What’s the Story?

This is the third report in the Reshaping Supply Chains for the 2020s series, in which we analyze the technologies and trends that are enabling the evolution of the supply chain.

We acknowledge the uncertainties brought about by the coronavirus crisis, and the short- and medium-term disruptions that it has caused to supply chains. However, we expect manufacturers to upgrade their operational and logistics platforms to remain competitive and reduce costs, by leveraging technologies such as RFID, 3D design and robotics.

Why It Matters

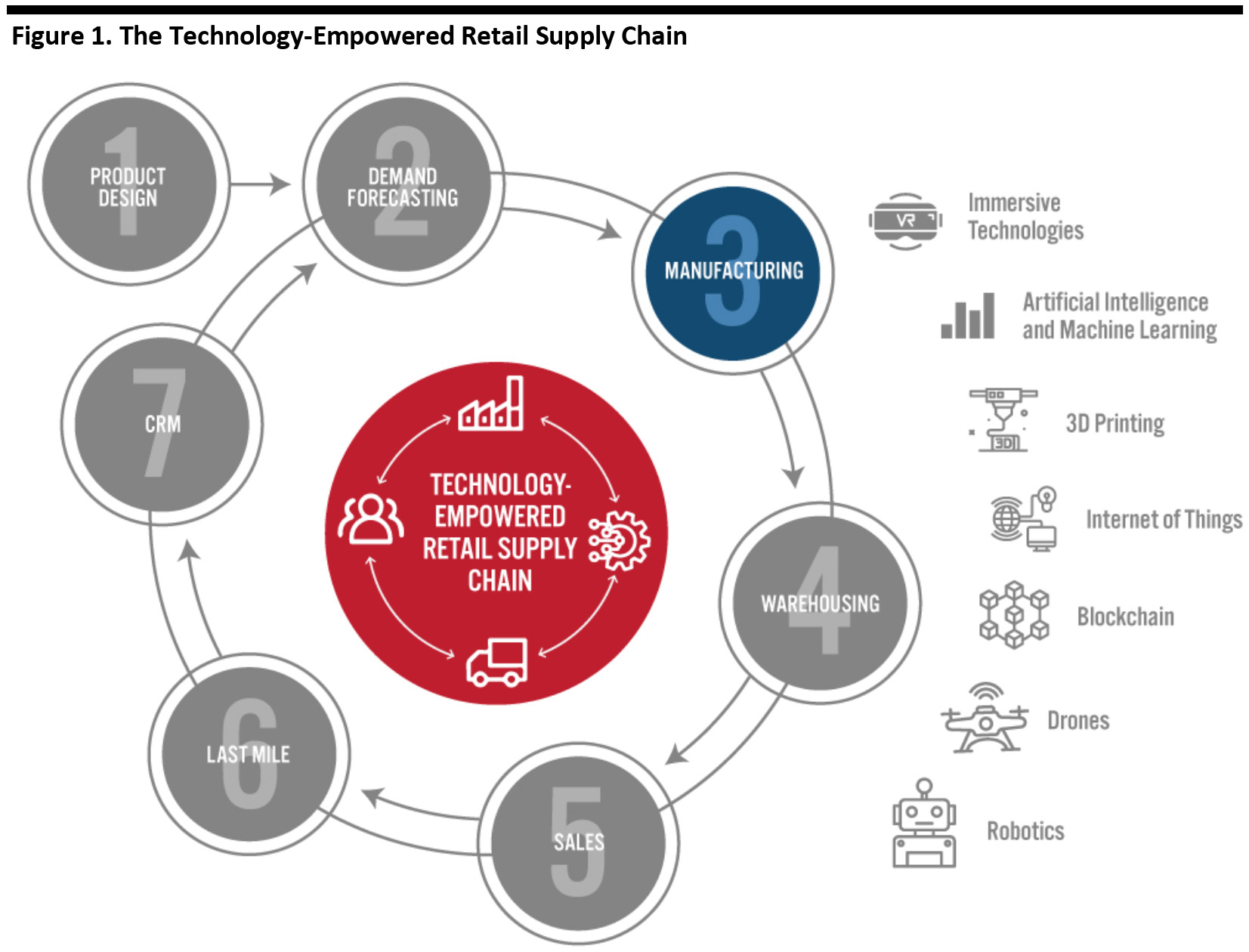

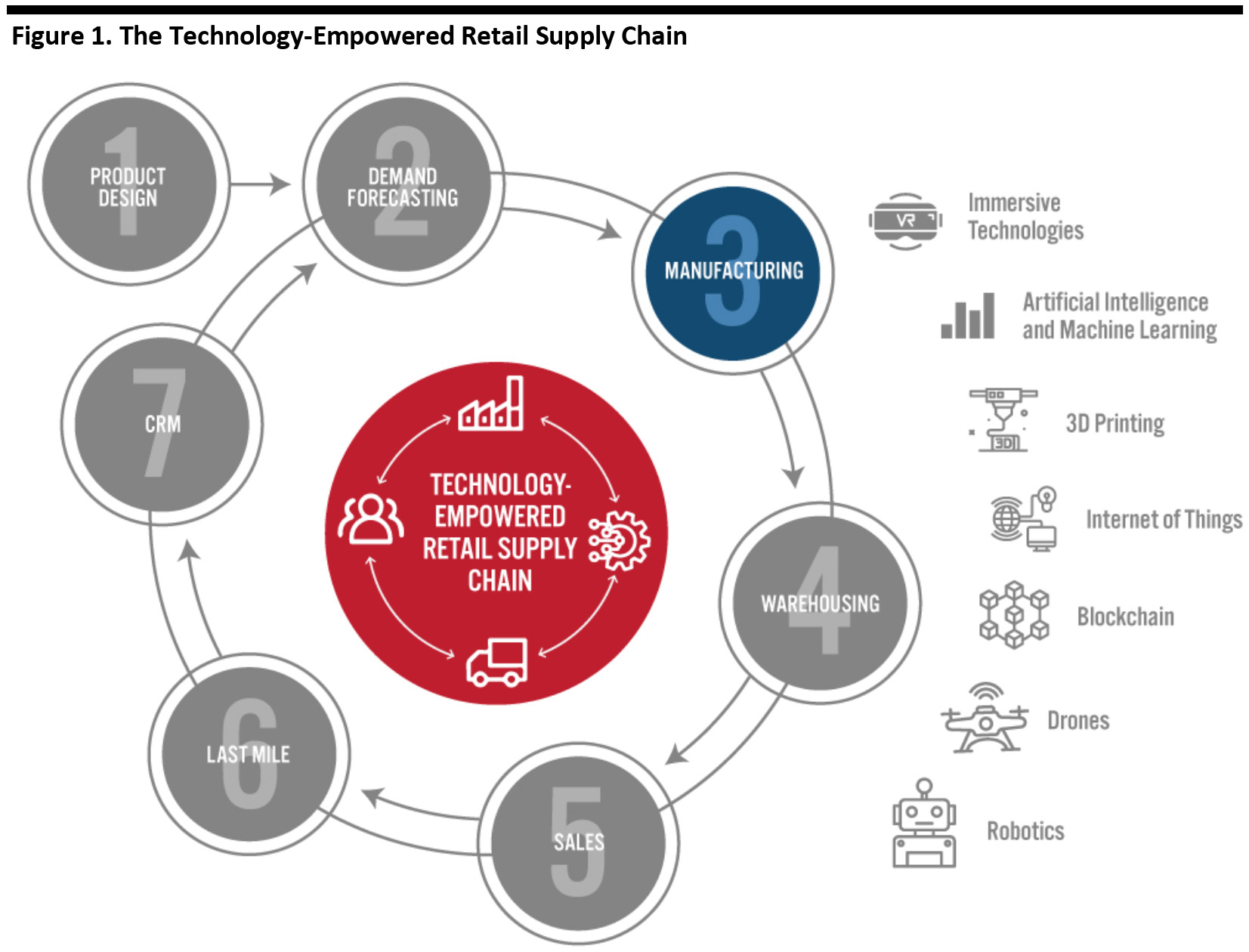

We identify seven major components of a technology-empowered supply chain that are integral to a retailer’s business model and can represent key sources of competitive advantage and differentiation: Companies that get their products to market faster and more efficiently than their competitors can better harness the opportunity to make a positive impact in the market. The execution of component processes is supported by various technologies throughout the supply chain—from product design to end-consumer.

[caption id="attachment_112938" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research[/caption]

The way in which companies manufacture their products has become critical in the fast-moving, global supply chain landscape. Manufacturing is increasingly being recognized as an important process that can reduce costs and lead time to the market. In this report, we look at the state of manufacturing for the retail industry in global supply chain management and the major technologies that are introducing innovation to supply chains. We also discuss case studies of relevant manufacturers.

