Reckitt Benckiser

Sector: CPG

Countries of operation: Operates in 62 countries—including Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, the UK, and the US— and sell in over 190 countries, across 6 continents, Africa, the Americas, Asia, Europe, and the Middle East

Key products: Household and personal care products

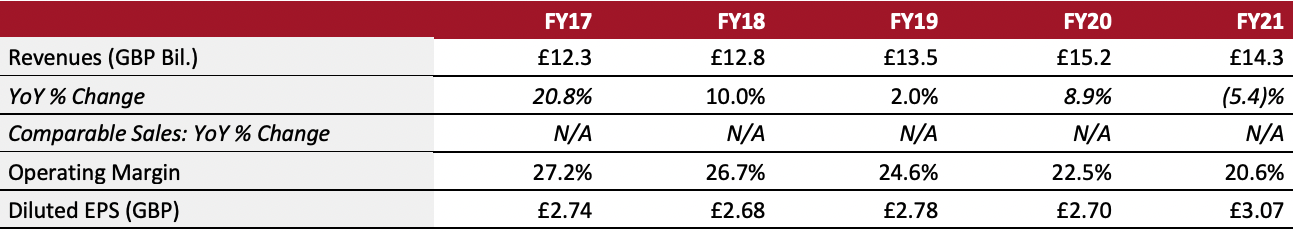

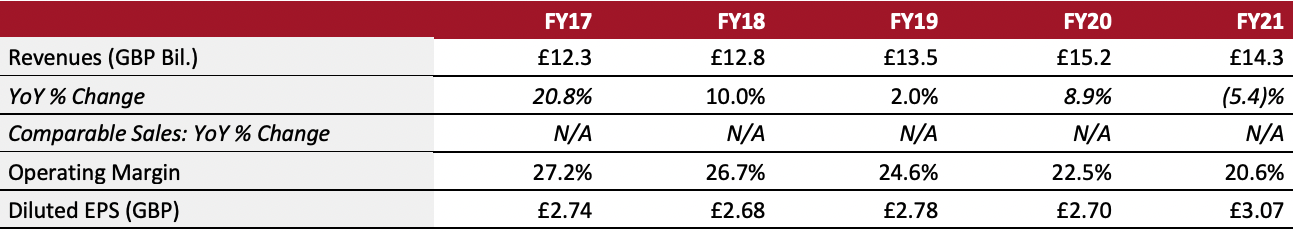

Annual Metrics

[caption id="attachment_152317" align="aligncenter" width="700"]

Fiscal year ends on December 31

Fiscal year ends on December 31[/caption]

Summary

Founded in 1819 and headquartered in Slough, England, Reckitt Benckiser offers household and personal products, operating in 62 countries and selling in over 190 countries. As one of the world’s biggest producers of household and personal products, its key brands include Airborne, Air Wick, Clearasil, Dettol, Durex, Finish, Lysol, Mead Johnson, Mucinex, Schiff and Woolite, among many others.

Company Analysis

Coresight Research insight: Reckitt Benckiser’s core strategy is focused on market expansion and innovation. We expect new products will drive organic growth in 2022, as Reckitt expanded its innovation pipeline by 50% in 2021 and is now in a position to capitalize on these new capabilities. The company is selective about the markets it enters and ensures that the products it advertises align with market demands. The company is also driving growth by actively managing its brand portfolio by pruning underperforming brands and acquiring fast-growing brands that will aid entry into new markets.

| Tailwinds |

Headwinds |

- Strong performance in hygiene and recovery in health segments, particularly in North America

- Market-leading brands across all its categories

- In-market competitiveness remains strong, as 62% of Reckitt’s core category market units, excluding Infant Formula and Child Nutrition (IFCN) China, held or gained share

- E-commerce net revenue, excluding IFCN China, grew by 17% in 2021 and accounted for 12% of group net revenue

- Reckitt plans to leverage deep consumer insights and technology to help it offer personalization across product categories

|

- Cost inflation of goods in the low teens in 2022, according to the company

- Logistics prices will soar due to the rising prices of tinplate, crude oil and other transport costs

|

Strategy

Reckitt Benckiser has outlined the following key focus areas to meet customers’ expectations and to futureproof the group:

1. Increase penetration by capturing new consumers

- Reckitt plans to apply appropriate pricing and net revenue growth management initiatives in 2022 to offset commodity inflation pressures.

- The company will sell targeted products to markets with significant demand. For example, it popularized its dishwasher products through targeted media campaigns and strategic alliances with dishwasher manufacturers in Turkey, the country with the highest dishwasher penetration.

- Reckitt will continue investing in its Lysol brand to meet continued demand—80% of consumers say that they will maintain their new sanitation habits after the pandemic.

