Introduction

Trade tensions have recently escalated between the US and China. Consumer goods were excluded from tariff discussions this year until July 10, when US President Donald Trump announced a list of product categories, worth around $200 billion, that could be subject to tariffs beginning in early September, depending on policy approval. The list includes apparel, accessories and handbags among other consumer goods.

The tariff war kicked off in March, when the US announced that it would apply new tariffs on $3 billion worth of Chinese goods imported to the US. Subsequent escalations saw US tariffs on goods worth $34 billion, including Chinese machinery and electronic parts, take effect on July 6. That was followed by an announcement by the US that it would subject another $200 billion worth of Chinese goods to tariffs, and that it would consider extending tariffs to an

additional $200 billion worth of goods if China retaliated with further tariffs of its own.

In this brief report, we examine the US-China tariff timeline and the likely impact of tariffs on the US retail economy, particularly with regard to textiles and apparel. In an appendix, we include a list of the consumer goods categories that are part of the latest (July 10) list of $200 billion worth of Chinese imports that may be subject to tariffs.

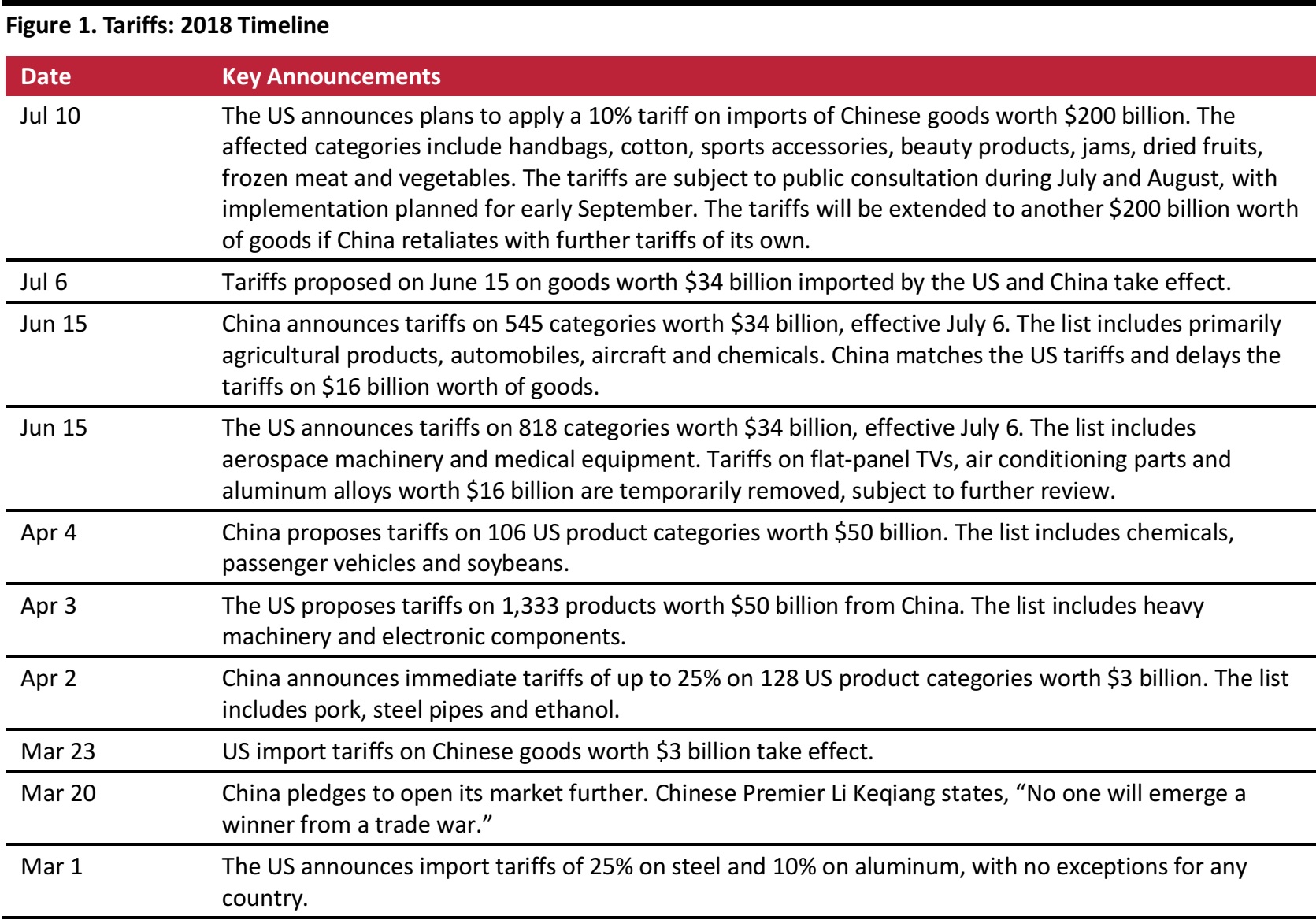

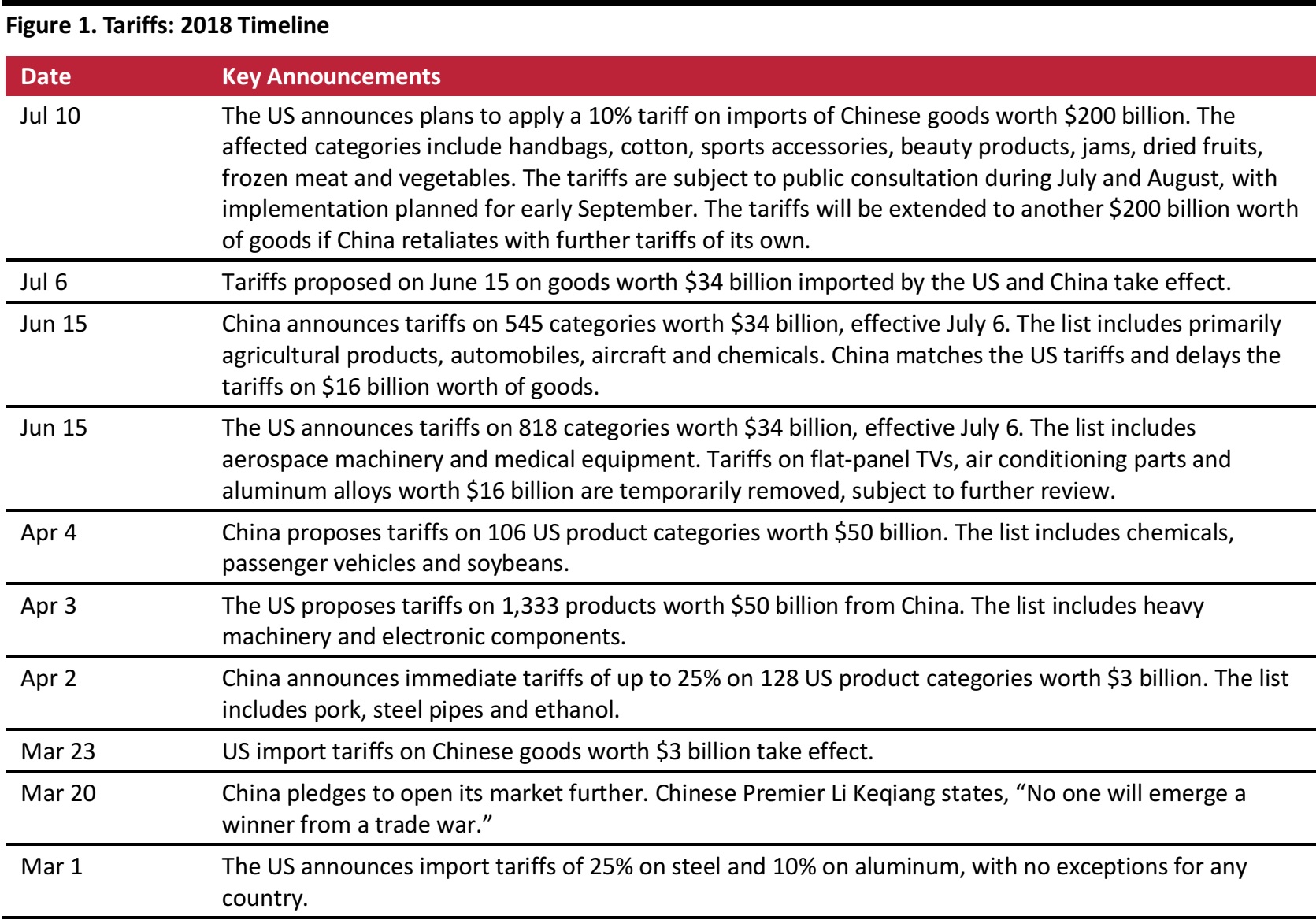

Tariff Timeline

The current trade war began in early March, when President Trump announced tariffs of 25% on steel and 10% on aluminum. Since then, the conflict has taken a number of turns, as leaders of the US, China and other concerned countries have made a flurry of announcements.

In the table below, we highlight the major events in the trade war between the US and China thus far in 2018.

