Web Developers

In this report, the latest in our series of retail-tech company profiles, we look at Scoop Retail, a startup that creates in-store digital platforms. We recently met with the company’s founders, Kim Weld-Blundell and Richard Mason, who told us about the idea behind Scoop Retail and how they see it helping to improve retail for both companies and customers.

Weld-Blundell told us that the idea behind establishing the company was to bridge the gap between online and offline shopping. The founders wanted to create a frictionless experience for customers who use a retailer’s digital technology in-store.

The company’s offering includes:

Weld-Blundell told us that the idea behind establishing the company was to bridge the gap between online and offline shopping. The founders wanted to create a frictionless experience for customers who use a retailer’s digital technology in-store.

The company’s offering includes:

Kim Weld-Blundell has extensive experience in digital strategy and marketing. He worked at several leading digital-marketing agencies, including Ogilvy and Razorfish, and spearheaded award-winning projects at retail design consultancy Dalziel & Pow for companies such as Argos, Hyundai, Primark, Debenhams and The White Company. At Scoop, Weld-Blundell oversees the strategic aspects of the business.

Richard Mason built a successful agency that operated as the white-label technical division for top creative and digital companies. His agency also developed websites and apps for companies such as Ford, Shell, Deloitte, Microsoft and Harvey Nichols. At Scoop, Mason oversees the technical and operational aspects of the business.

Kim Weld-Blundell has extensive experience in digital strategy and marketing. He worked at several leading digital-marketing agencies, including Ogilvy and Razorfish, and spearheaded award-winning projects at retail design consultancy Dalziel & Pow for companies such as Argos, Hyundai, Primark, Debenhams and The White Company. At Scoop, Weld-Blundell oversees the strategic aspects of the business.

Richard Mason built a successful agency that operated as the white-label technical division for top creative and digital companies. His agency also developed websites and apps for companies such as Ford, Shell, Deloitte, Microsoft and Harvey Nichols. At Scoop, Mason oversees the technical and operational aspects of the business.

Scoop’s applications are built on the main software platform and both the platform and applications are then built into each device. Applications vary by user and function, but may have some features that are common. For example, an application for a kiosk that customers use to make purchases is different from an application for a tablet that store staff use to carry out store functions. It is like using a Lenovo laptop (the hardware) that runs a Microsoft Windows operating system (the platform), but that has applications like Word, Excel and PowerPoint built into it. These applications have some common features, but serve different purposes.

Scoop’s applications are built on the main software platform and both the platform and applications are then built into each device. Applications vary by user and function, but may have some features that are common. For example, an application for a kiosk that customers use to make purchases is different from an application for a tablet that store staff use to carry out store functions. It is like using a Lenovo laptop (the hardware) that runs a Microsoft Windows operating system (the platform), but that has applications like Word, Excel and PowerPoint built into it. These applications have some common features, but serve different purposes.

COMPANY BACKGROUND

Scoop Retail was founded in London in 2015 to help retailers provide customers with an e-commerce-like in-store experience and to better equip store associates to serve customers. It was part of an accelerator called Collider and it closed its first funding round in March 2016. Weld-Blundell told us that the idea behind establishing the company was to bridge the gap between online and offline shopping. The founders wanted to create a frictionless experience for customers who use a retailer’s digital technology in-store.

The company’s offering includes:

Weld-Blundell told us that the idea behind establishing the company was to bridge the gap between online and offline shopping. The founders wanted to create a frictionless experience for customers who use a retailer’s digital technology in-store.

The company’s offering includes:

- Digital kiosks: These in-store kiosks, built around the endless-aisle concept, allow customers to browse and order products instantly.

- Handheld tablets for store associates: Tablets with Scoop’s software give store associates instant access to information about a product’s specifications, stock availability and other details. Associates can also use the tablets to generate a seasonal lookbook featuring coordinates and accessories for the products a shopper has chosen or browsed, thus increasing the retailer’s cross-sell opportunities.

FOUNDERS’ BACKGROUND

Kim Weld-Blundell has extensive experience in digital strategy and marketing. He worked at several leading digital-marketing agencies, including Ogilvy and Razorfish, and spearheaded award-winning projects at retail design consultancy Dalziel & Pow for companies such as Argos, Hyundai, Primark, Debenhams and The White Company. At Scoop, Weld-Blundell oversees the strategic aspects of the business.

