Introduction

Beauty is a bright spot for department stores, and major names such as Macy’s and JCPenney are investing to attract a greater share of spending flowing to categories such as skin care, color cosmetics and fragrances.

Indeed, among the different categories that department stores compete for, beauty is a higher-growth category overall. According to our analysis of data from the US Bureau of Economic Analysis, US consumers increased their spending on apparel and footwear by 1.7% in 2017, while they grew their spending on beauty and fragrance products by more than double that rate, at 3.9%.

In this brief report, we bring together market-share data, consumer survey findings and recent management commentary from major retailers to review how department stores are performing in the beauty category.

Beauty a Growth Story for Department Stores

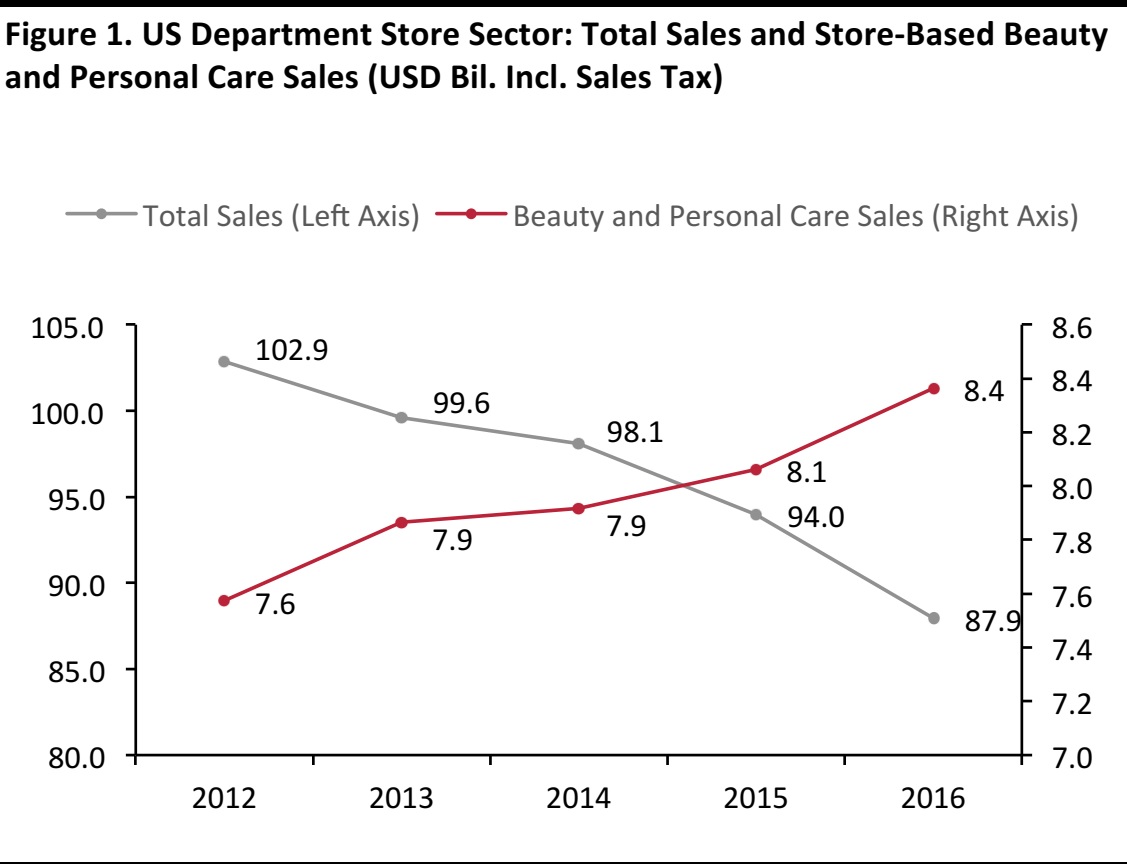

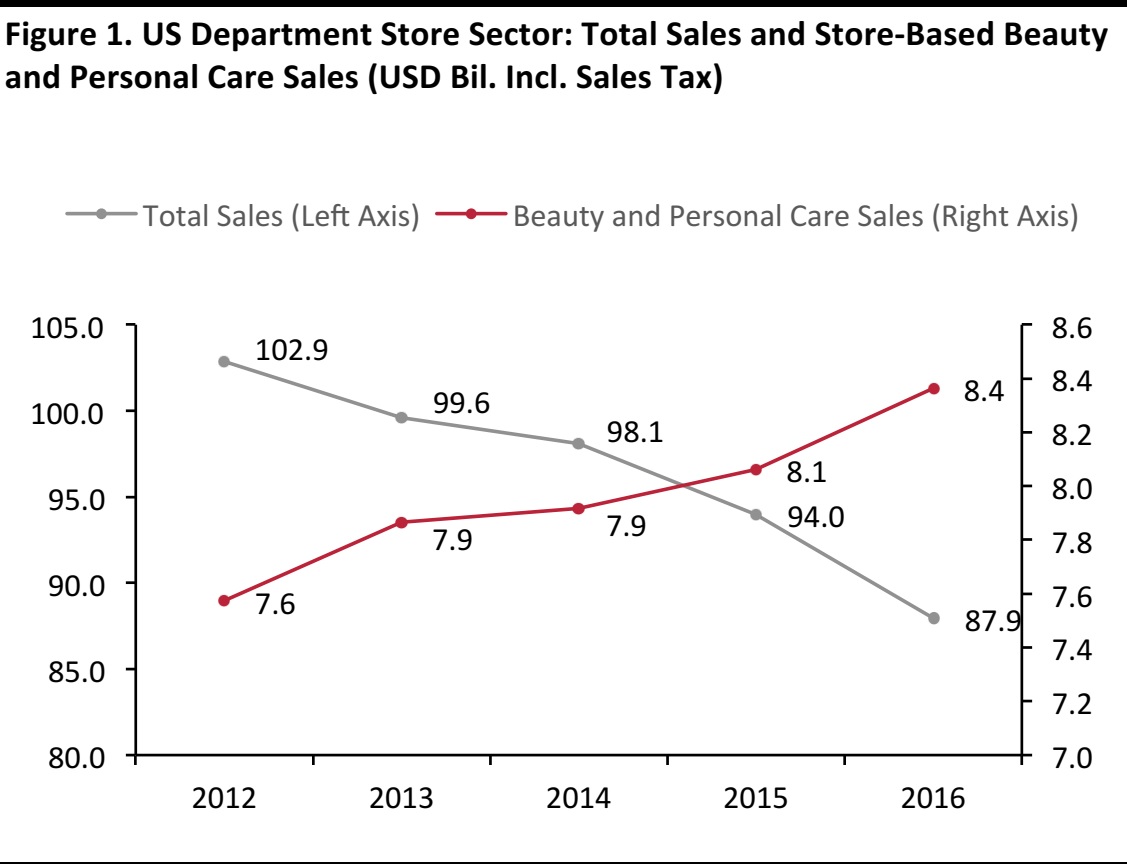

Despite the growth of e-commerce and specialized rivals such as Ulta and Sephora, department stores’ physical shops have lost only marginal share in beauty and personal care, according to Euromonitor International. The sector’s store-based share of total sales edged down to 9.8% in 2016 (latest available data) from 10.1% in 2012. Euromonitor’s data exclude online sales, and if we include e-commerce sales by department stores, the sector’s share would be higher than this.

In absolute terms, the department store sector has actually grown total store-based beauty and personal care sales, according to Euromonitor. In 2016, the sector’s store-based sales reached $8.4 billion. This is in the context of total declines in department store sales; indeed, Euromonitor records a total $15 billion decline in sector sales between 2012 and 2016 (latest).

Source: Euromonitor International

One reason for this contrasting performance is the decline of Sears. This chain has posted steep falls in total sales, which have dragged down total sales for the overall sector. However, Sears is not a beauty destination; instead, it skews toward alternative categories such as appliances.

Adding further support to growing sector sales have been Kohl’s overhaul of its beauty offering and JCPenney’s partnership with Sephora, which continues to see more Sephora shops-in-shops added into JCPenney stores.

