DIpil Das

[caption id="attachment_87791" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

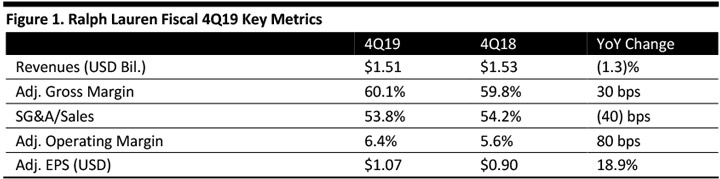

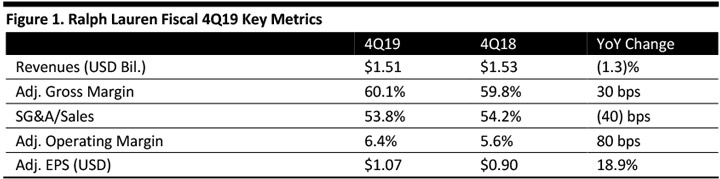

Ralph Lauren reported fiscal 4Q19 adjusted EPS of $1.07, up from $0.90 in the year-ago quarter and above the $0.89 consensus estimate. Total revenues were $1.51 billion, down 1.3% year over year (up 1.2% in constant currency) and above the $1.48 billion consensus estimate.

By region, North America revenues decreased 7% to $708 million, partly due to planned reductions in off-price sales; Europe revenues of $435 million were up 4% year over year (or 11.0% on a constant-currency basis) and revenues in Asia increased 6% (10% in constant currency) to $273 million.

In retail, comps in North America were down 4%, including a 7% decline in brick-and-mortar stores and a 6% rise in digital sales; in Europe, digital was up 6% and instore comps were 5% for a total European comp of 5%; and, Asia experienced a 4% lift in comp store sales. Growth in both stores and digital commerce benefitted Asia sales.

The company’s adjusted gross margin improved 30 basis points year over year, driven by initiatives to improve quality of sales through reduced promotional activity, but was partially offset by a negative currency impact. SG&A declined 40 bps to 53.8% of sales, for an adjusted operating margin of 6.4% of sales, an 80-bps margin expansion.

During the quarter, Ralph Lauren launched a direct-to-consumer shared inventory initiative in North America, driving increased efficiency in the distribution network and delivering strong progress on global lead time reductions.

FY19 Results

For FY19, the company’s revenues increased 2%, or 3% in constant currency, to $6.3 billion. North America revenue decreased 1% on a reported basis to $3.2 billion; Europe revenue increased 5% to $1.7 billion on a reported basis; Asia revenue increased 11% to $1.0 billion, led by over 30% growth in China. The company continued to expand with 135 new retail stores, including over 90 in Asia. In FY19, the company collaborated with UK-based streetwear brand Palace, attracting a new generation of consumers.

Outlook

For FY20, the company expects net revenues to improve 2% to 3%, to $6.4 billion to $6.5 billion. Foreign currency is expected to have a negative impact of 90-100 basis points for the year. The company expects operating margin to increase 40-60 basis points, excluding the impact of foreign currency, which is projected to be 10-20 basis points. In 1Q20, the company expects revenues to be up 3% to 5%, benefitting from the timing of Easter. Capital expenditures are projected at approximately $300 million in FY20.

Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

Ralph Lauren reported fiscal 4Q19 adjusted EPS of $1.07, up from $0.90 in the year-ago quarter and above the $0.89 consensus estimate. Total revenues were $1.51 billion, down 1.3% year over year (up 1.2% in constant currency) and above the $1.48 billion consensus estimate.

By region, North America revenues decreased 7% to $708 million, partly due to planned reductions in off-price sales; Europe revenues of $435 million were up 4% year over year (or 11.0% on a constant-currency basis) and revenues in Asia increased 6% (10% in constant currency) to $273 million.

In retail, comps in North America were down 4%, including a 7% decline in brick-and-mortar stores and a 6% rise in digital sales; in Europe, digital was up 6% and instore comps were 5% for a total European comp of 5%; and, Asia experienced a 4% lift in comp store sales. Growth in both stores and digital commerce benefitted Asia sales.

The company’s adjusted gross margin improved 30 basis points year over year, driven by initiatives to improve quality of sales through reduced promotional activity, but was partially offset by a negative currency impact. SG&A declined 40 bps to 53.8% of sales, for an adjusted operating margin of 6.4% of sales, an 80-bps margin expansion.

During the quarter, Ralph Lauren launched a direct-to-consumer shared inventory initiative in North America, driving increased efficiency in the distribution network and delivering strong progress on global lead time reductions.

FY19 Results

For FY19, the company’s revenues increased 2%, or 3% in constant currency, to $6.3 billion. North America revenue decreased 1% on a reported basis to $3.2 billion; Europe revenue increased 5% to $1.7 billion on a reported basis; Asia revenue increased 11% to $1.0 billion, led by over 30% growth in China. The company continued to expand with 135 new retail stores, including over 90 in Asia. In FY19, the company collaborated with UK-based streetwear brand Palace, attracting a new generation of consumers.

