Introduction

From bankruptcy filings to store closures to the most unlikely M&A deals, this year has been packed with more than a handful of surprising events and unexpected announcements. As 2017 draws to an end, we look back on 17 moments in retail and tech that made the year eventful and set the tone for the coming year.

17 Shocking Moments in Retail in 2017

Below, we list the 17 moments in retail that shocked many in 2017.

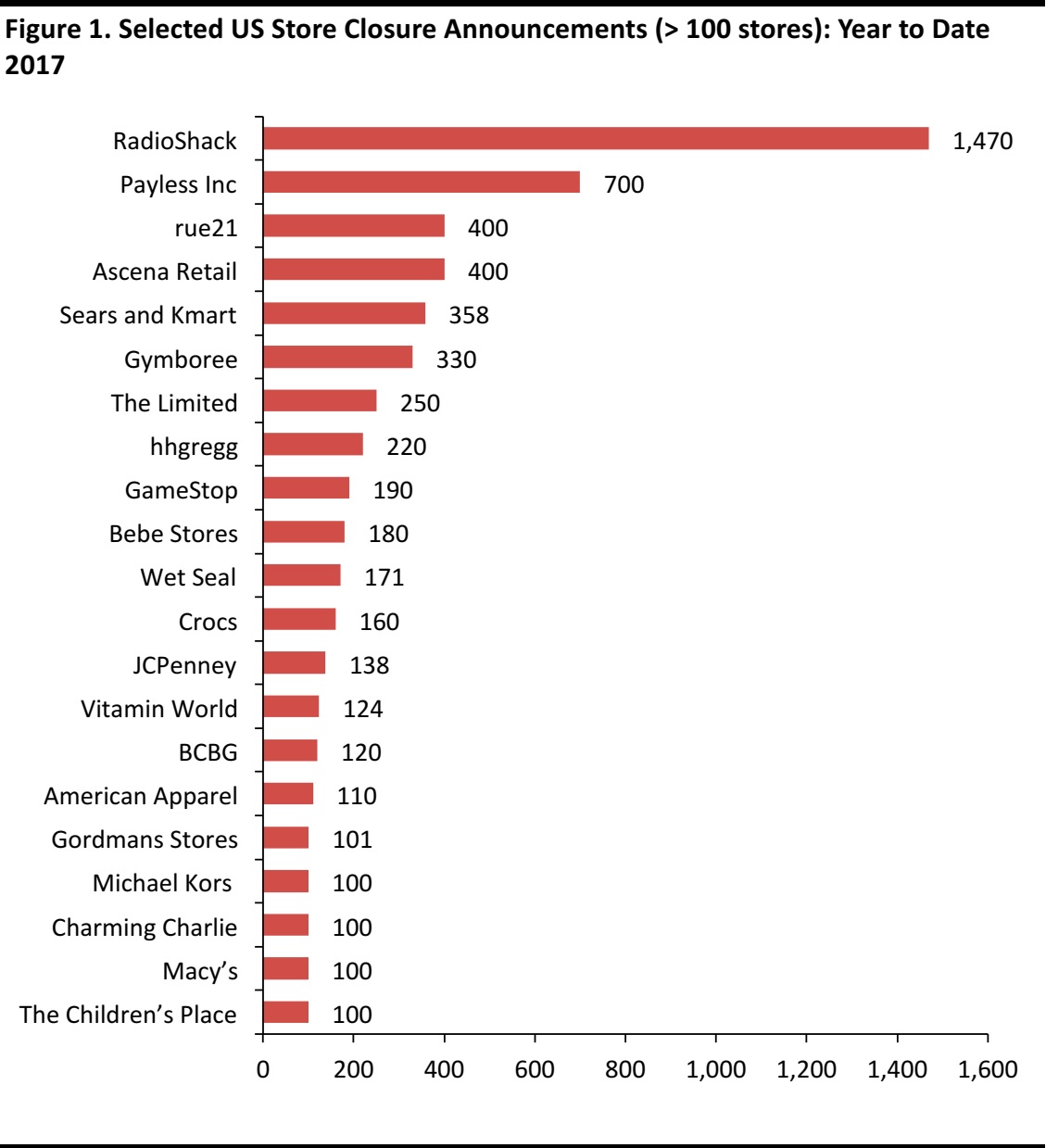

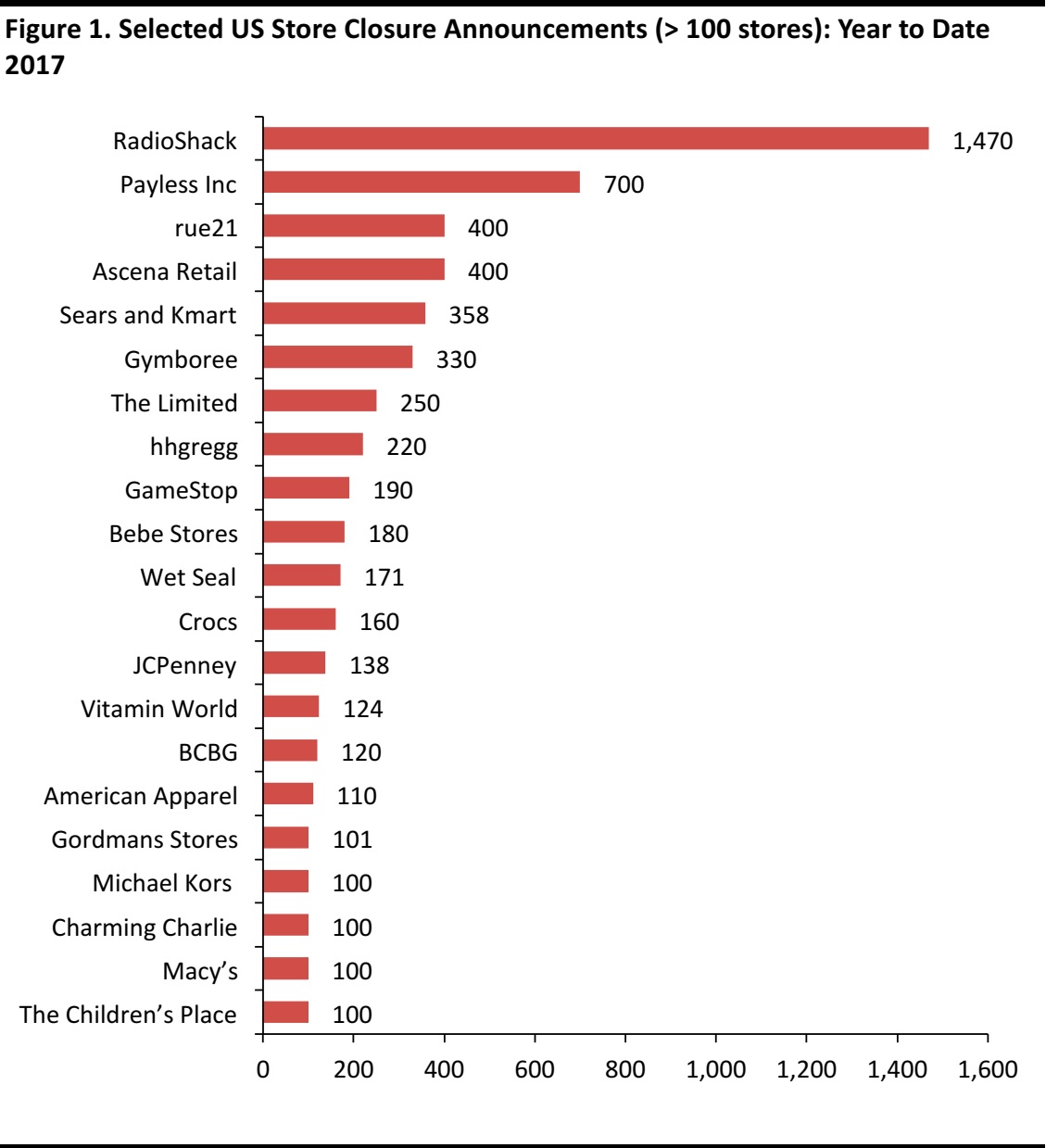

1. Store Closures Exceed Store Openings

In what seems to have been one of the toughest years for US retail, the number of store closure announcements continues to exceed store openings. As of December 2015, as outlined in our latest

Weekly Store Openings and Closures Tracker, the number of store closureannouncements in the US has increased 229%, bringing the total number of stores to be closed to 6,985.

As of December 22, 2017:

- H&M has announced a transformation plan which includes more store closures and fewer openings.

- Charming Charlie has filed for bankruptcy and plans to close 100 stores by the end of the year.

- Dollar General has announced plans to open 900 new stores in 2018.

- Gander Mountain has emerged from bankruptcy and has rebranded as Gander Outdoors.

- The Children’s Place will close 300 stores by 2020.

- Ascena will close between 268 and 667 stores by July 2019, depending on negotiations with landlords.

- Gap will close 200 stores by 2020.

- Urban Outfitters plans to close eight to nine stores in 2017.

- Vitamin World will close at least 50 stores.

Source: Company reports/FGRT

2. Luxury Moves Online

JD.com invested $397 million in Farfetch, a London-based online luxury retail platform in June 2017.

Luxury brands had previously hesitated about selling on e-commerce sites, but 2017 saw the tides shift, with notable e-commerce players revealing deals with some of the big names in luxury and investment in platforms making online a more attractive proposition:

- May: Several luxury brands such as Burberry, Dior, Longchamp and Cartier began testing sales to shoppers through Chinese messaging app WeChat, according to an article by The Wall Street Journal. The app boasts a vast user base—the largest in China at 963 million as of June 2017, according to Tencent—and a highly interactive multimedia platform that enables direct access to potential shoppers.

- June: Chinese e-commerce firm JD.com announced an investment worth $397 million for a stake in London-based online luxury retail platform Farfetch, hoping to bring high-end brands to its online store in China.

- August: Alibaba unveiled a new platform for premium and luxury brands, called The Luxury Pavilion, in a bid to expand its footing in high-end retail and attract super-wealthy Chinese consumers.

