DIpil Das

Introduction

What’s the Story? We discuss key metrics for major regional grocery chains by region and map their store locations using data analytics platform ChainXY. We also discuss two key M&A trends in the US regional grocery market. We consider US regional players with a footprint of 50–1,500 stores and exclude regional chains that are subsidiaries of national retailers. Why It Matters In the crowded, fragmented US grocery market, regional grocers are finding themselves in an increasingly difficult spot. Big grocery players are finding ways to expand by exploiting their scale to fund huge investments in online grocery and other innovations, which took on far greater significance amid the pandemic. Regional grocers are also being squeezed by alternative retail formats such as dollar stores and discounters such as Aldi, due to their aggressive store opening programs. Like other retailers, regional grocers must also contend with ongoing supply chain disruptions and wage pressures that are impacting their margins. The pandemic offered many regional grocers a lifeline, as the food-at-home channel gained share at the expense of food-away-from-home. As demand begins to normalize, small- and mid-tier regional players will face a huge bump in capital expenditure to keep up with pandemic-driven trends. We expect to see modest consolidation in the space as smaller players that cannot compete will ultimately drop out of the market or be acquired by more prominent players.Regional Grocery Chains in the US: Coresight Research Analysis

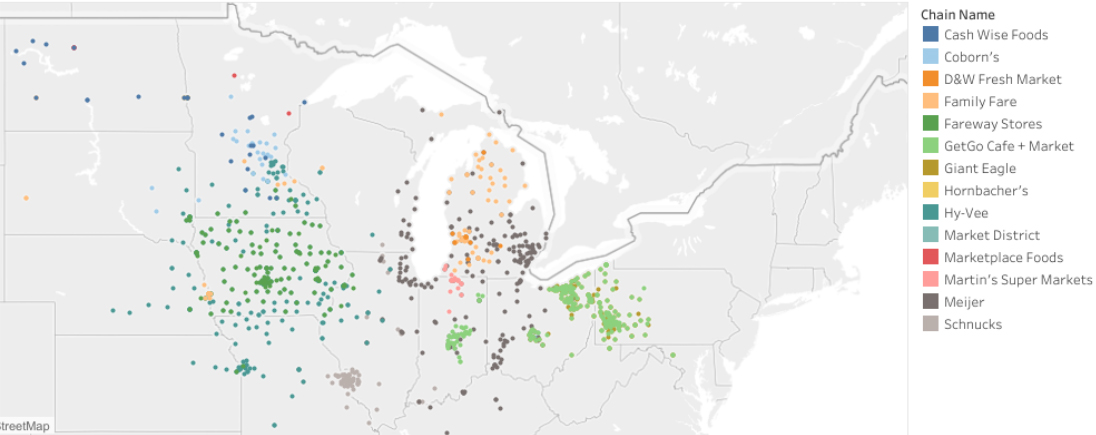

Major Regional Grocery Chains, by Region We provide total store counts and detail areas served by major regional grocery chains in each US region. We also provide maps showing these chains’ store footprint emphasizing how heavily segmented the US grocery market is. Midwest Hy-Vee is the dominant regional supermarket chain in the Midwest, with a total store count of 309. The company’s footprint is primarily concentrated in Iowa, where it operates 165 locations, over half its total fleet. In December 2021, Hy-Vee announced plans to expand outside the Midwestern region into four new states: Alabama, Indiana, Kentucky and Tennessee. Hy-Vee is followed by Giant Eagle, which has a physical presence in the Midwest, Northeast and South regions. The company operates a total 271 stores in the Midwestern states of Ohio and Indiana (comprising 160 GetGo stores, 100 Giant Eagle stores and 11 Market District locations).Figure 1. Midwestern Regional Grocers: Presence by State and Store Count [wpdatatable id=1894 table_view=regular]

Companies listed largest to smallest by store count Source: ChainXY/Coresight Research We show the store concentration of Midwestern regional grocery chains in Figure 2.

