Source: Company reports/FGRT

Fiscal 1Q18 Results

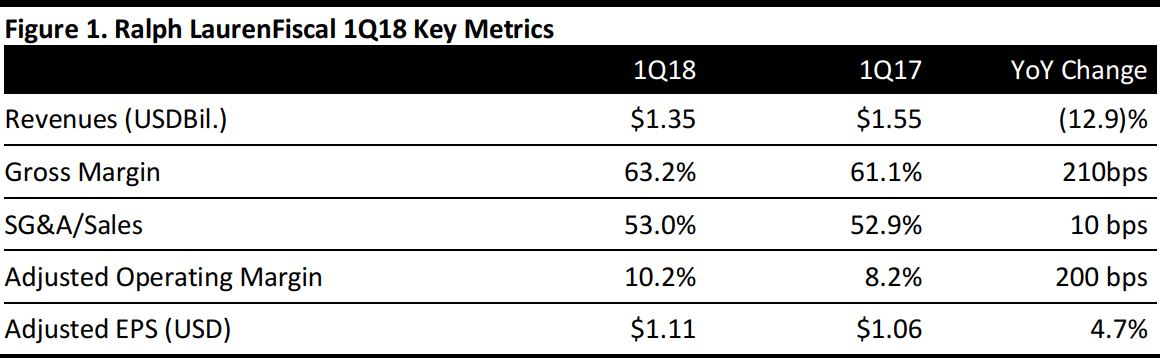

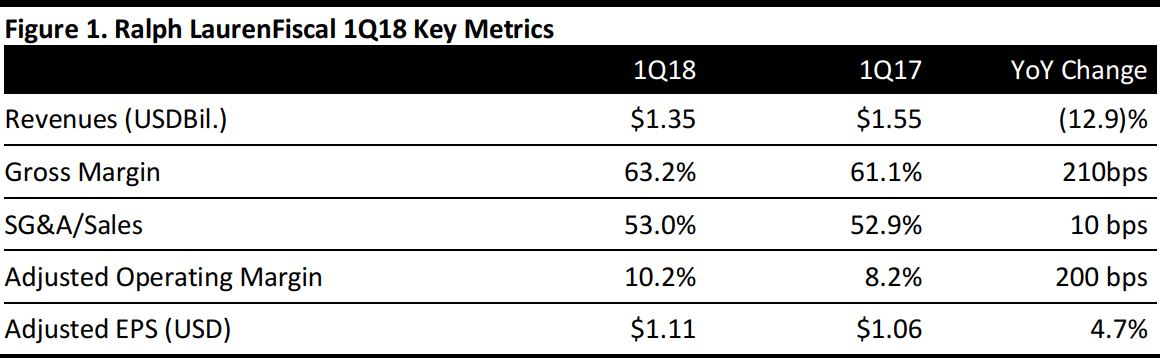

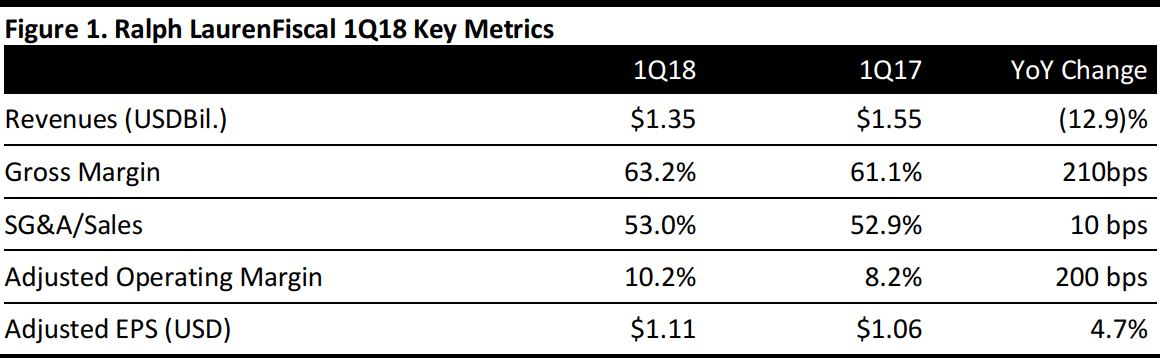

Ralph Lauren reported fiscal 1Q18 revenues of $1.35 billion, down 12.9% year over year. The decrease in revenues was driven by distribution and brand exits, a strategic reduction in shipments, reduced promotional activity and lower consumer demand.

Executive Chairman and Chief Creative Officer Ralph Lauren welcomed Patrice Louvet as President and Chief Executive Officer, saying that he was “thrilled to welcome Patrice Louvet as my partner to continue the exciting evolution of our company.”

Total Ralph Lauren comparable store sales decreased by 7% during the quarter, beating the consensus estimate of an 8.3% decline.

The company changed its reportable segments in 4Q17 to North America revenue, Europe revenue and Asia revenue. North America revenue in 1Q18 decreased by 17%, to $710 million, due to lower sales in both the retail and wholesale channels. On a constant-currency basis, comparable store sales in North America were down 8%, including a 4% decline in brick-and-mortar stores and a 22% decline in e-commerce, which reflected a reduction in inventory, reduced SKU count and reduced promotional activity.

Europe revenue in the first quarter decreased by 14% on a reported basis, to $323 million, and decreased by 10% on a constant-currency basis. The decline was driven by shifts in timing of shipments in the wholesale channel, brand exits and reduced markdowns to improve quality of sales. On a constant-currency basis, comparable store sales in Europe were down 8%,including an 8% decline in brick-and-mortar stores and a 5% decline in e-commerce. The company reported that it is focusing on pulling back on promotions and on driving quality in sales.

Asia revenue decreased by 1%, to $209 million, and increased by 1% on a constant-currency basis. Comparable store sales increased by 2% in constant currency, driven by higher traffic.

Outlook

The company maintained its guidance for FY18 on a constant-currency basis. The company expects net revenues to decrease by 8%–9% for the full year, excluding the impact of foreign currency, to $6.1–$6.2 billion.

In 2Q18, Ralph Lauren expects net revenues to be down by 9%–10%, excluding the impact of foreign currency, to $1.66–$1.67 billion.