DIpil Das

https://www.youtube.com/watch?v=sm4ScoFo5qA&feature=youtu.be

Introduction: Many Department Stores Lost their Charm Over the Years

Fifteen to 20 years ago, department stores were one of the major attractions in many malls and high streets. A corner spot at the mall was considered a sure path to success for many US department stores. Department stores such as Macy’s and JCPenney were the anchors that kept malls humming and foot traffic flowing.

However, over the years, department stores have lost their charm, and have been faltering. Times have changed, and some mall operators suggest they would be fine with major department stores leaving their spaces. General Growth Properties (GGP), the second-largest mall operator in the US in terms of retail space, implied at a real estate conference in 2016 that it would fare fine with Macy’s stores’ exit from some of its malls. GGP explained that the traditional mall model in which department-store anchors were the primary traffic driver, is becoming obsolete.

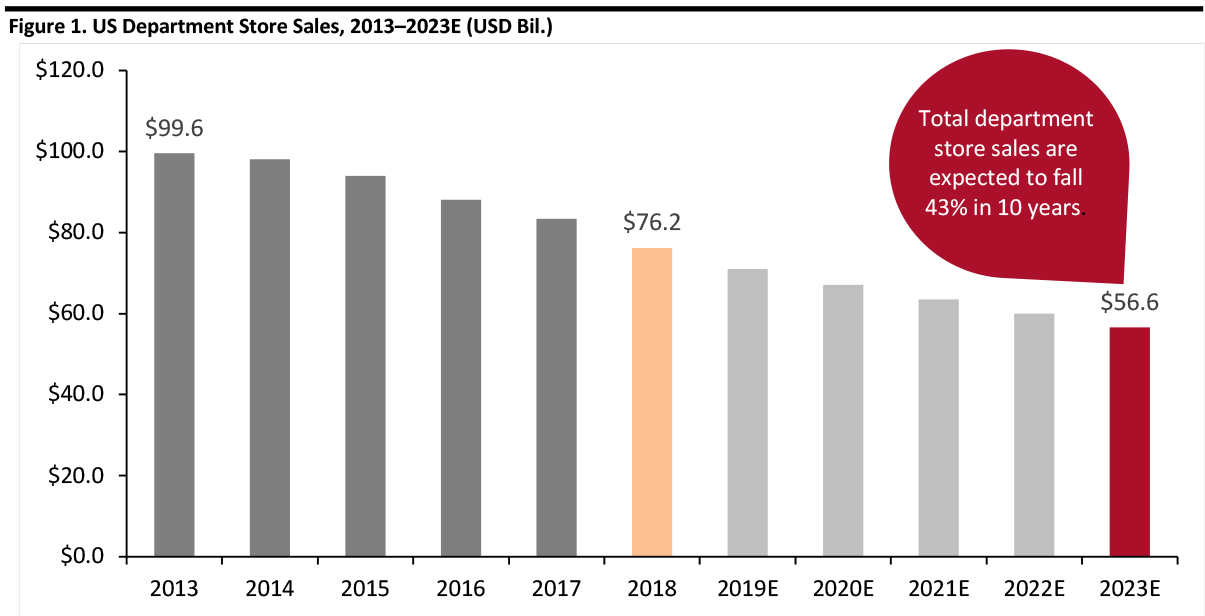

As we outlined in a recent report, the US department store industry is going through severe changes. Over the last five years, sales through US department stores fell 23.5%, or $23.2 billion, from $96.6 billion in 2013 to $76.2 billion in 2018, according to Euromonitor International. These figures exclude online sales made by department store retailers. Euromonitor forecasts department store sales will further decline in the coming years to $56.6 billion by 2023. Department stores continue to face stiff competition from online retailers such as Amazon and discount retailers such as Walmart, Target and T.J. Maxx. Once-leading department stores such as Bon Ton and Sears have announced massive store closures and bankruptcies in recent years.

However, the pace of closures is expected to slow, with fewer closures in 2019: The total is expected to fall just 4% this year, versus 13% last year, according to a recent report from Moody Analytics. Moody expects influential retailers, such as Macy's and Kohl's, to pick up market share from the mass closures of 2018, including Bon-Ton and Sears.

[caption id="attachment_94906" align="aligncenter" width="700"] Source: Euromonitor International[/caption]

Source: Euromonitor International[/caption]

Key Factors Contributing to the Department Stores’ Struggle

1. Inadequate upgrades. Many department stores have failed to invest adequately to upgrade their shop floors, products and online offerings. Sears was underinvested and lacked the appeal department stores must generate to survive today. In 2017, Sears spent about 91 cents per square foot on upgrading its in-store and online experience, compared to Best Buy’s $15.36, Kohl's $8.12 and JCPenney’s $4.13, according to a report from Susquehanna Financial Group. While its competitors moved away from the general department store model, Sears struggled to adapt to changing customer preferences, the rise of omnichannel and the growth of the Internet. Sears filed for bankruptcy in October 2018 but emerged in January 2019, but has announced 72 store closures year to date.