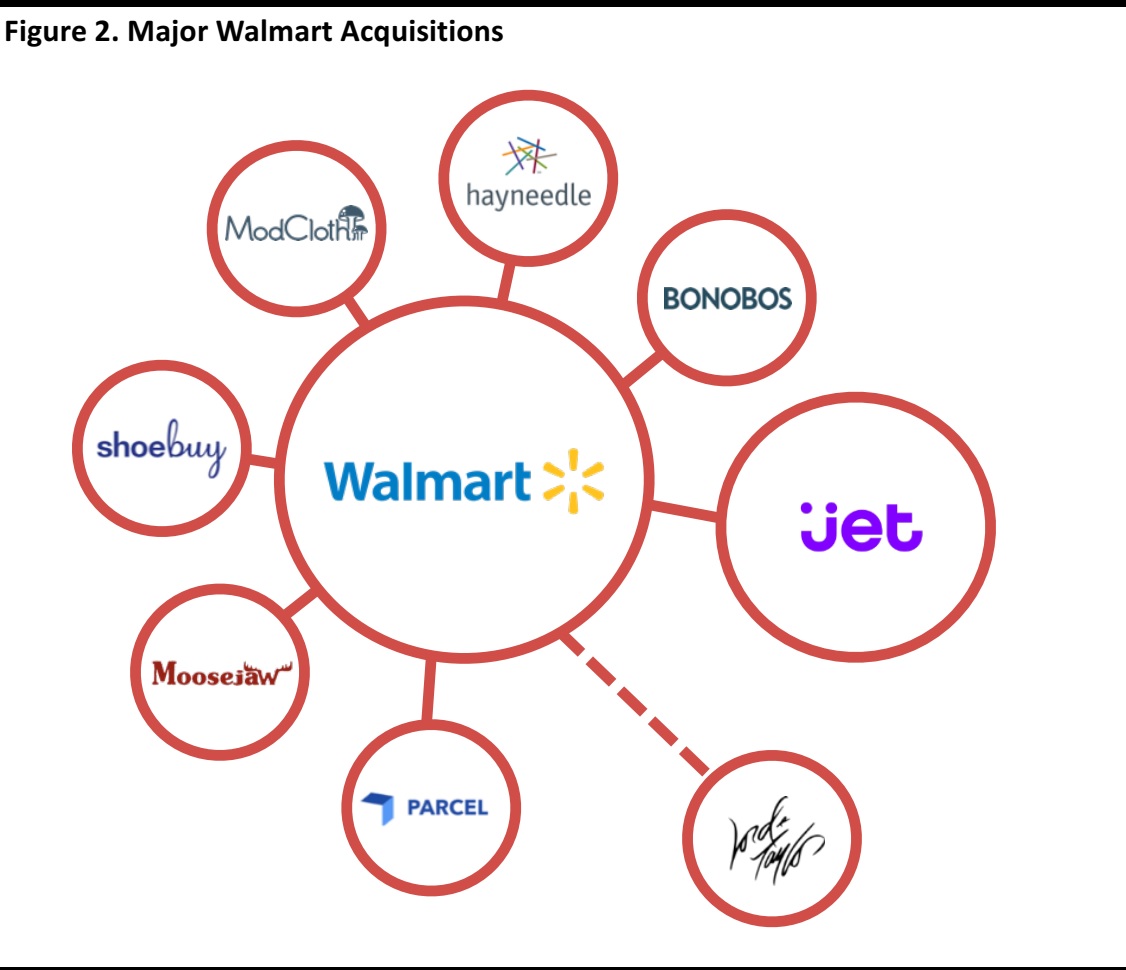

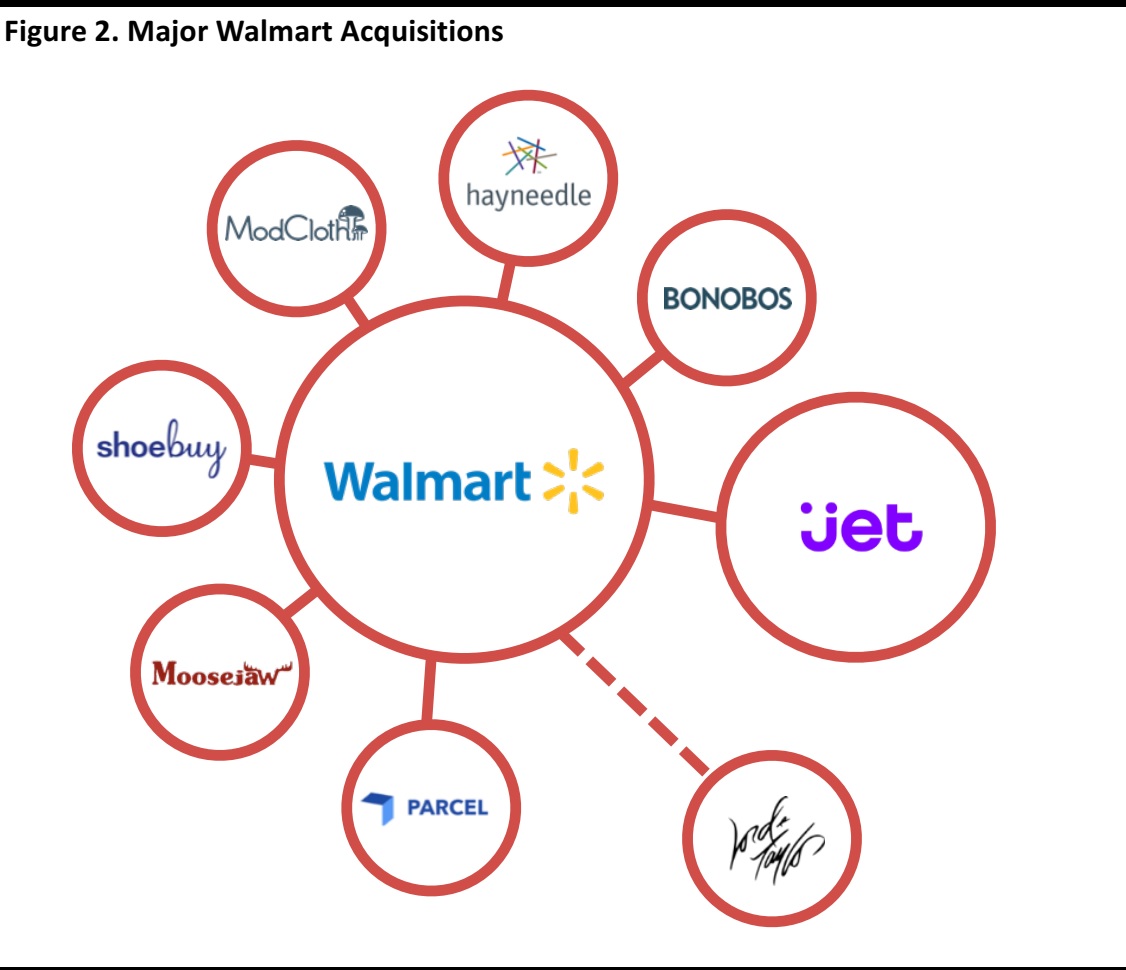

3. Walmart Embarks on an Acquisition Spree

Walmart continued to build its e-commerce proposition with a number of acquisitions this year. In addition to buying several online apparel companies such as Bonobos, Walmart will host a Lord & Taylor storefront on its website, starting in the spring of 2018. The intention is to create a premium fashion destination on Walmart.com. Walmart is beginning to build out “elements of discovery and inspiration” within the fashion portion of its website, according to the company.

