Nitheesh NH

We present insights across five key topics around how the Covid-19 pandemic has rewritten the rules of retail. These insights were presented by Coresight Research CEO and Founder Deborah Weinswig at Quinyx’s “Evolving to Thrive” virtual summit on August 10, 2020. The event hosted cross-sector industry leaders to discuss adapting and reinventing operations and workforces in a post-Covid world.

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

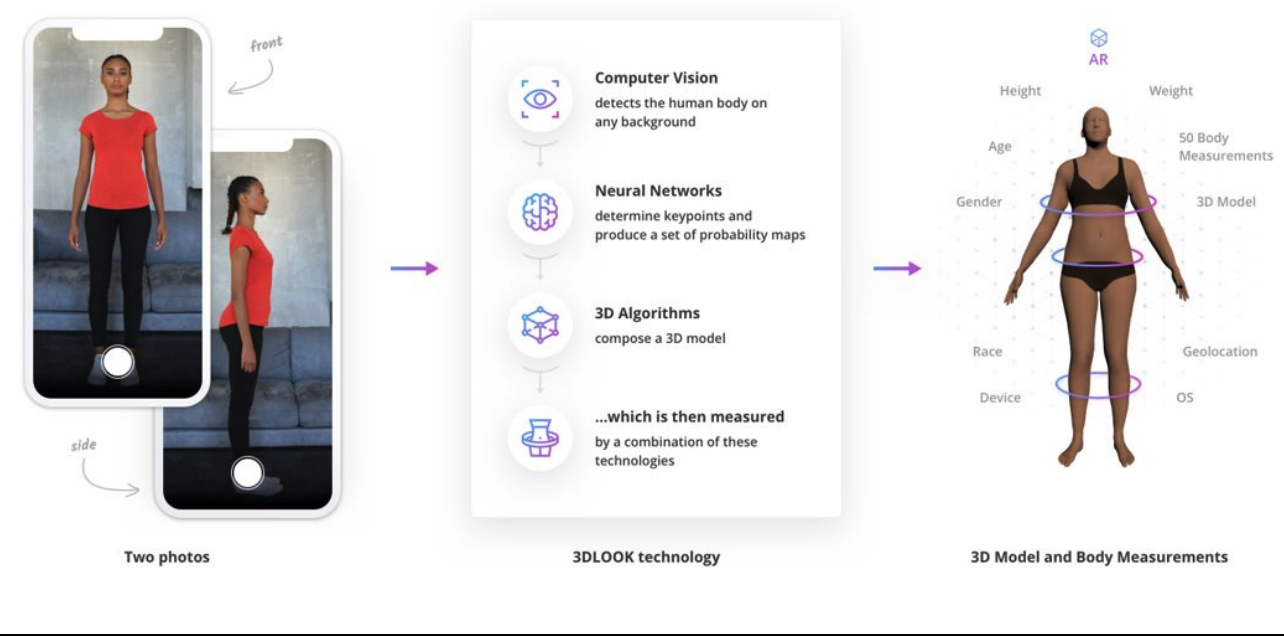

3DLOOK enables the creation of digital avatars that customers can use to “try on” clothes

3DLOOK enables the creation of digital avatars that customers can use to “try on” clothes

Source: 3DLOOK[/caption] Source: Coresight Research[/caption]

Weinswig’s presentation included consideration of the growing retail emphasis on sustainability. She credited this new focus on the environment to consumers’ increased awareness and access to information and retailers’ realization that sustainability efforts can help the bottom line as well as the planet. Companies are finding new ways to be sustainable, such as focusing on how they dispose of waste and examining water usage. Weinswig highlighted the following two companies as examples of major steps towards sustainability:

Source: Coresight Research[/caption]

Weinswig’s presentation included consideration of the growing retail emphasis on sustainability. She credited this new focus on the environment to consumers’ increased awareness and access to information and retailers’ realization that sustainability efforts can help the bottom line as well as the planet. Companies are finding new ways to be sustainable, such as focusing on how they dispose of waste and examining water usage. Weinswig highlighted the following two companies as examples of major steps towards sustainability:

