Source: Company reports/Fung Global Retail & Technology

4Q16 Results

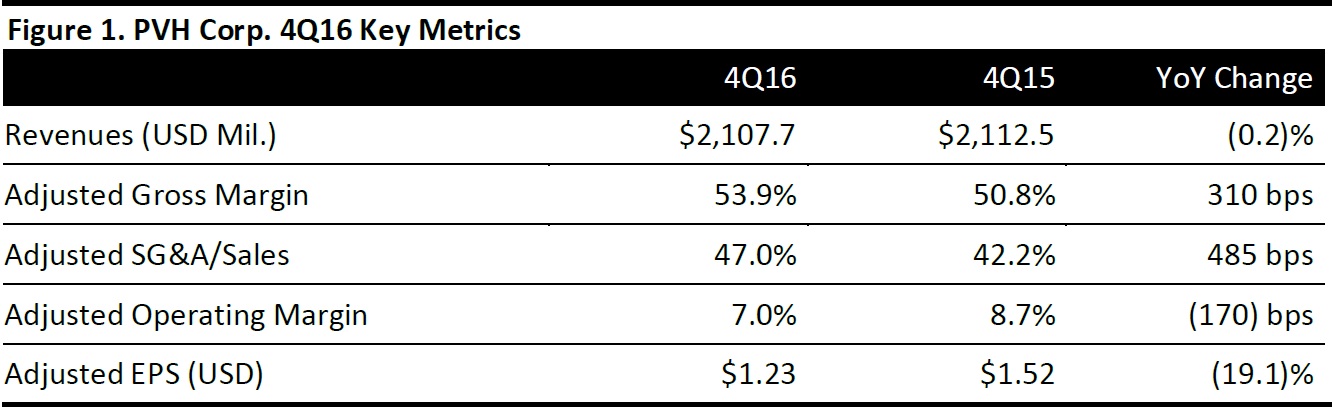

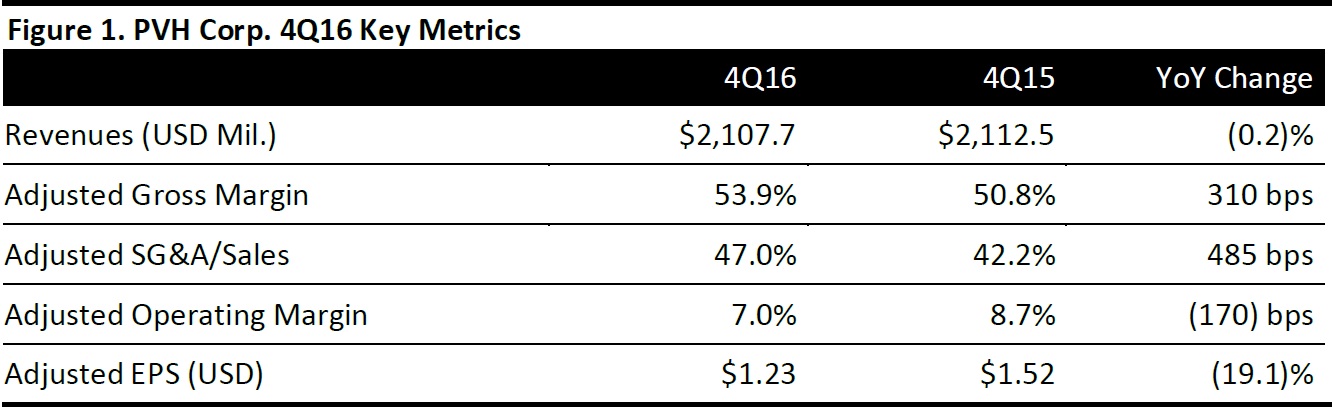

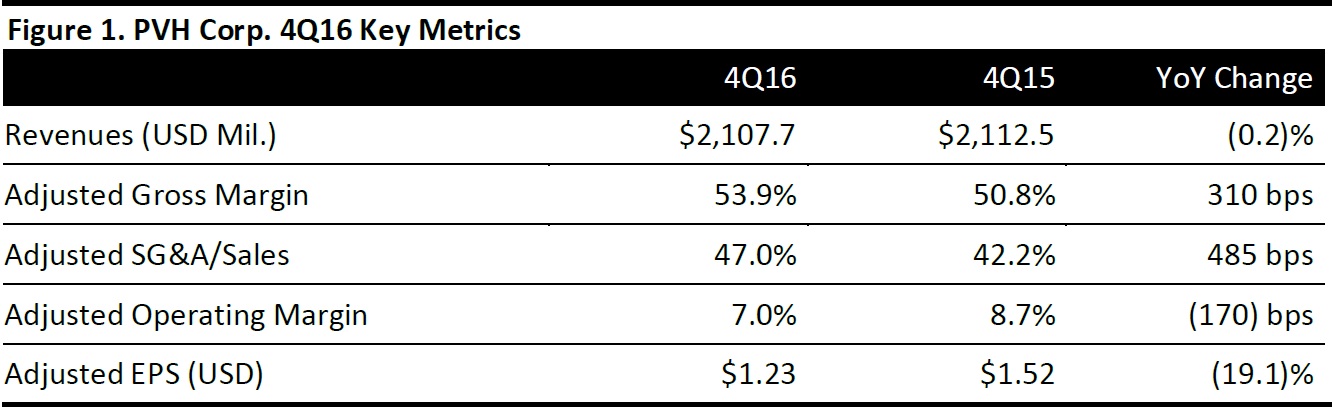

PVH Corp. reported 4Q16 adjusted EPS of $1.23, above the consensus estimate of $1.19.

Total revenues were flat at $2.11 billion and above expectations of $2.09 billion. Calvin Klein revenues increased by 1%, to $795 million, while Tommy Hilfiger revenues increased by 3%, to $932 million. Revenues in the Heritage Brands segment were down 5%. International sales were stronger than North America sales at both Calvin Klein and Tommy Hilfiger: international sales were up 11% for Calvin Klein and up 10% for Tommy Hilfiger. North America sales were down 11% for Calvin Klein and down 4% for Tommy Hilfiger.

2017 Outlook

Management provided 1Q17 EPS guidance of $1.58–$1.60 versus consensus of $1.59. Compared with the year-ago period, 1Q17 EPS is expected to be negatively impacted by approximately $0.10 per share related to foreign currency exchange rates. Revenues for the quarter are expected to increase by approximately 2% and by approximately 4% on a constant–currency basis.

For the full year, the company expects EPS of $7.30–$7.40 versus consensus of $7.26. Compared with the prior year,2017 EPS is expected to be negatively impacted by approximately $0.40 per share related to foreign currency exchange rates. Revenues for the full year are expected to increase by approximately 2% and by approximately 4% on a constant-currency basis.

Management noted that it is planning the business prudently for 2017, given the uncertain global retail landscape, macroeconomic and geopolitical volatility, and the strengthening US dollar.