Figure 2. Midwestern Regional Grocers: Store Distribution [caption id="attachment_145616" align="aligncenter" width="700"]

Source: ChainXY/Coresight Research[/caption]

Northeast

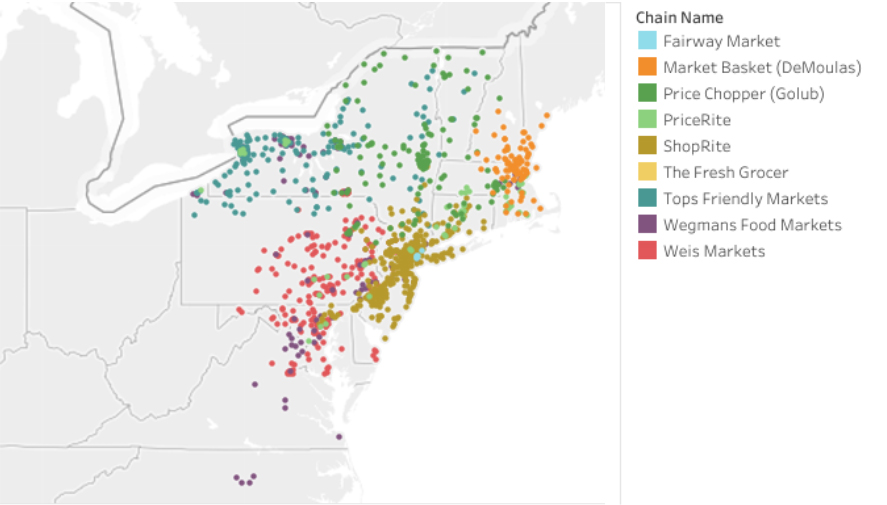

Retailer-owned cooperative Wakefern leads in the Northeast in terms of number of locations, operating 380 stores. The company trades under the banners Dearborn Market, Fairway Market, The Fresh Grocer, Gourmet Garage, PriceRite and ShopRite. Its largest banner, ShopRite, has 322 stores, the majority of which (185) are in New Jersey.

Northeast Grocery, a newly formed merger between New York-based grocery chains Price Chopper/Market 32 and Tops Friendly Markets, has a footprint of nearly 300 stores. The chains stated that the merger, completed in November 2021, would help them create scale and bring efficiencies to become more competitive. Both Price Chopper/Market 32 and Tops Friendly Market’s stores are concentrated in New York, where they operate 80 and 142 locations, respectively.

Source: ChainXY/Coresight Research[/caption]

Northeast

Retailer-owned cooperative Wakefern leads in the Northeast in terms of number of locations, operating 380 stores. The company trades under the banners Dearborn Market, Fairway Market, The Fresh Grocer, Gourmet Garage, PriceRite and ShopRite. Its largest banner, ShopRite, has 322 stores, the majority of which (185) are in New Jersey.

Northeast Grocery, a newly formed merger between New York-based grocery chains Price Chopper/Market 32 and Tops Friendly Markets, has a footprint of nearly 300 stores. The chains stated that the merger, completed in November 2021, would help them create scale and bring efficiencies to become more competitive. Both Price Chopper/Market 32 and Tops Friendly Market’s stores are concentrated in New York, where they operate 80 and 142 locations, respectively.

Figure 3. Northeastern Regional Grocers: Presence by State and Store Count [wpdatatable id=1895 table_view=regular]

Companies listed largest to smallest by store count Source: ChainXY/Coresight Research We show the store concentration of Northeastern regional grocery chains in Figure 4.

Figure 4. Northeastern Regional Distribution [caption id="attachment_145617" align="aligncenter" width="701"]

Source: ChainXY/Coresight Research[/caption]

