DIpil Das

What’s the Story?

Why It Matters

Coresight Research estimates that the US retail industry will witness 20,000–25,000 store closures in 2020, of which 50–60% will be mall-based—the crisis could prompt an overdue rationalization of mall space. With the rise in store closures and more tenant bankruptcies, some mall owners are looking into acquisitions as a way to work with brands and retailers to survive the crisis together.Mall Owners Are Looking To Acquire Struggling Retailers

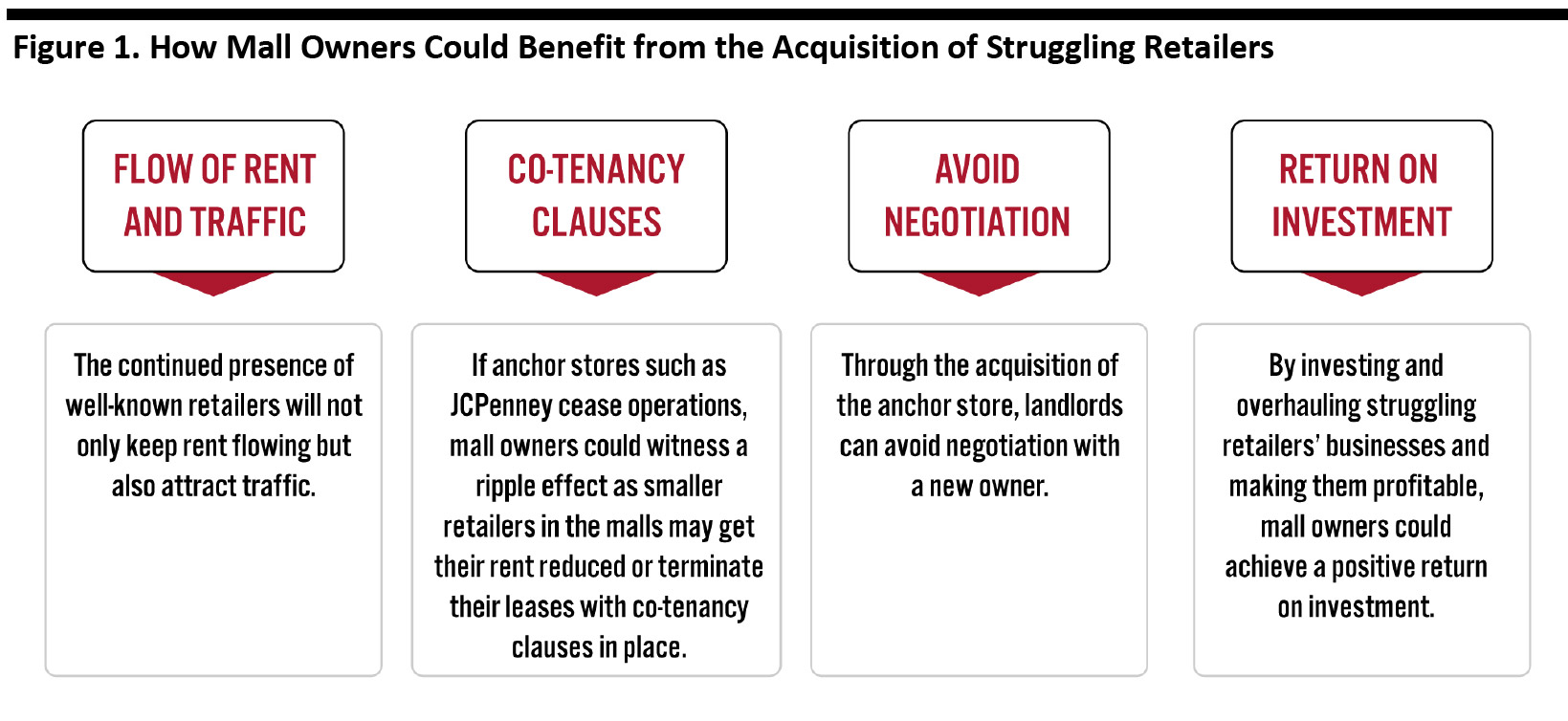

• JCPenney One of the largest US mall owners, Simon Property Group, is considering a joint venture with Brookfield Property Partners, a unit of Brookfield Asset Management, and brand management company Authentic Brands (primarily known for acquiring brands with licensing potential) to bid for department-store chain JCPenney, as reported by Bloomberg on June 15. With JCPenney already struggling with high debt and poor performance, the coronavirus pandemic made matters worse, and it filed for Chapter 11 bankruptcy protection in May this year. In its first quarter ending May 2020, JCPenney’s sales declined by 55.6% year over year—higher than sales decline of 43.5% for rival department store Kohl’s during the same period. More than 70% of JCPenney stores are mall-based, with 63 stores in Simon Property Group malls and 99 in Brookfield malls. JCPenney has witnessed low sales productivity across its mall locations. For fiscal year 2019 that ended on February 1, 2020, JCPenney generated $114 in sales per square foot, a decline of 6.6% year over year. On July 15, JCPenney announced that the company plans to close 152 stores across the US. However, these do not include any locations in Simon or Brookfield malls, according to our analysis. After the announced closures, there will be over 690 stores left in operation. Acquiring JCPenney would ensure the survival of one of mall owners’ most significant tenants amid a wave of coronavirus-related retail distress that has seen thousands of stores close permanently. Furthermore, JCPenney could benefit from Authentic Brand Group’s growing portfolio, such as lifestyle brand Nautica, if the licensed products from those brands and retailers are added to JCPenney’s line-up. The acquisition discussions are ongoing, and a deal has not yet been completed. In the case that the deal is completed, it would mark Simon Property Group’s third recent retailer takeover—following its acquisition of Forever 21 in February 2020 and Aéropostale in September 2016 (which we discuss later in this report). In the case that Simon Property Group and Brookfield do not reach a deal to bail out JCPenney, closures by the chain could lead to renegotiations with other retailers regarding co-tenancy clauses that specify the presence of a mall anchor store. Mall owners will seek to avoid such co-tenancy clauses kicking in. Aside from mall owners, private-equity firm Sycamore Partners is also holding preliminary talks to acquire JCPenney, as reported by Reuters on June 6. [caption id="attachment_113287" align="aligncenter" width="700"] Source: Coresight Research[/caption]

