Introduction

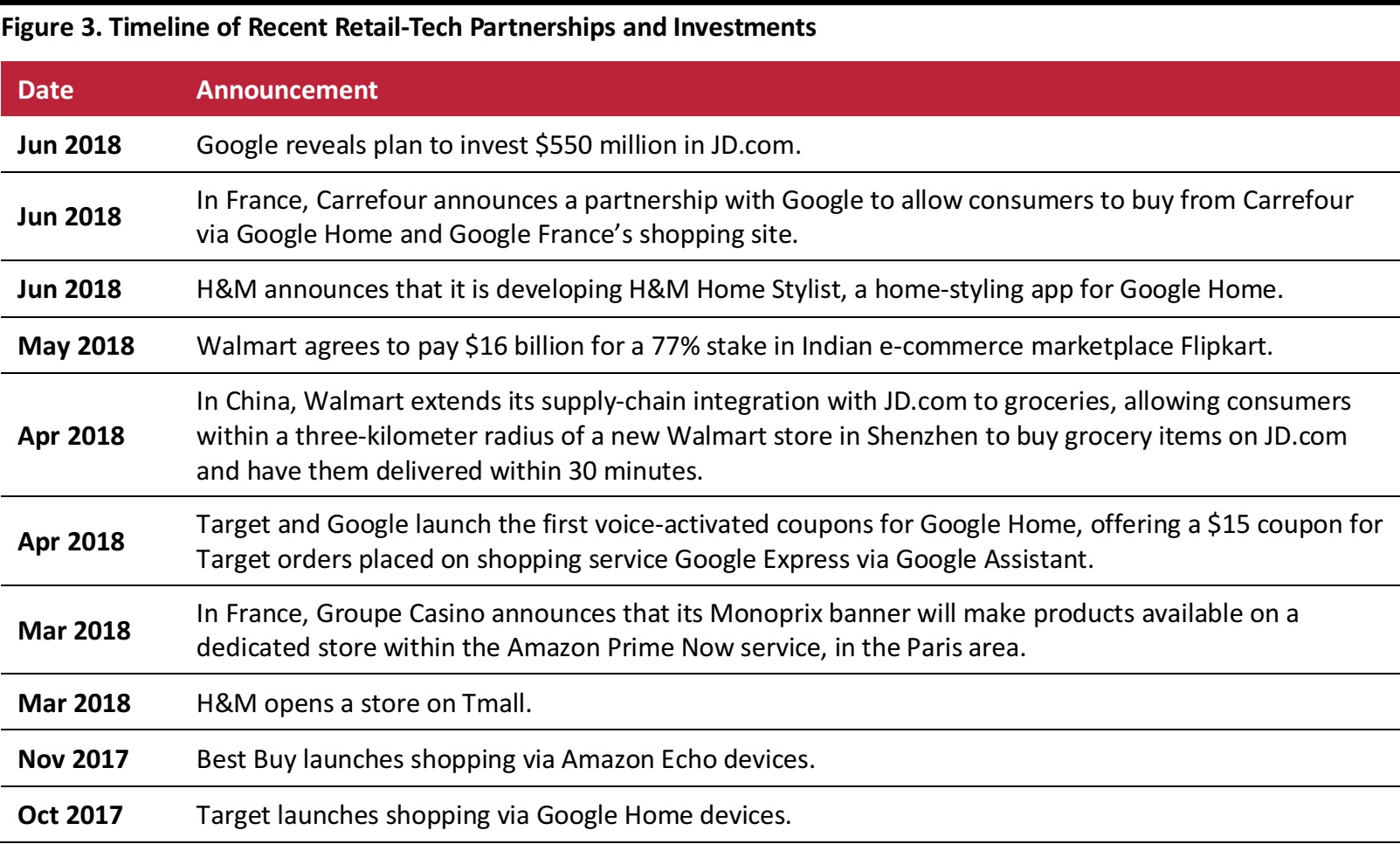

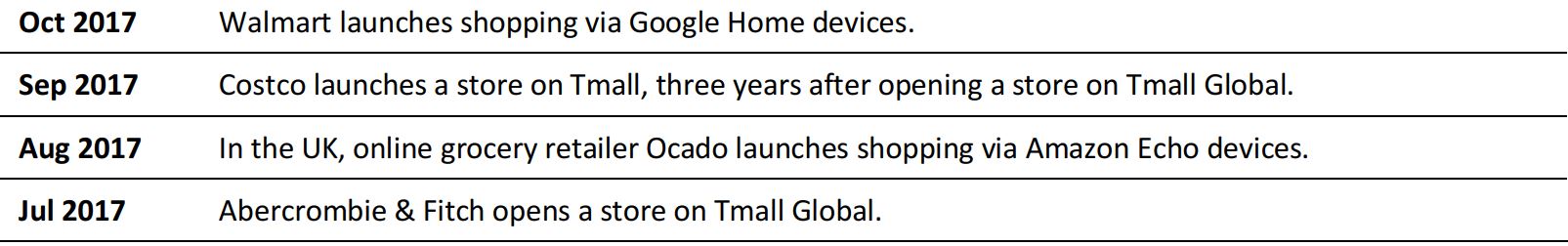

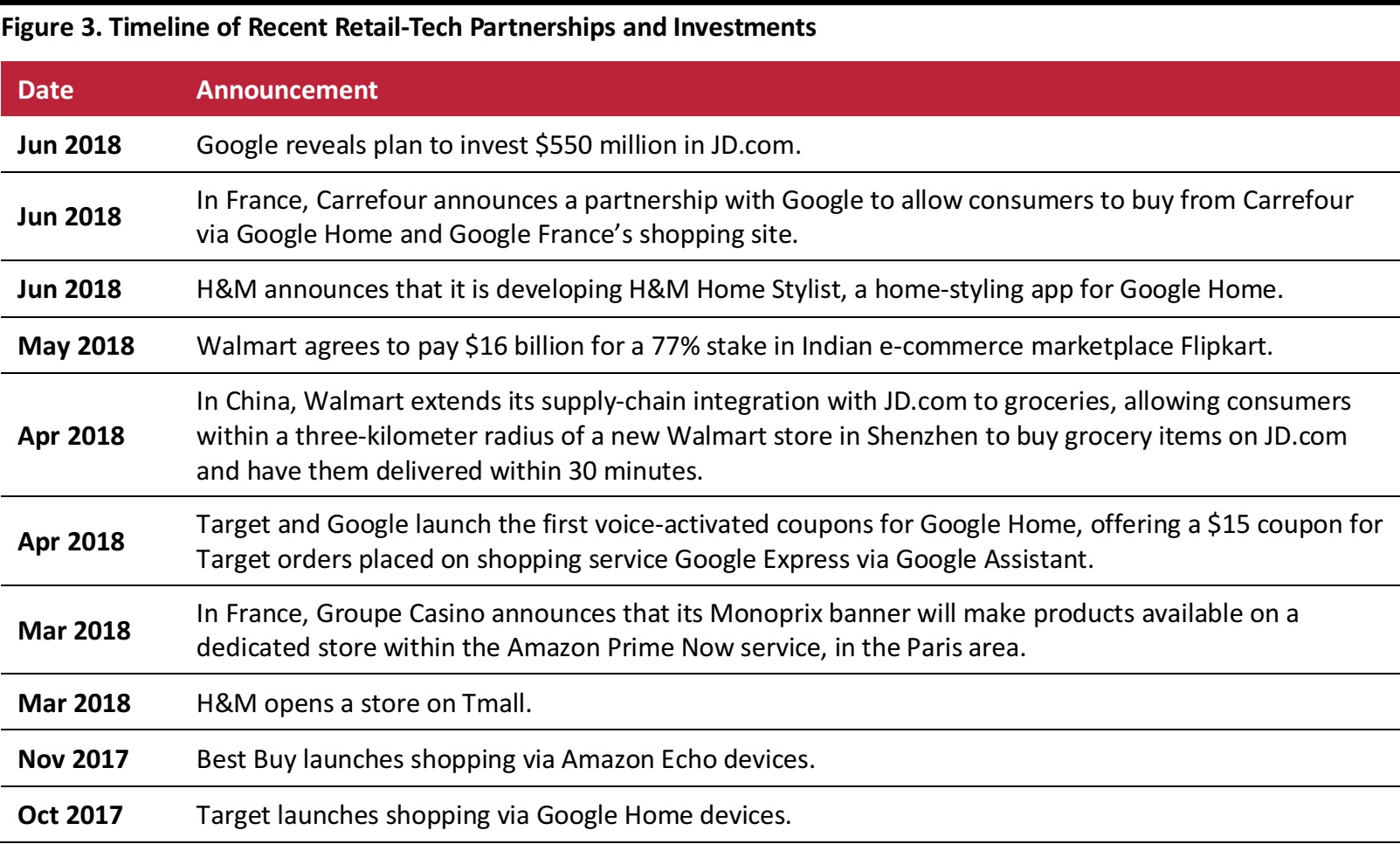

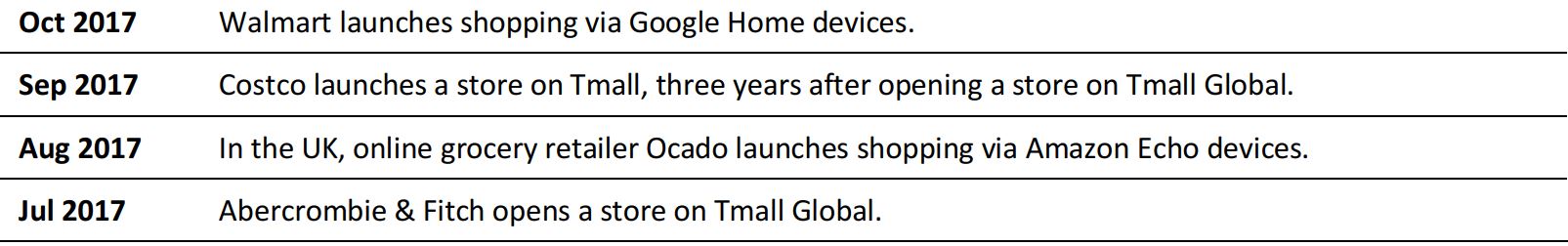

In this brief report, we note that digital platform operators hold the keys to two growth opportunities in retail: the emerging channel of voice commerce, via devices such as Amazon Echo and Google Home, and the high-growth retail markets of China and India. That “gatekeeper” status is prompting more and more retailers to partner with these digital firms, even if some—such as Amazon—would traditionally have been considered competitors.The year has seen a flurry of partnerships and investments involving retailers and technology firms. For example, Carrefour has partnered with Google in France, Walmart has bought a majority stake in India’s Flipkart, and a growing number of retailers are signing up to sell through Amazon’s and Google’s voice devices in the US and the Tmall marketplace in China.