1. Improvements in the Current US Retail Environment

Weinswig acknowledged the negative impact of the coronavirus pandemic on US retail, but highlighted that many commentators were pleasantly surprised by the strength of retail sales in June: Certain discretionary retail categories, including furniture, actually saw year-over-year spending increases in June. Even categories that were initially most affected by the crisis saw strong rebounds in June—the dip in clothing sales reduced from a 48% year-over-year decline in April to just 10% in June, according to data from the Bureau of Economic Analysis. Weinswig credits improvements in US sales numbers to the increasing flexibility and ingenuity of retailers in three areas:- Embracing options for customers to pick up online orders

- Ensuring the safety of employees and customers in stores

- Improving their online shopping platforms

2. Changes in Consumer Shopping Habits and Priorities

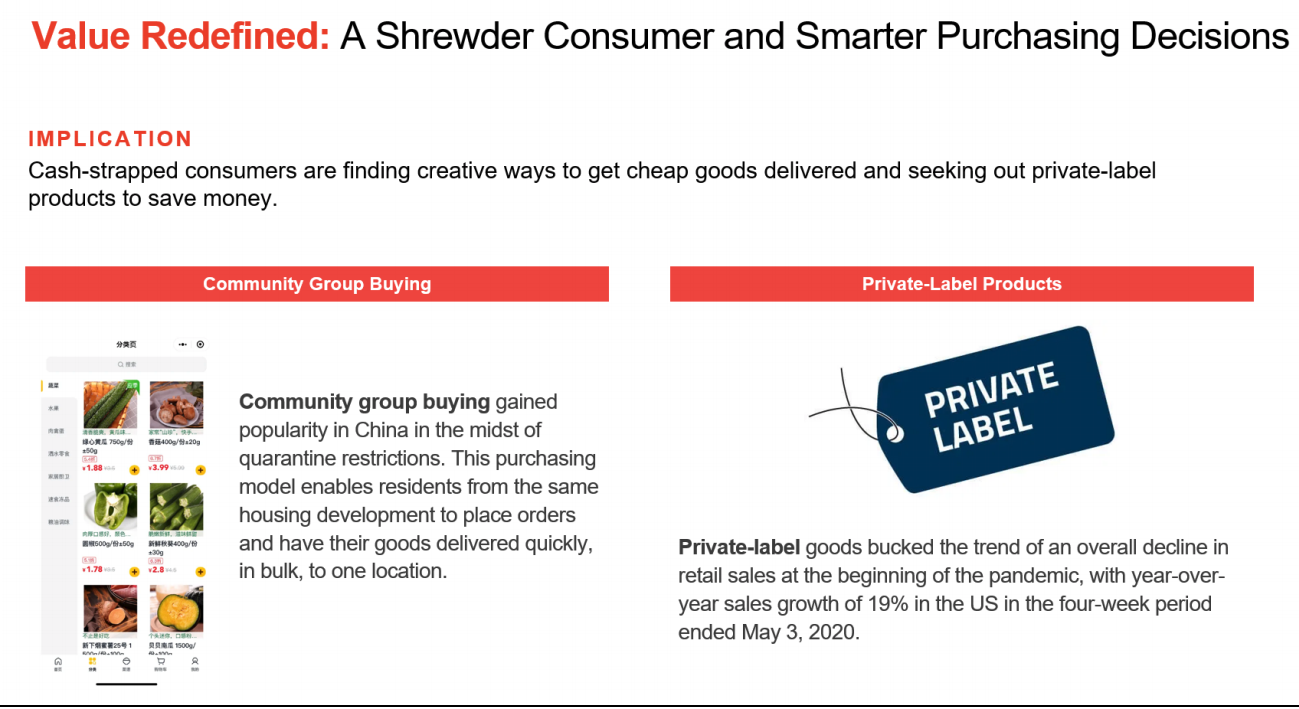

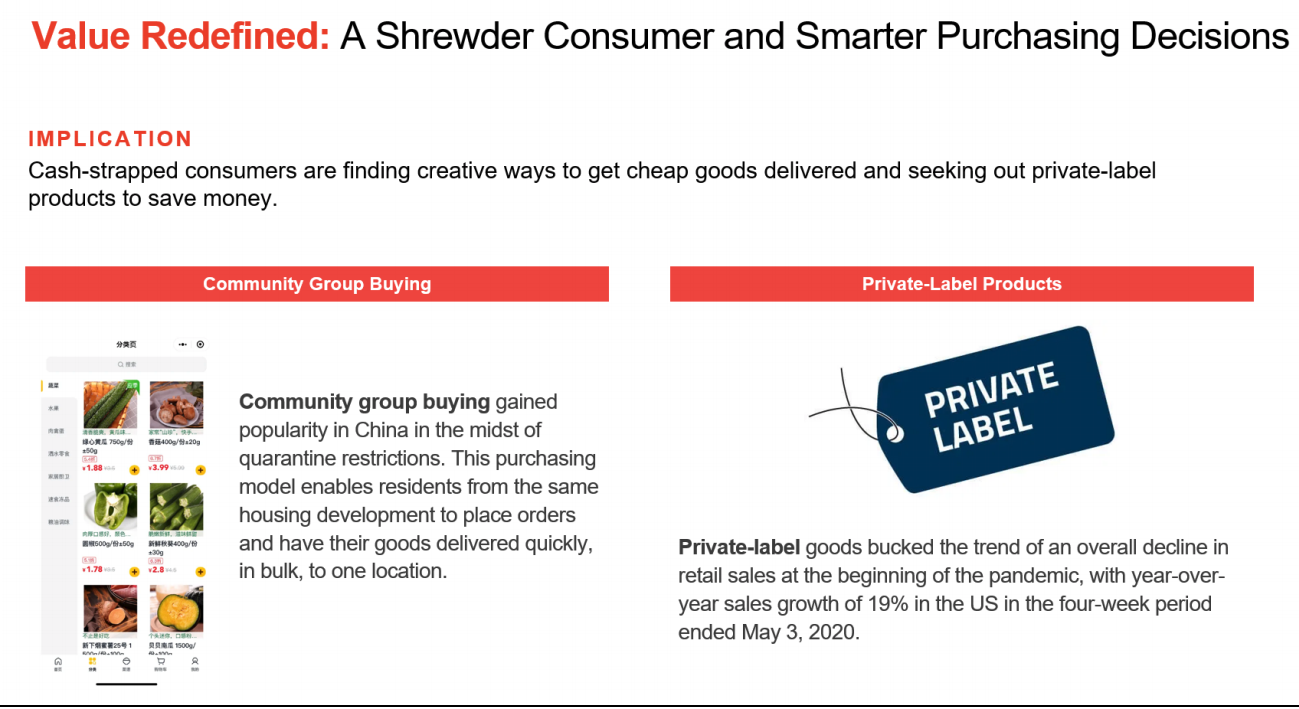

The pandemic has shifted more retail spending online. Beyond this general increase, Weinswig emphasized the changes in the demographics of consumers making online purchases and the types of goods being bought. Most notable is the shift in men over the age of 55—spending among this demographic has migrated online during the pandemic, despite greater reluctance toward online shopping compared to the rest of the population. Grocery delivery has boomed during the crisis, but Weinswig cautioned that many people may revert to their previous food shopping habits when the pandemic subsides. This caution reflects the specific preferences that people often have when grocery shopping—they are likely to be eager to go back to choosing their own fresh produce rather than relying on the judgement of paid shoppers. Outside of grocery, Weinswig noted that the shifts in the retail landscape may remain long after coronavirus-related restrictions have been lifted, as consumers expect to retain their changed shopping behaviors: According to a Coresight Research survey from July 22, 54.7% of US consumers believe that they will retain a changed way of living after the coronavirus pandemic. Weinswig compared consumers’ current emphasis on value to purchasing patterns in the wake of the 2008 financial crisis, which triggered increased scrutiny of spending habits among consumers. Today, consumers are again focusing on finding the best value for their money—as evidenced by the 19% year-over-year sales growth of private-label grocery goods, according to figures reported by IRI in April, at the height of the pandemic. Furthermore, the new phenomenon of community group buying—where residents of the same apartment block or residential street join up to place orders in bulk to save money—took off in China during the pandemic. Weinswig explained that this shopping model could make an impact in the US as consumers continue to pursue deals and purchases that provide the best value for money. [caption id="attachment_114648" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