Building a More Flexible and Cost-Efficient Manufacturing System after Covid-19: In Detail

Manufacturers Are Accumulating a Stockpile of Goods and Calling for Demand-Driven Technologies and Business Models To Lower Inventory Levels and Improve Efficiency

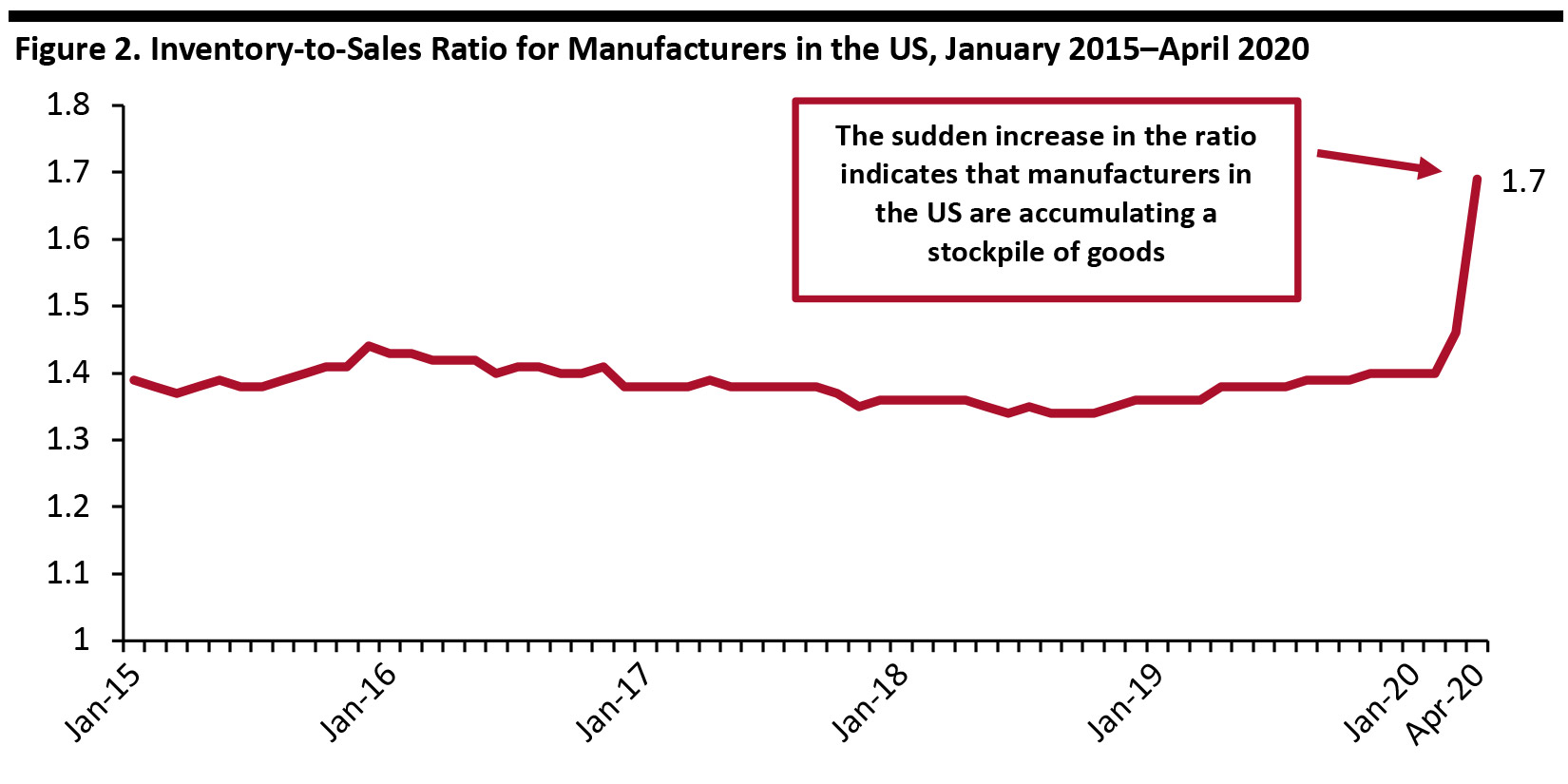

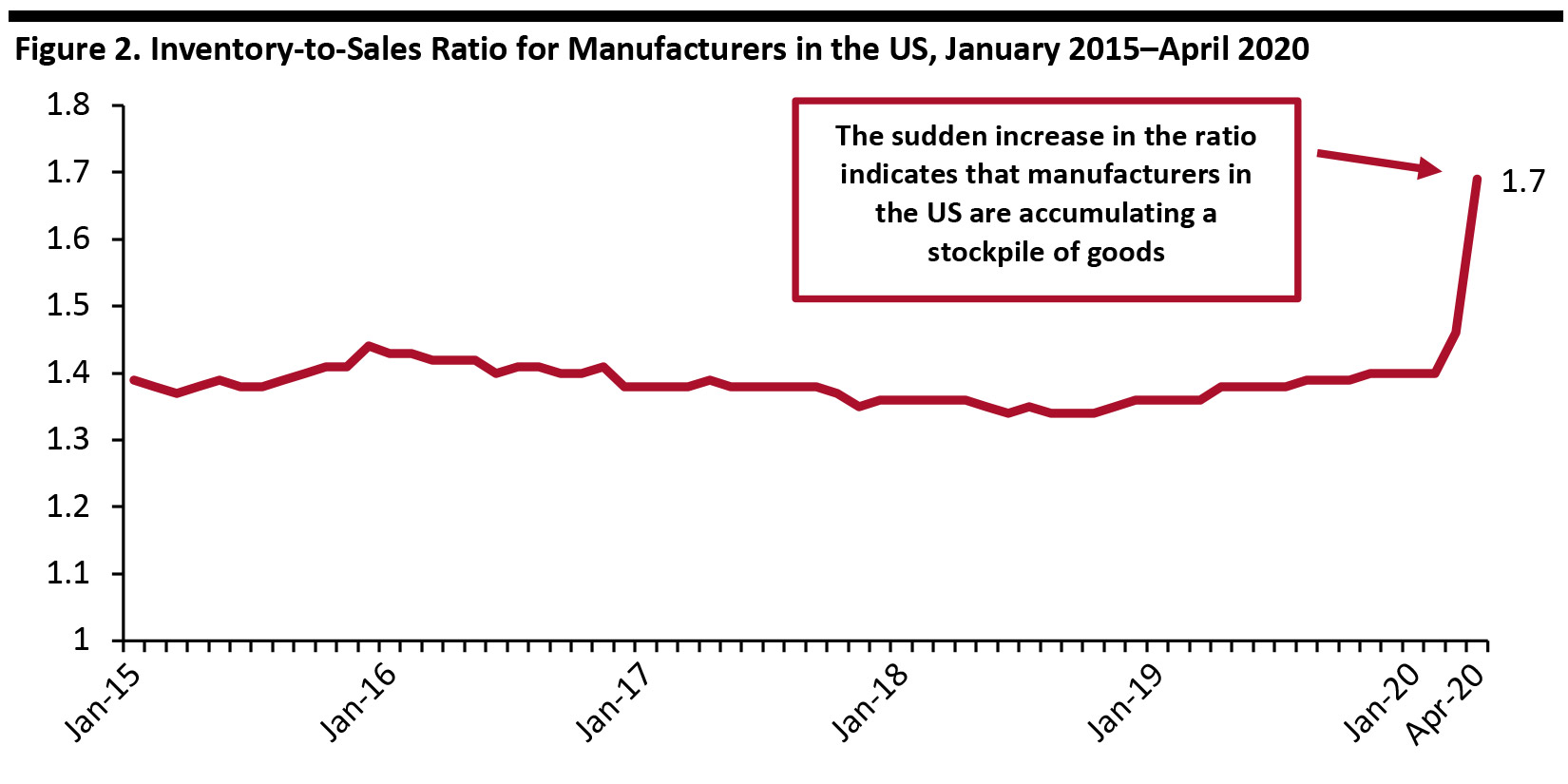

Inventory issues have been mounting during the coronavirus pandemic, and it is not surprising to see that manufacturers in the US are facing the challenge of storing excess inventory. The inventory-to-sales ratio (which shows the relationship between end-of-month inventory value and monthly sales) for US manufacturers was 1.69 at the end of April 2020, based on seasonally adjusted data from the US Census Bureau. This is significantly higher than the ratio from one year prior, at 1.38, and from January 2020, at 1.4. This sudden increase indicates that manufacturers in the US are accumulating a stockpile of goods, as products that were due to go out to retailers and brands were delayed and many orders were canceled during the pandemic.

