Reliance Retail Ventures

Sector: Food and mass retailers

Country of operation: India

Key product categories: Apparel, food and beverages, general merchandise, home and personal care

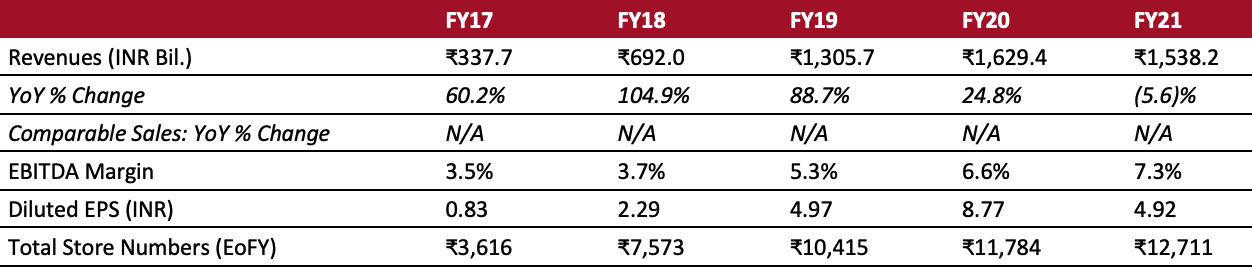

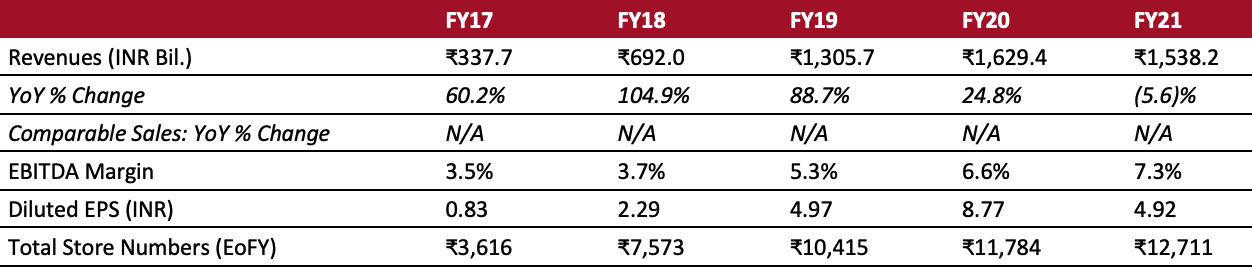

Annual Metrics

[caption id="attachment_138923" align="aligncenter" width="700"]

Fiscal year ends March 31 of the same calendar year

Fiscal year ends March 31 of the same calendar year[/caption]