South

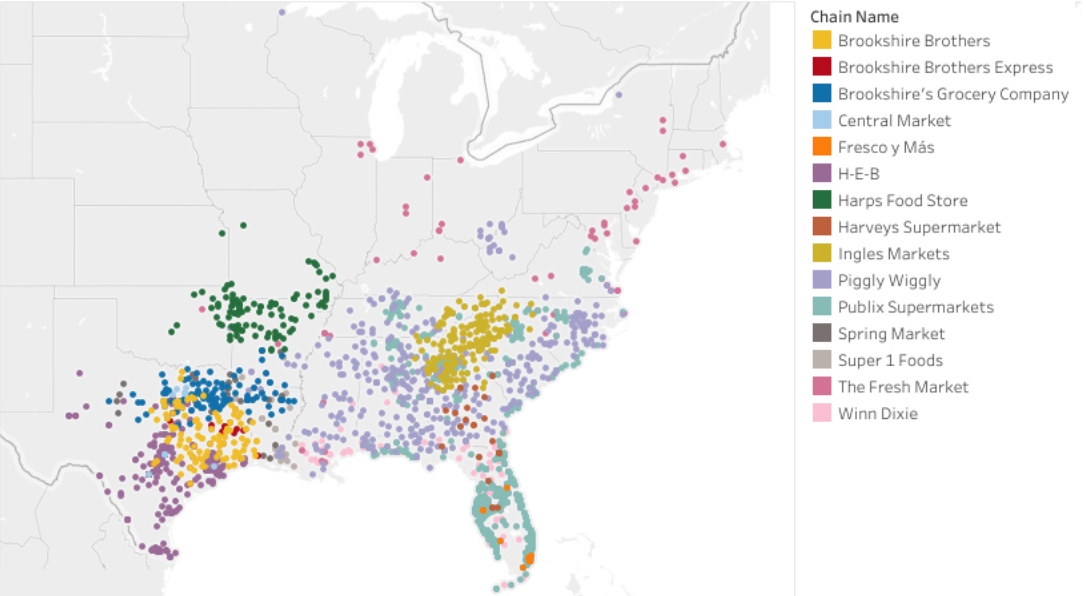

Publix is the major regional grocery chain in the South, operating 1,338 locations across eight states. Publix supermarkets are concentrated in Florida, where it operates 852 stores, 64% of all its locations.

Publix’s biggest southern competitor is Southeastern Grocers, which operates 424 locations. Southeastern Grocer’s most prominent banner, Winn Dixie, operates 370 stores, concentrated in Florida, where it has 284 locations.

Source: ChainXY/Coresight Research[/caption]

South

Publix is the major regional grocery chain in the South, operating 1,338 locations across eight states. Publix supermarkets are concentrated in Florida, where it operates 852 stores, 64% of all its locations.

Publix’s biggest southern competitor is Southeastern Grocers, which operates 424 locations. Southeastern Grocer’s most prominent banner, Winn Dixie, operates 370 stores, concentrated in Florida, where it has 284 locations.

Figure 5. Southern Regional Grocers: Presence by State and Store Count [wpdatatable id=1896 table_view=regular]

Companies listed largest to smallest by store count Source: ChainXY/Coresight Research We show the store concentration of Southern regional grocery chains in Figure 6.

Figure 6. Southern Regional Grocers: Store Distribution [caption id="attachment_145618" align="aligncenter" width="700"]

Source: ChainXY/Coresight Research[/caption]

West

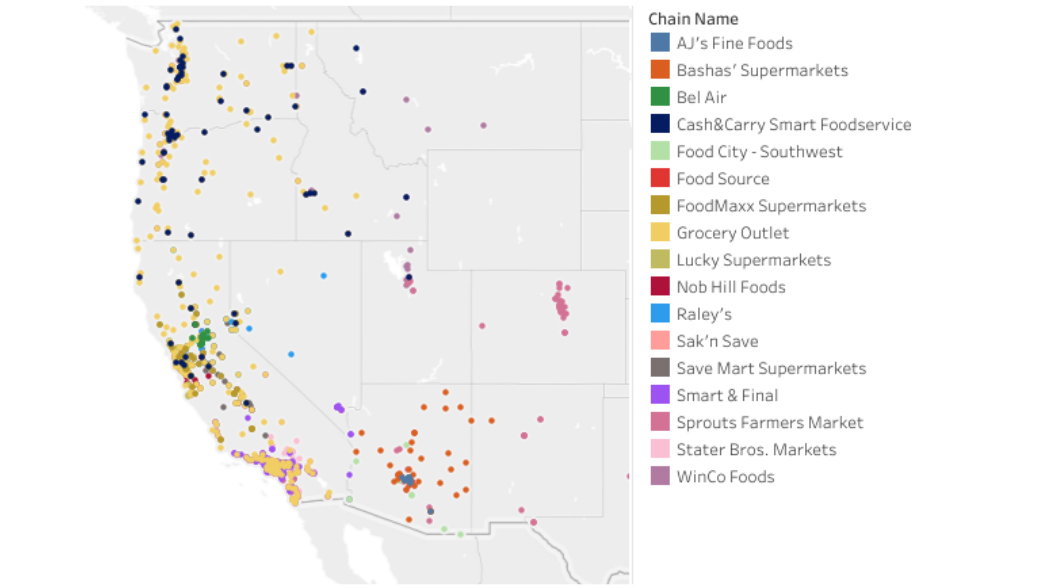

Grocery Outlet leads the number of locations in the West, operating 397 stores across California, Idaho, Nevada, Oregon and Washington. On the East Coast, it has 25 stores. Grocery Outlet’s stores are concentrated in California, where it operates 248 stores.

Smart & Final, which operates non-membership warehouse store formats, has around 265 stores, the majority of which (249) are in California.

Source: ChainXY/Coresight Research[/caption]

West

Grocery Outlet leads the number of locations in the West, operating 397 stores across California, Idaho, Nevada, Oregon and Washington. On the East Coast, it has 25 stores. Grocery Outlet’s stores are concentrated in California, where it operates 248 stores.