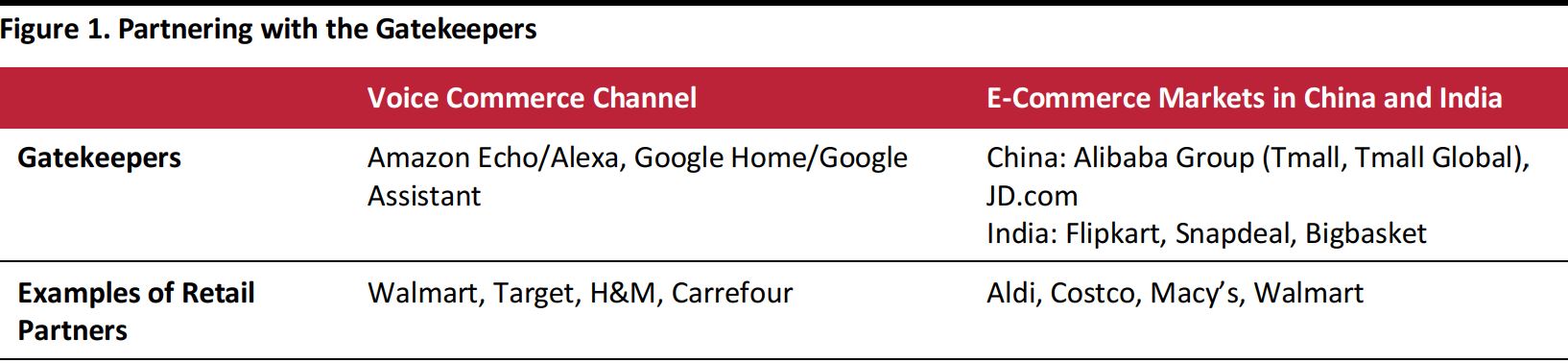

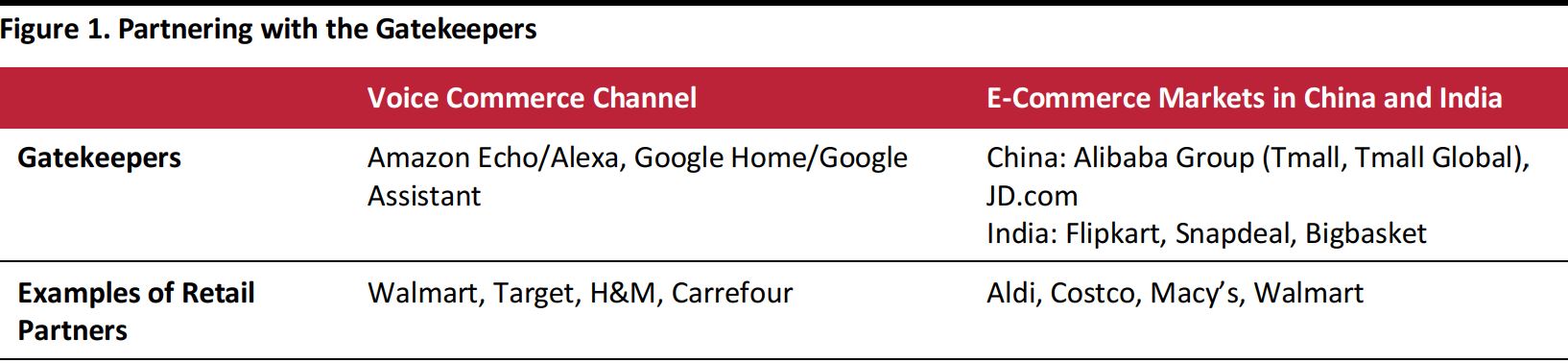

The table below shows the two types of digital gatekeepers and examples of the retailers that have sought to partner with them.

Source: Coresight Research

These gatekeepers are not simply providers of services to retailers; they are intermediaries that displace the direct connection retailers have traditionally enjoyed with their customers. Moreover, in both the voice channel and in Chinese e-commerce, there are two platform operators that hold dominant shares, creating real or effective duopolies that limit retailers’ ability to turn to alternatives.

We see these factors supporting further collaborations between retailers and platform operators in 2018 and into 2019.

Why Are These Intermediaries Significant?

The disruption of the traditional retailer-consumer relationship by these digital intermediaries has a number of implications:

- Retailers face a potential loss of control over brand experience, as third-party sites or services displace retailers as the initial contact point for shoppers.

- The strength of these intermediaries forces retailers to collaborate with rivals. In voice commerce, the main rival is Amazon. Google may look like a more attractive partner than Amazon to retailers—but its voice devices trail Amazon’s in terms of market share. Even marketplace sites can be potential rivals, if they combine traditional retail with hosting third-party sellers, as Amazon does.

- The introduction of an intermediary increases the risk of substitution, as a digital platform may find it attractive to suggest alternative brands or retailers to shoppers, to the detriment of some retailers selling on that platform. In February, management consultancy Bain & Company found that Amazon’s Alexa voice assistant tended to suggest Amazon-brand products when users requested to buy a particular item without specifying a brand.

- Shoppers are able to make more direct comparisons. The aggregatory nature of marketplace sites makes it is easier than ever for shoppers to compare different retailers’ prices and product specifications, leaving little scope for pricing differentials.

