Source: Company reports

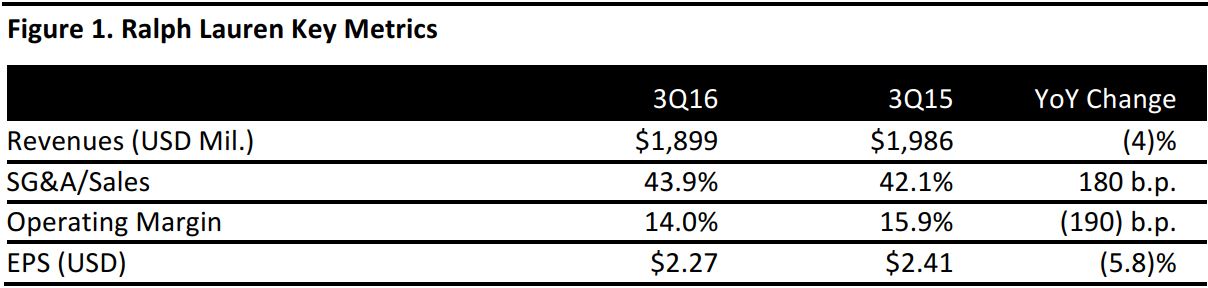

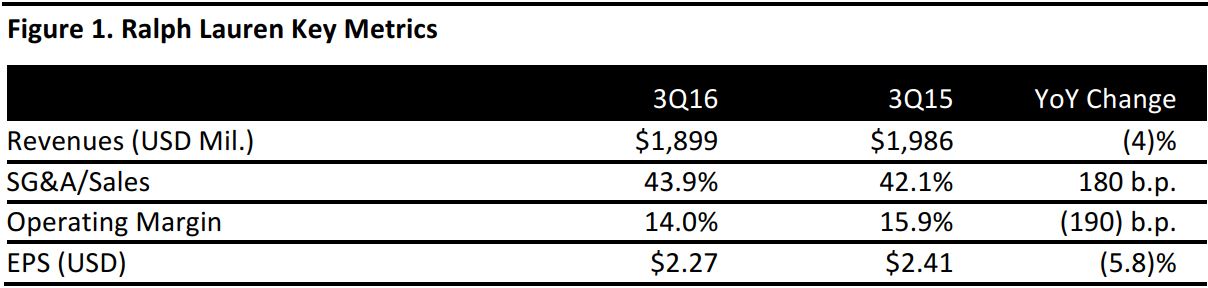

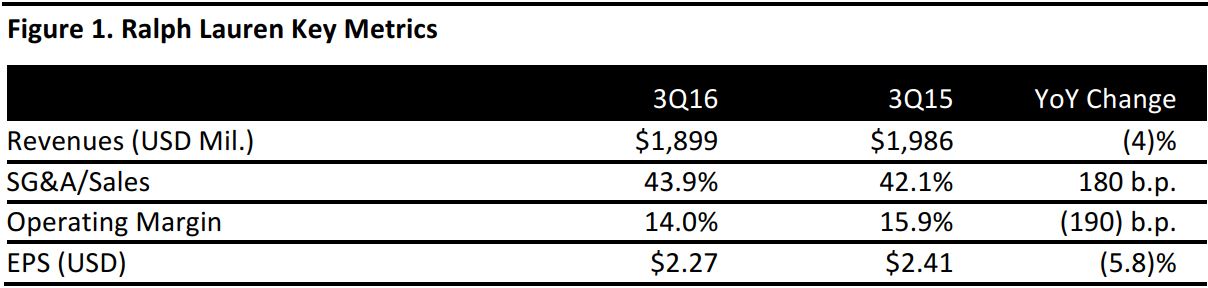

Ralph Lauren reported 3Q16 EPS of $2.27 (ex-items) versus consensus of $2.13.

Total revenues were down 4%, to $1.90 billion, versus consensus of $2.03 billion. The decrease was driven by weakness in the North American business, which declined by 4% due to unseasonably warm weather throughout the quarter, a drop in tourist traffic and product assortment challenges in the Lauren brand.

By segment, Wholesale sales were down 6%, to $786.0 million, versus consensus of $833.3 million. Retail sales were down 3%, to $1.11 billion, versus consensus of $1.14 billion. Growth in new stores and in the e-commerce channel was offset by lower comps, which were down 7% versus expectations of a 3% decline. Excluding foreign exchange, comps were down 5%. Licensing revenues were $47.0 million, inline with last year, versus consensus of $48.2 million.

Management provided 4Q guidance that calls for a 2% decline in revenues versus the consensus estimate of a 4% increase. Operating margins are expected to be down 400– 450basis points versus the prior year period due to excess inventory the company will need to clear as well as infrastructure investments and negative foreign exchange impacts.

Full-year guidance calls for a 3% decline in revenues versus prior guidance of flat sales and consensus of a 3.3% increase in sales. Operating margins are expected to decline by 290–320 basis points over the prior year due primarily to negative foreign currency effects. Previous guidance was for a decline of 180–230 basis points.