Source: Company reports

4Q16 RESULTS

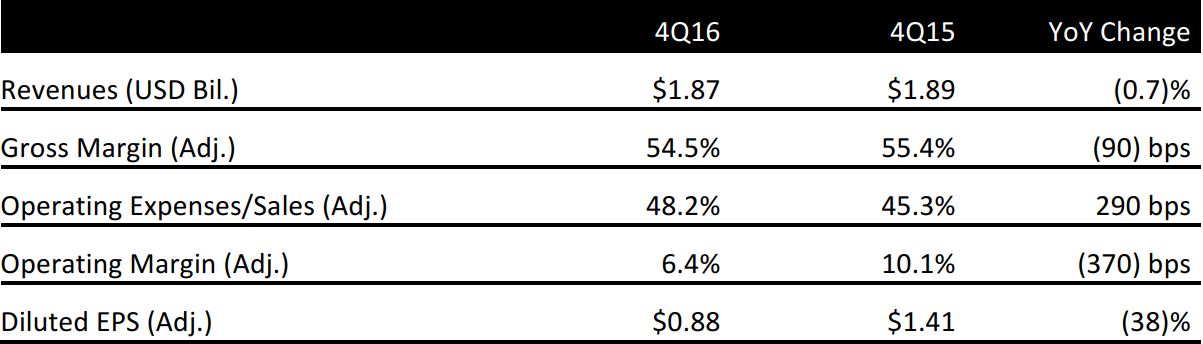

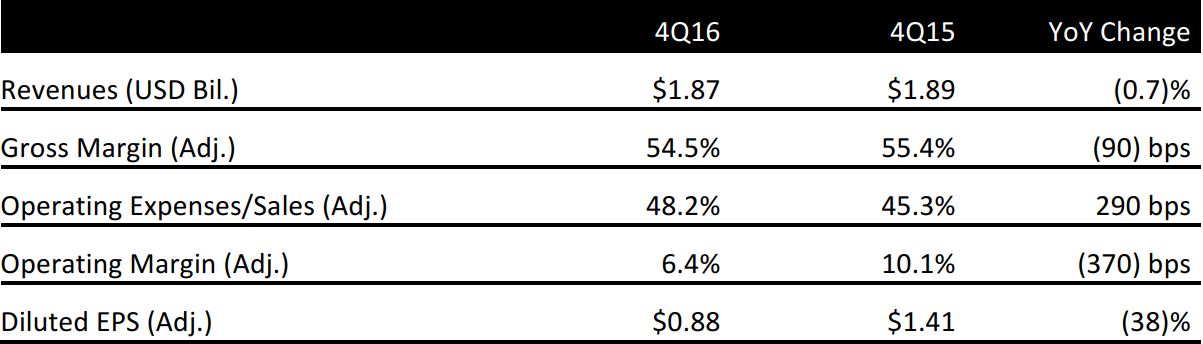

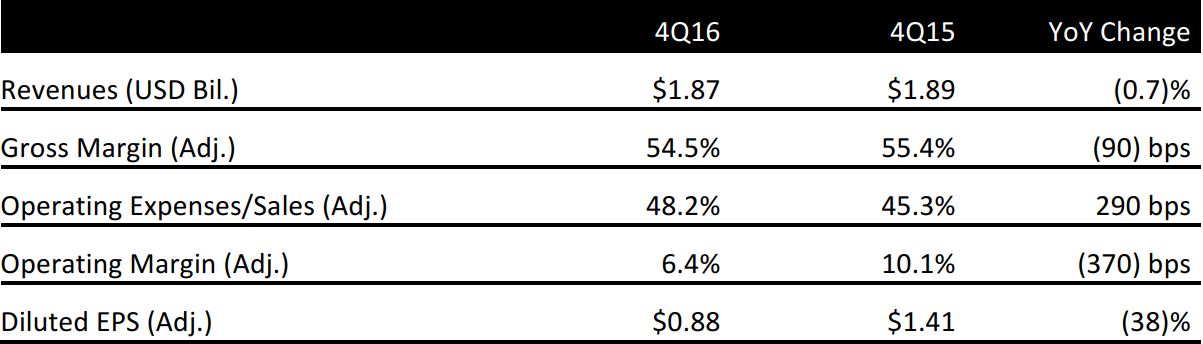

Ralph Lauren reported 4Q16 adjusted, diluted EPS of $0.88, versus the consensus estimate of $0.83 on stronger revenues and gross margins.

Total revenues were $1.87 billion, down 0.7% year over year and slightly ahead of consensus of $1.86 billion. Comps fell by 5% (excluding foreign exchange) and the EBIT margin contracted by 370 basis points; both results exceeded analysts’ expectations.

By category, wholesale revenues were down 6% year over year, to $942 million versus consensus of $970 million, primarily due to a decline in sales in North America. Sales in the retail category were $889 million (up 6% year over year) versus consensus of $846 million and were driven by the benefit of a 53rd week of sales, new store expansion, and e-commerce growth. Licensing sales totaled $40 million versus consensus of $37 million, and reflected higher royalties from increased sales of Ralph Lauren, Polo Ralph Lauren and Lauren products worldwide.

Total inventory was up 8% year over year at the end of the quarter, versus a 0.7% decline in sales during the period. During the results conference call, management mentioned that the company had taken measures (beginning during the holiday period) to begin reducing inventories. Despite this, total inventory was up, suggesting pressure via markdowns in the future. The company took a $22 million charge for underperforming stores that may be closed and announced that its board had authorized an additional $200 million share repurchase program.

FY17 OUTLOOK

The company will provide no forward guidance until its Investor Day on June 7.