Defining the Gatekeepers

We characterize platform operators as gatekeepers because of the unusually high levels of control they hold over various channels and markets. In our examples of voice commerce and emerging-market e-commerce marketplaces, there are examples of effective duopolies, which limit the opportunities for retailers to turn to alternatives.

Voice Commerce Platforms

Voice commerce differs from other digital channels such as e-commerce and m-commerce in the degree of control that tech giants exert over it. Unlike legacy digital channels, the voice channel is created and curated by two tech giants—Amazon and Google—that have designed and marketed the devices that enable voice commerce and created the artificial intelligence assistants that power those devices. Retailers selling through these platforms therefore face talking (literally) to their customers through an intermediary rather than directly as they traditionally have.

Voice commerce is in a high-growth phase, albeit from a base that remains miniscule in the context of total retail. Those retailers that want to tap this channel are forced to collaborate with firms such as Amazon—which they may traditionally have viewed as competitors.

Emerging-Market Marketplaces

In China and India, e-commerce marketplaces are the default destination for online shopping. Aggregators of third-party sellers, such as Alibaba Group and JD.com in China and Flipkart, Snapdeal and Bigbasket in India, hold dominant shares of the online retailing market. Therefore, many Western retailers turn to these platforms in order to enter these markets with a strong chance of generating meaningful sales online.