Source: Coresight Research

US Retail: Impact of Tariffs on Textile Industry

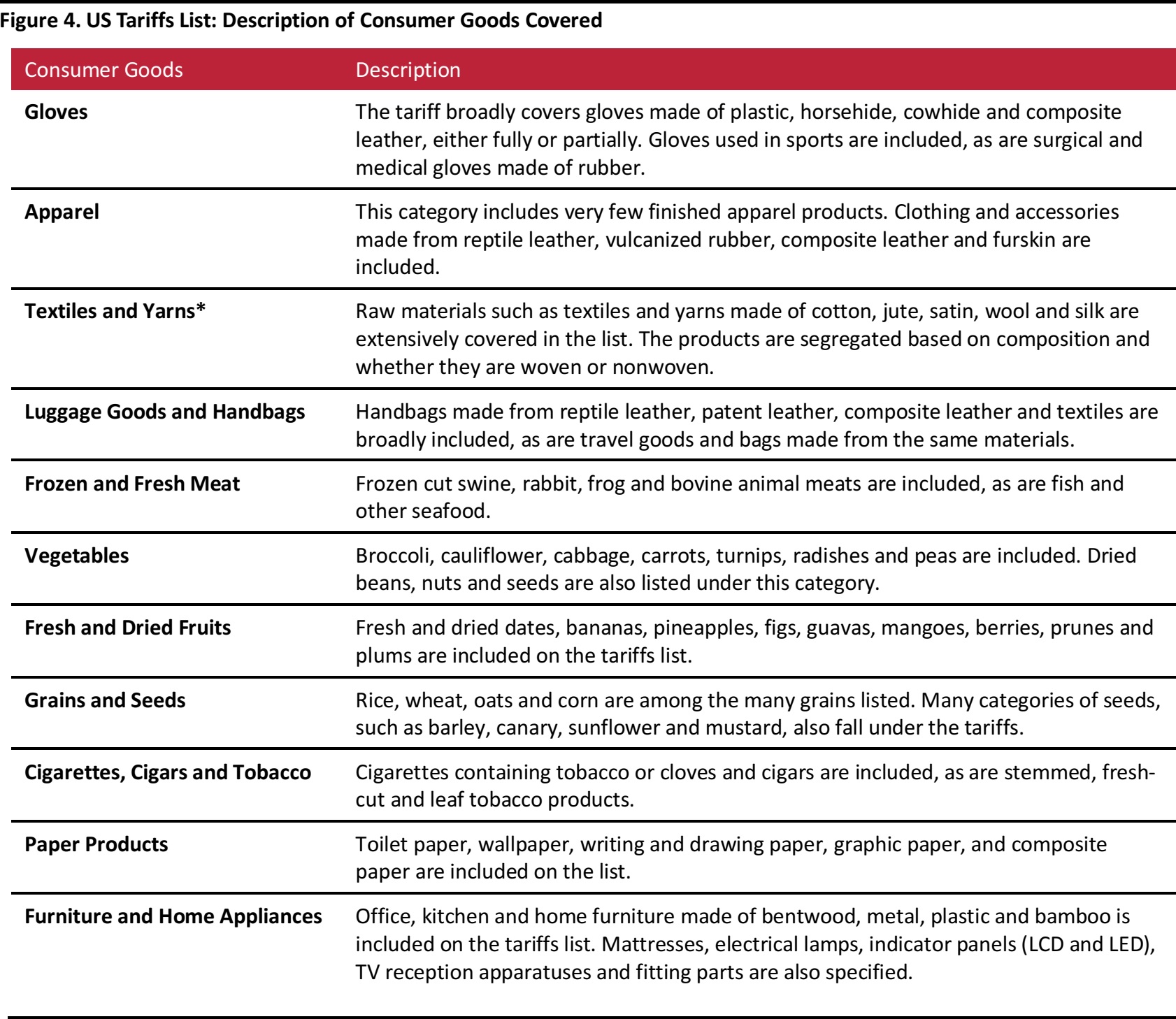

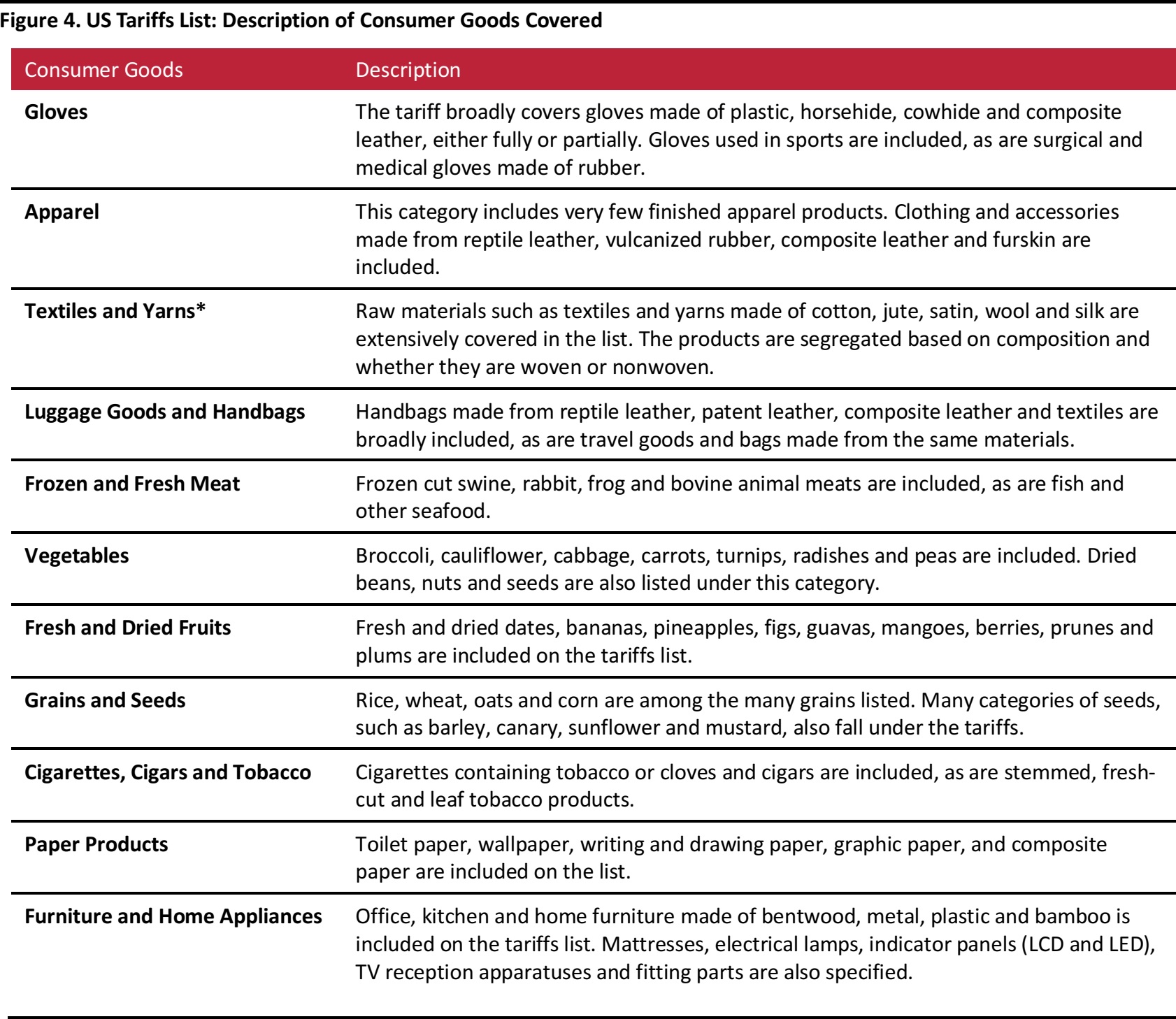

In a major shift, the tariff war has been extended to cover selected consumer goods imported to the US from China. Silk, cotton, satin and wool fabrics in woven and nonwoven form, frozen vegetables, tobacco, and dried fruits are among the products in the recent list of goods that will be subject to a 10% tariff should that list gain approval. Previously, US tariffs had focused heavily on industrial goods, leaving retailers immune to direct impacts.

The tariffs follow continual offshoring of jobs in apparel manufacturing in recent years: according to the US Bureau of Labor Statistics, US textile jobs fell from 52,400 in 2007 to 34,200 in 2017. China’s trading surplus with the US in apparel and textiles increased continually over the same period.