• Brooks Brothers

High-end clothing retailer Brooks Brothers filed for Chapter 11 bankruptcy protection on July 8, 2020. Brooks Brothers was experiencing upheaval before the coronavirus outbreak and has found its struggles exacerbated by the ensuing pandemic. In the bankruptcy filing, the retailer stated that it expects to close 51 of its 250 stores in North America and is pursuing a sale. Brooks Brothers owes between $500 million and $1 billion to 25,000 creditors, including approximately $8 million in rent. The apparel retailer’s annual sales remained flat at around $1 billion from 2017 to 2019. Brooks Brothers noted assets valued between $500 million and $1 billion.

Already joint owners of SPARC Group, which holds control of various clothing brands, Simon Property Group and Authentic Brands are considering the joint acquisition of the distressed Brooks Brothers, as reported by the financial news website TheStreet on July 10. Again, discussions are ongoing, and a deal is yet to be completed.

Meanwhile, Simon Property Group and Authentic Brands have successfully bid to supply an $80 million loan to carry Brooks Brothers through bankruptcy. Their joint offer beat brand-management platform WHP Global’s $75 million proposal, as revealed by Brooks Brothers’ lawyers during a virtual hearing in the US Bankruptcy Court in Wilmington, Delaware on July 10. The $80 million loan comes with no fees or interest, according to Brooks Brothers. However, the loan requires trademarks and branding as collateral, so that if Brooks Brothers ends up liquidating, Simon Property and Authentic Brands would gain control over the intellectual property.

In June, Simon Property Group filed a lawsuit against Brooks Brothers seeking $8.7 million in rent that has since been dropped. The lawsuit originally alleged that Brooks Brothers had threatened to permanently close all of its stores in the malls and had failed to make a payment toward rent for April, May and June 2020, among other charges.

• Lucky Brand Dungarees

Through their joint entity SPARC Group, Simon Property Group and Authentic Brands have made an initial bid of $140.1 million in cash and $51.5 million in credit to acquire almost all of the assets of bankrupt clothing retailer Lucky Brand Dungarees, as cited by Nasdaq on July 6, 2020. Lucky Brand Dungarees filed for bankruptcy on July 3 and announced plans to close 13 out of around 200 US stores, which are mostly located in malls.

In the bankruptcy court filing, the company’s Chief Restructuring Officer Mark Renzi stated that the SPARC Group offer could preserve most, if not all, of the brand’s current network of stores. Renzi also explained that the consumer shift away from brick-and-mortar stores was hurting the retail chain, an issue further compounded by the coronavirus outbreak. Furthermore, with limited liquidity, Lucky Brand had failed to get new inventory from vendors.