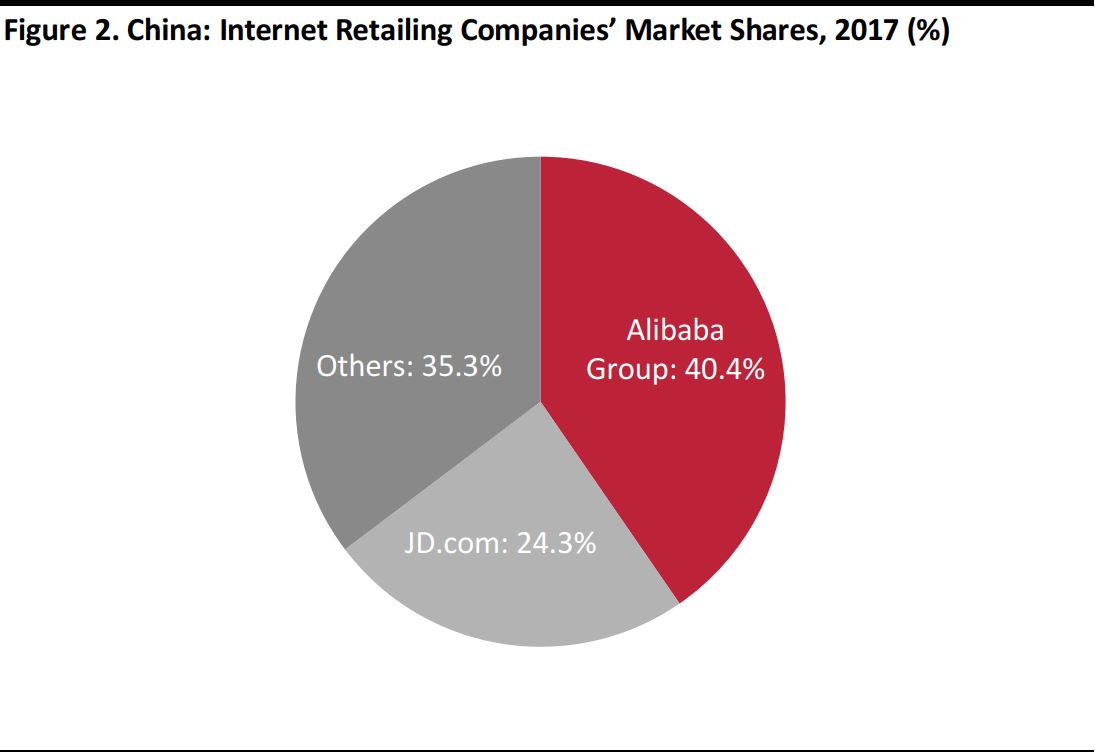

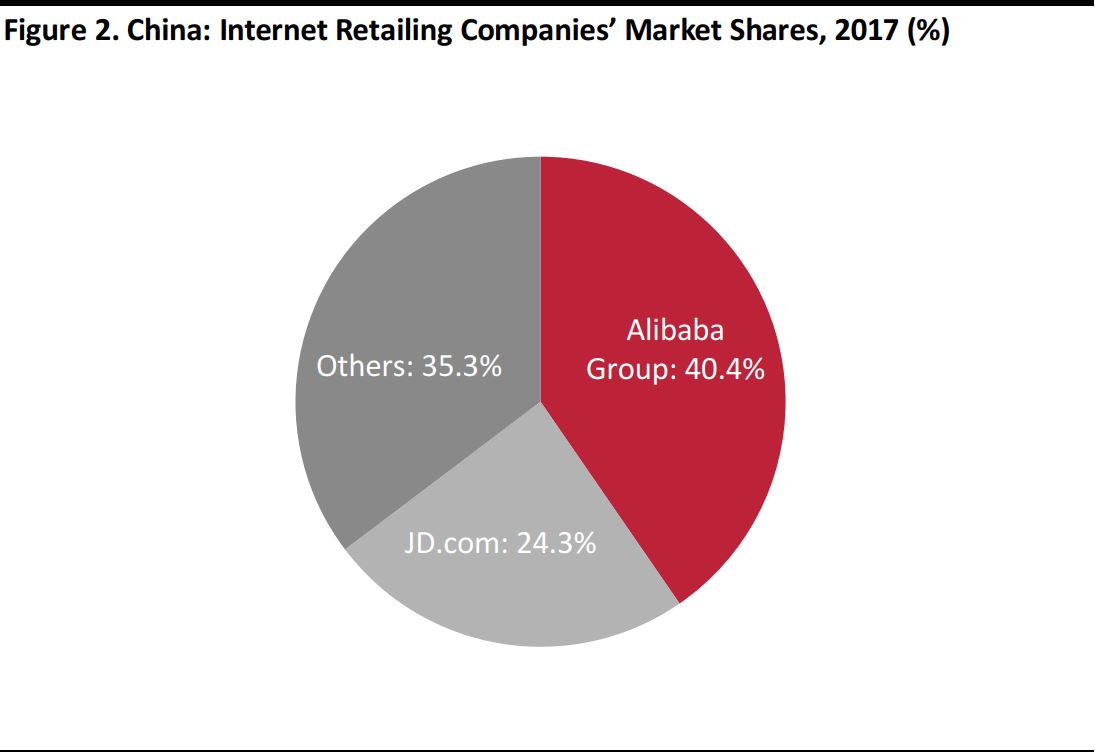

In China, Alibaba Group and JD.com dominate e-commerce. Names such as Macy’s, Aldi and Costco have collaborated with Alibaba Group, opening stores on its Tmall Global marketplace and, in some cases, on its domestic Tmall site, too. This year, Tmall stated that 18,000 international brands and retailers have turned to the site to sell to Chinese shoppers. Jet Jing, President of Tmall, has characterized the site as the “gateway to China” for international brands and retailers.

Walmart formed a strategic partnership with JD.com in 2016. The agreement was designed to drive online and offline initiatives, and saw Walmart’s Sam’s Club open a store on JD.com and Walmart’s China stores listed as a preferred retailer on JD.com. The companies

expanded this partnership in 2017 and recently extended it into grocery.

Source: Euromonitor International

In India, too, marketplace sites hold majority shares in e-commerce. These sites include Flipkart, Snapdeal and Bigbasket. Walmart’s May 2018 acquisition of a majority stake in Flipkart reflects the strength of this format in India.

Noting Selected Collaborations

We conclude by summarizing recent notable retail-tech partnerships and investments. Walmart, Target, Home Depot and Kohl’s are among those now offering voice shopping via Google Home. We also note Walmart’s recent extension of its partnership with JD.com and its acquisition of 77% of Flipkart.

Source: Company reports