Nitheesh NH

Introduction

What’s the Story? Quick-commerce players deliver groceries and essentials to customers in under an hour or as quickly as 10 minutes. In this report, we assess key emerging trends in quick commerce in Europe and the market prospects. Why It Matters Amid retention of pandemic-driven e-commerce habits and continued Covid-19 restrictions in parts of Europe in late 2021 and early 2022, we are seeing increased demand for doorstep deliveries in the region—following on from unprecedented growth in the quick-commerce space in the last 18 months. The number of quick-commerce players has boomed, with Coresight Research estimating that more than 35 companies operate in the European market as of December 2021, concentrated mostly in the vertically integrated segment. Investors are betting big in this space, with a host of companies securing significant seed or sequential financing rounds since the beginning of 2021. Coresight Research estimates that retail sales (predominantly grocery/essentials) by major players in the European quick-commerce market totaled $5.3 billion in 2021 and will surge by 109% in 2022 to reach $11.1 billion. Our estimates factor in management commentary by public companies Deliveroo, Delivery Hero and Uber, third-party data, industry discussions and our own analysis; the figures reflect the value of sales (gross merchandise volume) of pure-play delivery platforms and vertically integrated players and exclude retailer-owned delivery operations (such as Amazon rapid delivery).Quick Commerce in Europe: Coresight Research Analysis

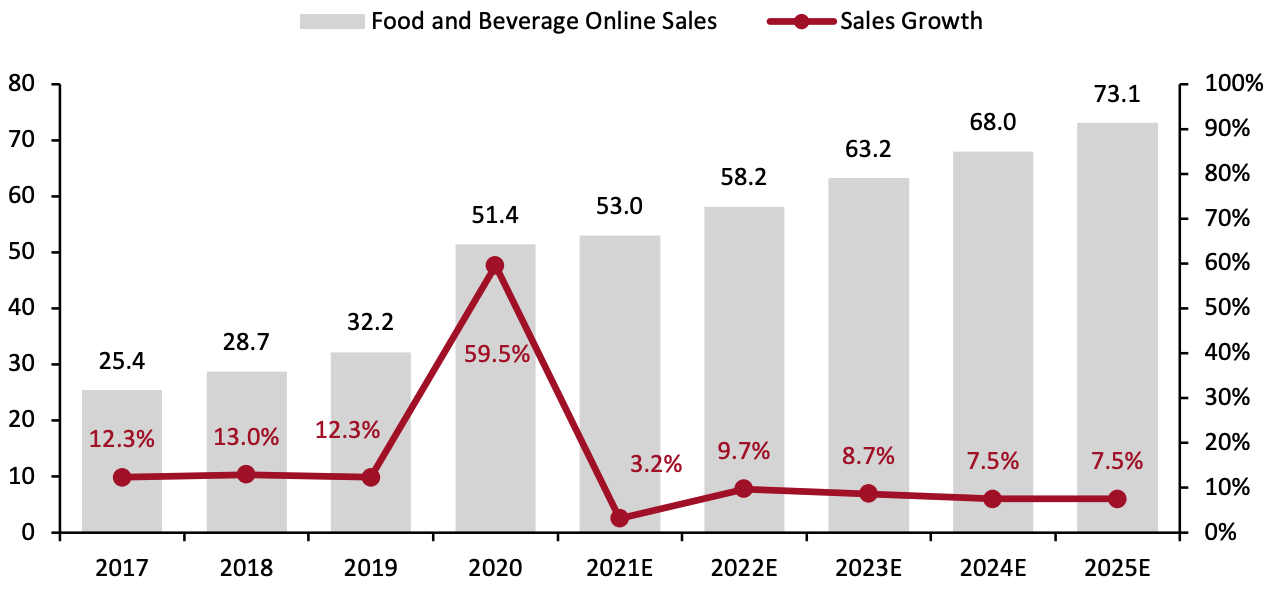

In France, Germany and the UK, aggregated food and beverage e-commerce is set to grow 9.7% in 2022, sustaining growth following a major spike of 59.5% year over year in 2020, according to Euromonitor data. A broad spectrum of consumers was introduced to the channel during lockdowns or had their previous perceptions changed amid convenience and safety benefits. This has created a fertile ground for the emergence of quick commerce, tailored to meet consumers’ growing expectations around speed, quality and convenience.Figure 1. France, Germany and UK Food and Beverage E-Commerce Market: Total Sales (Left Axis; USD Bil.) and YoY % Change (Right Axis; %) [caption id="attachment_142116" align="aligncenter" width="700"]

USD conversion at constant exchange rate

USD conversion at constant exchange rateSource: Euromonitor International Limited 2022 © All rights reserved[/caption] Quick-Commerce Models in Europe Quick-commerce players can largely be divided into three subsections: delivery platforms, vertically integrated instant-needs players and on-demand services by retailers, as shown in Figure 2. These models involve different combinations of stock-keeping unit (SKU) quantity, category coverage, pricing and delivery speed, bringing different value propositions for customers, depending on the nature of purchase (impulse or planned) as well as geography.