Source: Company reports/FGRT

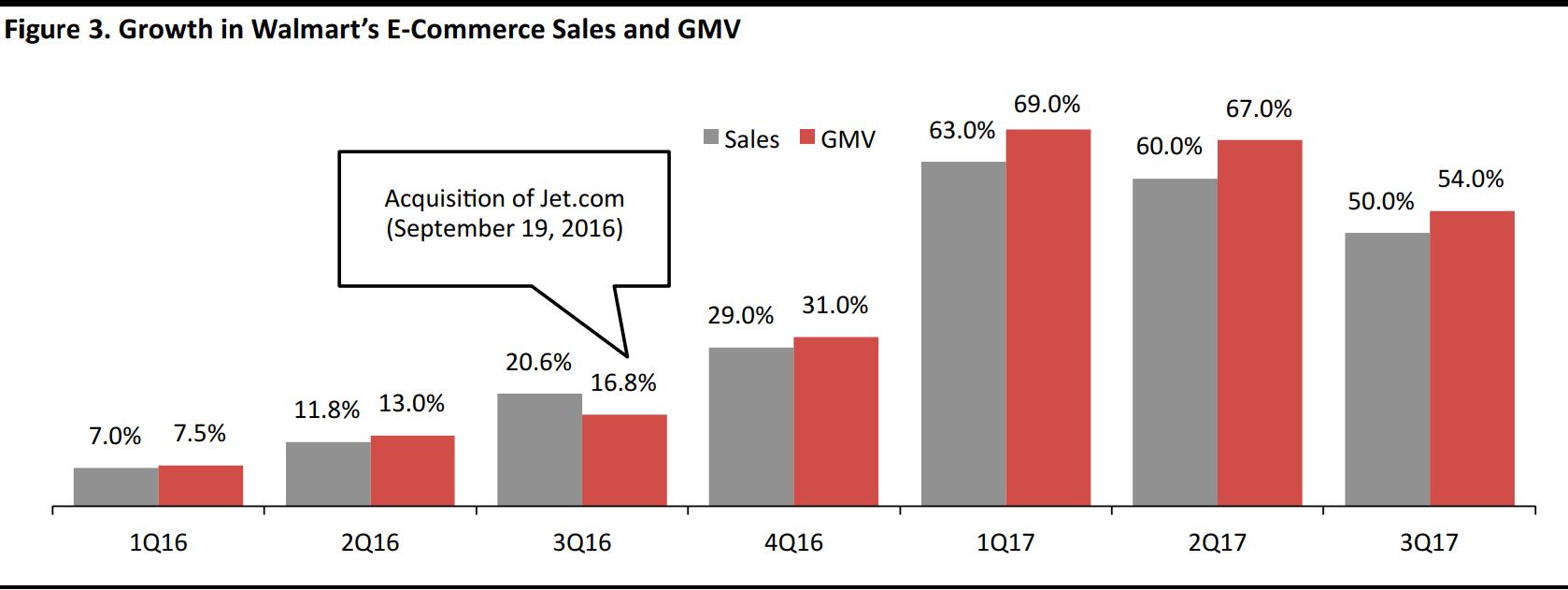

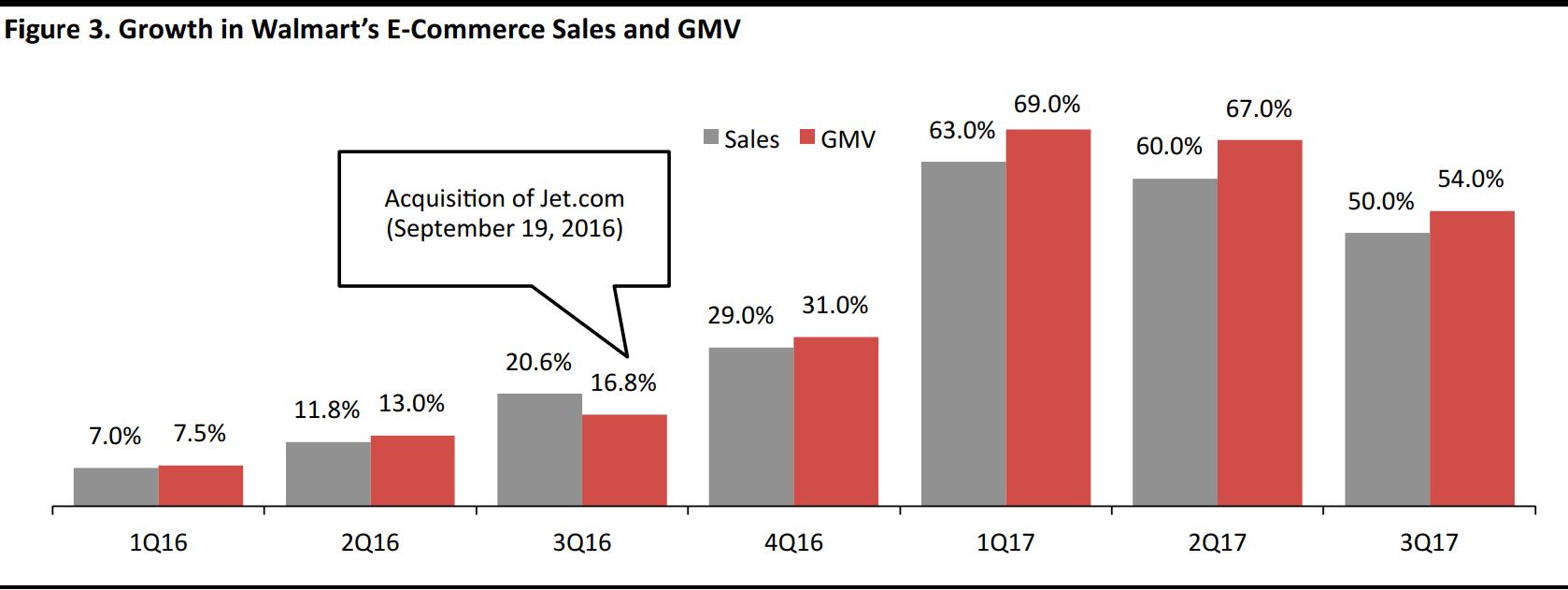

4. Walmart Sees Massive E-Commerce Growth

Online retail startup Jet.com was acquired by Walmart in 2016, for a consideration of $3 billion. Since then, Walmart’s e-commerce revenues and gross merchandise value (GMV) have grown significantly.

Source: Company reports

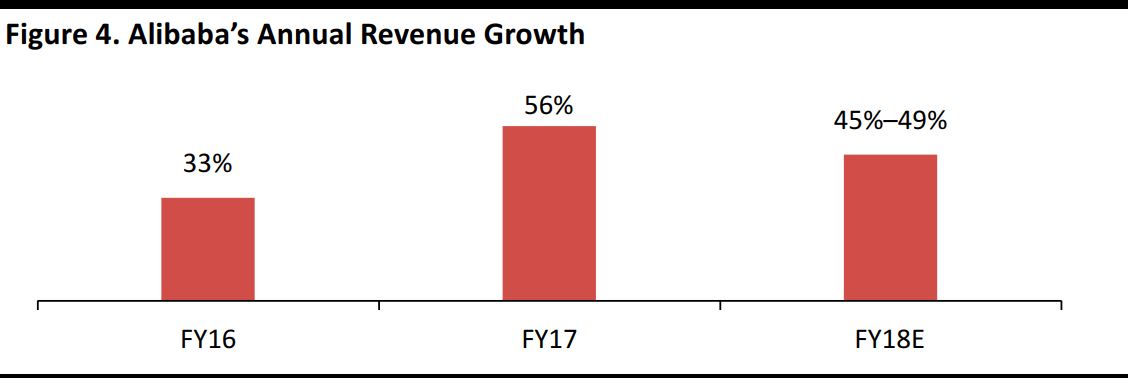

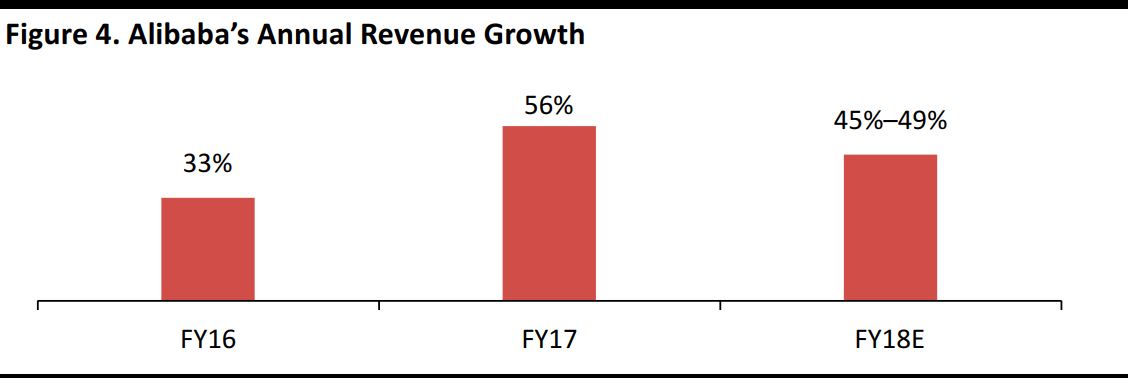

5. Alibaba Guides to 50% Revenue Growth

At a time when many retailers have been announcing disappointing results or warning of tough trading in subsequent periods, Chinese e-commerce giant Alibaba guided for robust revenue growth of 45%–49% for fiscal year 2018 (which ends in June), at its 2017 Investor Day.