Smart & Final, which operates non-membership warehouse store formats, has around 265 stores, the majority of which (249) are in California.

Figure 7. Western Regional Grocers: Presence by State and Store Count [wpdatatable id=1897 table_view=regular]

Companies listed largest to smallest by store count Source: ChainXY/Coresight Research We show the store concentration of Western regional grocery chains in Figure 8.

Figure 8. Western Regional Grocers: Store Distribution [caption id="attachment_145619" align="aligncenter" width="700"]

Some retailers’ locations outside the region are not shown

Some retailers’ locations outside the region are not shown Source: ChainXY/Coresight Research [/caption] Key M&A Trends for US Regional Grocery Chains 1. Regional Grocers Are Banding Together To Stay Competitive National grocery players engaged in a substantial number of M&A transactions in the five years prior to 2020, acquiring mid-sized regional competitors to boost their market share. However, during the pandemic, M&A activity has become more prominent within the regional ecosystem, with many mid-tier and smaller players acquiring or merging with other independent chains to boost their economies of scale.

- Texas-based grocery chain Brookshire Grocery Company acquired Reasor’s in January 2022. The acquisition added a fifth banner to Brookshire’s retail portfolio, expanding its total footprint to over 200 stores, from 184 previously.

- California-based grocery chain Raley’s acquired Arizona grocer Bashas’ in December 2021 to form The Raley’s Companies. The combined entity operates more than 200 stores across Northern California, Arizona, New Mexico and Nevada.

- Minnesota-based grocer Coborn acquired Upper-Midwest chain Tadych’s Econofoods in December 2021, and in doing so entered its fifth state, Michigan. The acquisition boosted Coborn’s store count by around 10% and further strengthened its position in the Midwest market.

- New York-based grocer Price Chopper/Market 32 merged with Tops in November 2021 to form a new enterprise, Northeast Grocery. The deal almost doubled the two independent chains’ collective footprint across the six Northeastern states. Northeastern Grocery operates a total of 293 stores.

- Grocery distributor C&S Wholesale entered a definitive agreement to acquire Piggly Wiggly Midwest in July 2021. It will own and operate 11 Piggly Wiggly corporate-run stores, 84 franchisees in Wisconsin and serve 14 Butera Market supermarkets.

- Southeastern Grocers joined forces with DoorDash in December 2021 to offer delivery in as little as 45 minutes from more than 400 stores across Alabama, Florida, Georgia, Louisiana and Mississippi—its fourth third-party partnership. The grocery chain announced partnerships with Instacart and Shipt in late 2019 and teamed up with Uber in 2020.

- Publix and Instacart launched a convenience service offering delivery in as little as 30 minutes in November 2021, expanding a collaboration that initially began in 2016. The service, called Publix Quick Picks, is available across the grocer’s seven-state footprint.

- Smart & Final partnered with Uber in January 2022 to expand its on-demand grocery delivery to customers across the West Coast.

What We Think

Regional grocers enjoy a high level of trust with their customers. The key issue for them going forward is to keep up with pandemic-driven trends and invest in technologies for e-commerce, marketing and personalization and automation, which will allow them to further strengthen their customer relationships. Implications for Retailers- Regional grocery chains should offer hyper-customized experiences such as tailored food assortments including niche products, private labels and local produce, which cannot be replicated by big-box retailers.

- Regionals should turn their smaller size to their advantage by moving more nimbly and rolling out concepts more quickly than heavily layered, larger competitors.

- Many regional chains embraced the third-party delivery model as a stopgap measure to manage the initial pandemic-driven online grocery shopping surge. As regionals look to acquire, engage and retain online grocery shoppers after the pandemic, they need to invest in their own digital offerings, working in parallel with third-party platforms to regain control over their relationships with their customers.

- Regionals will look to leverage innovation and technology to keep up with pandemic-driven industry trends, improve their margins and retain customer loyalty. Technology vendors must capitalize on the environment and highlight the importance of their solutions for grocery retailers’ pain points. For example, automated micro-fulfillment center technology providers must offer solutions that are flexible enough to work in regional grocers’ different retail locations and have the capacity to expand as online order volumes grow.

- Regional grocers will also seek access to tools to help them to narrow the digital capabilities gap and prevent the loss of brands’ advertising spend to third-party providers such as Instacart. Technology vendors should help such grocers to establish viable e-commerce apps and websites and the necessary infrastructure and analytics platforms to better understand and serve their customers, which can then support the construction of profitable media platforms.