Source: Company reports/Fung Global Retail & Technology

Fiscal 4Q17 Results

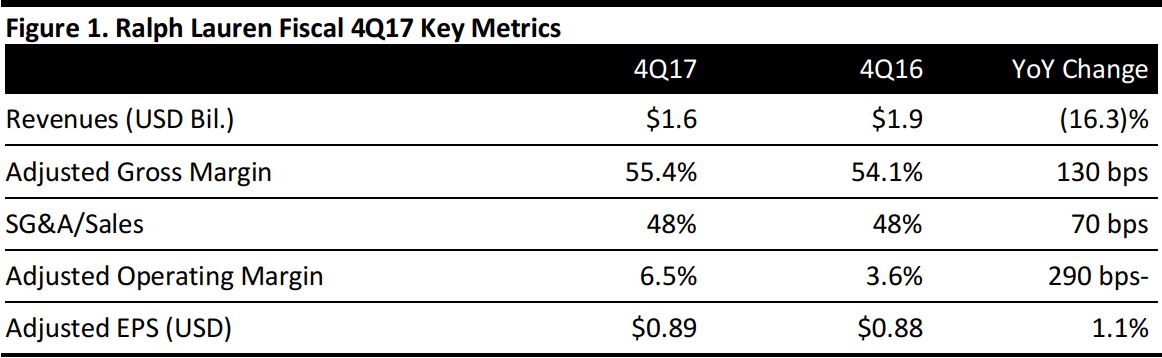

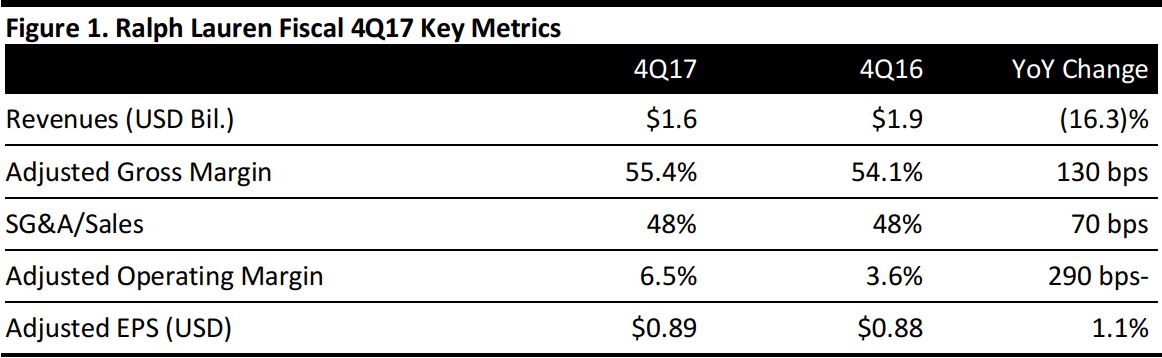

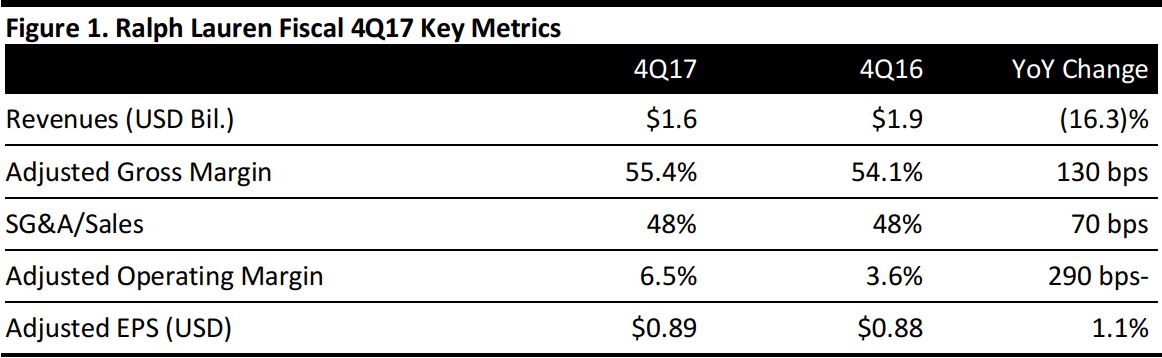

Ralph Lauren reported fiscal 4Q17 adjusted EPS of $0.89, above the $0.78 consensus estimate and in line with management guidance. Total revenues were $1.56 billion, in line with expectations, but down 16.3% year over year. Excluding the impact of foreign currency, total revenues were down 12%. Currency impacted quarterly revenue growth by approximately 100 basis points. An extra week in the year-ago quarter resulted in an additional $72 million of revenue in 4Q16.

Total comps were down 12%, missing the consensus estimate. Wholesale revenues decreased by 17%, to $777 million, and were down 15% on a constant currency basis. The decline was driven by a planned reduction in North America shipments. Retail segment revenues decreased by 16% year over year, to $745 million, and were down 9% on a constant currency basis. The lower retail sales were due to weak comp sales, challenging traffic and negative calendar impacts from Christmas and Easter. License segment revenues increased by 7%, to $43 million.

The company’s adjusted gross margin improved by 180 basis points year over year. The improvement was driven by improved quality of sales and reduced promotional activity, and was partially offset by a negative currency impact. Ralph Lauren reduced its inventory level by 30% during the quarter. The company also shortened its lead times and achieved its goal of having 50% of its business on a nine-month lead time. Ralph Lauren remains on track to reach its goal of having 90% of its business on a nine-month lead time by the end of FY18.

FY17 Results

For FY17, the company’s revenues decreased by 10%, to $6.7 billion, consistent with the prior guidance provided last June and in line with the company’s strategic Way Forward Plan. Full-year wholesale revenues decreased by 15%, to $2.8 billion, driven by a sales decline in the North America division. Retail revenues decreased by 6%, to $3.7 billion, and comp sales decreased by 7%.

Outlook

For FY18, the company expects net revenues to decrease by 8%–9%. Foreign currency is expected to have a negative impact of 150 basis points for the year. The company expects an operating margin of 9%–10.5%, excluding the impact of foreign currency, which is projected to be 50–75 basis points.

In 1Q18, the company expects revenues to be down by low double digits, excluding a negative impact of 225 basis points from foreign currency.