2. Mall locations and rise of online retailers. Most department stores, apart from Kohl's, are still in malls – but malls, especially class-B and class-C, are not the prime shopping destination anymore and have witnessed sharp declines in the foot traffic in recent years. Most JCPenney stores, for example, are in low performing malls. As of early 2015, half of the company’s stores were in B-rated malls, while one-quarter were in C-rated malls, held in place by leases.

Likewise, the rise of online platforms means fewer trips to physical stores, and being able to buy online any time of day or night has made department considerably less relevant. Though nearly 90% of US retail sales are still in physical stores, according to the US Department of Commerce quarterly report on online sales, online sales are rapidly growing while shopping at brick and mortar location is witnessing a decline.

3. Decline in the middle class. According to Pew Research Center analysis of the US Census Bureau data, the US middle class fell from 61% of the population in 1971 to just 50% in 2015. This demographic was hit hard by the Global Financial Crisis, and have never recovered. In the decade since, consumers have experienced a decline in disposable income, while costs for education and healthcare surged. Department stores such as Macy’s and Sears relied on this segment, and their shrinking numbers and declining spending power have driven severe sales declines.

According to a recent Bank of America report, more low- and middle-income shoppers are turning to low-price retailers such as Walmart and Dollar Tree. The study found that purchases by low-income shoppers (households making less than $50,000 per year) across the US rose 6% year over year in April, outpacing the spending growth rate of both middle- and upper-income shoppers.

In the next couple of segments, we explain how som leading US department stores are transforming themselves to remain relevant.

Department Stores are Collaborating with Other Retailers/Influencers to Drive Traffic

Many department stores are pairing up with unique partners to drive foot traffic.

Kohl's entered into a partnership to accept free returns of merchandise bought on Amazon in 2017. The pilot program, initially available at about 100 of Kohl’s 1,158 stores: The number of people walking into the Kohl’s stores that offer Amazon returns averaged 13.5% higher than conventional stores, according to a CNN report. According to Earnest Research analysis of payment data, the partnership with Amazon also led to a 9% rise in new customers and an 8% increase in total revenues. Under the terms of the partnership, customers returning Amazon purchases without a receipt get Kohl’s credit, not Amazon.

On July 9, Kohl's rolled out the Amazon returns program nationwide and said the partnership would start benefiting the company from the second half of 2019. Kohl's management believes this complementary breakthrough program will benefit both companies. Kohl's will invest in logistics and additional staffing to support the end-to-end returns process. In addition to the return program, Kohl's is also selling Amazon-branded products, such as Kindle readers and Alexa voice devices, in 30 of its stores.

In March 2018, Kohl's struck a deal to lease space in five to 10 stores to grocery discounter Aldi. Similarly, Kohl's signed an agreement with Planet Fitness for the latter to open nearly 10 gyms in space carved out from Kohl’s stores in 2019.

JCPenney first collaborated with Sephora in 2006 to offer product differentiation and attract young female shoppers to its stores. Over the years, JCPenney and Sephora have extended their partnership with the addition of new Sephora stores across various JCPenney locations. As of May 2018, Sephora had more than 600 stores in JCPenney locations, more than 75% of JCPenney’s store fleet.

In the second quarter 2018 earnings conference call, management commented that the partnership with Sephora had been a growth driver for the business. In a more recent earnings call, JCPenney CEO Jill Ann Soltau said the company has a renewed focus on its partnership with Sephora, saying the beauty sector is important and sees strong trends in skincare, fragrances, treatment and foundation.

Nordstrom collaborated with Arielle Charnas of Something Navy, who had about 1.2 million followers, to launch one of its biggest influencer collections. The partnership brought in about $1 million in just one day. In 2018, the company deepened the relationship with Arielle Charnas by giving Charnas a standalone Something Navy clothing line – which was so popular that demand crashed the Nordstrom website on launch day.

In 2018, Nordstrom entered into an exclusive partnership with Blair Eadie of Atlantic-Pacific (1.3 million followers) and fashion blogger Julia Engel of Gal Meets Glam (1.2 million followers). On a recent earnings conference call, Nordstrom Co-President Erik Nordstrom said that the first Something Navy collection fetched about $1.8 million in week one, while Engel’s dresses brought in $1.6 million in the first week.

In April 2019, Nordstrom teamed up with Rachel Parcell of lifestyle blog Pink Peonies with nearly one million followers. Under the terms of the agreement, Parcell will sell her personal dress line collection exclusively on Nordstrom.com and in its stores.

Shrinking Stores and Rightsizing to Smaller Formats

Department stores are changing from large mall anchor stores to smaller format stores by rightsizing and adjusting to consumer preferences. Speaking at Shoptalk in March, Nordstrom and Macy’s shared plans to stay relevant for the next 50 years, both saying they plan to reinvent themselves by rightsizing spaces to accommodate new formats based on customer convenience.

Nordstrom

In September 2017, Nordstrom unveiled Nordstrom Local, the company’s inventory-free showroom, which occupies a space of just 3,000 square feet, compared to a typical Nordstrom department store of about 140,000. These stores focus on various services, such as pick ups, alterations and returns. Nordstrom says Nordstrom Local is highly cost-effective as returns are processed twice as quickly as in a full-price store.