Summary

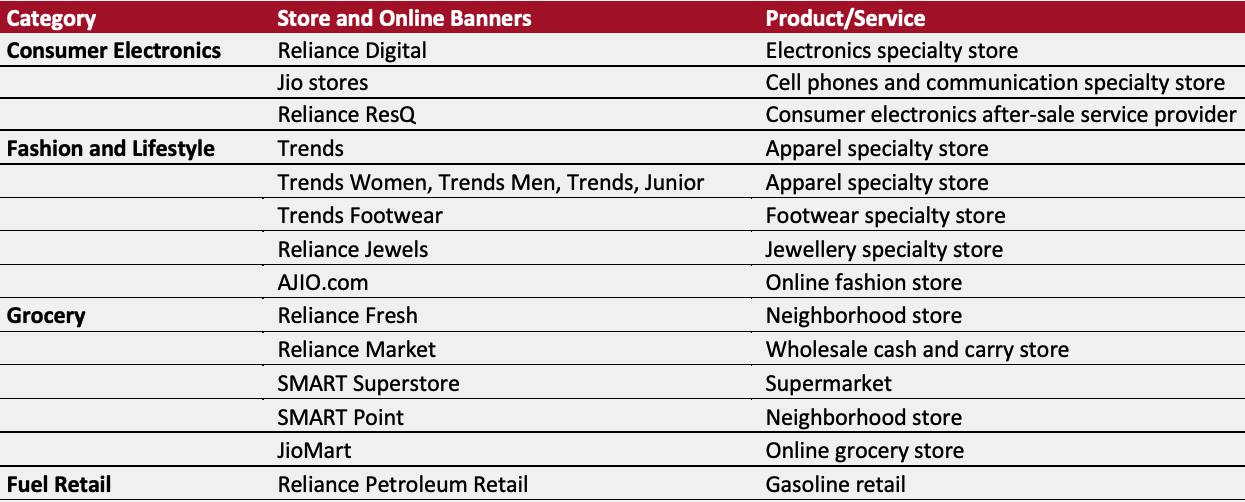

Reliance Retail Ventures was founded in 2006 and is headquartered in Mumbai, Maharashtra, India. The company operates a chain of online businesses, neighborhood stores, specialty stores, supermarkets, and wholesale cash-and-carry stores in India. It is a subsidiary of the Indian multinational conglomerate Reliance Industries Limited (RIL) and is the parent entity of Reliance Retail Limited, which operates its retail business. The company has established itself across five categories: Connectivity, Consumer Electronics, Fashion and Lifestyle, Fuel, and Grocery. As of March 31, 2021, the retailer operates a total of 12,711 stores in India, totaling 33.8 million square feet of retail space.

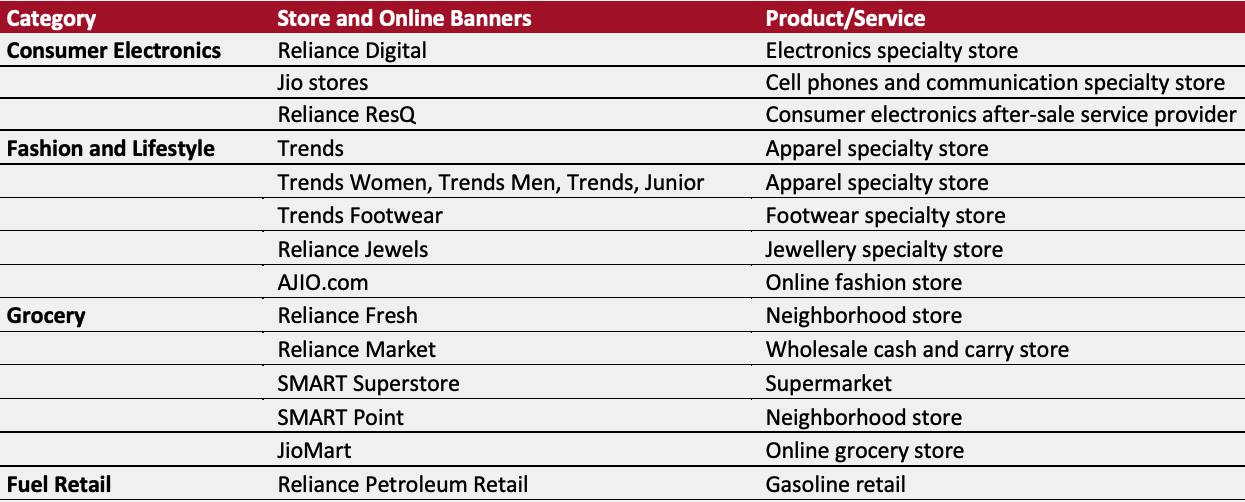

Reliance Retail’s Store and Online Banners

Company Analysis

Coresight Research insight: Reliance Retail is a heavyweight in India’s organized retail space—it is the county’s largest retailer by revenue and profitability and has the largest organized retail footprint. The company expanded aggressively into e-commerce in May 2020, launching its online grocery service JioMart in 200 cities, competing against online startups including BigBasket and Grofers. In July 2020, the company announced plans to expand JioMart beyond the grocery segment, into electronics, fashion, healthcare and pharmaceuticals, becoming a serious challenger to the Amazon-Flipkart duopoly. However, we believe that it may still find it tough to break Amazon and Flipkart’s market dominance—both competitors have deep pockets, proven expertise in e-commerce, offerings from popular brands and established customer loyalty.