3. Changes in the Consumer-Retailer Interaction Model

Even before the pandemic, the way that businesses and customers interact had been undergoing drastic change, but recent coronavirus-related restrictions have greatly accelerated its evolution. Consumers now expect to be able to interact with brands whenever and wherever they are, in one integrated experience. Weinswig noted that today’s consumer is highly informed and increasingly requires more touchpoints before they transact. It is no longer enough for brands and retailers to simply offer their customers the option to buy online or in stores—they must integrate these channels into one unified customer experience. The growth of “buy online, pick up in store” (BOPIS) services—208% year over year in the US in April, according to Adobe Analytics—indicates how unified online and offline shopping experiences have become. Retailers can also look to utilize social media selling, livestreaming and influencers to reach consumers across even more channels and create engaging content for potential customers who are spending more time at home due to coronavirus restrictions. Weinswig advised retailers that livestream selling is the most important trend in retail this year and is poised to grow rapidly in the US after already thriving in China. To succeed in this changing retail environment, Weinswig emphasized that retailers must enable their store associates and customers to leverage technology to improve and integrate shopping experiences. Store employees are increasingly using digital communication methods such as video chat, text message and email to provide customer service to consumers at home. Associates can use omnichannel technologies to display and sell inventory to customers at home or in stores, as well as utilizing 3D rendering, augmented reality and VR to enable shoppers to try on clothes virtually or view apparel collections in 3D online showrooms. [caption id="attachment_114649" align="aligncenter" width="700"]Source: 3DLOOK[/caption]

4. Streamlining Back-End Retail Operations

Innovations in 3D rendering have been not just been beneficial for fashion retailers’ consumer-facing operations, but also for back-end design processes. In categories such as clothing and footwear, designers can now create virtual samples at a fraction of the cost and time of physical samples. Vendors can also showcase their new products in virtual shows, which removes the need to travel and reduces the environmental impact. These developments were accelerated by the pandemic, and Weinswig expects them to shape how retailers and brands manage their back-end operations going forward. In order to further streamline supply chains and inventory management, Weinswig discussed how retailers can continue to look to the AI and machine learning solutions that have benefited from accelerated development during the pandemic. Machine learning enables retailers to use data on pricing, store layout, product demand—even external data on weather—to create accurate forecasts for individual products, stores and sales channels. These technologies can be leveraged both in fulfillment centers and stores. For instance, companies such as Trax are beginning to provide retailers with a store-monitoring and intelligence platform to help them track stock on shelves and implement store-execution technology. Weinswig recalled that when in-store inventory management technology was in its nascent stages, workers feared that it would reduce the number of retail jobs available. Instead, it has enabled retailers to place an increased emphasis on customer service and free up time for their associates to interact with people in stores or online.5. More “We,” Less “I”: Sustainability and Inclusion