Alibaba’s revenue growth in FY16 and FY17 was 33% and 56%, respectively.

Source: Company reports

6. Nordstrom Puts Plans to Go Private on Hold

In June, Nordstrom announced that some members of the retailer’s founding family were looking to take the company private, as it struggled to compete amid an industry-wide slowdown. Going private meant raising debt capital, which the Nordstrom family were having difficulty with, according to early October news reports. On October 16, Nordstrom finally announced that the decision to take the retailer private was on hold and that the company would revisit the decision after the holiday seaon.

7. Lord & Taylor Sells Space to WeWork

Hudson’s Bay Company (HBC), the parent firm of Lord & Taylor, announced in October that it was selling the luxury department store’s iconic Fifth Avenue flagship in New York to office space provider startup WeWork, for $850 million. The transaction, which is part of HBC’s effort to reduce its debt, will see much of the landmark building converted into WeWork’s headquarters in the heart of New York.

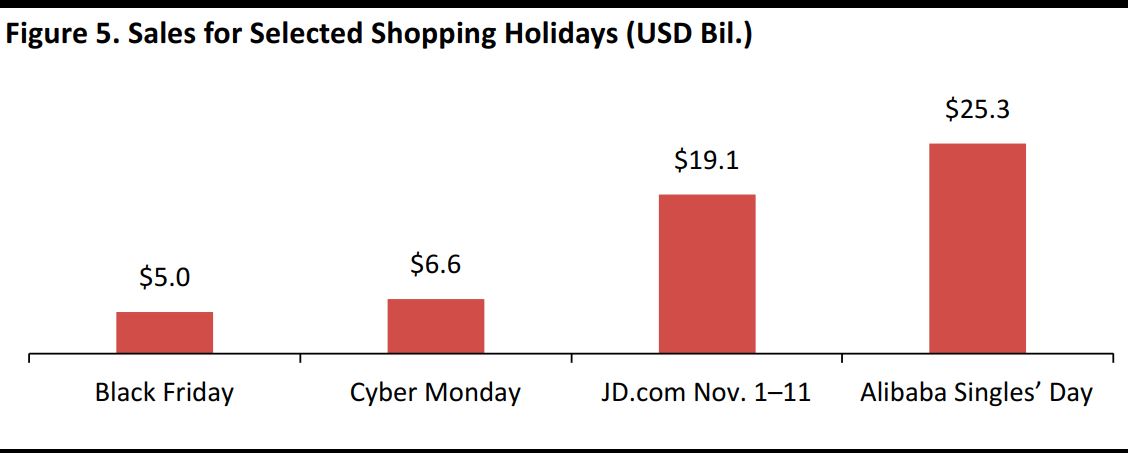

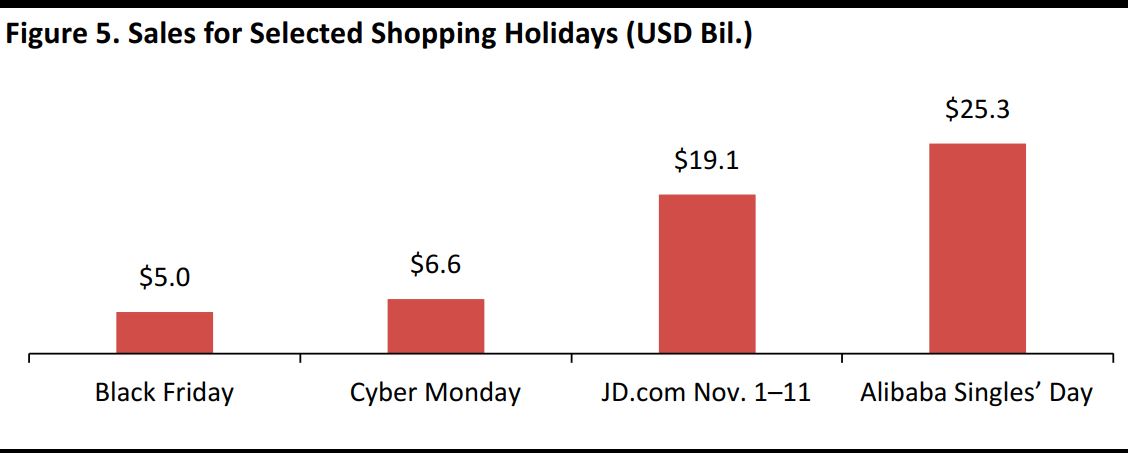

8. Singles’ Day Far Exceeds Black Friday

As an indication of the growing strength of Chinese e-commerce compared to Western retail, this year, Alibaba reported record sales for Singles’ Day, its hallmark shopping festival. Alibaba’s Singles’ Day recorded $25.3 billion in GMV (up 39% year over year) this year, exceeding that of Black Friday and Cyber Monday combined.

Source: Adobe/Company reports

9. Sears Exits Canada

Sears, one of America’s top retailers, which, over time, also became one of Canada’s top retailers. Earlier this year, riddled with financial difficulties which made it challenging to carry out business, the company announced its decision to close several of its Canadian stores and wind down operations. On October 16, Sears Canada received court approval to liquidate the furniture, fixtures and equipment located in its 166 remaining stores in the country.

10. Toys“R”Us Files for Chapter 11 Protection

Not even some of the largest retailers could escape the shifting consumer trends, the continual rise of e-commerce and the economic slowdown affecting the entire industry. One such casualty is the 69-year-old Toys“R”Us, which filed for bankruptcy protection under Chapter 11 of the US Bankruptcy Code.

The company said it will continue to operate its approximately 1,600 Toys“R”Us and Babies“R”Us stores around the world as usual. Its international businesses were not part of the bankruptcy proceedings.

11. Amazon Acquires Whole Foods Market

Amazon’s reputation to steamroll its way into the most improbable sectors and eventually dominate them is well known. However, few would have predicted its acquisition of a brick-and-mortar grocery store chain.

