albert Chan

Introduction

What’s the Story?

Customers, employees and governments are increasingly demanding sustainability efforts from businesses, and so US corporations are facing growing pressure to reduce their greenhouse gas (GHG) emissions across the board—from their own operations to logistics and production partners.

Coresight Research has identified sustainability as a key trend to watch in retail and a component trend of Coresight Research’s RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer-centricity, in 2022 and beyond (see the appendix of this report for more details).

To shed light on GHG emissions from retail supply chains, we discuss 10 US retailers known for the vastness of their global supply chains, selected from the Coresight 100 (our focus list of the largest and most influential companies in the global retail ecosystem).

Why It Matters

In 2018, the “Special Report on Global Warming of 1.5°C,” published by the Intergovernmental Panel on Climate Change (IPCC), a United Nations (UN) body, proposed that GHG emissions be halved by 2030 and reach net zero by 2050 to limit global warming to 1.5°C—said to be the critical milestone to preventing the worst consequences of climate change. Corporations have a significant role to play in meeting this goal as retail supply chains have global reach. Despite rising interest at home and worldwide, the lack of a strong legal frame has left retailers to take their own initiatives in addressing GHG emissions to meet demand from shareholders and consumers—resulting in unevenness in performance and commitment. Corporate sustainability is an ongoing project that requires cooperation between retailers, stakeholders (consumers and shareholders) and regulators.Reducing GHG Emissions in the Retail Supply Chain: Coresight Research Analysis

Scope 3: A New Focus for GHG Reduction Targets

According to the GHG Protocol (the world’s most widely used greenhouse gas accounting standards), GHG emissions fall under three “scopes”: Scope 1 covers direct emissions from owned or controlled sources; Scope 2 covers indirect emissions from purchased energy; and Scope 3 includes all other indirect emissions from the value chain. Stakeholders are increasing their focus on Scope 3 GHG emissions, and some large US retailers are recognizing the need to better monitor, disclose and reduce emissions through their supply chains.