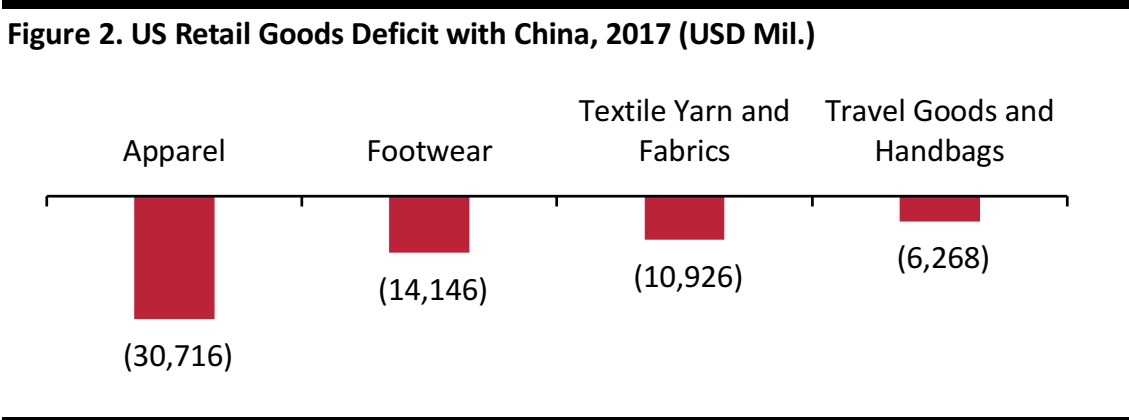

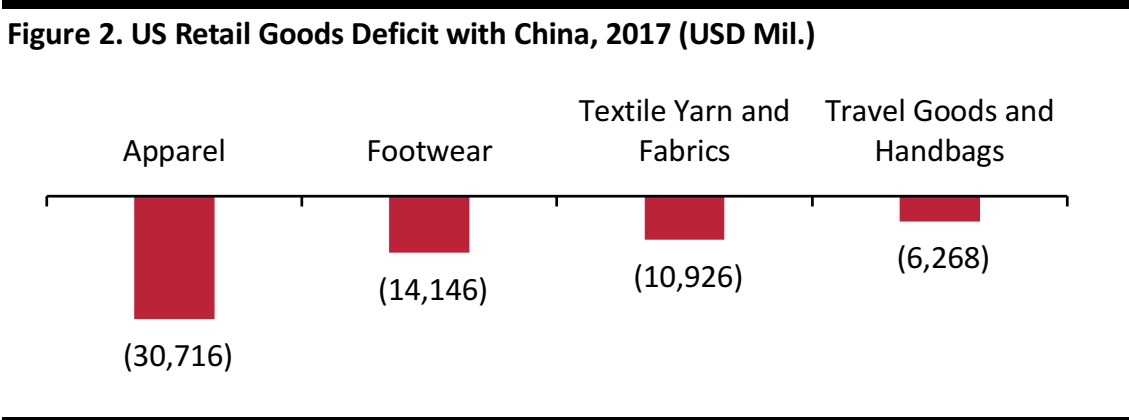

Source: International Monetary Fund

The result of these trends is that the US is a major importer of manufactured goods and apparel from China:

- In 2017, the US had a deficit with China of $30,716 million in the apparel trade and $10,926 million in the textile trade, according to the International Monetary Fund.

- China accounted for 37% of US apparel imports and 56% of US footwear imports in 2017, according to the US Department of Commerce.

In preparing the list of goods that will be subject to tariffs, the United States Trade Representative (USTR) has announced that American consumers will be impacted the least across the domestic supply chain, as only a fraction of the goods included in the latest list are end products readily available for purchase from retailers, such as apparel and handbags. The tariffs have been primarily levied on textiles and yarns, the raw materials for apparel production.

As reported by the International Trade Administration, China accounts for nearly 8% of the total imports of consumer goods on the USTR’s latest list. But no matter how small the percentage, US retailers and consumers will have to face the brunt, as the tariffs will increase inflationary costs throughout the supply chain, at least in the short run.