A Closer Look at Macy’s Beauty Shoppers

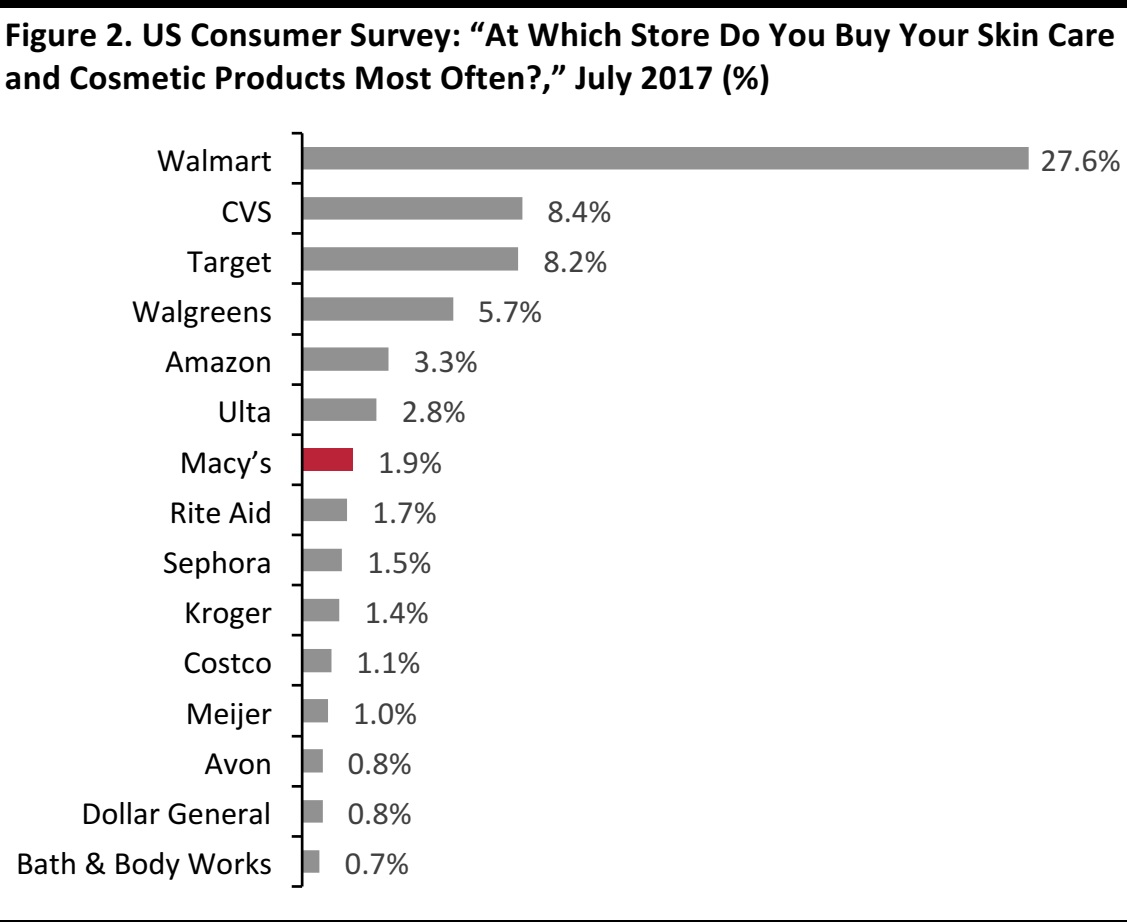

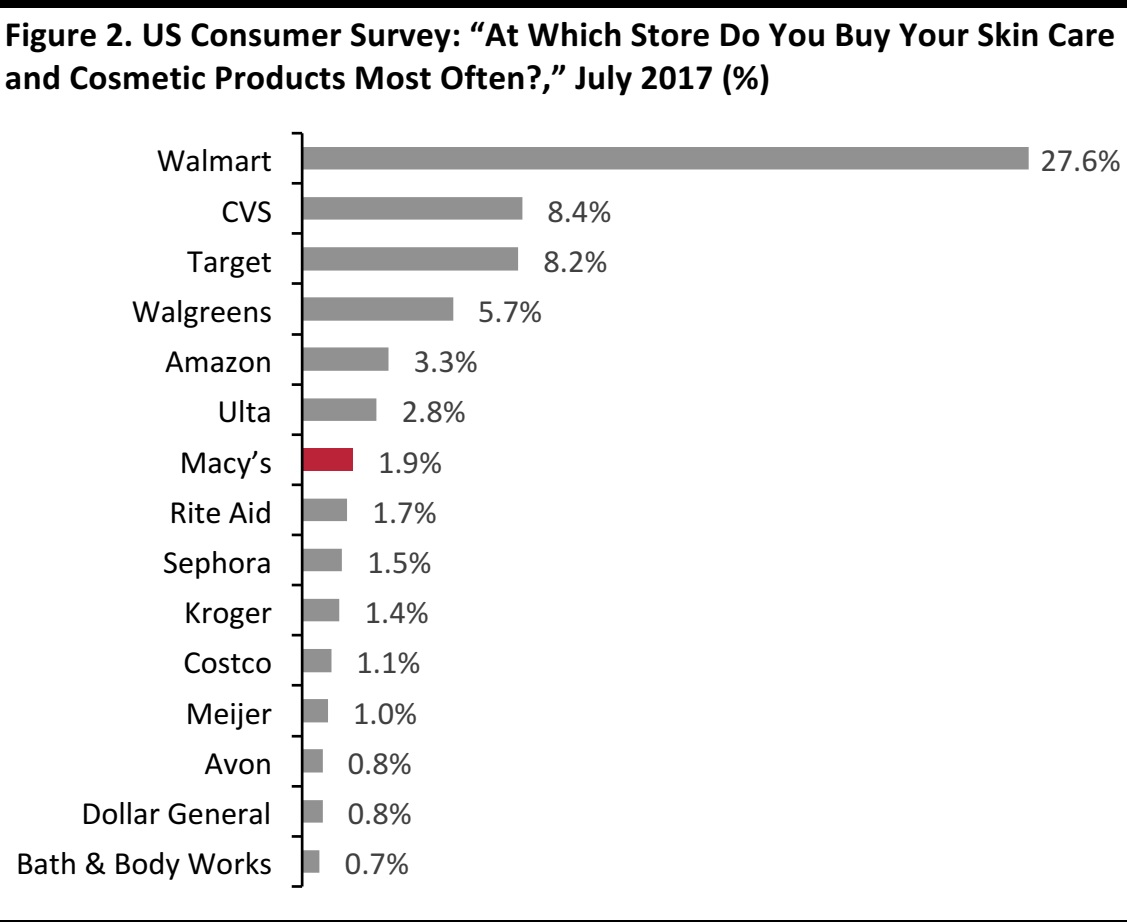

Macy’s is by far the most-shopped department store for the core skin care and cosmetics category, according to survey data from Prosper Insights & Analytics. It is the only department store to feature among the top-20 most-shopped retailers, although the strength of Sephora in the survey is likely to prove a boon to JCPenney.

Base: 7,266 US Internet users ages 18+.