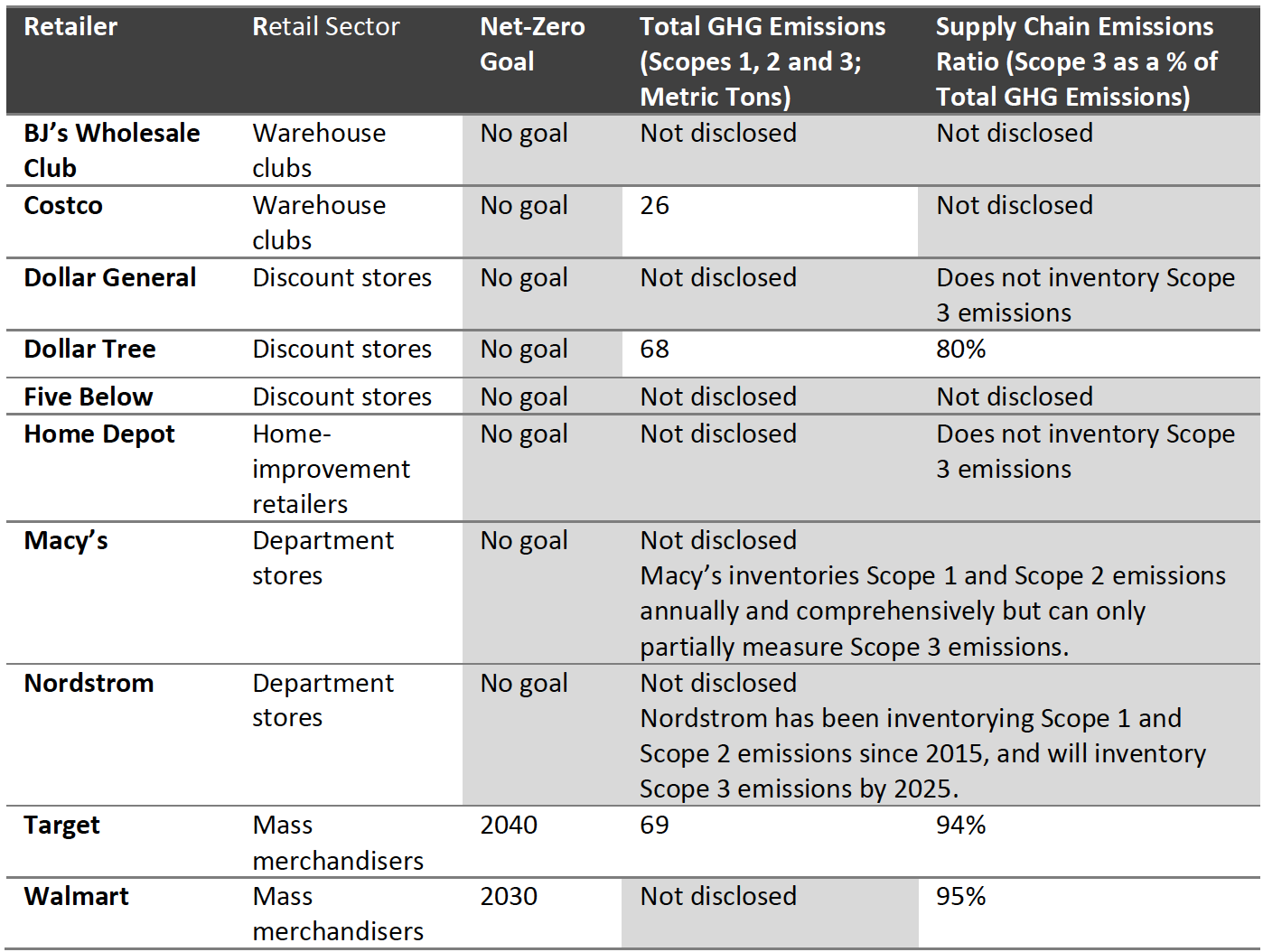

We discuss such initiatives among the 10 covered retailers and present a summary of the companies’ GHG emissions disclosures in Figure 1. The varying degree of commitment and disclosure regarding total GHG emissions is largely because disclosures are voluntary, not regulated.

- BJ’s Wholesale Club does not currently have any goals to reduce GHG emissions. Following a shareholder request in early 2022 that the company adopts and discloses such targets through its full value chain, BJ’s has committed to publicly disclose 2031 Scope 1 and 2 targets by December 2024.

- Costco has not yet disclosed the full extent of its Scope 3 emissions, nor has it set targets to reduce them. However, in January 2022, nearly 70% of the retailer’s shareholders voted in favor of a resolution for Costco to monitor and reduce supply chain GHG emissions, which was brought by mutual fund firm Green Century Capital Management. While the warehouse club has confirmed it is developing a Scope 3 inventory to lay out an action plan, it does not appear that Costco has a time-bound commitment to the reduction of Scope 3 emissions.

- In 2021, Five Below hired an outside expert to perform its first-ever environmental assessment of operations.

- Target is ahead of the curve, with plans to go net zero by 2040. The retailer inventories supply chain emissions by region. Only about 23% of its suppliers currently have reductions goals, but Target has requested that all suppliers set targets on Scope 1 and 2 emissions.

- Walmart plans to reach net zero by 2040, a decade ahead of the IPCC’s proposals. According to Zach Freeze, Senior Director of Sustainability at Walmart, said at NRF 2022 in January that 95% of Walmart’s carbon footprint is generated by supply chains. Since 2017, Walmart suppliers have avoided a total of 874 million metric tons of GHG emissions in six areas: energy use, nature, waste, packaging, transportation, and product use and design. In December 2021, in partnership with HSBC, the retailer launched a loan program to finance suppliers’ efforts to measure and reduce GHG emissions. Unregulated, however, Walmart does not disclose total amounts of GHG emissions despite its disclosure of reduction targets. The fulfillment of these goals is audited by an outsider, which Walmart does not disclose.