[caption id="attachment_113140" align="aligncenter" width="700"]

Note: Sales and inventories are adjusted for seasonal variations; manufacturers’ sales refer to the value of shipments by manufacturers

Note: Sales and inventories are adjusted for seasonal variations; manufacturers’ sales refer to the value of shipments by manufacturers

Source: US Census Bureau [/caption]

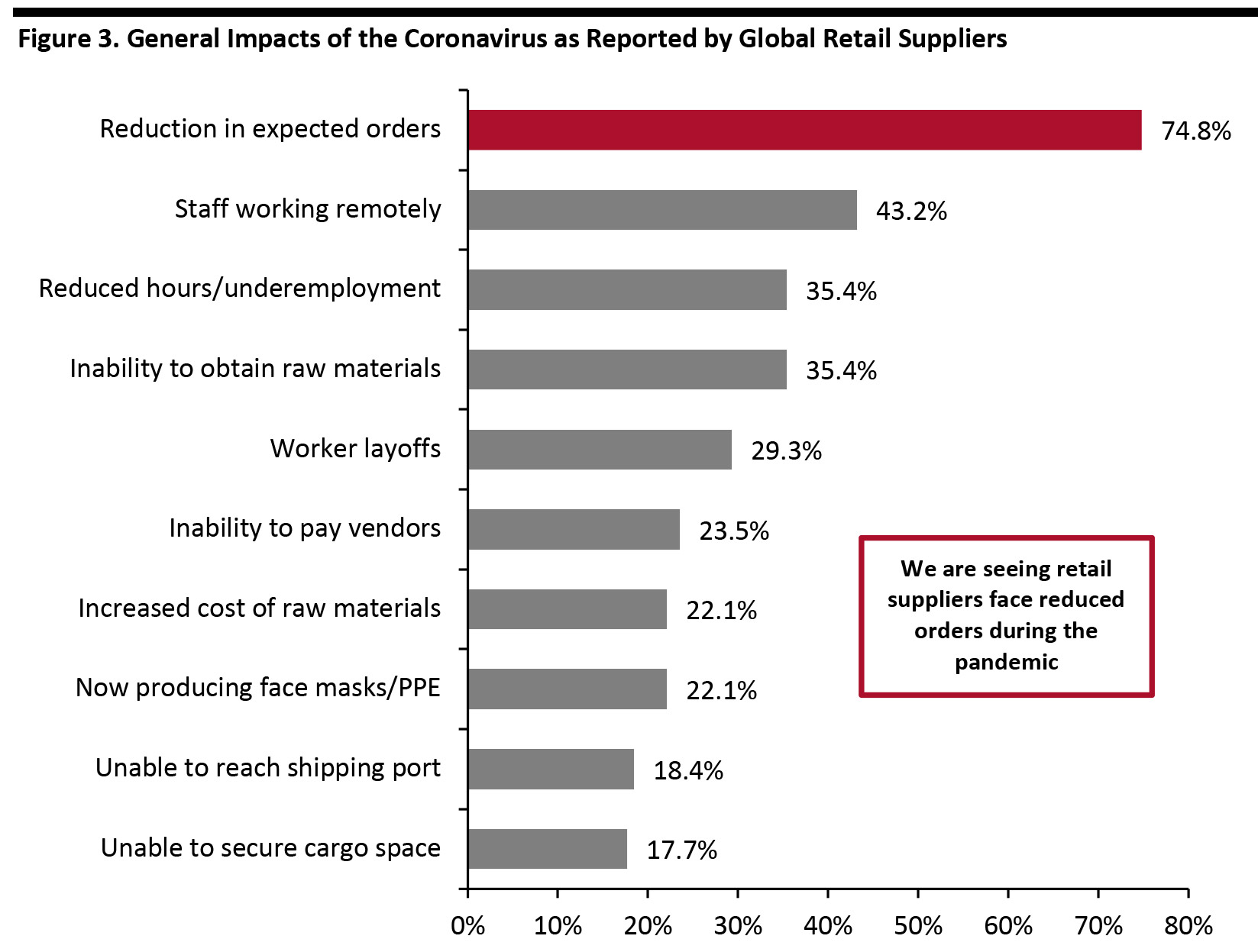

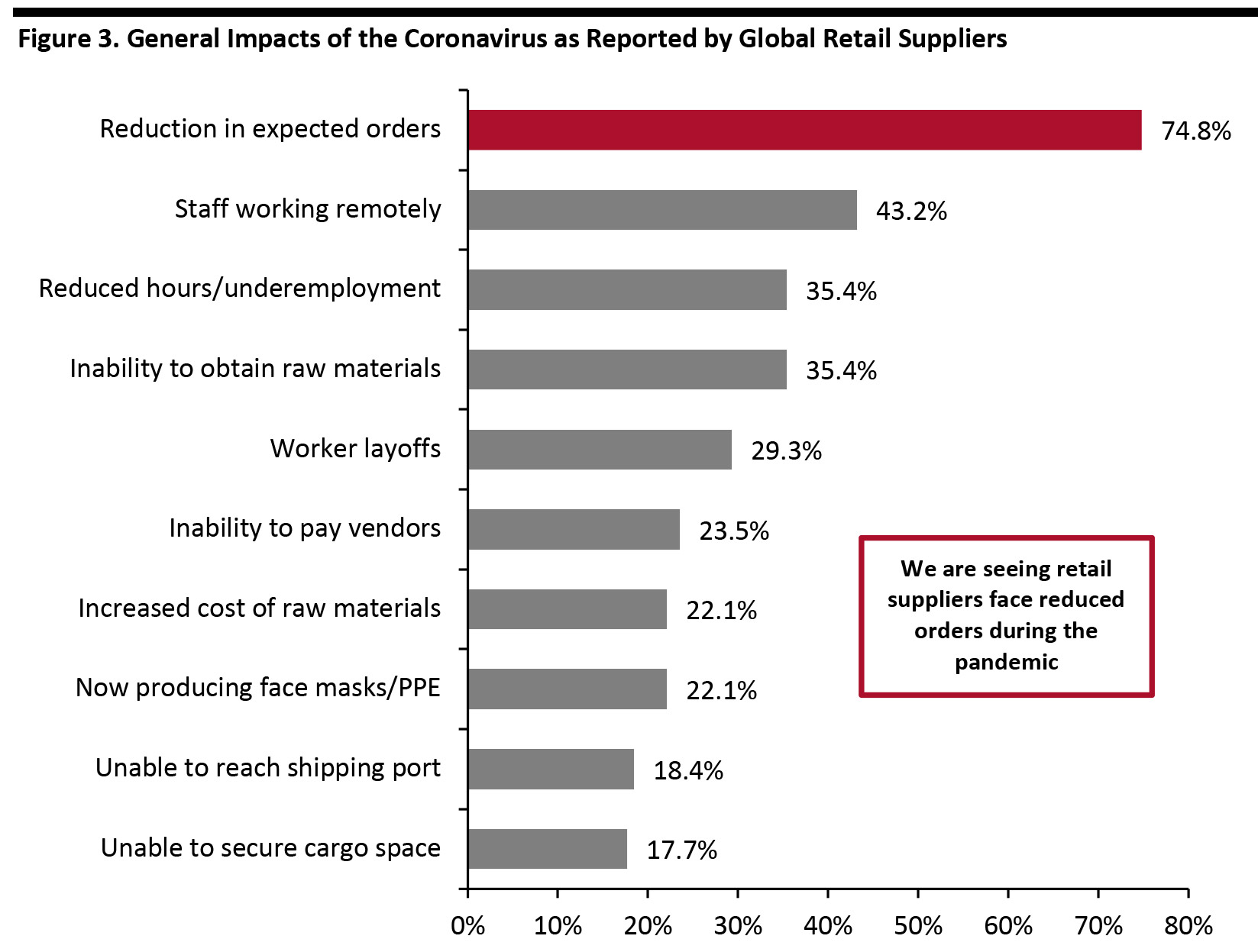

Globally, we are also seeing retail suppliers (including manufacturers, packagers and processors) facing reduced orders and piled-up inventory during the pandemic. According to a survey in March 2020 by Better Buying—an online ratings platform that encourages buyers to adhere to their contractual agreement—75% of retail suppliers reported that they are facing a reduction in expected orders.

[caption id="attachment_112940" align="aligncenter" width="700"]

Base: 294 retail suppliers from 39 countries, surveyed March 18–March 31, 2020

Base: 294 retail suppliers from 39 countries, surveyed March 18–March 31, 2020

Source: Better Buying [/caption]

In light of these challenges, as the world gradually emerges from the coronavirus crisis, we expect both US-based and global manufacturers to look for modern technologies and alternative business models—such as demand-driven manufacturing—to lower inventory levels and improve efficiency. The difference between traditional and demand-driven manufacturing is that the latter allows brands to order as little as one piece at a time, thereby having manufacturers produce only what is likely to be sold. Demand-driven manufacturing offers benefits around process streamlining too: For example, it leverages technologies to create a synchronized loop between customer ordering, production scheduling and manufacturing execution, all while simultaneously coordinating the flow of materials along the supply chain.