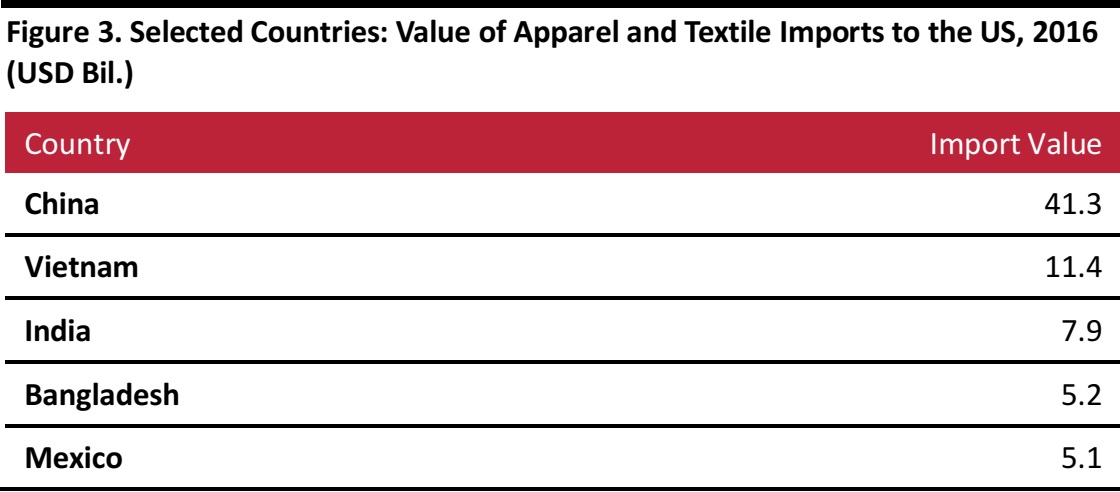

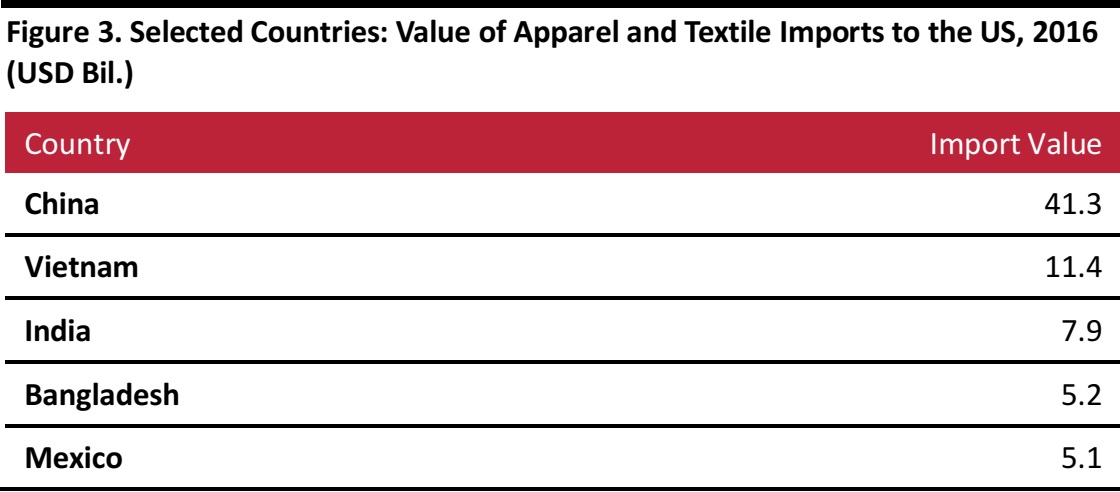

The tariffs on textiles and apparel could reduce America’s import dependence on China. They will make imports pricier and, should they persist, likely prompt brands and retailers to look for alternative low-cost manufacturing destinations in the medium term. However, if the USTR announces tariffs on a wider range of finished apparel—or extends them to other consumer goods categories—retailers may end up struggling to find other countries that could offer the production capacity that China has. China’s infrastructure and efficiency makes its supply base the largest, and the country offers high-end skills, quality levels and product variety that other countries cannot offer at the same scale.

According to the World Integrated Trade Solution, the US imported apparel and textiles worth $41.3 billion from China in 2016. That total was nearly four times higher than the $11.4 billion in apparel and textiles that the US imported from its second-largest import partner, Vietnam, that year.

Source: World Integrated Trade Solution

chains and changing import destinations, due to the scale of Chinese imports. Currently, this is not an impediment, as finished goods are largely exempted from the tariffs.

We expect some added costs to flow through to consumers in the form of slightly higher apparel prices, even if some retailers change production to low-cost countries such as Vietnam, Bangladesh and Indonesia. In-demand brands such as higher-growth sportswear brands look best positioned to pass on the costs of the new tariffs to consumers owing to sustained demand, but we think that many other US brands and retailers have more limited opportunities to pass on such costs.