Figure 2. Overview of Quick-Commerce Fulfillment Models in Europe [wpdatatable id=1751]

Source: Company reports/Coresight Research

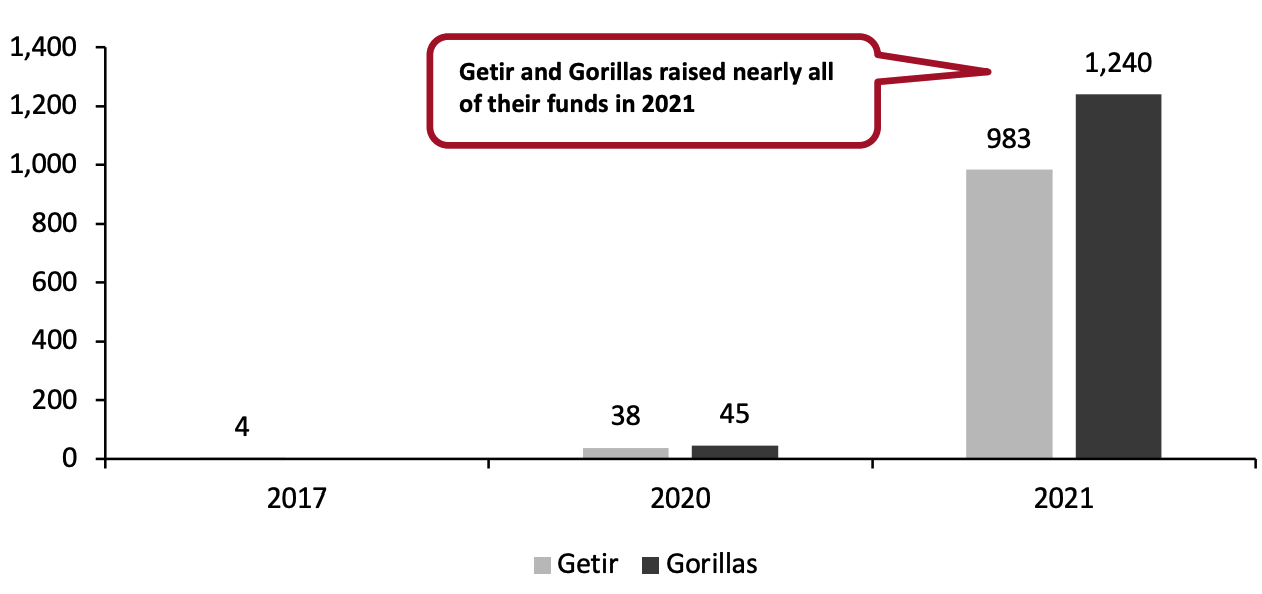

We discuss three key developments in the market. 1. Vertically Integrated Players Are Diversifying Rapidly The last 18 months have seen a rapid increase in the roll-out of new vertically integrated dark-store players in many European countries. The “instant needs” concept of delivering from small, localized warehouses was pioneered by Gopuff in the US and Getir in Turkey, which then triggered similar format operators to also launch in high-density cities in Europe promising doorstep delivery in under 15 minutes. The space is highly crowded with new players including Cajoo, Flink, Gorillas, JOKR and Weezy out their operations in dense urban locations. These ultrafast grocery delivery companies have raised significant capital in seed or sequential financing rounds as venture capitalists seek to invest in more capital-intensive businesses rather than gig-based models.Figure 3. Funds Raised by Vertically Integrated Firms Getir and Gorillas (USD Mil.) [caption id="attachment_142117" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Vertically integrated players are expanding fast across Europe and internationally. Figure 4 provides an overview of expansion plans among prominent companies operating in this space.

Source: Company reports/Coresight Research[/caption]

Vertically integrated players are expanding fast across Europe and internationally. Figure 4 provides an overview of expansion plans among prominent companies operating in this space.

Figure 4. Vertically Integrated Companies’ Expansion Plans [wpdatatable id=1752]

Source: Company reports/Coresight Research

Additionally, new players in the vertically integrated grocery delivery space emerged in Europe in 2021. This will create a more crowded market, with increased competition likely compressing margins even further throughout 2022.- March—Stash started operations in Switzerland.