Source: Prosper Insights & Analytics

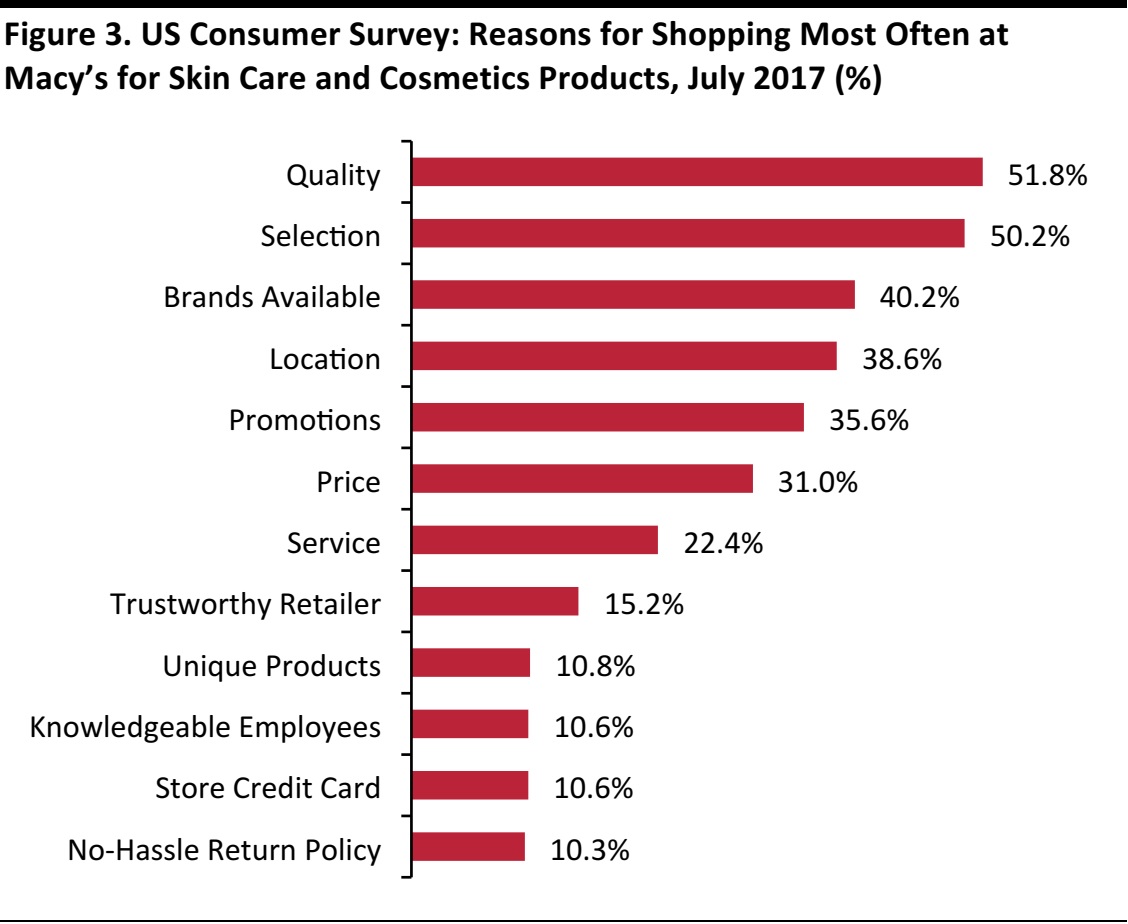

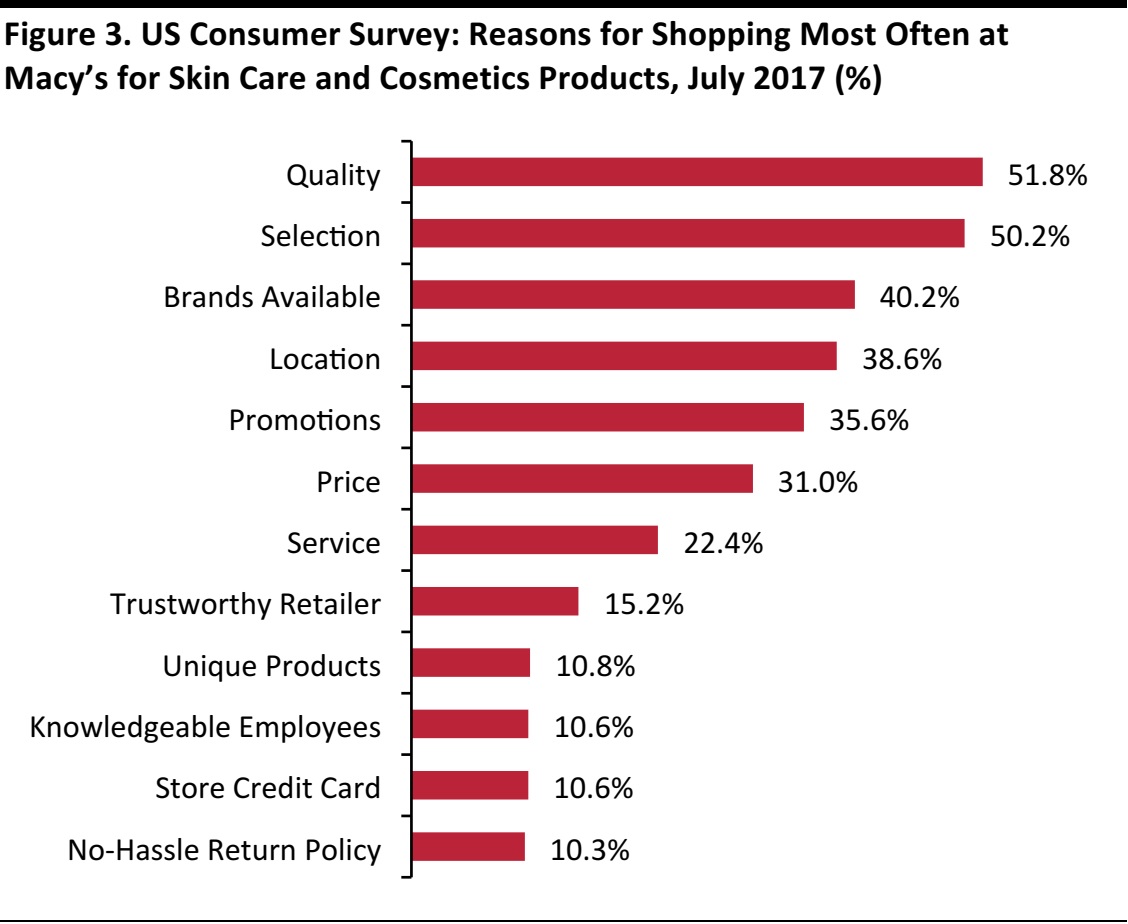

Reflecting its suite of premium brands and its strong brick-and-mortar presence, quality, choice, and location are the top reasons why Macy’s most-loyal beauty shoppers choose to buy from the retailer. Price is still a meaningful factor, even among those picking Macy’s over lower-price retailers as their most-shopped store.

To offer some comparison, the top-three reasons for shopping at Walmart were, in descending order: price, location and selection. Target shoppers chose the same reasons, but in a different order: price, selection and location. Quality came in fourth place for both Walmart and Target.

Base: 141 US Internet users ages 18+ who buy skin care and cosmetics most often from Macy’s.

Source: Prosper Insights & Analytics

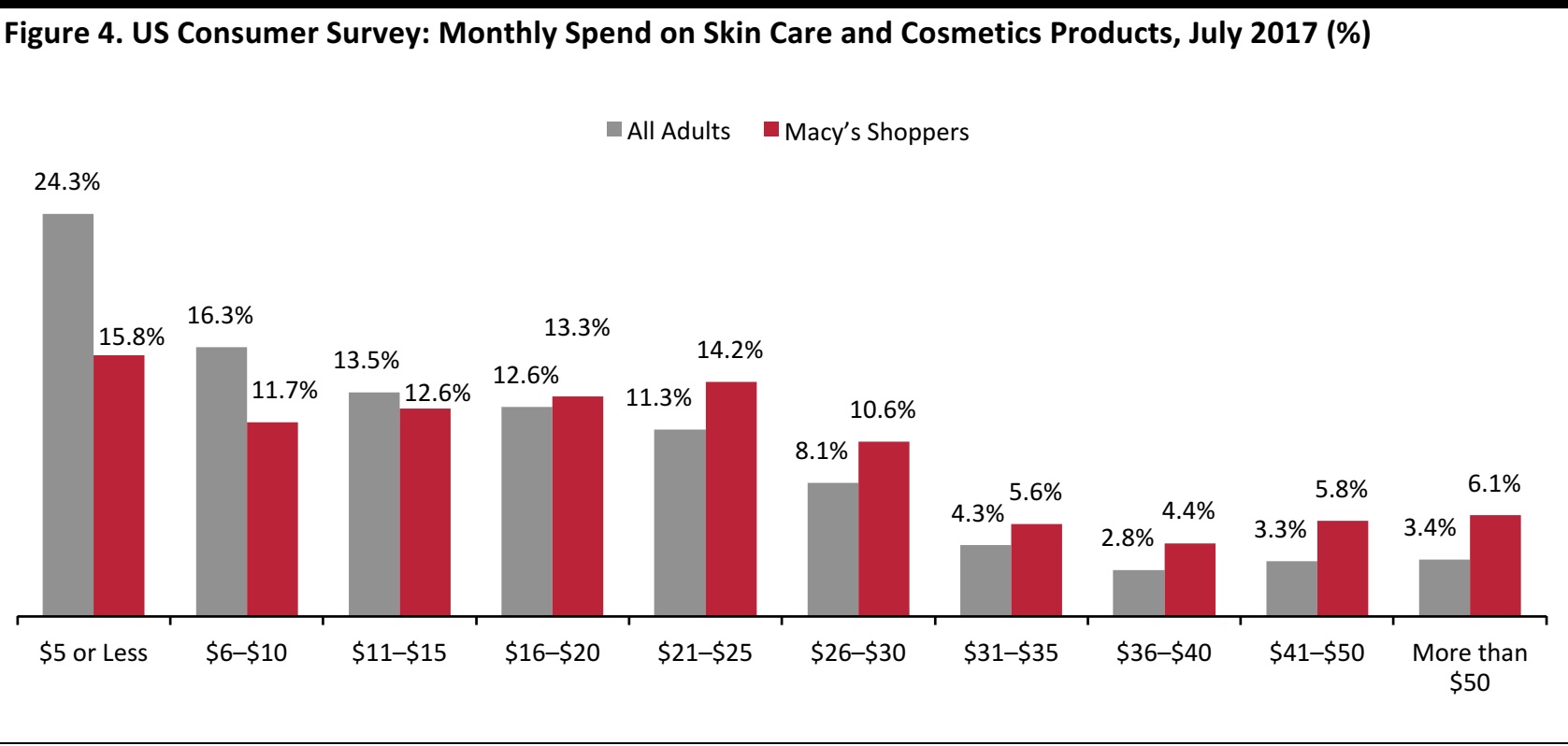

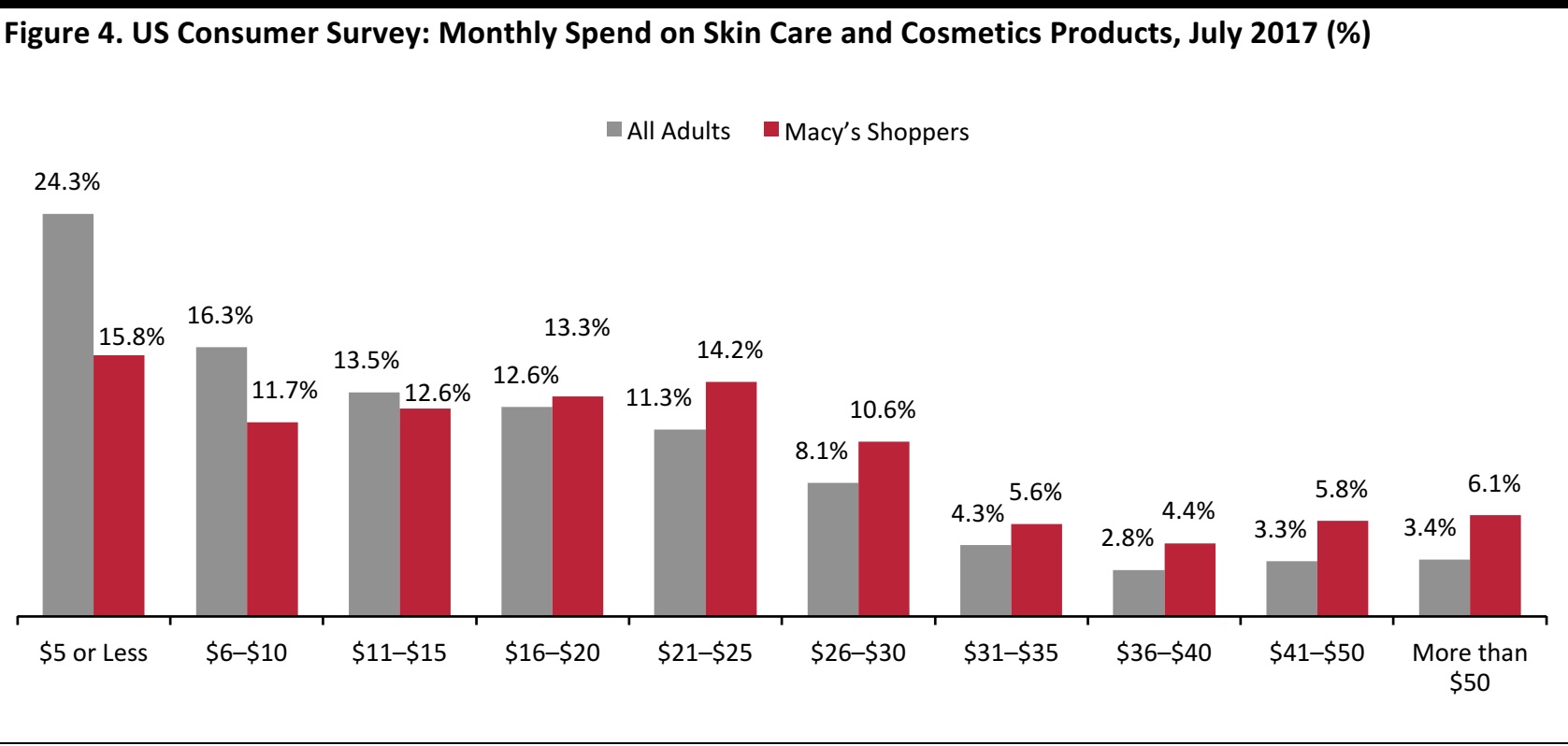

It is perhaps unsurprising that those shoppers who identify a department store as their most-shopped retailer for beauty products tend to spend more than average on beauty. We chart below how average spend splits out for Macy’s shoppers versus the average.

Almost half of those who say Macy’s is their top store for beauty spend more than $20 per month on skin care and cosmetics; among all respondents, only one-third say they spend more than $20.

Base: 7,266 US Internet users ages 18+, including 1,416 who identify as Macy’s shoppers.

Source: Prosper Insights & Analytics

A Wrap-up of Recent Management Commentary

In this section, we summarize recent commentary by management of Macy’s, JCPenney, Kohl’s and Nordstrom on the performance of the beauty category.

Macy’s

During Macy’s fourth-quarter earnings call in February, CEO and Chairman Jeffrey Gennette noted: “We saw an improved trend shift in beauty, driven by strong fragrance sales, gift sets and prestige skin care.”

Macy’s beauty offering is moving from a brand-centered format to a customer-centric model. In February, Gennette explained that “On the Beauty floor, you see us evolving from a brand-centric model to a customer-centric model, where … Beauty associates are cross-trained in the products that the customer may be interested in. So they know the best mascaras beyond the brand that they’re taking a paycheck with us from.”