2. Gain market share through superior solutions

- Reckitt plans to manage its portfolio more actively, navigating it towards higher growth. The company sold IFCN China Business and Scholl in 2021 and now plans to complete the sale of E45 in the second quarter of 2022. It also acquired Biofreeze, a top double-digit growth US-based topical analgesic business.

- Reckitt’s current innovation pipeline is 50% larger than it was in 2020. Similarly, its investment in capabilities has created a 2022 product pipeline that is almost 50% larger than its 2021 pipeline.

3. Expand into new adjacencies, channels, and geographies

- The company’s investment into emerging technologies will continue to drive high growth in its e-commerce platforms. Reckitt also plans to adopt an automation-first culture across all its functional areas and will move to a modular, application program interface (API) architecture for its technology stack.

- For 2022, Reckitt plans to scale up its machine learning model built in 2021 to predict consumer demand for its key categories, as well as strategic, commercial, and supply planning.

4. Shifting focus to consumer-led category growth

- Reckitt plans to shift from an innovation strategy led by brands to a category-led strategy that focuses on consumer demand. The new approach will leverage a combination of deep consumer data insights and technology to enable category thinking to drive growth.

5. Focus on developing partnerships

- The company will focus on developing more external partnerships in 2022 by launching its external partnering platform that includes technology providers, startups and accelerators, key suppliers and distributors, trade organizations, influencers and networks, and universities and research institutes.