- May—Macai launched in Italy and Stockholm.

- June—Ding Dong started grocery delivery in Brussels.

- August—Wuplo launched in Berlin.

- October—Pop Market launched in Athens.

Figure 5. Key European Dark-Store Model Operators and Geographical Presence as of November 2021 [wpdatatable id=1753]

Source: Company reports

While grocery remains the key strategic focus for new instant commerce players some are increasing their ready-made meals offerings, including Jiffy and Gorillas in the UK and Gorillas and Flink in Germany. With this move, the companies are looking to expand their addressable market by appealing to large family households, further increasing basket sizes and adoption. 2. European Grocers Are Developing Partnerships with Vertically Integrated Players Traditional grocery retailers are taking the quick-commerce threat seriously and are increasingly getting involved in the space. Many are launching commercial pilots with vertically integrated firms to speed up delivery services, enter valuable urban markets and extend their appeal to younger consumers.- In November 2021, Groupe Casino announced a partnership with Gorillas, which will see the rapid delivery firm undertake packing and fast delivery of goods purchased from the Monoprix and Franprix online platforms. Through the collaboration, Gorillas will offer Monoprix and Franprix branded products as well as national brands within 10 minutes in selected locations in Paris. Groupe Casino also announced that it has acquired a minority stake in Gorillas. Groupe Casino’s other online grocery offerings include a partnership with Ocado and Amazon Prime.

- Tesco announced a commercial partnership with Germany-based Gorillas in October 2021. Under the pilot program, Tesco will co-locate Gorilla’s micro-warehouses at several of its stores in London, offering a limited assortment for delivery by Gorillas to shoppers in 10 minutes or less. The deal leverages spare space in supermarkets that once housed items now largely bought online, such as kitchen appliances. Tesco’s other online grocery delivery services include Tesco Whoosh and a partnership with Deliveroo.

- In October 2021, Carrefour launched Carrefour Sprint in partnership with Uber Eats and Cajoo in France to offer a 15-minute grocery delivery service. Using Cajoo’s network of dark stores and Uber Eat’s delivery network, Carrefour shoppers will be promised orders in less than 15 minutes from a range of around 2,000 food and non-food products. In July 2021, Carrefour acquired a minority stake in Cajoo. Carrefour’s other online grocery offerings include partnerships with Deliveroo, Glovo and Uber Eats.

- In July 2021, German supermarket chain REWE Group invested in ultrafast grocery delivery company Flink, announcing a strategic partnership for nationwide merchandise supply.

- Finding attractive locations for their dark stores—for instance, Carrefour will reportedly help Cajoo in finding new leases

- Increasing efficiency, especially in the preliminary stages, as supermarket chains can directly replenish their partners’ dark stores, which is less resource-intensive than negotiating with numerous wholesalers and local producers

- Adjusting product mix to include more fresh produce and private labels, which can help to improve gross margins

- November 2021—Getir announced plans to acquire UK-based Weezy.

- November 2021—DoorDash announced plans to acquire Finnish delivery platform Wolt.

- September 2021—Glovo acquired Lola Market (Spain) and Mercadao (Portugal).

- August 2021—Gopuff acquired UK-based Dija.

- July 2021—Getir acquired Spain-based vertically integrated company Blok.

- May 2021—Gopuff acquired UK-based Fancy.

Figure 6. Players Likely To Lead M&As in Quick Commerce [wpdatatable id=1754]

What We Think

Quick commerce is an underlying trend that emerged during the lockdowns and became more established in consumer behaviors. Following the influx of new entrants, this space is looking unsustainably over-supplied and profit challenged. With some nascent players exiting the market, consolidation looks inevitable—especially given the glut of businesses competing on similar selling points and often in the same service areas. This will likely be compounded by established players continuing to expand aggressively. Implications for Brands/Retailers- In Europe, quick commerce is mainly limited to delivery of grocery and meal-kit items. Players operating in this space should look to diversify into higher-margin categories by putting the right infrastructure and logistics in place. Glovo, for example, has been expanding its product delivery range in areas including electronics and even furniture items.

- Vertically integrated players currently fulfill online orders manually from dark stores. They should look to transition from manual to automated fulfillment operations to cater to order volume increases and improve margins.

- The rise of ultrafast players is a threat to the convenience store sector, which so far had been shielded from the online grocery channel shift. Retailers with large convenience store estates, especially those with high convenience-store footprints in urban locations, would face the greatest risk of market share erosion in the profitable convenience segment.

Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved