Nitheesh NH

[caption id="attachment_70836" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

Brand Evolution at Ralph Lauren Driving Sales and Margin Improvement

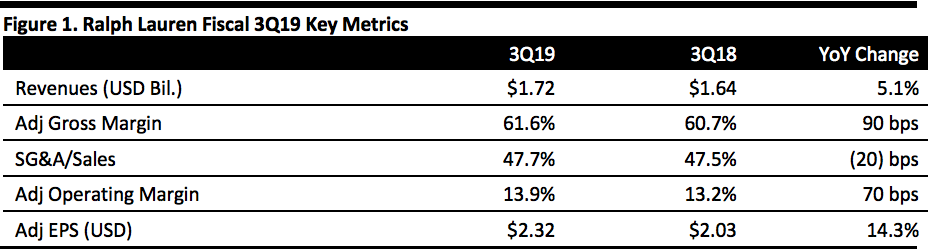

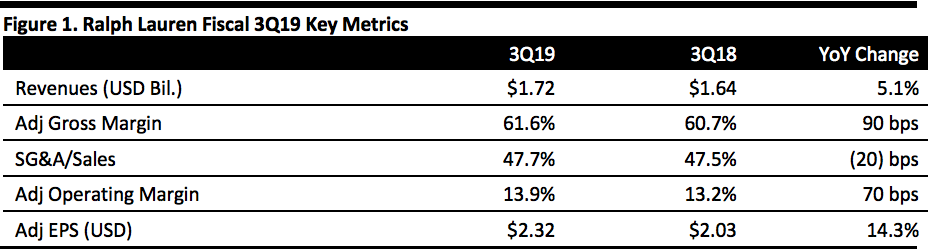

Ralph Lauren reported fiscal 3Q19 adjusted EPS of $2.32, up from adjusted EPS of $2.03 in the year-ago quarter and above the $2.15 consensus estimate. Total revenues were $1.73 billion, up 5.1% year over year (or 6% in constant currency) and above the $1.66 billion consensus estimate.

Same-store sales were up 4% during the quarter. By region, in North America digital sales rose 21%, comps were flat for a combined 4% comp; in Europe, digital was up 13% and the instore comp was 3% for a total European comp of 4%; and, Asia experienced a 62% lift in digital commerce and a 4% instore comp for a combined 4% comp. A 9% increase in AUR benefitted sales growth.

North America revenues rose 2.5% to $908.7 million; European revenues of $415.2 million were up 9.7% year over year (or 13.3% on a constant currency basis) and revenues in Asia increased 9.5% (11.4% in constant currency) to $274.8 million.

Wholesale revenues increased 2.5%, reflecting gains in Europe and Asia, offset by a 3.1% decline in the U.S. in tandem with the planned reduction of off-price sales. The company is strategically reducing off-price penetration within its wholesale channel and repositioning off-price as an excess inventory clearance channel. Retail revenues rose 6.3% to $1.12 billion as all geographies participated in the gain, notably Asia, up 10.1% to $261 million and North America, up 6.7% to $543 million.

Denim and outerwear enjoyed strong sales momentum during the quarter and the limited-edition Polo collection is gaining traction with the Polo mobile app and increased marketing (up 18% during the period).

Gross margin expanded 90 bps to 61.6% of sales, SG&A increased 20 bps to 47.7% of sales, for an adjusted operating margin of 13.9% of sales, a 70-bps margin expansion.

During the quarter, Ralph Lauren collaborated with U.K.-based streetwear brands Palace, attracting a new generation of consumers. 75% of the consumers who bought the Palace X Polo Ralph Lauren product were new to the Ralph Lauren brand, and on average, the consumers where ten years younger than the average Ralph Lauren shopper.

Outlook

Ralph Lauren updated guidance for FY19.

Source: Company reports/Coresight Research[/caption]

Brand Evolution at Ralph Lauren Driving Sales and Margin Improvement

Ralph Lauren reported fiscal 3Q19 adjusted EPS of $2.32, up from adjusted EPS of $2.03 in the year-ago quarter and above the $2.15 consensus estimate. Total revenues were $1.73 billion, up 5.1% year over year (or 6% in constant currency) and above the $1.66 billion consensus estimate.

Same-store sales were up 4% during the quarter. By region, in North America digital sales rose 21%, comps were flat for a combined 4% comp; in Europe, digital was up 13% and the instore comp was 3% for a total European comp of 4%; and, Asia experienced a 62% lift in digital commerce and a 4% instore comp for a combined 4% comp. A 9% increase in AUR benefitted sales growth.

North America revenues rose 2.5% to $908.7 million; European revenues of $415.2 million were up 9.7% year over year (or 13.3% on a constant currency basis) and revenues in Asia increased 9.5% (11.4% in constant currency) to $274.8 million.

Wholesale revenues increased 2.5%, reflecting gains in Europe and Asia, offset by a 3.1% decline in the U.S. in tandem with the planned reduction of off-price sales. The company is strategically reducing off-price penetration within its wholesale channel and repositioning off-price as an excess inventory clearance channel. Retail revenues rose 6.3% to $1.12 billion as all geographies participated in the gain, notably Asia, up 10.1% to $261 million and North America, up 6.7% to $543 million.

Denim and outerwear enjoyed strong sales momentum during the quarter and the limited-edition Polo collection is gaining traction with the Polo mobile app and increased marketing (up 18% during the period).

Gross margin expanded 90 bps to 61.6% of sales, SG&A increased 20 bps to 47.7% of sales, for an adjusted operating margin of 13.9% of sales, a 70-bps margin expansion.