Richard Mason built a successful agency that operated as the white-label technical division for top creative and digital companies. His agency also developed websites and apps for companies such as Ford, Shell, Deloitte, Microsoft and Harvey Nichols. At Scoop, Mason oversees the technical and operational aspects of the business.

Kim Weld-Blundell has extensive experience in digital strategy and marketing. He worked at several leading digital-marketing agencies, including Ogilvy and Razorfish, and spearheaded award-winning projects at retail design consultancy Dalziel & Pow for companies such as Argos, Hyundai, Primark, Debenhams and The White Company. At Scoop, Weld-Blundell oversees the strategic aspects of the business.

Richard Mason built a successful agency that operated as the white-label technical division for top creative and digital companies. His agency also developed websites and apps for companies such as Ford, Shell, Deloitte, Microsoft and Harvey Nichols. At Scoop, Mason oversees the technical and operational aspects of the business.

BUSINESS MODEL

Scoop works through a software-as-a-service (SaaS) delivery model. The company has partnered with established hardware providers to develop its devices, and it creates proprietary software and applications in-house. Scoop’s applications are built on the main software platform and both the platform and applications are then built into each device. Applications vary by user and function, but may have some features that are common. For example, an application for a kiosk that customers use to make purchases is different from an application for a tablet that store staff use to carry out store functions. It is like using a Lenovo laptop (the hardware) that runs a Microsoft Windows operating system (the platform), but that has applications like Word, Excel and PowerPoint built into it. These applications have some common features, but serve different purposes.

Scoop’s applications are built on the main software platform and both the platform and applications are then built into each device. Applications vary by user and function, but may have some features that are common. For example, an application for a kiosk that customers use to make purchases is different from an application for a tablet that store staff use to carry out store functions. It is like using a Lenovo laptop (the hardware) that runs a Microsoft Windows operating system (the platform), but that has applications like Word, Excel and PowerPoint built into it. These applications have some common features, but serve different purposes.

CLIENTELE

Scoop Retail is already working with Superdry, several British high-street retailers and an unnamed Indian company. Weld-Blundell tells us that one of the company’s high-street clients now sees some 20% of online sales generated through the in-store tablets and kiosks.DIFFERENTIATING FACTORS

There are several factors that differentiate Scoop’s service offering:- For many individual retailers, it is not economical to develop in-store technology on their own or through an external agency. Scoop has already built devices that run applications for in-store functions, so these retailers will only need these to be tailored to their brand and needs, and then set up in their stores.

- Most retailers have different systems installed to monitor various operational functions such as inventory management, warehouse management, and order and return processing. Scoop’s integration capability allows the platform to work with a retailer’s existing systems and draw data from them. Scoop then reformats that data in a way that its system can use, helping bring down costs while integrating Scoop’s devices with a client’s existing technology.

- Since all of Scoop’s applications that run on different devices are powered by its own platform, they are all connected, and can be controlled from the Scoop dashboard.

- If a retailer decides to upgrade one of its systems in the future, Scoop’s systems can integrate and work with the upgraded system, without any changes needing to be made to the Scoop platform.

CHALLENGES DURING INTEGRATION

Weld-Blundell and Mason both noted that they faced mostly operational challenges while setting up Scoop’s systems. Since retailers work with different payment providers, Scoop is designed to work with retailers’ existing providers—the retailer needs only to supply the PIN entry device for payments processing. When that is not possible, Scoop’s system can work with one of a number of other payment providers instead.GROWING DEMAND FOR IN-STORE TECHNOLOGIES