Figure 1. Selected 10 US Retailers: GHG Emissions Disclosure, of June 2022 [caption id="attachment_150799" align="aligncenter" width="550"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Measuring GHG Emissions from Supply Chains: Science-Based Targets

In the US, sustainability advocates and the Biden administration have recently stepped up pressure on corporations to adopt science-based targets. In March 2021, the Securities and Exchange Commission (SEC) proposed new rules requiring publicly traded companies to disclose emissions data from every partner in their supply chain. Two months later, in May, the Federal Acquisition Regulatory Council (FARC) began considering an amendment to the Federal Acquisition Regulation to require federal suppliers to disclose GHG emissions and climate-related financial risk and to set science-based reduction targets.

In the retail industry (as we discussed in the previous section), there are varying degrees of GHG reductions and measuring because a comprehensive framework has yet to emerge at the national or global level. The global initiative often espoused by corporations is the Science Based Targets initiative (SBTi), a collaboration forged in 2015 by the UN Global Compact, the World Resources Institute and the World Wide Fund for Nature (known as the World Wildlife Fund in the US). More than 1,000 corporations worldwide have worked with the initiative to lay out their science-based climate targets (which include GHG emissions).

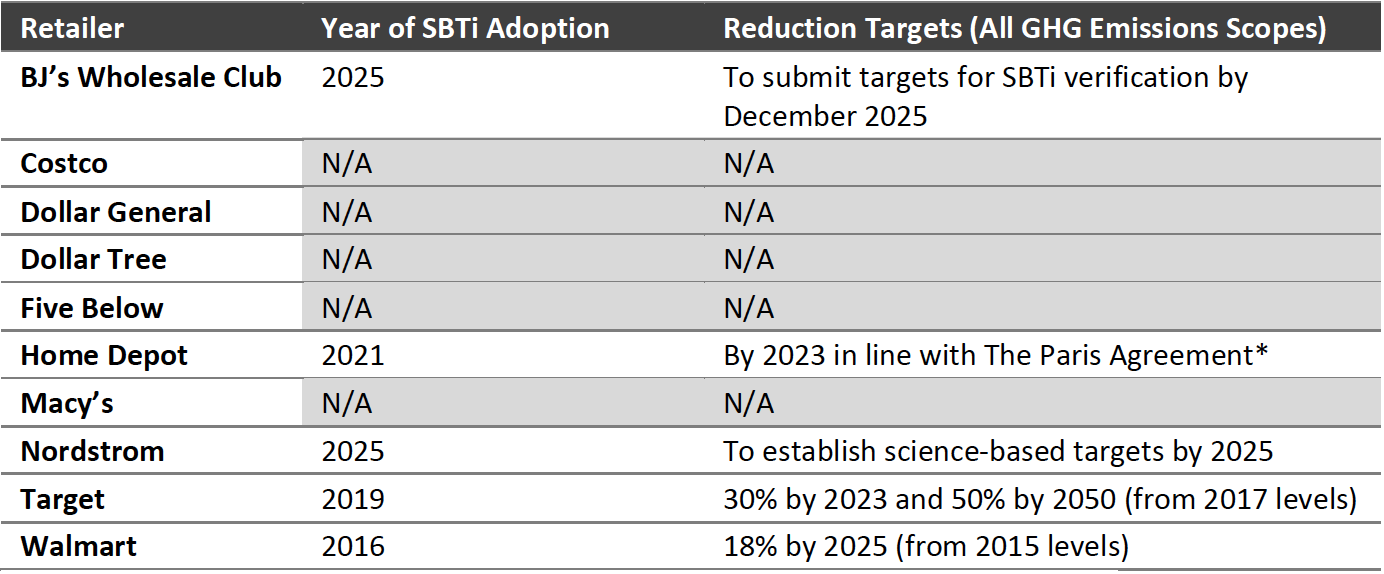

Among our 10 covered retailers, three have adopted science-based targets, and two have committed do so in the near future:

- In 2016, Walmart set GHG emissions reductions targets in line with the SBTi, making it the first US retailer and the 26th company worldwide to do so.

- Target joined the SBTi in 2019. The retailer will set a goal for Scope 3 reductions specifically by 2023. It has already set 2023 and 2050 targets for overall emissions reduction.