Company Analysis

Coresight Research insight: Reliance Retail is a heavyweight in India’s organized retail space—it is the county’s largest retailer by revenue and profitability and has the largest organized retail footprint. The company expanded aggressively into e-commerce in May 2020, launching its online grocery service JioMart in 200 cities, competing against online startups including BigBasket and Grofers. In July 2020, the company announced plans to expand JioMart beyond the grocery segment, into electronics, fashion, healthcare and pharmaceuticals, becoming a serious challenger to the Amazon-Flipkart duopoly. However, we believe that it may still find it tough to break Amazon and Flipkart’s market dominance—both competitors have deep pockets, proven expertise in e-commerce, offerings from popular brands and established customer loyalty.

| Tailwinds |

Headwinds |

- Strong increase in revenue per store across formats, indicating that stores launched gaining foothold in their respective catchment areas

- Launch of the beta version of online grocery platform JioMart across 200 cities, leveraging its well-established supply chain infrastructure and network of grocery stores

- Raised a total of $6.32 billion from foreign investors in 2020 s

- The scale and resources available as India’s largest retailer by reach, revenue and profits

- Opportunities for sustained expansion outside India

|

- Increasing capex aimed at growing both existing and new businesses, including its new commerce initiative

- High competition from the unorganized segment, which operates in company’s various addressable markets

|

Strategy

In its fiscal 2021 annual report, Reliance Retail outlined the following framework for inclusive growth and build sustainable societal value. We detail the strategies below:

1. Invest in design and development

- Invest in building design and product development centers to offer relevant, contemporary and high-quality products to meet customers’ diverse needs.

2. Develop sourcing ecosystem

- Grow its sourcing ecosystem by working with small producers and manufacturers, regional, national and international brands. Develop this ecosystem by supporting small producers to modernize their operations, minimize inefficiencies and reduce leakages.

3. Upgrade supply chain infrastructure

- Invest in building state-of-the-art supply chain infrastructure in India. Link all major sourcing locations through an automated and scalable warehousing, logistics and last-mile fulfilment ecosystem.

4. Expand retail network

- Expand the network of stores and digital commerce platforms to serve customers across the country.

5. Empower merchants

- Partner with millions of unorganized merchants through an inclusive model of growth and digitally empower them. Offer a compelling value proposition to grow partners’ businesses and earnings.