Source: Coresight Research[/caption]

• Brooks Brothers

High-end clothing retailer Brooks Brothers filed for Chapter 11 bankruptcy protection on July 8, 2020. Brooks Brothers was experiencing upheaval before the coronavirus outbreak and has found its struggles exacerbated by the ensuing pandemic. In the bankruptcy filing, the retailer stated that it expects to close 51 of its 250 stores in North America and is pursuing a sale. Brooks Brothers owes between $500 million and $1 billion to 25,000 creditors, including approximately $8 million in rent. The apparel retailer’s annual sales remained flat at around $1 billion from 2017 to 2019. Brooks Brothers noted assets valued between $500 million and $1 billion.

Already joint owners of SPARC Group, which holds control of various clothing brands, Simon Property Group and Authentic Brands are considering the joint acquisition of the distressed Brooks Brothers, as reported by the financial news website TheStreet on July 10. Again, discussions are ongoing, and a deal is yet to be completed.

Meanwhile, Simon Property Group and Authentic Brands have successfully bid to supply an $80 million loan to carry Brooks Brothers through bankruptcy. Their joint offer beat brand-management platform WHP Global’s $75 million proposal, as revealed by Brooks Brothers’ lawyers during a virtual hearing in the US Bankruptcy Court in Wilmington, Delaware on July 10. The $80 million loan comes with no fees or interest, according to Brooks Brothers. However, the loan requires trademarks and branding as collateral, so that if Brooks Brothers ends up liquidating, Simon Property and Authentic Brands would gain control over the intellectual property.

In June, Simon Property Group filed a lawsuit against Brooks Brothers seeking $8.7 million in rent that has since been dropped. The lawsuit originally alleged that Brooks Brothers had threatened to permanently close all of its stores in the malls and had failed to make a payment toward rent for April, May and June 2020, among other charges.

• Lucky Brand Dungarees

Through their joint entity SPARC Group, Simon Property Group and Authentic Brands have made an initial bid of $140.1 million in cash and $51.5 million in credit to acquire almost all of the assets of bankrupt clothing retailer Lucky Brand Dungarees, as cited by Nasdaq on July 6, 2020. Lucky Brand Dungarees filed for bankruptcy on July 3 and announced plans to close 13 out of around 200 US stores, which are mostly located in malls.

In the bankruptcy court filing, the company’s Chief Restructuring Officer Mark Renzi stated that the SPARC Group offer could preserve most, if not all, of the brand’s current network of stores. Renzi also explained that the consumer shift away from brick-and-mortar stores was hurting the retail chain, an issue further compounded by the coronavirus outbreak. Furthermore, with limited liquidity, Lucky Brand had failed to get new inventory from vendors.

Brookfield Asset Management Retail Revitalization Program

In May, Brookfield Asset Management launched its $5 billion Retail Revitalization Program, which will focus on non-control investments in retail businesses that have at least $250 million in normalized revenues and have been operating for at least two years. The program is designed to assist medium-sized enterprises that have been hit by the coronavirus pandemic. This program could be a lifeline for many of Brookfield’s tenants, and the mall owner will be able to acquire a stake in their future. Given the qualifier of $250 million in revenue, retailers are likely to already have backing from institutional investors and could rebound with recapitalization.Recent Retail Acquisitions by Mall Owners

While it may not be common for mall owners to acquire brands and retailers, the strategy has been used before. In 2016 and earlier in 2020, Simon Property Group collaborated with other mall landlords to bail out two distressed apparel companies—Forever 21 and Aéropostale.Figure 2. Acquisition Details of Forever 21 and Aéropostale [wpdatatable id=333]