At the Bank of America Merrill Lynch Consumer & Retail Technology Conference in March 2018, Gennette noted that the acquired Bluemercury beauty format had been rolled out to 20 Macy’s stores.

And what you’re seeing in Bluemercury within Macy’s is the advanced skincare is really doing well. We’re getting double-digit growth in that, which is quite nice. We’re also doing quite well with the proprietary brands, that’s in huge adoption on M-61 and Lune+Aster, that when you add those together, it’s the #2 brand in Bluemercury in stores. And we’re finding that the customers are loving having access to this whole portfolio of new content that is within Macy’s stores.

At the conference, Gennette remarked that Macy’s focus in beauty was “getting makeup and skin care right,” by leveraging Bluemercury and its Impulse concept,which brings together niche brands.

Also in March, Macy’s announced that it would launch a Beauty Box subscription service this spring. The box will cost $15 a month and includes five deluxe beauty samples, a bonus sample and a $5 coupon to use in-store or online for the next beauty purchase.

JCPenney

On JCPenney’s fourth-quarter conference call in March 2018, Chairman and CEO Marvin Ellison remarked that its “best-in-class” partnership with Sephora is a key component of JCPenney’s beauty strategy.

The retailer opened 70 new Sephora locations in 2017, bringing the total number of Sephoras inside JCPenney shops to 641 at the end of the fourth quarter, meaning Sephora is present in almost 75% of all JCPenney stores. Ellison noted that the retailer will open approximately 30 Sephora shops in JCPenney stores in 2018, which would take the total to approximately 670 Sephora shops.

In September 2017, Sephora launched Fenty Beauty, a line from pop singer Rihanna, and JCPenney noted gains from the launch. On JCPenney’s third-quarter earnings call in November, Ellison noted “an incredible reaction from our multicultural customers.”In March, Ellison said that the retailer was “very pleased with our launch of Fenty Beauty by Rihanna … We believe this new launch will continue to drive significant incremental sales and foot traffic to our Sephora inside JCPenney shops throughout 2018.”

JCPenney is developing its beauty services offering, too. Since 2015, it has been rebranding its store salons as Salon by InStyle, as part of a collaboration with InStyle magazine. In March, Ellison pointed to “a great year of positive sales growth in our salons.” In 2018, JCPenney plans to rebrand and remodel another 100 salons to Salon by InStyle. Ellison stated that when the retailer rebrands a salon, the sales performance in these sales locations improves“on average, by 400 basis points.”He also remarked that salon customers visit a store twice as often as non-salon customers.

Kohl’s

In August 2016, Kohl’s completed its program to refresh its beauty offering, which included bringing in premium brands such as Bliss and Pür cosmetics and introducing trained beauty advisors at all of its stores. However, management has offered a little commentary on its performance in beauty. Kohl’s did not comment on the category’s performance in any of its quarterly updates or earnings calls in the year ended January 2018. The most recent management commentary on its beauty business was in February 2017, when former CFO Wesley McDonald noted “the continued strength of the beauty business, and we expect to continue to grow that in 2017 as well.”

In December 2017, a Kohl’s spokeswoman told fashion-news website WWD.com, “Kohl’s has seen positive results with these [recent] enhancements, and will continue to focus on broadening the beauty assortment, including color cosmetics, fragrance brands and more, to deliver unexpected product and remain competitive.”

Also in December, Kohl’s announced that it had appointed Bob Jezowski as Vice President and Divisional Merchandise Manager of Beauty. Jezowski was previously VP of Beauty and Fragrance at Belk.

Nordstrom

Nordstrom management has pointed to beauty being a solid category, but has provided few detailed comments. On its fourth-quarter earnings conference call in March 2018, Co-President and Director Erik B. Nordstrom remarked that “Beauty continues to be very strong for us….A lot of it is … driven by new or not highly distributed brands and brand launches. So that business continues to be very healthy and solid.”

On the prior quarter’s earnings call in November 2017,Co-President and Director Peter E. Nordstrom noted that “our beauty business has been consistently good for quite some time.”

Key Takeaways

Department stores’ physical shops still account for one in every $10 of spending on beauty and personal care. Add in e-commerce sales by department store retailers and the sector’s share of beauty spend would be slightly higher.

Beauty is a higher-growth category than apparel and remains a pocket of opportunity for department stores. Macy’s, with Bluemercury, and JCPenney, with Sephora and InStyle Salons, are among those retailers making efforts to further build their share of beauty spending.