After Nordstrom Local’s success in the Los Angeles market, the company plans to expand to New York City, Nordstrom’s largest online market in terms of sales. Nordstrom plans to open a women’s flagship store and two Nordstrom local hubs in New York City this fall.

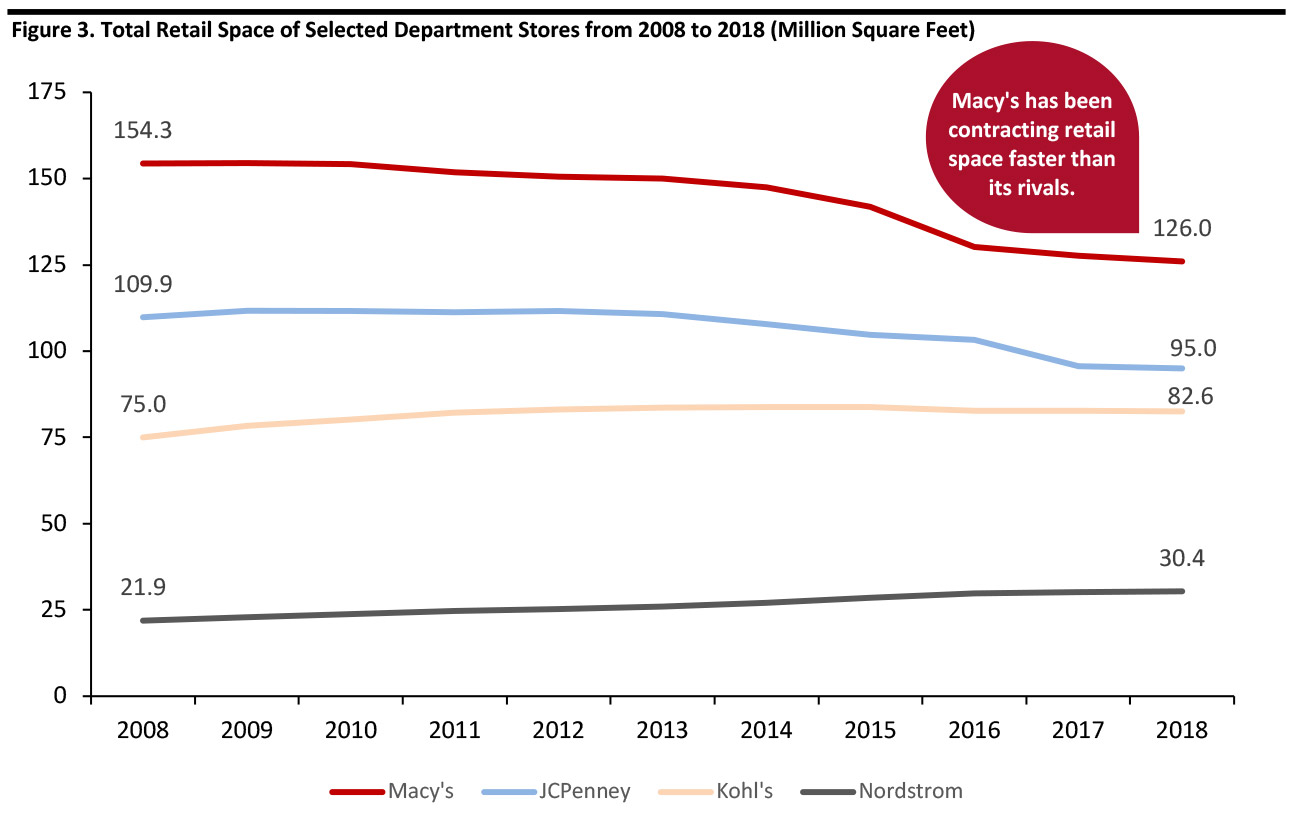

[caption id="attachment_94878" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

Kohl's

Kohl's is among the few department stores shrinking stores instead of closing them. The typical Kohl's store is 90,000 square feet, compared to 130,000 for the average Macy’s. In the past couple of years, Kohl's has downsized nearly half of its fleet, shrinking square footage by about 30% and adding a wall to create an open space of nearly 25,000 square feet that can be sublet. These stores have also been optimized with interior layouts, adjusted fixtures and balanced inventory. Kohl's says they helped drive down inventory and that the smaller stores generate the same revenues from at lower cost. As of March 7, 2019, Kohl's operated 500 of these rightsized stores.

Kohl's has also been testing even smaller format stores: 35,000 square feet, opening 13 in the past three years. These 35,000 square feet stores have 60% less space and carry 60% less inventory than an average Kohl’s. The company says these stores are flexible and efficient, and fixtures can be adapted for localized merchandise and assortments.

Compared to other department stores, Kohl's has a significant advantage in terms of location. Nearly nine of 10 Kohl's stores are in suburban strip malls instead of enclosed shopping malls, and so have been less affected by declining mall traffic.

We believe subletting the extra space in rightsized stores could be extended to hundreds of stores in the coming years, which will create a new income stream and drive foot traffic.