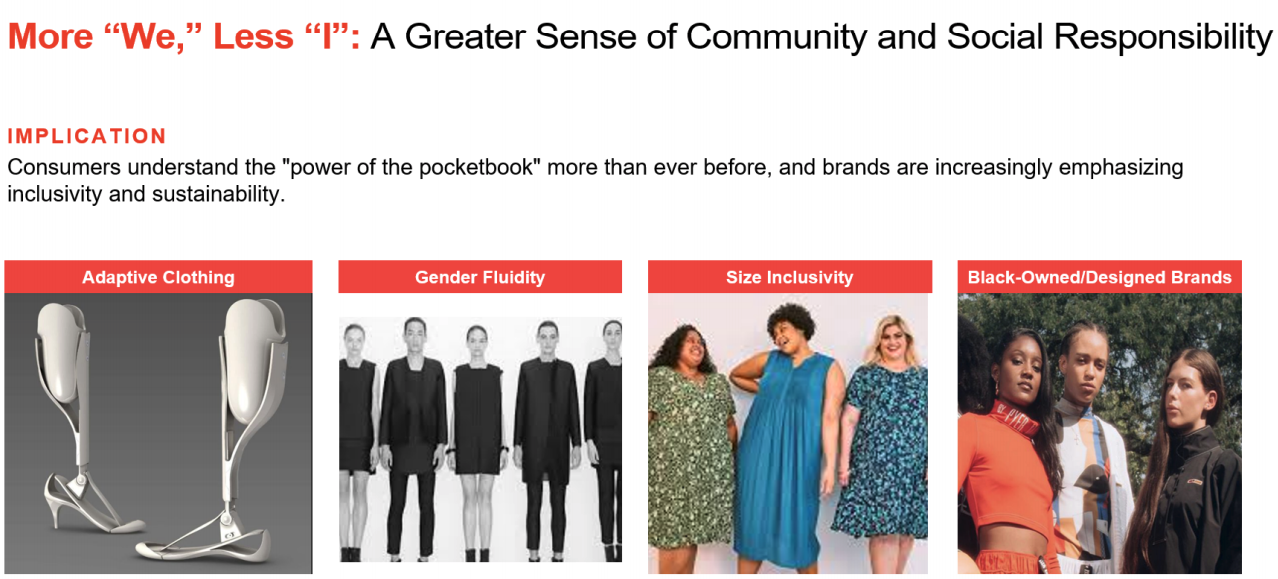

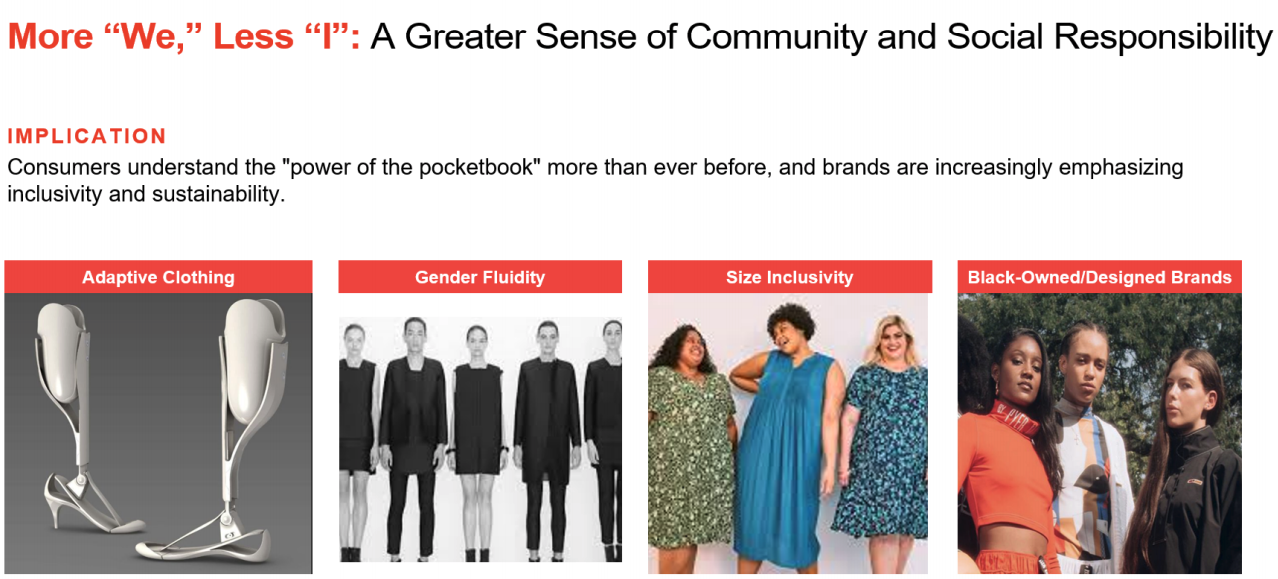

While the pandemic has heightened a sense of community among individuals and companies for many, Weinswig referred to first witnessing this trend at Coresight’s Trailblazer’s 2018 Event—One Size Does Not Fit All. She discussed feeling heartened by the amount of interest in the event, which focused on adaptive and inclusive fashion. Today, retailers are embracing size inclusivity, adaptive fashion and gender-fluid fashion more than ever before. Many retailers are also making a point of featuring minority-owned and -designed brands in their collections. In addition to the societal benefits of creating an inclusive fashion and retail environment, Weinswig noted that including previously marginalized groups in the shopping world opens up an entirely new market for retailers to explore. [caption id="attachment_114650" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Weinswig’s presentation included consideration of the growing retail emphasis on sustainability. She credited this new focus on the environment to consumers’ increased awareness and access to information and retailers’ realization that sustainability efforts can help the bottom line as well as the planet. Companies are finding new ways to be sustainable, such as focusing on how they dispose of waste and examining water usage. Weinswig highlighted the following two companies as examples of major steps towards sustainability:

Source: Coresight Research[/caption]

Weinswig’s presentation included consideration of the growing retail emphasis on sustainability. She credited this new focus on the environment to consumers’ increased awareness and access to information and retailers’ realization that sustainability efforts can help the bottom line as well as the planet. Companies are finding new ways to be sustainable, such as focusing on how they dispose of waste and examining water usage. Weinswig highlighted the following two companies as examples of major steps towards sustainability:

- American Eagle Outfitters has reduced its carbon footprint by 32%, with an additional 40% goal by 2030 and 60% by 2040.

- Target is transitioning away from fossil fuels in a move that is expected to save the company $200–300 million by 2040.