On June 16, Amazon announced its plan to purchase Whole Foods Market for $13.7 billion in cash, making it the online retailer’s biggest acquisition ever. Amazon closed the deal on August 28 and, as one of its first moves, it began selling Amazon tech products at Whole Foods stores that same day. It also reduced prices at its Whole Food stores by as much as 43% on the day the deal closed and, to up its competitiveness, again on November 15

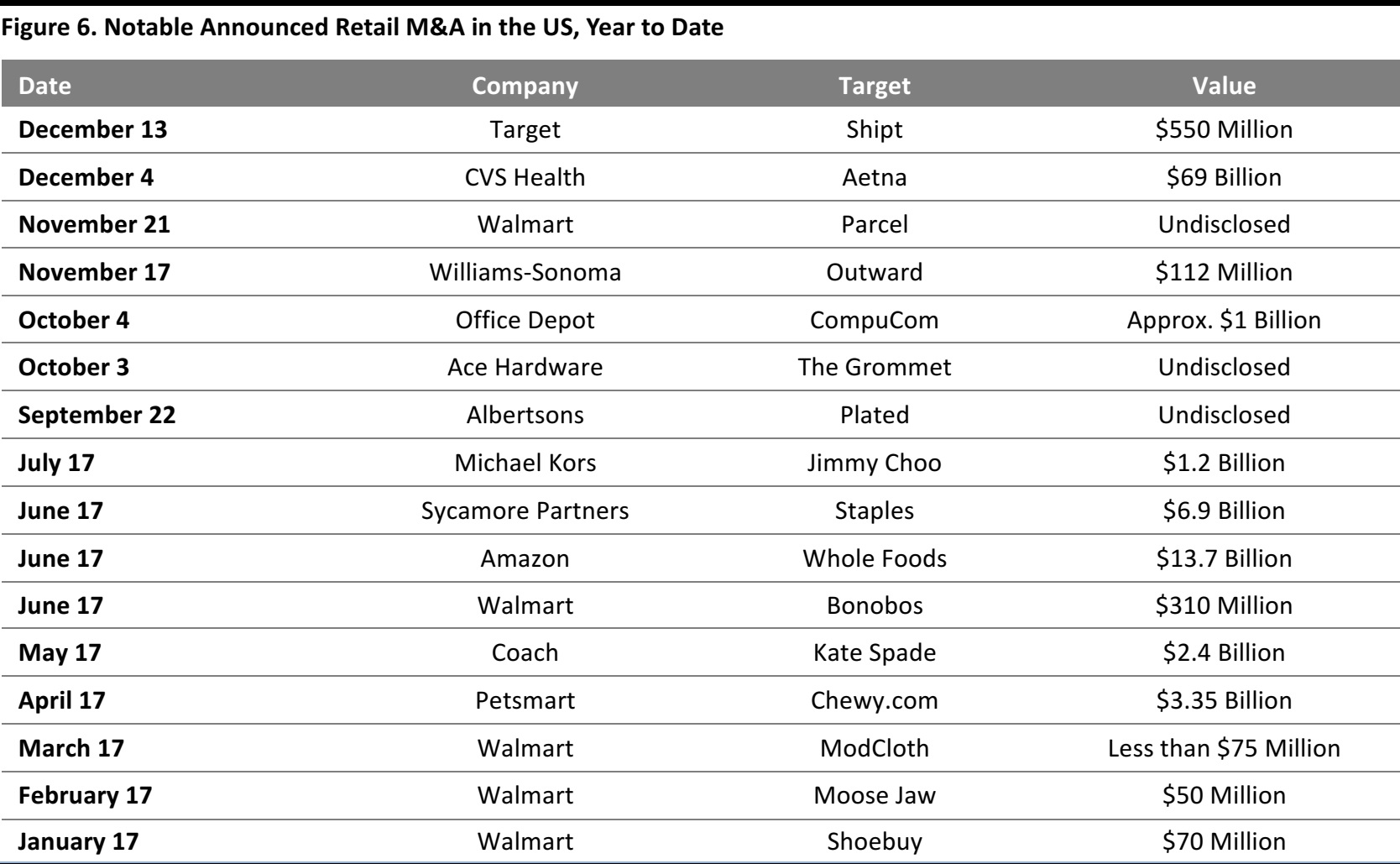

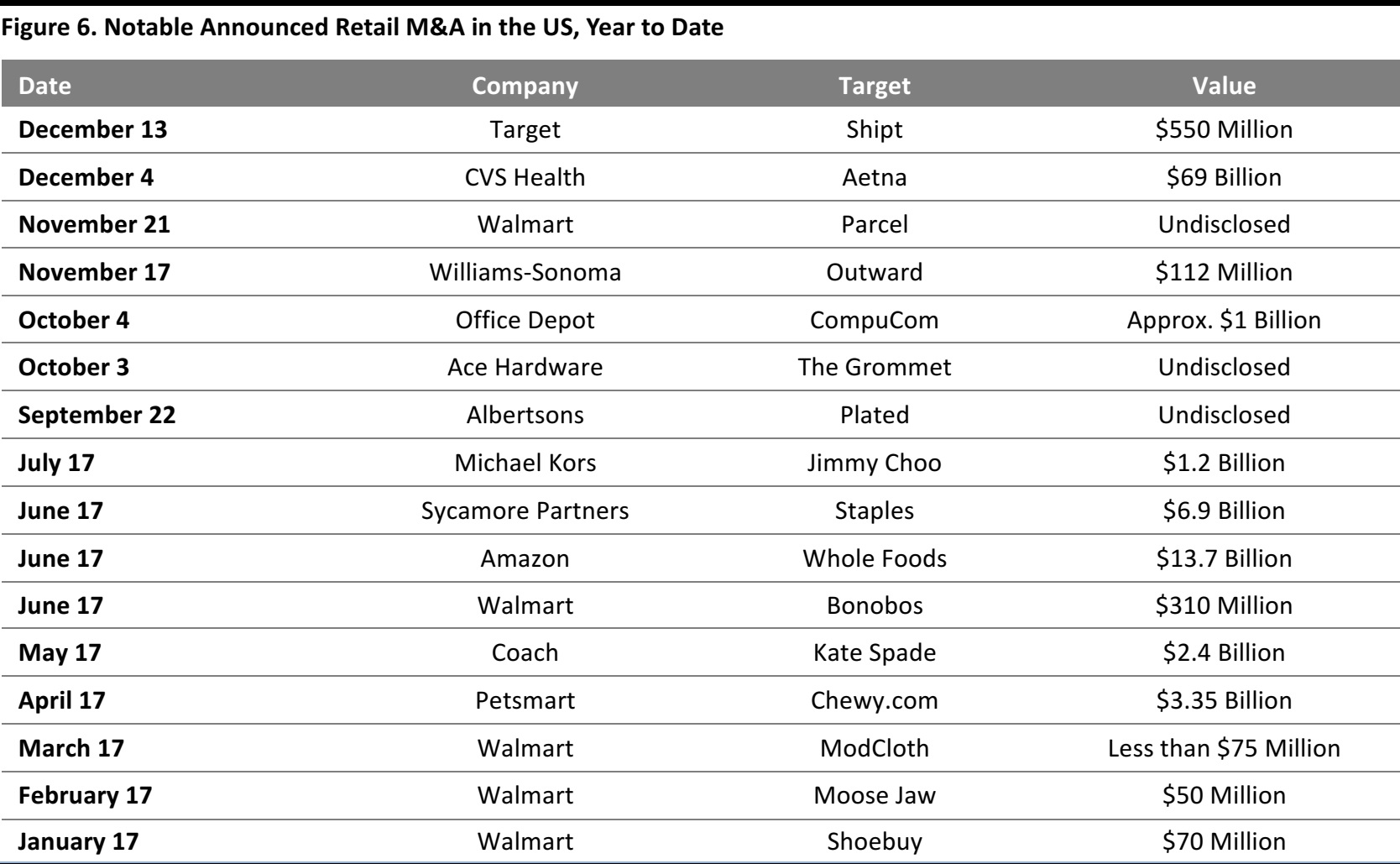

12. A Surge in Retail M&A Activity

This year has seen a surge in M&A activity and consolidation across the board to weather this year’s choppy retail waters. Some of the notable M&A activity we saw this year, are:

Legacy Retailers Investing in Internet Brands

Notable examples: Walmart’s purchase of numerous Internet-focused apparel brands and retailers, Target’s investment in mattress firm Casper and grocery retailer Albertsons’s acquisition of meal-kit firm Plated.

Key takeaway: Long-standing retailers are not simply seeking to accelerate their e-commerce revenues, they have recognized that consumers are turning to distinctive, specialized brands that resonate with their lifestyles, and have acquired some of these brands as a result.

Healthcare Retailers Seeking New Opportunities

Notable examples: The Walgreens Boots Alliance acquisition of just under half of Rite Aid’s store network and CVS Health’s plans to acquire health-services provider Aetna.