- Home Depot joined the SBTi in 2021.

- As part of its commitments to reduce GHG emissions in response to a shareholder request (as discussed in the previous section), BJ’s Wholesale Club stated in January 2022 that it will submit targets covering all scopes for SBTi verification by December 2025.

- Nordstrom will establish a science-based target by 2025.

Figure 2. Selected 10 US Retailers: Adoption of SBTi, as of June 2022 [caption id="attachment_150800" align="aligncenter" width="550"]

*The Paris Agreement calls for a net domestic reduction of at least 44% by 2030 from 2016 levels

*The Paris Agreement calls for a net domestic reduction of at least 44% by 2030 from 2016 levelsSource: Coresight Research[/caption]

The Need for Sustainability-Proactive Boards and Executive Leadership

As more retailers adopt SBTi, more information will be publicly available over the next several years about GHG emissions in the retail industry. However, SBTi has so far finalized standardization for only six of 13 sectors: aluminum; apparel and footwear; aviation; financial institutions; information and communication technology; and power. (As of the end of June 2022, the remaining seven are in development: buildings; chemicals; cement; forest, land and agriculture; oil and gas; steel; and transport.)

Although retail is not among these manufacturing-centric 13 areas, SBTi still approves GHG goals and action plans for retailers.

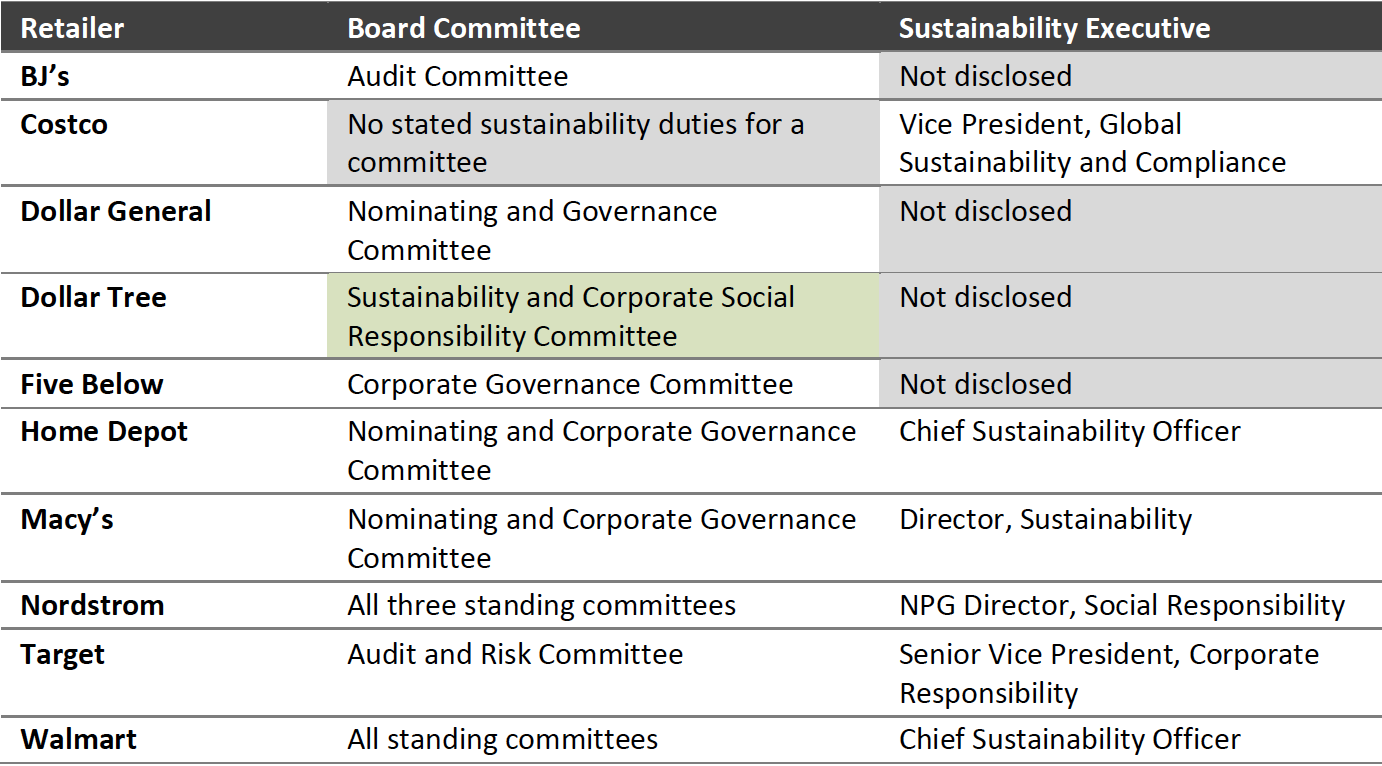

To date, amid a lack of a solid regulatory regime or a comprehensive industrywide standard, retailers’ own commitment and initiatives have played a central role in monitoring and reducing supply chain emissions, which requires sustainability-proactive boards and executive structures.

Among the 10 covered retailers, Dollar Tree is the only company that has formed a committee on its board that is responsible exclusively for sustainability/GHG matters. At other retailers, sustainability oversight is often integrated into governance committees, whose areas of responsibility can cover all three pillars of ESG (environmental, social and corporate governance). The convergence of these pillars has become common among US corporations, but it may overstretch a committee whose primary focus is typically on selecting and nominating director candidates. Alternatively, some boards have expanded the function of audit committees to monitor supply chain issues (including GHG emissions).

However, in terms of executive structure, six of the 10 covered retailers have named executive roles that take responsibility for sustainability.

Figure 3. Selected 10 US Retailers: Responsibility for Sustainability, by Board Committee and Executive Roles

[caption id="attachment_150802" align="aligncenter" width="550"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

What We Think