US apparel is a highly competitive market, and one in which nontraditional retailers are growing rapidly at the expense of legacy midmarket retailers. These nontraditional retailers include Amazon; European fashion retailers such as Inditex, ASOS, Boohoo.com and Primark; and off-pricers such as T.J. Maxx. We think that the level of competition in the market will limit the ability of many domestic specialty retailers and department stores to meaningfully increase prices if the US imposes tariffs on Chinese apparel and footwear. We think that any such tariffs would therefore likely result in margin erosion for these types of retailers. Indeed, any significant hike in prices by midmarket retailers risks accelerating shoppers’ migration to price-competitive rivals such as off-pricers and e-commerce retailers.

What We Think

The tariffs on textiles, apparel and handbags will likely result in slightly increased prices for these goods, but we do not expect the inflationary pressure to have a broad impact unless the US enacts further consumer goods tariffs.

In-demand brands and retailers are better positioned to pass on any higher costs resulting from tariffs to consumers. This is not the case for a number of midmarket retailers in the US, as they face stiff competition from Amazon, certain European fashion retailers and off-price retailers.

If the USTR increases the coverage of consumer goods subject to tariffs, prices across broader categories will rise. In the medium term, we expect retailers to switch some of their sourcing from China to countries such as Vietnam and Bangladesh. China’s scale of production and technical advancements are hard to replicate in total, though, and this will be the foremost challenge for domestic importers. As a result, prices are likely to rise should the US proceed with further tariffs on consumer goods.

Appendix

*Category is included due to its impact on finished apparel products that are manufactured in the US.

Source: USTR.gov