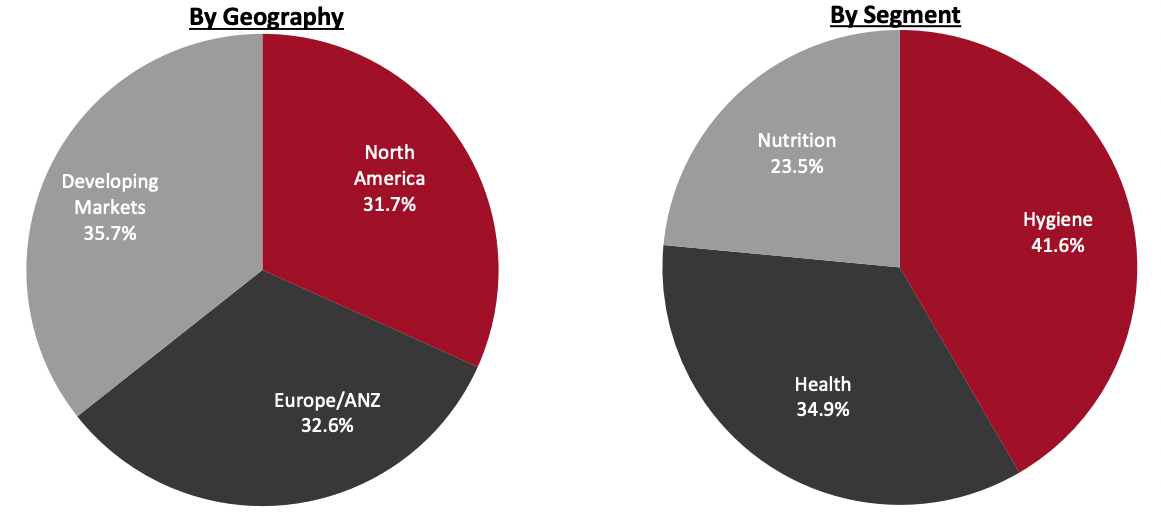

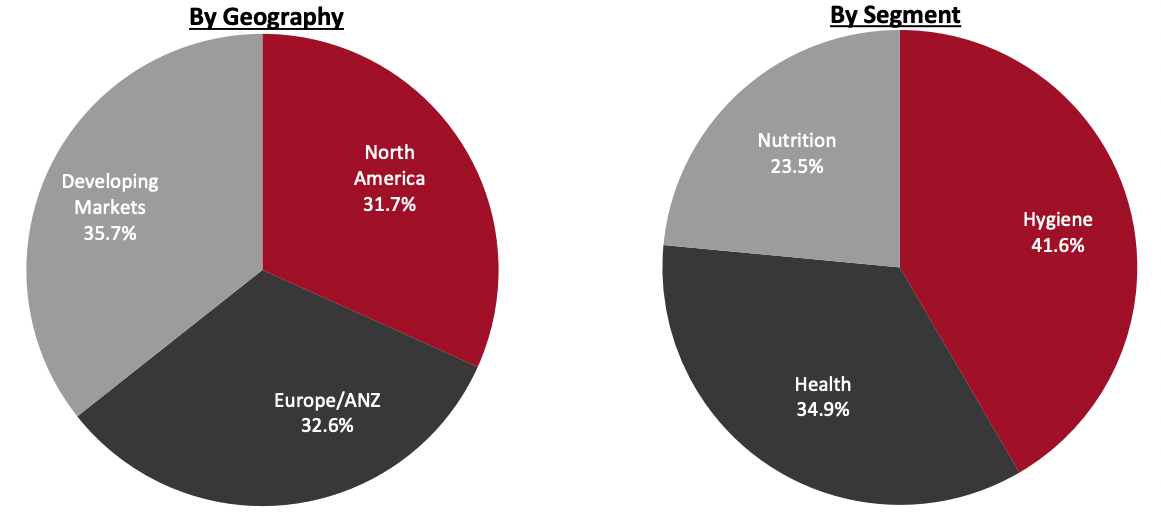

Revenue Breakdown (FY21)

[caption id="attachment_152318" align="aligncenter" width="700"]

Source: Company reports/S&P Capital IQ

Source: Company reports/S&P Capital IQ[/caption]

Company Developments

| Date |

Development |

| June 1, 2022 |

Reckitt signs Amazon’s Climate Pledge to drive improvement across its board on sustainability and the planet, and plans to become carbon neutral by 2040. |

| Mar 25, 2022 |

Reckitt announces that it has entered into an agreement to sell its Dermicool brand to Indian FMCG company Emami Limited. |

| Feb 17, 2022 |

Reckitt states that the cost of goods inflation accelerated and finished at 11% in the fourth quarter of 2022 versus 2020. Meanwhile, material costs grew by low double digits, factory conversion costs grew by mid-single-digit rates due to inflation and logistics costs grew at strong double-digit rates. |

| Dec 8, 2021 |

Reckitt partners with the University of Oxford to measure and evaluate the ecosystems and biodiversity affected by the company’s value chains. |

| Oct 26, 2021 |

Reckitt announces that nine of its top 10 brands were up double-digits on a 2-year stack basis in the third quarter of 2021. |

| Sept 23, 2021 |

Reckitt focuses on addressing its “5 megatrends:” Hygiene as a foundation of health, the importance of self-care, the need to address the global sexual infection crisis, the need for nutrition for all ages and the digital explosion. |

| July 27, 2021 |

Reckitt says it will offset the 8–9% inflation in the total cost of goods through incremental pricing and productivity. |

| July 27, 2021 |

Reckitt announces that its cold and flu over-the-counter (OTC) brands declined in the second quarter of 2022 due to a historically low flu season during the winter of 2020-2021. |

Management Team

- Christopher A. Sinclair—Chairman of the Board

- Laxman Narasimhan—Group CEO and Executive Director

- Jeffrey Carr—Group CFO and Executive Director

- Filippo Catalano—Chief Information and Digitisation Officer

- Richard Joyce—Head of Investor Relations

Source: Company reports/S&P Capital IQ

Fiscal year ends on December 31[/caption]

Summary

Founded in 1819 and headquartered in Slough, England, Reckitt Benckiser offers household and personal products, operating in 62 countries and selling in over 190 countries. As one of the world’s biggest producers of household and personal products, its key brands include Airborne, Air Wick, Clearasil, Dettol, Durex, Finish, Lysol, Mead Johnson, Mucinex, Schiff and Woolite, among many others.

Company Analysis

Coresight Research insight: Reckitt Benckiser’s core strategy is focused on market expansion and innovation. We expect new products will drive organic growth in 2022, as Reckitt expanded its innovation pipeline by 50% in 2021 and is now in a position to capitalize on these new capabilities. The company is selective about the markets it enters and ensures that the products it advertises align with market demands. The company is also driving growth by actively managing its brand portfolio by pruning underperforming brands and acquiring fast-growing brands that will aid entry into new markets.

Fiscal year ends on December 31[/caption]

Summary

Founded in 1819 and headquartered in Slough, England, Reckitt Benckiser offers household and personal products, operating in 62 countries and selling in over 190 countries. As one of the world’s biggest producers of household and personal products, its key brands include Airborne, Air Wick, Clearasil, Dettol, Durex, Finish, Lysol, Mead Johnson, Mucinex, Schiff and Woolite, among many others.

Company Analysis

Coresight Research insight: Reckitt Benckiser’s core strategy is focused on market expansion and innovation. We expect new products will drive organic growth in 2022, as Reckitt expanded its innovation pipeline by 50% in 2021 and is now in a position to capitalize on these new capabilities. The company is selective about the markets it enters and ensures that the products it advertises align with market demands. The company is also driving growth by actively managing its brand portfolio by pruning underperforming brands and acquiring fast-growing brands that will aid entry into new markets.

Source: Company reports/S&P Capital IQ[/caption]

Company Developments

Source: Company reports/S&P Capital IQ[/caption]

Company Developments