Key takeaway: Prompted by an aging society and consumer demand for value-for-money health services, healthcare retailers appear to have spotted opportunities to strengthen their presence in services.

Online to Offline

Notable examples: Alibaba’s announcement to buy a stake in Sun Art Group and Amazon’s acquisition of Whole Foods Market.

Key takeaway: These two acquisitions confirm that grocery stands apart from nonfood categories in terms of online versus offline retailing. Even the biggest players in e-commerce appear to have acknowledged that cracking the grocery market in the foreseeable future requires ownership of a substantial brick-and-mortar network.

Online Luxury

Notable examples: JD.com’s investment in Farfetch and private equity firm Apax Partner’s acquisition of a majority stake in Matchesfashion.com.

Key takeaway: Online multi-brand portals are a growth area in the still-immature luxury e-commerce market. We see such portals catering to consumer demand for a compelling mix of authenticity and trusted brands, a strong service proposition and a wide choice selection.

Source: Company reports

13. WeWork Moves Into Retail

In addition to buying Lord & Taylor’s iconic Fifth Avenue department store for $850 million, office space provider WeWork has made several moves into retail. The company absorbed several staff of online electronics retailer Sharkk, including its founder who joined WeWork as “Director of Retail.” WeWork’s principals have also invested in retail-tech startup Outernets

