Source: Company reports/Fung Global Retail & Technology

Results

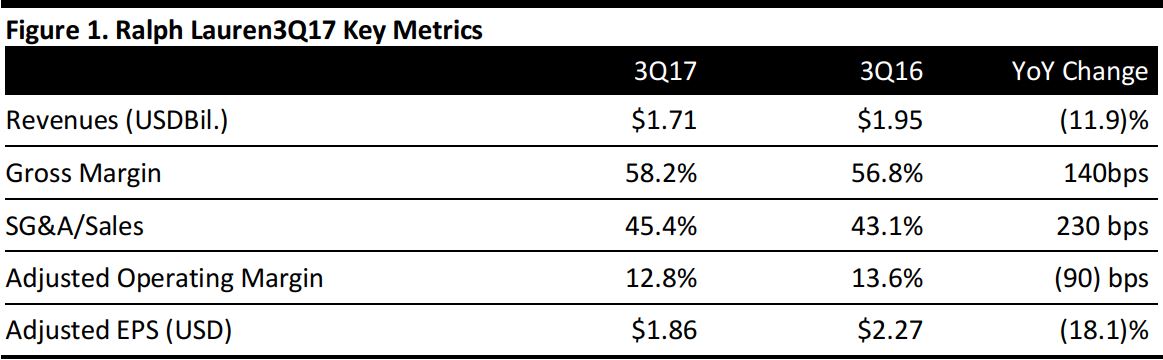

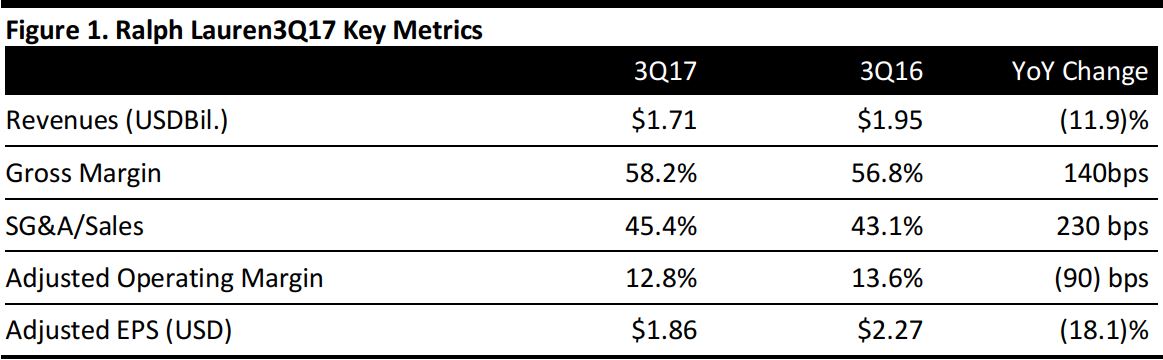

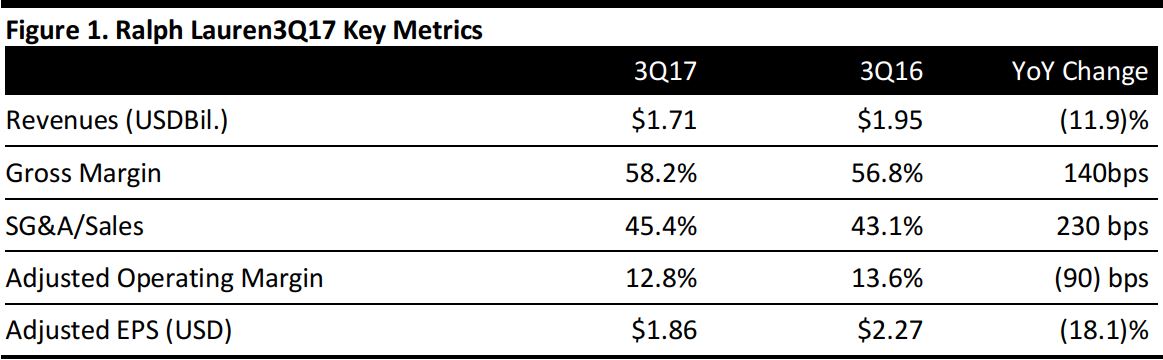

Ralph Lauren reported 3Q17 revenues of $1.71 billion, down 12% year over year.

In the retail segment, revenues decreased by 2% on a reported basis, to $1.1 billion, and decreased by 4% on a constant currency basis. Comparable store sales decreased by 5% on a reported basis and by 9% in constant currency. Declines in traffic were partially offset by favorable timing that drove post-Christmas-week sales into the company’s third fiscal quarter.

In the wholesale segment, revenues decreased by 26% on a reported and constant currency basis, to $582 million.The decrease was driven by a decline in North America, as shipments were strategically reduced as part of the Way Forward plan.

International net revenues declined by 6% in the quarter, while North America revenues were down 15% compared with the year-ago quarter.

The company also announced that CEO Stefan Larsson will depart on May 1, 2017. Larsson joined the company in November 2015 and was seen as the architect of the Way Forward plan. Executive Chairman and Chief Creative Officer Ralph Lauren and Larsson have held different views as to “how to evolve creative and consumer-facing parts of the company,” such as product, marketing and shopping experience. CFO Jane Nielsen will lead the execution of the Way Forward plan until a new CEO joins the firm.

Outlook

The company maintained its guidance for FY17 and 4Q17; full-year net revenue is expected to decrease at a low-double-digit rate, consistent with the Way Forward plan. The company continues to expect an operating margin of approximately 10% for the full year.

For 4Q17, Ralph Lauren expects a net revenue decline in the low-double-digit to low-teen-digit range, on a reported basis. Foreign currency is expected pressure revenue growth by about 100 basis points and to pressure gross margin by about 70 basis points. The operating margin for the fourth quarter is expected to be 6.0%–6.5%.