For example, MTO is one type of demand-driven manufacturing business practice, in which manufacturing starts once a customer’s order has been received, known as “being pulled by demand.” One retailer using this method is Ministry of Supply, a Boston-based high-performance businesswear brand for men and women, which has tested made-to-order knitted blazers and dresses. After a customer chooses from multiple colors and style permutations, their order will be routed to the company’s manufacturing system, and within two days, the garment will be produced and sent out to them. The manufacturers that Ministry of Supply work with can make up to 18 garments per machine, per day.

Retailers such as Adidas and Eloquii have also experimented with on-demand, 3D-printed apparel. Companies such as OnPoint Manufacturing can now facilitate a production process that allows shoppers to obtain apparel in different fit and size combinations. We believe the future of manufacturing for the retail industry will be consumer-centric, demand-driven and fueled by advances in technology—which we discuss below.

Key Technologies That Manufacturers Can Adopt To Improve Efficiency

Analytics entails applying data patterns to inform effective decision-making, using statistical tools or artificial intelligence.

Analytics can be used to address consumer demand. For example, Shenzhen Jiaweishi Electronic Technology Co, a manufacturer of brand-name consumer goods including Whirlpool and Philips, is using data analytics to test the market and plan inventory. In 2019, the manufacturer produced a limited number of robot vacuum cleaners and gathered customer feedback on online sales through Pinduoduo’s “New Brand Initiative” program. Based on the data and analysis collected from Pinduoduo, the manufacturer modified the robot vacuum’s randomized cleaning route to a more orderly one and redesigned the product’s appearance to align it with consumer preferences—in an example of a consumer-to-manufacturer (C2M model. The manufacturer also opened up livestreaming channels to make the manufacturing process transparent to consumers, while addressing their concerns with regards to product quality. Pinduoduo’s proposition aims to offer products at low prices by leveraging initiatives such as the C2M model, and through partnerships with small and medium-sized merchants.

Real-time data collection and advanced analytics technologies can provide a more detailed, accurate and up-to-date picture of factory operations. For example, Quantzig, a global analytics firm, collaborated with a sporting goods manufacturing company during the coronavirus pandemic to help it reduce rising operational costs; the order-fulfillment solution can retrieve real-time inventory management data in factories.

Various retailers and manufacturers (of clothing as well as consumer goods)—such as Benetton, CVS, Prada, Procter & Gamble, Tesco and Walmart—are implementing RFID technology in manufacturing. Using RFID tags in apparel processing and weaving provides fabric tracking, to avoid mixing different yarn lots, which can be a major problem in spinning mills. In the packing process, mixing different styles and sizes can be also avoided by using RFID tags.

3D design and sampling techniques are increasingly being used to create custom production parts with fewer manufacturing constraints than traditional manufacturing techniques. 3D design and sampling saves time, reduces material waste and allows for ongoing communication among designers, merchant and manufacturers.

Automation in manufacturing aims to perform procedures with minimal human assistance. For example, Grabit, a startup based in the San Francisco Bay Area, is developing a technology that uses electroadhesion to handle fabrics. Using technology that channels static cling to act as a magnet that enables automatic handling, the company built an auto-layering robot capable of handling textiles and automating and speeding-up garment production. According to the company, its technology increases manufacturers’ productivity twentyfold.

Another example of robotics in manufacturing is Sewbo’s robotics, which allow manufacturers to create quality clothing at lower costs, as the sewing robotics technology creates close stitches that improve the durability of clothing. This technology could shorten supply chains by bringing about more onshore manufacturing, as well as lessen the long lead times that hamper the fashion and apparel industries.

The IoT takes networked sensors and intelligent devices and puts these technologies to use directly on the manufacturing floor, controlling the production process and ensuring product quality.

Inspectorio’s mobile inspection tool is one example of technology based on the IoT. This tool can help apparel manufacturers to find out why certain fabrics, production methods and items drive higher-than-average scrap levels. Real-time data can also be collected and analyzed to identify the specific processes—across cutting, sewing and finishing—that lead to rejected garments. The data generated from mobile inspections are indispensable for apparel retailers and manufacturers in tracking performance quality across their entire production and supplier networks.

The IoT can also be used to test product authentication. In 2019, Ralph Lauren worked with EVRYTHING, a consumer product IoT platform, to create a unique digital identity for its products. The digital platform ensures the authenticity of its products from manufacturer through to purchase.

