Source: Company reports/Fung Global Retail & Technology

4Q16 Results

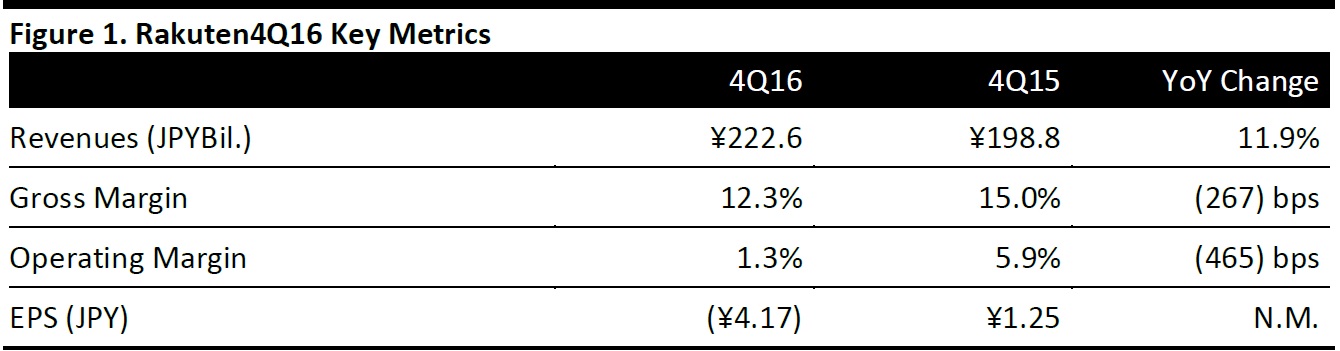

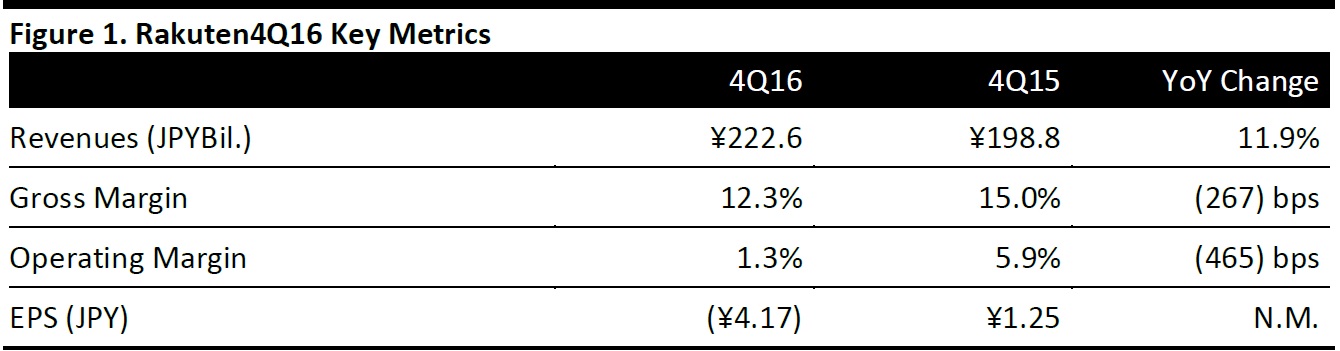

Rakuten reported 4Q16 EPS of (¥4.16), down from ¥1.25 in the year-ago quarter and missing the consensus estimate of ¥13.88.

The company posted an impairment loss of ¥24.3 billion, which included a ¥21.4 billion loss for its US subsidiary Viki. According to the company statement, Viki “fell behind the original targets due to changes in the market environment and trends in competition.”

Revenues were ¥222.6 billion, up 11.9% year over year and beating the ¥215.1 billion consensus estimate. Global e-commerce gross merchandise sales (GMS) was up 17.1% year over year, while domestic GMS was up 14.7% year over year.

Segment Breakdown for the Quarter

- Internet Services segment: Including domestic e-commerce, communication & sports, as well as others, revenue for the Internet Services segment was ¥165.8 billion, up 14.6% year over year. Domestice-commerce revenue, which remained the largest subsegment, was ¥90.1 billion, up 14.8% year over year. The growth was driven by Rakuten’s Super Point Up rewards program, as well as quality improvement work,including search logic enhancements, diversification of pickup points and data optimization.

- FinTechsegment: Revenue for this segment was ¥77.3 billion, up 9.2% year over year. Card and Bank posted strong profit growth, with operating income of¥7.2 and ¥4.8 billion, respectively, up 11.2% and 18.2% year over year. The growth in Rakuten Card membership has resulted in a steady rise in revenue and profits, while the increase in interest income from loans has helped to drive profit growth in banking services.

FY16 Results

Revenue: For FY16, revenues rose 9.6% to ¥781.9 billion, from ¥713.6 billion the previous year.

EPS: Rakuten reported EPS of ¥26.44, down 17.6% from the previous year at ¥32.09.

Outlook

Although Rakuten did not provide full-year forecasts for 2017, it targets double-digit revenue growth, excluding the securities services, which is impacted significantly by stock market volatility.

Rakuten plans to grow its domestic e-commerce services further through aggressive sales activities, winning new users and building a base of loyal, long-term customers. As for the FinTech segment, Rakuten hopes to increase the transaction value of its credit card services by growing its market share and promoting group synergies.