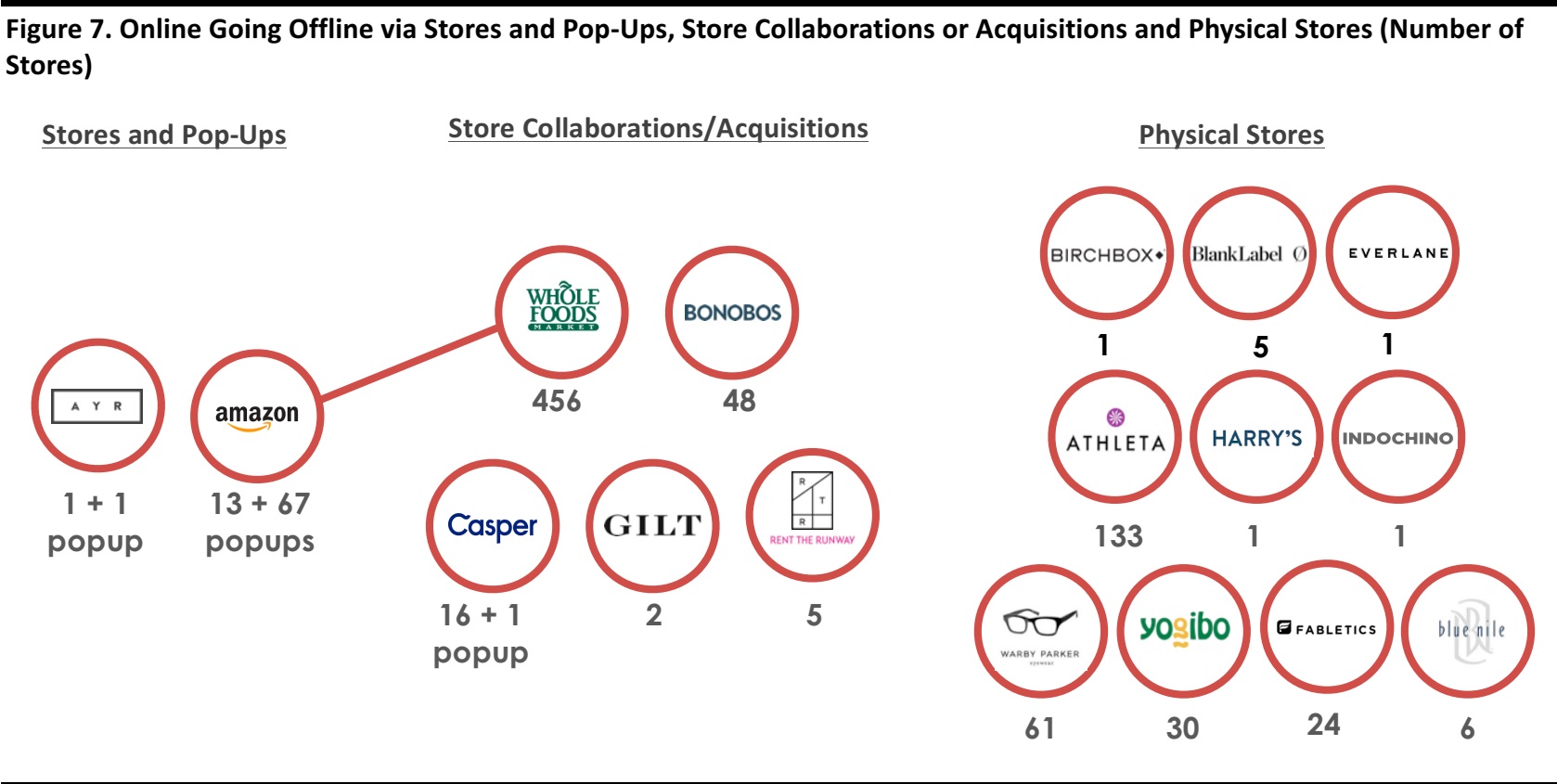

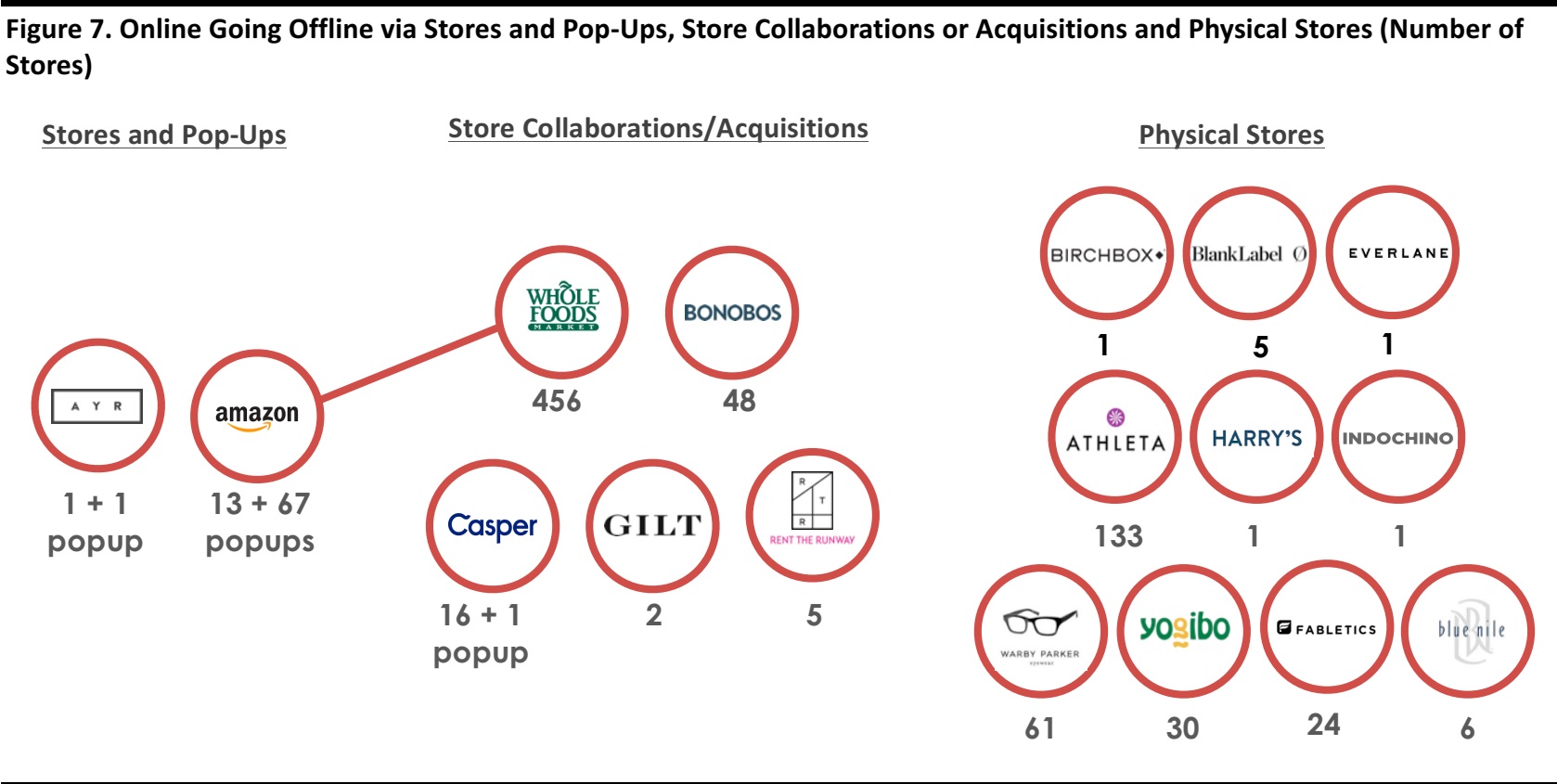

14. Online Heads Offline

This year saw online retailers make further forays into offline retail. For e-commerce retailers, physical stores are marketing assets that support their online business models. Notable examples include Amazon selling via 13 stores and hosting 67 pop-ups as of October 2017 and the 456 Whole Foods stores it has access to, and Birchbox, Everlane and Warby Parker opening standalone physical stores.

Source: Company reports as of October 2017

15. Ofo Comes to the US

Bike-sharing companies in China have raised more than $2 billion in venture funding over the last 18 months, according to

Business Insider. There are over 40 bike-sharing platforms in China, however, Mobike and Ofo claim 95% of the market.

This year, one of the Chinese bike-sharing market leaders arrived in the US. Ofo currently serves four US markets: Seattle, Washington DC, Colorado and Massachusetts.

16. Tencent’s Market Capitalization Exceeds Facebook’s

The war for market leadership among global tech giants continued to heat up this year. For a brief time on November 21, Chinese social media group Tencent’s market capitalization rose as high as $534.5 billion and surpassed that of Facebook’s, which was $519.4 billion. This was just one day after Tencent became the first Chinese company to break through the $500 billion mark.

17. Walmart Becomes a Platform

In a move to hold its ground amid the encroaching threat from Amazon, Walmart’s recent moves are transforming it into a platform for various products and services. Walmart stores already include optical, automotive and financial services, and it even simplified its name from Wal-Mart Stores to just Walmart. Some of its recent activities and acquisitions that make Walmart more of a platform, are:

- Expands marketplace business

- com—for e-commerce

- Moosejaw—vertical integration

- Bonobos—vertical integration

- Hayneedle—vertical integration

Bonus: Walmart Launches Store No. 8 Incubator

Finally, Walmart launched Store No. 8, a technology-startup incubator in Silicon Valley, which is operating under Marc Lore. Store No. 8 aims to identify changes that will reshape the retail experience, including virtual reality (VR), autonomous vehicle and drone delivery, and personalized shopping. In August, Store No. 8 hired Jennifer Fleiss, Cofounder of Rent-the-Runway, to oversee Code Eight, the incubator’s first portfolio company.