Source: Company reports/Fung Global Retail & Technology

2Q17 RESULTS

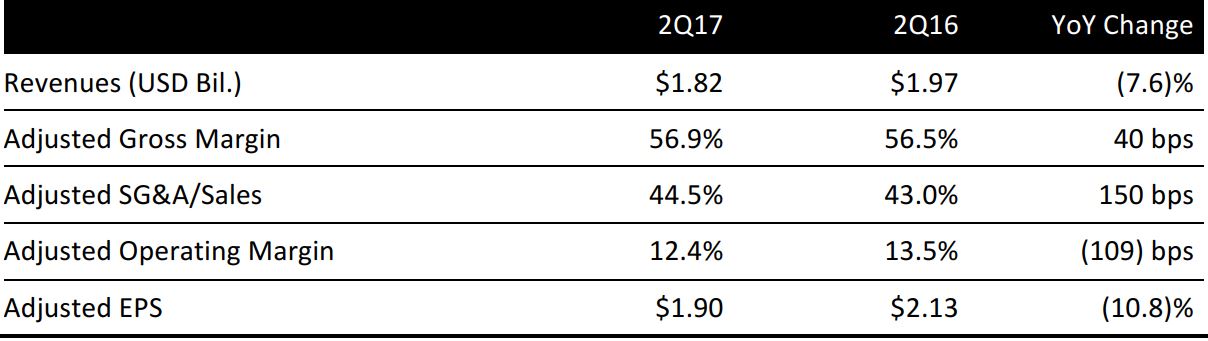

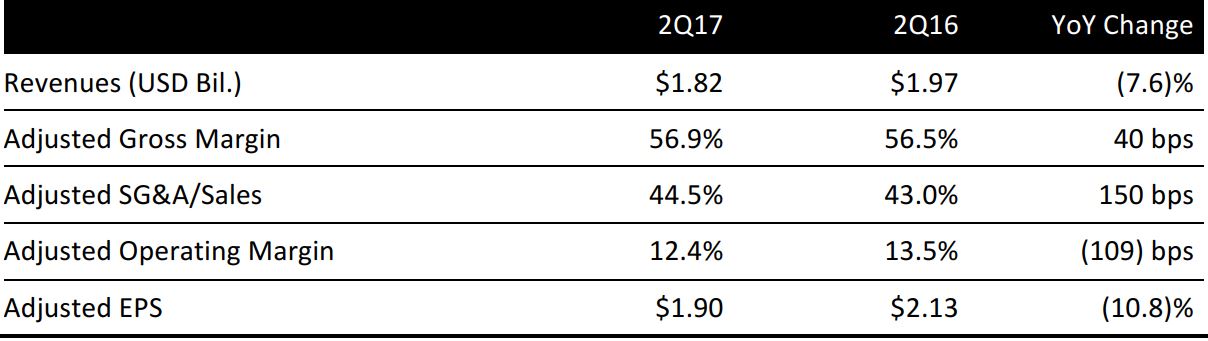

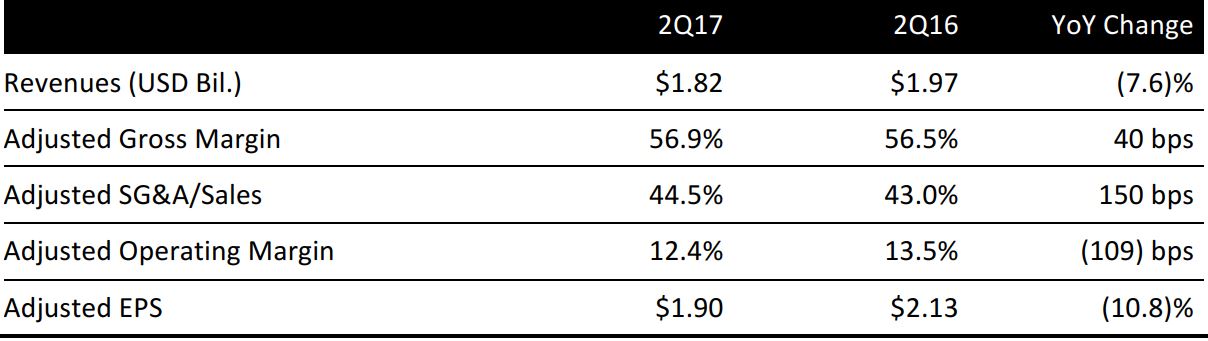

Ralph Lauren reported 2Q17 revenues of $1.82 billion, down 7.6% year over year, but beating the consensus estimate of $1.81 billion. International net revenues rose by 2%.

The wholesale segment’s revenue decreased by 10% on both a reported and constant-currency basis, to $831 million. The decrease was driven by a decline in North America, as shipments were strategically reduced as part of the company’s “Way Forward” plan. This decrease was partially offset by an increase in Europe.

The retail segment’s revenue decreased by 5% on a reported basis, to $942 million, and decreased by 6% on a constant-currency basis. Comparable-store sales decreased by 8% on a reported basis and by 9% in constant currency. The declines in traffic were partially offset by moderate markdowns.

The company improved efficiencies by lowering inventory levels by 15%, and by reducing fall 2016 SKUs by 10% across its apparel brands. The company reported that it is on track to achieve a 20% SKU reduction by spring 2017 and that this improved discipline in assortment creation enables it to buy closer to market and to reduce early commitments.

2017 OUTLOOK

For fiscal 2017, the company is maintaining its guidance: net revenue is expected to decrease at a low double-digit rate. The company continues to expect operating margin for fiscal 2017 to be approximately 10%.

For the third quarter of 2017, Ralph Lauren expects net revenues to be down in the low double digits to the low teens on a reported basis. Foreign currency is expected to have minimal impact on revenue growth in the third quarter and will pressure gross margin by at least 120 basis points. The operating margin is expected to be down by approximately 200–225 basis points.