Source: Company reports/Coresight Research • Forever 21 Fast-fashion retailer Forever 21, which sees global annual sales of more than $2 billion, filed for Chapter 11 bankruptcy protection in September 2019 and announced closures of approximately 350 of its 815 stores. At the time of filing, Forever 21 noted that it owed Simon Property Group and Brookfield $8.1 million and $5.3 million, respectively. In February 2020, Simon Property Group, Brookfield Property Partners and Authentic Brands reached an agreement to acquire Forever 21 for $81 million. At that time, just under 100 of Forever 21’s stores were in Simon Property Group-owned malls. Mall owners may have feared lower overall foot traffic if a popular chain such as Forever 21 were to leave those malls, as well as the potential knock-on effect for other tenants’ sales—and potentially more of those stores closing. One major challenge for the mall owners was the size of Forever 21’s stores. Its largest stores covered 100,000 square feet, compared to an average store size of 40,000 square feet, making it difficult to lease them out to other retailers. As of September 30 2019, Forever 21 was Simon Property Group’s seventh-largest tenant in terms of rental income. Simon Property Group stated that the aim of the retail investment is to gain a return and not just to maintain its rent. On the company’s fourth-quarter 2019 earnings call in February 2020, the group’s CEO David E. Simon stated, “We believe that Forever 21, similar to Aéropostale, presents a very interesting repositioning opportunity. If the transaction is consummated, the NewCo contemplates the continued operations of many of Forever 21 stores and e-commerce business and maintaining many jobs.” In the fourth fiscal quarter of 2019, Simon Property Group’s earnings results were negatively impacted by the rent reductions provided to stabilize the Forever 21 business. However, the company believes that if it is successful in turning around Forever 21, it will make money on its investment and receive the rent it is due. To help the retailer return to profitability, Simon Property Group and Brookfield should overhaul the quality of products and services to win back shoppers, shrink some of their remaining stores and close unprofitable locations. • Aéropostale In September 2016, Simon Property Group partnered with General Growth Properties (now owned by Brookfield Property Partners) to acquire teen-apparel retailer Aéropostale out of bankruptcy. Of the $55 million acquisition, Simon Property contributed $33 million for a 44% stake. At that time, there were Aéropostale stores across 166 malls owned by Simon Property Group and 77 stores in General Growth Properties’ locations. During a conference call held in July 2019, Simon reported that the company is considering more retail investment opportunities, stating, “We are certainly as good as the private-equity guys when it comes to retail investment. We will work together on other distressed situations. We are only going to buy into companies that we think have brands and that have the volume that is worth doing it.” Simon Property Group’s cash investment in Aéropostale in 2016 was approximately $25 million, of which the company has already received $13 million of distributions, so its net cash investment is $12 million. On a conference call in February 2020, Simon stated that Aéropostale was producing negative EBITDA of $100 million and had more than 500 stores at the time of acquisition. In the fiscal year 2020 ending in February 2021, the company estimates that Aéropostale will generate approximately $80 million of pre-royalty EBITDA (EBITDA plus royalty fees and sublicense income minus overhead expenses) from 575 stores. As of February 4, 2020, Aéropostale had a market capitalization of $350 million and Simon Property Group’s stake in the apparel company had increased to around 50%. [caption id="attachment_113288" align="aligncenter" width="700"]

Simon Property Group’s and Aéropostale’s gift cards

Simon Property Group’s and Aéropostale’s gift cards Source: Simon Property Group/Twitter [/caption]

What We Think

From a strategic perspective, the anticipated joint bid by Simon Property Group, Brookfield and Authentic Brands for JCPenney makes sense. These two mall owners could redevelop some of their best assets by introducing mixed-use elements—including retail, commercial offices, hospitality and residential—into a single project, although it would require substantial capital, zoning approvals and time. We also believe that investments, collaborations and long-term partnerships, such as the Brookfield Asset Management Retail Revitalization Program, will help retailers and mall owners to survive and thrive in the post-coronavirus world. However, these developments are indicative of how challenging the current retail environment is. Without large retailers or hedge funds that are willing to purchase JCPenney, mall owners are the only viable acquirers—they have an interest in keeping struggling retailers afloat as it impacts their overall businesses. We believe the acquisition of retailers by mall owners could have a number of implications, which we discuss below. Implications for Brands/Retailers- A few struggling retailers would be saved from liquidation and could be provided with capital and other support to rebuild themselves.

- Acquisitions present opportunities to fix what is not working—longer-term strategies could address the core retail business misdirection that led to the collapse of a retailer.

- Retailers would lose control over their operations, but there could be substantial synergies.

- Acquisitions could preserve the confidence of the other tenants and smaller retailers in the mall, as well as the developer to some extent, as bailing out anchor retailers would retain traffic to the mall—the success of the retail tenants is tied to the success of the mall and vice-versa. However, if retailers perceive that rivals that have been acquired by mall owners are gaining from the deals in terms of lowered rent and recapitalization, it could damage their relationship with the mall owners and change their perception of the strategy due to a conflict of interest.

- Mall owners would have control over the retailer’s operations and could sign them into longer lease agreements that otherwise might be difficult to secure in the current environment.

- Acquiring retailers raises questions about mall owners’ long-term viability—mall owners cannot buy every anchor retailer in their malls, and often they will have to let stores fail instead of propping them up. We think the acquisition strategy should be based on the retailer’s potential, with sound planning for improving businesses.

- Mall owners could earn positive returns on investment if they successfully overhaul and make the retailers’ businesses profitable through recapitalization.

- Landlords could avoid vacancies at their malls, which could stop other retailers from exiting their leases or demanding reduced rents under co-tenancy agreements.

- These potential acquisitions could protect the overall mall ecosystem, benefitting mall landlords, retailers and employees and giving them a chance to recoup their losses.