JCPenney

JCPenney has also shrunk its stores over the years. Through store closures, the company reduced its retail space from 109.9 million square feet in 2008 to about 95 million square feet in 2018.

In addition to reducing its total retail space, JCPenney is also testing smaller format stores. In 2018 JCPenney opened a new 75,000 square foot concept store in Brooklyn. Despite its smaller footprint, JCPenney managed to fit both a Sephora boutique and an appliance showroom. In the third quarter fiscal 2019 earnings conference call held in November 2018, CEO Jill Soltau said the stores are over-assorted and high on inventory. She commented that the adoption of smaller format stores would enable JCPenney to cut inventory substantially.

In early 2018, JCPenney had 872 stores, with average store size less than 110,000 square feet. A recent report from The Wall Street Journal said JCPenney management prefers average store size between 70,000 and 90,000 square feet, which can adequateky display merchandise with lesss space. Most of JCPenney’s mall-based stores are larger. For instance, the JCPenney stores in Washington Prime Group’s malls average 128,000 square feet, while its stores in malls owned by CBL & Associates average 120,000 square feet. We believe JCPenney can shrink its stores, but subleasing will not be easy since most stores are in older buildings attached to regional malls.

Macy’s

Macy’s has slashed space faster than its rivals over the past couple of years, from approximately 154.3 million square feet in 2008 to around 126.0 million square feet in 2019.

And Macy’s is also testing smaller format stores, cutting as much as one-fifth of square footage at four locations and turning those shops into neighborhood stores. In an interview with The Wall Street Journal in November 2018, CEO Jeff Gennette commented if Macy’s were building new stores today, it would build them smaller.

[caption id="attachment_94879" align="aligncenter" width="700"] Source: S&P Capital IQ/Coresight Research[/caption]

Source: S&P Capital IQ/Coresight Research[/caption]

Macy’s is Testing Experiential Concepts, Including Virtual Shopping and Pop-up Marketplaces

Macy’s had an action-packed 2018 as it attempted to transform its customer experience across various channels, be it launching The Market @ Macy’s, acquiring STORY or in-store deployment of virtual reality (VR) experiences with Marxent.

In early 2018, Macy’s launched its owned concept, The Market @ Macy’s, an in-store pop-up marketplace that features rotating collections of brands, and shop-in-shops with b8ta, helping digitally native brands break into brick and mortar. In November 2018, Facebook brought products from nearly 100 digitally native businesses to Macy’s marketplace.

In May 2018, Macy’s acquired STORY, a retail concept store in New York City that operates as a marketplace, rotating the concept every four to six weeks. In April 2019, the company launched STORY at Macy’s, bringing curated products and community events from more than 70 brands to 36 of its stores in 15 states. Macy’s has trained over 270 associates to staff the 36 Story shops.

On July 9, the company unveiled an outdoor-themed STORY shop in collaboration with Miracle-Grow and Dick’s Sporting Goods which will focus on entertainment and recreational activities.

In October 2018, Macy’s partnered with Marxent, a 3D product visualization company, to rollout VR installations in 70 Macy’s stores nationwide. The VR headsets help consumers visualize furniture selections before buying so they make better informed buying decisions. VR-influenced furniture sales, in the three pilot stores, grew more than 60% compared to their non-VR counterparts and cut returns to less than 2%.

In October 2018, Macy’s also began relaunching its stores as part of its Growth 50 program, a strategy that calls for a $200 million investment to renovate and modernize 50 of its best-located stores. Stores got physical upgrades, such as new fitting rooms, lighting, flooring, bathrooms and designated spaces for in-store pickups and returns of online purchases. These Growth 50 stores also provide experiential shopping using VR for furniture purchases and virtual beauty departments.

In the first quarter of fiscal 2019, Macy’s brick and mortar business improved, driven by the Growth 50 stores, which outperformed the rest of the fleet. Macy’s plans to expand this program to an additional 100 stores this year.