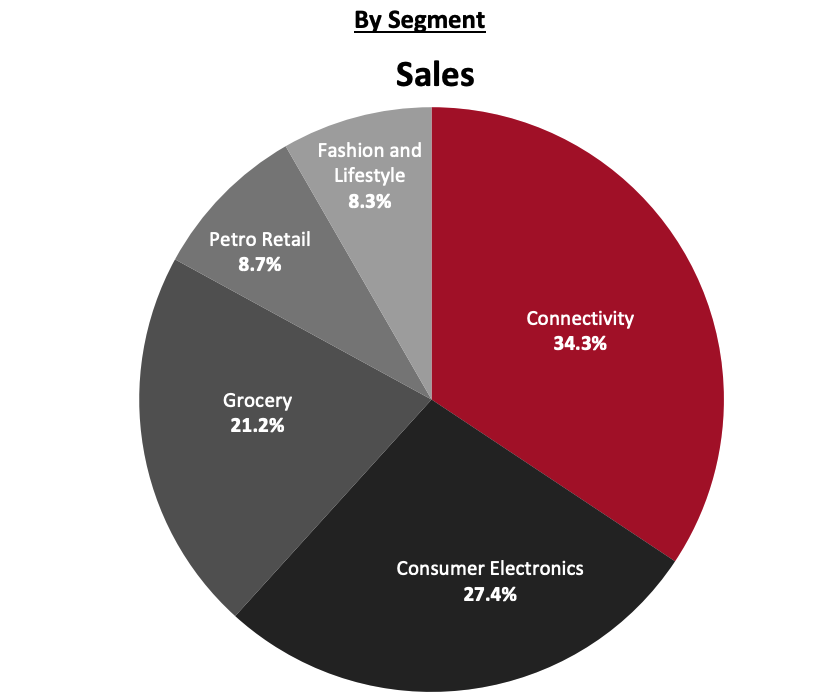

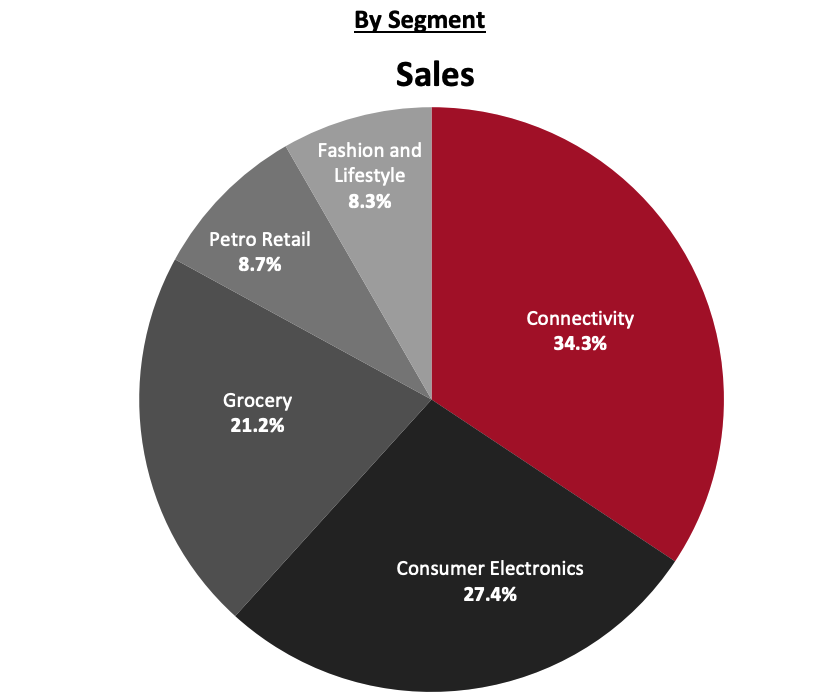

Revenue Breakdown (FY20)

[caption id="attachment_130432" align="aligncenter" width="520"]

Revenue breakdown for FY21 is not provided in its annual report.

Revenue breakdown for FY21 is not provided in its annual report.[/caption]

Company Developments

| Date |

Development |

| October 27, 2021 |

Iconix Lifestyle Private Limited, a joint venture between Reliance Retail and Iconix Brand Group, announces the acquisition of Lee Cooper’s IP rights for India. |

| October 7, 2021 |

Reliance Retail Ventures announces that it has entered into a franchisee agreement with 7-Eleven to launch 7-Eleven convenience stores in India. |

| September 2, 2021 |

Reliance Retail Ventures takes sole control of Indian local search engine platform Just Dial, acquiring 40.98% in the company. |

| November 5, 2020 |

RIL announces that Saudi Arabia-based Public Investment Fund will invest ₹95.6 billion ($1.3 billion) for an equity stake of 2.0% in Reliance Retail Ventures. |

| October 6, 2020 |

RIL announces that Abu Dhabi Investment Authority (ADIA) will invest ₹55.1 billion ($739.4 million) in Reliance Retail Ventures, translating to a 1.2% equity stake on a fully diluted basis. |

| October 3, 2020 |

RIL announces that global investment firm TPG will invest ₹18.4 billion ($246.5 million) into Reliance Retail Ventures, which will translate into a 0.4% equity stake in the company on a fully diluted basis. |

| October 2, 2020 |

RIL announces that global investment firm GIC will invest ₹55.1 billion ($739.4 million) in Reliance Retail Ventures, translating into a 1.2% equity stake in the company on a fully diluted basis. |

| October 1, 2020 |

RIL announces that the Abu Dhabi-based Mubadala Investment Company will invest ₹62.5 billion ($838 million) in Reliance Retail Ventures, which will translate into a 1.4% equity stake in the company on a fully diluted basis. |

| September 30, 2020 |

RIL announces that global equity firm General Atlantic will invest ₹36.8 billion ($493 million) in Reliance Retail Ventures, which will translate into a 0.8% equity stake in the company on a fully diluted basis. |

| September 30, 2020 |

RIL announces that co-investors of private equity firm Silver Lake will invest ₹18.8 billion ($251.5 million) in Reliance Retail Ventures, bringing the total investment by Silver Lake to ₹93.8 billion ($1.25 billion), translating a 2.1% equity stake. Silver Lake previously invested ₹75 billion ($1.01 billion) on September 9. |