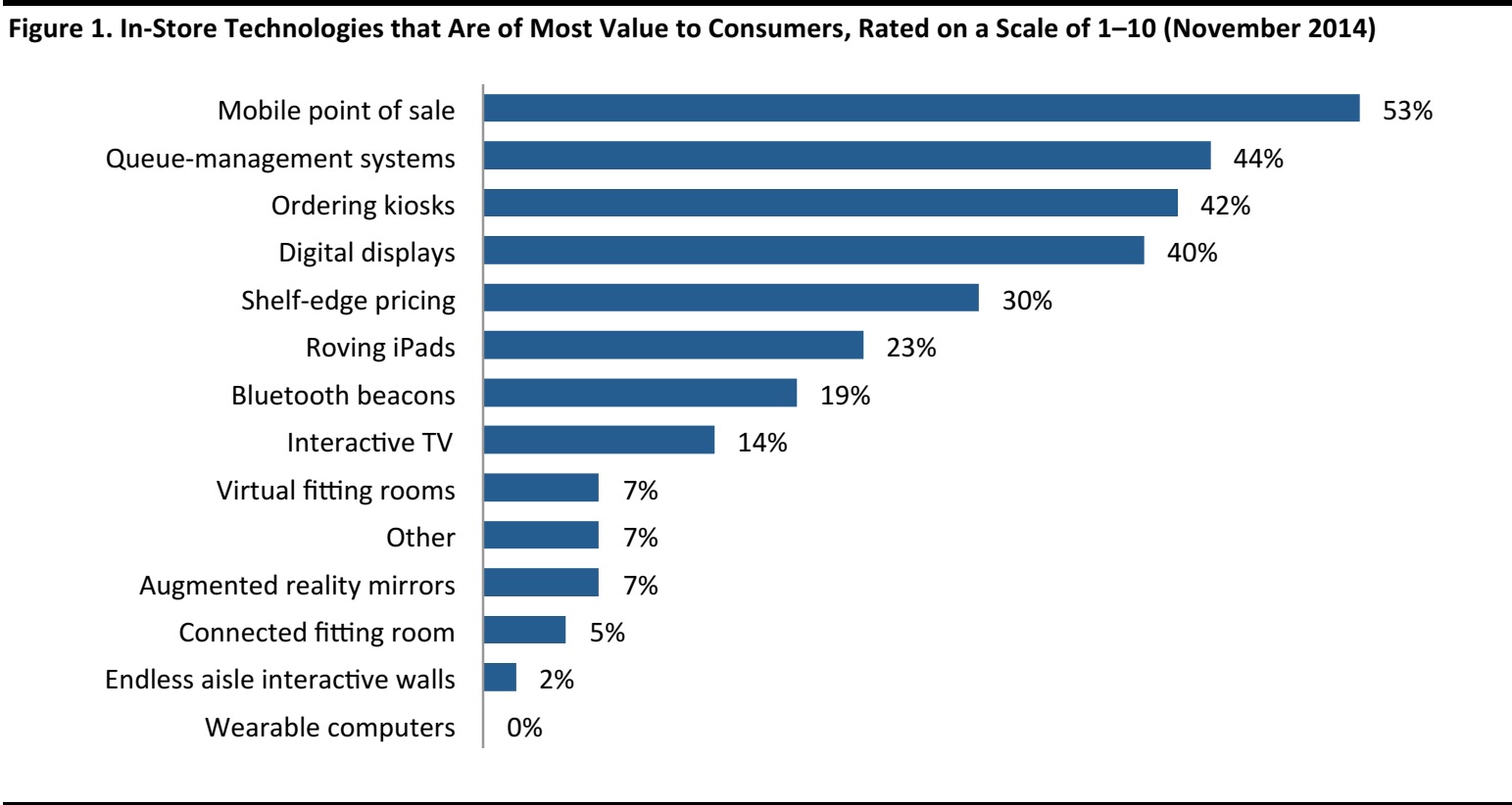

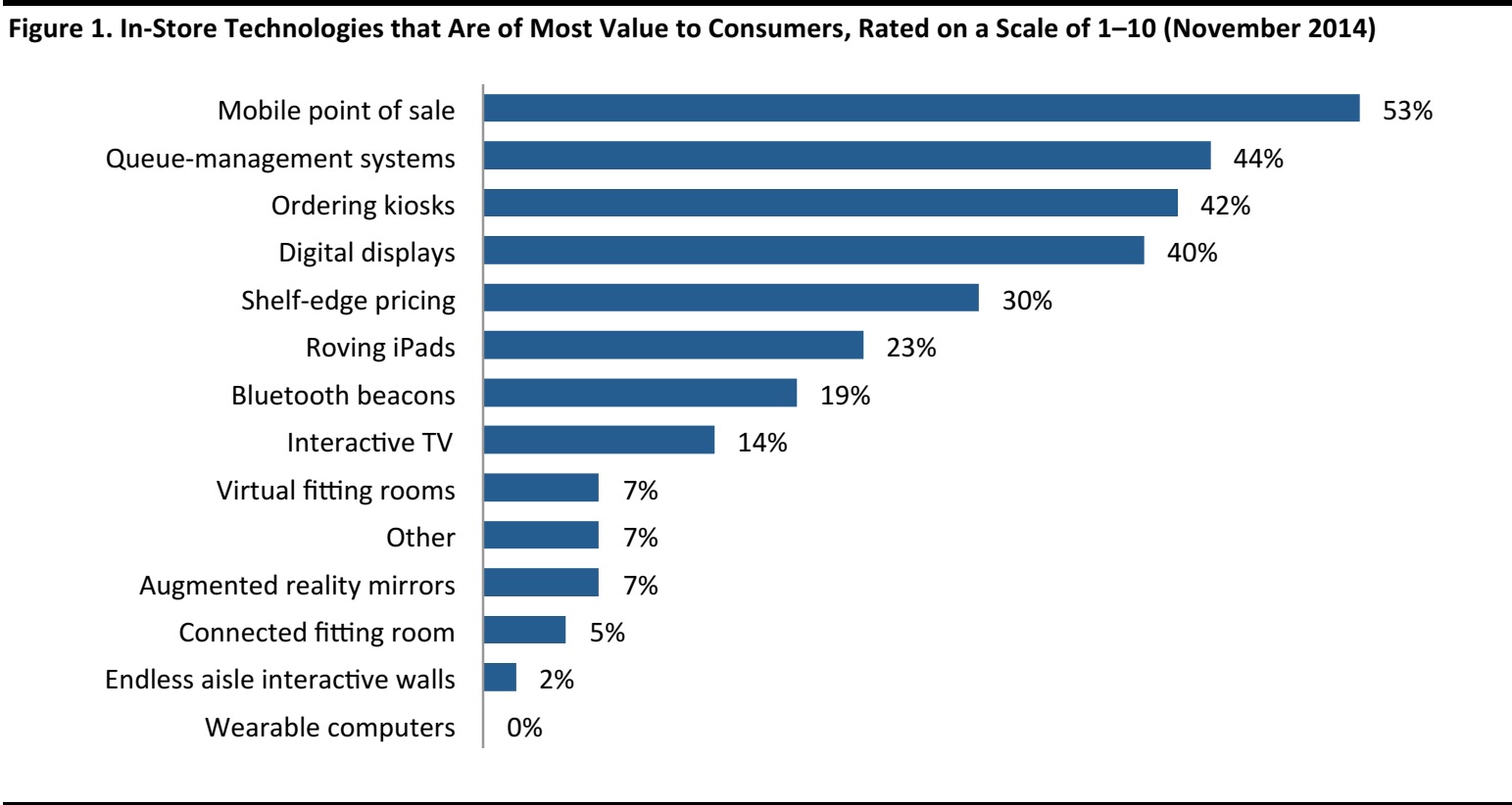

More consumers seem to be interested in using in-store technology to complete their shopping journey. Retail Week undertook a survey in November 2014 and asked consumers to rate various in-store tech on a scale of importance from one to 10. The survey found that mobile POS, queue-management systems and ordering kiosks are the three technologies consumers think are most important while shopping.

Source: Retail Week/Fung Global Retail & Technology

WHAT WE THINK

Scoop and companies like it have a number of tailwinds at their backs: millennial consumers are entering their peak earning and spending years and are often looking for convenient, information-rich and tech-enabled shopping experiences; brick-and-mortar retailers continue to look for ways to integrate their online and in-store experiences; and Internet retailers are increasingly opening physical stores. Scoop’s applications cater to the demands arising from these shifts by providing online-like shopping experiences in brick-and-mortar stores. These applications put product information at store associates’ fingertips, make availability information and ordering options visible across the retailer’s complete inventory, and offer features such as look books that can help shoppers make more informed choices and increase sales at the same time.