Source: Company reports/Coresight Research

Fiscal 2Q18 Results

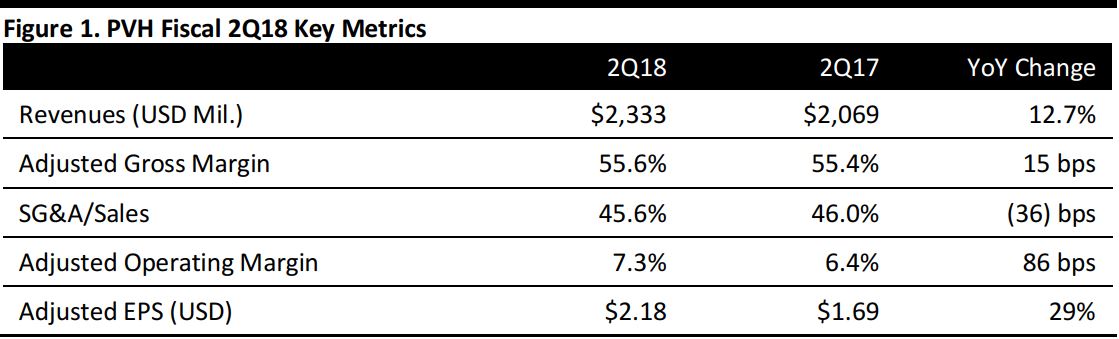

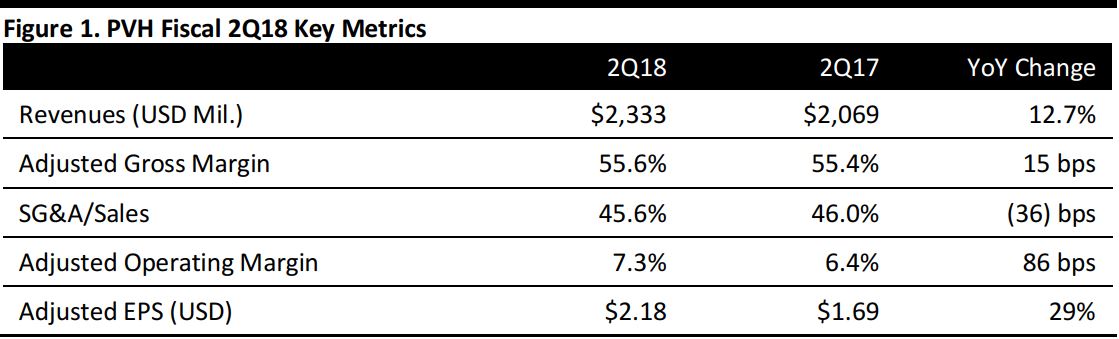

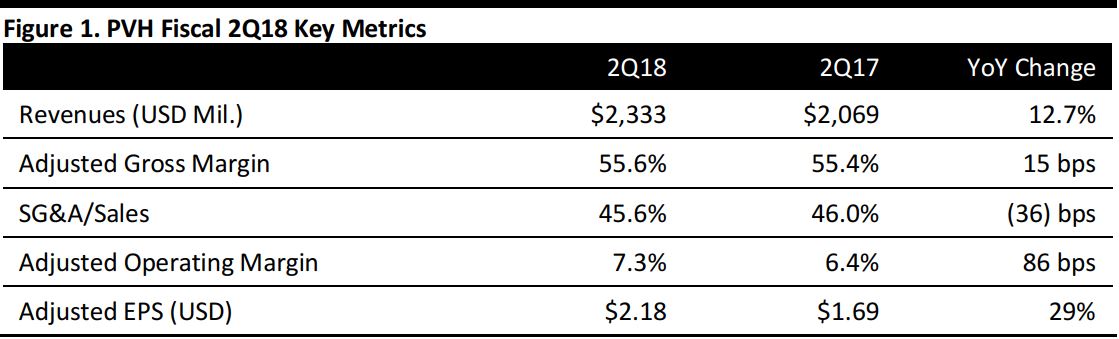

PVH Corp. reported fiscal 2Q18 revenues of $2,333 million, up 12.7% year over year and beating the $2,290 million consensus estimate. Adjusted EPS was $2.18, beating the consensus estimate of $2.09 and up from adjusted EPS of $1.69 from the year-ago quarter.

Tommy Hilfiger revenues were up 15%, inclusive of a 2% increase due to currency effects. Tommy Hilfiger International revenues increased 20%, inclusive of a 4% benefit from currency effects. The Tommy Hilfiger revenue increase was driven by strong performances in all regions and channels. Tommy Hilfiger North America revenues were up by 9%, driven by strong wholesale performance and solid retail growth.

In terms of brand highlights, Tommy Hilfiger is collaborating with Lewis Hamilton, Formula 1 world champion, Tommy Hilfiger global men's ambassador. Lewis has been wearing Tommy Hilfiger sportswear on and off the racetrack and the brand is resonating with the consumer, particularly in Europe and Asia. The company is hosting a TommyNow fashion show in Shanghai on September 4, and the TOMMYxLEWIS product capsule will be available during that live show. In addition, Tommy Hilfiger is partnering with Tmall for a Super Brand Day on September 4, which will bring the full impact of the brand's see now, buy now platform to China, together with some special offers for consumers and exciting activations on Tmall.com.

Calvin Klein revenues were up 18%, inclusive of a 2% foreign exchange benefit. Calvin Klein International revenues increased 16%, inclusive of a 3% benefit in foreign exchange. The performance was driven by performance in Europe and Asia. For North America, Calvin Klein revenues increased by 19%, driven by a strong wholesale performance in all categories.

The company reported that Calvin Klein North America revenues were up as the company saw improved trends through the quarter, particularly in wholesale, where they saw strength in underwear, sportswear and men's denim categories, and average unit retail rose across most categories. Additionally, digital was the healthiest channel across department store customers, PVH sites, sites and pure-play partners.

Total revenues in the Heritage Brands business fell 3%, with comparable store sales up 3%.

Outlook

The company offered 3Q18 non-GAAP EPS guidance of $3.10–$3.13, versus the consensus estimate to $3.13. The company expects revenue in the third quarter to increase 7% (9% on a constant-currency basis) compared to the consensus estimate of $2.44 billion. For the full year, the company raised EPS guidance to $9.20–$9.25 from $9.05–9.15 compared to the consensus estimate of $9.18.