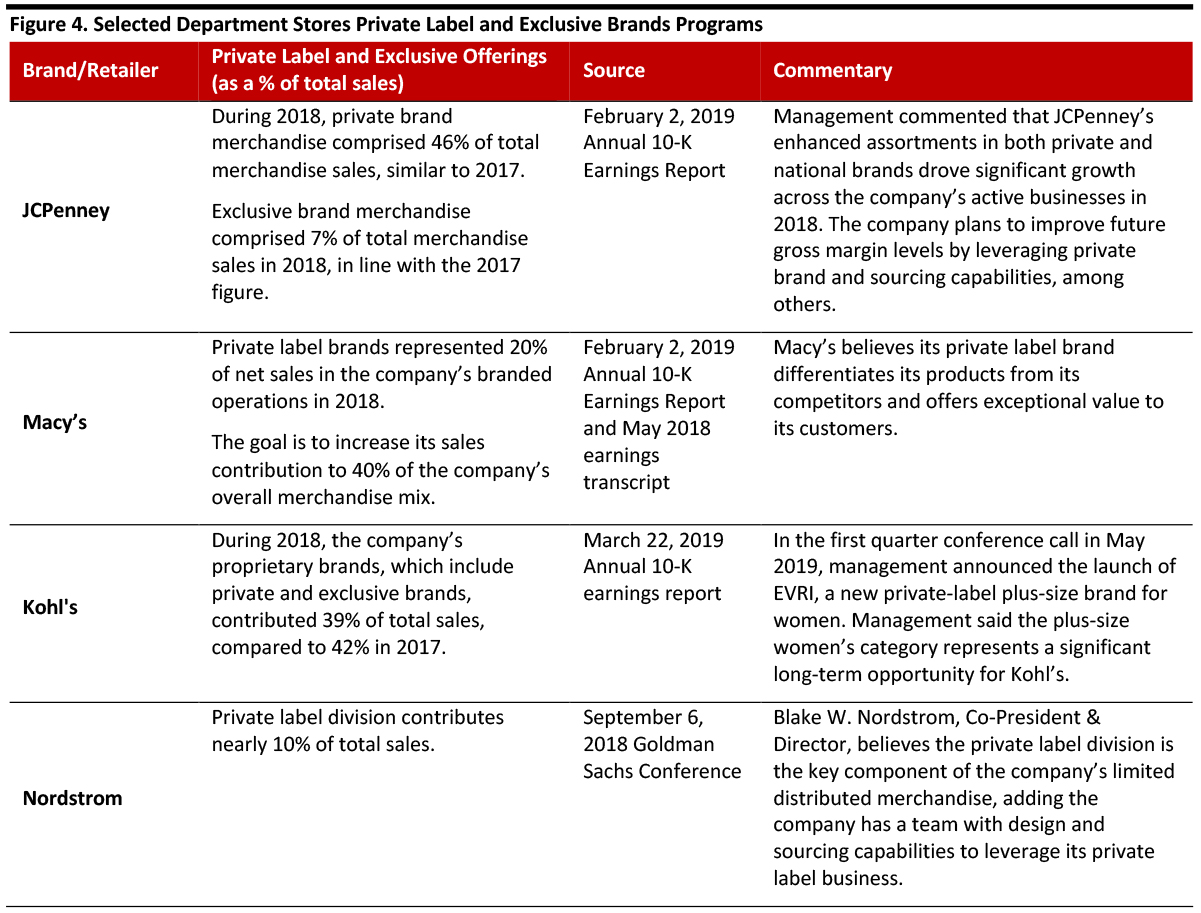

Department Stores Are Focusing on Private Label and Exclusive Brands

Private label and exclusive brands have become priorities for many department stores, including Kohl's, Macy’s, JCPenney and Nordstrom. These brands offer high margins and product differentiation.

Kohl's private label and exclusive brands contribute 39% of the company’s total revenues. The company’s private label brands, which include Croft & Barrow, Sonoma Goods for Life and Apt. 9, are worth $1 billion in terms of revenues. Kohl's offers exclusive lines from various celebrities, such as skateboarder Tony Hawk and designer Vera Wang. In May, the company announced a collaboration with fashion designer Jason Wu to introduce a women’s apparel capsule for the winter holiday season. The company also expanded its plus-size offerings with Nike in the spring.

JCPenney private brand merchandise contributed 46% of the company’s total merchandise sales in 2018, while exclusive brands contributed 7%, both in line with 2017. Macy’s private labels account for 20% of sales, while Nordstrom’s are 10%.

[caption id="attachment_94907" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