The adoption of blockchain technology could help the manufacturing industry by making the supply chain more secure and processes more transparent. For instance, OriginTrail designed protocols to tackle the key challenges limiting the exchange and integrity of data in product supply chains. By scanning the unique digital code on each apparel item’s label with their smartphones, consumers can view an item’s journey and track it all the way from the factory to the point of sale. This technology raises the bar on the promise of transparency and sustainability in the apparel industry.

Retailers Are Moving Manufacturing out of China

Following the coronavirus outbreak, more multinational companies are looking to move their factories, suppliers or vendors out of China:

- Abercrombie & Fitch reduced its dependence on suppliers in China in 2019 by more than 40% compared to 2018.

- Lululemon has moved part of its production out of China to places such as Cambodia and Vietnam.

- Uniqlo is moving its production out of China to Indonesia.

Sparked by the global crisis, some retailers are considering bringing manufacturing work back to the US, as they recognize the value of a flexible supply chain. According to Thomas, a product sourcing and supplier network, 64% of surveyed retailers, manufacturers and suppliers said that they are “likely to extremely likely” to bring sourcing or production back to the US after the outbreak. Business of Fashion also forecasts that over 20% of US fashion companies’ sourcing volume could be nearshored by 2025, thanks to automation technology and increasing consumer demand for speed to market. Read our recent deep dive report for more information on the top five trends that are shaping apparel sourcing.

- Hickory Brands, a North Carolina shoelace manufacturer, has stated that bringing its manufacturing back to the US from China has yielded greater efficiency due to improved proximity.

- Denim producer Levi Strauss is reshoring part of its jeans-manufacturing process back to the US and leveraging automation to cut lead times and improve its response to shoppers’ demands. In partnership with technology firm Jeanologica, the retailer is testing a laser technology that automates the finishing phase to give jeans a “worn-in” look. The company built a large finishing facility at its Sky Harbor distribution center near Las Vegas to get ready for full-scale adoption of the technology in 2020. The laser finishing is not only faster, but also more environmentally friendly than the traditional denim finishing process as it dramatically reduces the use of chemicals.

- Opie Way, a brand focused on quality leather shoes in the US, is bringing its shoe-making operations and related jobs back to the US in 2020, specifically to North Carolina.

The decision to move away from China may also be influenced by unstable policies on trade tariffs. According to The American Apparel and Footwear Association, 91.6% of apparel and 52.5% of footwear imports from China were expected to be hit with a 15% tariff (from the previous 8–12%) beginning September 1, 2019. Although the US Trade Representative issued a Federal Register notice reducing this rate to 7.5%, effective February 14, 2020, we still expect to see apparel retailers impacted by the tariff. Many retailers, including American Eagle Outfitters, Macy’s and Walmart, have announced that they are implementing strategies to reduce this impact.

What We Think

Implications for Manufacturers and Retailers

Inventory issues have been mounting during the coronavirus pandemic, and it is not surprising to see that manufacturers and retailers globally are facing the challenge of handling excess inventory. A demand-driven manufacturing model with advanced technologies could be the solution. We believe that retailers and manufacturers will become increasingly more automated and data-driven.

We suggest that retailers re-examine their sourcing mix and encourage greater onshoring or nearshoring of production to build a more flexible supply chain.

Source: Coresight Research[/caption]

The way in which companies manufacture their products has become critical in the fast-moving, global supply chain landscape. Manufacturing is increasingly being recognized as an important process that can reduce costs and lead time to the market. In this report, we look at the state of manufacturing for the retail industry in global supply chain management and the major technologies that are introducing innovation to supply chains. We also discuss case studies of relevant manufacturers.

Source: Coresight Research[/caption]

The way in which companies manufacture their products has become critical in the fast-moving, global supply chain landscape. Manufacturing is increasingly being recognized as an important process that can reduce costs and lead time to the market. In this report, we look at the state of manufacturing for the retail industry in global supply chain management and the major technologies that are introducing innovation to supply chains. We also discuss case studies of relevant manufacturers.

Note: Sales and inventories are adjusted for seasonal variations; manufacturers’ sales refer to the value of shipments by manufacturers

Note: Sales and inventories are adjusted for seasonal variations; manufacturers’ sales refer to the value of shipments by manufacturers  Base: 294 retail suppliers from 39 countries, surveyed March 18–March 31, 2020

Base: 294 retail suppliers from 39 countries, surveyed March 18–March 31, 2020