Fueled by public interest in, and their own commitment to, GHG reductions, many retailers are embarking on a long journey to achieve net-zero carbon emissions. However, regulations and standards are needed to boost and balance retailers’ efforts.

Sustainability is strongly associated with a brand’s image, and retailers will likely find themselves under stakeholders’ and regulatory pressure to improve GHG reduction. Businesses need to make sustainability a focal point of strategy planning, set definite targets and communicate progress periodically to all stakeholders, including consumers. Retailers should also strengthen board and managerial structures to meet sustainability needs.Brands and retailers can look to Coresight Research’s EnCORE framework to internalize a sustainability strategy. The final component of that framework—excellence in communication and reporting—will become more essential as consumers look for quantifiable reassurance on sustainability.

Technology vendors can capitalize on likely growth in demand from retail companies for digital tools to measure and monitor supply chain emissions.

Appendix: About Coresight Research’s RESET Framework

Coresight Research’s RESET framework for change in retail serves as a call to action for retail companies. The framework aggregates the retail trends that our analysts identify as meaningful for 2022 and beyond, as well as our recommendations to capitalize on those trends, around five areas of evolution. To remain relevant and stand equipped for change, we urge retailers to be Responsive, Engaging, Socially responsible, Expansive and Tech-enabled. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes.

RESET was ideated as a means to aggregate more than a dozen of our identified retail trends into a higher-level framework. The framework enhances accessibility, serving as an entry point into the longer list of more specific trends that we think should be front of mind for retail companies as they seek to maintain relevance. Retailers can dive into these trends as they cycle through the RESET framework.

The components of RESET serve as a template for approaching adaptation in retail. Companies can consolidate processes such as the identification of opportunities, internal capability reviews, competitor analysis and implementation of new processes and competencies around these RESET segments.

Through 2022, our research will assist retailers in understanding the drivers of evolution in retail and managing the resulting processes of adaptation. The RESET framework’s constituent trends will form a pillar of our research and analysis through 2022, with our analysts dedicated to exploring these trends in detail. Readers will see this explainer and the RESET framework identifier on further reports as we continue that coverage.

Appendix Figure 1. RESET Framework

[caption id="attachment_143517" align="aligncenter" width="550"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]