologis opened a carbon-neutral warehouse facility for L’Oréal in Muggensturm, Germany. The facility is L’Oréal’s largest distribution center worldwide and covers over 1 million square feet. It features 322,917 square feet of green space on the roof and 7,400 solar cells.

What We Think

Implications for Brands/Retailers- Brands and retailers can adopt key technologies to enable smarter and automated warehousing.

- Preparations are required to be able to provide sufficient warehouse space, including multistory warehouses in close proximity to cities, as the growth of e-commerce during the Covid-19 crisis is driving rising demand, and retailers are looking for lean supply chains.

- It is important for logistics real estate facilities to integrate sustainable design features, such as cooling roofs that reduce the urban heat island effect, energy-efficient lighting that reduces energy consumption, and recycled and locally sourced construction materials that decrease carbon footprints.

- Opportunities exist for suppliers of robotics technology, clean-energy providers and providers of IoT solutions to work with brands and retailers to optimize their warehouse spaces.