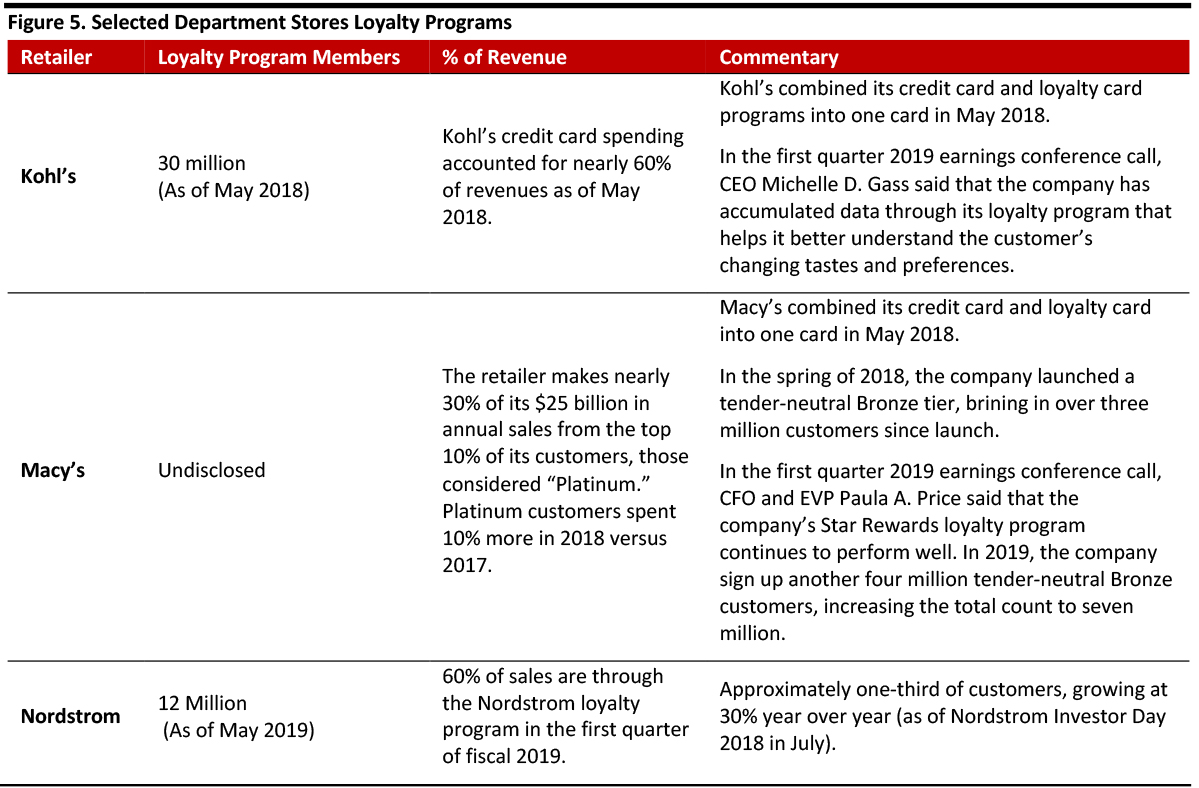

Revamping Loyalty Programs

In recent years, major US department stores, including Kohl's, Macy’s and Nordstrom, have spent billions of dollars to reinvent their loyalty programs. In 2018, the US loyalty program market was worth $47-55 billion in terms of spending by companies, according to estimates compiled by market intelligence firm Beroe. According to data from LoyaltyOne, department stores and apparel retailers generally spend more on loyalty programs than other retailers.

Kohl's had 30 million active members in its customer loyalty reward program, as of May 2018 and is piloting a next-generation loyalty program, Kohl's Rewards. The new program features modified offerings to optimize the reward offerings to create the most significant impact for customers. Kohl's plans to rollout the new, revamped loyalty program to all customers in 2020.

Macy’s Star Rewards member loyalty program drove up platinum loyalty spending 10% in 2018. Platinum customers generate about 30% of the company’s total sales. In 2018, Macy’s also launched a neutral option as part of its loyalty program, which added three million new members.

Nordstrom introduced a nw loyalty program called Nordy Club in late 2018. Nordy Club focuses on personalization and offers curbside pick up, fast redemption and additional benefits such as access to brands that are not available to other shoppers and beauty workshops. As of May, the program had 12 million members, who account for 60% of the company’s total sales.

[caption id="attachment_94908" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