Outlook

For FY20, the company expects net revenues to improve 2% to 3%, to $6.4 billion to $6.5 billion. Foreign currency is expected to have a negative impact of 90-100 basis points for the year. The company expects operating margin to increase 40-60 basis points, excluding the impact of foreign currency, which is projected to be 10-20 basis points. In 1Q20, the company expects revenues to be up 3% to 5%, benefitting from the timing of Easter. Capital expenditures are projected at approximately $300 million in FY20.

Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

Ralph Lauren reported fiscal 4Q19 adjusted EPS of $1.07, up from $0.90 in the year-ago quarter and above the $0.89 consensus estimate. Total revenues were $1.51 billion, down 1.3% year over year (up 1.2% in constant currency) and above the $1.48 billion consensus estimate.

By region, North America revenues decreased 7% to $708 million, partly due to planned reductions in off-price sales; Europe revenues of $435 million were up 4% year over year (or 11.0% on a constant-currency basis) and revenues in Asia increased 6% (10% in constant currency) to $273 million.

In retail, comps in North America were down 4%, including a 7% decline in brick-and-mortar stores and a 6% rise in digital sales; in Europe, digital was up 6% and instore comps were 5% for a total European comp of 5%; and, Asia experienced a 4% lift in comp store sales. Growth in both stores and digital commerce benefitted Asia sales.

The company’s adjusted gross margin improved 30 basis points year over year, driven by initiatives to improve quality of sales through reduced promotional activity, but was partially offset by a negative currency impact. SG&A declined 40 bps to 53.8% of sales, for an adjusted operating margin of 6.4% of sales, an 80-bps margin expansion.

During the quarter, Ralph Lauren launched a direct-to-consumer shared inventory initiative in North America, driving increased efficiency in the distribution network and delivering strong progress on global lead time reductions.

FY19 Results

For FY19, the company’s revenues increased 2%, or 3% in constant currency, to $6.3 billion. North America revenue decreased 1% on a reported basis to $3.2 billion; Europe revenue increased 5% to $1.7 billion on a reported basis; Asia revenue increased 11% to $1.0 billion, led by over 30% growth in China. The company continued to expand with 135 new retail stores, including over 90 in Asia. In FY19, the company collaborated with UK-based streetwear brand Palace, attracting a new generation of consumers.

Outlook

For FY20, the company expects net revenues to improve 2% to 3%, to $6.4 billion to $6.5 billion. Foreign currency is expected to have a negative impact of 90-100 basis points for the year. The company expects operating margin to increase 40-60 basis points, excluding the impact of foreign currency, which is projected to be 10-20 basis points. In 1Q20, the company expects revenues to be up 3% to 5%, benefitting from the timing of Easter. Capital expenditures are projected at approximately $300 million in FY20.

Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

Ralph Lauren reported fiscal 4Q19 adjusted EPS of $1.07, up from $0.90 in the year-ago quarter and above the $0.89 consensus estimate. Total revenues were $1.51 billion, down 1.3% year over year (up 1.2% in constant currency) and above the $1.48 billion consensus estimate.

By region, North America revenues decreased 7% to $708 million, partly due to planned reductions in off-price sales; Europe revenues of $435 million were up 4% year over year (or 11.0% on a constant-currency basis) and revenues in Asia increased 6% (10% in constant currency) to $273 million.

In retail, comps in North America were down 4%, including a 7% decline in brick-and-mortar stores and a 6% rise in digital sales; in Europe, digital was up 6% and instore comps were 5% for a total European comp of 5%; and, Asia experienced a 4% lift in comp store sales. Growth in both stores and digital commerce benefitted Asia sales.

The company’s adjusted gross margin improved 30 basis points year over year, driven by initiatives to improve quality of sales through reduced promotional activity, but was partially offset by a negative currency impact. SG&A declined 40 bps to 53.8% of sales, for an adjusted operating margin of 6.4% of sales, an 80-bps margin expansion.

During the quarter, Ralph Lauren launched a direct-to-consumer shared inventory initiative in North America, driving increased efficiency in the distribution network and delivering strong progress on global lead time reductions.

FY19 Results

For FY19, the company’s revenues increased 2%, or 3% in constant currency, to $6.3 billion. North America revenue decreased 1% on a reported basis to $3.2 billion; Europe revenue increased 5% to $1.7 billion on a reported basis; Asia revenue increased 11% to $1.0 billion, led by over 30% growth in China. The company continued to expand with 135 new retail stores, including over 90 in Asia. In FY19, the company collaborated with UK-based streetwear brand Palace, attracting a new generation of consumers.

Outlook

For FY20, the company expects net revenues to improve 2% to 3%, to $6.4 billion to $6.5 billion. Foreign currency is expected to have a negative impact of 90-100 basis points for the year. The company expects operating margin to increase 40-60 basis points, excluding the impact of foreign currency, which is projected to be 10-20 basis points. In 1Q20, the company expects revenues to be up 3% to 5%, benefitting from the timing of Easter. Capital expenditures are projected at approximately $300 million in FY20.