During the quarter, Ralph Lauren collaborated with U.K.-based streetwear brands Palace, attracting a new generation of consumers. 75% of the consumers who bought the Palace X Polo Ralph Lauren product were new to the Ralph Lauren brand, and on average, the consumers where ten years younger than the average Ralph Lauren shopper.

Outlook

Ralph Lauren updated guidance for FY19.

Source: Company reports/Coresight Research[/caption]

Brand Evolution at Ralph Lauren Driving Sales and Margin Improvement

Ralph Lauren reported fiscal 3Q19 adjusted EPS of $2.32, up from adjusted EPS of $2.03 in the year-ago quarter and above the $2.15 consensus estimate. Total revenues were $1.73 billion, up 5.1% year over year (or 6% in constant currency) and above the $1.66 billion consensus estimate.

Same-store sales were up 4% during the quarter. By region, in North America digital sales rose 21%, comps were flat for a combined 4% comp; in Europe, digital was up 13% and the instore comp was 3% for a total European comp of 4%; and, Asia experienced a 62% lift in digital commerce and a 4% instore comp for a combined 4% comp. A 9% increase in AUR benefitted sales growth.

North America revenues rose 2.5% to $908.7 million; European revenues of $415.2 million were up 9.7% year over year (or 13.3% on a constant currency basis) and revenues in Asia increased 9.5% (11.4% in constant currency) to $274.8 million.

Wholesale revenues increased 2.5%, reflecting gains in Europe and Asia, offset by a 3.1% decline in the U.S. in tandem with the planned reduction of off-price sales. The company is strategically reducing off-price penetration within its wholesale channel and repositioning off-price as an excess inventory clearance channel. Retail revenues rose 6.3% to $1.12 billion as all geographies participated in the gain, notably Asia, up 10.1% to $261 million and North America, up 6.7% to $543 million.

Denim and outerwear enjoyed strong sales momentum during the quarter and the limited-edition Polo collection is gaining traction with the Polo mobile app and increased marketing (up 18% during the period).

Gross margin expanded 90 bps to 61.6% of sales, SG&A increased 20 bps to 47.7% of sales, for an adjusted operating margin of 13.9% of sales, a 70-bps margin expansion.

During the quarter, Ralph Lauren collaborated with U.K.-based streetwear brands Palace, attracting a new generation of consumers. 75% of the consumers who bought the Palace X Polo Ralph Lauren product were new to the Ralph Lauren brand, and on average, the consumers where ten years younger than the average Ralph Lauren shopper.

Outlook

Ralph Lauren updated guidance for FY19.

Source: Company reports/Coresight Research[/caption]

Brand Evolution at Ralph Lauren Driving Sales and Margin Improvement

Ralph Lauren reported fiscal 3Q19 adjusted EPS of $2.32, up from adjusted EPS of $2.03 in the year-ago quarter and above the $2.15 consensus estimate. Total revenues were $1.73 billion, up 5.1% year over year (or 6% in constant currency) and above the $1.66 billion consensus estimate.

Same-store sales were up 4% during the quarter. By region, in North America digital sales rose 21%, comps were flat for a combined 4% comp; in Europe, digital was up 13% and the instore comp was 3% for a total European comp of 4%; and, Asia experienced a 62% lift in digital commerce and a 4% instore comp for a combined 4% comp. A 9% increase in AUR benefitted sales growth.

North America revenues rose 2.5% to $908.7 million; European revenues of $415.2 million were up 9.7% year over year (or 13.3% on a constant currency basis) and revenues in Asia increased 9.5% (11.4% in constant currency) to $274.8 million.

Wholesale revenues increased 2.5%, reflecting gains in Europe and Asia, offset by a 3.1% decline in the U.S. in tandem with the planned reduction of off-price sales. The company is strategically reducing off-price penetration within its wholesale channel and repositioning off-price as an excess inventory clearance channel. Retail revenues rose 6.3% to $1.12 billion as all geographies participated in the gain, notably Asia, up 10.1% to $261 million and North America, up 6.7% to $543 million.

Denim and outerwear enjoyed strong sales momentum during the quarter and the limited-edition Polo collection is gaining traction with the Polo mobile app and increased marketing (up 18% during the period).

Gross margin expanded 90 bps to 61.6% of sales, SG&A increased 20 bps to 47.7% of sales, for an adjusted operating margin of 13.9% of sales, a 70-bps margin expansion.

During the quarter, Ralph Lauren collaborated with U.K.-based streetwear brands Palace, attracting a new generation of consumers. 75% of the consumers who bought the Palace X Polo Ralph Lauren product were new to the Ralph Lauren brand, and on average, the consumers where ten years younger than the average Ralph Lauren shopper.

Outlook

Ralph Lauren updated guidance for FY19.

- Management expects revenues to be up slightly in constant currency for FY19 reflecting a slight decline in North America and growth internationally. Foreign currency is expected to have a negative impact on revenue growth of approximately 80-90 bps.

- Operating margin guidance is for 60 bps expansion, at the high end of previous guidance of a 40-60 bps expansion.

- 4Q19 revenues are expected to be down slightly in constant currency, with growth in North America retail and international businesses offset by a planned reduction in North America off-price sales. Foreign currency is expected to negatively impact revenue growth by about 300 bps in 4Q. Timing-related headwinds are expected to impact 4Q revenue growth, including a shift of European wholesale shipments from 4Q into 3Q and the strategic reduction in off-price sales, which is heavily weighted toward 4Q. Easter’s timing is expected to negatively impact 4Q comps about 3 percentage points (300 basis points) but will benefit 1Q FY20.

- Operating margin for 4Q19 is expected to be up about 70 bps versus the year ago period in constant currency. Foreign currency is expected to negatively impact operating margin by about 60 basis points in the quarter.

- Capital expenditures are projected at approximately $250 million in FY19, below previous guidance of $275 million.