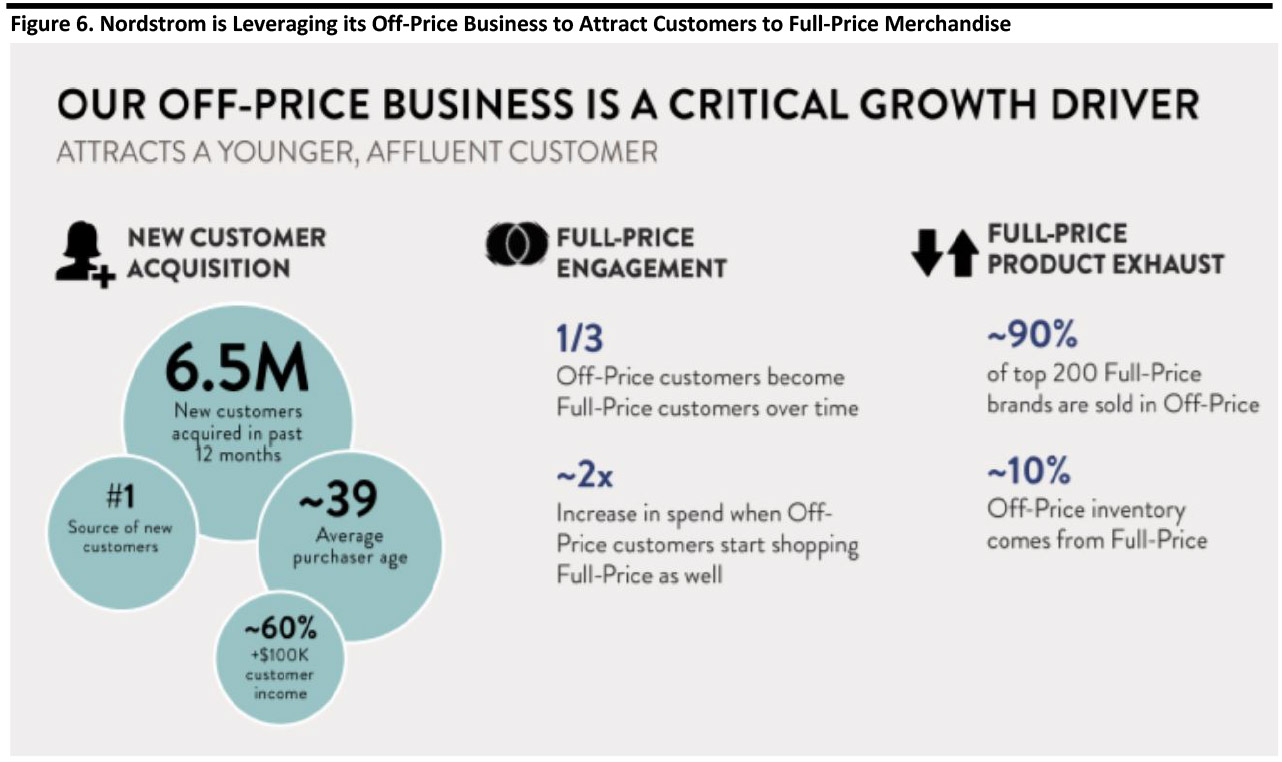

Nordstrom and Macy’s Are Leveraging Off-Price Businesses to Boost Traffic

Nordstrom and Macy’s have expanded their off-price businesses to attract customers to full-price merchandise.

Nordstrom’s off-price business has grown from a single clearance store in Seattle in 1973 to 238 as of April 2019. In 2018, the off-price business contributed 33% of the company’s total revenues. Nordstrom added about 6.5 million new customers to its off-price business in 2018, of which one-third became full-price customers.

In the first quarter 2019 earnings conference call, Co-President Erik B. Nordstrom said the company entered the year with plans to improve profitability in the off-price business. As a part of the plan, the company eliminated some unprofitable events in the first quarter, such as slashing the number of flash events on HauteLook, removing some low-price merchandise from the off-price online site and reducing the number of Clear the Rack events.

[caption id="attachment_94882" align="aligncenter" width="700"] Source: Company report [/caption]

Source: Company report [/caption]

Macy’s began rolling out Backstage locations in 2016, its only in-mall off-price option in the US. With declining mall traffic, most Macy’s stores had more space than needed: Backstage helped Macy’s repurpose unproductive space in mall-based stores with an off-price concept that brought in new customers and encouraged existing customers to spend more time in stores. In 2018, Macy’s stores with Backstage outlets saw sales rise more than 5% compared to comparable stores without the off-price option. On the first quarter 2019 earnings conference call in May, Macy’s Chairman Jeffrey Gennette said nearly 15% of shoppers with Backstage buy in both areas (off-price and full price) of the store, increasing average purchase 40%. The company expects Backstage to drive the comp growth for the entire store.

As of the first quarter of fiscal 2019, Macy’s had 181 Backstage stores, of which 174 were located inside the company’s full-line stores. Macy’s plans to open 41 new Backstage stores by the end of the third quarter of this fiscal year. Also, the company will open a distribution center in the third quarter dedicated to Backstage stores.

Some Department Stores Are Betting on BOPIS

Nordstrom, Kohl's and Macy’s are leveraging their brick and mortar locations to create an omnichannel experience with buy online, pick up in store (BOPIS).

Nordstrom was a BOPIS pioneer in 2008, and the company’s omnichannel efforts have gained steam ever since. At Shoptalk 2019, Nordstrom Co-President Erik Nordstrom said about 50% of in-store visits begin with an online session and that nearly 35% of online sessions begin with an in-store visit. In 2018, the company’s digital sales (including online sales, BOPIS, ship to store and its digital selling tool Style Board) grew 7% year over year and accounted for 31% of the company’s total revenues, up from 28% in 2017.

The company says Nordstrom Local BOPIS customers spend over twice as much as other customers who order online and shop in-store. As of March 18, 2019, Nordstrom offered BOPIS service in all of its 115 full-line stores and three Nordstrom Locals in the US. In April 2019, Nordstrom joined the Narvar Concierge platform to enhance its BOPIS retail offering. Narvar Concierge, a customer experience platform, connects digital to physical commerce experiences in-store and through its partner network. With this partnership, in addition to Nordstrom’s existing fulfillment options, BOPIS customers can select a Narvar Concierge location to pick up online orders.

Macy’s announced the full roll-out of its BOPIS offering in 2014. As of May 2019, BOPIS and buy online ship to store (BOSS) accounted for more than 10% of the company’s total digital demand, compared to just 3.5% a year before. The company expects BOPIS to continue growing. In the first quarter 2020 earnings conference call, management said its BOPIS and BOSS offerings have become an important part of the company’s omnichannel strategy and shoppers like the security and convenience of in-store pick up.

Kohl's rolled out its BOPIS service at all of its locations (then 1,164) in 2015, after pilot testing in 2014. Within one month of launch, the company saw a sales lift in stores. In 2015, company CFO Wesley McDonald said that 15-20% of shoppers who come to pick up online orders buy something else. McDonald commented that BOPIS saves about $5 a box on average on shipping costs.

Kohl's launched its BOSS program in July 2018. In the third quarter 2018 earnings conference call, the company’s CEO Michelle D. Gass said BOSS significantly broadens the assortment available to BOPIS shoppers. Gass also commented that Kohl's is leveraging its Smart Cart technology, launched in the third quarter of 2017, to incentivize customers in real-time to pick up online orders in store versus shipping it to both drive traffic and cut shipping costs.