| September 23, 2020 |

RIL announces that global investment firm KKR will invest ₹55 billion ($744.4 million) in Reliance Retail Ventures, translating into a 1.3% equity stake in the company. |

| August 29, 2020 |

Reliance Retail Ventures announces that it is acquiring the retail, wholesale, logistics and warehousing operations of Future Group for ₹247.1 billion ($3.31 billion). Reliance Retail Ventures will own and control Future Group’s brands Big Bazaar, Easy Day, Foodhall, Foodworld, Heritage Fresh, HyperCity and Nilgiris (supermarket chains); Brand Factory, Central and FBB (Fashion and Lifestyle stores); and E-Zone (a Consumer Electronics chain). |

| August 18, 2020 |

Reliance Retail Ventures announces the acquisition of a majority equity stake in e-pharmacy Netmed’s parent company Vitalic for ₹6.2 billion ($83.15 million). |

Management Team

- V. Subramaniam—Managing Director

- Pankaj Pawar—Director

- Dinesh Thapar—CFO

Source: Company reports

Fiscal year ends March 31 of the same calendar year[/caption]

Summary

Reliance Retail Ventures was founded in 2006 and is headquartered in Mumbai, Maharashtra, India. The company operates a chain of online businesses, neighborhood stores, specialty stores, supermarkets, and wholesale cash-and-carry stores in India. It is a subsidiary of the Indian multinational conglomerate Reliance Industries Limited (RIL) and is the parent entity of Reliance Retail Limited, which operates its retail business. The company has established itself across five categories: Connectivity, Consumer Electronics, Fashion and Lifestyle, Fuel, and Grocery. As of March 31, 2021, the retailer operates a total of 12,711 stores in India, totaling 33.8 million square feet of retail space.

Reliance Retail’s Store and Online Banners

Fiscal year ends March 31 of the same calendar year[/caption]

Summary

Reliance Retail Ventures was founded in 2006 and is headquartered in Mumbai, Maharashtra, India. The company operates a chain of online businesses, neighborhood stores, specialty stores, supermarkets, and wholesale cash-and-carry stores in India. It is a subsidiary of the Indian multinational conglomerate Reliance Industries Limited (RIL) and is the parent entity of Reliance Retail Limited, which operates its retail business. The company has established itself across five categories: Connectivity, Consumer Electronics, Fashion and Lifestyle, Fuel, and Grocery. As of March 31, 2021, the retailer operates a total of 12,711 stores in India, totaling 33.8 million square feet of retail space.

Reliance Retail’s Store and Online Banners

Company Analysis

Coresight Research insight: Reliance Retail is a heavyweight in India’s organized retail space—it is the county’s largest retailer by revenue and profitability and has the largest organized retail footprint. The company expanded aggressively into e-commerce in May 2020, launching its online grocery service JioMart in 200 cities, competing against online startups including BigBasket and Grofers. In July 2020, the company announced plans to expand JioMart beyond the grocery segment, into electronics, fashion, healthcare and pharmaceuticals, becoming a serious challenger to the Amazon-Flipkart duopoly. However, we believe that it may still find it tough to break Amazon and Flipkart’s market dominance—both competitors have deep pockets, proven expertise in e-commerce, offerings from popular brands and established customer loyalty.

Company Analysis

Coresight Research insight: Reliance Retail is a heavyweight in India’s organized retail space—it is the county’s largest retailer by revenue and profitability and has the largest organized retail footprint. The company expanded aggressively into e-commerce in May 2020, launching its online grocery service JioMart in 200 cities, competing against online startups including BigBasket and Grofers. In July 2020, the company announced plans to expand JioMart beyond the grocery segment, into electronics, fashion, healthcare and pharmaceuticals, becoming a serious challenger to the Amazon-Flipkart duopoly. However, we believe that it may still find it tough to break Amazon and Flipkart’s market dominance—both competitors have deep pockets, proven expertise in e-commerce, offerings from popular brands and established customer loyalty.

Revenue breakdown for FY21 is not provided in its annual report.[/caption]

Company Developments

Revenue breakdown for FY21 is not provided in its annual report.[/caption]

Company Developments