In the Coresight Research report What are US Consumers Picking Up in Stores and Where, we found Kohl's and Macy’s to be the fifth and seventh most-used BOPIS retailers in the US, respectively. The study found that nearly 13% of US BOPIS shoppers had collected online orders from Kohl's in the past 12 months, while some 10% of shoppers picked up online orders from Macy’s.

Embracing New and Intelligent Technology to Refine their Businesses

Many retailers are transforming their business models to incorporate new technologies. For instance, clothing store H&M is incorporating its digital concept into brick and mortar locations. In 2018, the company introduced new technologies into its stores, such as smart mirrors that allow shoppers to try on outfits digitally. This closes the gap between online and physical sales as it allows customers in store to see what an item available online only would look like on them, and creates an interactive in-store shopping experience.

Nordstrom is another department store using technology to bring customers to physical stores. The company offers self-service bins that allow shoppers to drop off returns and receive instant credit. It has also modernized its personal stylist service and offers various online styling services, such as “Stitch Fix.” Nordstrom is generating synergy by sharing data from its rewards program with brands to track purchasing trends, and has leveraged its relationships with brands to install in-store pop-ups with brands lsuch as Allbirds, Goop and Comme des Garçons.

To boost its shopping experience with new technologies, Nordstrom also acquired two retail tech companies, BevyUp and MessageYes, in 2018. With Style Boards, a BevyUp feature, store associates can provide personalized product recommendations and advice – even of they’re not in the store. MessageYes enables Nordstrom to send consumers personalized text messages and notificationx. The partnership with MessageYes will help Nordstrom to leverage shoppers’ data to better understand the end-to-end consumer journey and also to build digital communication with shoppers in-store.

Some US department stores have also benefitted from RFID inventory tracking systems. This Internet of Things (IoT) technology has the potential to transform the way retailers track the location and movement of items in-store. For example, RFID tagging helped Macy’s maintain gross unit variance in a 2% to 4.5% range and allowed the company to count items 30 times faster than with traditional barcodes and scanners, according to the Platt Retail Institute’s analysis of Macy’s data in 2017. As of December 2018, Macy’s had tagged apparel items in more than 900 locations with RFID.

Similarly, Kohl's has also adopted RFID to track goods in real-time and improve inventory management, helping avoid markdowns on overstocked goods and promoting understocked products. The company held $3.7 billion in inventory as of the first quarter of fiscal 2019, down from $4.2 billion four years earlier. Kohl’s has been able to reduce its inventory in lower-volume stores without shrinking store size.

Besides RFID, Kohl's is using machine learning software to help store managers track best selling items and better manage assortment. The company has also added 2,500 handheld devices and introduced smart fulfillment so store associates can more quickly replenish inventory.

Kohl's, through localization, has also tailored assortments to meet the unique requirements of each of its stores. According to the company’s CEO Kevin Mansell, nearly 95% of assortments are localized by store and this strategy has improved the style relevance and cut inventory at the end of each selling season.

The Way Ahead

In recent years, department stores have made some improvements; however, they have generally not been able to evolve as quickly as rivals such as Walmart and Target. In the first quarter of 2019, Kohl's comparable sales declined 3.4%, the first negative growth since the second quarter of 2017, while Nordstrom saw a decline of 3.5% after posting five consecutive quarters of positive comp sales. Both Kohl's and Nordstrom lowered full-year profit expectations.

JCPenney’s same-store sales decreased 5.5%, below the consensus estimate of a 4.1% decline. However, Macy’s posted strong first quarter fiscal 2019 results, reporting a sixth consecutive quarter of comparable sales growth and double-digit growth in digital, with improvements in brick and mortar stores, too.

Many department stores are still struggling to address fundamental issues such as mall locations and inadequate upgrades. To reinvent themselves, we believe department stores need solid transformation plans, such as investing in strong digital brands, creating an attractive product mix and enhancing brick and mortar locations to boost omnichannel fulfillment.

Going forward, we will continue to see department stores rightsizing and partnering with other retailers and unique partners to drive store traffic and generate revenue by leasing unused store space. More brands/retailers will rethink their in-store experiences to draw shoppers back to the store. As with Macy’s, department stores will implement experiential concepts, including pop-up marketplaces and virtual shopping.

Department stores will offer more assorted merchandise to appeal to younger audiences with greater ranges in brands and designer mixes from high-end designers to everyday names. This merchandising approach will include more frequent (and exclusive) items that may be found in a marketplace setting, pop-up, shop-in-shop or “drop” model.

We believe technology will play an important role in refining business processes and helping department stores focus on critical business areas. Department stores offer a more interactive in-store retail experience, using virtual fitting rooms, augmented reality (AR) for shoppers to see themselves in various apparel and accessories, and touchscreen panels to find and combine merchandise.

Department stores are just beginning to set up service hubs, establish self-checkout stations and kiosks, and equip store associates with mobile devices to better serve customers – all of which are already standard in other sectors.

In the coming years, we will see department stores experimenting with self-driving small stores, high-end AR/VR locations, and back-end systems that track details about customers. Some retailers will also introduce robotic process automation (RPA) in stores to free up staff to interact with customers.